444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The New Jersey data center market represents a critical component of the Northeast United States digital infrastructure landscape, serving as a strategic hub for enterprise computing, cloud services, and digital transformation initiatives. New Jersey’s unique positioning between major metropolitan areas like New York City and Philadelphia has established it as a premier destination for data center development and operations. The state’s robust telecommunications infrastructure, reliable power grid, and favorable business environment contribute to its growing prominence in the regional data center ecosystem.

Market dynamics indicate substantial growth momentum driven by increasing demand for cloud computing services, edge computing deployments, and enterprise digital transformation initiatives. The market benefits from strategic geographic advantages, including proximity to major financial centers, excellent fiber connectivity, and access to diverse power sources. Industry analysis reveals that New Jersey’s data center market is experiencing accelerated expansion, with growth rates reaching 8.5% annually as organizations prioritize digital infrastructure investments.

Key market characteristics include a diverse mix of hyperscale facilities, enterprise data centers, and colocation services that cater to various industry verticals. The state’s data center infrastructure supports critical applications across financial services, healthcare, manufacturing, and technology sectors. Regional positioning advantages continue to attract major cloud service providers, telecommunications companies, and enterprise organizations seeking reliable, scalable data center solutions within the Northeast corridor.

The New Jersey data center market refers to the comprehensive ecosystem of facilities, services, and infrastructure dedicated to housing, managing, and supporting digital computing resources within New Jersey state boundaries. This market encompasses various facility types including hyperscale data centers, colocation facilities, enterprise data centers, and edge computing installations that provide essential digital infrastructure services to businesses and organizations.

Data center operations in New Jersey involve the provision of secure, climate-controlled environments equipped with redundant power systems, advanced cooling technologies, and high-speed network connectivity. These facilities serve as the backbone for cloud computing services, application hosting, data storage, disaster recovery, and business continuity operations. Market participants include facility operators, colocation providers, cloud service providers, and managed service companies that deliver comprehensive data center solutions.

Strategic significance of New Jersey’s data center market extends beyond state boundaries, serving as a critical node in the broader Northeast digital infrastructure network. The market supports diverse computing workloads, from traditional enterprise applications to modern cloud-native services, artificial intelligence processing, and Internet of Things deployments that require low-latency, high-availability infrastructure solutions.

New Jersey’s data center market demonstrates robust growth trajectory supported by strategic geographic positioning, excellent connectivity infrastructure, and strong demand from diverse industry verticals. The market benefits from proximity to major metropolitan areas, creating opportunities for both hyperscale deployments and edge computing initiatives that require low-latency connectivity to end users and business applications.

Market expansion is driven by several key factors including cloud migration initiatives, digital transformation projects, and increasing demand for hybrid IT infrastructure solutions. Enterprise organizations are increasingly adopting multi-cloud strategies that require reliable colocation services and interconnection capabilities. Growth indicators show that data center capacity utilization rates have reached 78% across major facilities, indicating strong market demand and limited available inventory in prime locations.

Competitive landscape features a mix of global data center operators, regional colocation providers, and specialized service companies that offer comprehensive infrastructure solutions. Market leaders are investing significantly in facility expansions, technology upgrades, and sustainability initiatives to meet evolving customer requirements. Investment trends indicate continued capital deployment in renewable energy integration, advanced cooling systems, and edge computing infrastructure development.

Future prospects remain highly positive with projected growth rates exceeding regional averages due to New Jersey’s strategic advantages and continued digital infrastructure investment. The market is well-positioned to capitalize on emerging technologies including 5G networks, artificial intelligence applications, and Internet of Things deployments that require robust, scalable data center infrastructure.

Strategic positioning analysis reveals several critical insights that define New Jersey’s data center market dynamics and competitive advantages:

Market maturity indicators demonstrate that New Jersey has evolved from a secondary data center market to a primary destination for enterprise and hyperscale deployments. Infrastructure investments continue to strengthen the state’s position as a critical component of the Northeast digital ecosystem.

Digital transformation initiatives represent the primary catalyst driving New Jersey data center market expansion. Organizations across all industry verticals are modernizing their IT infrastructure to support cloud computing, artificial intelligence, and data analytics applications that require robust, scalable data center resources. Enterprise adoption of hybrid cloud strategies necessitates reliable colocation services and interconnection capabilities that New Jersey providers excel at delivering.

