444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands Combined Heat and Power market represents a critical component of the country’s energy transition strategy, demonstrating remarkable growth as industries and municipalities seek efficient energy solutions. Combined Heat and Power (CHP) systems have gained substantial traction across the Netherlands, driven by stringent environmental regulations and ambitious carbon neutrality goals. The market encompasses diverse applications ranging from industrial facilities to residential complexes, with natural gas-fired systems currently dominating the landscape while renewable-based CHP solutions are rapidly emerging.

Market dynamics indicate that the Netherlands CHP sector is experiencing robust expansion, with adoption rates increasing by approximately 8.5% annually across various industrial segments. The country’s commitment to reducing greenhouse gas emissions by 49% by 2030 has created favorable conditions for CHP technology deployment. Industrial applications account for the largest market share, particularly in chemical processing, food production, and manufacturing sectors where simultaneous heat and electricity demands align perfectly with CHP capabilities.

Government initiatives and supportive policy frameworks have established the Netherlands as a leading European market for combined heat and power solutions. The integration of smart grid technologies and district heating networks has further enhanced the appeal of CHP systems, creating opportunities for distributed energy generation and improved overall energy efficiency across urban and industrial areas.

The Netherlands Combined Heat and Power market refers to the comprehensive ecosystem of technologies, services, and applications that simultaneously generate electricity and useful thermal energy from a single fuel source within Dutch territory. CHP systems, also known as cogeneration, capture and utilize waste heat that would otherwise be lost in conventional power generation, achieving overall efficiency rates of 80-90% compared to separate heat and power production.

Market participants include equipment manufacturers, system integrators, energy service companies, and end-users across industrial, commercial, and residential sectors. The market encompasses various technology types including gas turbines, reciprocating engines, steam turbines, and emerging fuel cell systems. Biomass-fired CHP units and biogas applications represent growing segments aligned with the Netherlands’ circular economy objectives.

System capacities range from small-scale micro-CHP units for residential applications to large industrial installations exceeding several megawatts. The market includes both grid-connected systems that can sell excess electricity back to the network and island mode operations for critical facilities requiring energy independence and reliability.

Strategic market positioning reveals that the Netherlands Combined Heat and Power market has established itself as a cornerstone of the country’s energy security and sustainability strategy. Industrial demand continues to drive market expansion, with manufacturing facilities increasingly adopting CHP solutions to reduce energy costs while meeting environmental compliance requirements. The market demonstrates strong resilience and growth potential, supported by favorable regulatory frameworks and increasing awareness of energy efficiency benefits.

Technology evolution within the market shows a clear trend toward higher efficiency systems and integration with renewable energy sources. Hybrid CHP systems combining traditional fuel sources with solar thermal or biomass are gaining popularity, offering enhanced flexibility and reduced carbon footprints. Digitalization trends are transforming market dynamics, with smart monitoring and predictive maintenance capabilities becoming standard features in modern CHP installations.

Market segmentation analysis indicates that the industrial sector maintains the largest share, followed by commercial applications and emerging residential micro-CHP adoption. Regional distribution shows concentrated activity in industrial clusters around major ports and manufacturing centers, with urban district heating projects expanding rapidly in metropolitan areas. The market’s future trajectory appears strongly positive, with MarkWide Research projecting continued growth driven by energy transition policies and technological advancement.

Primary market drivers encompass several interconnected factors that collectively propel the Netherlands CHP market forward:

Market penetration rates vary significantly across different sectors, with heavy industry achieving approximately 35% CHP adoption while commercial and residential segments show substantial growth potential. Technology preferences are shifting toward more flexible and environmentally friendly solutions, with biogas-powered systems experiencing particularly strong demand growth.

Environmental regulations serve as the primary catalyst for Netherlands CHP market expansion, with the government implementing increasingly stringent emissions standards and energy efficiency requirements. Industrial facilities face mandatory energy audits and efficiency improvement targets, making CHP systems an attractive solution for compliance while reducing operational costs. The EU Emissions Trading System further incentivizes CHP adoption by creating economic advantages for high-efficiency energy generation.

Economic factors significantly influence market dynamics, particularly the rising costs of grid electricity and the availability of government incentives for CHP installations. Energy price volatility has increased interest in on-site generation capabilities, with CHP systems offering price stability and reduced exposure to market fluctuations. Payback periods for CHP investments have improved substantially, with many projects achieving returns within 5-7 years under current market conditions.

