444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Network Detection and Response (NDR) market represents a critical segment of the cybersecurity industry, focusing on advanced threat detection and automated response capabilities within network infrastructures. This rapidly evolving market addresses the growing need for organizations to identify, analyze, and respond to sophisticated cyber threats in real-time. Network Detection and Response solutions leverage artificial intelligence, machine learning, and behavioral analytics to monitor network traffic patterns and detect anomalous activities that may indicate security breaches.

Market dynamics indicate substantial growth driven by increasing cyber attack sophistication and the expanding digital transformation initiatives across industries. Organizations are experiencing a 45% increase in advanced persistent threats, creating urgent demand for comprehensive network security solutions. The market encompasses various deployment models including on-premises, cloud-based, and hybrid solutions, catering to diverse organizational requirements and security architectures.

Key market segments include enterprise networks, cloud environments, and industrial control systems, each presenting unique security challenges and opportunities. The integration of NDR technologies with existing security infrastructure has become increasingly important as organizations seek to establish comprehensive security operations centers and enhance their overall cybersecurity posture.

The Network Detection and Response market refers to the comprehensive ecosystem of cybersecurity solutions designed to continuously monitor network traffic, detect potential threats, and automatically respond to security incidents in real-time. These solutions combine advanced analytics, machine learning algorithms, and threat intelligence to provide organizations with enhanced visibility into their network environments and rapid response capabilities against cyber threats.

NDR solutions fundamentally differ from traditional security approaches by focusing on network-based threat detection rather than endpoint or perimeter security alone. They analyze network communications, metadata, and traffic patterns to identify indicators of compromise, lateral movement, and data exfiltration attempts. The technology enables security teams to detect threats that may have bypassed other security controls and provides detailed forensic capabilities for incident investigation and response.

Core components of NDR systems include network traffic analysis engines, behavioral analytics platforms, threat intelligence integration, automated response mechanisms, and comprehensive reporting dashboards. These elements work together to create a unified security platform that enhances organizational resilience against evolving cyber threats while reducing the time required for threat detection and response activities.

Network Detection and Response market demonstrates exceptional growth potential driven by escalating cybersecurity threats and increasing organizational awareness of advanced attack techniques. The market benefits from significant technological advancements in artificial intelligence and machine learning, enabling more sophisticated threat detection capabilities and reducing false positive rates by approximately 60% compared to traditional security solutions.

Key growth drivers include regulatory compliance requirements, digital transformation initiatives, and the increasing adoption of cloud computing and remote work models. Organizations are investing heavily in NDR solutions to address security gaps created by expanding attack surfaces and the limitations of traditional perimeter-based security approaches. The market shows particularly strong growth in sectors such as financial services, healthcare, and critical infrastructure.

Competitive landscape features established cybersecurity vendors alongside innovative startups, creating a dynamic environment for technological advancement and market expansion. Major players are focusing on product differentiation through enhanced analytics capabilities, improved integration with existing security tools, and comprehensive managed services offerings. The market is experiencing consolidation trends as larger vendors acquire specialized NDR companies to expand their security portfolios.

Future prospects indicate continued robust growth supported by increasing cyber threat sophistication, expanding regulatory requirements, and growing recognition of NDR solutions as essential components of comprehensive cybersecurity strategies. Organizations are expected to increase their security spending allocation toward network-based detection and response capabilities.

Market penetration analysis reveals significant opportunities for NDR solution adoption across various industry verticals and organizational sizes. Current adoption rates show that approximately 35% of large enterprises have implemented comprehensive NDR solutions, while mid-market organizations lag behind with lower adoption rates, presenting substantial growth opportunities for vendors targeting this segment.

Cybersecurity threat evolution serves as the primary driver for NDR market growth, with organizations facing increasingly sophisticated attack techniques that traditional security solutions cannot effectively detect. Advanced persistent threats, zero-day exploits, and insider threats require comprehensive network monitoring capabilities that NDR solutions provide. The frequency and impact of cyber attacks continue to escalate, creating urgent demand for proactive threat detection and response capabilities.

Digital transformation initiatives across industries are expanding organizational attack surfaces and creating new security challenges that drive NDR adoption. Cloud migration, IoT device proliferation, and remote work models have fundamentally changed network architectures, requiring advanced monitoring and detection capabilities. Organizations recognize that traditional perimeter security approaches are insufficient for protecting modern distributed network environments.

