444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria data center cooling market represents a rapidly expanding sector within the country’s digital infrastructure landscape, driven by increasing digitalization, cloud adoption, and the growing demand for reliable data storage solutions. Nigeria’s position as West Africa’s largest economy has positioned it as a strategic hub for data center investments, with cooling systems playing a critical role in maintaining optimal operational efficiency.

Market dynamics indicate that the sector is experiencing robust growth, with adoption rates increasing by approximately 12.5% annually as organizations prioritize energy-efficient cooling solutions. The tropical climate conditions in Nigeria create unique challenges for data center operations, making advanced cooling technologies essential for maintaining server performance and preventing equipment failures.

Key market drivers include the expansion of telecommunications infrastructure, increased internet penetration reaching 73% of the population, and the growing adoption of cloud services by both enterprises and government institutions. The market encompasses various cooling technologies, from traditional air conditioning systems to innovative liquid cooling solutions and hybrid approaches designed to address Nigeria’s specific environmental conditions.

Industry stakeholders are increasingly focusing on sustainable cooling solutions that reduce energy consumption while maintaining optimal performance standards. The integration of artificial intelligence and IoT technologies in cooling systems is gaining traction, with smart cooling solutions showing 25-30% improved efficiency compared to conventional systems.

The Nigeria data center cooling market refers to the comprehensive ecosystem of technologies, systems, and services designed to maintain optimal temperature and humidity levels within data center facilities across Nigeria. This market encompasses various cooling methodologies, equipment, and infrastructure solutions specifically tailored to address the unique climatic and operational challenges present in the Nigerian environment.

Data center cooling involves the systematic management of thermal conditions to ensure servers, networking equipment, and storage systems operate within manufacturer-specified temperature ranges. In Nigeria’s tropical climate, where ambient temperatures frequently exceed 35°C (95°F), effective cooling becomes critical for preventing hardware failures, maintaining system reliability, and optimizing energy efficiency.

The market includes precision air conditioning units, computer room air handlers (CRAH), liquid cooling systems, evaporative cooling solutions, and hybrid cooling technologies. These systems work in conjunction with building management systems, monitoring software, and energy management platforms to create comprehensive cooling environments that support Nigeria’s growing digital infrastructure needs.

Nigeria’s data center cooling market is experiencing unprecedented growth as the country accelerates its digital transformation initiatives and positions itself as a regional technology hub. The market is characterized by increasing investments in modern cooling infrastructure, driven by the expansion of hyperscale data centers, colocation facilities, and enterprise data centers across major Nigerian cities.

Key growth factors include the government’s digital economy agenda, increasing foreign direct investment in technology infrastructure, and the rising demand for cloud services. The market is witnessing a shift toward energy-efficient cooling solutions, with organizations seeking to reduce operational costs while meeting stringent uptime requirements.

Technology adoption patterns show a growing preference for precision cooling systems, with approximately 68% of new installations incorporating advanced monitoring and control capabilities. The integration of renewable energy sources with cooling systems is gaining momentum, particularly in response to Nigeria’s power grid challenges and sustainability commitments.

Market segmentation reveals strong demand across various cooling technologies, with air-based cooling systems maintaining the largest market share while liquid cooling solutions are experiencing rapid adoption rates of 18% annually. The competitive landscape includes both international technology providers and local system integrators working to address Nigeria’s specific market requirements.

Strategic market analysis reveals several critical insights that define the Nigeria data center cooling landscape. The market is experiencing a fundamental shift toward intelligent cooling solutions that leverage predictive analytics and machine learning to optimize performance while reducing energy consumption.

Digital transformation initiatives across Nigeria’s public and private sectors are creating substantial demand for reliable data center infrastructure, with cooling systems representing a critical component of these investments. The government’s National Digital Economy Policy and Strategy is driving significant investments in digital infrastructure, creating favorable conditions for cooling technology adoption.

Telecommunications expansion continues to fuel market growth, with major operators investing in network infrastructure to support 5G deployment and improved connectivity. These investments require sophisticated data center facilities with advanced cooling capabilities to handle increased processing demands and heat generation from next-generation equipment.

Cloud adoption acceleration among Nigerian enterprises is driving demand for colocation and cloud service provider facilities, each requiring specialized cooling solutions. The shift toward hybrid and multi-cloud strategies is creating opportunities for cooling technology providers to support diverse infrastructure requirements.

