444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria cloud computing market represents one of Africa’s most dynamic and rapidly evolving technology sectors, driven by increasing digital transformation initiatives across industries and growing demand for scalable IT infrastructure solutions. Nigeria’s cloud computing landscape has experienced remarkable growth momentum, with adoption rates accelerating at 12.5% annually as organizations seek to modernize their operations and enhance competitive positioning in the digital economy.

Digital transformation initiatives across Nigeria’s key sectors including banking, telecommunications, oil and gas, and government services have created substantial demand for cloud-based solutions. The market encompasses various service models including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), with SaaS solutions commanding approximately 45% market share due to their accessibility and cost-effectiveness for Nigerian businesses.

Government digitization programs and regulatory frameworks supporting cloud adoption have significantly contributed to market expansion. The Nigerian government’s commitment to digital governance and e-government initiatives has created opportunities for cloud service providers to deliver scalable solutions that support public sector modernization efforts while ensuring data sovereignty and security compliance.

The Nigeria cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions deployed across Nigerian organizations to deliver computing resources, applications, and data storage through internet-connected networks rather than traditional on-premises hardware systems.

Cloud computing in Nigeria encompasses the delivery of various computing services including servers, storage, databases, networking, software, analytics, and intelligence over the internet to offer faster innovation, flexible resources, and economies of scale. This market includes public cloud services provided by global and local providers, private cloud implementations within organizations, and hybrid cloud solutions that combine both deployment models.

Market participants include international cloud giants, local technology companies, telecommunications providers, and system integrators who collaborate to deliver comprehensive cloud solutions tailored to Nigerian business requirements and regulatory compliance needs.

Nigeria’s cloud computing market demonstrates exceptional growth potential driven by accelerating digital transformation across multiple sectors and increasing recognition of cloud technologies’ strategic value for business competitiveness. The market benefits from improving telecommunications infrastructure, growing internet penetration rates, and supportive government policies promoting digital innovation.

Key market dynamics include the rapid adoption of mobile-first cloud solutions, increasing demand for data analytics and artificial intelligence capabilities, and growing emphasis on cybersecurity and data protection. Nigerian organizations are increasingly leveraging cloud platforms to enhance operational efficiency, reduce IT costs, and enable remote work capabilities that became critical during recent global disruptions.

Sector-specific adoption varies significantly, with financial services leading cloud implementation at 38% adoption rate, followed by telecommunications, manufacturing, and government sectors. Small and medium enterprises represent a particularly dynamic segment, with cloud adoption rates increasing by 28% annually as these organizations seek to compete effectively with larger enterprises through technology leverage.

Strategic market insights reveal several critical trends shaping Nigeria’s cloud computing landscape:

Digital transformation imperatives serve as the primary catalyst for Nigeria’s cloud computing market expansion, with organizations across sectors recognizing cloud technologies as essential for maintaining competitive advantage in increasingly digital business environments. The accelerating pace of digitization has created urgent demand for scalable, flexible IT infrastructure that can adapt to rapidly changing business requirements.

Cost optimization pressures drive significant cloud adoption as Nigerian organizations seek to reduce capital expenditure on IT infrastructure while maintaining operational flexibility. Cloud computing enables organizations to transform fixed IT costs into variable expenses, allowing better resource allocation and improved financial planning capabilities.

Government digitization initiatives create substantial market opportunities through e-government programs, digital identity systems, and public sector modernization efforts. These initiatives require robust, scalable cloud infrastructure to deliver citizen services effectively while ensuring data security and regulatory compliance.

Telecommunications infrastructure improvements including expanded fiber optic networks and improved internet connectivity enable reliable cloud service delivery across Nigeria’s diverse geographic regions. Enhanced network infrastructure reduces latency concerns and supports bandwidth-intensive cloud applications.

Remote work requirements accelerated by global workplace changes have increased demand for cloud-based collaboration tools, virtual desktop infrastructure, and secure remote access solutions that enable distributed workforce productivity.

Infrastructure limitations including inconsistent power supply and limited high-speed internet access in certain regions create challenges for comprehensive cloud adoption across Nigeria. These infrastructure constraints can impact cloud service reliability and user experience, particularly for bandwidth-intensive applications.