Regulatory compliance requirements in various industries mandate comprehensive network monitoring and incident response capabilities, driving organizational investment in NDR solutions. Regulations such as GDPR, HIPAA, and industry-specific standards require organizations to demonstrate effective threat detection and response capabilities. Compliance frameworks increasingly emphasize continuous monitoring and rapid incident response, aligning with NDR solution capabilities.

Cybersecurity skills shortage motivates organizations to invest in automated NDR solutions that can augment limited security team capabilities. The global shortage of qualified cybersecurity professionals has reached critical levels, with organizations struggling to maintain adequate security operations. NDR solutions provide automated threat detection and response capabilities that help organizations maintain effective security postures despite staffing challenges.

Implementation complexity presents significant challenges for organizations considering NDR solution deployment, particularly those with limited technical expertise or complex network environments. The integration of NDR platforms with existing security infrastructure requires careful planning, specialized knowledge, and substantial time investment. Organizations often struggle with the technical requirements for proper deployment and configuration of comprehensive NDR solutions.

High initial investment costs associated with NDR solution deployment can limit adoption, especially among smaller organizations with constrained security budgets. The total cost of ownership includes not only software licensing but also hardware infrastructure, professional services, and ongoing maintenance requirements. Budget constraints often force organizations to prioritize other security investments over comprehensive NDR capabilities.

False positive challenges remain a concern for organizations evaluating NDR solutions, as excessive alerts can overwhelm security teams and reduce overall effectiveness. While modern NDR platforms have significantly improved accuracy, the potential for false positives continues to influence purchasing decisions. Organizations require confidence that NDR solutions will enhance rather than burden their security operations.

Privacy and data protection concerns related to network traffic monitoring and analysis can create organizational resistance to NDR deployment. Some organizations worry about the potential privacy implications of comprehensive network monitoring, particularly in regions with strict data protection regulations. Balancing security requirements with privacy considerations requires careful solution selection and implementation planning.

Small and medium enterprise market represents substantial untapped opportunity for NDR vendors willing to develop solutions tailored to smaller organizational requirements and budgets. Currently, most NDR solutions target large enterprises, leaving a significant market gap for SME-focused offerings. Simplified deployment models, managed service options, and cost-effective pricing strategies could unlock this market segment.

Industry-specific solutions present opportunities for vendors to develop specialized NDR platforms addressing unique sector requirements and compliance needs. Healthcare, financial services, manufacturing, and critical infrastructure sectors have distinct security challenges that generic NDR solutions may not fully address. Specialized offerings can command premium pricing and establish strong market positions.

Managed security services integration offers opportunities for both NDR vendors and managed service providers to develop comprehensive security offerings. Many organizations prefer outsourced security operations, creating demand for managed NDR services that combine technology platforms with expert analysis and response capabilities. This model can accelerate market adoption and provide recurring revenue opportunities.

Emerging technology integration including 5G networks, edge computing, and IoT environments creates new market opportunities for NDR solutions designed to address these evolving architectures. As organizations adopt new technologies, they require security solutions capable of monitoring and protecting these environments. Early movers in these emerging areas can establish competitive advantages and capture market share.

Competitive intensity within the NDR market continues to increase as established cybersecurity vendors expand their portfolios and new entrants introduce innovative solutions. This competition drives rapid technological advancement, improved solution capabilities, and more competitive pricing models. Vendors are differentiating through specialized features, industry focus, and comprehensive service offerings.

Technology convergence trends are reshaping the NDR market as vendors integrate multiple security capabilities into unified platforms. The boundaries between NDR, SIEM, SOAR, and other security technologies are blurring, creating opportunities for comprehensive security platforms. Organizations increasingly prefer integrated solutions that reduce complexity and improve operational efficiency.

Customer expectations are evolving toward solutions that provide immediate value with minimal deployment complexity and ongoing maintenance requirements. Organizations expect NDR solutions to integrate seamlessly with existing infrastructure, provide actionable intelligence, and demonstrate clear return on investment. Vendor success increasingly depends on meeting these elevated customer expectations.

