444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The New Zealand property and casualty insurance market represents a critical component of the country’s financial services sector, providing essential risk management solutions for individuals, businesses, and organizations across diverse industries. Property and casualty insurance encompasses comprehensive coverage for physical assets, liability protection, and various specialized insurance products tailored to New Zealand’s unique geographical and economic landscape. The market demonstrates robust growth patterns with increasing penetration rates driven by regulatory requirements, natural disaster awareness, and evolving consumer protection needs.

Market dynamics in New Zealand reflect the country’s exposure to natural catastrophes, including earthquakes, floods, and severe weather events, which significantly influence insurance demand and pricing strategies. The sector encompasses multiple product categories including motor insurance, home and contents insurance, commercial property coverage, public liability insurance, and specialized agricultural insurance products. Digital transformation initiatives are reshaping traditional insurance delivery models, with insurers investing heavily in technology platforms to enhance customer experience and operational efficiency.

Regulatory frameworks established by the Reserve Bank of New Zealand (RBNZ) and the Financial Markets Authority (FMA) provide comprehensive oversight, ensuring market stability and consumer protection. The market exhibits strong growth momentum with expanding coverage options, innovative product development, and increasing adoption of usage-based insurance models. Climate change considerations are becoming increasingly important, driving demand for enhanced risk assessment capabilities and sustainable insurance solutions.

The New Zealand property and casualty insurance market refers to the comprehensive ecosystem of insurance providers, products, and services that offer financial protection against property damage, liability claims, and various casualty risks within New Zealand’s jurisdiction. This market encompasses traditional insurance companies, mutual insurers, captive insurance entities, and specialized risk management providers that deliver coverage solutions for residential, commercial, and industrial clients.

Property insurance components include coverage for residential homes, commercial buildings, industrial facilities, and personal belongings, protecting against risks such as fire, theft, natural disasters, and accidental damage. Casualty insurance elements encompass liability protection, motor vehicle insurance, workers’ compensation, professional indemnity, and public liability coverage. The market operates through multiple distribution channels including direct sales, insurance brokers, online platforms, and bancassurance partnerships.

Risk assessment and underwriting processes in New Zealand incorporate sophisticated modeling techniques that account for the country’s unique geological characteristics, weather patterns, and regulatory environment. The market serves diverse customer segments ranging from individual homeowners and vehicle owners to large corporations, government entities, and specialized industries such as agriculture, tourism, and marine operations.

New Zealand’s property and casualty insurance market demonstrates exceptional resilience and growth potential, driven by increasing awareness of risk management importance and regulatory compliance requirements. The market benefits from strong economic fundamentals, stable regulatory environment, and growing consumer sophistication regarding insurance products. Digital innovation is transforming traditional business models, with insurers implementing advanced analytics, artificial intelligence, and mobile technologies to enhance service delivery and risk assessment capabilities.

Market penetration rates continue expanding across all major product categories, with motor insurance achieving 95% market penetration and home insurance reaching 85% adoption rates among eligible households. Commercial insurance segments show particularly strong growth, driven by increasing business formation, regulatory compliance requirements, and enhanced risk awareness among small and medium enterprises. The market exhibits healthy competition with both domestic and international insurers competing for market share through product innovation and competitive pricing strategies.

Natural disaster preparedness remains a key market driver, with New Zealand’s exposure to earthquakes, floods, and severe weather events creating sustained demand for comprehensive property protection. Climate adaptation strategies are becoming increasingly important, with insurers developing specialized products and risk assessment tools to address evolving environmental challenges. The market outlook remains highly positive with continued growth expected across all major segments.

Strategic market insights reveal several critical trends shaping New Zealand’s property and casualty insurance landscape. The market demonstrates exceptional stability supported by robust regulatory frameworks and strong consumer confidence in insurance institutions.

Primary market drivers propelling New Zealand’s property and casualty insurance sector include comprehensive regulatory requirements, natural disaster exposure, and increasing consumer awareness of risk management importance. Mandatory insurance requirements for motor vehicles and certain commercial activities create sustained baseline demand, while voluntary insurance adoption continues expanding across residential and business segments.