Cloud migration trends continue to accelerate as businesses seek to reduce operational complexity while improving scalability and cost efficiency. Major cloud service providers are expanding their presence in New Jersey to serve enterprise customers who require low-latency access to cloud resources. Market research indicates that cloud adoption rates among New Jersey businesses have increased by 42% over the past two years, driving substantial demand for supporting data center infrastructure.

Edge computing deployment requirements are creating new opportunities for data center development in strategic locations throughout New Jersey. As Internet of Things applications, autonomous vehicles, and real-time analytics become more prevalent, organizations need computing resources positioned closer to end users and data sources. 5G network rollouts further amplify edge computing requirements, creating demand for smaller, distributed data center facilities.

Regulatory compliance requirements in industries such as financial services and healthcare drive demand for secure, compliant data center environments. New Jersey’s established regulatory framework and experienced service providers offer organizations confidence in meeting stringent compliance requirements while maintaining operational efficiency.

Real estate availability presents ongoing challenges for data center expansion in prime New Jersey locations. As the market matures, suitable sites with adequate power infrastructure, fiber connectivity, and zoning approvals become increasingly scarce and expensive. Development constraints in densely populated areas limit opportunities for large-scale hyperscale facility construction, potentially directing some investments to alternative locations.

Power grid capacity limitations in certain regions may restrict the scale of data center deployments, particularly for high-density computing applications that require substantial electrical infrastructure. While New Jersey’s overall power infrastructure is robust, localized capacity constraints can impact development timelines and project feasibility in specific areas.

Skilled workforce competition intensifies as demand for qualified data center technicians, engineers, and operations personnel exceeds supply. The competitive job market for technical talent can increase operational costs and impact service quality if staffing challenges are not effectively addressed through training programs and competitive compensation packages.

Environmental regulations and sustainability requirements may increase compliance costs and operational complexity for data center operators. While environmental stewardship is important for long-term market sustainability, evolving regulations can create uncertainty and additional investment requirements for facility upgrades and renewable energy integration.

Edge computing expansion presents significant growth opportunities as organizations deploy distributed computing resources to support real-time applications and reduce latency. New Jersey’s strategic location and connectivity infrastructure position it well to capture edge computing investments from enterprises, telecommunications providers, and content delivery networks seeking to improve application performance.

Artificial intelligence workloads are creating demand for specialized data center infrastructure optimized for GPU computing and machine learning applications. Organizations developing AI capabilities require high-performance computing resources with advanced cooling systems and low-latency networking. Market analysis suggests that AI-optimized data center capacity demand is growing at 35% annually in the Northeast region.

Sustainability initiatives offer opportunities for data center operators to differentiate their services through renewable energy integration, energy-efficient technologies, and green building certifications. Corporate customers increasingly prioritize environmental responsibility in their vendor selection processes, creating competitive advantages for operators who invest in sustainable infrastructure solutions.

Interconnection services represent a high-value opportunity as organizations adopt multi-cloud strategies and require seamless connectivity between different cloud providers, enterprise networks, and third-party services. Data center operators can generate additional revenue streams by offering comprehensive interconnection platforms that simplify network architecture and improve performance.

Supply and demand dynamics in New Jersey’s data center market reflect strong customer demand coupled with constrained supply in prime locations. Capacity utilization rates averaging 82% across major facilities indicate healthy market conditions with limited available inventory driving competitive pricing and long-term lease commitments from enterprise customers.

Competitive intensity continues to increase as global data center operators expand their New Jersey presence to capture market share and serve growing customer demand. Market leaders are differentiating through service quality, technology innovation, and strategic partnerships that provide comprehensive solutions beyond basic colocation services.

Technology evolution drives continuous infrastructure upgrades as data center operators invest in advanced cooling systems, higher-density computing configurations, and software-defined infrastructure management platforms. Innovation adoption rates show that 67% of major facilities have implemented artificial intelligence-powered infrastructure management systems to optimize efficiency and reliability.

Customer relationship dynamics are shifting toward longer-term strategic partnerships as enterprises seek stable, reliable infrastructure providers who can support their digital transformation initiatives over multiple years. This trend benefits established operators with proven track records and comprehensive service capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable insights into New Jersey’s data center market dynamics. Primary research includes direct interviews with data center operators, enterprise customers, technology vendors, and industry experts who provide firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, regulatory filings, facility announcements, and technology deployment data to validate primary research findings and identify broader market patterns. Data collection processes ensure representative sampling across different facility types, customer segments, and geographic regions within New Jersey.