Market consolidation activities are reshaping the competitive landscape as larger vendors acquire specialized NDR companies to expand their capabilities and market reach. These acquisitions often result in enhanced product offerings and broader market coverage but may also reduce innovation and increase market concentration. The consolidation trend is expected to continue as the market matures.

Comprehensive market analysis was conducted using multiple research approaches to ensure accurate and reliable insights into the Network Detection and Response market. Primary research included extensive interviews with industry executives, technology vendors, end-users, and cybersecurity experts to gather firsthand insights into market trends, challenges, and opportunities. These interviews provided valuable perspectives on current market conditions and future growth prospects.

Secondary research encompassed analysis of industry reports, vendor documentation, regulatory filings, and academic publications to validate primary research findings and identify additional market insights. This approach ensured comprehensive coverage of market dynamics, competitive landscape, and technological developments. Multiple data sources were cross-referenced to verify accuracy and eliminate potential biases.

Quantitative analysis involved examination of market data, adoption rates, pricing trends, and growth projections from various industry sources. Statistical modeling techniques were applied to identify patterns and trends within the market data. The analysis focused on growth rates, market share distributions, and adoption patterns across different industry segments and geographic regions.

Expert validation processes were implemented to ensure research findings accurately reflect current market conditions and future prospects. Industry experts reviewed preliminary findings and provided feedback on market dynamics, competitive positioning, and growth projections. This validation process enhanced the reliability and credibility of the research conclusions.

North American market maintains the largest share of global NDR adoption, driven by advanced cybersecurity awareness, regulatory requirements, and significant technology investment. The region benefits from a mature cybersecurity ecosystem, extensive vendor presence, and high organizational security spending. United States organizations account for approximately 65% of regional NDR deployments, with strong growth in both enterprise and government sectors.

European market demonstrates strong growth potential supported by stringent data protection regulations and increasing cybersecurity investment. GDPR compliance requirements have accelerated NDR adoption as organizations seek to demonstrate comprehensive security monitoring capabilities. The region shows particular strength in financial services and critical infrastructure sectors, with Germany and United Kingdom leading regional adoption rates.

Asia-Pacific region represents the fastest-growing market for NDR solutions, driven by rapid digital transformation, increasing cyber threats, and growing security awareness. Countries such as Japan, Australia, and Singapore are leading regional adoption, while emerging markets including India and Southeast Asian nations show significant growth potential. The region’s diverse regulatory environment creates opportunities for localized NDR solutions.

Latin American and Middle Eastern markets are experiencing gradual NDR adoption growth, supported by increasing cybersecurity investment and regulatory development. These regions present significant long-term opportunities as organizations modernize their security infrastructure and address evolving threat landscapes. Government initiatives and international partnerships are driving market development in these emerging regions.

Market leadership is distributed among several categories of vendors, including established cybersecurity companies, specialized NDR providers, and emerging technology startups. The competitive landscape reflects the market’s relative immaturity and rapid technological evolution, with no single vendor dominating market share across all segments.

Competitive strategies focus on technological differentiation, industry specialization, and comprehensive service offerings. Vendors are investing heavily in AI and machine learning capabilities to improve detection accuracy and reduce false positives. Strategic partnerships and acquisitions are common as companies seek to expand their capabilities and market reach.

By Component: The NDR market segments into software platforms, hardware appliances, and professional services. Software-based solutions dominate the market due to their flexibility and scalability advantages. Cloud-native platforms are gaining significant traction as organizations embrace cloud-first security strategies.

By Deployment Model: Market segmentation includes on-premises, cloud-based, and hybrid deployment options. Cloud deployments are experiencing the fastest growth, driven by scalability benefits and reduced infrastructure requirements. Hybrid models appeal to organizations with complex compliance and data sovereignty requirements.

By Organization Size: The market serves large enterprises, mid-market organizations, and small businesses, with large enterprises currently representing the majority of deployments. However, the mid-market segment shows the highest growth potential as solutions become more accessible and cost-effective.

By Industry Vertical: Key sectors include financial services, healthcare, government, manufacturing, retail, and telecommunications. Each vertical presents unique security challenges and regulatory requirements that influence NDR solution selection and implementation approaches.

By Application: Primary use cases encompass threat detection, incident response, compliance monitoring, forensic analysis, and network performance monitoring. Multi-purpose platforms that address multiple applications are increasingly preferred by organizations seeking to maximize their security investment.

