444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands water consumption market represents a sophisticated ecosystem of water management, distribution, and utilization across residential, commercial, and industrial sectors. Water consumption patterns in the Netherlands reflect the country’s advanced infrastructure, environmental consciousness, and commitment to sustainable resource management. The market encompasses municipal water supply systems, private water services, industrial water usage, and innovative water conservation technologies that position the Netherlands as a global leader in water management practices.

Market dynamics indicate robust growth driven by urbanization, industrial expansion, and increasing environmental regulations. The Netherlands demonstrates exceptional water efficiency with consumption rates showing 15% improvement in efficiency over the past decade through advanced metering infrastructure and conservation initiatives. Regional distribution varies significantly, with the Randstad metropolitan area accounting for approximately 45% of total consumption due to high population density and industrial concentration.

Technological advancement plays a crucial role in shaping consumption patterns, with smart water meters achieving 78% penetration rate across residential sectors. The market benefits from comprehensive regulatory frameworks, substantial infrastructure investments, and growing awareness of water scarcity challenges that drive innovation in consumption optimization and resource conservation strategies.

The Netherlands water consumption market refers to the comprehensive ecosystem encompassing the procurement, distribution, utilization, and management of water resources across all economic sectors within Dutch territory. This market includes municipal water supply systems, industrial water usage, residential consumption patterns, commercial water services, and the technological infrastructure supporting efficient water distribution and conservation.

Water consumption in this context extends beyond simple usage metrics to include water quality management, treatment processes, recycling systems, and sustainable consumption practices. The market encompasses both potable water for human consumption and non-potable water for industrial processes, irrigation, and other commercial applications. Market participants include water utilities, technology providers, regulatory bodies, industrial consumers, and residential users who collectively shape consumption patterns and drive market evolution.

Comprehensive scope covers water sourcing from groundwater, surface water, and recycled sources, along with the infrastructure systems that enable efficient distribution and consumption monitoring. The market reflects the Netherlands’ unique geographical challenges, including water management in below-sea-level areas and the integration of flood protection with consumption systems.

Strategic positioning of the Netherlands water consumption market demonstrates exceptional resilience and innovation in addressing growing demand while maintaining environmental sustainability. The market exhibits steady growth patterns driven by population expansion, industrial development, and increasing focus on water efficiency optimization. Key performance indicators show consumption efficiency improvements of 12% annually through advanced technology adoption and conservation initiatives.

Market segmentation reveals diverse consumption patterns across residential, commercial, and industrial sectors, with residential consumption representing the largest segment by volume. Industrial water usage shows particular strength in manufacturing, agriculture, and energy sectors, contributing significantly to overall market dynamics. Technological integration accelerates through smart metering systems, IoT-enabled monitoring, and predictive analytics that enhance consumption optimization.

Competitive landscape features established water utilities, innovative technology providers, and emerging service companies that collectively drive market evolution. Regional variations in consumption patterns reflect local economic activities, population density, and infrastructure development levels. Future prospects indicate continued growth supported by sustainable development initiatives, regulatory compliance requirements, and increasing environmental awareness among consumers and businesses.

Primary market insights reveal fundamental trends shaping the Netherlands water consumption landscape:

Population growth serves as a fundamental driver for water consumption market expansion, with urban areas experiencing steady demographic increases that directly translate to higher residential and commercial water demand. Economic development across industrial sectors, particularly manufacturing, agriculture, and energy production, creates substantial demand for both process water and cooling applications.

Environmental regulations increasingly mandate efficient water usage and conservation practices, driving adoption of advanced technologies and sustainable consumption patterns. The Netherlands’ commitment to circular economy principles promotes water recycling, reuse systems, and closed-loop industrial processes that reshape traditional consumption models. Climate adaptation strategies respond to changing precipitation patterns and temperature variations that affect both supply availability and consumption requirements.

Technological advancement enables more sophisticated water management through smart meters, predictive analytics, and automated distribution systems that optimize consumption efficiency. Infrastructure modernization programs replace aging distribution networks with advanced systems that reduce losses and improve service reliability. Quality standards continue evolving upward, requiring enhanced treatment processes and monitoring systems that support premium water services across all market segments.

