444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands pet food market represents a dynamic and rapidly evolving sector within the European pet care industry, characterized by sophisticated consumer preferences and premium product positioning. Dutch pet owners demonstrate exceptional commitment to their companion animals’ nutritional well-being, driving demand for high-quality, specialized pet food products across multiple categories. The market encompasses traditional dry and wet food segments alongside emerging categories including organic, natural, and functional pet nutrition products.

Market dynamics in the Netherlands reflect broader European trends toward premiumization and health-conscious pet ownership, with consumers increasingly viewing pets as family members deserving optimal nutrition. The sector benefits from strong purchasing power among Dutch consumers and a well-established retail infrastructure supporting both traditional and online distribution channels. Growth trajectories indicate sustained expansion driven by increasing pet ownership rates, particularly among urban households, and rising expenditure per pet on premium nutrition products.

Innovation leadership characterizes the Dutch market landscape, with manufacturers introducing advanced formulations targeting specific health conditions, life stages, and dietary preferences. The market demonstrates robust growth potential supported by demographic trends including an aging population seeking companionship and younger consumers prioritizing pet wellness as part of their lifestyle choices.

The Netherlands pet food market refers to the comprehensive ecosystem of manufactured nutritional products designed for domestic companion animals, including dogs, cats, birds, fish, and small mammals, distributed through retail channels across the Dutch territory. This market encompasses all commercial pet nutrition products from basic maintenance diets to specialized therapeutic and premium formulations.

Market scope includes dry kibble, wet canned foods, treats and snacks, raw and freeze-dried products, and emerging categories such as fresh and refrigerated pet meals. The definition extends beyond traditional pet food to include nutritional supplements, functional foods targeting specific health outcomes, and specialized diets for pets with medical conditions or dietary restrictions.

Industry boundaries encompass manufacturers, importers, distributors, retailers, and service providers supporting the pet nutrition value chain. The market serves diverse pet ownership segments from budget-conscious consumers seeking value-oriented products to premium buyers demanding organic, natural, and scientifically formulated nutrition solutions for their companion animals.

Strategic positioning of the Netherlands pet food market reflects a mature, sophisticated consumer base driving demand for premium and super-premium pet nutrition products. The market demonstrates resilient growth characteristics supported by stable pet ownership rates, increasing humanization of pets, and growing awareness of nutrition’s role in pet health and longevity.

Key market drivers include rising disposable incomes, urbanization trends supporting smaller pet ownership, and demographic shifts toward pet-friendly households. Premium segment expansion represents the most significant growth opportunity, with consumers increasingly willing to invest in high-quality nutrition products that promise health benefits and enhanced quality of life for their pets.

Competitive landscape features a mix of global multinational corporations and specialized regional brands, with market leadership determined by product innovation, brand trust, and distribution effectiveness. Digital transformation increasingly influences purchasing decisions, with online channels gaining market share and direct-to-consumer brands emerging as significant competitors to traditional retail models.

Future outlook indicates continued market expansion driven by product innovation, category diversification, and evolving consumer preferences toward natural, sustainable, and health-focused pet nutrition solutions. The market benefits from favorable regulatory environment and strong consumer spending power supporting premium product adoption.

Consumer behavior analysis reveals sophisticated purchasing patterns among Dutch pet owners, with decision-making influenced by veterinary recommendations, ingredient transparency, and brand reputation. Premium positioning dominates market growth, with consumers demonstrating willingness to pay higher prices for products promising superior nutrition and health benefits.

Demographic transformation serves as the primary catalyst for Netherlands pet food market expansion, with changing household compositions and lifestyle preferences supporting increased pet adoption rates. Urbanization trends create favorable conditions for pet ownership, particularly smaller companion animals suitable for apartment living, driving demand for convenient, high-quality nutrition solutions.

Income growth among Dutch consumers enables higher spending on pet care products, with pet food representing the largest category within overall pet expenditure. Pet humanization trends fundamentally reshape consumer expectations, with owners increasingly viewing pets as family members deserving premium nutrition comparable to human food quality standards.

Health awareness drives demand for functional pet foods targeting specific health outcomes, including joint health, digestive wellness, skin and coat condition, and weight management. Veterinary influence strengthens as professional recommendations carry significant weight in consumer decision-making processes, particularly for therapeutic and prescription diet products.

Convenience factors support market growth as busy lifestyles create demand for easy-to-serve, nutritionally complete products that simplify pet care routines. Digital connectivity enables informed purchasing decisions through online research, reviews, and direct-to-consumer subscription services offering convenience and cost savings.