Software Platform Category represents the largest and fastest-growing segment of the NDR market, driven by the flexibility and scalability advantages of software-based solutions. These platforms offer rapid deployment, easy updates, and integration capabilities that hardware-based solutions cannot match. Cloud-native software platforms are particularly popular among organizations embracing digital transformation initiatives.

Professional Services Category includes implementation, integration, training, and ongoing support services that are essential for successful NDR deployments. This segment is experiencing strong growth as organizations recognize the complexity of NDR implementation and the value of expert guidance. Managed services within this category are particularly attractive to organizations with limited internal security expertise.

Hardware Appliance Category continues to serve organizations with specific performance requirements or regulatory constraints that mandate on-premises deployment. While this segment is growing more slowly than software-based alternatives, it remains important for certain use cases and customer requirements. High-performance appliances are essential for organizations with demanding network monitoring requirements.

Integration Services Category addresses the critical need for NDR solutions to work seamlessly with existing security infrastructure. This category includes API development, custom integrations, and workflow automation services that maximize the value of NDR investments. Organizations increasingly view integration capabilities as essential selection criteria for NDR solutions.

Enhanced Threat Detection capabilities provide organizations with significantly improved ability to identify sophisticated cyber threats that traditional security solutions might miss. NDR solutions analyze network behavior patterns and identify anomalies that indicate potential security incidents, enabling proactive threat response before significant damage occurs.

Reduced Response Times through automated detection and response capabilities help organizations minimize the impact of security incidents. MarkWide Research analysis indicates that organizations using comprehensive NDR solutions experience 70% faster incident response times compared to those relying solely on traditional security tools.

Improved Compliance Posture results from comprehensive network monitoring and detailed audit capabilities that NDR solutions provide. Organizations can demonstrate continuous security monitoring and rapid incident response capabilities required by various regulatory frameworks. This compliance support reduces regulatory risk and potential penalties.

Cost Optimization occurs through reduced security incident impact, improved operational efficiency, and optimized security team productivity. While NDR solutions require initial investment, they typically provide positive return on investment through reduced incident costs and improved security effectiveness.

Strategic Security Insights enable organizations to better understand their threat landscape and optimize their overall security strategies. NDR solutions provide detailed analytics and reporting that support strategic security planning and investment decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the NDR market, with vendors increasingly incorporating advanced AI and machine learning capabilities into their platforms. These technologies enable more accurate threat detection, reduced false positives, and automated response capabilities that enhance overall security effectiveness. Organizations are prioritizing AI-powered solutions that can adapt to evolving threat landscapes.

Cloud-Native Architecture adoption is accelerating as organizations embrace cloud-first security strategies and seek scalable, flexible NDR solutions. Cloud-native platforms offer advantages including rapid deployment, automatic updates, and elastic scaling capabilities that traditional on-premises solutions cannot match. This trend is particularly strong among organizations undergoing digital transformation initiatives.

Extended Detection and Response (XDR) evolution is influencing NDR market development as vendors expand their platforms to include endpoint, email, and cloud security capabilities. This convergence trend reflects organizational preferences for integrated security platforms that provide comprehensive threat visibility and coordinated response capabilities across multiple attack vectors.

Automation and Orchestration capabilities are becoming essential features as organizations seek to address cybersecurity skills shortages and improve response efficiency. Automated threat hunting, incident response workflows, and integration with security orchestration platforms are increasingly important selection criteria for NDR solutions.

Industry-Specific Solutions are emerging as vendors recognize the unique security requirements and regulatory constraints of different sectors. Specialized NDR platforms for healthcare, financial services, and critical infrastructure offer tailored capabilities and compliance features that generic solutions cannot provide.

Strategic Acquisitions continue to reshape the NDR market landscape as larger cybersecurity vendors acquire specialized companies to expand their capabilities and market reach. Recent notable acquisitions include VMware’s acquisition of Lastline and Arista Networks’ purchase of Awake Security, demonstrating the strategic value of NDR technologies.

Technology Partnerships between NDR vendors and cloud service providers are creating new market opportunities and deployment models. These partnerships enable integrated security offerings that leverage cloud infrastructure capabilities while providing specialized NDR functionality. Major cloud providers are increasingly incorporating NDR capabilities into their security service portfolios.