Infrastructure limitations present significant challenges in older urban areas where distribution networks require substantial capital investment for modernization and capacity expansion. Regulatory complexity creates compliance burdens that particularly affect smaller water utilities and service providers, limiting market entry and innovation adoption rates.

High capital requirements for advanced water treatment, distribution, and monitoring technologies create barriers for infrastructure upgrades and system expansions. Environmental constraints related to groundwater protection, surface water quality, and ecosystem preservation limit extraction rates and require expensive treatment processes for certain water sources.

Economic sensitivity affects industrial water consumption during economic downturns, creating volatility in demand patterns and revenue streams for water utilities. Technical complexity of integrating new technologies with existing infrastructure systems requires specialized expertise and extended implementation timelines. Public acceptance challenges emerge around water recycling initiatives and pricing adjustments necessary for sustainable system operation and expansion.

Smart city initiatives create substantial opportunities for integrated water management systems that combine consumption monitoring, quality control, and predictive maintenance capabilities. Industrial symbiosis programs enable water sharing and recycling between different industrial facilities, creating new service markets and efficiency optimization opportunities.

Technology innovation in areas such as membrane filtration, advanced oxidation processes, and AI-driven consumption optimization presents opportunities for market differentiation and premium service offerings. Circular economy principles drive demand for water recycling technologies, closed-loop systems, and resource recovery solutions that transform waste streams into valuable inputs.

International expansion opportunities exist for Dutch water management expertise and technologies in global markets facing similar water challenges. Public-private partnerships enable innovative financing models for infrastructure development and technology deployment. Data monetization through consumption analytics, predictive modeling, and optimization services creates new revenue streams beyond traditional water supply services.

Supply-demand equilibrium in the Netherlands water consumption market reflects sophisticated balancing mechanisms that account for seasonal variations, economic cycles, and long-term demographic trends. Demand patterns show increasing sophistication with peak consumption management, load balancing, and predictive demand forecasting becoming standard practices across major utilities.

Price dynamics incorporate environmental costs, infrastructure maintenance requirements, and quality improvement investments that support sustainable market development. Competition intensity varies by market segment, with residential services showing stable utility-based provision while industrial and commercial segments demonstrate increasing service differentiation and competitive offerings.

Innovation cycles accelerate through collaborative research initiatives, technology partnerships, and pilot program implementations that test new approaches to consumption optimization and service delivery. Regulatory evolution continues shaping market dynamics through updated standards, environmental requirements, and efficiency mandates that drive continuous improvement across all market participants. Stakeholder engagement increasingly influences market development through consumer advocacy, environmental groups, and industry associations that shape policy and operational practices.

Comprehensive research approach combines quantitative data analysis with qualitative market insights to provide thorough understanding of Netherlands water consumption market dynamics. Primary research includes structured interviews with water utility executives, industrial water managers, technology providers, and regulatory officials to capture current market perspectives and future outlook assessments.

Secondary research encompasses analysis of government statistics, utility reports, industry publications, and academic studies that provide historical context and trend analysis. Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification of key findings and market projections.

Market modeling utilizes advanced analytical techniques including regression analysis, scenario planning, and Monte Carlo simulations to project future market developments under various conditions. Segmentation analysis employs clustering techniques and demographic modeling to identify distinct market segments and consumption patterns. Competitive intelligence gathering includes analysis of company reports, technology patents, and strategic initiatives that shape market evolution and competitive positioning.

North Holland dominates the regional consumption landscape, accounting for approximately 32% of total market volume due to Amsterdam’s metropolitan area and high industrial concentration. The region demonstrates advanced infrastructure development with smart metering penetration exceeding 85% and strong adoption of water conservation technologies across residential and commercial sectors.

South Holland represents another major consumption center with 28% market share, driven by The Hague, Rotterdam, and surrounding urban areas. The region shows particular strength in industrial water usage, especially in petrochemical and shipping industries that require substantial process water volumes. Zeeland and surrounding coastal provinces demonstrate unique consumption patterns influenced by agricultural irrigation needs and tourism-related seasonal variations.

Eastern provinces including Gelderland and Overijssel show steady consumption growth driven by manufacturing expansion and residential development. These regions benefit from abundant groundwater resources while implementing advanced conservation measures to maintain sustainable extraction rates. Northern provinces exhibit lower consumption density but demonstrate innovation in agricultural water management and rural distribution system optimization.

