444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The NFT (Non-Fungible Token) Analytics Tools market is witnessing a remarkable surge in interest and growth, as the NFT space continues to gain traction in the digital ecosystem. NFTs, being unique and non-interchangeable cryptographic tokens representing ownership of digital or physical assets, have created new possibilities for artists, collectors, and investors alike. The market for NFT Analytics Tools has emerged in response to the increasing demand for data-driven insights and performance metrics within the NFT ecosystem.

Meaning

NFT Analytics Tools refer to a suite of software and platforms designed to analyze, interpret, and present data related to Non-Fungible Tokens. These tools provide stakeholders with valuable information, enabling them to gain better visibility into NFT transactions, trends, and overall market behavior. By tracking and visualizing critical metrics, such as transaction volumes, token valuations, ownership history, and market sentiment, these tools empower users to make informed decisions in an otherwise rapidly evolving and complex NFT landscape.

Executive Summary

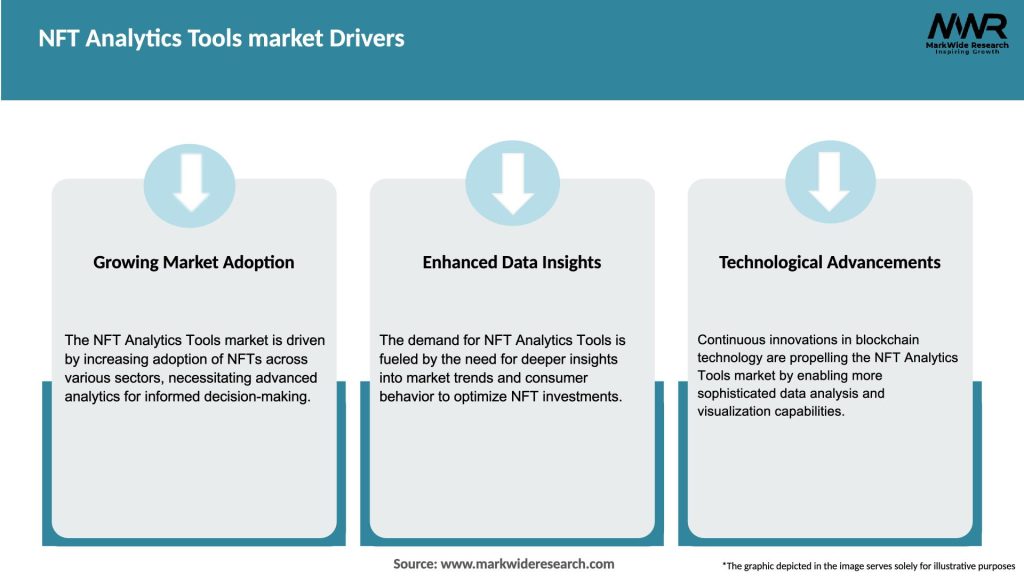

The NFT Analytics Tools market is experiencing rapid growth due to the widespread adoption of NFTs across various industries. These tools play a pivotal role in providing real-time insights and in-depth analysis to market participants, enabling them to optimize their strategies and maximize their returns. As blockchain technology gains momentum and NFTs become more mainstream, the demand for sophisticated analytics solutions is expected to further escalate.

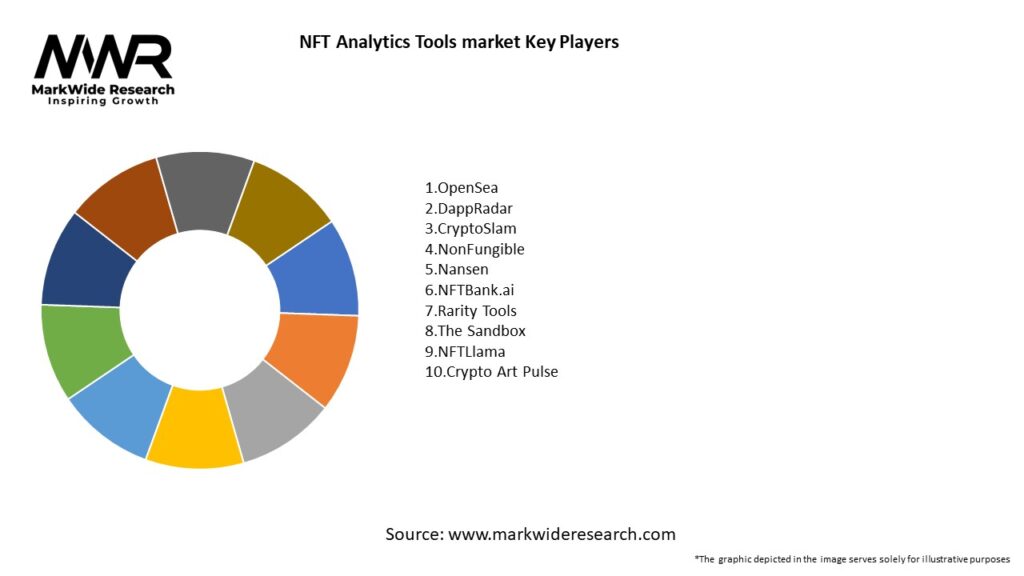

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The NFT Analytics Tools market is characterized by rapid technological advancements, increasing user adoption, and dynamic partnerships. As NFTs become more ingrained in mainstream culture and industries, the demand for data-driven insights is set to soar. Key players in the space are constantly innovating to meet these demands and enhance the scope and functionalities of their analytics solutions.

The market is highly competitive, with both established tech companies and startups vying for market share. The continuous evolution of blockchain technology, coupled with the NFT market’s ever-changing dynamics, has created an environment where adaptability and innovation are crucial for success.

