444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands data center cooling market represents a critical component of the country’s rapidly expanding digital infrastructure ecosystem. As one of Europe’s leading digital hubs, the Netherlands has witnessed unprecedented growth in data center development, driven by its strategic location, robust connectivity, and favorable business environment. Data center cooling systems have become essential for maintaining optimal operating temperatures and ensuring reliable performance of high-density computing equipment.

Market dynamics indicate that the Netherlands is experiencing significant expansion in cooling technology adoption, with traditional air-based systems increasingly being supplemented by advanced liquid cooling solutions. The market encompasses various cooling methodologies including precision air conditioning, liquid cooling systems, free cooling technologies, and hybrid cooling solutions. Industry analysis reveals that energy efficiency requirements are driving adoption rates of approximately 23% annually for next-generation cooling technologies.

Geographic concentration shows that the Amsterdam metropolitan area, known as the Amsterdam Internet Exchange (AMS-IX), dominates the market landscape, accounting for a substantial portion of cooling infrastructure investments. The region’s hyperscale data centers and colocation facilities are increasingly implementing sophisticated cooling architectures to manage growing computational demands while adhering to strict environmental regulations.

The Netherlands data center cooling market refers to the comprehensive ecosystem of technologies, systems, and services designed to maintain optimal operating temperatures within data center facilities across the Dutch territory. This market encompasses the procurement, installation, maintenance, and optimization of cooling infrastructure that ensures reliable operation of servers, storage systems, and networking equipment while maximizing energy efficiency and minimizing environmental impact.

Cooling technologies within this market include traditional computer room air conditioning (CRAC) units, precision air conditioning systems, liquid cooling solutions, immersion cooling technologies, and innovative free cooling systems that leverage the Netherlands’ favorable climate conditions. The market also encompasses cooling infrastructure components such as chillers, cooling towers, heat exchangers, pumps, and advanced monitoring systems that enable intelligent temperature management.

Market participants include cooling equipment manufacturers, system integrators, maintenance service providers, and technology consultants who collectively support the Netherlands’ position as a leading European data center hub. The market serves various facility types including enterprise data centers, colocation facilities, hyperscale cloud infrastructure, and edge computing deployments throughout the country.

Strategic positioning of the Netherlands as a premier European data center destination has created substantial demand for advanced cooling solutions. The market demonstrates robust growth trajectory driven by increasing digitalization, cloud adoption, and the proliferation of data-intensive applications across various industries. Cooling efficiency has become a primary differentiator for data center operators seeking to optimize operational costs while meeting stringent environmental compliance requirements.

Technology evolution within the market shows a clear shift toward more sophisticated cooling architectures. Traditional raised-floor cooling systems are being enhanced or replaced by containment solutions, direct liquid cooling, and immersion cooling technologies that offer superior efficiency and density support. Market analysis indicates that liquid cooling adoption is growing at approximately 31% annually as operators seek to manage increasing heat densities from modern processors and AI workloads.

Regulatory influence plays a significant role in shaping market dynamics, with the Dutch government’s commitment to carbon neutrality driving demand for energy-efficient cooling solutions. The market benefits from favorable policies supporting sustainable data center development, including incentives for waste heat recovery and renewable energy integration. Industry consolidation and strategic partnerships are creating opportunities for innovative cooling technology deployment across the Netherlands’ expanding data center landscape.

Market intelligence reveals several critical insights shaping the Netherlands data center cooling landscape:

Digital transformation across Dutch enterprises and government organizations continues to fuel demand for data center capacity, directly driving cooling infrastructure requirements. The accelerating pace of cloud migration and increasing reliance on digital services has created sustained demand for reliable, efficient cooling solutions that can support growing computational workloads.

Hyperscale expansion represents a primary market driver, with major cloud service providers establishing significant presence in the Netherlands. These facilities require advanced cooling architectures capable of managing massive scale and high-density deployments while maintaining optimal energy efficiency. The concentration of hyperscale facilities in the Amsterdam region has created a cluster effect, attracting additional investments in cooling technology innovation.

Regulatory compliance requirements are driving adoption of energy-efficient cooling solutions. Dutch environmental regulations mandate specific Power Usage Effectiveness (PUE) targets, compelling data center operators to invest in advanced cooling technologies. The government’s commitment to achieving carbon neutrality by 2050 has intensified focus on sustainable cooling practices and renewable energy integration.

