444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands electric vehicle charging equipment market represents one of Europe’s most progressive and rapidly evolving sectors in sustainable transportation infrastructure. As a pioneer in environmental sustainability and clean energy adoption, the Netherlands has positioned itself at the forefront of electric vehicle infrastructure development, creating a comprehensive ecosystem that supports the nation’s ambitious climate goals and transportation electrification initiatives.

Market dynamics in the Netherlands reflect a unique combination of government policy support, consumer adoption rates, and technological innovation that has resulted in one of the world’s highest electric vehicle charging station densities per capita. The country’s commitment to achieving carbon neutrality by 2050 has accelerated investments in charging infrastructure, with growth rates consistently exceeding 15% annually across various charging equipment categories.

Infrastructure development has been particularly robust in urban areas, with Amsterdam, Rotterdam, and The Hague leading the deployment of advanced charging solutions. The market encompasses a diverse range of charging equipment types, from residential Level 1 and Level 2 chargers to high-power DC fast charging stations strategically positioned along major transportation corridors and commercial districts.

Technology integration has become increasingly sophisticated, with smart charging capabilities, grid integration features, and renewable energy compatibility driving market expansion. The Netherlands’ advanced digital infrastructure and high internet penetration rates have facilitated the adoption of connected charging solutions that optimize energy consumption and provide real-time monitoring capabilities.

The Netherlands electric vehicle charging equipment market refers to the comprehensive ecosystem of hardware, software, and services designed to provide electrical energy to electric vehicles within the Dutch territory. This market encompasses all forms of charging infrastructure, from basic home charging units to sophisticated commercial and public charging networks that support the country’s transition to sustainable transportation.

Charging equipment categories include residential charging solutions for private use, workplace charging systems for employee vehicle fleets, public charging stations for general consumer access, and specialized fast-charging networks designed for long-distance travel and commercial vehicle operations. The market also incorporates supporting technologies such as payment systems, energy management software, and grid integration capabilities.

Market participants range from international charging equipment manufacturers and energy companies to local installation services and software developers who create the digital platforms that enable seamless charging experiences. The ecosystem includes both hardware providers and service operators who manage charging networks and customer relationships.

Strategic positioning of the Netherlands in the global electric vehicle charging market reflects the country’s commitment to sustainable transportation and environmental leadership. The market has experienced unprecedented growth driven by supportive government policies, increasing electric vehicle adoption rates, and substantial private sector investments in charging infrastructure development.

Key growth drivers include the Netherlands’ ambitious target of having all new car sales be electric by 2030, comprehensive government incentive programs, and the country’s compact geography that facilitates efficient charging network deployment. Consumer adoption rates have reached approximately 25% for new vehicle purchases, creating substantial demand for accessible charging solutions.

Market segmentation reveals strong performance across residential, commercial, and public charging categories, with DC fast charging experiencing particularly robust growth as consumers demand shorter charging times and greater convenience. The integration of renewable energy sources has become a critical differentiator, with solar-powered charging stations gaining significant market traction.

Competitive dynamics feature both established international players and innovative Dutch companies that leverage local market knowledge and technological expertise. The market benefits from the Netherlands’ position as a European logistics hub, facilitating efficient supply chain management and technology distribution across the region.

Market intelligence reveals several critical insights that define the Netherlands electric vehicle charging equipment landscape and its future trajectory:

Consumer behavior analysis indicates strong preference for charging solutions that offer convenience, reliability, and integration with existing energy systems. Home charging remains the primary method for daily vehicle charging, while public fast charging serves long-distance travel and urban convenience needs.

Government policy support serves as the primary catalyst for market expansion, with comprehensive incentive programs, regulatory frameworks, and infrastructure investment commitments creating favorable conditions for charging equipment deployment. The Netherlands’ National Climate Agreement provides clear targets and financial support for electric vehicle infrastructure development.

Environmental consciousness among Dutch consumers drives demand for sustainable transportation solutions, with electric vehicle adoption rates consistently exceeding European averages. The country’s strong environmental awareness culture creates natural market demand for charging infrastructure that supports clean transportation alternatives.

Technological advancement in charging equipment capabilities, including faster charging speeds, improved energy efficiency, and enhanced user interfaces, attracts both individual consumers and commercial fleet operators. Innovation in smart charging technologies enables grid optimization and renewable energy integration.