Foreign investment influx in Nigeria’s technology sector is bringing international standards and best practices for data center design and operation. These investments often include requirements for energy-efficient cooling systems that meet global sustainability standards while addressing local environmental conditions.

Power grid challenges in Nigeria are paradoxically driving innovation in cooling technology, with solutions that can operate efficiently during power fluctuations and integrate with backup power systems becoming increasingly valuable to data center operators.

Infrastructure limitations present significant challenges for the Nigeria data center cooling market, particularly regarding reliable power supply and telecommunications connectivity. Inconsistent electricity supply affects cooling system performance and increases operational complexity, requiring additional investments in backup power and energy storage solutions.

High initial investment costs associated with advanced cooling technologies can be prohibitive for smaller organizations and emerging data center operators. The need for specialized installation, commissioning, and maintenance services adds to the total cost of ownership, potentially limiting market adoption among price-sensitive segments.

Skills shortage in specialized cooling system design, installation, and maintenance creates operational challenges for data center operators. The limited availability of certified technicians and engineers with expertise in modern cooling technologies constrains market growth and increases operational risks.

Import dependency for advanced cooling equipment and components creates supply chain vulnerabilities and increases costs due to foreign exchange fluctuations and import duties. Limited local manufacturing capabilities for sophisticated cooling technologies contribute to longer lead times and higher prices.

Regulatory uncertainties regarding environmental standards, energy efficiency requirements, and building codes can create hesitation among investors and operators when selecting cooling technologies. The evolving regulatory landscape requires continuous adaptation and compliance monitoring.

Government digitalization programs present substantial opportunities for cooling technology providers, as public sector organizations modernize their IT infrastructure and establish new data center facilities. The National Broadband Plan and various e-governance initiatives are creating demand for reliable, efficient cooling solutions across government facilities.

Renewable energy integration opportunities are emerging as organizations seek to reduce operational costs and environmental impact. Solar-powered cooling systems and hybrid renewable energy solutions are gaining interest, particularly in regions with abundant solar resources and unreliable grid power.

Edge computing expansion is creating new market segments for compact, efficient cooling solutions designed for smaller, distributed data center facilities. The growth of IoT applications, smart city initiatives, and local content delivery requirements are driving demand for edge data centers with specialized cooling needs.

Regional hub positioning as Nigeria strengthens its role as West Africa’s technology center creates opportunities for large-scale data center investments. International cloud service providers and content delivery networks are evaluating Nigeria as a strategic location, requiring world-class cooling infrastructure.

Technology localization initiatives present opportunities for establishing local manufacturing and assembly capabilities for cooling equipment. Government policies supporting local content development and technology transfer could create favorable conditions for domestic cooling technology production.

Supply chain evolution in the Nigeria data center cooling market is characterized by increasing collaboration between international technology providers and local partners. This dynamic is creating more responsive supply chains while building local technical capabilities and reducing dependency on imports for routine maintenance and support services.

Technology convergence is reshaping market dynamics as cooling systems integrate with building management platforms, energy management systems, and predictive maintenance solutions. This convergence is creating new value propositions and changing the competitive landscape as traditional cooling equipment manufacturers compete with software and IoT solution providers.

Customer expectations are evolving toward comprehensive cooling solutions that include monitoring, maintenance, and optimization services rather than standalone equipment purchases. This shift is driving service-oriented business models and long-term partnerships between cooling technology providers and data center operators.

Competitive intensity is increasing as both established international players and emerging local companies compete for market share. According to MarkWide Research analysis, this competition is driving innovation and improving cost-effectiveness while creating more options for data center operators.

Regulatory influence on market dynamics is growing as environmental standards and energy efficiency requirements become more stringent. These regulations are creating opportunities for advanced cooling technologies while potentially limiting the viability of less efficient solutions.

Comprehensive market analysis for the Nigeria data center cooling market employed a multi-faceted research approach combining primary and secondary data collection methods. The methodology incorporated extensive stakeholder interviews, industry surveys, and detailed analysis of market trends, competitive dynamics, and technological developments.

Primary research activities included structured interviews with data center operators, cooling technology providers, system integrators, and industry experts across Nigeria’s major commercial centers. These interviews provided insights into market challenges, technology preferences, investment patterns, and future growth expectations.

Secondary research components encompassed analysis of industry reports, government publications, regulatory documents, and company financial statements. This research provided quantitative data on market trends, technology adoption rates, and competitive positioning within the Nigerian market context.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis to ensure data accuracy and reliability. The research methodology ensured comprehensive coverage of all major market segments and stakeholder perspectives.