Regional Analysis

The demand for NFT Analytics Tools is witnessing global growth as NFT adoption transcends geographical boundaries. However, certain regions have emerged as prominent hubs for NFT activity and, consequently, the use of analytics tools.

Competitive Landscape

Leading Companies in NFT Analytics Tools Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

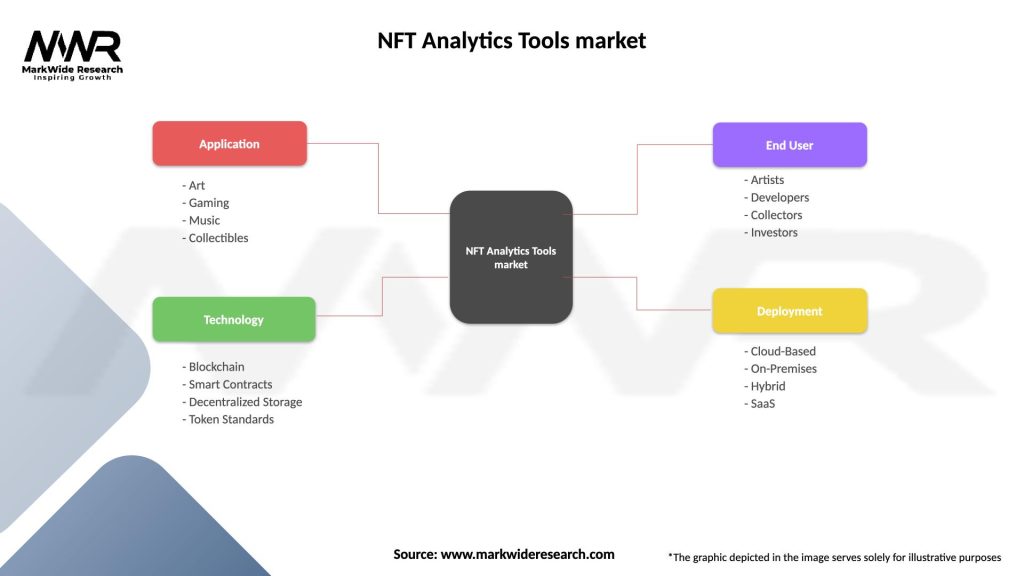

Segmentation

The NFT Analytics Tools market can be segmented based on the type of analytics solutions offered and the industries they cater to.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on various industries, including NFTs. As physical gatherings and activities were restricted, many artists and content creators turned to digital platforms and NFTs to reach their audience and monetize their work. This surge in interest contributed to the rapid growth of the NFT market and, consequently, the demand for NFT Analytics Tools.

Additionally, the pandemic accelerated the adoption of blockchain technology and cryptocurrencies as people sought alternative digital assets and investment opportunities. NFTs, as a unique use case for blockchain, gained increased attention during this period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of NFT Analytics Tools appears promising, with the NFT market showing no signs of slowing down. As NFT adoption becomes more widespread, the demand for sophisticated data analytics solutions is likely to increase. Analytics providers are expected to leverage advancements in AI, ML, and blockchain interoperability to offer more comprehensive and accurate insights.

Moreover, as regulatory frameworks around NFTs become more defined, analytics tools will play an essential role in ensuring compliance and transparency within the market.

Conclusion

The NFT Analytics Tools market is at the forefront of innovation, supporting the rapid growth and adoption of NFTs across various industries. These tools provide critical data-driven insights, empowering investors, creators, and platforms to navigate the dynamic and evolving NFT landscape. With continuous advancements in technology and strategic collaborations, the future outlook for NFT Analytics Tools remains optimistic, positioning them as indispensable components within the flourishing NFT ecosystem.

What is NFT Analytics Tools?

NFT Analytics Tools are software solutions designed to analyze and provide insights into non-fungible tokens (NFTs). They help users track market trends, evaluate asset performance, and understand buyer behavior in the NFT space.

What are the key players in the NFT Analytics Tools market?

Key players in the NFT Analytics Tools market include DappRadar, NonFungible.com, and CryptoSlam, among others. These companies offer various analytics services that cater to collectors, investors, and creators in the NFT ecosystem.

What are the growth factors driving the NFT Analytics Tools market?

The NFT Analytics Tools market is driven by the increasing popularity of NFTs, the growing demand for data-driven insights, and the expansion of digital art and collectibles. Additionally, the rise of blockchain technology enhances the need for effective analytics tools.

What challenges does the NFT Analytics Tools market face?

The NFT Analytics Tools market faces challenges such as data accuracy, the volatility of NFT prices, and the rapid evolution of the market. These factors can complicate the analysis and forecasting of trends within the NFT space.

What opportunities exist in the NFT Analytics Tools market?

Opportunities in the NFT Analytics Tools market include the development of advanced predictive analytics, integration with emerging blockchain platforms, and the potential for partnerships with NFT marketplaces. These advancements can enhance user experience and broaden market reach.

What trends are shaping the NFT Analytics Tools market?

Trends shaping the NFT Analytics Tools market include the rise of AI-driven analytics, increased focus on user-friendly interfaces, and the integration of social media metrics. These trends aim to provide deeper insights and improve accessibility for users.

NFT Analytics Tools market

| Segmentation Details | Description |

|---|---|

| Application | Art, Gaming, Music, Collectibles |

| Technology | Blockchain, Smart Contracts, Decentralized Storage, Token Standards |

| End User | Artists, Developers, Collectors, Investors |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in NFT Analytics Tools Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at