Technological advancement in server and processor technologies is creating new cooling challenges and opportunities. The deployment of AI and machine learning workloads generates significantly higher heat densities, requiring more sophisticated cooling approaches. Graphics processing units (GPUs) and specialized AI chips demand precision cooling solutions that traditional air-based systems cannot adequately address.

Capital investment requirements for advanced cooling systems present significant barriers for smaller data center operators. The transition from traditional cooling to liquid cooling or immersion systems requires substantial upfront investments that may not be feasible for all market participants. Implementation costs for retrofitting existing facilities with modern cooling infrastructure can be particularly challenging.

Technical complexity associated with advanced cooling technologies creates operational challenges for data center teams. Liquid cooling systems require specialized expertise for installation, maintenance, and troubleshooting that may not be readily available in the local market. The learning curve for transitioning from air-based to liquid-based cooling can impact operational efficiency during implementation phases.

Space constraints in established data center markets like Amsterdam limit opportunities for cooling system upgrades. Existing facilities may lack adequate space for cooling infrastructure expansion or modification, constraining the ability to implement more efficient cooling technologies. Urban density and real estate costs further complicate cooling system optimization efforts.

Supply chain dependencies for specialized cooling components can create vulnerabilities in project timelines and costs. The Netherlands’ reliance on international suppliers for advanced cooling technologies exposes the market to global supply chain disruptions and component availability challenges. Long lead times for custom cooling solutions can delay data center deployment schedules.

Waste heat recovery presents substantial opportunities for data center operators to create additional revenue streams while improving overall energy efficiency. The Netherlands’ district heating networks provide infrastructure for heat reuse applications, enabling data centers to contribute to urban heating systems. Innovative partnerships between data center operators and municipal utilities are creating new business models around waste heat monetization.

Edge computing expansion is creating demand for distributed cooling solutions optimized for smaller, unmanned facilities. The deployment of 5G networks and Internet of Things (IoT) applications requires edge data centers with efficient, reliable cooling systems. This trend opens opportunities for modular cooling solutions and remote monitoring technologies.

Artificial intelligence and machine learning workloads are driving demand for specialized cooling solutions capable of managing extreme heat densities. The growing adoption of AI applications across industries creates opportunities for cooling technology providers to develop targeted solutions for high-performance computing environments. GPU-intensive workloads require precision cooling approaches that represent significant market opportunities.

Sustainability initiatives are creating opportunities for innovative cooling technologies that align with environmental objectives. The integration of renewable energy sources with cooling systems, development of carbon-neutral cooling solutions, and implementation of circular economy principles in cooling infrastructure represent emerging market opportunities.

Competitive landscape dynamics show increasing consolidation among cooling technology providers, with larger players acquiring specialized companies to expand their solution portfolios. This consolidation is driving innovation while creating more comprehensive service offerings for data center operators. Strategic partnerships between cooling vendors and data center developers are becoming more common to ensure optimal integration of cooling systems.

Technology convergence is reshaping market dynamics as cooling solutions become more integrated with broader data center infrastructure management systems. The adoption of software-defined cooling and AI-driven optimization is creating new competitive advantages for technology providers who can offer intelligent, automated cooling management capabilities.

Customer expectations are evolving toward more comprehensive cooling solutions that include installation, maintenance, and optimization services. Data center operators increasingly prefer turnkey cooling solutions that minimize operational complexity while maximizing efficiency. This shift is driving cooling vendors to expand their service capabilities and develop long-term customer relationships.

Market maturation is evident in the standardization of cooling performance metrics and the development of industry best practices. The establishment of cooling efficiency benchmarks and standardized measurement protocols is enabling more informed decision-making and driving continuous improvement in cooling technology performance.

Comprehensive market analysis was conducted through multiple research methodologies to ensure accurate and reliable insights into the Netherlands data center cooling market. The research approach combined primary and secondary data collection methods to provide a holistic view of market dynamics, competitive landscape, and future growth prospects.

Primary research involved structured interviews with key market participants including data center operators, cooling technology vendors, system integrators, and industry consultants. These interviews provided insights into current market challenges, technology adoption trends, and future investment priorities. Survey methodology was employed to gather quantitative data on cooling technology preferences, implementation timelines, and budget allocations.

Secondary research encompassed analysis of industry reports, government publications, regulatory documents, and company financial statements. Market intelligence was gathered from trade associations, industry conferences, and technical publications to understand technology trends and competitive positioning. Patent analysis and technology roadmap reviews provided insights into future innovation directions.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market insights. The research methodology incorporated both quantitative and qualitative analysis techniques to provide comprehensive market understanding and actionable intelligence for industry stakeholders.