Economic sensitivity poses potential challenges to market growth during periods of economic uncertainty, as pet food purchases may face budget constraints despite strong emotional attachment to pets. Price volatility in raw material costs, particularly protein sources and grains, creates margin pressure for manufacturers and potential price increases for consumers.

Regulatory complexity surrounding pet food safety, labeling requirements, and health claims creates compliance costs and market entry barriers for smaller manufacturers. Supply chain disruptions can impact product availability and cost structures, particularly for imported ingredients and finished products.

Market saturation in traditional segments limits growth opportunities for established brands, requiring continuous innovation and differentiation to maintain market position. Consumer skepticism regarding marketing claims and ingredient quality may slow adoption of new products without strong scientific backing or veterinary endorsement.

Competition intensity from both established multinational brands and emerging direct-to-consumer companies creates pricing pressure and requires significant marketing investment to maintain market share. Retail consolidation may reduce distribution opportunities for smaller brands while increasing the bargaining power of major retail chains.

Premium segment expansion presents the most significant growth opportunity, with consumers increasingly willing to invest in high-quality nutrition products that promise enhanced pet health and longevity. Functional food development offers substantial potential for manufacturers capable of creating scientifically backed formulations targeting specific health conditions and life stages.

E-commerce channel development provides opportunities for both established brands and new market entrants to reach consumers directly, offering personalized nutrition solutions and subscription-based convenience services. Sustainability positioning creates competitive advantages for brands emphasizing environmental responsibility through sustainable sourcing, eco-friendly packaging, and carbon-neutral operations.

Customization trends enable premium pricing for personalized nutrition solutions based on individual pet characteristics, health status, and owner preferences. Raw and fresh food segments represent emerging opportunities for brands capable of managing cold chain logistics and meeting safety requirements for minimally processed products.

Senior pet nutrition offers growth potential as the pet population ages and requires specialized formulations supporting age-related health challenges. International expansion opportunities exist for successful Dutch brands to leverage their premium positioning in neighboring European markets with similar consumer preferences.

Competitive forces shape the Netherlands pet food market through continuous innovation cycles, brand positioning strategies, and distribution channel optimization. Consumer empowerment through digital information access creates more informed purchasing decisions and higher expectations for product transparency and quality.

Supply chain evolution reflects changing sourcing strategies as manufacturers seek sustainable, traceable ingredients while managing cost pressures and quality requirements. Retail transformation encompasses both traditional channel optimization and digital platform development, with omnichannel strategies becoming essential for market success.

Innovation acceleration drives product development cycles as brands compete to introduce novel formulations, ingredients, and delivery formats that meet evolving consumer preferences. Regulatory adaptation requires continuous compliance monitoring and adjustment to changing safety standards and labeling requirements.

Market consolidation trends influence competitive dynamics as larger companies acquire specialized brands to expand their product portfolios and market reach. Consumer loyalty patterns demonstrate the importance of brand trust and consistent product quality in maintaining market position despite competitive pressures.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Netherlands pet food market dynamics. Primary research includes structured interviews with industry stakeholders, consumer surveys, and retail partner discussions to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and trade association data to establish market baselines and identify trends. Quantitative analysis utilizes statistical modeling to project market growth trajectories and segment performance based on historical data and identified market drivers.

Qualitative assessment incorporates expert opinions, industry observations, and consumer behavior analysis to provide context for quantitative findings and identify emerging market opportunities. Data triangulation ensures research accuracy by cross-referencing multiple information sources and validating findings through independent verification methods.

Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific needs and preferences. Competitive intelligence gathering includes product analysis, pricing studies, and distribution strategy evaluation to understand competitive positioning and market dynamics.

Geographic distribution across the Netherlands reveals distinct regional preferences and market characteristics influenced by urbanization levels, income distribution, and cultural factors. Amsterdam metropolitan area demonstrates the highest concentration of premium pet food purchases, with urban consumers showing strong preference for convenience and quality products.

Rotterdam region exhibits balanced market characteristics with strong representation across all price segments, reflecting diverse demographic composition and established retail infrastructure. The Hague area shows premium market tendencies similar to Amsterdam, with government employees and international residents driving demand for high-quality pet nutrition products.

Northern provinces including Groningen and Friesland demonstrate more price-sensitive purchasing patterns while maintaining strong pet ownership rates, creating opportunities for value-oriented premium products. Southern regions encompassing North Brabant and Limburg show increasing adoption of premium products as economic development supports higher disposable incomes.

