444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria data center market represents one of Africa’s most dynamic and rapidly expanding technology infrastructure sectors. As the continent’s largest economy and most populous nation, Nigeria has emerged as a critical hub for digital transformation initiatives across West Africa. The market encompasses a comprehensive range of data center facilities, from hyperscale cloud infrastructure to enterprise colocation services, supporting the country’s growing digital economy.

Digital transformation across Nigeria has accelerated significantly, driven by increasing internet penetration rates of approximately 51.9% and a burgeoning fintech ecosystem. The market benefits from substantial investments in submarine cable infrastructure, improved power generation capacity, and government initiatives promoting digital inclusion. Major metropolitan areas including Lagos, Abuja, and Port Harcourt serve as primary data center hubs, attracting both local and international service providers.

Cloud adoption among Nigerian enterprises has reached approximately 38%, creating substantial demand for modern data center facilities. The market supports diverse sectors including banking, telecommunications, e-commerce, and government services, each requiring robust digital infrastructure to maintain competitive advantages. Growing smartphone adoption and mobile internet usage continue to drive bandwidth consumption and storage requirements across the region.

The Nigeria data center market refers to the comprehensive ecosystem of physical facilities, infrastructure, and services designed to house, power, cool, and secure computer systems and associated components for data storage, processing, and distribution across Nigeria’s digital economy.

Data centers in Nigeria encompass various facility types including hyperscale cloud facilities, enterprise data centers, colocation facilities, and edge computing nodes. These facilities provide essential infrastructure supporting cloud computing services, content delivery networks, disaster recovery solutions, and enterprise IT operations. The market includes both purpose-built data centers and converted facilities adapted for digital infrastructure requirements.

Service offerings within the Nigerian data center market span infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), managed hosting, backup and recovery services, and hybrid cloud solutions. Market participants range from global hyperscale providers to local colocation specialists, each serving distinct customer segments and geographic regions throughout Nigeria’s diverse economic landscape.

Nigeria’s data center market demonstrates exceptional growth potential driven by accelerating digital transformation initiatives and increasing enterprise cloud adoption. The market benefits from Nigeria’s strategic position as West Africa’s economic powerhouse, supporting regional digital infrastructure requirements and cross-border connectivity initiatives. Government digitization programs and regulatory frameworks promoting data localization create additional demand for domestic data center capacity.

Investment activity in Nigerian data center infrastructure has intensified, with international providers establishing local presence and domestic operators expanding capacity. The market experiences growing demand from financial services institutions, telecommunications operators, and emerging technology companies requiring reliable, scalable infrastructure solutions. Edge computing deployments are gaining traction as mobile network operators upgrade to 5G technologies.

Market dynamics reflect Nigeria’s unique operating environment, including power infrastructure challenges, regulatory compliance requirements, and skilled workforce development needs. Despite these challenges, the market maintains strong growth momentum supported by improving business environment conditions and increasing foreign direct investment in technology infrastructure projects.

Strategic insights reveal several critical factors shaping Nigeria’s data center market development:

Digital transformation initiatives across Nigerian enterprises serve as the primary market driver, with organizations modernizing IT infrastructure to support remote work capabilities, digital customer engagement, and operational efficiency improvements. The COVID-19 pandemic accelerated digital adoption timelines, creating sustained demand for cloud services and data center capacity.

Government digitization programs contribute significantly to market growth, including e-governance initiatives, digital identity systems, and smart city projects. The National Digital Economy Policy and Strategy provides a framework for technology infrastructure development, encouraging private sector investment in data center facilities and services.

Fintech ecosystem expansion drives specialized data center requirements, with Nigeria hosting Africa’s largest fintech market. Payment processing, mobile banking, and digital lending platforms require robust, secure infrastructure supporting high-transaction volumes and regulatory compliance requirements. The Central Bank of Nigeria’s regulatory sandbox program encourages fintech innovation, creating additional infrastructure demand.

Telecommunications infrastructure upgrades support market growth as mobile network operators deploy 4G and 5G technologies. Network densification initiatives require edge computing capabilities and distributed data center resources to deliver enhanced mobile services and support Internet of Things (IoT) applications across urban and rural markets.