Regulatory Developments across various regions are influencing NDR market growth and solution requirements. New cybersecurity regulations and updated compliance frameworks are creating additional demand for comprehensive network monitoring and incident response capabilities. Organizations are investing in NDR solutions to meet evolving regulatory requirements.

Innovation Investments in areas such as quantum-resistant encryption, 5G security, and IoT protection are driving next-generation NDR solution development. Vendors are investing heavily in research and development to address emerging security challenges and maintain competitive advantages in the rapidly evolving market.

Market Expansion into new geographic regions and industry verticals is accelerating as NDR vendors seek growth opportunities beyond their traditional markets. This expansion is supported by increasing global cybersecurity awareness and growing recognition of NDR solutions as essential security components.

Vendor Selection Strategy should prioritize solutions that offer comprehensive integration capabilities, proven scalability, and strong vendor support. Organizations should evaluate NDR platforms based on their specific network architectures, compliance requirements, and existing security infrastructure. MWR recommends conducting thorough proof-of-concept evaluations to validate solution effectiveness in real-world environments.

Implementation Planning requires careful consideration of organizational readiness, technical requirements, and change management processes. Successful NDR deployments depend on adequate preparation, stakeholder buy-in, and comprehensive training programs. Organizations should develop detailed implementation roadmaps that address technical, operational, and organizational aspects of NDR adoption.

Skills Development initiatives should accompany NDR solution deployment to ensure organizations can effectively utilize their security investments. Training programs, certification courses, and knowledge transfer activities are essential for maximizing NDR solution value. Organizations may also consider managed service options to supplement internal capabilities.

Continuous Optimization processes should be established to ensure NDR solutions remain effective as threat landscapes and organizational requirements evolve. Regular performance reviews, configuration updates, and threat intelligence integration are necessary for maintaining optimal security posture. Organizations should plan for ongoing solution evolution and enhancement.

Strategic Integration with broader cybersecurity strategies ensures NDR solutions contribute effectively to overall organizational security objectives. NDR platforms should complement existing security tools and processes rather than creating additional complexity or operational silos. Integrated security architectures provide superior protection and operational efficiency.

Market growth trajectory indicates continued robust expansion driven by escalating cyber threats, regulatory requirements, and digital transformation initiatives. The NDR market is expected to maintain strong growth rates as organizations recognize the critical importance of network-based threat detection and response capabilities. Adoption rates are projected to increase significantly across all organizational sizes and industry verticals.

Technology evolution will focus on enhanced AI capabilities, improved automation, and better integration with emerging technologies such as 5G networks and edge computing environments. Next-generation NDR solutions will offer more sophisticated threat detection algorithms, reduced false positive rates, and seamless integration with cloud-native architectures. Innovation cycles are expected to accelerate as competition intensifies.

Market consolidation trends will likely continue as larger vendors acquire specialized NDR companies and smaller players struggle to compete with comprehensive security platforms. This consolidation may reduce vendor diversity but could result in more mature, feature-rich solutions. Organizations should consider vendor stability and long-term viability in their selection processes.

Geographic expansion will accelerate as NDR awareness grows in emerging markets and regulatory frameworks evolve to require comprehensive network monitoring capabilities. Asia-Pacific and Latin American regions represent significant growth opportunities for vendors willing to adapt their solutions to local requirements and market conditions.

Service model evolution toward managed and cloud-delivered NDR capabilities will continue as organizations seek to leverage specialized expertise without expanding internal teams. The managed services segment is expected to grow at above-average rates as organizations prioritize outcomes over technology ownership.

The Network Detection and Response market represents a critical and rapidly evolving segment of the cybersecurity industry, driven by escalating cyber threats, regulatory requirements, and organizational digital transformation initiatives. Market analysis reveals substantial growth potential supported by technological advancement, increasing security awareness, and expanding attack surfaces that traditional security solutions cannot adequately address.

Key market dynamics including AI integration, cloud adoption, and automation capabilities are reshaping solution offerings and customer expectations. Organizations are increasingly recognizing NDR solutions as essential components of comprehensive cybersecurity strategies, driving sustained market growth across various industry verticals and geographic regions. The competitive landscape continues to evolve through strategic acquisitions, technology partnerships, and innovation investments.