Rural areas maintain distinct purchasing patterns with preference for larger package sizes and traditional retail channels, though online penetration continues growing. Urban centers collectively represent approximately 70% of premium segment sales while accounting for 60% of total market volume, indicating higher per-capita spending in metropolitan areas.

Market leadership in the Netherlands pet food sector reflects a combination of global multinational corporations and specialized regional brands, each leveraging distinct competitive advantages to capture market share. Brand positioning strategies range from mass market value propositions to ultra-premium positioning targeting affluent pet owners seeking the highest quality nutrition solutions.

Innovation strategies differentiate competitors through product development, ingredient sourcing, and marketing approaches targeting specific consumer segments and pet health needs.

Product category segmentation reveals distinct market dynamics across different pet food types, with each segment exhibiting unique growth patterns and consumer preferences. Dry food products maintain the largest market share due to convenience, shelf stability, and cost-effectiveness, while wet food segments show stronger growth rates driven by palatability and perceived freshness benefits.

By Pet Type:

By Price Segment:

By Distribution Channel:

Dry food category maintains market dominance through convenience, cost-effectiveness, and extended shelf life, with premium segments showing strongest growth as consumers seek higher quality kibble formulations. Innovation focus centers on novel protein sources, grain-free formulations, and functional ingredients targeting specific health benefits.

Wet food segment demonstrates robust growth driven by palatability advantages and consumer perception of freshness and quality. Premium wet foods incorporating human-grade ingredients and gourmet flavors capture increasing market share among discerning pet owners willing to pay premium prices for perceived quality benefits.

Treat and snack category represents the fastest-growing segment with 12% annual growth rates, driven by humanization trends and desire to provide rewards and enrichment for pets. Functional treats combining indulgence with health benefits create premium pricing opportunities and strong consumer loyalty.

Raw and freeze-dried products emerge as significant growth categories among health-conscious consumers seeking minimally processed nutrition options. Fresh refrigerated foods gain traction in urban markets with adequate cold chain infrastructure and consumer willingness to pay premium prices for perceived freshness benefits.

Prescription and therapeutic diets maintain steady growth supported by aging pet populations and increased veterinary awareness of nutrition’s role in health management. Specialized formulations for specific health conditions command premium pricing and demonstrate strong customer loyalty once established.

Manufacturers benefit from strong market growth prospects and consumer willingness to pay premium prices for quality products, enabling healthy profit margins and investment in innovation. Brand differentiation opportunities allow companies to develop unique market positions through specialized formulations, ingredient sourcing, and marketing strategies.

Retailers gain from pet food’s role as a traffic driver and high-frequency purchase category, with premium products offering attractive margins and customer loyalty benefits. E-commerce platforms benefit from subscription model opportunities and direct-to-consumer relationships enabling personalized marketing and customer retention.

Consumers receive access to increasingly sophisticated nutrition options supporting their pets’ health and well-being, with transparent labeling and scientific backing providing confidence in purchasing decisions. Convenience benefits through online ordering, subscription services, and improved product availability enhance the overall pet ownership experience.

Veterinary professionals benefit from expanded therapeutic diet options and stronger partnerships with pet food manufacturers, enabling better health outcomes for patients and additional revenue streams through product recommendations. Pet health improvements result from better nutrition options and increased owner awareness of diet’s role in wellness.

Supply chain participants including ingredient suppliers, packaging companies, and logistics providers benefit from market growth and premiumization trends requiring specialized services and higher-value inputs. Innovation ecosystem development supports research institutions, technology providers, and specialized service companies serving the pet food industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Humanization acceleration drives the most significant trend in the Netherlands pet food market, with consumers increasingly applying human food standards and preferences to pet nutrition decisions. Clean label demands reflect consumer desire for transparency in ingredient sourcing, processing methods, and nutritional benefits, forcing manufacturers to simplify formulations and improve communication.

Sustainability integration becomes increasingly important as environmentally conscious consumers seek brands demonstrating commitment to sustainable sourcing, eco-friendly packaging, and carbon footprint reduction. Protein diversification includes exploration of alternative protein sources including insects, plant-based options, and novel animal proteins to address sustainability concerns and allergies.

Personalization trends enable customized nutrition solutions based on individual pet characteristics, health status, and owner preferences, supported by digital platforms and data analytics. Functional nutrition growth reflects consumer interest in foods providing specific health benefits beyond basic nutrition, including joint health, cognitive function, and digestive wellness.

