444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The New Zealand solar energy industry market represents a rapidly evolving sector that has gained significant momentum in recent years. Solar power adoption across New Zealand has accelerated dramatically, driven by government initiatives, environmental consciousness, and declining technology costs. The market encompasses residential, commercial, and utility-scale solar installations, with photovoltaic systems leading the technological advancement.

Market dynamics indicate robust growth potential, with solar energy contributing an increasing percentage to New Zealand’s renewable energy mix. The industry benefits from favorable geographic conditions, particularly in the North Island, where solar irradiance levels support efficient energy generation. Residential solar installations have experienced remarkable growth, with adoption rates increasing by 35% annually over the past three years.

Government support through various incentive programs and renewable energy targets has created a conducive environment for market expansion. The Clean Car Discount scheme and other sustainability initiatives have indirectly boosted solar energy demand as consumers seek comprehensive clean energy solutions. Commercial sector adoption has also accelerated, with businesses recognizing the long-term cost benefits and sustainability credentials of solar power systems.

The New Zealand solar energy industry market refers to the comprehensive ecosystem encompassing the development, manufacturing, installation, and maintenance of solar power systems across New Zealand’s residential, commercial, and utility sectors. This market includes photovoltaic panel manufacturing, system integration services, energy storage solutions, and supporting infrastructure development.

Solar energy systems in New Zealand primarily utilize photovoltaic technology to convert sunlight into electricity, with installations ranging from small residential rooftop systems to large-scale solar farms. The market encompasses various stakeholders including equipment manufacturers, installation contractors, energy retailers, and technology providers who collectively drive the industry’s growth and innovation.

Market participants operate across the entire value chain, from importing and distributing solar panels to providing comprehensive installation and maintenance services. The industry also includes emerging segments such as battery storage integration, smart grid connectivity, and energy management systems that enhance the overall value proposition of solar energy solutions.

New Zealand’s solar energy market has emerged as a critical component of the country’s renewable energy transition, experiencing unprecedented growth across all market segments. The industry has benefited from declining technology costs, supportive government policies, and increasing environmental awareness among consumers and businesses.

Residential installations dominate the market landscape, accounting for approximately 68% of total installations by volume. This segment has been particularly responsive to government incentives and financing options that make solar energy more accessible to homeowners. Commercial and industrial applications represent the fastest-growing segment, with businesses increasingly adopting solar solutions to reduce operational costs and meet sustainability objectives.

Technology advancement continues to drive market evolution, with higher efficiency panels, integrated storage solutions, and smart monitoring systems becoming standard offerings. The integration of artificial intelligence and IoT technologies has enhanced system performance and maintenance capabilities, contributing to improved return on investment for consumers.

Market challenges include grid integration complexities, seasonal variations in solar generation, and the need for continued policy support to maintain growth momentum. However, these challenges are being addressed through innovative solutions and collaborative efforts between industry stakeholders and government agencies.

Strategic market analysis reveals several critical insights that define the New Zealand solar energy landscape. The following key insights demonstrate the market’s current position and future trajectory:

Government policy support serves as the primary catalyst for New Zealand’s solar energy market expansion. The government’s commitment to achieving net-zero emissions by 2050 has created a favorable regulatory environment that encourages renewable energy adoption. Feed-in tariffs and net metering policies enable consumers to monetize excess solar generation, improving the economic viability of solar investments.

Declining technology costs have made solar energy increasingly competitive with traditional electricity sources. Panel prices have decreased significantly over the past decade, while efficiency improvements have enhanced the value proposition for consumers. Installation costs have also declined due to improved installation techniques, standardized processes, and increased competition among service providers.

Environmental consciousness among New Zealand consumers continues to drive market demand. Growing awareness of climate change impacts and the desire to reduce carbon footprints motivate both residential and commercial customers to invest in solar energy solutions. Corporate sustainability initiatives have particularly accelerated commercial sector adoption as businesses seek to demonstrate environmental responsibility.

Energy security concerns and rising electricity prices have created additional market drivers. Solar energy provides consumers with greater energy independence and protection against future price increases. Grid reliability issues in some regions have also highlighted the value of distributed energy generation, making solar plus storage solutions increasingly attractive.

