444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands telecom market represents one of Europe’s most advanced and competitive telecommunications landscapes, characterized by robust infrastructure development and high digital adoption rates. Market dynamics in the Netherlands showcase exceptional penetration of fiber-optic networks, with coverage reaching approximately 85% of households nationwide. The Dutch telecommunications sector demonstrates remarkable resilience and innovation, driven by substantial investments in 5G technology and next-generation network infrastructure.

Digital transformation initiatives across the Netherlands have accelerated telecommunications service adoption, particularly in enterprise segments and smart city applications. The market exhibits strong competitive intensity among major operators including KPN, VodafoneZiggo, and T-Mobile Netherlands, each pursuing aggressive expansion strategies in mobile and fixed-line services. Consumer demand for high-speed internet connectivity and integrated digital services continues driving market evolution, with mobile data consumption growing at approximately 12% annually.

Regulatory frameworks established by the Authority for Consumers and Markets (ACM) promote fair competition while encouraging infrastructure investment. The Netherlands’ strategic position as a European digital hub enhances its telecommunications market attractiveness, supporting both domestic growth and international connectivity requirements. Innovation ecosystems throughout major cities foster telecommunications technology development, positioning the market for sustained expansion in emerging technologies and service offerings.

The Netherlands telecom market refers to the comprehensive ecosystem of telecommunications services, infrastructure, and technologies operating within Dutch borders, encompassing mobile communications, fixed-line services, internet connectivity, and emerging digital solutions. This market includes traditional voice services, broadband internet provision, mobile data services, enterprise telecommunications solutions, and advanced technologies such as 5G networks and Internet of Things (IoT) connectivity.

Market scope extends beyond basic communication services to include cloud-based solutions, managed network services, cybersecurity offerings, and digital transformation enablers for businesses and consumers. The Dutch telecommunications landscape integrates multiple service delivery platforms, from legacy copper networks to cutting-edge fiber-optic infrastructure and wireless technologies. Service providers operate across various segments including residential consumers, small and medium enterprises, large corporations, and government entities.

Technological convergence within the Netherlands telecom market creates synergies between traditional telecommunications services and emerging digital technologies, enabling comprehensive connectivity solutions that support the country’s digital economy objectives and smart nation initiatives.

Strategic positioning of the Netherlands telecom market reflects exceptional infrastructure maturity and competitive dynamics that drive continuous innovation and service enhancement. The market demonstrates strong fundamentals across all major segments, with particularly robust performance in fiber-optic deployment and mobile network advancement. Investment flows into next-generation technologies continue supporting market expansion, with operators allocating significant resources toward 5G rollout and network modernization initiatives.

Consumer adoption patterns indicate growing demand for integrated digital services, with approximately 78% of households utilizing multiple telecommunications services from single providers. Enterprise segment growth remains particularly strong, driven by digital transformation requirements and cloud migration trends. Market consolidation activities have created stronger competitive positions while maintaining healthy competition levels that benefit consumers through improved service quality and competitive pricing.

Regulatory support for infrastructure development and fair competition practices creates favorable conditions for sustained market growth. The Netherlands’ position as a European digital gateway enhances market attractiveness for international telecommunications providers and technology companies seeking regional expansion opportunities. Future prospects remain highly positive, supported by continued investment in advanced technologies and growing demand for sophisticated telecommunications solutions across all market segments.

Infrastructure excellence distinguishes the Netherlands telecom market through comprehensive fiber-optic coverage and advanced mobile network deployment. Key insights reveal several critical market characteristics that define competitive dynamics and growth opportunities:

Market maturity enables sophisticated service offerings while maintaining growth potential through technological advancement and service innovation. These insights demonstrate the Netherlands’ position as a leading European telecommunications market with exceptional infrastructure and competitive dynamics.

Digital transformation initiatives across Dutch enterprises and government organizations create substantial demand for advanced telecommunications services and infrastructure. Organizations increasingly require sophisticated connectivity solutions to support remote work capabilities, cloud computing adoption, and digital service delivery. Technological advancement in areas such as artificial intelligence, machine learning, and IoT applications drives demand for high-capacity, low-latency network services that traditional telecommunications infrastructure cannot adequately support.