Future market prospects remain highly positive, with continued growth expected across all market segments and regions. Success in this market will depend on vendors’ ability to deliver sophisticated yet manageable solutions that integrate seamlessly with existing security infrastructure while providing demonstrable value and return on investment. Organizations investing in NDR capabilities today are positioning themselves for enhanced security resilience and competitive advantage in an increasingly challenging threat environment.

What is Network Detection And Response?

Network Detection And Response refers to a set of technologies and processes designed to detect and respond to security threats within a network. It involves monitoring network traffic, identifying anomalies, and taking action to mitigate potential risks.

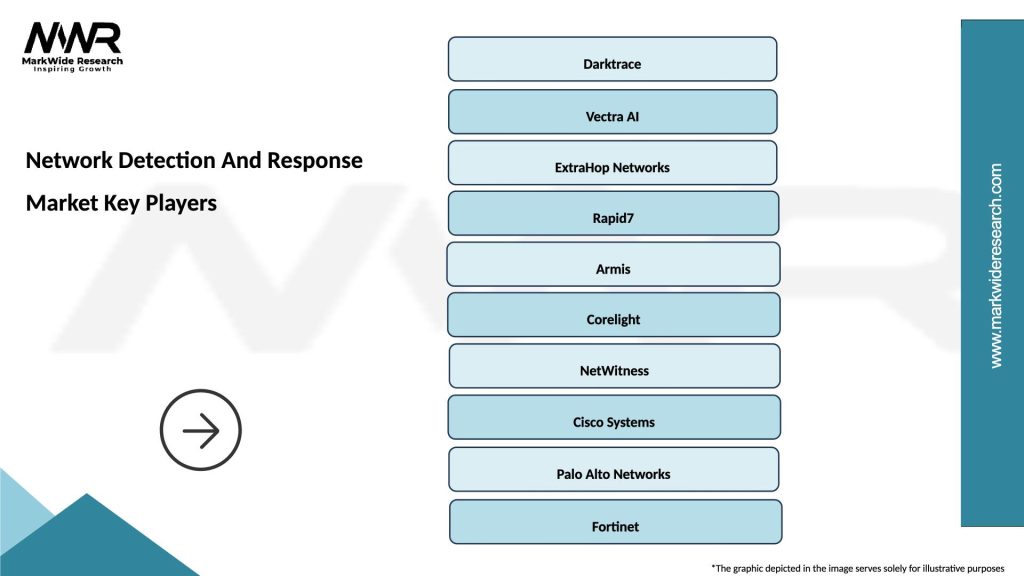

What are the key players in the Network Detection And Response Market?

Key players in the Network Detection And Response Market include companies like Darktrace, Vectra AI, and Cisco, which provide advanced solutions for threat detection and response. These companies focus on leveraging artificial intelligence and machine learning to enhance network security, among others.

What are the main drivers of growth in the Network Detection And Response Market?

The growth of the Network Detection And Response Market is driven by the increasing frequency of cyberattacks, the need for real-time threat detection, and the growing adoption of cloud-based solutions. Organizations are prioritizing network security to protect sensitive data and maintain compliance.

What challenges does the Network Detection And Response Market face?

Challenges in the Network Detection And Response Market include the complexity of integrating new solutions with existing systems and the shortage of skilled cybersecurity professionals. Additionally, evolving cyber threats require continuous updates and adaptations of detection technologies.

What opportunities exist in the Network Detection And Response Market?

Opportunities in the Network Detection And Response Market include the development of more sophisticated AI-driven solutions and the expansion into emerging markets. As organizations increasingly recognize the importance of cybersecurity, there is a growing demand for innovative detection and response technologies.

What trends are shaping the Network Detection And Response Market?

Trends in the Network Detection And Response Market include the rise of automated threat response systems and the integration of machine learning for enhanced detection capabilities. Additionally, there is a growing focus on user behavior analytics to identify potential insider threats.

Network Detection And Response Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, Healthcare, BFSI, Telecommunications |

| Solution | Intrusion Detection, Threat Intelligence, Incident Response, Security Analytics |

| Technology | AI-Driven, Machine Learning, Behavioral Analysis, Network Traffic Analysis |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Network Detection And Response Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at