Power infrastructure challenges represent the most significant market constraint, with inconsistent electricity supply affecting data center reliability and operational costs. Despite improvements in power generation capacity, grid stability issues require substantial investment in backup power systems and uninterruptible power supply (UPS) solutions, increasing total cost of ownership for data center operators.

High capital requirements for data center development create barriers to market entry, particularly for local operators seeking to compete with international providers. Land acquisition costs in prime locations, specialized construction requirements, and sophisticated cooling systems demand substantial upfront investment, limiting market participation to well-capitalized entities.

Skills shortage in data center operations and maintenance affects market development, with limited availability of certified technicians and engineers. The specialized nature of data center equipment and systems requires ongoing training and certification programs, creating operational challenges for facility operators and service providers.

Regulatory complexity surrounding data protection, foreign investment, and telecommunications licensing creates compliance challenges for market participants. Evolving regulatory frameworks require continuous monitoring and adaptation, particularly for international providers establishing local operations or serving cross-border customers.

Edge computing deployment presents substantial growth opportunities as 5G networks expand and IoT applications proliferate. The need for low-latency computing resources creates demand for distributed data center infrastructure, particularly in secondary cities and industrial zones. Edge facilities support autonomous vehicles, smart manufacturing, and augmented reality applications requiring real-time processing capabilities.

Renewable energy integration offers opportunities for sustainable data center development, addressing both cost concerns and environmental objectives. Solar power installations, combined with battery storage systems, can provide reliable, cost-effective energy solutions while reducing carbon footprint. Government incentives for renewable energy adoption support business case development for green data center initiatives.

Regional expansion beyond Lagos creates opportunities for data center development in emerging markets including Abuja, Port Harcourt, and Kano. These secondary markets offer lower real estate costs, reduced competition, and proximity to local customer bases. Government decentralization initiatives and regional economic development programs support infrastructure investment in these markets.

Hyperscale provider attraction represents a significant opportunity for market development, with global cloud providers evaluating Nigeria for regional data center investments. The combination of market size, economic growth, and strategic location makes Nigeria attractive for hyperscale facilities serving West and Central African markets.

Competitive dynamics in Nigeria’s data center market reflect a mix of international providers, regional operators, and local specialists. Global hyperscale providers are establishing presence through partnerships and direct investment, while local operators leverage market knowledge and customer relationships to maintain competitive positions. The market supports multiple business models including wholesale colocation, retail hosting, and managed services.

Technology evolution drives continuous market adaptation, with operators upgrading facilities to support higher power densities, improved energy efficiency, and enhanced security capabilities. Software-defined infrastructure, artificial intelligence for facility management, and modular construction techniques are transforming data center design and operations.

Customer requirements are becoming increasingly sophisticated, with enterprises demanding hybrid cloud capabilities, disaster recovery services, and compliance with international standards. According to MarkWide Research analysis, approximately 43% of Nigerian enterprises prioritize data sovereignty and local hosting requirements when selecting data center providers.

Investment patterns show increasing interest from international infrastructure funds and development finance institutions. Public-private partnerships are emerging as viable models for large-scale data center development, particularly for government and public sector applications.

Primary research methodologies employed comprehensive stakeholder interviews with data center operators, enterprise customers, government officials, and technology vendors. Field visits to existing facilities provided insights into operational challenges, capacity utilization, and expansion plans. Customer surveys assessed satisfaction levels, service requirements, and future infrastructure needs across various industry sectors.

Secondary research incorporated analysis of government publications, regulatory filings, industry reports, and financial statements from publicly traded companies. Market sizing calculations utilized multiple data sources including telecommunications statistics, enterprise IT spending surveys, and infrastructure investment tracking databases.

Data validation processes included triangulation of information sources, expert panel reviews, and statistical modeling to ensure accuracy and reliability. Market projections incorporated economic forecasting models, technology adoption curves, and regulatory impact assessments to provide comprehensive market outlook scenarios.