Consumer behavior evolution toward digital-first lifestyles increases demand for integrated telecommunications services that combine mobile, fixed-line, and digital entertainment offerings. The Netherlands’ high smartphone penetration and digital literacy rates create favorable conditions for advanced service adoption. Government initiatives supporting digital economy development and smart city implementations require robust telecommunications infrastructure, driving public and private sector investment in network expansion and modernization.

Economic factors including the Netherlands’ position as a European business hub and logistics center create demand for enterprise-grade telecommunications services. International companies establishing European operations require sophisticated connectivity solutions for global communications and data management. Competitive dynamics among major operators drive continuous service improvement and innovation, creating positive market conditions that benefit consumers and businesses through enhanced service quality and competitive pricing structures.

Infrastructure costs associated with next-generation network deployment create significant financial challenges for telecommunications operators, particularly in rural and less densely populated areas where return on investment timelines extend considerably. Regulatory complexity surrounding spectrum allocation, network sharing agreements, and consumer protection requirements can slow market development and increase operational compliance costs for service providers.

Market saturation in traditional telecommunications services limits growth opportunities in voice and basic internet services, requiring operators to develop new revenue streams through advanced technologies and value-added services. Competitive pressure from international technology companies offering over-the-top services reduces traditional telecommunications revenue while increasing network capacity requirements without corresponding revenue increases.

Cybersecurity concerns and data privacy regulations require substantial investment in security infrastructure and compliance systems, increasing operational costs while potentially limiting service innovation speed. Economic uncertainty and changing business requirements can reduce enterprise spending on telecommunications services, particularly for advanced solutions that require significant upfront investment. Technology obsolescence risks require continuous investment in infrastructure upgrades, creating ongoing capital expenditure pressures that can limit profitability and expansion capabilities.

5G technology deployment creates substantial opportunities for new service development and revenue generation across multiple market segments. Advanced mobile networks enable innovative applications in areas such as autonomous vehicles, industrial automation, and augmented reality services. Internet of Things expansion presents significant growth potential as smart city initiatives, industrial IoT applications, and consumer connected devices require sophisticated connectivity solutions that generate recurring revenue streams.

Edge computing development offers opportunities for telecommunications operators to provide low-latency computing services closer to end users, creating new revenue opportunities while leveraging existing network infrastructure investments. Cloud services integration allows operators to expand beyond traditional connectivity services into comprehensive digital solutions that address enterprise digital transformation requirements.

International expansion opportunities exist for Dutch telecommunications companies to leverage their advanced infrastructure expertise and service capabilities in other European markets. Partnership opportunities with technology companies, content providers, and enterprise software vendors create potential for innovative service bundles and integrated solutions. Sustainability initiatives including green technology adoption and energy-efficient network operations create competitive advantages while addressing environmental concerns and regulatory requirements for sustainable business practices.

Competitive forces within the Netherlands telecom market create dynamic conditions that drive continuous innovation and service improvement. Major operators maintain market positions through differentiated service offerings, network quality advantages, and customer relationship management excellence. Technology evolution requires operators to balance investment in next-generation infrastructure with maintaining existing network performance and reliability standards.

Consumer expectations for seamless connectivity, high-speed services, and integrated digital experiences drive service development priorities and investment allocation decisions. According to MarkWide Research analysis, customer satisfaction levels directly correlate with network performance and service integration capabilities. Regulatory dynamics influence market structure through spectrum allocation decisions, infrastructure sharing requirements, and consumer protection measures that affect competitive strategies and operational approaches.

Economic conditions impact both consumer and enterprise spending patterns on telecommunications services, creating cyclical demand variations that operators must manage through flexible service offerings and pricing strategies. Technological convergence between telecommunications, media, and technology sectors creates both competitive threats and collaboration opportunities that reshape traditional market boundaries. Investment cycles in infrastructure development require careful timing and resource allocation to maximize return on investment while maintaining competitive positioning in rapidly evolving market conditions.