Direct-to-consumer expansion transforms distribution strategies as brands seek closer customer relationships and higher margins through subscription services and online platforms. Premiumization continuation shows no signs of slowing, with consumers consistently trading up to higher-quality products despite economic pressures.

Technology integration includes smart packaging, IoT-enabled feeding solutions, and mobile apps supporting pet health monitoring and nutrition optimization. Veterinary partnerships strengthen as brands collaborate with professionals to develop therapeutic products and build credibility through scientific backing.

Product innovation acceleration characterizes recent industry developments, with manufacturers launching increasingly sophisticated formulations targeting specific health conditions, life stages, and dietary preferences. Ingredient technology advancement enables incorporation of functional components including probiotics, prebiotics, and nutraceuticals previously unavailable in pet food applications.

Acquisition activity intensifies as major corporations seek to expand their portfolios through strategic purchases of specialized brands and innovative companies. Sustainability initiatives gain prominence with companies investing in renewable energy, sustainable packaging, and responsible sourcing programs to meet consumer expectations.

Digital platform development accelerates as companies build e-commerce capabilities, subscription services, and direct-to-consumer relationships to capture growing online demand. Regulatory compliance enhancement reflects industry efforts to exceed minimum standards and build consumer confidence through voluntary quality certifications.

Research collaboration increases between pet food manufacturers and academic institutions to develop evidence-based nutrition solutions and validate health claims. Supply chain optimization focuses on improving traceability, reducing environmental impact, and ensuring consistent quality throughout the production process.

According to MarkWide Research analysis, these developments collectively indicate a maturing industry focused on differentiation through innovation, quality, and consumer engagement rather than traditional price-based competition.

Strategic positioning recommendations emphasize the importance of premium brand development and clear value proposition communication to capture growing consumer willingness to invest in pet health and nutrition. Innovation investment should focus on functional ingredients, sustainable sourcing, and personalized nutrition solutions that address specific consumer needs and preferences.

Distribution strategy optimization requires balanced approach combining traditional retail partnerships with direct-to-consumer capabilities and e-commerce platform development. Digital marketing investment becomes essential for reaching younger consumers and building brand awareness in increasingly crowded marketplace.

Supply chain resilience building should prioritize diversified sourcing, local ingredient partnerships, and sustainable practices that support long-term business continuity and consumer trust. Regulatory compliance excellence provides competitive advantage through consumer confidence and reduced risk of market disruption.

Partnership development with veterinary professionals, pet retailers, and technology companies can enhance market access and credibility while providing valuable consumer insights. Market research investment enables better understanding of evolving consumer preferences and identification of emerging opportunities before competitors.

Sustainability integration throughout operations and product development addresses growing consumer concerns while potentially reducing costs and improving brand reputation. International expansion consideration for successful brands can leverage Dutch market success in similar European markets with comparable consumer preferences.

Growth trajectory for the Netherlands pet food market remains positive, supported by fundamental demographic trends, increasing pet ownership, and continued premiumization of consumer preferences. Market expansion is expected to continue at steady growth rates with premium segments significantly outperforming traditional categories.

Innovation acceleration will drive market development as manufacturers compete to introduce novel formulations, ingredients, and delivery formats that meet evolving consumer expectations. Digital transformation will reshape distribution and marketing strategies, with online channels expected to capture increasing market share over the forecast period.

Sustainability requirements will become increasingly important for market success, with consumers and retailers demanding environmental responsibility throughout the value chain. Personalization trends will create opportunities for premium pricing and customer loyalty through customized nutrition solutions.

Consolidation activity may continue as larger companies seek to acquire innovative brands and specialized capabilities, while successful independent brands may explore international expansion opportunities. Regulatory evolution will likely focus on enhanced safety standards and clearer health claim requirements, benefiting companies with strong compliance capabilities.

MWR projects that the market will continue evolving toward higher-value products and services, with successful companies being those that can effectively combine innovation, quality, sustainability, and consumer engagement in their market strategies.

The Netherlands pet food market represents a dynamic and sophisticated sector characterized by strong consumer demand for premium nutrition products and continuous innovation in formulations and delivery methods. Market fundamentals remain robust, supported by affluent consumer base, high pet ownership rates, and cultural values that prioritize animal welfare and health.

Growth prospects appear favorable across multiple segments, with premium and super-premium categories leading expansion as consumers increasingly view pets as family members deserving high-quality nutrition. Innovation opportunities abound in functional foods, sustainable products, and personalized nutrition solutions that address specific consumer needs and preferences.