Technological advancement continues to drive market growth through improved system efficiency, reduced maintenance requirements, and enhanced operational flexibility. Smart grid integration capabilities allow CHP systems to participate in energy markets and provide grid services, creating additional revenue streams. Modular system designs enable scalable installations that can grow with facility requirements, reducing initial capital barriers and improving project feasibility across various applications.

Capital investment requirements represent the most significant barrier to CHP market expansion, particularly for smaller commercial and industrial facilities. Initial system costs can be substantial, requiring comprehensive financial planning and often external financing arrangements. Project complexity involving permitting, grid interconnection, and system integration creates additional cost burdens that may deter potential adopters, especially in competitive market environments.

Technical challenges related to system sizing, load matching, and maintenance requirements can complicate CHP implementation. Heat demand variability across seasons and operational cycles affects system utilization rates and economic performance. Grid interconnection requirements and utility regulations may impose additional technical and administrative burdens, particularly for smaller installations seeking to sell excess electricity back to the grid.

Market competition from alternative energy solutions, including renewable energy systems and energy storage technologies, creates pressure on CHP market positioning. Natural gas price fluctuations can impact the economic attractiveness of gas-fired CHP systems, while renewable energy cost reductions may challenge traditional CHP value propositions. Skilled workforce availability for system installation, operation, and maintenance remains a constraint in some market segments, potentially limiting deployment rates.

Renewable integration opportunities present substantial growth potential for the Netherlands CHP market, particularly through hybrid systems combining traditional cogeneration with solar thermal, biomass, or biogas technologies. Circular economy initiatives create demand for waste-to-energy CHP applications, transforming organic waste streams into valuable energy resources. Agricultural sector applications offer significant untapped potential, with biogas-powered CHP systems providing sustainable energy solutions for farming operations and food processing facilities.

District heating expansion represents a major market opportunity, with numerous Dutch municipalities planning new heating networks or expanding existing systems. Industrial cluster development creates opportunities for shared CHP infrastructure serving multiple facilities, improving economics through scale and load diversity. Data center applications are emerging as a high-growth segment, with facilities requiring reliable power and having substantial cooling heat recovery potential.

Technology innovation opens new market segments through improved efficiency, reduced emissions, and enhanced operational flexibility. Hydrogen-ready CHP systems position the market for future fuel transitions, while carbon capture integration could create additional value streams. Energy storage coupling with CHP systems offers enhanced grid services and improved economic performance, particularly in markets with high renewable energy penetration and variable electricity pricing.

Supply chain dynamics within the Netherlands CHP market reflect a mature ecosystem with established equipment manufacturers, experienced system integrators, and specialized service providers. International suppliers maintain strong presence alongside domestic companies, creating competitive pricing and technology innovation. Local content requirements and preferences for Dutch engineering services provide advantages for domestic market participants while ensuring high-quality installations and ongoing support.

Demand patterns show seasonal variations aligned with heating requirements, though industrial applications provide more consistent year-round demand. Load factor optimization has become increasingly important as facilities seek to maximize CHP system utilization and economic returns. Grid interaction dynamics are evolving with increased renewable energy penetration, creating opportunities for CHP systems to provide flexibility services and grid stabilization.

Regulatory dynamics continue to shape market development through evolving environmental standards, grid codes, and support mechanisms. Policy stability remains crucial for long-term investment decisions, with market participants closely monitoring potential changes to subsidy schemes and carbon pricing mechanisms. European Union directives on energy efficiency and renewable energy create additional market drivers while harmonizing technical standards across member states.

Comprehensive market analysis for the Netherlands Combined Heat and Power market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include extensive interviews with industry stakeholders, equipment manufacturers, system integrators, end-users, and regulatory authorities. Secondary research encompasses analysis of government publications, industry reports, academic studies, and company financial statements to validate market trends and quantify market dynamics.

Data collection processes utilize both quantitative and qualitative approaches, incorporating statistical analysis of installation data, capacity additions, and market share information. Industry surveys provide insights into technology preferences, investment plans, and market barriers from various stakeholder perspectives. Expert interviews with technology providers and project developers offer detailed understanding of market challenges and opportunities across different application segments.

