444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The New Zealand medical imaging services market is a vital component of the country’s healthcare infrastructure, providing essential diagnostic services to patients across various medical specialties. Medical imaging plays a crucial role in the early detection, diagnosis, and management of diseases and injuries, enabling healthcare providers to deliver timely and effective patient care. With advancements in imaging technologies, increasing disease prevalence, and evolving healthcare delivery models, the demand for medical imaging services in New Zealand continues to grow, driving market expansion and innovation.

Meaning

Medical imaging services encompass a range of diagnostic techniques and modalities used to visualize internal structures and functions of the body for clinical assessment and interpretation. These services include X-ray, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, nuclear medicine, mammography, and fluoroscopy, among others. Medical imaging plays a critical role in various medical specialties, including radiology, cardiology, oncology, orthopedics, neurology, and obstetrics, facilitating the detection, diagnosis, and monitoring of diseases and injuries.

Executive Summary

The New Zealand medical imaging services market is experiencing steady growth, driven by factors such as population aging, increasing disease burden, technological advancements, and healthcare infrastructure development. The market offers opportunities for industry participants to expand service offerings, invest in advanced imaging technologies, and enhance patient care delivery. However, challenges such as workforce shortages, equipment costs, and regulatory constraints pose barriers to market growth and require strategic interventions to address.

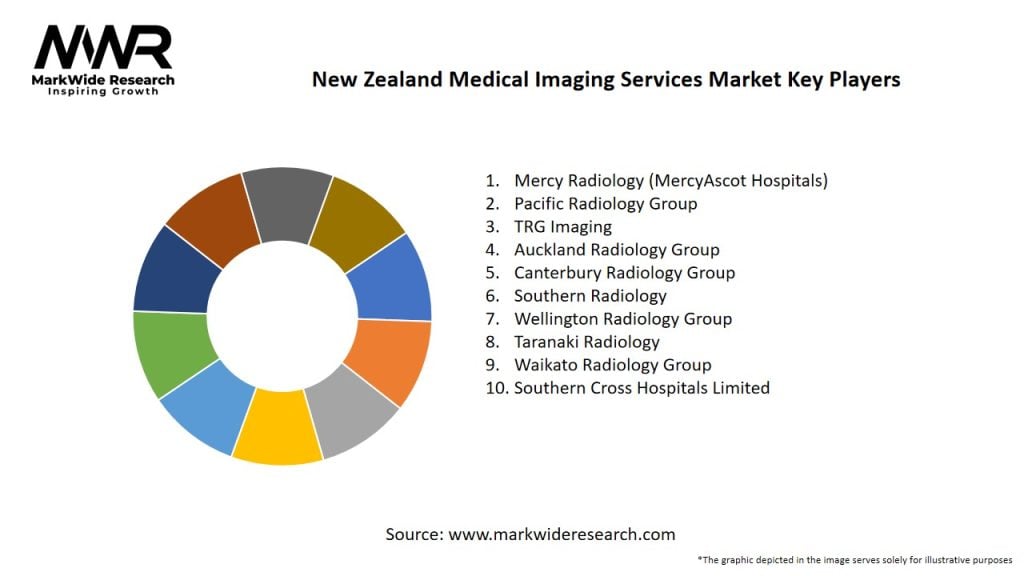

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Population Aging: The aging population in New Zealand is driving demand for medical imaging services, as elderly individuals are more prone to age-related health conditions and chronic diseases that require diagnostic imaging for diagnosis and management.

Technological Advancements: Advances in medical imaging technologies, such as digital X-ray, multi-slice CT scanners, high-field MRI systems, and 3D/4D ultrasound, enable superior image quality, faster scanning times, and enhanced diagnostic accuracy, improving patient care outcomes.

Rising Disease Prevalence: The increasing prevalence of chronic diseases, such as cardiovascular diseases, cancer, diabetes, and musculoskeletal disorders, necessitates frequent diagnostic imaging for disease screening, monitoring, and treatment planning.

Healthcare Infrastructure Development: Investments in healthcare infrastructure, including hospitals, clinics, imaging centers, and mobile imaging units, expand access to medical imaging services across urban and rural areas, addressing healthcare disparities and improving patient outcomes.

Market Drivers

Increasing Demand for Diagnostic Imaging: The growing need for diagnostic imaging services, driven by demographic trends, disease prevalence, and advancements in medical technology, fuels market growth and creates opportunities for imaging providers to expand their service portfolios and reach new patient populations.