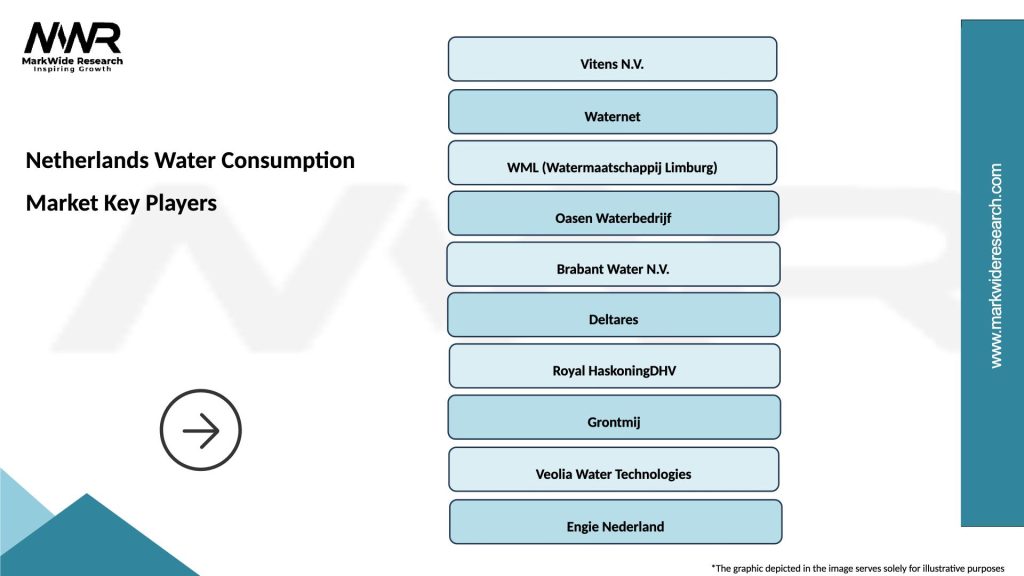

Market leadership is distributed among several key players who collectively shape the Netherlands water consumption market:

Technology providers including KWR Water Research Institute, Royal HaskoningDHV, and Deltares contribute significant innovation and research capabilities that support market development and efficiency improvements across the competitive landscape.

By End-User:

By Water Type:

By Technology:

Residential consumption demonstrates steady evolution toward greater efficiency and conservation awareness. Smart home integration enables automated consumption monitoring and optimization, with connected devices providing real-time usage feedback and leak detection capabilities. Behavioral changes driven by environmental consciousness and cost considerations result in reduced per-capita consumption while maintaining quality of life standards.

Industrial water usage shows increasing sophistication in process optimization and recycling implementation. Manufacturing sectors invest heavily in closed-loop systems that minimize freshwater intake and wastewater discharge. Energy industries develop advanced cooling systems and heat recovery technologies that optimize water efficiency while maintaining operational performance.

Commercial applications focus on sustainability credentials and operational cost optimization through efficient water management systems. Hospitality and retail sectors implement comprehensive conservation programs that reduce consumption while enhancing customer experience. Office buildings integrate water efficiency into green building certifications and corporate sustainability initiatives.

Agricultural consumption evolves through precision irrigation technologies, soil moisture monitoring, and crop-specific water management systems. Greenhouse operations achieve remarkable efficiency gains through recirculation systems and climate-controlled water delivery. Livestock applications benefit from automated watering systems and waste management integration that optimize resource utilization.

Water utilities benefit from advanced metering infrastructure that reduces operational costs, improves customer service, and enables predictive maintenance programs. Revenue optimization occurs through better demand forecasting, reduced non-revenue water, and premium service offerings that differentiate market positioning.

Industrial consumers achieve significant cost savings through process optimization, recycling implementation, and efficiency improvements that reduce both water procurement and wastewater treatment expenses. Environmental compliance becomes more manageable through comprehensive monitoring and reporting systems that ensure regulatory adherence.

Technology providers access expanding market opportunities through innovation in smart metering, treatment technologies, and data analytics services. Service differentiation enables premium pricing for advanced solutions that deliver measurable efficiency gains and environmental benefits.

Residential consumers benefit from improved service reliability, better water quality, and cost savings through conservation programs and efficient appliances. Environmental impact reduction aligns with sustainability values while maintaining convenience and quality of life standards.