Market sizing methodologies utilize facility capacity data, utilization rates, and growth projections to develop comprehensive market assessments. Research validation includes cross-referencing multiple data sources and conducting follow-up interviews to confirm key findings and assumptions.

Analytical frameworks incorporate both quantitative and qualitative assessment techniques to provide balanced perspectives on market dynamics, competitive positioning, and future growth prospects. Regular research updates ensure findings reflect current market conditions and emerging trends that impact strategic decision-making.

Northern New Jersey represents the largest and most mature segment of the state’s data center market, benefiting from proximity to New York City and excellent transportation infrastructure. This region hosts numerous hyperscale facilities and enterprise data centers serving financial services, media, and technology companies. Market concentration in northern counties accounts for approximately 65% of total state capacity, reflecting the area’s strategic advantages and established infrastructure.

Central New Jersey offers emerging opportunities for data center development with lower real estate costs and available land for large-scale facility construction. The region’s growing business community and improving connectivity infrastructure make it attractive for enterprises seeking cost-effective data center solutions while maintaining reasonable proximity to major metropolitan areas.

Southern New Jersey presents unique advantages for organizations requiring disaster recovery capabilities and business continuity services outside primary business centers. The region’s lower population density and available real estate create opportunities for specialized data center deployments serving specific industry verticals and use cases.

Connectivity corridors along major highways and fiber routes influence data center location decisions and development patterns throughout the state. Infrastructure investments in telecommunications and transportation continue to expand viable locations for data center development beyond traditional concentration areas.

Market leadership in New Jersey’s data center sector includes a diverse mix of global operators, regional specialists, and emerging technology companies that serve different customer segments and use cases:

Competitive differentiation strategies focus on service quality, technology innovation, sustainability initiatives, and strategic partnerships that provide comprehensive solutions beyond basic infrastructure services. Market positioning varies from hyperscale-focused operators to specialized providers serving specific industry verticals or geographic regions.

By Facility Type:

By Industry Vertical:

By Service Type:

Hyperscale segment dominates capacity consumption in New Jersey’s data center market, driven by major cloud service providers expanding their regional presence to serve enterprise customers. These facilities typically feature high-density configurations, advanced cooling systems, and substantial power requirements that necessitate specialized infrastructure design and operational expertise.

Colocation services represent the fastest-growing segment as enterprises adopt hybrid IT strategies requiring flexible, scalable infrastructure solutions. Market trends indicate that colocation demand is increasing at 12% annually as organizations seek to reduce capital expenditures while maintaining control over their IT infrastructure and applications.

Edge computing category emerges as a significant growth opportunity with organizations deploying distributed computing resources to support real-time applications, IoT deployments, and content delivery requirements. Edge facilities typically feature smaller footprints but require strategic locations with excellent connectivity to serve local markets effectively.

Managed services integration becomes increasingly important as customers seek comprehensive solutions that combine infrastructure hosting with professional services including monitoring, maintenance, and technical support. This trend creates opportunities for data center operators to expand revenue streams and strengthen customer relationships through value-added services.

Enterprise customers benefit from New Jersey’s data center market through access to reliable, scalable infrastructure solutions that support digital transformation initiatives while reducing capital expenditure requirements. Strategic advantages include proximity to major business centers, excellent connectivity options, and comprehensive service provider ecosystem that supports diverse IT requirements and compliance obligations.

Data center operators capitalize on strong market demand, strategic geographic positioning, and diverse customer base that provides stable revenue streams and growth opportunities. The market’s maturity and infrastructure advantages enable operators to achieve operational efficiency while expanding service offerings and customer relationships.

Technology vendors find opportunities to deploy innovative solutions including advanced cooling systems, software-defined infrastructure, and artificial intelligence-powered management platforms. New Jersey’s competitive market environment encourages technology adoption and creates demand for cutting-edge solutions that improve efficiency and reliability.

Economic stakeholders benefit from job creation, tax revenue generation, and infrastructure investment that supports broader economic development throughout New Jersey. Data center operations create high-skilled employment opportunities and attract related technology businesses that contribute to regional economic growth and competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with data center operators investing heavily in renewable energy sources, energy-efficient technologies, and green building certifications. Environmental initiatives include solar panel installations, advanced cooling systems, and waste heat recovery programs that reduce environmental impact while improving operational efficiency. MarkWide Research analysis indicates that 73% of major facilities have implemented or planned significant sustainability upgrades within the next two years.