Natural disaster preparedness serves as a fundamental market driver, with New Zealand’s location on the Pacific Ring of Fire creating ongoing demand for earthquake insurance and comprehensive property protection. Climate change impacts are intensifying weather-related risks, driving increased adoption of flood insurance, storm damage coverage, and specialized climate adaptation products. The Canterbury earthquake sequence significantly heightened public awareness of insurance importance, creating lasting demand for comprehensive coverage.

Economic growth and increasing property values are expanding the total insurable value base, driving premium growth and market expansion. Business formation rates and entrepreneurial activity create growing demand for commercial insurance products, while regulatory compliance requirements ensure sustained market participation. Digital lifestyle adoption is creating new insurance needs including cyber liability coverage, identity theft protection, and technology-related risks.

Consumer sophistication regarding insurance products is increasing, with customers demanding more comprehensive coverage options, flexible policy terms, and enhanced service delivery. Demographic trends including population growth, urbanization, and changing household compositions are creating evolving insurance needs and market opportunities.

Market restraints affecting New Zealand’s property and casualty insurance sector include affordability challenges, regulatory complexity, and natural disaster exposure that can impact insurer profitability and market stability. Premium affordability concerns, particularly for comprehensive home insurance in high-risk areas, can limit market penetration and create coverage gaps among vulnerable populations.

Regulatory compliance costs associated with meeting RBNZ solvency requirements and FMA conduct standards can create operational challenges for smaller insurers and impact market competition. Natural disaster exposure creates significant capital requirements and can lead to market capacity constraints during periods of high catastrophe activity. Reinsurance costs for New Zealand risks can be substantial due to the country’s natural disaster exposure, impacting pricing and profitability.

Claims inflation driven by increasing construction costs, vehicle repair expenses, and medical treatment costs can pressure insurer margins and necessitate premium increases. Fraud and claims leakage continue to impact market efficiency, requiring ongoing investment in detection and prevention technologies. Market concentration in certain segments can limit consumer choice and competitive pricing dynamics.

Economic volatility and interest rate fluctuations can impact insurer investment returns and capital adequacy, affecting market stability and growth potential. Talent acquisition challenges in specialized areas such as actuarial science, underwriting, and claims management can constrain market development and innovation capabilities.

Significant market opportunities exist within New Zealand’s property and casualty insurance sector, driven by technological innovation, demographic changes, and evolving risk landscapes. Digital transformation initiatives offer substantial opportunities for insurers to enhance operational efficiency, improve customer experience, and develop innovative product offerings through artificial intelligence, machine learning, and advanced analytics.

Climate adaptation insurance represents a growing opportunity as businesses and individuals seek protection against evolving environmental risks. Sustainable insurance products including green building coverage, renewable energy protection, and carbon offset insurance are emerging as significant market opportunities. Cyber insurance demand is expanding rapidly as digital transformation accelerates across all sectors of the New Zealand economy.

Agricultural insurance innovation offers substantial opportunities given New Zealand’s significant farming sector and exposure to weather-related risks. Parametric insurance products that provide rapid payouts based on predefined triggers are gaining traction for natural disaster and agricultural applications. Usage-based insurance models for motor insurance and other applications offer opportunities for more precise risk pricing and customer engagement.

Commercial insurance expansion among small and medium enterprises presents significant growth opportunities as business awareness of risk management increases. Specialty insurance products for emerging industries such as renewable energy, technology startups, and sharing economy businesses offer substantial market potential. Insurance technology partnerships with fintech companies and digital platforms create opportunities for market expansion and innovation.

Market dynamics within New Zealand’s property and casualty insurance sector reflect complex interactions between regulatory requirements, natural disaster exposure, competitive pressures, and technological innovation. Competitive intensity varies significantly across product segments, with motor insurance showing intense price competition while specialized commercial lines maintain more stable pricing dynamics.

Customer behavior patterns are evolving rapidly, with increasing demand for digital service delivery, transparent pricing, and flexible policy terms. Claims frequency and severity trends show varying patterns across different product lines, with motor insurance experiencing changing accident patterns due to improved vehicle safety technologies and changing driving behaviors. Natural disaster cycles create periodic market disruptions that test insurer resilience and capital adequacy.