Government stakeholders achieve policy objectives related to environmental protection, resource conservation, and sustainable development through market-driven efficiency improvements and innovation adoption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the water consumption market through IoT sensors, cloud-based analytics, and mobile applications that enable real-time monitoring and optimization. Predictive maintenance becomes standard practice, reducing system downtime and extending infrastructure lifespan through data-driven maintenance scheduling.

Sustainability integration drives adoption of circular economy principles, with water recycling and reuse becoming mainstream practices across industrial and commercial applications. Carbon footprint reduction influences water treatment and distribution system design, promoting energy-efficient technologies and renewable energy integration.

Customer engagement evolves through digital platforms, personalized consumption insights, and gamification approaches that encourage conservation behaviors. Demand response programs enable dynamic pricing and consumption management during peak periods or supply constraints.

Regulatory evolution continues toward more stringent environmental standards, quality requirements, and efficiency mandates that drive continuous improvement across market participants. Public-private collaboration increases through innovative financing models, technology partnerships, and shared infrastructure development initiatives.

Infrastructure modernization programs across major Dutch cities implement comprehensive smart water networks with advanced metering, leak detection, and quality monitoring capabilities. Amsterdam’s water system integration project demonstrates successful combination of supply, treatment, and flood protection services under unified management.

Technology partnerships between water utilities and innovation companies accelerate development of AI-driven consumption optimization, blockchain-based water trading platforms, and advanced treatment technologies. Research collaborations with universities and international organizations advance understanding of water-energy nexus and climate adaptation strategies.

Regulatory updates include revised drinking water standards, enhanced environmental protection requirements, and new efficiency mandates that shape market development priorities. International cooperation initiatives expand Dutch water expertise globally while bringing innovative technologies and practices back to domestic markets.

Investment programs focus on resilience building, climate adaptation, and technology upgrade initiatives that strengthen market foundation for future growth. Sustainability certifications become increasingly important for market differentiation and customer preference alignment.

Strategic recommendations for market participants emphasize technology adoption, sustainability integration, and customer engagement enhancement as key success factors. MarkWide Research analysis indicates that companies investing in smart infrastructure and data analytics capabilities achieve superior performance and market positioning.

Investment priorities should focus on predictive maintenance systems, customer portal development, and advanced treatment technologies that deliver measurable efficiency gains and service improvements. Partnership strategies with technology providers, research institutions, and international water companies can accelerate innovation adoption and market expansion opportunities.

Regulatory compliance requires proactive monitoring of evolving standards and early adoption of best practices that exceed minimum requirements. Sustainability initiatives should integrate environmental, social, and governance considerations into core business strategies rather than treating them as separate compliance activities.

Market differentiation opportunities exist through premium service offerings, specialized industrial solutions, and innovative financing models that address diverse customer needs and preferences. Data monetization strategies should balance privacy protection with value creation through analytics services and optimization consulting.

Market evolution over the next decade will be characterized by increasing digitalization, sustainability focus, and service sophistication that transforms traditional water utility models. Growth projections indicate steady expansion driven by population growth, industrial development, and infrastructure modernization requirements.

Technology integration will accelerate through AI-powered optimization systems, blockchain-based trading platforms, and advanced sensor networks that enable unprecedented efficiency and service quality levels. MWR projections suggest that smart water technologies will achieve 95% penetration across urban areas within the next five years.

Sustainability transformation will reshape market dynamics through circular economy implementation, carbon neutrality objectives, and ecosystem-based management approaches. Climate adaptation strategies will become increasingly important as weather patterns change and extreme events become more frequent.

International expansion opportunities will grow as Dutch water management expertise gains recognition globally, creating export markets for technologies, services, and consulting capabilities. Innovation ecosystems will strengthen through increased collaboration between utilities, technology companies, research institutions, and government agencies.

The Netherlands water consumption market represents a sophisticated and rapidly evolving ecosystem that combines advanced infrastructure, innovative technologies, and strong sustainability commitments to deliver exceptional water services across all economic sectors. Market dynamics reflect the country’s leadership in water management, environmental stewardship, and technological innovation that positions the Netherlands as a global benchmark for sustainable water consumption practices.