Artificial intelligence adoption transforms data center operations through predictive maintenance, automated infrastructure management, and optimized resource allocation. AI-powered systems enable operators to improve efficiency, reduce downtime, and enhance service quality while managing increasingly complex infrastructure environments.

Edge computing proliferation drives demand for distributed data center infrastructure positioned closer to end users and data sources. This trend creates opportunities for smaller, specialized facilities that complement traditional centralized data centers while serving latency-sensitive applications and IoT deployments.

Hybrid cloud strategies influence customer requirements for flexible, interconnected infrastructure solutions that seamlessly integrate public cloud services with private infrastructure. Data center operators respond by enhancing connectivity options and developing comprehensive hybrid IT service offerings.

Security enhancement becomes increasingly critical as cyber threats evolve and regulatory requirements expand. Advanced security measures include biometric access controls, AI-powered threat detection, and comprehensive compliance frameworks that protect customer data and infrastructure assets.

Major facility expansions continue throughout New Jersey as established operators invest in additional capacity to meet growing customer demand. Recent announcements include significant capacity additions by leading providers who recognize the market’s strategic importance and growth potential within the Northeast corridor.

Technology partnerships between data center operators and cloud service providers create new service offerings and expand market reach. These collaborations enable customers to access comprehensive solutions that combine infrastructure hosting with managed cloud services and professional support.

Renewable energy initiatives gain momentum as operators commit to carbon neutrality goals and sustainable operations. Solar installations, wind energy contracts, and energy storage systems become standard components of modern data center infrastructure development and operations.

Regulatory developments at state and local levels impact data center operations through updated zoning requirements, environmental standards, and tax incentive programs. These changes influence development decisions and operational strategies for both existing and planned facilities.

Workforce development programs emerge through partnerships between data center operators, educational institutions, and government agencies to address skilled labor shortages and support industry growth. Training initiatives focus on technical skills, safety protocols, and emerging technologies that define modern data center operations.

Strategic positioning recommendations emphasize the importance of differentiating through service quality, technology innovation, and comprehensive solution offerings rather than competing solely on price. Operators should focus on developing long-term customer relationships and expanding service portfolios to capture additional revenue opportunities within existing accounts.

Investment priorities should emphasize sustainability initiatives, edge computing capabilities, and advanced technology integration that align with customer requirements and regulatory trends. MWR analysis suggests that operators investing in renewable energy and AI-powered infrastructure management achieve 15% higher customer retention rates compared to traditional approaches.

Market expansion strategies should consider geographic diversification within New Jersey to capture emerging opportunities in underserved regions while maintaining presence in established markets. Edge computing deployments and specialized service offerings can create competitive advantages in specific market segments.

Partnership development with cloud service providers, technology vendors, and managed service companies can enhance service capabilities and market reach. Strategic alliances enable operators to offer comprehensive solutions while leveraging partner expertise and resources to accelerate growth.

Talent acquisition and retention strategies become critical success factors as competition for skilled personnel intensifies. Comprehensive training programs, competitive compensation packages, and career development opportunities help operators build strong technical teams that deliver exceptional customer service.

Long-term growth prospects for New Jersey’s data center market remain highly positive, supported by continued digital transformation initiatives, cloud adoption, and emerging technology deployments. The market is well-positioned to benefit from ongoing trends including artificial intelligence, Internet of Things, and 5G network rollouts that require robust, scalable infrastructure solutions.

Capacity expansion will continue as operators respond to strong customer demand and limited available inventory in prime locations. Development projections indicate that total data center capacity could increase by 25% over the next three years through both new facility construction and expansion of existing sites.

Technology evolution will drive continuous infrastructure upgrades as operators adopt advanced cooling systems, higher-density computing configurations, and software-defined management platforms. Edge computing deployments will create new market segments and revenue opportunities for operators who can effectively serve distributed computing requirements.

Sustainability initiatives will become increasingly important as corporate customers prioritize environmental responsibility and regulatory requirements evolve. Operators who invest early in renewable energy and green technologies will achieve competitive advantages and improved customer relationships.

Market consolidation may occur as smaller operators seek partnerships or acquisition opportunities to compete effectively with larger, well-capitalized providers. This trend could create opportunities for strategic investors and private equity firms seeking exposure to the growing data center sector.

New Jersey’s data center market represents a dynamic, rapidly evolving sector that plays a critical role in the Northeast United States digital infrastructure ecosystem. The market’s strategic advantages including geographic positioning, excellent connectivity, and robust infrastructure create sustainable competitive advantages that support continued growth and investment.