Amsterdam metropolitan area dominates the Netherlands data center cooling market, accounting for approximately 68% of total cooling infrastructure investments. The region’s position as a major internet exchange point and its concentration of hyperscale facilities drive substantial demand for advanced cooling solutions. Schiphol Airport area has emerged as a secondary hub for data center development, benefiting from excellent connectivity and available land for large-scale facilities.

Rotterdam region represents a growing market segment, with approximately 15% of national cooling infrastructure investments. The area’s industrial heritage and port facilities provide advantages for data centers requiring substantial power and cooling infrastructure. Sustainable cooling initiatives in Rotterdam focus on integration with industrial waste heat networks and renewable energy sources.

The Hague area shows steady growth in data center cooling demand, driven by government digitalization initiatives and financial services sector requirements. The region accounts for roughly 8% of national cooling market activity, with emphasis on high-security facilities and specialized cooling requirements for sensitive government and financial applications.

Regional distribution of cooling technologies varies based on local infrastructure and regulatory requirements. Northern provinces are increasingly attracting data center investments due to cooler climate conditions that enhance free cooling effectiveness, while southern regions focus on integration with existing industrial cooling networks and cross-border connectivity advantages.

Market leadership in the Netherlands data center cooling sector is characterized by a mix of global technology providers and specialized regional players. The competitive environment emphasizes innovation, energy efficiency, and comprehensive service capabilities.

By Technology:

By Application:

By End User:

Air-based cooling systems continue to dominate the Netherlands market, representing approximately 72% of installed cooling capacity. However, this segment is evolving rapidly with the adoption of containment strategies, variable speed drives, and intelligent controls that significantly improve efficiency. Traditional raised-floor cooling is being supplemented by row-based cooling and rack-level cooling solutions that provide more precise temperature control.

Liquid cooling technologies are experiencing accelerated adoption, particularly in facilities supporting AI and high-performance computing workloads. Direct-to-chip cooling solutions are gaining traction for managing extreme heat densities, while immersion cooling is being deployed for specialized applications requiring maximum efficiency. Market penetration of liquid cooling is growing at approximately 35% annually as operators seek to address increasing thermal challenges.

Free cooling systems leverage the Netherlands’ favorable climate conditions to achieve significant energy savings. Air-side economizers and water-side economizers are widely deployed, with some facilities achieving free cooling operation for over 60% of annual operating hours. Integration of free cooling with traditional systems creates hybrid architectures that optimize efficiency across varying climate conditions.

Hybrid cooling approaches are emerging as optimal solutions for many data center operators, combining the reliability of traditional air cooling with the efficiency of liquid cooling and free cooling technologies. These integrated systems provide operational flexibility and risk mitigation while maximizing energy efficiency and supporting diverse workload requirements.

Data center operators benefit from advanced cooling technologies through reduced operational costs, improved energy efficiency, and enhanced reliability. Modern cooling systems enable higher server densities, reduced floor space requirements, and improved Power Usage Effectiveness (PUE) metrics that directly impact profitability and competitive positioning.

Technology vendors gain opportunities to differentiate their offerings through innovative cooling solutions that address specific market needs. The growing complexity of cooling requirements creates opportunities for value-added services, long-term maintenance contracts, and strategic partnerships with data center developers and operators.

End users of data center services benefit from improved application performance, reduced latency, and enhanced reliability resulting from optimized cooling infrastructure. Sustainable cooling practices also support corporate environmental objectives and regulatory compliance requirements.

Government stakeholders benefit from the economic development and job creation associated with data center investments, while advanced cooling technologies support national sustainability goals and energy efficiency objectives. The development of waste heat recovery systems contributes to broader urban energy efficiency initiatives.

Environmental benefits include reduced energy consumption, lower carbon emissions, and integration with renewable energy sources. Advanced cooling technologies enable data centers to operate more sustainably while supporting the Netherlands’ commitment to carbon neutrality and circular economy principles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Liquid cooling adoption is accelerating rapidly as data centers grapple with increasing heat densities from modern processors and AI workloads. Direct-to-chip cooling and immersion cooling technologies are moving from experimental deployments to mainstream adoption, particularly in hyperscale facilities and high-performance computing environments.

Artificial intelligence integration is transforming cooling system management through predictive analytics, automated optimization, and intelligent load balancing. Machine learning algorithms are being deployed to optimize cooling efficiency in real-time, reducing energy consumption while maintaining optimal operating conditions.