High upfront capital costs remain a significant barrier to solar energy adoption, particularly for residential customers with limited financial resources. Despite declining technology costs, the initial investment required for quality solar installations can be substantial, deterring potential customers who cannot access favorable financing options.

Grid integration challenges pose technical and regulatory obstacles to market growth. New Zealand’s electricity grid was not originally designed to accommodate high levels of distributed generation, creating complexities in managing bidirectional power flows and maintaining grid stability. Interconnection delays and technical requirements can slow installation timelines and increase project costs.

Seasonal generation variability affects the economic performance of solar installations, particularly in southern regions where winter solar generation is significantly reduced. This variability necessitates backup power sources or energy storage systems, increasing overall system costs and complexity.

Regulatory uncertainty regarding future policy changes creates hesitation among potential investors and customers. Changes to feed-in tariff rates, net metering policies, or incentive programs can significantly impact project economics, making long-term planning challenging for both consumers and industry participants.

Energy storage integration presents substantial growth opportunities as battery technology costs continue to decline and performance improves. The combination of solar generation with energy storage systems addresses intermittency concerns while providing additional value through peak shaving, backup power, and grid services. Virtual power plant concepts are emerging as innovative business models that aggregate distributed solar and storage resources.

Commercial and industrial segment expansion offers significant market potential as businesses increasingly recognize the financial and environmental benefits of solar energy. Large-scale installations can achieve superior economies of scale, while corporate sustainability commitments drive demand for renewable energy solutions. Power purchase agreements and third-party ownership models are facilitating commercial adoption.

Agrivoltaics applications represent an emerging opportunity that combines solar energy generation with agricultural activities. This dual land use approach can provide additional revenue streams for farmers while maintaining agricultural productivity. Rural electrification projects also present opportunities for off-grid solar solutions in remote areas.

Electric vehicle integration creates synergistic opportunities as EV adoption accelerates in New Zealand. Solar-powered EV charging systems can provide cost-effective transportation energy while supporting grid stability through smart charging algorithms. Vehicle-to-grid technology may eventually enable EVs to serve as mobile energy storage resources.

Supply chain dynamics significantly influence the New Zealand solar energy market, with most equipment imported from international manufacturers. Global supply chain disruptions and trade policies can impact equipment availability and pricing, affecting project timelines and costs. Local assembly and manufacturing capabilities are gradually developing to reduce import dependence.

Competitive dynamics have intensified as the market matures, with numerous local and international companies competing for market share. This competition has driven innovation, improved service quality, and reduced costs for consumers. Market consolidation trends are emerging as larger companies acquire smaller installers to achieve scale advantages.

Technology evolution continues to reshape market dynamics, with new innovations regularly entering the market. Advanced monitoring systems, artificial intelligence optimization, and improved inverter technologies enhance system performance and reliability. Digitalization trends are transforming customer acquisition, system design, and maintenance processes.

Financial market dynamics play a crucial role in market development, with various financing options becoming available to support solar adoption. Green bonds, solar loans, and leasing programs have expanded access to solar energy for different customer segments. Investment flows from both domestic and international sources continue to support market growth.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies. Primary research involved extensive interviews with industry stakeholders, including solar installers, equipment suppliers, policy makers, and end customers across different market segments.

Secondary research encompassed analysis of government publications, industry reports, academic studies, and company financial statements. Data validation was performed through triangulation of multiple sources to ensure accuracy and reliability of market insights and projections.

Quantitative analysis utilized statistical modeling techniques to analyze market trends, growth patterns, and correlation factors. Installation data, pricing information, and performance metrics were analyzed to identify key market drivers and constraints affecting industry development.

Qualitative research included focus groups with consumers and in-depth interviews with industry experts to understand market perceptions, barriers to adoption, and future opportunities. This approach provided valuable insights into customer decision-making processes and market dynamics that quantitative data alone cannot capture.

Auckland region dominates the New Zealand solar energy market, accounting for approximately 38% of total installations due to its large population base and favorable solar conditions. The region benefits from strong government support, established installer networks, and high levels of environmental awareness among residents. Commercial installations are particularly concentrated in Auckland’s business districts and industrial areas.