Technological Innovations: Continuous innovation in imaging modalities, software algorithms, and image processing techniques enhances diagnostic capabilities, improves workflow efficiency, and enables personalized medicine approaches, driving adoption and utilization of advanced imaging technologies.

Integrated Healthcare Delivery Models: The shift towards integrated healthcare delivery models, such as accountable care organizations (ACOs) and collaborative care networks, promotes care coordination, information sharing, and value-based reimbursement models, incentivizing providers to invest in diagnostic imaging as part of comprehensive patient care pathways.

Market Restraints

Workforce Shortages: Shortages of qualified radiologists, radiographers, and imaging technologists pose challenges to meeting growing demand for medical imaging services, leading to workforce constraints, longer wait times, and potential quality-of-care issues.

Equipment Costs: High capital costs associated with acquiring, maintaining, and upgrading medical imaging equipment, such as MRI scanners, CT scanners, and ultrasound machines, create financial barriers for imaging providers, particularly small practices and rural facilities.

Regulatory Compliance: Compliance with regulatory requirements, quality standards, radiation safety guidelines, and accreditation processes imposes administrative burdens and financial costs on imaging facilities, impacting operational efficiency and profitability.

Market Opportunities

Telemedicine and Teleradiology: The adoption of telemedicine and teleradiology technologies enables remote interpretation of medical images, facilitates second opinions, and expands access to specialized radiology services in underserved areas, creating opportunities for imaging providers to extend their reach and collaborate with remote specialists.

Point-of-Care Imaging: Point-of-care imaging solutions, such as handheld ultrasound devices, portable X-ray systems, and mobile imaging units, enable bedside imaging assessments, emergency diagnostics, and community-based screenings, enhancing patient care delivery and reducing healthcare disparities.

Artificial Intelligence (AI) Integration: Integration of AI-based image analysis algorithms, machine learning models, and deep learning techniques into medical imaging workflows enhances diagnostic accuracy, automates routine tasks, and improves clinical decision support, driving efficiency gains and clinical outcomes improvement.

Market Dynamics

The New Zealand medical imaging services market operates in a dynamic environment influenced by technological advancements, regulatory changes, economic factors, and patient preferences. Market dynamics shape industry trends, competitive strategies, and investment priorities, requiring stakeholders to adapt and innovate to remain competitive and meet evolving market demands.

Regional Analysis

The New Zealand medical imaging services market exhibits regional variations in demand, infrastructure, and service availability due to differences in population density, healthcare resources, and geographic accessibility. Urban centers, such as Auckland, Wellington, and Christchurch, have well-established imaging facilities and specialized services, while rural and remote areas may face challenges in access to timely and comprehensive imaging diagnostics.

Competitive Landscape

Leading Companies in New Zealand Medical Imaging Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