Comprehensive analysis of the Netherlands telecom market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include structured interviews with industry executives, telecommunications operators, regulatory officials, and key market participants to gather firsthand perspectives on market conditions, competitive dynamics, and future trends. Secondary research incorporates analysis of published industry reports, regulatory filings, financial statements, and market data from authoritative sources.

Quantitative analysis utilizes statistical modeling techniques to analyze market trends, growth patterns, and competitive positioning across different market segments and geographic regions. Qualitative assessment methods include expert interviews, focus group discussions, and case study analysis to understand market dynamics, customer behavior patterns, and strategic decision-making processes among market participants.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review, and statistical verification methods. Market segmentation analysis employs demographic, geographic, and behavioral criteria to identify distinct market segments and their specific characteristics. Trend analysis incorporates historical data review, current market assessment, and forward-looking projections to identify emerging opportunities and potential challenges facing market participants in the evolving telecommunications landscape.

Amsterdam metropolitan area represents the largest telecommunications market concentration within the Netherlands, accounting for approximately 35% of total market activity due to high population density, business concentration, and advanced infrastructure deployment. The region demonstrates exceptional demand for enterprise telecommunications services, driven by international business presence and technology company operations. Rotterdam-The Hague corridor shows strong market performance with significant port-related telecommunications requirements and government sector demand.

Northern provinces including Groningen and Friesland present unique market characteristics with lower population density but growing demand for rural connectivity solutions and agricultural technology applications. Southern regions encompassing North Brabant and Limburg demonstrate robust industrial telecommunications demand, particularly in manufacturing and logistics sectors that require sophisticated connectivity solutions.

Eastern Netherlands markets show balanced growth across residential and business segments, with particular strength in technology sector telecommunications requirements. Infrastructure distribution varies significantly across regions, with urban areas achieving near-universal fiber coverage while rural areas continue requiring targeted investment for comprehensive service availability. Regional competition dynamics reflect national market trends while incorporating local market characteristics and specific customer requirements that influence service development and pricing strategies.

Market leadership in the Netherlands telecom sector is characterized by intense competition among several major operators, each maintaining distinct competitive advantages and market positioning strategies. The competitive environment promotes innovation while ensuring comprehensive service coverage across all market segments.

Competitive strategies emphasize network quality, service integration, and customer experience differentiation. Market share distribution remains relatively stable with ongoing competition for customer acquisition and retention across all service categories. Innovation focus areas include 5G deployment, IoT services, and enterprise digital transformation solutions that create competitive advantages and new revenue opportunities.

Service-based segmentation of the Netherlands telecom market reveals distinct categories with unique growth characteristics and competitive dynamics. Each segment demonstrates specific customer requirements and market development patterns that influence operator strategies and investment priorities.

By Service Type:

By Customer Segment:

By Technology Platform:

Mobile telecommunications category demonstrates exceptional growth momentum driven by 5G network deployment and increasing mobile data consumption patterns. Consumer adoption of unlimited data plans reaches approximately 82% of mobile subscribers, reflecting strong demand for high-capacity mobile services. Enterprise mobile solutions show particular strength in IoT applications and mobile workforce enablement services.

Fixed-line services category experiences transformation through fiber-optic infrastructure deployment, with traditional voice services declining while high-speed internet services show robust growth. Fiber adoption rates continue accelerating as consumers and businesses recognize performance advantages over legacy copper-based services. Bundled service offerings combining fixed-line, mobile, and entertainment services gain market traction.

Enterprise telecommunications category shows consistent growth driven by digital transformation initiatives and cloud adoption trends. Managed services demand increases as organizations seek to outsource telecommunications infrastructure management while focusing on core business activities. Security services integration becomes increasingly important as cybersecurity concerns influence telecommunications service selection decisions.

Emerging technology categories including IoT connectivity, edge computing, and artificial intelligence-enabled services represent significant growth opportunities. These categories require substantial investment in network infrastructure and service development capabilities while offering potential for premium pricing and differentiated service offerings.