Competitive dynamics will continue evolving as traditional manufacturers compete with emerging direct-to-consumer brands and technology-enabled companies offering novel approaches to pet nutrition. Success factors include strong brand positioning, product innovation, distribution excellence, and ability to adapt to changing consumer preferences and market conditions.

The Netherlands pet food market offers attractive opportunities for companies capable of delivering high-quality products that meet sophisticated consumer demands while building sustainable competitive advantages through innovation, brand development, and operational excellence. Future success will depend on understanding and responding to evolving consumer preferences while maintaining focus on product quality, safety, and value delivery.

What is Pet Food?

Pet food refers to the various types of food products specifically formulated for domestic animals, including dogs, cats, birds, and other pets. It encompasses a wide range of products, including dry kibble, wet food, treats, and specialized diets tailored to the nutritional needs of different species.

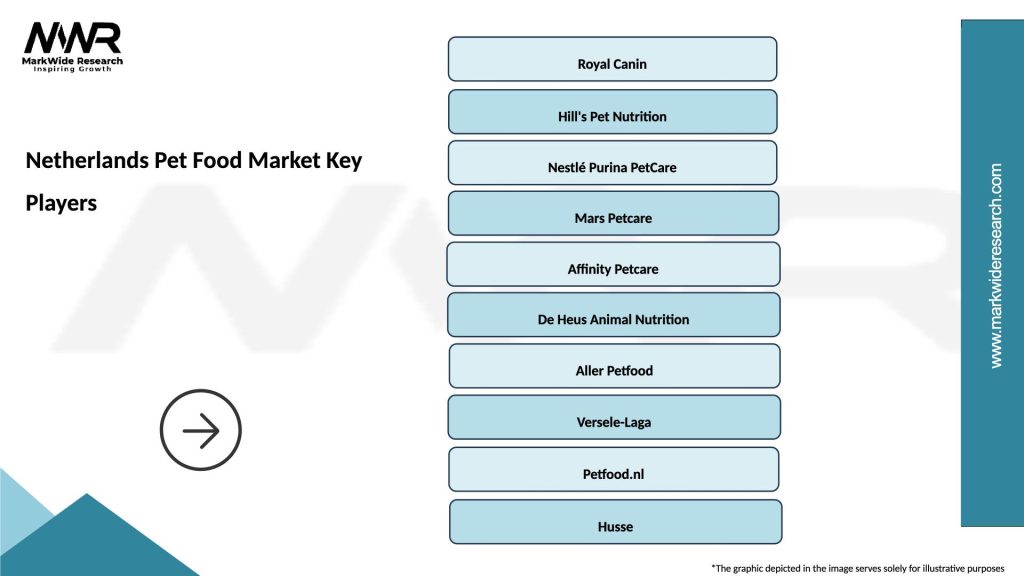

What are the key players in the Netherlands Pet Food Market?

Key players in the Netherlands Pet Food Market include companies such as Nestlé Purina, Mars Petcare, and Hill’s Pet Nutrition. These companies are known for their extensive product lines and commitment to quality, catering to the diverse needs of pet owners in the region, among others.

What are the growth factors driving the Netherlands Pet Food Market?

The Netherlands Pet Food Market is driven by factors such as the increasing pet ownership rates, rising awareness of pet nutrition, and the growing trend of premium and organic pet food products. Additionally, the humanization of pets has led to a demand for higher-quality food options.

What challenges does the Netherlands Pet Food Market face?

Challenges in the Netherlands Pet Food Market include stringent regulations regarding pet food safety and quality, fluctuating raw material prices, and competition from private label brands. These factors can impact production costs and market dynamics.

What opportunities exist in the Netherlands Pet Food Market?

Opportunities in the Netherlands Pet Food Market include the growing demand for natural and organic pet food, the rise of e-commerce for pet product sales, and innovations in pet food formulations that cater to specific health needs. These trends present avenues for growth and expansion.

What trends are shaping the Netherlands Pet Food Market?

Trends in the Netherlands Pet Food Market include the increasing popularity of plant-based pet food options, the focus on sustainability in packaging, and the development of personalized nutrition for pets. These trends reflect changing consumer preferences and a shift towards more responsible pet ownership.

Netherlands Pet Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Raw Food |

| Customer Type | Pet Owners, Retailers, Veterinarians, Online Shoppers |

| Distribution Channel | Supermarkets, Pet Stores, E-commerce, Specialty Shops |

| End User | Dogs, Cats, Birds, Small Mammals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Pet Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at