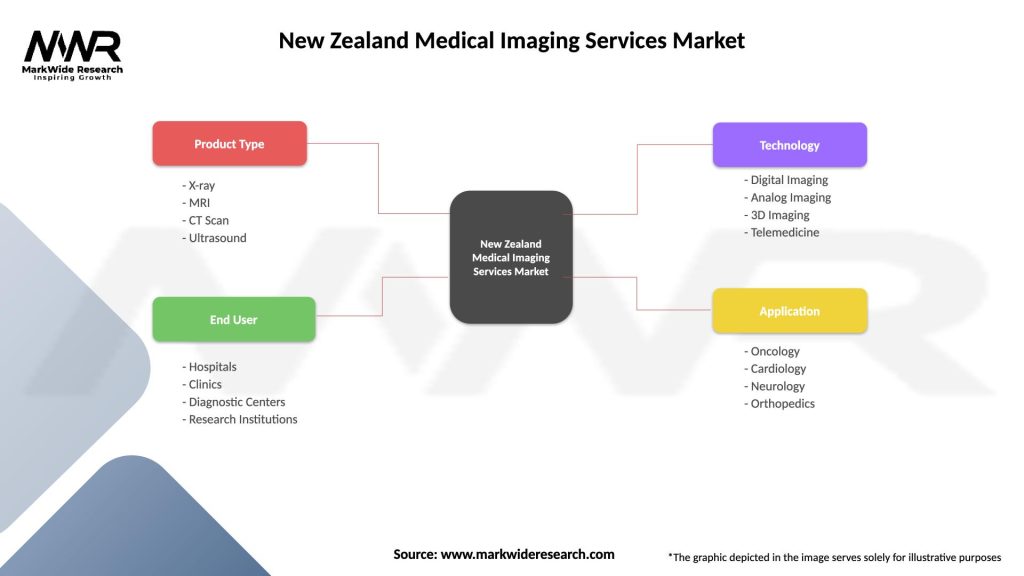

Segmentation

The New Zealand medical imaging services market can be segmented based on various factors such as imaging modality, clinical specialty, service setting, patient demographics, and geographic location. Segmentation enables providers to tailor their service offerings to specific patient needs, clinical indications, and reimbursement requirements, optimizing resource allocation and patient care delivery.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the New Zealand medical imaging services market, affecting patient volumes, service delivery, and operational workflows. During the pandemic, imaging providers experienced disruptions in elective procedures, outpatient visits, and non-urgent imaging studies, leading to reduced revenue, staffing challenges, and financial uncertainty. However, imaging facilities adapted to the changing environment by implementing infection control measures, telemedicine consultations, and remote reporting solutions to ensure continuity of care and patient safety. The pandemic also accelerated digital transformation initiatives, telehealth adoption, and AI integration in imaging workflows, driving innovation and resilience in the face of healthcare crises.

Key Industry Developments

Analyst Suggestions

Future Outlook

The New Zealand medical imaging services market is poised for continued growth and innovation driven by factors such as technological advancements, demographic trends, healthcare infrastructure development, and regulatory reforms. Despite challenges such as workforce shortages, equipment costs, and regulatory constraints, the market presents opportunities for imaging providers to expand service offerings, adopt digital solutions, and enhance patient care delivery. By investing in technology, expanding telemedicine services, fostering collaborations, and focusing on patient-centered care, providers can navigate market dynamics, drive growth, and contribute to improved health outcomes in New Zealand.

Conclusion

The New Zealand medical imaging services market plays a critical role in the country’s healthcare system, providing essential diagnostic services to patients across various medical specialties. With increasing demand for imaging services, technological advancements, and evolving healthcare delivery models, the market presents opportunities for providers to expand service offerings, invest in advanced technologies, and enhance patient care delivery. By addressing challenges such as workforce shortages, equipment costs, and regulatory compliance, providers can navigate market dynamics, drive innovation, and contribute to improved health outcomes and patient satisfaction in New Zealand.

What is Medical Imaging Services?

Medical Imaging Services encompass a range of diagnostic techniques used to visualize the interior of the body for clinical analysis and medical intervention. Common modalities include X-rays, MRI, CT scans, and ultrasound, which are essential in diagnosing various health conditions.

What are the key players in the New Zealand Medical Imaging Services Market?

Key players in the New Zealand Medical Imaging Services Market include Auckland Radiology, Radiology Partners, and Southern Cross Healthcare, among others. These companies provide a variety of imaging services and are integral to the healthcare infrastructure.

What are the growth factors driving the New Zealand Medical Imaging Services Market?

The growth of the New Zealand Medical Imaging Services Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technology, and a growing aging population requiring diagnostic services. Additionally, the rising demand for early disease detection contributes to market expansion.

What challenges does the New Zealand Medical Imaging Services Market face?

Challenges in the New Zealand Medical Imaging Services Market include high operational costs, regulatory compliance issues, and the need for continuous technological upgrades. These factors can hinder the accessibility and affordability of imaging services for patients.

What opportunities exist in the New Zealand Medical Imaging Services Market?

Opportunities in the New Zealand Medical Imaging Services Market include the integration of artificial intelligence in imaging analysis, the expansion of telemedicine services, and the development of portable imaging devices. These innovations can enhance service delivery and patient outcomes.

What trends are shaping the New Zealand Medical Imaging Services Market?

Trends in the New Zealand Medical Imaging Services Market include the increasing adoption of digital imaging technologies, the rise of personalized medicine, and a focus on patient-centered care. These trends are transforming how imaging services are delivered and utilized in clinical settings.

New Zealand Medical Imaging Services Market

| Segmentation Details | Description |

|---|---|

| Product Type | X-ray, MRI, CT Scan, Ultrasound |

| End User | Hospitals, Clinics, Diagnostic Centers, Research Institutions |

| Technology | Digital Imaging, Analog Imaging, 3D Imaging, Telemedicine |

| Application | Oncology, Cardiology, Neurology, Orthopedics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in New Zealand Medical Imaging Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at