Data security concerns and regulatory compliance requirements create hesitation among organizations considering cloud migration, particularly for sensitive data and mission-critical applications. Nigerian businesses often express concerns about data sovereignty and cross-border data transfer regulations.

Skills shortage in cloud computing expertise limits market growth as organizations struggle to find qualified professionals capable of implementing, managing, and optimizing cloud solutions. This talent gap affects both cloud service providers and end-user organizations seeking to maximize cloud investment returns.

Economic volatility and currency fluctuations impact cloud service pricing and affordability, particularly for international cloud services priced in foreign currencies. Economic uncertainties can delay cloud investment decisions and affect long-term technology planning.

Legacy system integration challenges create complexity and additional costs for organizations seeking to migrate existing applications and data to cloud platforms while maintaining business continuity and operational efficiency.

Emerging technology integration presents significant opportunities for cloud service providers to differentiate their offerings through artificial intelligence, machine learning, Internet of Things, and blockchain capabilities. These advanced technologies require cloud-scale computing resources and create new revenue streams for innovative service providers.

Small and medium enterprise segment represents substantial untapped potential as these organizations increasingly recognize cloud computing’s value for leveling competitive playing fields with larger enterprises. Tailored cloud solutions addressing SME-specific requirements can drive significant market expansion.

Industry-specific cloud solutions offer opportunities for specialized service providers to develop vertical-focused platforms addressing unique requirements in sectors such as healthcare, education, agriculture, and manufacturing. These specialized solutions can command premium pricing while delivering superior value to industry participants.

Edge computing deployment creates opportunities for local cloud providers to establish edge data centers and computing infrastructure that reduces latency and improves performance for mobile applications and IoT deployments across Nigeria’s major urban centers.

Public-private partnerships in digital infrastructure development offer opportunities for cloud providers to collaborate with government agencies in delivering citizen services, smart city initiatives, and digital governance platforms that require scalable, secure cloud infrastructure.

Competitive dynamics in Nigeria’s cloud computing market reflect intense competition between global cloud giants and emerging local providers, with differentiation occurring through pricing strategies, local presence, regulatory compliance capabilities, and industry-specific expertise. Market consolidation trends are emerging as larger providers acquire specialized local companies to enhance their Nigerian market presence and capabilities.

Technology evolution continues reshaping market dynamics through continuous innovation in cloud services, security capabilities, and integration tools. Providers must balance investment in cutting-edge technologies with practical solutions addressing immediate Nigerian business requirements and infrastructure constraints.

Regulatory environment evolution influences market dynamics through data protection laws, cybersecurity requirements, and digital governance frameworks that affect cloud service delivery models and compliance obligations. According to MarkWide Research analysis, regulatory clarity has improved cloud adoption confidence by 22% among Nigerian enterprises.

Customer expectations continue evolving toward more sophisticated cloud solutions that integrate seamlessly with existing business processes while delivering measurable performance improvements and cost savings. Organizations increasingly demand cloud providers demonstrate clear return on investment and business value creation.

Comprehensive market research methodology combines primary and secondary research approaches to deliver accurate, actionable insights into Nigeria’s cloud computing market dynamics, trends, and growth opportunities. Primary research includes structured interviews with cloud service providers, end-user organizations, technology integrators, and industry experts across Nigeria’s major business centers.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, company financial statements, and technology trend analyses to provide comprehensive market context and validate primary research findings. Data triangulation ensures research accuracy and reliability.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing cloud service adoption rates, pricing models, and market penetration across different sectors and organization sizes. Quantitative analysis focuses on growth rates, market share distributions, and adoption percentages rather than absolute market valuations.

Forecasting models incorporate multiple variables including economic indicators, technology adoption curves, regulatory changes, and competitive dynamics to project market evolution and identify emerging opportunities and challenges affecting future market development.

Lagos State dominates Nigeria’s cloud computing market with approximately 42% market share, driven by its concentration of financial institutions, multinational corporations, and technology companies. The region benefits from superior telecommunications infrastructure, skilled workforce availability, and proximity to submarine cable landing points that enhance international connectivity.

Abuja Federal Capital Territory represents the second-largest market segment with 18% market share, primarily driven by government digitization initiatives and the presence of federal agencies implementing cloud-based solutions. The region’s focus on e-government services creates consistent demand for secure, compliant cloud platforms.