Canterbury region represents the second-largest market segment, with 22% market share driven by reconstruction activities following earthquakes and strong agricultural sector adoption. The region’s high solar irradiance levels and supportive local policies have encouraged both residential and commercial installations. Rural applications are particularly prominent in Canterbury’s agricultural areas.

Bay of Plenty and Waikato regions collectively account for 25% of market activity, benefiting from excellent solar resources and growing population centers. These regions have experienced rapid residential market growth, supported by lifestyle block developments and increasing environmental consciousness. Horticultural applications are emerging as a significant market segment in these regions.

Wellington region shows strong commercial and government sector adoption, though residential uptake has been slower due to challenging topography and variable weather conditions. The region accounts for 12% of total installations, with government buildings and commercial facilities leading adoption efforts. Policy influence from the capital city continues to support national market development.

Market competition in New Zealand’s solar energy industry is characterized by a mix of international equipment manufacturers, local installation companies, and integrated service providers. The competitive landscape has evolved significantly as the market has matured, with companies differentiating through service quality, technology offerings, and customer experience.

Competitive strategies include vertical integration, technology partnerships, financing innovation, and customer service differentiation. Companies are increasingly offering comprehensive energy solutions rather than just solar installations, including battery storage, energy management systems, and ongoing maintenance services.

Market segmentation analysis reveals distinct characteristics and growth patterns across different categories within the New Zealand solar energy industry. Understanding these segments is crucial for stakeholders to identify opportunities and develop targeted strategies.

By Application:

By Technology:

By System Type:

Residential category insights reveal strong growth momentum driven by increasing environmental awareness and improving economics. Average system sizes have increased as homeowners seek greater energy independence and prepare for electric vehicle adoption. Premium installations with integrated storage systems are becoming more common, particularly in areas with unreliable grid supply.

Commercial category development shows accelerating adoption as businesses recognize the financial and reputational benefits of solar energy. Large retailers, manufacturers, and office buildings are leading adoption, often as part of comprehensive sustainability initiatives. Corporate procurement strategies increasingly include renewable energy requirements, driving demand for solar solutions.

Utility-scale category growth has been more limited due to New Zealand’s existing renewable energy infrastructure, but opportunities exist for grid support and peak demand management. Distributed generation concepts are gaining traction as alternatives to traditional centralized power plants, particularly for serving growing urban areas.

Agricultural category potential remains largely untapped, with significant opportunities for irrigation systems, dairy operations, and rural electrification. Agrivoltaics applications could provide dual benefits of energy generation and agricultural productivity, though adoption requires education and demonstration projects.

Equipment manufacturers benefit from growing market demand and opportunities to introduce innovative technologies. The New Zealand market provides a testing ground for new products and systems before broader international deployment. Local assembly opportunities may emerge as the market scales, reducing logistics costs and import dependencies.

Installation companies enjoy expanding business opportunities across multiple market segments, with potential for service diversification into energy storage, maintenance, and energy management. Skilled workforce development creates employment opportunities and supports local economic development in regions with strong solar adoption.

Financial institutions can develop specialized solar financing products and services, tapping into growing consumer demand for renewable energy investments. Green finance initiatives align with sustainability commitments while providing attractive returns on investment.

Utility companies benefit from reduced peak demand pressures and opportunities to develop new business models around distributed energy resources. Grid modernization investments supported by solar integration can improve overall system reliability and efficiency.

End customers realize multiple benefits including reduced electricity costs, increased property values, energy independence, and environmental impact reduction. Energy security improvements provide protection against future price increases and supply disruptions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration trends are reshaping the New Zealand solar energy landscape, with smart inverters, monitoring systems, and artificial intelligence optimization becoming standard features. Internet of Things connectivity enables remote monitoring and predictive maintenance, improving system reliability and performance while reducing operational costs.

Energy storage adoption continues accelerating as battery costs decline and performance improves. Approximately 48% of new residential installations now include battery storage, reflecting growing demand for energy independence and backup power capabilities. Virtual power plant concepts are emerging as innovative approaches to aggregate distributed resources.

Financing innovation has expanded access to solar energy through diverse funding mechanisms including solar loans, leasing programs, and power purchase agreements. Green mortgages and property-assessed financing options are making solar installations more accessible to homeowners with limited upfront capital.