Market fundamentals remain strong with healthy demand from diverse industry verticals, limited supply in prime locations, and ongoing technology trends that require scalable, reliable data center infrastructure. The combination of established market presence and emerging opportunities in edge computing, artificial intelligence, and sustainability initiatives positions New Jersey as a premier data center destination.

Future success will depend on operators’ ability to adapt to evolving customer requirements, invest in advanced technologies, and maintain operational excellence while managing increasing competition and regulatory complexity. Organizations that focus on service quality, innovation, and strategic partnerships will be best positioned to capitalize on the market’s substantial growth potential and achieve long-term success in New Jersey’s thriving data center ecosystem.

What is Data Center?

A data center is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It is essential for managing and storing large amounts of data for various applications, including cloud computing, web hosting, and enterprise IT operations.

What are the key players in the New Jersey Data Center Market?

Key players in the New Jersey Data Center Market include Digital Realty, Equinix, and CoreSite, which provide a range of services from colocation to cloud solutions. These companies are pivotal in supporting the growing demand for data storage and processing capabilities in the region, among others.

What are the growth factors driving the New Jersey Data Center Market?

The New Jersey Data Center Market is driven by factors such as the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced data security. Additionally, the proximity to major metropolitan areas makes New Jersey an attractive location for data center operations.

What challenges does the New Jersey Data Center Market face?

Challenges in the New Jersey Data Center Market include high operational costs, regulatory compliance issues, and the need for sustainable energy solutions. These factors can impact the profitability and scalability of data center operations in the region.

What opportunities exist in the New Jersey Data Center Market?

Opportunities in the New Jersey Data Center Market include the expansion of edge computing, the growth of hybrid cloud solutions, and advancements in energy-efficient technologies. These trends present avenues for innovation and investment in the sector.

What trends are shaping the New Jersey Data Center Market?

Trends shaping the New Jersey Data Center Market include the increasing adoption of artificial intelligence for data management, the shift towards modular data center designs, and the emphasis on sustainability practices. These trends are influencing how data centers operate and evolve in response to market demands.

New Jersey Data Center Market

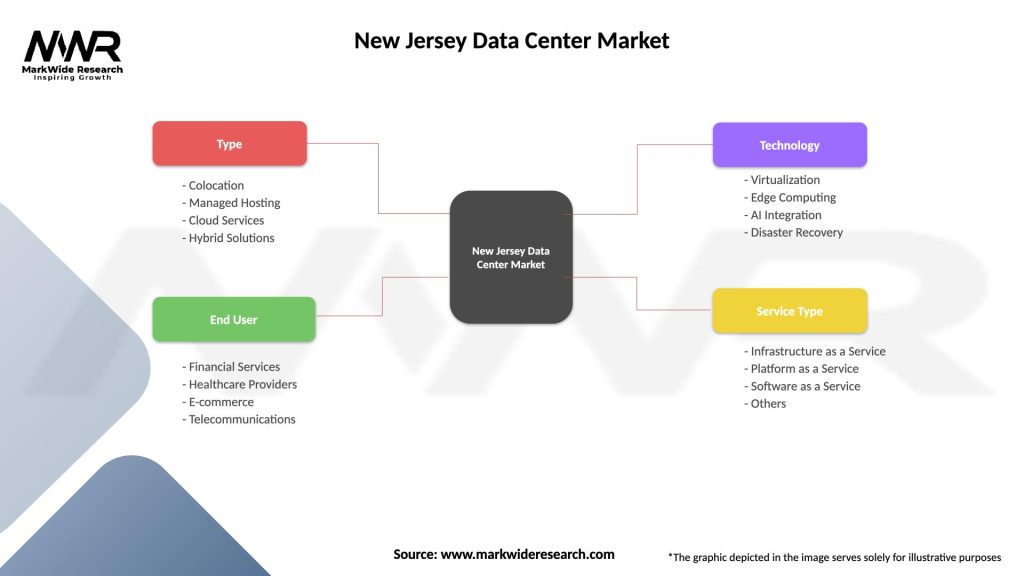

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Managed Hosting, Cloud Services, Hybrid Solutions |

| End User | Financial Services, Healthcare Providers, E-commerce, Telecommunications |

| Technology | Virtualization, Edge Computing, AI Integration, Disaster Recovery |

| Service Type | Infrastructure as a Service, Platform as a Service, Software as a Service, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the New Jersey Data Center Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at