Economic incentives including tax benefits, purchase subsidies, and reduced operational costs for electric vehicles create compelling value propositions that drive charging equipment demand. The total cost of ownership advantages for electric vehicles become more pronounced with accessible charging infrastructure.

Infrastructure investment from both public and private sectors accelerates market growth through large-scale charging network deployments. Major energy companies and charging network operators continue expanding coverage to meet growing demand and capture market opportunities.

European Union directives and regulations mandate charging infrastructure development targets, creating regulatory certainty that encourages long-term investment planning and market participation from equipment manufacturers and service providers.

High initial investment requirements for charging equipment installation, particularly for DC fast charging stations, can limit deployment in certain market segments and geographic areas. The substantial capital requirements may deter smaller operators and property owners from participating in market expansion.

Grid capacity limitations in some areas constrain the installation of high-power charging equipment, requiring costly electrical infrastructure upgrades that can delay project implementation and increase total system costs. Utility coordination and approval processes can extend deployment timelines.

Technical complexity associated with advanced charging systems, including smart charging features and grid integration capabilities, requires specialized installation and maintenance expertise that may not be readily available in all regions. This complexity can increase operational costs and reduce system reliability.

Standardization challenges across different charging protocols and payment systems can create consumer confusion and limit interoperability between charging networks. The lack of universal standards may fragment the market and reduce overall user experience quality.

Real estate constraints in densely populated urban areas limit available space for charging station installation, particularly for residents without private parking facilities. Property owner cooperation and municipal permitting processes can create deployment barriers.

Competition intensity among charging network operators and equipment manufacturers can pressure profit margins and limit investment returns, particularly in saturated urban markets where multiple providers compete for prime locations and customer relationships.

Rural market expansion presents significant growth opportunities as charging infrastructure deployment extends beyond urban centers to serve suburban and rural communities. These underserved markets offer substantial potential for network operators and equipment manufacturers seeking geographic diversification.

Commercial fleet electrification creates demand for specialized charging solutions designed for delivery vehicles, public transportation, and corporate fleets. The transition to electric commercial vehicles requires dedicated charging infrastructure with higher utilization rates and predictable revenue streams.

Renewable energy integration opportunities include solar-powered charging stations, energy storage systems, and grid balancing services that provide additional revenue streams beyond basic charging services. These solutions appeal to environmentally conscious consumers and support grid stability objectives.

Smart city initiatives throughout the Netherlands create opportunities for integrated charging solutions that connect with broader urban management systems, traffic optimization, and energy distribution networks. These comprehensive approaches can differentiate service providers and create competitive advantages.

Technology innovation in wireless charging, ultra-fast charging, and vehicle-to-grid capabilities opens new market segments and service offerings. Early adoption of emerging technologies can establish market leadership positions and attract technology-focused consumers.

Export potential leverages the Netherlands’ position as a European logistics hub to serve surrounding markets with proven charging solutions and operational expertise. Successful domestic implementations can be scaled to international markets through strategic partnerships and technology licensing.

Supply chain evolution reflects the maturing market with established relationships between equipment manufacturers, installation contractors, and network operators. The development of local supply chains reduces costs and improves service quality while supporting domestic economic development objectives.

Competitive positioning increasingly focuses on service quality, network reliability, and user experience rather than pure equipment specifications. Market leaders differentiate through comprehensive service offerings, customer support capabilities, and strategic location portfolios.

Technology convergence between charging equipment, energy management systems, and digital payment platforms creates integrated solutions that appeal to both consumers and commercial operators. This convergence drives innovation and creates barriers to entry for new market participants.

Regulatory evolution continues shaping market development through updated safety standards, interoperability requirements, and environmental regulations. According to MarkWide Research analysis, regulatory compliance costs represent approximately 8% of total project expenses for new charging installations.

Consumer expectations drive market evolution toward faster charging speeds, improved reliability, and seamless payment experiences. Service providers must continuously upgrade infrastructure and capabilities to meet rising consumer standards and maintain competitive positions.

Investment patterns show increasing private sector participation alongside continued government support, creating sustainable funding models for long-term market development. The balance between public and private investment influences market structure and competitive dynamics.