Market modeling techniques incorporated both bottom-up and top-down approaches to validate market size estimates and growth projections. The methodology considered Nigeria-specific factors including climate conditions, infrastructure constraints, and regulatory requirements that influence cooling technology adoption and performance.

Lagos State dominates the Nigeria data center cooling market, accounting for approximately 45% of total market activity due to its position as the country’s commercial and financial center. The state hosts the majority of international data center investments and colocation facilities, creating substantial demand for advanced cooling solutions.

Abuja Federal Capital Territory represents the second-largest regional market, driven by government digitalization initiatives and the presence of major telecommunications operators. The region’s planned infrastructure development and regulatory environment create favorable conditions for cooling technology investments.

Port Harcourt and the Niger Delta region are experiencing growing demand for data center cooling solutions, supported by oil and gas industry digitalization and increasing telecommunications infrastructure investments. The region’s industrial base creates opportunities for specialized cooling applications.

Northern Nigeria markets including Kano, Kaduna, and Jos are emerging as growth areas for data center cooling, driven by agricultural technology adoption, financial services expansion, and government decentralization initiatives. These regions present unique opportunities for cooling solutions adapted to different climatic conditions.

Regional distribution patterns show that urban centers account for approximately 78% of cooling system deployments, while rural and semi-urban areas represent emerging opportunities for edge computing and distributed data center applications requiring specialized cooling approaches.

Market leadership in Nigeria’s data center cooling sector is characterized by a mix of international technology providers and local system integrators, each bringing distinct capabilities and market approaches. The competitive environment is evolving rapidly as demand for sophisticated cooling solutions increases.

Competitive strategies focus on local partnership development, technical training programs, and customization of cooling solutions for Nigeria’s specific environmental and operational requirements. Companies are investing in local service capabilities and spare parts inventory to improve customer support and reduce downtime risks.

Technology-based segmentation reveals distinct market categories, each addressing specific cooling requirements and operational preferences within Nigeria’s data center ecosystem. The segmentation reflects varying levels of sophistication, energy efficiency, and investment requirements.

By Technology:

By Application:

By End User:

Precision air conditioning systems continue to dominate the Nigerian market due to their proven reliability and relatively lower initial investment requirements. These systems are particularly popular among small to medium-sized data centers and enterprise facilities that prioritize operational simplicity and maintenance accessibility.

Liquid cooling solutions are experiencing accelerated adoption, particularly in hyperscale and high-performance computing applications. The technology’s superior heat removal capabilities and energy efficiency advantages are driving interest despite higher initial costs and complexity requirements.

Modular cooling systems are gaining traction as organizations seek scalable solutions that can grow with their infrastructure needs. These systems offer flexibility in deployment and expansion while providing standardized performance characteristics across different facility sizes.

Smart cooling platforms incorporating IoT sensors, predictive analytics, and automated control systems are becoming increasingly important for organizations seeking to optimize energy consumption and prevent equipment failures. These solutions typically demonstrate 20-25% energy savings compared to traditional cooling approaches.

Hybrid cooling architectures combining multiple technologies are emerging as preferred solutions for mission-critical applications. These systems provide redundancy, optimize performance across varying load conditions, and offer flexibility to adapt to changing operational requirements.

Data center operators benefit from advanced cooling technologies through improved operational efficiency, reduced energy costs, and enhanced equipment reliability. Modern cooling systems provide better temperature control, humidity management, and predictive maintenance capabilities that minimize downtime risks and extend equipment lifecycles.

Technology providers gain access to a rapidly expanding market with significant growth potential and opportunities for long-term service relationships. The Nigerian market offers possibilities for technology localization, skills development, and regional expansion into other West African markets.

System integrators benefit from increasing demand for specialized installation, commissioning, and maintenance services. The complexity of modern cooling systems creates opportunities for value-added services and ongoing support contracts that provide recurring revenue streams.

End-user organizations achieve improved IT infrastructure reliability, reduced operational costs, and enhanced sustainability performance through efficient cooling solutions. Advanced cooling technologies enable higher server densities and improved application performance while meeting corporate environmental objectives.

Government stakeholders benefit from improved digital infrastructure capabilities that support economic development, attract foreign investment, and enable delivery of digital government services. Efficient cooling technologies contribute to national energy conservation goals and environmental sustainability commitments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration in cooling systems is transforming operational efficiency and predictive maintenance capabilities. AI-powered cooling solutions can optimize performance in real-time, predict equipment failures, and automatically adjust cooling parameters based on server loads and environmental conditions.

