444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Netherlands zero emission vehicle (ZEV) market is at the forefront of the global transition towards sustainable transportation solutions. With a strong focus on reducing greenhouse gas emissions, improving air quality, and promoting renewable energy use, the Dutch government has implemented ambitious policies and incentives to accelerate the adoption of zero emission vehicles. As a result, the Netherlands has emerged as a leading market for electric vehicles (EVs), hydrogen fuel cell vehicles (FCVs), and other clean mobility alternatives.

Meaning

The Netherlands zero emission vehicle market encompasses the development, production, and adoption of vehicles powered by alternative energy sources such as electricity, hydrogen, and renewable fuels. Zero emission vehicles aim to minimize or eliminate tailpipe emissions, offering environmentally friendly transportation options for consumers, businesses, and public fleets. With a strong commitment to sustainability and innovation, the Netherlands is paving the way for a zero emission future in the automotive sector.

Executive Summary

The Netherlands zero emission vehicle market is experiencing rapid growth driven by supportive government policies, technological advancements, and increasing consumer demand for clean transportation solutions. With a comprehensive charging infrastructure network, generous incentives for EV buyers, and ambitious targets for carbon neutrality, the Netherlands is poised to become a global leader in zero emission mobility.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Netherlands ZEV market is shaped by dynamic forces, including technological advancements, changing consumer preferences, and evolving government policies. Automakers are focusing on the development of more efficient and affordable ZEVs, while infrastructure providers are expanding the availability of charging and refueling stations. Government regulations are playing a key role in shaping the market, with strict emissions standards and incentives driving ZEV adoption. Additionally, businesses are aligning their fleet management strategies with sustainability goals, further fueling demand for zero-emission vehicles.

Regional Analysis

The Netherlands ZEV market shows significant regional variations based on infrastructure, population density, and government initiatives:

Competitive Landscape

Leading Companies in the Netherlands Zero Emission Vehicle Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

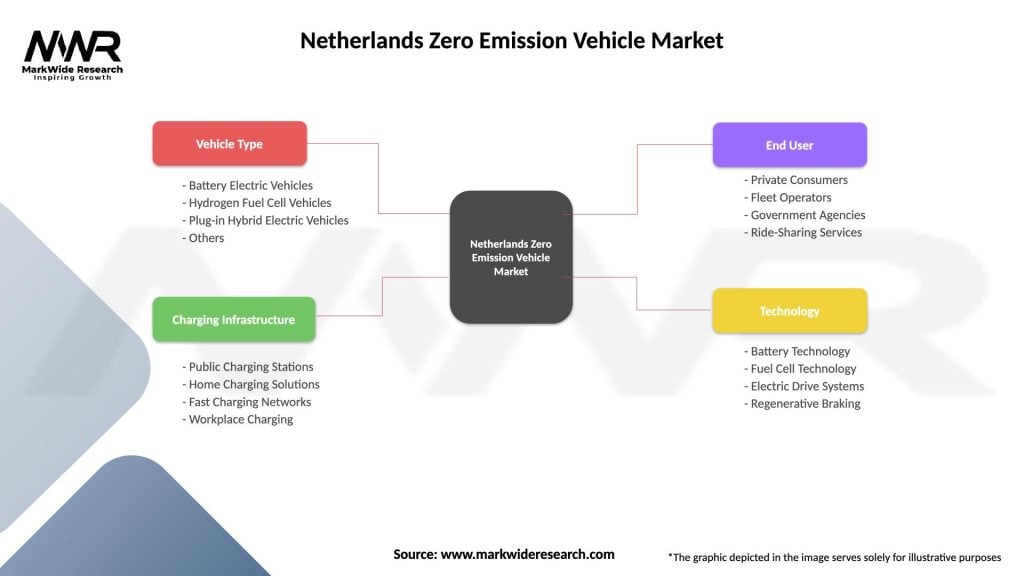

Segmentation

The Netherlands ZEV market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Netherlands ZEV market offers several benefits for stakeholders involved:

SWOT Analysis

Market Key Trends

Covid-19 Impact

The pandemic has both positively and negatively impacted the Netherlands ZEV market:

Key Industry Developments

Analyst Suggestions

To thrive in the Netherlands zero emission vehicle market, businesses should consider the following strategies:

Future Outlook

The future of the Netherlands zero emission vehicle market looks promising, with strong government support, a favorable regulatory environment, and a growing demand for sustainable transportation. The market is expected to witness significant growth in the adoption of electric and hydrogen vehicles, as well as further development of the charging and refueling infrastructure. As automakers introduce more affordable ZEV options and businesses prioritize fleet electrification, the market is set to play a critical role in the country’s transition to a low-carbon economy.

Conclusion

The Netherlands zero emission vehicle market is at the forefront of Europe’s transition to sustainable transportation. With strong government policies, extensive infrastructure, and increasing consumer demand for eco-friendly vehicles, the market is positioned for continued growth. However, challenges such as the high upfront cost of ZEVs and limited hydrogen infrastructure must be addressed to unlock the full potential of the market. By investing in technology, expanding infrastructure, and introducing more affordable options, the Netherlands can lead the way in creating a cleaner, greener future for transportation.

What is Zero Emission Vehicle?

Zero Emission Vehicles (ZEVs) are vehicles that produce no tailpipe emissions, including electric vehicles and hydrogen fuel cell vehicles. They are designed to reduce air pollution and greenhouse gas emissions, contributing to a more sustainable transportation system.

What are the key players in the Netherlands Zero Emission Vehicle Market?

Key players in the Netherlands Zero Emission Vehicle Market include Tesla, Nissan, and BMW, which are known for their electric vehicle offerings. Additionally, local companies like Lightyear are also making strides in the ZEV sector, among others.

What are the main drivers of the Netherlands Zero Emission Vehicle Market?

The main drivers of the Netherlands Zero Emission Vehicle Market include government incentives for electric vehicle adoption, increasing consumer awareness of environmental issues, and advancements in battery technology that enhance vehicle range and performance.

What challenges does the Netherlands Zero Emission Vehicle Market face?

Challenges in the Netherlands Zero Emission Vehicle Market include the need for extensive charging infrastructure, high initial costs of electric vehicles, and consumer concerns regarding battery life and range limitations.

What opportunities exist in the Netherlands Zero Emission Vehicle Market?

Opportunities in the Netherlands Zero Emission Vehicle Market include the potential for growth in public transportation electrification, increased investment in renewable energy sources for charging, and the development of innovative technologies such as autonomous electric vehicles.

What trends are shaping the Netherlands Zero Emission Vehicle Market?

Trends shaping the Netherlands Zero Emission Vehicle Market include the rise of shared mobility solutions, the integration of smart technology in vehicles, and a growing emphasis on sustainability in automotive manufacturing practices.

Netherlands Zero Emission Vehicle Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Battery Electric Vehicles, Hydrogen Fuel Cell Vehicles, Plug-in Hybrid Electric Vehicles, Others |

| Charging Infrastructure | Public Charging Stations, Home Charging Solutions, Fast Charging Networks, Workplace Charging |

| End User | Private Consumers, Fleet Operators, Government Agencies, Ride-Sharing Services |

| Technology | Battery Technology, Fuel Cell Technology, Electric Drive Systems, Regenerative Braking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Netherlands Zero Emission Vehicle Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at