Data collection approaches for analyzing the Netherlands electric vehicle charging equipment market incorporate multiple research methodologies to ensure comprehensive market understanding and accurate trend identification. Primary research includes direct interviews with industry participants, equipment manufacturers, and charging network operators.

Market analysis techniques combine quantitative data analysis with qualitative insights from industry experts, government officials, and consumer surveys. This multi-faceted approach provides balanced perspectives on market dynamics, growth drivers, and future development trajectories.

Industry consultation involves regular engagement with key stakeholders including charging equipment manufacturers, installation contractors, energy companies, and regulatory authorities. These consultations provide real-time market insights and validate analytical findings through expert opinion.

Government data integration incorporates official statistics from Dutch government agencies, European Union reports, and international organizations to ensure accuracy and completeness of market assessments. Public data sources provide authoritative baseline information for market analysis.

Technology assessment includes evaluation of emerging charging technologies, patent analysis, and innovation tracking to identify future market opportunities and potential disruptions. This forward-looking analysis supports strategic planning and investment decision-making.

Validation processes ensure data accuracy through cross-referencing multiple sources, statistical verification, and expert review. Quality control measures maintain research integrity and support reliable market forecasting and strategic recommendations.

North Holland region leads market development with Amsterdam serving as the primary hub for charging infrastructure innovation and deployment. The region accounts for approximately 35% of total charging stations and hosts major network operator headquarters and technology development centers.

South Holland province demonstrates strong market growth centered around Rotterdam and The Hague, with significant port-related commercial charging infrastructure supporting logistics and transportation sectors. The region’s industrial base drives demand for specialized commercial charging solutions.

Utrecht province benefits from its central location and high population density, creating favorable conditions for charging network deployment and utilization. The region serves as a strategic connection point between major metropolitan areas and demonstrates above-average adoption rates.

Brabant region shows rapid market expansion driven by technology companies and manufacturing facilities that support employee electric vehicle adoption. The area’s economic diversity creates demand across residential, commercial, and industrial charging applications.

Rural provinces including Friesland, Groningen, and Zeeland represent emerging markets with significant growth potential as charging infrastructure extends beyond urban centers. These regions require different deployment strategies focused on strategic corridor locations and community charging hubs.

Cross-border connectivity with Germany and Belgium creates opportunities for integrated charging networks that serve international travelers and commercial transportation. Border regions benefit from increased traffic volumes and strategic positioning for network expansion.

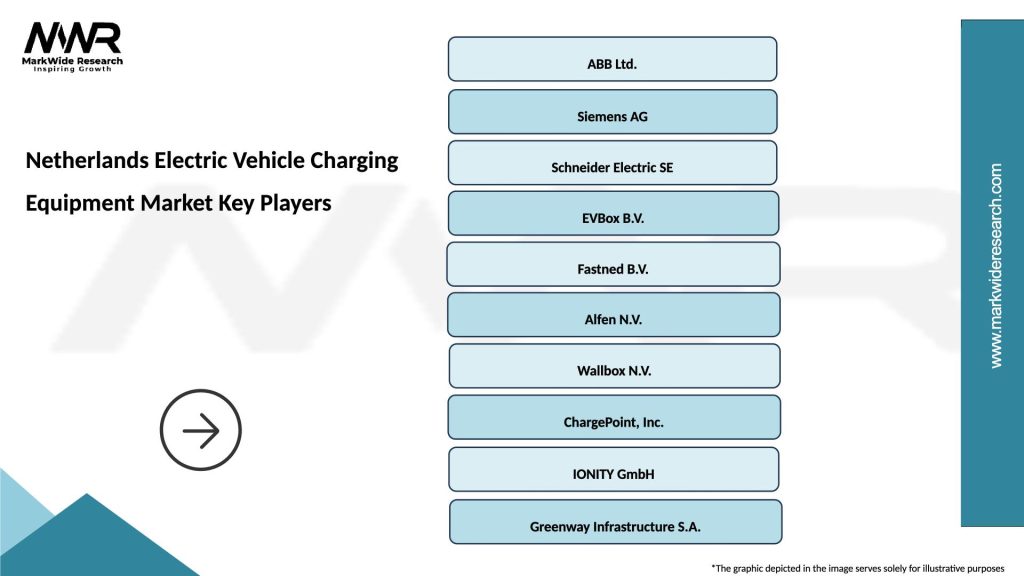

Market leadership in the Netherlands electric vehicle charging equipment sector features a diverse mix of international corporations and specialized Dutch companies that leverage local market knowledge and technological innovation:

Competitive strategies focus on network expansion, technology differentiation, and service quality improvements. Market leaders invest heavily in customer experience enhancements, mobile applications, and payment system integration to build customer loyalty and market share.