Strategic opportunities abound for market participants who embrace digital transformation, sustainability integration, and customer-centric service delivery models. The market’s foundation of advanced infrastructure, regulatory stability, and innovation culture provides strong support for continued growth and development. Future success will depend on adaptability to changing environmental conditions, technological advancement, and evolving customer expectations that shape market evolution.

Investment in smart technologies, sustainable practices, and collaborative partnerships will determine competitive positioning and long-term market success. The Netherlands water consumption market continues demonstrating that environmental responsibility and economic prosperity can advance together through innovative approaches to resource management and service delivery excellence.

What is Water Consumption?

Water consumption refers to the total amount of water used by individuals, industries, and agriculture within a specific area. In the context of the Netherlands, it encompasses domestic use, agricultural irrigation, and industrial processes.

What are the key players in the Netherlands Water Consumption Market?

Key players in the Netherlands Water Consumption Market include Vitens, Waternet, and Brabant Water, which provide essential water services and infrastructure. These companies focus on sustainable water management and efficient distribution, among others.

What are the main drivers of the Netherlands Water Consumption Market?

The main drivers of the Netherlands Water Consumption Market include increasing population density, rising agricultural demands, and the need for sustainable water management practices. Additionally, urbanization and climate change are influencing water consumption patterns.

What challenges does the Netherlands Water Consumption Market face?

The Netherlands Water Consumption Market faces challenges such as water scarcity, pollution of water sources, and the impact of climate change on water availability. Regulatory compliance and the need for infrastructure upgrades also pose significant hurdles.

What opportunities exist in the Netherlands Water Consumption Market?

Opportunities in the Netherlands Water Consumption Market include advancements in water recycling technologies, increased investment in sustainable water infrastructure, and the potential for smart water management systems. These innovations can enhance efficiency and reduce waste.

What trends are shaping the Netherlands Water Consumption Market?

Trends shaping the Netherlands Water Consumption Market include a growing emphasis on sustainability, the adoption of smart metering technologies, and increased public awareness of water conservation. These trends are driving changes in consumer behavior and industry practices.

Netherlands Water Consumption Market

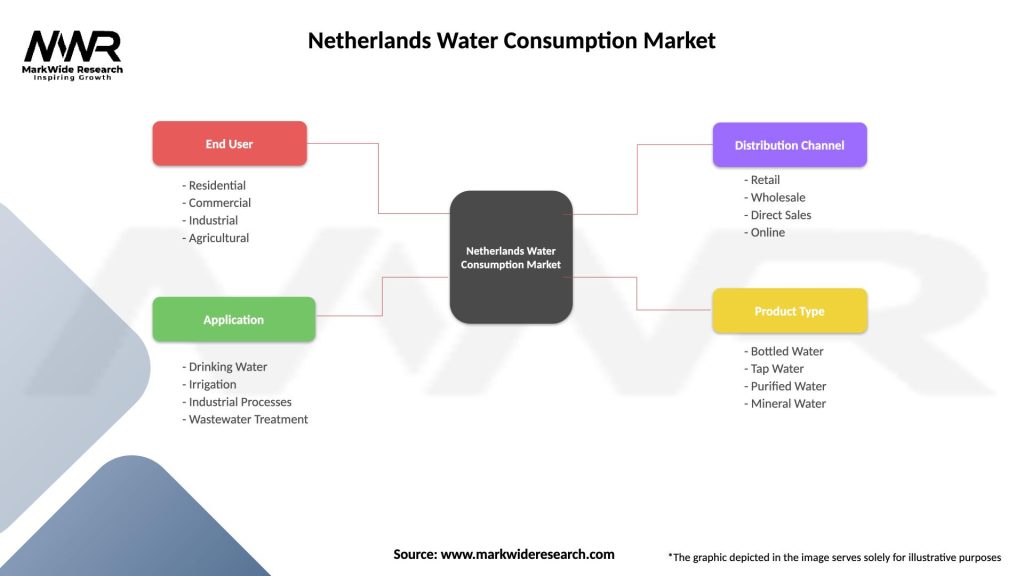

| Segmentation Details | Description |

|---|---|

| End User | Residential, Commercial, Industrial, Agricultural |

| Application | Drinking Water, Irrigation, Industrial Processes, Wastewater Treatment |

| Distribution Channel | Retail, Wholesale, Direct Sales, Online |

| Product Type | Bottled Water, Tap Water, Purified Water, Mineral Water |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at