Edge computing proliferation is driving demand for distributed cooling solutions designed for smaller, unmanned facilities. These edge data centers require reliable, efficient cooling systems that can operate autonomously while maintaining optimal performance for latency-sensitive applications.

Sustainability focus is becoming increasingly important as organizations seek to reduce their environmental impact and operational costs. Green cooling technologies, renewable energy integration, and circular economy principles are influencing technology selection and deployment strategies.

Liquid cooling adoption is accelerating as server densities increase and traditional air cooling approaches reach their limits. Direct-to-chip cooling, immersion cooling, and hybrid liquid-air systems are gaining acceptance for high-performance computing and AI workloads.

Service-oriented models are replacing traditional equipment sales approaches as customers seek comprehensive cooling solutions including monitoring, maintenance, and optimization services. Cooling-as-a-Service models are emerging to provide predictable operational costs and guaranteed performance levels.

Major infrastructure investments by international data center operators are driving demand for world-class cooling solutions in Nigeria. These investments include hyperscale facilities designed to serve regional markets and support cloud service expansion across West Africa.

Technology partnerships between international cooling equipment manufacturers and Nigerian system integrators are creating local capabilities for installation, maintenance, and support services. These partnerships are essential for building sustainable market presence and customer confidence.

Regulatory developments including energy efficiency standards and environmental regulations are influencing cooling technology selection and deployment practices. New building codes and data center standards are establishing minimum performance requirements for cooling systems.

Skills development initiatives by industry associations, educational institutions, and technology providers are addressing the shortage of qualified cooling system technicians and engineers. These programs are essential for supporting market growth and ensuring reliable system operation.

Innovation in climate-adapted solutions is addressing Nigeria’s specific environmental challenges through cooling technologies optimized for tropical conditions. These developments include enhanced humidity control, dust filtration, and energy efficiency improvements tailored to local operating conditions.

Investment prioritization should focus on proven cooling technologies with strong local support capabilities rather than cutting-edge solutions that may lack adequate maintenance and service infrastructure. MWR analysis suggests that reliability and serviceability are more important than technological sophistication in the current Nigerian market context.

Partnership strategies with local system integrators and service providers are essential for international cooling technology companies seeking sustainable market presence. These partnerships provide market knowledge, customer relationships, and service capabilities that are difficult to develop independently.

Modular deployment approaches offer advantages in the Nigerian market by allowing phased investments that align with business growth and cash flow requirements. Scalable cooling architectures provide flexibility to adapt to changing requirements while minimizing initial capital investments.

Energy efficiency emphasis should be a primary consideration given Nigeria’s power challenges and rising energy costs. Cooling solutions that demonstrate clear energy savings and reduced operational costs will have competitive advantages in the market.

Service capability development is crucial for long-term success, as customers increasingly value comprehensive support including preventive maintenance, emergency response, and performance optimization services. Companies should invest in local service infrastructure and technical training programs.

Market expansion is expected to continue at robust pace, driven by ongoing digitalization initiatives, telecommunications infrastructure development, and increasing cloud service adoption. The market is projected to maintain strong growth momentum with cooling technology adoption rates increasing by 15-18% annually over the next five years.

Technology evolution will favor intelligent, energy-efficient cooling solutions that can adapt to varying operational conditions and provide predictive maintenance capabilities. Liquid cooling technologies are expected to gain significant market share, particularly in high-density and high-performance computing applications.

Regional integration opportunities will emerge as Nigeria strengthens its position as West Africa’s technology hub. Data center operators may leverage Nigerian facilities to serve regional markets, creating demand for larger, more sophisticated cooling infrastructure.

Sustainability requirements will become increasingly important as environmental regulations strengthen and organizations prioritize carbon footprint reduction. Cooling solutions incorporating renewable energy, waste heat recovery, and circular economy principles will gain competitive advantages.

Local capability development will progress through technology transfer initiatives, skills training programs, and potential manufacturing investments. According to MarkWide Research projections, local content in cooling system deployment could reach 40-45% within the next decade through strategic industry development initiatives.

The Nigeria data center cooling market represents a dynamic and rapidly evolving sector with substantial growth potential driven by the country’s digital transformation journey and strategic position in West Africa. The market is characterized by increasing sophistication in cooling technology adoption, growing emphasis on energy efficiency, and expanding service requirements that create opportunities for both international technology providers and local partners.