Digitalization trends are transforming customer acquisition, system design, and installation processes. Online platforms, virtual consultations, and automated design tools are improving efficiency and reducing costs throughout the value chain. Customer experience improvements through digital tools are becoming key competitive differentiators.

Sustainability integration extends beyond energy generation to encompass circular economy principles, with focus on panel recycling, sustainable installation practices, and lifecycle environmental impact reduction. Corporate sustainability commitments are driving demand for comprehensive renewable energy solutions.

Regulatory developments have strengthened the market foundation through updated building codes, electrical standards, and grid connection requirements. Recent amendments to the Electricity Industry Participation Code have clarified distributed generation rights and responsibilities, providing greater certainty for market participants.

Technology partnerships between international manufacturers and local companies have accelerated innovation adoption and market development. MarkWide Research analysis indicates that strategic partnerships have reduced technology deployment timelines by approximately 25% compared to independent market entry approaches.

Infrastructure investments in grid modernization and smart meter deployment are supporting higher levels of solar integration. Electricity distribution companies have committed substantial resources to upgrading network infrastructure to accommodate bidirectional power flows and advanced grid management systems.

Workforce development initiatives have expanded training programs for solar installers, system designers, and maintenance technicians. Industry associations and educational institutions have collaborated to develop certification programs ensuring quality installations and safety standards compliance.

Research and development activities have intensified, with universities and research institutions conducting studies on solar integration, energy storage, and grid stability. These efforts support evidence-based policy development and technology optimization for New Zealand conditions.

Market participants should focus on developing comprehensive energy solutions rather than standalone solar installations to capture greater value and improve customer satisfaction. Integration of energy storage, monitoring systems, and energy management capabilities creates competitive advantages and higher profit margins.

Policy makers should maintain consistent support mechanisms while gradually transitioning toward market-based approaches as the industry matures. Long-term policy certainty is crucial for continued investment and market development, particularly for large-scale projects with extended development timelines.

Financial institutions should develop specialized solar financing products that address diverse customer needs and risk profiles. Innovative financing mechanisms such as on-bill financing and community solar programs could expand market access and accelerate adoption rates.

Utility companies should embrace distributed generation as an opportunity rather than a threat, developing new business models that leverage solar energy for grid optimization and customer service enhancement. Demand response programs and virtual power plant concepts offer promising revenue opportunities.

Equipment suppliers should focus on products optimized for New Zealand conditions, including high wind resistance, salt air tolerance, and performance in variable weather conditions. Local technical support and warranty services are becoming increasingly important competitive factors.

Market growth projections indicate continued expansion across all segments, with residential installations maintaining strong momentum and commercial adoption accelerating. MWR projections suggest the market will experience sustained growth rates of 25-30% annually over the next five years, driven by improving economics and supportive policies.

Technology evolution will continue driving performance improvements and cost reductions, with next-generation solar panels, advanced inverters, and integrated storage systems becoming mainstream. Perovskite tandem cells and other emerging technologies may provide significant efficiency gains within the forecast period.

Grid integration will become increasingly sophisticated, with solar installations serving multiple functions including energy generation, grid support services, and demand management. Bi-directional charging capabilities and vehicle-to-grid integration will create additional value streams for solar system owners.

Market maturation will lead to increased competition, service standardization, and focus on customer experience differentiation. Consolidation among smaller installers is likely as the market requires greater scale and technical capabilities to remain competitive.

Export opportunities may emerge as New Zealand companies develop expertise and experience that can be applied in other markets, particularly Pacific Island nations seeking renewable energy solutions. Knowledge transfer and technical assistance programs could support regional market development while creating new revenue streams for New Zealand companies.

New Zealand’s solar energy industry market stands at a pivotal point in its development, with strong fundamentals supporting continued growth and evolution. The combination of excellent solar resources, supportive government policies, and increasing environmental awareness creates a favorable environment for sustained market expansion across residential, commercial, and utility segments.

Market dynamics continue to evolve as technology costs decline, financing options expand, and integration with energy storage and electric vehicle infrastructure creates new value propositions. The industry has successfully transitioned from an emerging technology to a mainstream energy solution, with installation rates and market penetration accelerating significantly.