Market validation procedures include cross-referencing multiple data sources, conducting stakeholder feedback sessions, and applying statistical verification methods to ensure data accuracy. Trend analysis incorporates historical market performance data with forward-looking indicators to project future market development. Regional analysis examines provincial and municipal market variations to provide comprehensive geographic market understanding.

North Holland leads the Netherlands CHP market with approximately 28% market share, driven by high industrial concentration around Amsterdam and significant district heating infrastructure. Port of Amsterdam industrial complex hosts numerous large-scale CHP installations serving chemical and manufacturing facilities. Urban district heating projects in Amsterdam and surrounding municipalities create substantial demand for medium-scale CHP systems, with several major expansion projects currently under development.

South Holland represents the second-largest regional market, accounting for roughly 24% of total installations, with the Rotterdam port area serving as a major industrial CHP hub. Petrochemical complexes and manufacturing facilities in the region operate some of the country’s largest CHP systems. Greenhouse agriculture in the Westland region creates unique CHP applications combining electricity generation with CO2 production for crop enhancement.

North Brabant demonstrates strong market growth with approximately 18% regional market share, supported by diverse industrial base and progressive municipal energy policies. Food processing industries and manufacturing facilities drive CHP adoption, while several municipalities have implemented ambitious district heating expansion plans. Limburg province shows emerging market potential, particularly in chemical processing and cross-border industrial cooperation projects with Germany and Belgium.

Eastern provinces including Gelderland and Overijssel collectively represent about 15% of market activity, with agricultural applications and food processing facilities driving demand. Biomass and biogas CHP systems show particularly strong adoption rates in these regions, aligned with agricultural waste availability and circular economy initiatives.

Market leadership in the Netherlands CHP sector is distributed among several key players offering diverse technology solutions and comprehensive service capabilities:

Competitive strategies focus on technology innovation, service excellence, and strategic partnerships with local system integrators. Market differentiation occurs through efficiency improvements, fuel flexibility, and integration capabilities with renewable energy systems. Service offerings have expanded beyond equipment supply to include comprehensive energy service contracts and performance guarantees.

By Technology Type:

By Fuel Type:

By Application:

Industrial CHP applications demonstrate the strongest market performance, with chemical processing facilities leading adoption due to consistent heat and power demands. Process integration opportunities in these facilities enable high system utilization rates exceeding 85% annually. Food and beverage industries show increasing CHP adoption, driven by energy cost pressures and sustainability commitments. Manufacturing facilities benefit from CHP systems’ ability to provide both process heat and electricity while reducing overall energy costs.

District heating CHP systems represent a rapidly growing category, with municipalities increasingly recognizing the benefits of centralized heat generation. Urban planning integration has become crucial, with new residential developments incorporating district heating infrastructure from the design phase. Seasonal energy storage integration with district heating CHP systems offers enhanced system flexibility and improved economics.

Commercial CHP applications show strong growth potential, particularly in healthcare facilities, hotels, and educational institutions with consistent heat and power demands. Building energy management systems integration enables optimized CHP operation and improved overall building efficiency. Micro-CHP systems for residential applications remain a niche but growing segment, with technology improvements reducing costs and improving reliability.

Energy cost reduction represents the primary benefit for CHP system operators, with typical savings of 20-40% compared to separate heat and power procurement. Energy security enhancement through on-site generation reduces dependence on grid electricity and provides backup power capabilities during outages. Environmental compliance benefits help facilities meet regulatory requirements while demonstrating corporate sustainability commitments to stakeholders and customers.

Operational advantages include improved energy efficiency, reduced transmission losses, and enhanced power quality for sensitive industrial processes. Revenue generation opportunities through excess electricity sales and grid services provide additional economic benefits. Carbon footprint reduction supports corporate environmental goals and may qualify for carbon credit programs and sustainability certifications.

Strategic benefits encompass enhanced competitiveness through reduced energy costs, improved operational resilience, and alignment with circular economy principles. Technology partnerships with CHP providers often include performance guarantees and comprehensive service agreements, reducing operational risks. Future-proofing through fuel-flexible systems positions facilities for energy transition scenarios and changing regulatory requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization transformation is reshaping the Netherlands CHP market through advanced monitoring systems, predictive maintenance capabilities, and artificial intelligence-driven optimization. Smart CHP systems can automatically adjust operation based on electricity prices, heat demand, and grid conditions, maximizing economic returns. Remote monitoring capabilities enable proactive maintenance and improved system reliability while reducing operational costs.