Key success factors for market participants include understanding Nigeria’s unique environmental and operational challenges, developing strong local partnerships, and providing comprehensive service capabilities that ensure reliable system operation. The market rewards solutions that balance technological advancement with practical considerations including serviceability, energy efficiency, and cost-effectiveness.

Future market development will be shaped by continued digitalization, regulatory evolution, and increasing sustainability requirements. Organizations that invest in local capabilities, adapt their solutions to Nigerian conditions, and provide exceptional customer support will be best positioned to capitalize on the market’s significant growth potential and contribute to Nigeria’s digital infrastructure development.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data processing environments.

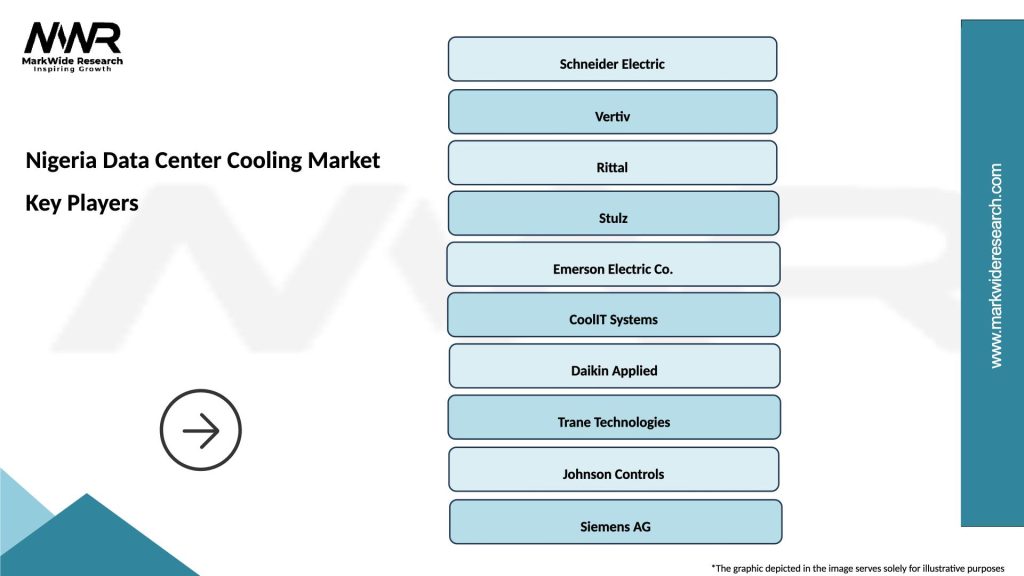

What are the key players in the Nigeria Data Center Cooling Market?

Key players in the Nigeria Data Center Cooling Market include companies like Vertiv, Schneider Electric, and Rittal, which provide various cooling solutions and technologies. These companies focus on innovative cooling systems to enhance energy efficiency and reliability, among others.

What are the main drivers of the Nigeria Data Center Cooling Market?

The main drivers of the Nigeria Data Center Cooling Market include the increasing demand for data storage and processing, the growth of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the rise in digital transformation initiatives across various sectors is contributing to market growth.

What challenges does the Nigeria Data Center Cooling Market face?

Challenges in the Nigeria Data Center Cooling Market include high energy costs, the need for skilled personnel to manage advanced cooling systems, and the environmental impact of cooling technologies. These factors can hinder the adoption of efficient cooling solutions in data centers.

What opportunities exist in the Nigeria Data Center Cooling Market?

Opportunities in the Nigeria Data Center Cooling Market include the adoption of green cooling technologies, the integration of AI and IoT for monitoring and optimization, and the expansion of data centers to support growing digital services. These trends can lead to innovative solutions and improved operational efficiency.

What trends are shaping the Nigeria Data Center Cooling Market?

Trends shaping the Nigeria Data Center Cooling Market include the shift towards liquid cooling solutions, the use of modular cooling systems, and the emphasis on sustainability and energy efficiency. These trends reflect the industry’s response to increasing demands for performance and environmental responsibility.

Nigeria Data Center Cooling Market

| Segmentation Details | Description |

|---|---|

| Type | Air Conditioning, Liquid Cooling, Evaporative Cooling, Hybrid Cooling |

| Technology | Chilled Water Systems, Direct Expansion Systems, Immersion Cooling, Thermoelectric Cooling |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Installation | New Construction, Retrofit, Modular, Containerized |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at