Modular cooling solutions are gaining popularity as data center operators seek flexible, scalable infrastructure that can adapt to changing requirements. Prefabricated cooling modules enable faster deployment and easier expansion while maintaining consistent performance standards across multiple facilities.

Sustainability integration is becoming a fundamental requirement rather than an optional feature. Data center operators are implementing waste heat recovery systems, renewable energy integration, and circular economy principles in their cooling infrastructure design and operation.

Edge computing proliferation is driving demand for compact, efficient cooling solutions suitable for unmanned, distributed deployments. Self-monitoring cooling systems with remote management capabilities are essential for edge data center success.

Major hyperscale operators have announced significant investments in advanced cooling technologies for their Netherlands facilities, including deployment of liquid cooling systems and waste heat recovery infrastructure. These investments are driving innovation and creating demonstration sites for next-generation cooling technologies.

Government initiatives have introduced new regulations and incentives supporting sustainable data center cooling practices. The Dutch government’s Climate Agreement includes specific provisions for data center energy efficiency and waste heat utilization that are shaping market development.

Technology partnerships between cooling vendors and data center operators are creating innovative solutions tailored to specific market needs. Collaborative development programs are accelerating the deployment of advanced cooling technologies and creating competitive advantages for participating companies.

Research institutions in the Netherlands are conducting cutting-edge research in cooling technologies, including development of novel cooling fluids, advanced heat exchangers, and AI-driven optimization systems. These research initiatives are positioning the Netherlands as a global leader in data center cooling innovation.

Industry consolidation continues with strategic acquisitions and mergers among cooling technology providers, creating larger, more comprehensive solution providers capable of serving the complex needs of modern data centers.

MarkWide Research analysis indicates that data center operators should prioritize investment in flexible cooling architectures that can adapt to evolving technology requirements. The rapid advancement of AI and machine learning workloads necessitates cooling systems capable of managing variable and extreme heat densities.

Strategic recommendations include early adoption of liquid cooling technologies for facilities planning to support high-density computing workloads. Organizations should evaluate hybrid cooling approaches that combine traditional air cooling with liquid cooling capabilities to maximize flexibility and efficiency.

Investment priorities should focus on cooling technologies that support sustainability objectives and regulatory compliance. Waste heat recovery systems and integration with renewable energy sources will become increasingly important for maintaining competitive positioning in the Netherlands market.

Partnership strategies with cooling technology vendors should emphasize long-term relationships that include ongoing optimization services and technology roadmap alignment. Data center operators should seek vendors capable of providing comprehensive solutions rather than point products.

Risk mitigation strategies should address potential supply chain disruptions and technology obsolescence through diversified vendor relationships and modular system designs that enable component-level upgrades without complete system replacement.

Market evolution over the next five years will be characterized by continued growth in cooling infrastructure investments, driven by expanding data center capacity and increasing heat density requirements. MWR projections indicate that liquid cooling adoption will accelerate significantly, potentially reaching 45% of new data center deployments by 2029.

Technology advancement will focus on integration of artificial intelligence and machine learning capabilities into cooling system management. Autonomous cooling systems capable of self-optimization and predictive maintenance will become standard features in new data center deployments.

Sustainability requirements will drive continued innovation in energy-efficient cooling technologies and waste heat recovery systems. The integration of data center cooling with broader urban energy systems will create new business models and revenue opportunities for facility operators.

Market consolidation is expected to continue as larger technology providers acquire specialized cooling companies to expand their solution portfolios. This consolidation will create more comprehensive service offerings while potentially reducing the number of independent cooling specialists.

Regulatory evolution will likely introduce more stringent energy efficiency requirements and carbon emission limitations that will further accelerate adoption of advanced cooling technologies. Data center operators must prepare for increasingly demanding environmental compliance requirements.

The Netherlands data center cooling market represents a dynamic and rapidly evolving sector driven by increasing digitalization, technological advancement, and sustainability requirements. The market’s strategic importance extends beyond national borders, as the Netherlands serves as a critical digital infrastructure hub for Europe and global connectivity.

Market fundamentals remain strong, supported by continued investment in data center capacity, growing demand for cloud services, and the emergence of new technologies requiring advanced cooling solutions. The transition from traditional air-based cooling to more sophisticated liquid cooling and hybrid systems reflects the industry’s response to increasing thermal challenges and efficiency requirements.