Fuel diversification trends show increasing interest in renewable and low-carbon fuel options, with biogas-powered CHP systems experiencing particularly strong growth. Hydrogen readiness has become a key requirement for new CHP installations, positioning systems for future fuel transitions. Hybrid energy systems combining CHP with solar thermal, heat pumps, or energy storage are gaining popularity for enhanced flexibility and sustainability.

Circular economy integration drives demand for waste-to-energy CHP applications, transforming organic waste streams into valuable energy resources. Industrial symbiosis projects create opportunities for shared CHP infrastructure serving multiple facilities. Carbon capture integration with CHP systems represents an emerging trend for industrial facilities seeking carbon neutrality while maintaining high-efficiency energy generation.

Recent technological advancement include the deployment of several large-scale biogas CHP projects utilizing agricultural waste and organic municipal waste streams. Major industrial facilities have announced significant CHP capacity additions, with several chemical processing plants installing state-of-the-art gas turbine systems. Municipal district heating expansions in Amsterdam, Rotterdam, and other major cities have created substantial new CHP demand.

Strategic partnerships between CHP manufacturers and renewable energy developers are creating innovative hybrid energy solutions. MarkWide Research analysis indicates that several pilot projects combining CHP systems with hydrogen production and carbon capture technologies are under development. Grid modernization initiatives are enhancing CHP integration capabilities and creating new revenue opportunities through ancillary services.

Regulatory developments include updated building codes requiring energy efficiency improvements and new environmental standards for industrial emissions. Subsidy program modifications have been implemented to better support smaller-scale CHP applications and renewable fuel utilization. International cooperation projects with neighboring countries are exploring cross-border district heating networks and shared CHP infrastructure.

Market participants should focus on developing fuel-flexible CHP systems capable of utilizing various energy sources including natural gas, biogas, and future hydrogen supplies. Technology providers are advised to invest in digitalization capabilities and smart system integration to differentiate their offerings. System integrators should develop expertise in hybrid energy systems combining CHP with renewable energy and storage technologies.

End-users considering CHP investments should conduct comprehensive feasibility studies examining heat and power load profiles, fuel availability, and regulatory compliance requirements. Financial planning should incorporate potential changes to energy prices, carbon pricing, and support mechanisms. Partnership strategies with experienced CHP providers can reduce project risks and ensure optimal system performance.

Policy makers should maintain stable support frameworks while encouraging innovation and renewable fuel utilization. Grid operators need to develop enhanced interconnection procedures and market mechanisms for CHP systems providing grid services. Municipal authorities should integrate CHP considerations into urban planning and district heating development strategies to maximize system benefits and cost-effectiveness.

Market projections indicate continued strong growth for the Netherlands CHP market, with expansion expected across all major application segments. Industrial demand will remain the primary growth driver, supported by increasing energy costs and environmental regulations. District heating applications are projected to experience the highest growth rates, with municipal expansion plans creating substantial new opportunities.

Technology evolution will focus on improved efficiency, reduced emissions, and enhanced fuel flexibility. Hydrogen-ready systems will become standard offerings as the country develops hydrogen infrastructure and supply chains. Carbon capture integration may create additional value streams for industrial CHP applications, supporting the transition to carbon neutrality while maintaining high-efficiency energy generation.

Market maturation will likely result in increased standardization, improved economics, and broader adoption across various sectors. MWR forecasts that renewable fuel utilization will increase significantly, with biogas and biomass CHP systems achieving substantial market penetration. Integration trends with smart grids, energy storage, and renewable energy systems will create more sophisticated and flexible energy solutions, positioning CHP technology as a crucial component of the Netherlands’ sustainable energy future.

The Netherlands Combined Heat and Power market stands at a pivotal juncture, with strong fundamentals supporting continued growth while technological innovation opens new opportunities for market expansion. Government commitment to carbon reduction goals and energy efficiency improvements creates a favorable environment for CHP deployment across industrial, commercial, and municipal applications. Market maturity combined with ongoing technological advancement positions the sector for sustained development through the energy transition period.

Strategic opportunities in renewable fuel utilization, district heating expansion, and hybrid energy systems offer substantial potential for market participants willing to invest in innovative solutions. Challenges related to capital costs and technical complexity remain manageable through improved financing mechanisms and enhanced service offerings. Future success will depend on continued policy support, technological innovation, and effective integration with broader energy system transformation initiatives, ensuring that CHP technology remains a vital component of the Netherlands’ sustainable energy landscape.