Regulatory evolution continues shaping market dynamics, with ongoing reforms to conduct regulation, capital requirements, and consumer protection standards. Technology adoption rates among insurers vary significantly, creating competitive advantages for early adopters and market pressure for digital transformation. Distribution channel evolution shows increasing importance of direct digital channels while traditional broker networks remain significant for complex commercial risks.

Reinsurance market conditions significantly influence New Zealand insurer capacity and pricing, particularly for natural catastrophe exposures. Investment market performance affects insurer profitability and capital adequacy, influencing underwriting appetite and pricing strategies. Economic cycles impact both insurance demand and claims patterns, creating dynamic market conditions that require adaptive strategies.

Comprehensive research methodology employed for analyzing New Zealand’s property and casualty insurance market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability. Primary research activities include structured interviews with industry executives, regulatory officials, insurance brokers, and key market participants to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research components encompass analysis of regulatory filings, industry reports, financial statements, and statistical data from authoritative sources including the Reserve Bank of New Zealand, Financial Markets Authority, and Statistics New Zealand. Market data collection involves systematic gathering of premium volumes, claims statistics, market share information, and competitive intelligence across all major product segments.

Analytical frameworks employed include competitive landscape analysis, regulatory impact assessment, customer behavior analysis, and risk factor evaluation. Statistical modeling techniques are utilized to identify market trends, growth patterns, and correlation factors affecting market performance. Validation processes include cross-referencing multiple data sources, expert review panels, and sensitivity analysis to ensure research accuracy.

Market segmentation analysis employs detailed categorization by product type, customer segment, distribution channel, and geographic region. Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified market drivers and constraints. Quality assurance protocols ensure data integrity, analytical rigor, and objective reporting throughout the research process.

Regional market analysis reveals significant variations in insurance penetration, product preferences, and risk characteristics across New Zealand’s diverse geographic regions. Auckland region dominates market activity, accounting for approximately 35% of total premium volume due to high population density, property values, and commercial activity concentration. The region shows strong demand for comprehensive home insurance, motor coverage, and commercial property protection.

Canterbury region demonstrates unique market characteristics shaped by earthquake experiences, with enhanced earthquake insurance adoption rates exceeding 90% penetration among residential properties. The region shows strong preference for comprehensive natural disaster coverage and building code compliance insurance. Wellington region exhibits high commercial insurance penetration driven by government sector presence and professional services concentration.

Rural regions including Waikato, Bay of Plenty, and Southland show specialized insurance needs focused on agricultural risks, rural property protection, and farming-related liability coverage. Agricultural insurance penetration varies significantly by region, with dairy farming areas showing higher adoption rates compared to sheep and beef farming regions. West Coast region faces unique challenges due to natural disaster exposure and limited insurer appetite for certain risks.

Regional pricing variations reflect local risk characteristics, with earthquake-prone areas experiencing higher premiums for property insurance and flood-prone regions showing elevated pricing for comprehensive home coverage. Distribution channel preferences vary regionally, with rural areas showing higher reliance on insurance brokers while urban centers demonstrate increasing adoption of direct digital channels.

Competitive landscape analysis reveals a dynamic market structure characterized by both domestic and international insurers competing across multiple product segments. The market demonstrates healthy competition with no single insurer dominating all segments, creating opportunities for specialization and innovation.

Market competition intensifies through product innovation, digital transformation initiatives, and customer service enhancement programs. Competitive strategies include pricing optimization, distribution channel expansion, and specialized product development for emerging risks.

Market segmentation analysis reveals distinct characteristics and growth patterns across multiple dimensions including product type, customer segment, distribution channel, and coverage scope. Product segmentation encompasses personal lines, commercial lines, and specialty insurance categories, each demonstrating unique market dynamics and competitive structures.

By Product Type:

By Customer Segment:

Category-wise analysis provides detailed insights into performance patterns, growth drivers, and market characteristics across major insurance product categories within New Zealand’s property and casualty market.