Future success in this market will depend on the ability of cooling technology providers and data center operators to adapt to rapidly changing requirements while maintaining focus on sustainability and operational efficiency. The integration of artificial intelligence, waste heat recovery, and renewable energy sources will define the next generation of cooling infrastructure in the Netherlands.

Strategic positioning for market participants requires understanding of both current technology trends and future regulatory requirements. Organizations that invest in flexible, scalable cooling architectures while building strong partnerships across the value chain will be best positioned to capitalize on the substantial opportunities in the Netherlands data center cooling market.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperatures in data centers, ensuring efficient operation of servers and IT equipment. This includes various cooling systems such as air conditioning, liquid cooling, and immersion cooling.

What are the key players in the Netherlands Data Center Cooling Market?

Key players in the Netherlands Data Center Cooling Market include companies like Vertiv, Schneider Electric, and Rittal, which provide innovative cooling solutions for data centers. These companies focus on energy efficiency and advanced cooling technologies, among others.

What are the main drivers of the Netherlands Data Center Cooling Market?

The main drivers of the Netherlands Data Center Cooling Market include the increasing demand for data storage and processing, the growth of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the rise in digital transformation across industries fuels this demand.

What challenges does the Netherlands Data Center Cooling Market face?

Challenges in the Netherlands Data Center Cooling Market include high energy consumption associated with cooling systems and the need for continuous innovation to keep up with evolving technology. Additionally, regulatory pressures regarding energy efficiency can pose challenges for operators.

What opportunities exist in the Netherlands Data Center Cooling Market?

Opportunities in the Netherlands Data Center Cooling Market include the development of sustainable cooling technologies and the integration of AI for predictive maintenance. Furthermore, the increasing focus on green data centers presents avenues for growth.

What trends are shaping the Netherlands Data Center Cooling Market?

Trends shaping the Netherlands Data Center Cooling Market include the adoption of liquid cooling solutions and the use of renewable energy sources for cooling operations. Additionally, there is a growing emphasis on modular cooling systems that offer flexibility and scalability.

Netherlands Data Center Cooling Market

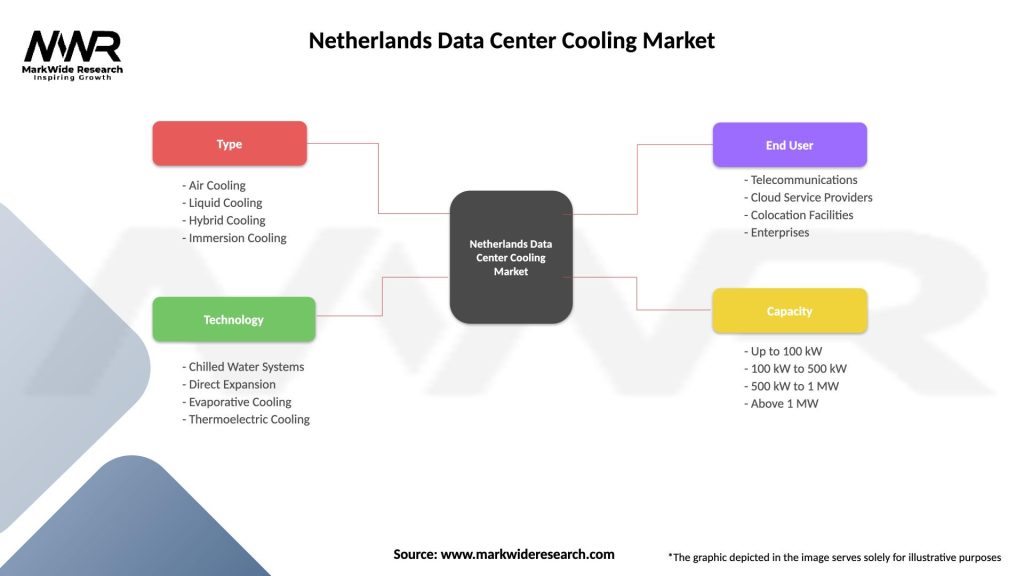

| Segmentation Details | Description |

|---|---|

| Type | Air Cooling, Liquid Cooling, Hybrid Cooling, Immersion Cooling |

| Technology | Chilled Water Systems, Direct Expansion, Evaporative Cooling, Thermoelectric Cooling |

| End User | Telecommunications, Cloud Service Providers, Colocation Facilities, Enterprises |

| Capacity | Up to 100 kW, 100 kW to 500 kW, 500 kW to 1 MW, Above 1 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at