What is Combined Heat and Power?

Combined Heat and Power (CHP) refers to a technology that simultaneously generates electricity and useful heat from the same energy source, improving overall efficiency. It is commonly used in industrial processes, district heating, and large commercial buildings.

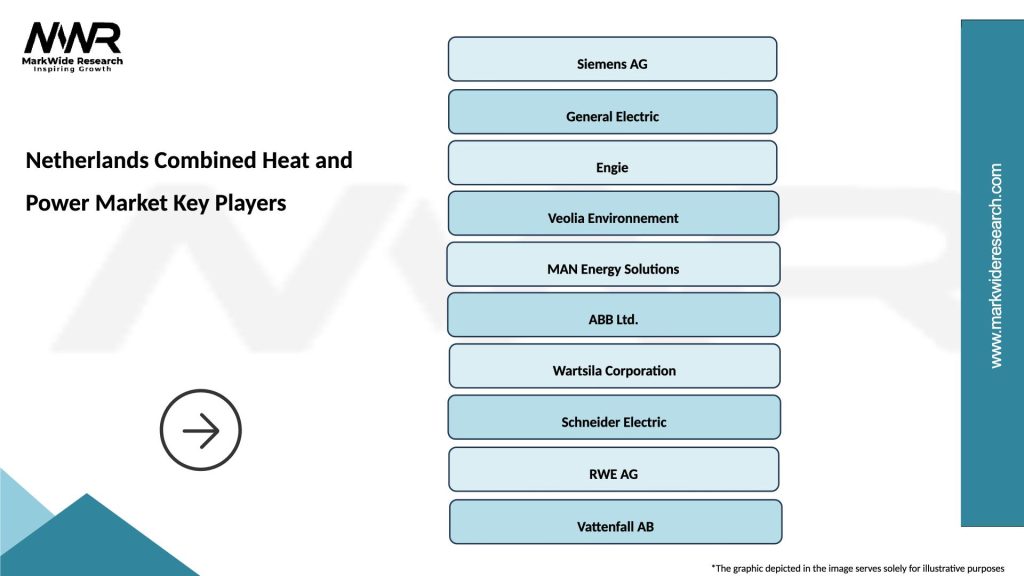

What are the key players in the Netherlands Combined Heat and Power Market?

Key players in the Netherlands Combined Heat and Power Market include companies like Siemens, General Electric, and Wärtsilä, which provide advanced CHP systems and solutions. These companies are known for their innovative technologies and extensive experience in energy management, among others.

What are the growth factors driving the Netherlands Combined Heat and Power Market?

The growth of the Netherlands Combined Heat and Power Market is driven by increasing energy efficiency demands, rising energy costs, and government incentives for sustainable energy solutions. Additionally, the push for reducing carbon emissions and enhancing energy security plays a significant role.

What challenges does the Netherlands Combined Heat and Power Market face?

Challenges in the Netherlands Combined Heat and Power Market include high initial investment costs, regulatory hurdles, and competition from alternative energy sources. These factors can hinder the widespread adoption of CHP technologies in various sectors.

What opportunities exist in the Netherlands Combined Heat and Power Market?

Opportunities in the Netherlands Combined Heat and Power Market include advancements in technology that enhance efficiency and reduce costs, as well as increasing demand for renewable energy integration. The growing focus on sustainability and energy independence also presents significant potential for CHP systems.

What trends are shaping the Netherlands Combined Heat and Power Market?

Trends in the Netherlands Combined Heat and Power Market include the integration of smart grid technologies, the use of biomass and waste as fuel sources, and the development of hybrid systems that combine CHP with renewable energy sources. These innovations are aimed at improving efficiency and reducing environmental impact.

Netherlands Combined Heat and Power Market

| Segmentation Details | Description |

|---|---|

| Type | Micro CHP, Large Scale CHP, Industrial CHP, Residential CHP |

| Technology | Gas Turbine, Steam Turbine, Reciprocating Engine, Fuel Cell |

| End User | Industrial Sector, Commercial Buildings, Residential Sector, District Heating |

| Installation | On-site, Off-site, Combined Heat and Power Plants, Retrofit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Combined Heat and Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at