444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria container glass market represents a dynamic and rapidly evolving sector within the country’s manufacturing landscape. As Africa’s most populous nation with over 200 million inhabitants, Nigeria presents substantial opportunities for container glass manufacturers serving diverse industries including food and beverages, pharmaceuticals, cosmetics, and personal care products. The market has experienced consistent growth driven by urbanization, rising disposable income, and increasing consumer preference for packaged goods.

Market dynamics indicate that the Nigerian container glass industry is benefiting from both domestic demand and regional export opportunities. The sector encompasses various product categories including bottles, jars, vials, and specialty containers designed for specific applications. Local manufacturing capabilities have expanded significantly, with several international players establishing production facilities to serve the West African market.

Growth projections suggest the market will continue expanding at a robust CAGR of 8.2% over the forecast period, driven by increasing beverage consumption, pharmaceutical sector growth, and rising demand for premium packaging solutions. The market’s resilience stems from glass packaging’s inherent advantages including recyclability, chemical inertness, and premium brand positioning capabilities.

The Nigeria container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of glass containers used for packaging various products across multiple industries within Nigeria’s borders. This market includes manufacturers, suppliers, distributors, and end-users who collectively drive demand for glass packaging solutions ranging from beverage bottles to pharmaceutical vials.

Container glass specifically denotes hollow glass products designed to hold, protect, and preserve contents while providing barrier properties against moisture, oxygen, and contaminants. The Nigerian market encompasses both domestically produced and imported container glass products, with local production accounting for approximately 72% of total market supply.

Market participants include multinational corporations, local manufacturers, packaging converters, and end-user industries. The sector plays a crucial role in Nigeria’s industrial development, providing employment opportunities and contributing to the country’s manufacturing GDP while supporting various downstream industries.

Nigeria’s container glass market demonstrates remarkable resilience and growth potential, positioning itself as a key component of the country’s packaging industry. The market benefits from strong domestic demand across multiple sectors, with the beverage industry representing the largest consumption segment at approximately 58% market share.

Key market drivers include rapid urbanization, expanding middle-class population, and increasing consumer awareness regarding sustainable packaging solutions. The pharmaceutical sector’s growth, driven by healthcare infrastructure development and rising health consciousness, contributes significantly to specialized container glass demand.

Manufacturing capabilities within Nigeria have strengthened considerably, with local production facilities adopting advanced technologies and quality standards. This domestic production capacity reduces import dependency and provides cost advantages for local businesses while creating employment opportunities across the value chain.

Competitive landscape features both international players and emerging local manufacturers, fostering innovation and competitive pricing. The market’s future outlook remains positive, supported by government initiatives promoting local manufacturing and sustainable packaging solutions.

Strategic insights reveal several critical factors shaping the Nigeria container glass market’s trajectory:

Population growth and urbanization represent fundamental drivers propelling Nigeria’s container glass market forward. With urban population expanding at 4.3% annually, demand for packaged goods and beverages continues rising, directly benefiting container glass manufacturers and suppliers.

Economic development and rising disposable income levels enable consumers to purchase premium packaged products, driving demand for high-quality glass containers. The expanding middle class demonstrates increasing preference for branded products packaged in glass containers, particularly in beverage and food categories.

Healthcare sector growth creates substantial opportunities for pharmaceutical glass containers. Government healthcare initiatives, private sector investment, and increasing health awareness drive demand for medicines, vaccines, and medical products requiring specialized glass packaging solutions.

Sustainability initiatives and environmental consciousness favor glass packaging over plastic alternatives. Consumers and businesses increasingly recognize glass containers’ recyclability and environmental benefits, supporting market growth across multiple application segments.

Government policies promoting local manufacturing and import substitution create favorable conditions for domestic container glass production. Industrial development incentives, tax benefits, and infrastructure investments support market expansion and technological advancement.

High capital requirements for establishing glass manufacturing facilities present significant barriers to market entry. The substantial investment needed for furnaces, forming equipment, and quality control systems limits the number of potential market participants and constrains rapid capacity expansion.

Energy costs represent a major operational challenge for container glass manufacturers. Glass production requires intensive energy consumption for melting and forming processes, making manufacturers vulnerable to energy price fluctuations and supply disruptions.

Competition from alternative packaging materials, particularly plastic containers, poses ongoing challenges. Plastic packaging offers advantages including lighter weight, lower transportation costs, and reduced breakage risks, appealing to cost-conscious manufacturers and consumers.

Infrastructure limitations including transportation networks, power supply reliability, and logistics capabilities can impact manufacturing efficiency and distribution effectiveness. These challenges particularly affect rural market penetration and export potential.

Skilled labor shortages in specialized glass manufacturing processes can limit production capacity and quality consistency. Technical expertise requirements for modern glass production equipment necessitate ongoing training and development investments.