Challenges remain in areas such as grid integration, seasonal generation variability, and maintaining policy support as the market matures. However, ongoing technological innovation, infrastructure investments, and collaborative efforts between industry stakeholders and government agencies are addressing these challenges systematically.

Future prospects for the New Zealand solar energy industry market remain highly positive, with opportunities for continued growth, technology advancement, and market sophistication. The industry’s contribution to New Zealand’s renewable energy goals and climate commitments will continue expanding, supported by improving economics and evolving customer preferences toward sustainable energy solutions.

What is Solar Energy?

Solar energy refers to the energy harnessed from the sun’s rays, which can be converted into electricity or heat. It is a renewable energy source that plays a crucial role in reducing carbon emissions and promoting sustainability.

What are the key players in the New Zealand Solar Energy Industry Market?

Key players in the New Zealand Solar Energy Industry Market include companies like Meridian Energy, Contact Energy, and Genesis Energy, which are involved in solar power generation and distribution, among others.

What are the growth factors driving the New Zealand Solar Energy Industry Market?

The growth of the New Zealand Solar Energy Industry Market is driven by increasing demand for renewable energy, government incentives for solar installations, and advancements in solar technology that enhance efficiency and reduce costs.

What challenges does the New Zealand Solar Energy Industry Market face?

Challenges in the New Zealand Solar Energy Industry Market include regulatory hurdles, the intermittency of solar power, and competition from other renewable energy sources, which can impact market growth.

What opportunities exist in the New Zealand Solar Energy Industry Market?

Opportunities in the New Zealand Solar Energy Industry Market include the potential for residential solar installations, growth in commercial solar projects, and innovations in energy storage solutions that can enhance solar energy utilization.

What trends are shaping the New Zealand Solar Energy Industry Market?

Trends in the New Zealand Solar Energy Industry Market include the increasing adoption of solar panels in residential areas, the rise of community solar projects, and the integration of smart grid technologies to optimize energy distribution.

New Zealand Solar Energy Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Photovoltaic Panels, Inverters, Mounting Systems, Batteries |

| Technology | Monocrystalline, Polycrystalline, Thin-Film, Bifacial |

| End User | Residential, Commercial, Industrial, Agricultural |

| Installation | Rooftop, Ground-Mounted, Carport, Floating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

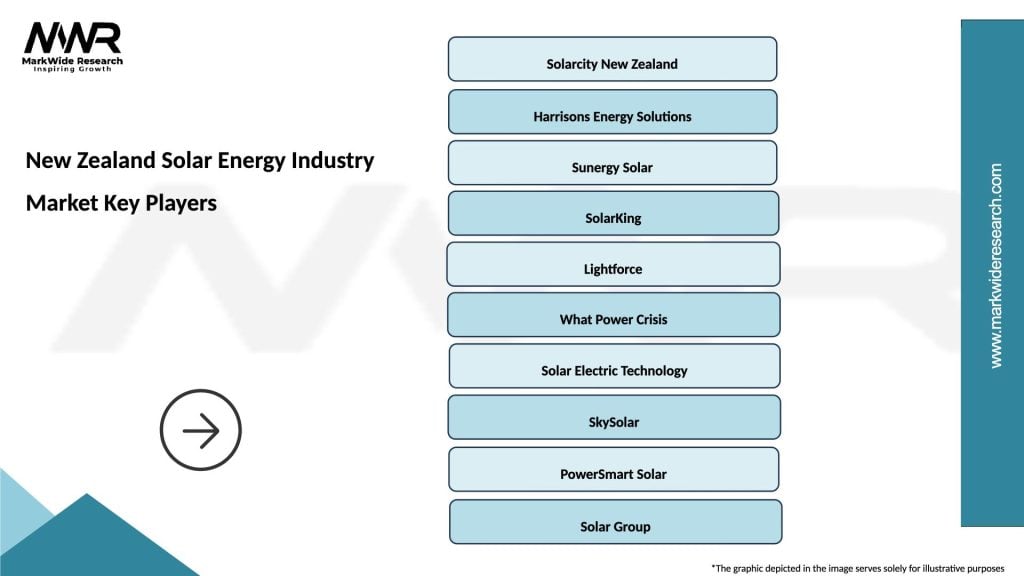

Leading companies in the New Zealand Solar Energy Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at