Rivers State and the broader Niger Delta region account for 12% market share, with cloud adoption driven primarily by oil and gas industry requirements for data analytics, remote monitoring, and collaboration platforms supporting offshore operations and international partnerships.

Kano State and northern Nigeria represent emerging opportunities with 8% current market share but significant growth potential as telecommunications infrastructure improves and local businesses increasingly adopt digital technologies. Agricultural technology applications and small business digitization drive cloud demand in these regions.

Other regions collectively represent 20% market share, with growth opportunities emerging in secondary cities as internet penetration increases and local businesses recognize cloud computing benefits for operational efficiency and market expansion.

Market leadership in Nigeria’s cloud computing sector reflects a dynamic mix of global technology giants and emerging local providers, each leveraging distinct competitive advantages to capture market share and serve diverse customer segments.

Competitive strategies focus on local presence establishment, regulatory compliance capabilities, industry-specific solution development, and strategic partnerships with local system integrators and consulting firms to enhance market penetration and customer service delivery.

By Service Model:

By Deployment Model:

By Organization Size:

Financial Services lead cloud adoption with sophisticated implementations including core banking systems, mobile banking platforms, and regulatory compliance solutions. Banks and fintech companies leverage cloud infrastructure to enhance customer experience, improve operational efficiency, and support digital payment innovations.

Telecommunications sector utilizes cloud computing for network function virtualization, customer service platforms, and data analytics solutions that optimize network performance and enhance service delivery. Telecom operators also serve as cloud service providers, leveraging existing infrastructure investments.

Oil and Gas industry implements cloud solutions for seismic data processing, remote monitoring systems, and collaboration platforms supporting international operations. Cloud computing enables real-time data analysis and decision-making for exploration and production activities.

Government Sector increasingly adopts cloud platforms for e-government services, digital identity systems, and inter-agency collaboration tools. Cloud solutions support transparency initiatives and improve citizen service delivery while ensuring data security and regulatory compliance.

Healthcare organizations utilize cloud computing for electronic health records, telemedicine platforms, and medical imaging solutions that improve patient care delivery and enable remote healthcare services across Nigeria’s diverse geographic regions.

Education sector leverages cloud platforms for learning management systems, virtual classrooms, and administrative solutions that support both traditional and distance learning models increasingly important for Nigerian educational institutions.

Cost Reduction Benefits enable organizations to significantly reduce IT infrastructure investments while maintaining operational flexibility and scalability. Cloud computing transforms capital expenditure into operational expenditure, improving cash flow management and enabling better resource allocation for core business activities.

Scalability Advantages allow Nigerian businesses to rapidly adjust computing resources based on demand fluctuations without significant infrastructure investments. This flexibility particularly benefits seasonal businesses and organizations experiencing rapid growth or market expansion.

Innovation Acceleration through cloud platforms enables organizations to access cutting-edge technologies including artificial intelligence, machine learning, and advanced analytics without substantial upfront investments. These capabilities support digital transformation initiatives and competitive differentiation strategies.

Business Continuity improvements through cloud-based disaster recovery and backup solutions ensure operational resilience against infrastructure failures, natural disasters, and other business disruptions. Cloud platforms provide geographic redundancy and automated failover capabilities.

Collaboration Enhancement enables distributed teams to work effectively through cloud-based communication and collaboration tools that support remote work, international partnerships, and multi-location operations increasingly common in Nigerian business environments.

Compliance Support through cloud providers’ security frameworks and compliance certifications helps organizations meet regulatory requirements while reducing internal compliance management complexity and costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a transformative trend as Nigerian organizations increasingly seek cloud platforms that provide built-in AI and machine learning capabilities. This trend enables businesses to leverage advanced analytics, predictive modeling, and automated decision-making without developing internal AI expertise.

Edge Computing Adoption grows rapidly as organizations require reduced latency and improved performance for mobile applications, IoT deployments, and real-time data processing. Edge computing brings cloud capabilities closer to end-users and data sources, improving application responsiveness.