Export market expansion presents significant growth opportunities for Nigerian container glass manufacturers. The country’s strategic location provides access to West African markets experiencing similar economic development and packaging demand growth.

Pharmaceutical sector development offers substantial opportunities for specialized glass container production. Growing healthcare infrastructure, vaccine manufacturing initiatives, and pharmaceutical industry expansion create demand for high-quality medical glass containers.

Premium beverage segments including craft beer, premium spirits, and specialty beverages drive demand for distinctive glass packaging solutions. These segments prioritize quality, aesthetics, and brand differentiation, supporting higher-value container glass products.

Sustainable packaging trends favor glass containers over plastic alternatives, creating opportunities for market share expansion. Corporate sustainability commitments and consumer environmental consciousness support glass packaging adoption across various industries.

Technology integration and automation present opportunities for efficiency improvements and quality enhancement. Advanced manufacturing technologies can reduce production costs, improve consistency, and enable customization capabilities.

Supply chain dynamics within Nigeria’s container glass market reflect complex interactions between raw material availability, manufacturing capacity, and end-user demand. Local silica sand deposits provide cost advantages for domestic manufacturers, while imported materials ensure quality consistency for specialized applications.

Demand patterns demonstrate seasonal variations aligned with beverage consumption cycles, agricultural harvesting periods, and pharmaceutical production schedules. Manufacturers adapt production planning to accommodate these fluctuations while maintaining operational efficiency.

Pricing dynamics balance raw material costs, energy expenses, and competitive pressures. Local manufacturers benefit from reduced transportation costs compared to imported alternatives, while maintaining competitive pricing for domestic customers.

Innovation trends focus on lightweight container designs, improved barrier properties, and enhanced aesthetic appeal. Manufacturers invest in research and development to meet evolving customer requirements and differentiate their product offerings.

Regulatory environment influences market dynamics through quality standards, environmental regulations, and trade policies. Compliance requirements drive investments in quality systems and environmental management practices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Nigeria’s container glass market. Primary research includes interviews with industry executives, manufacturers, distributors, and end-users across various market segments.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements. This approach provides historical context and validates primary research findings through triangulation of data sources.

Market sizing utilizes bottom-up and top-down approaches, analyzing production capacity, consumption patterns, and trade flows. Regional analysis considers geographic variations in demand patterns, manufacturing capabilities, and distribution networks.

Competitive analysis examines market participants’ strategies, capabilities, and performance metrics. This includes assessment of production capacity, product portfolios, geographic presence, and strategic initiatives.

Trend analysis identifies emerging opportunities and challenges through examination of technological developments, regulatory changes, and evolving customer preferences. Forward-looking analysis projects market evolution scenarios based on identified trends and drivers.

Lagos State dominates Nigeria’s container glass market, accounting for approximately 42% of total consumption. The region’s industrial concentration, port facilities, and consumer population create substantial demand across all application segments. Major manufacturing facilities and distribution centers are strategically located to serve this critical market.

Northern regions including Kano, Kaduna, and Abuja represent growing market segments driven by agricultural processing, pharmaceutical manufacturing, and beverage production. These areas show 12% annual growth in container glass consumption, supported by industrial development initiatives.

South-South region benefits from oil industry activities and related economic development, creating demand for industrial and consumer glass containers. Port Harcourt and surrounding areas demonstrate strong growth potential for specialized container applications.

South-East region shows increasing market activity driven by small and medium enterprise development and agricultural processing industries. Local manufacturing initiatives and entrepreneurship culture support container glass demand growth.

South-West region beyond Lagos maintains significant market presence through industrial activities, agricultural processing, and consumer goods manufacturing. Regional distribution networks effectively serve diverse customer requirements across multiple states.