Strategic partnerships between charging operators, automotive manufacturers, and energy companies create comprehensive ecosystems that serve consumer needs while optimizing operational efficiency and market coverage.

By Charging Type:

By Installation Location:

By Power Output:

By Technology Features:

Residential charging equipment represents the largest market segment by volume, driven by home ownership rates and consumer preference for overnight charging convenience. Smart charging features increasingly become standard offerings, enabling load management and renewable energy integration.

Public fast charging demonstrates the highest growth rates as consumers demand convenient charging options for longer trips and urban mobility needs. Strategic location selection and reliable operation become critical success factors for network operators in this competitive segment.

Commercial workplace charging shows strong adoption as employers support employee electric vehicle transition and corporate sustainability objectives. These installations typically feature higher utilization rates and predictable usage patterns that support business case development.

Fleet charging solutions emerge as a specialized segment requiring customized equipment configurations, energy management systems, and maintenance support tailored to commercial vehicle operations and duty cycles.

Smart charging technology gains market share across all segments as consumers and operators recognize the benefits of grid integration, energy optimization, and remote monitoring capabilities. MWR data indicates that smart charging adoption rates exceed 45% for new installations.

Renewable energy integration becomes increasingly important across all categories, with solar-powered charging stations and energy storage systems providing environmental benefits and operational cost advantages that appeal to sustainability-focused consumers and businesses.

Equipment manufacturers benefit from sustained market growth, technology innovation opportunities, and export potential that leverages successful Netherlands implementations for international expansion. The mature market provides stable demand and opportunities for premium product positioning.

Network operators gain from increasing utilization rates, diverse revenue streams, and strategic market positioning that supports long-term profitability and growth. The Netherlands market offers favorable regulatory conditions and consumer acceptance that facilitate business development.

Energy companies capitalize on new business opportunities, grid optimization services, and customer relationship expansion through charging infrastructure investments. Integration with existing energy services creates comprehensive value propositions and competitive advantages.

Property owners enhance property values, attract environmentally conscious tenants, and generate additional revenue streams through charging station installations. Commercial properties particularly benefit from increased foot traffic and customer dwell time.

Consumers access convenient charging options, reduced transportation costs, and environmental benefits that support sustainable lifestyle choices. The expanding charging network reduces range anxiety and supports electric vehicle adoption decisions.

Government entities achieve environmental objectives, economic development goals, and energy security benefits through successful charging infrastructure deployment. The market supports job creation and technology leadership positioning in sustainable transportation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Ultra-fast charging adoption accelerates as consumers demand shorter charging times comparable to traditional refueling experiences. Technology improvements enable charging speeds exceeding 150 kW while maintaining battery health and safety standards.

Smart charging integration becomes standard practice with grid optimization, renewable energy coordination, and demand response capabilities built into charging infrastructure. These features provide operational benefits and additional revenue opportunities for network operators.

Wireless charging development progresses from pilot projects to commercial deployments, particularly in specialized applications such as public transportation and premium residential installations. The technology offers convenience advantages despite current efficiency limitations.

Vehicle-to-grid implementation expands as bidirectional charging capabilities enable electric vehicles to serve as distributed energy storage resources. This trend supports grid stability and provides additional value streams for vehicle owners.

Subscription service models gain popularity as consumers prefer predictable monthly charging costs rather than pay-per-use pricing. These models improve customer retention and provide stable revenue streams for network operators.

Renewable energy integration increases with solar-powered charging stations, energy storage systems, and green energy sourcing becoming standard features. Environmental benefits and operational cost advantages drive this trend across all market segments.

Mobile payment adoption reaches near-universal levels as consumers demand seamless, contactless payment experiences. Advanced payment systems integrate with vehicle systems and mobile applications for enhanced user convenience.