Motor Insurance Category: Demonstrates mature market characteristics with high penetration rates and intense price competition. The category benefits from mandatory third-party coverage requirements while comprehensive insurance adoption continues growing. Technology integration including telematics and usage-based insurance models is reshaping traditional pricing and risk assessment approaches. Electric vehicle insurance represents an emerging growth opportunity as EV adoption accelerates.

Home Insurance Category: Shows steady growth patterns driven by increasing property values, natural disaster awareness, and enhanced coverage options. The category demonstrates strong correlation with property market performance and mortgage lending activity. Smart home technology integration is creating new coverage needs and risk mitigation opportunities. Climate change adaptation is driving demand for enhanced natural disaster protection.

Commercial Insurance Category: Exhibits robust growth potential driven by business formation, regulatory compliance requirements, and increasing risk awareness among SMEs. The category shows significant variation in penetration rates across industry sectors and business sizes. Cyber liability insurance is experiencing rapid growth as digital transformation accelerates. Professional indemnity coverage shows strong demand among service-based businesses.

Agricultural Insurance Category: Demonstrates specialized market characteristics with coverage tailored to farming operations, livestock protection, and weather-related risks. The category benefits from government support programs and industry-specific risk management initiatives. Parametric insurance products are gaining traction for weather-related agricultural risks.

Industry participants and stakeholders in New Zealand’s property and casualty insurance market realize substantial benefits through comprehensive risk management, regulatory compliance, and business continuity protection. Insurance companies benefit from stable regulatory environment, growing market demand, and opportunities for product innovation and digital transformation.

Policyholders gain essential financial protection against property damage, liability claims, and various casualty risks, enabling business continuity and personal asset protection. Enhanced coverage options provide comprehensive protection tailored to specific risk profiles and industry requirements. Digital service delivery improvements offer convenient policy management, claims processing, and customer support capabilities.

Insurance brokers and intermediaries benefit from growing market demand, expanding product portfolios, and enhanced technology platforms that improve service delivery and client management capabilities. Professional development opportunities in specialized areas such as cyber insurance, climate risk, and agricultural insurance create career advancement potential.

Regulatory authorities achieve market stability, consumer protection objectives, and systemic risk management through comprehensive oversight and prudential regulation. Economic stakeholders including banks, investors, and business communities benefit from reduced systemic risk and enhanced financial stability. Technology providers find significant opportunities in insurance technology development, data analytics, and digital platform solutions.

Reinsurance companies benefit from New Zealand’s sophisticated risk management practices and regulatory framework, creating attractive market opportunities for capacity deployment and risk sharing arrangements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping New Zealand’s property and casualty insurance sector reflect technological advancement, changing risk landscapes, and evolving customer expectations. Digital transformation continues accelerating with insurers investing heavily in artificial intelligence, machine learning, and automated underwriting systems to enhance operational efficiency and customer experience.

Climate adaptation strategies are becoming increasingly important as insurers develop sophisticated risk models and specialized products to address evolving environmental challenges. Parametric insurance products are gaining traction, offering rapid payouts based on predefined triggers for natural disasters and agricultural risks. Usage-based insurance models are expanding beyond motor insurance to other product categories, enabling more precise risk pricing and customer engagement.

Cyber insurance demand is experiencing explosive growth as businesses recognize increasing digital risks and regulatory compliance requirements. Sustainable insurance solutions including green building coverage and renewable energy protection are emerging as significant market trends. Customer experience enhancement through mobile applications, online policy management, and streamlined claims processing is becoming a key competitive differentiator.

Regulatory technology adoption is improving compliance efficiency and risk management capabilities across the industry. Data analytics advancement is enabling more sophisticated risk assessment, fraud detection, and pricing optimization. Partnership strategies between insurers and technology companies are accelerating innovation and market development. Microinsurance products are emerging to serve previously underserved market segments with affordable, targeted coverage options.

Recent industry developments demonstrate the dynamic nature of New Zealand’s property and casualty insurance market, with significant initiatives in technology adoption, regulatory compliance, and product innovation. Digital platform launches by major insurers are transforming customer interaction models and operational efficiency standards across the industry.