Telecommunications operators benefit from the Netherlands’ advanced regulatory framework that promotes fair competition while encouraging infrastructure investment and innovation. Market stability and predictable regulatory environment enable long-term planning and substantial capital investment in next-generation technologies. Strong consumer purchasing power and high digital adoption rates create favorable conditions for premium service offerings and revenue growth.

Enterprise customers gain access to world-class telecommunications infrastructure that supports digital transformation initiatives and competitive business operations. Service quality standards in the Netherlands enable reliable business communications and data connectivity that support international operations and complex business requirements. Competitive market conditions ensure reasonable pricing and continuous service improvement.

Technology vendors and equipment suppliers benefit from ongoing network modernization and expansion activities that create substantial demand for advanced telecommunications equipment and solutions. Innovation ecosystem in the Netherlands supports technology development and testing environments for next-generation telecommunications solutions.

Consumers enjoy access to high-quality telecommunications services at competitive prices, with comprehensive coverage and advanced features that support digital lifestyle requirements. Service integration opportunities provide convenience and value through bundled offerings that combine multiple telecommunications and digital services from single providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Network virtualization and software-defined networking adoption accelerate across Dutch telecommunications operators as they seek to improve operational efficiency and service flexibility. Cloud-native network functions enable rapid service deployment and reduced infrastructure costs while supporting innovative service offerings. Operators increasingly adopt artificial intelligence and machine learning technologies for network optimization, predictive maintenance, and customer service enhancement.

Sustainability initiatives gain prominence as telecommunications operators focus on reducing energy consumption and environmental impact through green technology adoption and renewable energy utilization. Circular economy principles influence equipment procurement and network deployment strategies, with emphasis on recyclable materials and energy-efficient operations.

Edge computing deployment expands as operators recognize opportunities to provide low-latency computing services closer to end users, supporting applications such as autonomous vehicles, industrial automation, and augmented reality services. Network slicing capabilities enable customized service delivery for specific applications and customer requirements, creating opportunities for premium pricing and differentiated service offerings.

Customer experience focus intensifies as operators invest in digital customer service platforms, self-service capabilities, and personalized service offerings. Data analytics utilization improves customer insights and enables targeted service development and marketing strategies that enhance customer satisfaction and retention rates.

Infrastructure investments continue at substantial levels as major operators expand fiber-optic networks and deploy 5G infrastructure across urban and suburban areas. Network sharing agreements between operators enable more efficient infrastructure utilization while reducing deployment costs and environmental impact. Recent developments include expanded coverage in rural areas and enhanced network capacity in high-demand urban locations.

Merger and acquisition activity shapes market structure as operators seek to achieve scale advantages and expand service capabilities. Strategic partnerships between telecommunications operators and technology companies create opportunities for innovative service development and market expansion. International collaboration initiatives enhance the Netherlands’ position as a European telecommunications hub.

Regulatory developments include spectrum allocation decisions that support 5G deployment and policies that promote infrastructure sharing and competition. MWR analysis indicates that regulatory support for innovation and investment creates favorable conditions for continued market development. Technology standardization efforts ensure interoperability and support for international connectivity requirements.

Innovation initiatives include pilot programs for emerging technologies such as 6G research, quantum communications, and advanced IoT applications. Sustainability programs focus on reducing network energy consumption and implementing circular economy principles in network operations and equipment management.

Strategic focus on next-generation technology deployment should prioritize areas with highest return on investment potential while ensuring comprehensive coverage across all market segments. Investment allocation decisions should balance infrastructure development with service innovation to maintain competitive positioning in rapidly evolving market conditions. Operators should consider partnership strategies that leverage complementary capabilities while reducing individual investment requirements.

Customer experience enhancement should remain a top priority through digital service platforms, personalized offerings, and proactive customer support capabilities. Data analytics utilization can provide competitive advantages through improved customer insights and targeted service development. Service integration opportunities should be pursued to create comprehensive solutions that address multiple customer requirements through single provider relationships.