Network expansion announcements from major operators indicate continued infrastructure investment and geographic coverage improvements. Recent commitments include thousands of new charging points across urban and highway locations throughout the Netherlands.

Technology partnerships between charging equipment manufacturers and automotive companies create integrated solutions that optimize charging performance and user experience. These collaborations accelerate innovation and market adoption of advanced features.

Government funding programs provide substantial financial support for charging infrastructure deployment, particularly in underserved areas and for innovative technology demonstrations. These programs reduce deployment barriers and accelerate market development.

Standardization initiatives progress toward universal charging protocols and payment systems that improve interoperability and user experience. Industry collaboration addresses technical and operational challenges that have historically fragmented the market.

Corporate sustainability commitments from major employers drive workplace charging installations and fleet electrification programs. These initiatives create substantial demand for commercial charging solutions and support broader market growth.

International expansion by successful Dutch charging companies leverages domestic expertise for European and global market development. These expansions validate business models and create additional growth opportunities for the domestic industry.

Strategic positioning recommendations emphasize the importance of technology differentiation and service quality excellence in an increasingly competitive market environment. Companies should focus on unique value propositions that address specific customer needs and market segments.

Investment priorities should target smart charging capabilities, renewable energy integration, and customer experience improvements that create sustainable competitive advantages. According to MarkWide Research analysis, companies investing in these areas demonstrate superior market performance and customer retention rates.

Geographic expansion strategies should balance urban market saturation with rural market opportunities, considering infrastructure requirements, utilization projections, and competitive dynamics. Successful expansion requires careful site selection and local partnership development.

Partnership development with automotive manufacturers, energy companies, and property owners creates comprehensive service offerings and market access advantages. Strategic alliances can accelerate growth while sharing investment risks and operational responsibilities.

Technology roadmap planning should anticipate emerging trends including wireless charging, ultra-fast charging, and vehicle-to-grid capabilities. Early adoption of promising technologies can establish market leadership positions and attract technology-focused customers.

Regulatory engagement remains critical as policy developments significantly impact market conditions and business opportunities. Active participation in industry associations and government consultations helps shape favorable regulatory environments.

Market evolution over the next decade will be characterized by continued rapid growth, technology advancement, and market maturation as electric vehicle adoption reaches mainstream levels. The Netherlands is positioned to maintain its leadership role in European charging infrastructure development.

Technology integration will advance significantly with smart charging becoming universal, renewable energy integration standard, and vehicle-to-grid capabilities widely deployed. These developments will transform charging infrastructure from simple energy delivery to comprehensive energy management systems.

Geographic expansion will extend charging networks throughout rural areas and cross-border corridors, creating comprehensive coverage that supports electric vehicle adoption across all market segments and use cases. Network density will continue increasing in urban areas while rural coverage gaps are addressed.

Service evolution will emphasize customer experience, convenience, and value-added services that differentiate providers in competitive markets. Subscription models, integrated payment systems, and personalized services will become standard offerings.

Industry consolidation may occur as market maturity and competitive pressures favor larger operators with comprehensive service capabilities and financial resources. Strategic acquisitions and partnerships will reshape the competitive landscape.

International influence of the Netherlands charging market will grow as successful domestic implementations serve as models for other countries and Dutch companies expand globally. The country’s expertise and technology leadership will support export opportunities and international partnerships.

The Netherlands electric vehicle charging equipment market represents a dynamic and rapidly evolving sector that exemplifies successful sustainable transportation infrastructure development. The market’s strong foundation of government support, consumer adoption, and technological innovation creates favorable conditions for continued growth and market leadership.

Strategic opportunities abound for industry participants who can effectively navigate competitive dynamics while delivering superior customer experiences and operational efficiency. The market’s maturity provides stability while continued growth offers expansion potential across multiple segments and geographic regions.

Future success will depend on companies’ ability to adapt to evolving consumer needs, integrate emerging technologies, and maintain competitive positioning in an increasingly sophisticated market environment. The Netherlands’ commitment to sustainable transportation and environmental leadership ensures continued market support and development opportunities.

Market participants who invest in technology innovation, customer experience excellence, and strategic partnerships will be best positioned to capitalize on the substantial opportunities presented by the Netherlands’ transition to electric transportation and the broader European market expansion potential.