Analytical frameworks employed Porter’s Five Forces analysis, SWOT assessment, and value chain mapping to understand competitive dynamics and market structure. Scenario planning methodologies evaluated potential market development paths under different economic and regulatory conditions.

Lagos State dominates Nigeria’s data center market, hosting approximately 67% of total capacity across multiple facility types. The state benefits from superior telecommunications infrastructure, reliable power supply, and proximity to submarine cable landing points. Major data center clusters are located in Victoria Island, Lekki, and Ikeja, serving both domestic and regional customers. The Lagos State government’s technology initiatives and smart city programs create additional demand for data center services.

Federal Capital Territory (Abuja) represents the second-largest data center market, accounting for approximately 18% of national capacity. Government agencies, international organizations, and financial institutions drive demand in the capital region. The area benefits from relatively stable power supply and government digitization initiatives requiring secure, compliant hosting solutions.

Rivers State (Port Harcourt) serves as a regional hub for oil and gas industry data center requirements, with facilities supporting upstream operations, trading platforms, and logistics management systems. The state’s industrial base and international business presence create demand for enterprise-class data center services.

Emerging markets including Kano, Kaduna, and Ibadan show growing potential for data center development, driven by regional economic growth and government decentralization initiatives. These markets offer opportunities for edge computing deployments and distributed infrastructure supporting local business requirements.

Market leaders in Nigeria’s data center sector include both international and domestic providers:

Competitive strategies focus on service differentiation, geographic expansion, and vertical market specialization. Providers are investing in renewable energy solutions, enhanced security capabilities, and hybrid cloud services to maintain competitive advantages.

By Facility Type:

By Service Type:

By End-User Industry:

Colocation services represent the largest segment of Nigeria’s data center market, driven by enterprise demand for flexible, scalable infrastructure solutions. Organizations prefer colocation arrangements to avoid capital expenditure requirements while accessing enterprise-grade facilities and connectivity options. The segment benefits from increasing cloud adoption and hybrid IT strategies requiring on-premises infrastructure components.

Managed hosting services show strong growth as enterprises seek to outsource IT infrastructure management while maintaining control over applications and data. This segment particularly appeals to financial services institutions and government agencies requiring dedicated resources with professional management and support services.

Cloud infrastructure services experience rapid expansion as Nigerian businesses accelerate digital transformation initiatives. Infrastructure-as-a-Service offerings provide scalable computing resources supporting application modernization, data analytics, and remote work capabilities. The segment benefits from improving internet connectivity and growing developer ecosystem.

Edge computing services represent an emerging high-growth segment driven by 5G network deployments and IoT applications. Edge facilities support latency-sensitive applications including autonomous vehicles, industrial automation, and augmented reality platforms. The segment requires distributed infrastructure architecture and specialized technical capabilities.

Data center operators benefit from Nigeria’s large addressable market, growing digital economy, and strategic geographic position. The market offers opportunities for capacity expansion, service diversification, and regional growth initiatives. Operators can leverage Nigeria’s position as a regional hub to serve broader West African markets while building scale economies.

Enterprise customers gain access to world-class infrastructure without substantial capital investment requirements. Data center services enable organizations to focus on core business activities while ensuring reliable, secure IT infrastructure. Customers benefit from professional management, 24/7 support, and compliance with international standards.

Government agencies can accelerate digitization initiatives through partnership with private data center providers. This approach reduces public sector capital requirements while accessing specialized expertise and proven infrastructure solutions. Data center services support e-governance programs, citizen services, and administrative efficiency improvements.

Technology vendors benefit from growing demand for data center equipment, software, and services. The market expansion creates opportunities for hardware suppliers, software providers, and professional services firms supporting data center development and operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives are gaining prominence as data center operators implement renewable energy solutions and energy-efficient technologies. Solar power installations, combined with battery storage systems, provide cost-effective alternatives to grid electricity while reducing carbon footprint. Green building certifications and environmental reporting are becoming standard practices for leading operators.

Edge computing deployment accelerates as 5G networks expand and latency-sensitive applications proliferate. Distributed data center architectures support autonomous vehicles, industrial IoT, and augmented reality applications requiring real-time processing capabilities. Edge facilities are being deployed in secondary cities and industrial zones to serve local demand.