Multi-Cloud Strategies become prevalent as organizations avoid vendor lock-in and optimize performance across different workloads. Nigerian enterprises increasingly implement multi-cloud approaches that leverage best-of-breed solutions from multiple providers while maintaining operational flexibility.

Industry-Specific Solutions emerge as cloud providers develop specialized platforms addressing unique requirements in sectors such as banking, oil and gas, healthcare, and agriculture. These vertical solutions offer deeper functionality and compliance capabilities than generic cloud platforms.

Security-First Approach becomes critical as organizations prioritize cybersecurity and data protection in cloud implementations. MWR research indicates that security considerations influence 78% of cloud adoption decisions among Nigerian enterprises.

Containerization and Microservices adoption accelerates as organizations modernize applications for cloud deployment. These technologies enable greater application portability, scalability, and development efficiency in cloud environments.

Data Center Expansion initiatives by major cloud providers establish local infrastructure to reduce latency, improve performance, and address data sovereignty requirements. These investments demonstrate long-term commitment to the Nigerian market and enable enhanced service delivery.

Strategic Partnerships between international cloud providers and local system integrators create comprehensive service delivery capabilities that combine global technology expertise with local market knowledge and customer relationships.

Regulatory Framework development including the Nigeria Data Protection Regulation and cybersecurity guidelines provides clarity for cloud adoption while ensuring appropriate data protection and security standards.

Skills Development Programs launched by cloud providers, educational institutions, and government agencies address the talent shortage through training initiatives, certification programs, and university partnerships that develop local cloud computing expertise.

Innovation Hubs and technology incubators increasingly focus on cloud-based solutions, fostering local innovation and entrepreneurship in cloud computing applications and services tailored to Nigerian market requirements.

Financial Services Innovation drives cloud adoption through fintech companies and traditional banks implementing cloud-based payment systems, mobile banking platforms, and regulatory compliance solutions that transform financial services delivery.

Market Entry Strategies for cloud providers should prioritize local presence establishment through data center investments, strategic partnerships with local system integrators, and compliance with Nigerian regulatory requirements. Understanding local business culture and requirements proves critical for successful market penetration.

Customer Education initiatives should address security concerns and demonstrate clear return on investment for cloud adoption. Providers should invest in educational programs, case studies, and proof-of-concept implementations that showcase cloud computing benefits for Nigerian organizations.

Pricing Strategies must consider local economic conditions and currency volatility while maintaining service quality and profitability. Flexible pricing models and local currency options can improve accessibility for Nigerian businesses.

Skills Development investments through training programs, certification initiatives, and university partnerships create sustainable competitive advantages while addressing market constraints. Building local expertise supports long-term market growth and customer success.

Industry Specialization offers differentiation opportunities through vertical-specific solutions that address unique requirements in key Nigerian sectors. Deep industry expertise can command premium pricing while delivering superior customer value.

Government Engagement strategies should focus on supporting digital transformation initiatives, participating in public-private partnerships, and contributing to policy development that promotes cloud adoption while ensuring appropriate security and compliance standards.

Market evolution over the next five years will be characterized by accelerating adoption across all sectors, with particular growth expected in small and medium enterprises as cloud solutions become more accessible and affordable. MarkWide Research projects that cloud adoption rates will reach 65% among Nigerian businesses by 2028.

Technology advancement will drive market transformation through artificial intelligence integration, edge computing deployment, and enhanced security capabilities that address current adoption barriers. These technological improvements will enable more sophisticated cloud implementations and broader market acceptance.

Infrastructure development including improved telecommunications networks, expanded data center capacity, and enhanced power reliability will support market growth by addressing current constraints and enabling reliable cloud service delivery across Nigeria’s diverse regions.

Regulatory maturation will provide greater clarity and confidence for cloud adoption while ensuring appropriate data protection and security standards. Continued policy development supporting digital transformation will create favorable conditions for market expansion.

Competitive landscape evolution will feature increased local provider capabilities, strategic partnerships between global and local companies, and continued innovation in service delivery models that address specific Nigerian market requirements and opportunities.

Nigeria’s cloud computing market represents a compelling growth opportunity driven by digital transformation imperatives, government support for technology adoption, and increasing recognition of cloud computing’s strategic value for business competitiveness. Despite infrastructure constraints and skills challenges, the market demonstrates strong fundamentals and significant potential for sustained expansion.