What is Electric Vehicle Charging Equipment?

Electric Vehicle Charging Equipment refers to the devices and infrastructure used to charge electric vehicles, including home chargers, public charging stations, and fast chargers. These systems are essential for supporting the growing adoption of electric vehicles in various sectors.

What are the key players in the Netherlands Electric Vehicle Charging Equipment Market?

Key players in the Netherlands Electric Vehicle Charging Equipment Market include companies like Allego, Fastned, and EVBox, which provide a range of charging solutions for electric vehicles. These companies are actively expanding their networks to meet increasing demand, among others.

What are the main drivers of the Netherlands Electric Vehicle Charging Equipment Market?

The main drivers of the Netherlands Electric Vehicle Charging Equipment Market include the increasing adoption of electric vehicles, government incentives for EV infrastructure, and the growing focus on sustainable transportation solutions. These factors are contributing to a robust market environment.

What challenges does the Netherlands Electric Vehicle Charging Equipment Market face?

Challenges in the Netherlands Electric Vehicle Charging Equipment Market include the high initial costs of installation, the need for extensive infrastructure development, and potential grid capacity issues. These factors can hinder the rapid expansion of charging networks.

What opportunities exist in the Netherlands Electric Vehicle Charging Equipment Market?

Opportunities in the Netherlands Electric Vehicle Charging Equipment Market include advancements in charging technology, the integration of renewable energy sources, and the potential for smart charging solutions. These developments can enhance the efficiency and accessibility of charging infrastructure.

What trends are shaping the Netherlands Electric Vehicle Charging Equipment Market?

Trends shaping the Netherlands Electric Vehicle Charging Equipment Market include the rise of ultra-fast charging stations, the implementation of smart grid technologies, and the increasing collaboration between public and private sectors to expand charging networks. These trends are crucial for meeting future demand.

Netherlands Electric Vehicle Charging Equipment Market

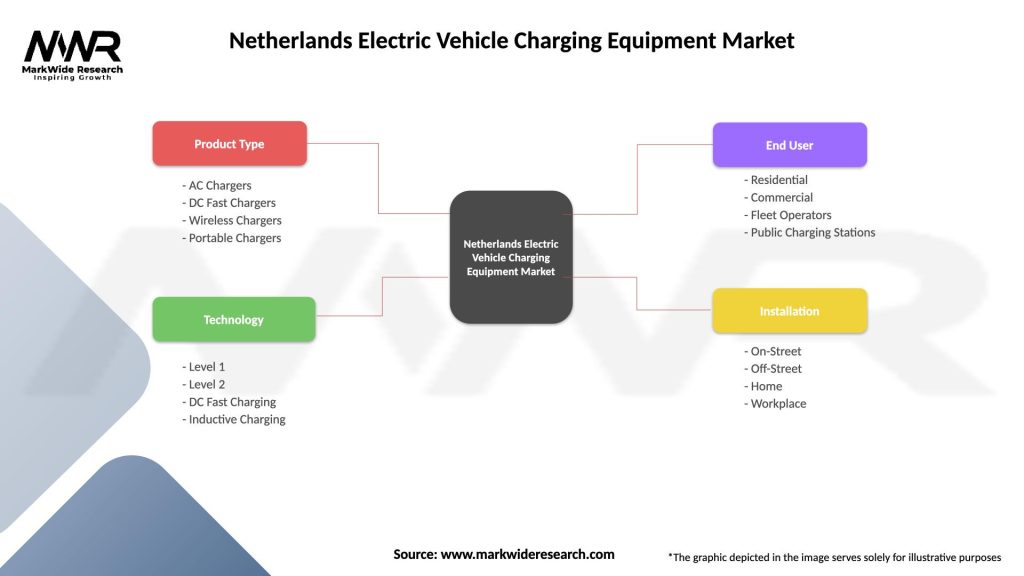

| Segmentation Details | Description |

|---|---|

| Product Type | AC Chargers, DC Fast Chargers, Wireless Chargers, Portable Chargers |

| Technology | Level 1, Level 2, DC Fast Charging, Inductive Charging |

| End User | Residential, Commercial, Fleet Operators, Public Charging Stations |

| Installation | On-Street, Off-Street, Home, Workplace |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Electric Vehicle Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at