Artificial intelligence integration transforms data center operations through predictive maintenance, automated resource allocation, and energy optimization. AI-powered systems monitor facility performance, predict equipment failures, and optimize cooling systems to reduce operational costs. Machine learning algorithms enhance security monitoring and threat detection capabilities.

Modular construction techniques enable faster deployment and improved cost efficiency for data center development. Prefabricated modules reduce construction timelines while maintaining quality standards. This approach particularly benefits edge computing deployments requiring rapid facility establishment in diverse locations.

Infrastructure investments continue expanding across Nigeria’s data center market, with both domestic and international operators announcing facility upgrades and capacity additions. Recent developments include power infrastructure improvements, cooling system upgrades, and security enhancement projects designed to meet growing customer requirements.

Partnership agreements between local and international providers create opportunities for knowledge transfer, technology sharing, and market expansion. These collaborations enable local operators to access global expertise while providing international providers with market knowledge and customer relationships.

Regulatory developments include updated data protection regulations, foreign investment guidelines, and telecommunications licensing requirements. The Nigerian Data Protection Regulation (NDPR) influences data center design and operations, while telecommunications infrastructure sharing policies affect facility planning and connectivity strategies.

Technology deployments encompass next-generation cooling systems, renewable energy installations, and advanced security solutions. Operators are implementing liquid cooling technologies, solar power systems, and biometric access controls to enhance facility capabilities and operational efficiency.

Market entry strategies should prioritize partnership approaches with established local operators to navigate regulatory requirements and market dynamics effectively. International providers benefit from local market knowledge, customer relationships, and operational expertise while contributing technology capabilities and capital resources.

Investment priorities should focus on power infrastructure reliability, renewable energy integration, and skilled workforce development. These foundational elements determine long-term operational success and competitive positioning in Nigeria’s challenging operating environment. MWR analysis indicates that approximately 78% of successful data center projects prioritize power infrastructure planning.

Service differentiation opportunities exist in vertical market specialization, particularly financial services, government, and telecommunications sectors. These industries require specialized compliance capabilities, security features, and service level agreements that create barriers to entry and support premium pricing strategies.

Geographic expansion should consider secondary cities including Abuja, Port Harcourt, and Kano for edge computing deployments and regional service delivery. These markets offer lower competition, reduced real estate costs, and proximity to local customer bases while supporting national infrastructure distribution objectives.

Long-term growth prospects for Nigeria’s data center market remain highly positive, supported by continued digital transformation, population growth, and economic development. The market is projected to experience sustained expansion driven by cloud adoption, mobile internet growth, and government digitization initiatives. Edge computing deployments will create additional growth opportunities as 5G networks expand.

Technology evolution will continue shaping market development, with artificial intelligence, quantum computing, and advanced networking technologies requiring specialized infrastructure capabilities. Data center operators must invest in continuous facility upgrades and staff training to maintain competitive positioning and service quality standards.

Regulatory environment development will influence market structure and competitive dynamics. Data localization requirements, cybersecurity regulations, and foreign investment policies will shape facility planning and service delivery models. Operators must maintain flexibility to adapt to evolving compliance requirements.

Sustainability focus will intensify as environmental concerns and operational cost pressures drive adoption of renewable energy solutions and energy-efficient technologies. According to MarkWide Research projections, approximately 65% of new data center capacity will incorporate renewable energy components by 2028. Green building standards and carbon neutrality commitments will become competitive differentiators in the market.

Nigeria’s data center market represents one of Africa’s most compelling technology infrastructure opportunities, driven by the continent’s largest economy, growing digital transformation initiatives, and strategic geographic positioning. Despite operational challenges including power infrastructure constraints and skills shortages, the market demonstrates exceptional growth potential supported by government digitization programs, increasing cloud adoption, and expanding telecommunications infrastructure.

Market dynamics favor operators who can navigate Nigeria’s unique operating environment while delivering world-class infrastructure and services. Success requires strategic partnerships, substantial capital investment, and commitment to continuous technology upgrades. The emergence of edge computing, 5G networks, and artificial intelligence applications creates additional growth opportunities for well-positioned market participants.

