444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The New Energy Car Insurance Market represents a burgeoning segment within the insurance industry, catering specifically to the unique needs and risks associated with electric and hybrid vehicles. With the global transition towards sustainable transportation solutions, driven by environmental concerns and regulatory mandates, the adoption of new energy vehicles (NEVs) is on the rise. As a result, there is a growing demand for insurance products and services tailored to the distinct characteristics of these vehicles, including their advanced technology, battery systems, and associated charging infrastructure.

Meaning

New Energy Car Insurance refers to insurance policies designed to provide coverage for electric vehicles (EVs), hybrid vehicles, and other forms of new energy vehicles (NEVs). These insurance products are tailored to address the unique risks and requirements associated with alternative fuel vehicles, including battery performance, charging infrastructure, specialized components, and repair costs. By offering comprehensive coverage options and tailored solutions, new energy car insurance aims to provide peace of mind to EV owners while promoting the adoption of sustainable transportation technologies.

Executive Summary

The New Energy Car Insurance Market is witnessing rapid growth and evolution in tandem with the global transition towards electric and hybrid vehicles. As governments worldwide implement policies to promote clean energy adoption and combat climate change, the demand for insurance products tailored to the unique needs of new energy vehicles is escalating. Insurance providers are innovating and expanding their offerings to address the specific risks associated with EV ownership, including battery degradation, charging infrastructure vulnerabilities, and technological complexities. By leveraging advanced analytics, telematics, and risk assessment tools, insurers aim to provide comprehensive coverage options and personalized services to meet the evolving needs of EV owners and facilitate the mainstream adoption of sustainable mobility solutions.

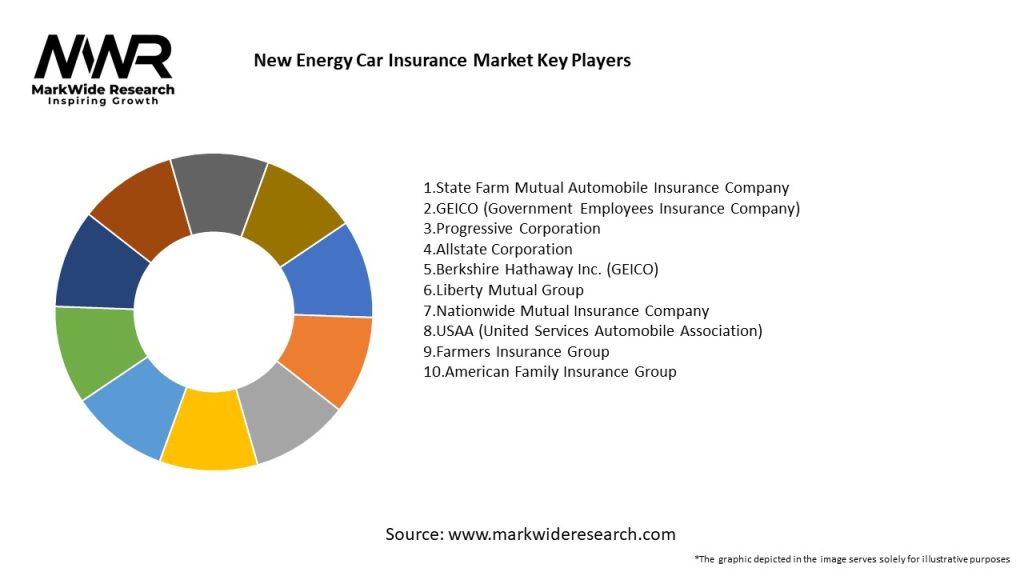

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The New Energy Car Insurance Market operates within a dynamic ecosystem shaped by various factors, including technological advancements, regulatory developments, consumer preferences, and market competition. Insurers must navigate these dynamics adeptly, leveraging their expertise and insights to develop innovative products and services that address the evolving needs of EV owners and promote the widespread adoption of sustainable transportation solutions.

Regional Analysis

The global landscape of the New Energy Car Insurance Market exhibits regional variations influenced by factors such as government policies, infrastructure development, consumer preferences, and market maturity:

Competitive Landscape

Leading Companies in the New Energy Car Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The new energy car insurance market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The New Energy Car Insurance Market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the New Energy Car Insurance Market reveals the following insights:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had mixed implications for the New Energy Car Insurance Market, reshaping consumer behaviors, mobility patterns, and insurance industry dynamics:

Key Industry Developments

Analyst Suggestions

Future Outlook

The New Energy Car Insurance Market is poised for significant growth and transformation in the coming years, driven by the global transition towards sustainable transportation solutions, technological advancements in electric mobility, and evolving consumer preferences for environmentally friendly vehicles. Insurers that innovate, differentiate, and adapt to changing market dynamics will be well-positioned to capitalize on emerging opportunities and establish leadership in the dynamic landscape of new energy car insurance.

Conclusion

The New Energy Car Insurance Market represents a promising frontier within the insurance industry, offering insurers opportunities to innovate, differentiate, and capitalize on the growing demand for sustainable transportation solutions. As electric and hybrid vehicles gain momentum worldwide, the need for specialized insurance products and services tailored to the unique risks and requirements of EV ownership will continue to grow. By embracing digital transformation, fostering partnerships, and prioritizing customer engagement, insurers can position themselves for sustained success and leadership in the dynamic market for new energy car insurance.

What is New Energy Car Insurance?

New Energy Car Insurance refers to specialized insurance products designed for vehicles that utilize alternative energy sources, such as electric and hybrid cars. This type of insurance often includes coverage tailored to the unique risks and benefits associated with new energy vehicles.

What are the key players in the New Energy Car Insurance Market?

Key players in the New Energy Car Insurance Market include companies like Geico, Progressive, and Allstate, which offer tailored policies for electric and hybrid vehicles. These companies are adapting their offerings to meet the growing demand for new energy vehicles among consumers, among others.

What are the growth factors driving the New Energy Car Insurance Market?

The growth of the New Energy Car Insurance Market is driven by the increasing adoption of electric vehicles, government incentives for green technology, and rising consumer awareness about environmental issues. Additionally, advancements in battery technology and charging infrastructure are contributing to this growth.

What challenges does the New Energy Car Insurance Market face?

The New Energy Car Insurance Market faces challenges such as the higher initial costs of electric vehicles, which can lead to increased insurance premiums. Additionally, the evolving technology and regulatory landscape can create uncertainties for insurers in assessing risks accurately.

What opportunities exist in the New Energy Car Insurance Market?

Opportunities in the New Energy Car Insurance Market include the potential for innovative insurance products that cater to the unique needs of electric vehicle owners, such as coverage for home charging stations. Furthermore, partnerships with automotive manufacturers can enhance product offerings and customer reach.

What trends are shaping the New Energy Car Insurance Market?

Trends shaping the New Energy Car Insurance Market include the integration of telematics to monitor driving behavior and offer personalized premiums. Additionally, the rise of subscription-based insurance models is gaining traction, providing flexibility for consumers who prefer not to commit to traditional policies.

New Energy Car Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Liability, Collision, Comprehensive, Personal Injury Protection |

| Customer Type | Individual Owners, Fleet Operators, Dealerships, Corporations |

| Vehicle Type | Battery Electric Vehicles, Plug-in Hybrid Vehicles, Hydrogen Fuel Cell Vehicles, Others |

| Policy Duration | Short-term, Annual, Multi-year, Pay-per-mile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the New Energy Car Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at