Market expansion strategies should consider both domestic growth opportunities in emerging technology segments and international expansion possibilities that leverage Dutch telecommunications expertise. Sustainability initiatives should be integrated into core business strategies to address environmental concerns while potentially reducing operational costs. Regulatory engagement remains important to ensure favorable policy development and spectrum allocation decisions that support long-term market growth and innovation capabilities.

Growth prospects for the Netherlands telecom market remain highly positive, supported by continued investment in advanced technologies and growing demand for sophisticated telecommunications solutions. 5G network expansion is expected to reach comprehensive coverage within the next three years, enabling new service categories and revenue opportunities. Digital transformation trends across all economic sectors will continue driving demand for enterprise telecommunications services and integrated digital solutions.

Technology evolution toward 6G research and development positions the Netherlands as a potential leader in next-generation mobile communications technology. IoT market expansion is projected to grow at approximately 18% annually over the next five years, creating substantial opportunities for connectivity service providers. Edge computing deployment will accelerate as applications requiring ultra-low latency become more prevalent across multiple industries.

Market consolidation may continue as operators seek scale advantages and expanded service capabilities, while maintaining competitive market conditions that benefit consumers and businesses. International connectivity requirements will grow as the Netherlands strengthens its position as a European digital hub, supporting both domestic economic growth and international business operations. Sustainability focus will increasingly influence technology choices and operational strategies, creating opportunities for operators that successfully integrate environmental considerations into their business models.

The Netherlands telecom market demonstrates exceptional strength across all major performance indicators, from infrastructure quality and competitive dynamics to innovation capabilities and regulatory support. Market fundamentals remain robust, with continued investment in next-generation technologies and growing demand for sophisticated telecommunications solutions across residential, enterprise, and government segments. The combination of advanced infrastructure, competitive market conditions, and supportive regulatory framework creates favorable conditions for sustained growth and continued innovation.

Strategic opportunities in emerging technologies such as 5G, IoT, and edge computing provide substantial potential for revenue growth and market expansion. Competitive positioning among major operators continues driving service improvement and innovation while maintaining market stability and customer choice. The Netherlands’ position as a European digital hub enhances market attractiveness and supports both domestic growth and international expansion opportunities for telecommunications operators and technology companies.

Future prospects remain highly positive, supported by continued technology advancement, growing digital adoption, and favorable economic conditions that support telecommunications service demand across all market segments. The Netherlands telecom market is well-positioned to maintain its leadership position in European telecommunications while continuing to drive innovation and service excellence that benefits all market participants and stakeholders.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as mobile communication, internet access, and broadcasting, which are essential for personal and business connectivity.

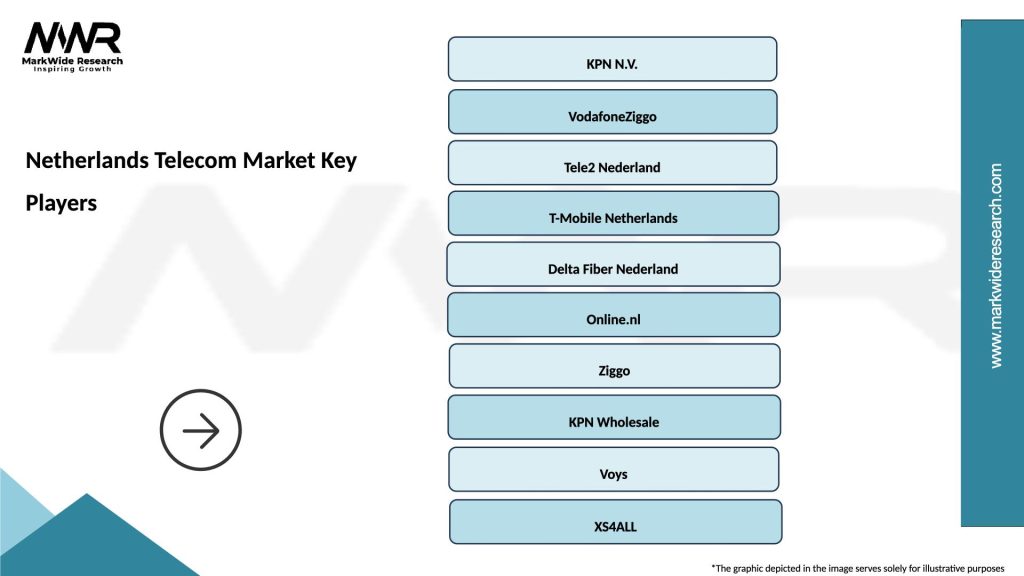

What are the key players in the Netherlands Telecom Market?