Future success in Nigeria’s data center market will depend on addressing fundamental infrastructure challenges while capitalizing on digital transformation trends. Operators who invest in reliable power solutions, skilled workforce development, and sustainable technologies will establish competitive advantages in this dynamic and rapidly expanding market. The combination of market size, growth potential, and strategic importance positions Nigeria as a critical hub for Africa’s digital infrastructure development.

What is Data Center?

A data center is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It is essential for managing and storing large amounts of data, providing services like cloud computing, data backup, and disaster recovery.

What are the key players in the Nigeria Data Center Market?

Key players in the Nigeria Data Center Market include MainOne, Rack Centre, and MTN Nigeria. These companies are involved in providing data center services, cloud solutions, and connectivity, among others.

What are the growth factors driving the Nigeria Data Center Market?

The Nigeria Data Center Market is driven by increasing internet penetration, the rise of cloud computing, and the growing demand for data storage solutions. Additionally, the expansion of digital services and e-commerce is contributing to market growth.

What challenges does the Nigeria Data Center Market face?

Challenges in the Nigeria Data Center Market include inadequate infrastructure, high energy costs, and regulatory hurdles. These factors can hinder the development and expansion of data center facilities in the region.

What opportunities exist in the Nigeria Data Center Market?

Opportunities in the Nigeria Data Center Market include the increasing demand for colocation services and the potential for investment in renewable energy solutions. The growth of the fintech sector also presents new avenues for data center services.

What trends are shaping the Nigeria Data Center Market?

Trends in the Nigeria Data Center Market include the adoption of edge computing, advancements in cooling technologies, and a focus on sustainability. These trends are influencing how data centers operate and meet the needs of modern businesses.

Nigeria Data Center Market

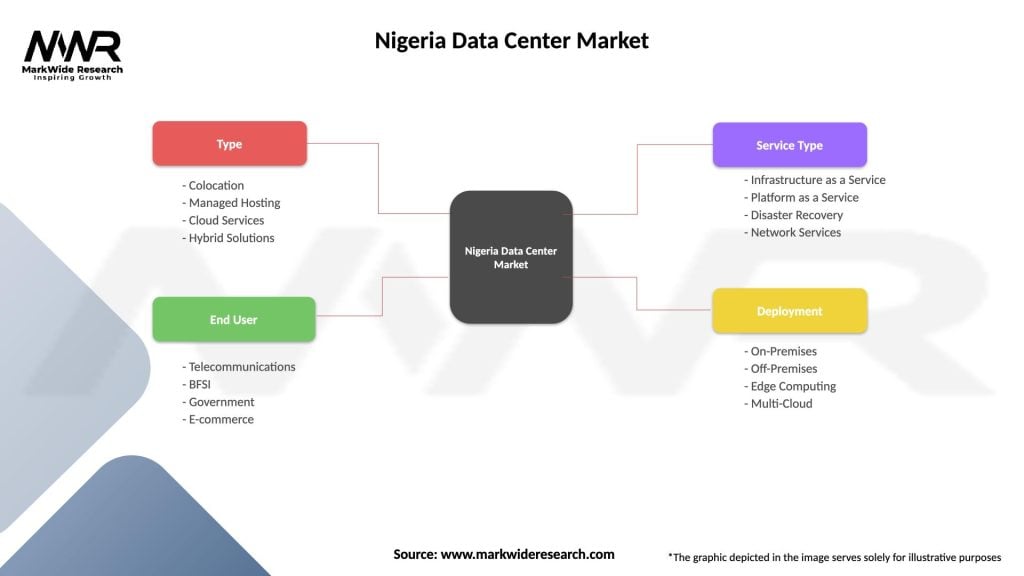

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Managed Hosting, Cloud Services, Hybrid Solutions |

| End User | Telecommunications, BFSI, Government, E-commerce |

| Service Type | Infrastructure as a Service, Platform as a Service, Disaster Recovery, Network Services |

| Deployment | On-Premises, Off-Premises, Edge Computing, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Data Center Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at