Regulatory framework enhancements including updated conduct standards and capital adequacy requirements are strengthening market stability and consumer protection. Climate risk disclosure requirements are driving improved risk assessment and transparency in climate-related exposures. Cyber security regulations are creating new compliance requirements and insurance demand across all business sectors.

Product innovation initiatives include launch of parametric insurance products for agricultural risks, enhanced cyber liability coverage options, and specialized insurance for emerging industries. Distribution channel evolution shows increasing importance of direct digital sales while maintaining strong broker relationships for complex commercial risks. Claims processing automation is reducing settlement times and improving customer satisfaction across multiple product lines.

Market consolidation activities and strategic partnerships are reshaping competitive dynamics and creating opportunities for enhanced service delivery. Sustainability initiatives including ESG integration and climate-conscious investment strategies are becoming standard practice among leading insurers. Technology partnerships with insurtech companies are accelerating innovation and creating new business model opportunities.

Strategic recommendations for market participants focus on leveraging technological capabilities, enhancing risk management practices, and capitalizing on emerging market opportunities. MarkWide Research analysis suggests that insurers should prioritize digital transformation initiatives to maintain competitive advantage and meet evolving customer expectations.

Product development strategies should emphasize climate adaptation insurance, cyber liability coverage, and specialized products for emerging industries. Risk management enhancement through advanced analytics, artificial intelligence, and sophisticated modeling capabilities will be crucial for maintaining profitability in an evolving risk landscape. Customer experience optimization through seamless digital interfaces and streamlined service delivery should remain a top priority.

Market expansion opportunities in commercial insurance, particularly among SMEs, warrant significant attention and resource allocation. Partnership strategies with technology providers, distribution partners, and specialized service providers can accelerate growth and innovation. Regulatory compliance excellence should be maintained as a competitive advantage and market stability factor.

Sustainability integration including ESG considerations and climate risk management should be embedded in strategic planning and operational processes. Talent development in specialized areas such as data analytics, cyber risk, and climate modeling will be essential for long-term success. Capital optimization through efficient reinsurance arrangements and risk transfer mechanisms should support growth and stability objectives.

Future market outlook for New Zealand’s property and casualty insurance sector remains highly positive, with sustained growth expected across all major product segments driven by increasing risk awareness, regulatory requirements, and technological innovation. Market expansion is projected to continue with annual growth rates expected to maintain strong momentum over the next five years.

Digital transformation will continue reshaping industry dynamics, with artificial intelligence, machine learning, and automation becoming standard operational tools. Climate adaptation insurance is expected to emerge as a major growth category as environmental risks intensify and awareness increases. Cyber insurance demand will likely experience continued rapid expansion as digital transformation accelerates across all economic sectors.

Regulatory evolution will continue enhancing market stability and consumer protection while promoting innovation and competition. Product innovation in areas such as parametric insurance, usage-based models, and specialized coverage for emerging risks will drive market differentiation and growth. Customer expectations for digital service delivery, transparent pricing, and comprehensive coverage will continue rising.

Market consolidation may continue as insurers seek scale advantages and operational efficiency improvements. International expansion opportunities for New Zealand insurers with specialized expertise in natural disaster management and agricultural insurance may emerge. Sustainability considerations will become increasingly important in product development, investment strategies, and operational practices. MWR projects that the market will maintain its position as a stable, well-regulated insurance environment with strong growth prospects and innovation potential.

New Zealand’s property and casualty insurance market represents a dynamic and resilient sector characterized by strong regulatory frameworks, innovative product development, and comprehensive risk management capabilities. The market demonstrates exceptional stability while maintaining robust growth momentum across all major product segments, driven by increasing risk awareness, regulatory compliance requirements, and technological advancement.

Key success factors include effective natural disaster risk management, digital transformation leadership, and comprehensive product portfolios tailored to local market needs. The sector benefits from healthy competition, regulatory excellence, and strong consumer confidence, creating a stable foundation for continued growth and innovation. Emerging opportunities in climate adaptation insurance, cyber liability coverage, and specialized products for new industries offer substantial potential for market expansion.