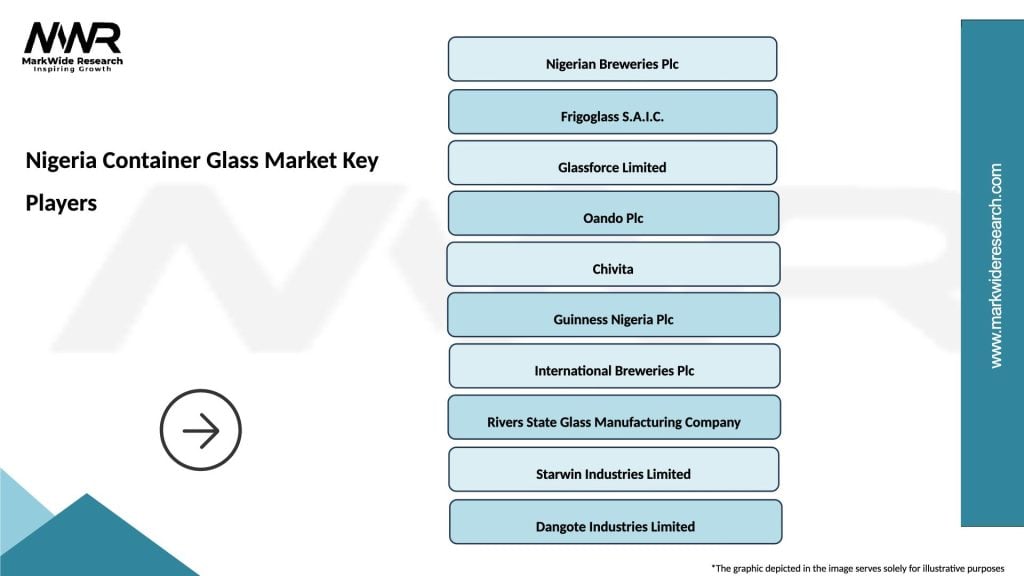

Market leadership is shared among several key players combining international expertise with local market knowledge:

Competitive strategies emphasize quality improvement, capacity expansion, and customer service excellence. Companies invest in modern equipment, employee training, and quality certification to differentiate their offerings and maintain market position.

Strategic partnerships between manufacturers and end-users create long-term supply relationships and collaborative product development opportunities. These partnerships enhance market stability and drive innovation in container design and functionality.

By Product Type:

By Application:

By End-User:

Beverage containers represent the dominant category within Nigeria’s container glass market, driven by robust consumption of soft drinks, beer, and packaged water. This segment benefits from year-round demand with seasonal peaks during festive periods and hot weather months. Premium beverage brands increasingly prefer glass packaging for brand positioning and product differentiation.

Pharmaceutical glass containers demonstrate the highest growth potential, expanding at 11.5% annually due to healthcare sector development and increasing medicine production. Quality requirements for pharmaceutical applications drive demand for specialized glass formulations and precise manufacturing tolerances.

Food packaging applications show steady growth supported by processed food industry expansion and changing consumer preferences. Glass containers appeal to health-conscious consumers seeking chemical-free packaging options for food storage and preservation.

Cosmetic and personal care containers represent a premium market segment emphasizing aesthetic appeal and brand differentiation. This category drives innovation in container design, decoration techniques, and specialized glass formulations.

Industrial and chemical applications require specialized container properties including chemical resistance, temperature tolerance, and precise specifications. This segment supports higher-value products with specific performance requirements.

Manufacturers benefit from Nigeria’s growing domestic market and strategic location for regional expansion. Local production capabilities reduce transportation costs, enable rapid response to customer requirements, and provide protection against currency fluctuations affecting imported alternatives.

End-users gain access to reliable supply sources, competitive pricing, and customization capabilities. Local manufacturing enables collaborative product development, reduced lead times, and responsive customer service supporting business growth objectives.

Investors find attractive opportunities in Nigeria’s container glass market through growing demand, favorable demographics, and government support for local manufacturing. The market’s resilience and growth potential offer compelling investment returns.

Consumers benefit from improved product availability, competitive pricing, and enhanced quality standards. Local production ensures consistent supply while supporting economic development and employment creation within Nigeria.

Government stakeholders achieve industrial development objectives, employment creation, and reduced import dependency through a thriving container glass industry. Tax revenues, export earnings, and technology transfer contribute to national economic development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus emerges as a dominant trend driving container glass market evolution. Companies and consumers increasingly prioritize environmentally friendly packaging solutions, with glass containers offering superior recyclability compared to plastic alternatives. This trend supports premium positioning and market share growth for glass packaging.

Lightweight container design represents a significant technological trend addressing transportation cost concerns while maintaining structural integrity. Manufacturers invest in advanced forming techniques and glass formulations to reduce container weight by 18-25% without compromising quality or performance.

Customization capabilities become increasingly important as brands seek differentiation through unique packaging designs. Advanced manufacturing technologies enable cost-effective small-batch production and rapid prototyping for specialized container requirements.

Digital integration transforms manufacturing processes through automation, quality monitoring, and predictive maintenance systems. These technologies improve production efficiency, reduce waste, and enhance quality consistency across all product categories.

Regional integration trends support cross-border trade and market expansion opportunities. Harmonized standards and trade agreements facilitate export growth and regional supply chain development.

Capacity expansion projects by major manufacturers demonstrate confidence in market growth prospects. Recent investments in new production lines and facility upgrades increase domestic manufacturing capacity while improving product quality and efficiency.

Technology partnerships between Nigerian manufacturers and international equipment suppliers bring advanced glass forming technologies to the local market. These collaborations enhance production capabilities and enable manufacture of specialized container types.