Key players in the Netherlands Telecom Market include KPN, VodafoneZiggo, and T-Mobile Netherlands, which provide a range of services from mobile and fixed-line telephony to broadband internet and television services, among others.

What are the growth factors driving the Netherlands Telecom Market?

The Netherlands Telecom Market is driven by increasing demand for high-speed internet, the proliferation of mobile devices, and advancements in technology such as 5G networks. Additionally, the growing trend of remote work and digital services is further fueling market growth.

What challenges does the Netherlands Telecom Market face?

Challenges in the Netherlands Telecom Market include intense competition among service providers, regulatory pressures, and the need for continuous investment in infrastructure to keep up with technological advancements. These factors can impact profitability and service quality.

What opportunities exist in the Netherlands Telecom Market?

Opportunities in the Netherlands Telecom Market include the expansion of IoT applications, the rollout of 5G technology, and the increasing demand for digital services in sectors like healthcare and education. These trends present avenues for innovation and growth.

What trends are shaping the Netherlands Telecom Market?

Trends shaping the Netherlands Telecom Market include the shift towards digital transformation, the rise of cloud-based services, and the growing importance of cybersecurity. Additionally, consumer preferences are shifting towards bundled services and enhanced customer experiences.

Netherlands Telecom Market

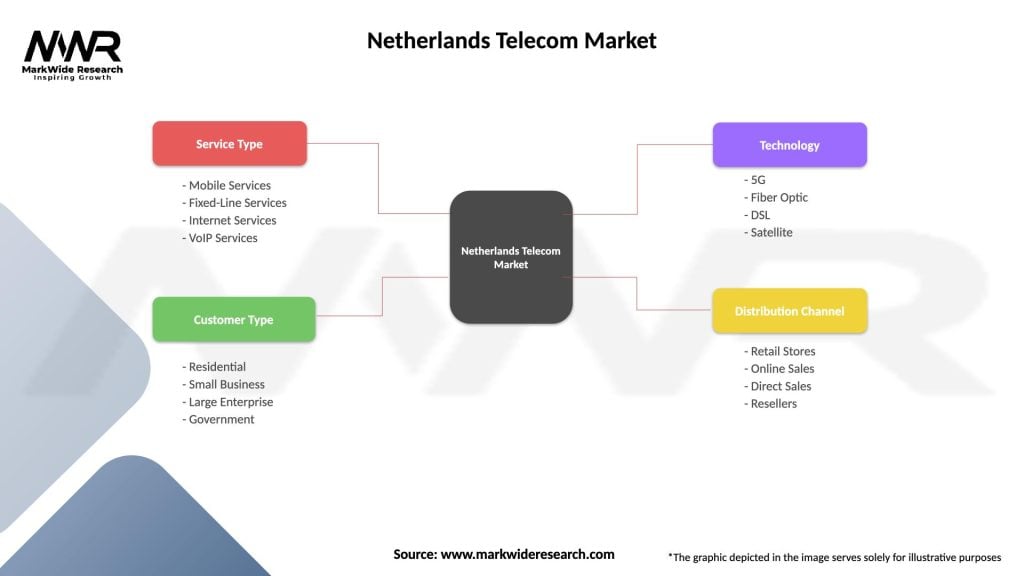

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile Services, Fixed-Line Services, Internet Services, VoIP Services |

| Customer Type | Residential, Small Business, Large Enterprise, Government |

| Technology | 5G, Fiber Optic, DSL, Satellite |

| Distribution Channel | Retail Stores, Online Sales, Direct Sales, Resellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at