Strategic priorities for market participants should focus on digital transformation, customer experience enhancement, and product innovation to maintain competitive advantage in an evolving marketplace. The market outlook remains highly positive with sustained growth expected across all segments, supported by favorable regulatory environment, increasing insurance penetration, and ongoing technological advancement. New Zealand’s property and casualty insurance market is well-positioned to continue serving as a critical component of the country’s financial services sector while adapting to emerging risks and opportunities in an increasingly complex global environment.

What is Property And Casualty Insurance?

Property and casualty insurance refers to a type of coverage that protects individuals and businesses from financial losses related to property damage and liability claims. This includes various policies such as homeowners, auto, and commercial insurance.

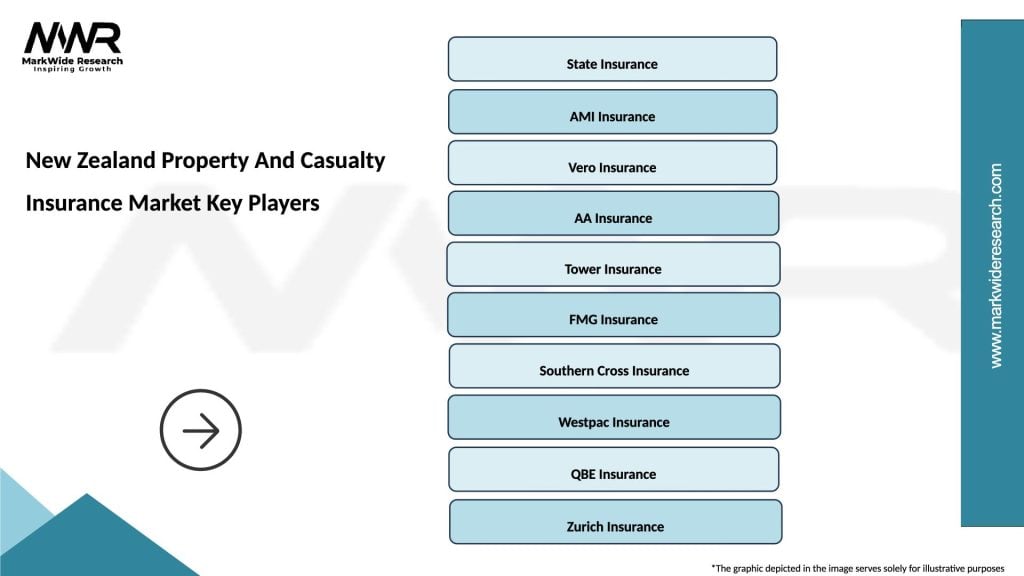

What are the key players in the New Zealand Property And Casualty Insurance Market?

Key players in the New Zealand Property And Casualty Insurance Market include IAG New Zealand, Vero Insurance, and AMI Insurance, among others. These companies offer a range of products catering to both personal and commercial insurance needs.

What are the growth factors driving the New Zealand Property And Casualty Insurance Market?

The growth of the New Zealand Property And Casualty Insurance Market is driven by factors such as increasing property ownership, rising awareness of insurance products, and the growing need for risk management solutions among businesses.

What challenges does the New Zealand Property And Casualty Insurance Market face?

Challenges in the New Zealand Property And Casualty Insurance Market include regulatory changes, increasing competition, and the impact of natural disasters on claims and underwriting processes.

What opportunities exist in the New Zealand Property And Casualty Insurance Market?

Opportunities in the New Zealand Property And Casualty Insurance Market include the expansion of digital insurance solutions, the rise of insurtech companies, and the potential for tailored insurance products to meet specific consumer needs.

What trends are shaping the New Zealand Property And Casualty Insurance Market?

Trends in the New Zealand Property And Casualty Insurance Market include the increasing use of technology for claims processing, a focus on sustainability in insurance practices, and the growing demand for personalized insurance offerings.

New Zealand Property And Casualty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Insurance, Auto Insurance, Commercial Property Insurance, Liability Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire & Theft, Natural Disaster |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the New Zealand Property And Casualty Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at