Quality certification achievements by local manufacturers meet international standards for pharmaceutical and food packaging applications. These certifications open export opportunities and support premium market positioning.

Sustainability initiatives include recycling program development and energy efficiency improvements. According to MarkWide Research analysis, these programs reduce environmental impact while creating cost savings for manufacturers and customers.

Strategic acquisitions and joint ventures reshape the competitive landscape as companies seek to strengthen market position and expand capabilities. These developments create opportunities for technology transfer and market consolidation.

Investment priorities should focus on energy efficiency improvements and automation technologies to enhance competitiveness against imported alternatives. Manufacturers can achieve significant cost reductions through modern furnace designs and automated production systems.

Market diversification strategies should emphasize pharmaceutical and specialty container segments offering higher margins and growth potential. These segments require specialized capabilities but provide protection against commodity market pressures.

Export development represents a crucial growth strategy for Nigerian container glass manufacturers. Regional market opportunities in West Africa offer substantial potential for capacity utilization and revenue growth.

Sustainability positioning should become central to marketing and product development strategies. Environmental benefits of glass packaging create competitive advantages in premium market segments and corporate customer relationships.

Workforce development investments are essential for maintaining quality standards and supporting capacity expansion. Technical training programs and knowledge transfer initiatives ensure sustainable competitive advantages.

Long-term growth prospects for Nigeria’s container glass market remain highly positive, supported by demographic trends, economic development, and increasing industrialization. MarkWide Research projects continued market expansion driven by domestic demand growth and regional export opportunities.

Technology advancement will continue reshaping manufacturing processes, enabling higher efficiency, better quality, and greater customization capabilities. Smart manufacturing systems and Industry 4.0 technologies will become standard across leading facilities.

Market consolidation may occur as smaller players face competitive pressures and capital requirements for technology upgrades. This consolidation could create opportunities for strategic partnerships and market leadership strengthening.

Regulatory evolution will likely emphasize environmental protection and product safety standards. Companies investing in compliance and sustainability will gain competitive advantages in both domestic and export markets.

Regional integration trends suggest increasing trade flows and market connectivity across West Africa. Nigerian manufacturers are well-positioned to benefit from regional economic development and cross-border commerce growth.

Nigeria’s container glass market presents compelling opportunities for growth and development across multiple industry segments. The market’s fundamental strengths including large domestic demand, raw material availability, and strategic geographic location create sustainable competitive advantages for local manufacturers and investors.

Market dynamics favor continued expansion driven by urbanization, economic development, and increasing consumer preference for quality packaging solutions. The pharmaceutical sector’s growth and sustainability trends provide additional growth catalysts supporting long-term market development.

Challenges including energy costs, infrastructure limitations, and competitive pressures require strategic responses through technology investment, operational efficiency improvements, and market diversification. Companies successfully addressing these challenges will capture disproportionate market share and profitability.

Future success in Nigeria’s container glass market will depend on manufacturers’ ability to balance cost competitiveness with quality excellence while developing capabilities for specialized applications and export markets. The market’s evolution toward sustainability and premium positioning creates opportunities for value creation and differentiation.

Strategic positioning for long-term success requires investment in modern manufacturing technologies, workforce development, and customer relationship building. Companies embracing these priorities will benefit from Nigeria’s container glass market growth and contribute to the country’s industrial development objectives.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Nigeria Container Glass Market?

Key players in the Nigeria Container Glass Market include Nigerian Breweries Plc, Glassforce, and Frigoglass, among others. These companies are involved in the production and supply of container glass for various industries, including food and beverage.

What are the growth factors driving the Nigeria Container Glass Market?

The Nigeria Container Glass Market is driven by increasing demand for packaged beverages and food products, as well as a growing emphasis on sustainable packaging solutions. Additionally, the rise in consumer awareness regarding product safety and quality is contributing to market growth.

What challenges does the Nigeria Container Glass Market face?

The Nigeria Container Glass Market faces challenges such as high production costs and competition from alternative packaging materials like plastics. Additionally, fluctuations in raw material prices can impact the profitability of glass manufacturers.

What opportunities exist in the Nigeria Container Glass Market?

Opportunities in the Nigeria Container Glass Market include the expansion of the beverage industry and the increasing trend towards eco-friendly packaging solutions. Furthermore, innovations in glass manufacturing technology can enhance production efficiency and product quality.

What trends are shaping the Nigeria Container Glass Market?

Trends in the Nigeria Container Glass Market include a shift towards lightweight glass containers and the adoption of smart packaging technologies. Additionally, there is a growing focus on recycling and sustainability, influencing consumer preferences and industry practices.

Nigeria Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Tumblers |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Grade | Recycled, Virgin, Specialty, Standard |

| Packaging Type | Bulk, Retail, Custom, Eco-friendly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at