Success factors for market participants include local presence establishment, regulatory compliance capabilities, industry-specific expertise, and commitment to customer education and skills development. Organizations that address these requirements while delivering reliable, secure cloud solutions will capture substantial market opportunities in Africa’s largest economy.

Future market development will be shaped by continued infrastructure improvements, regulatory framework evolution, and technological advancement that addresses current adoption barriers while enabling more sophisticated cloud implementations. The convergence of these factors creates favorable conditions for accelerated market growth and transformation across Nigeria’s diverse economic sectors.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing power, and software applications. It enables users to access and manage data remotely, facilitating flexibility and scalability in various sectors.

What are the key players in the Nigeria Cloud Computing Market?

Key players in the Nigeria Cloud Computing Market include companies like MainOne, MTN Nigeria, and Google Cloud, which provide a range of cloud services such as infrastructure as a service (IaaS) and software as a service (SaaS), among others.

What are the growth factors driving the Nigeria Cloud Computing Market?

The Nigeria Cloud Computing Market is driven by factors such as the increasing adoption of digital transformation by businesses, the growing demand for data storage solutions, and the rise of remote work practices that necessitate cloud services.

What challenges does the Nigeria Cloud Computing Market face?

Challenges in the Nigeria Cloud Computing Market include concerns over data security and privacy, limited internet infrastructure in some regions, and a lack of awareness among potential users about the benefits of cloud solutions.

What opportunities exist in the Nigeria Cloud Computing Market?

Opportunities in the Nigeria Cloud Computing Market include the potential for growth in sectors like e-commerce and fintech, the increasing investment in technology startups, and the expansion of internet access in rural areas, which can drive cloud adoption.

What trends are shaping the Nigeria Cloud Computing Market?

Trends in the Nigeria Cloud Computing Market include the rise of hybrid cloud solutions, the integration of artificial intelligence and machine learning into cloud services, and a growing focus on sustainability and energy-efficient data centers.

Nigeria Cloud Computing Market

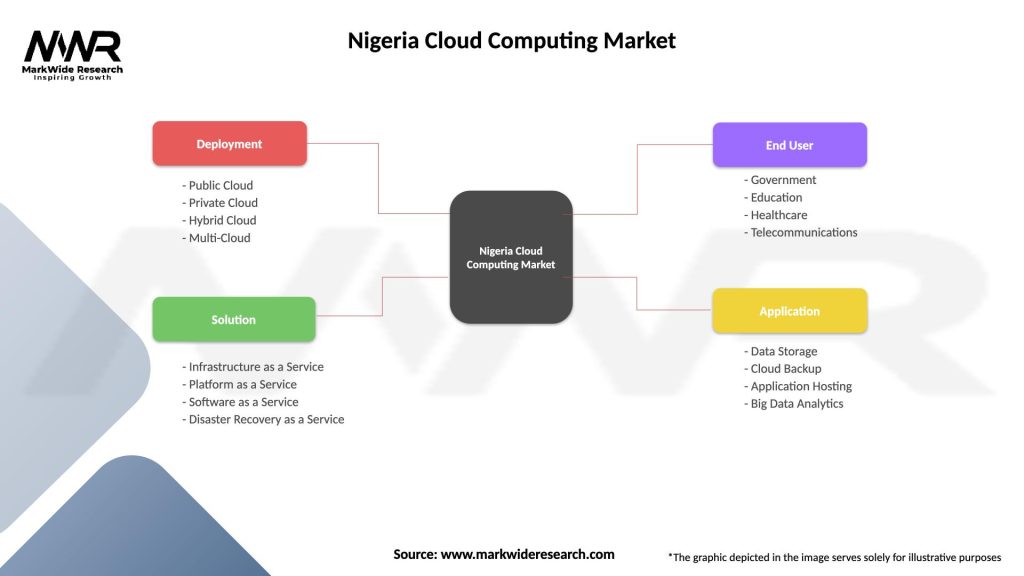

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Infrastructure as a Service, Platform as a Service, Software as a Service, Disaster Recovery as a Service |

| End User | Government, Education, Healthcare, Telecommunications |

| Application | Data Storage, Cloud Backup, Application Hosting, Big Data Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at