444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nepal seeds market represents a vital component of the country’s agricultural ecosystem, serving as the foundation for food security and rural livelihoods. Nepal’s agricultural sector employs approximately 65% of the population, making the seeds market critically important for national economic stability. The market encompasses various seed categories including cereals, pulses, vegetables, and cash crops, with traditional varieties coexisting alongside modern hybrid and improved seeds.

Agricultural transformation in Nepal has been gaining momentum through government initiatives and international development programs focused on improving seed quality and accessibility. The market demonstrates significant potential for growth, driven by increasing awareness of high-yielding varieties and sustainable farming practices. Smallholder farmers constitute the primary consumer base, with average farm sizes of less than one hectare creating unique market dynamics.

Climate diversity across Nepal’s geographical regions from the Terai plains to the mountain zones creates distinct seed requirements and market segments. The market experiences seasonal fluctuations aligned with monsoon patterns and traditional planting cycles. Seed distribution networks face challenges related to remote geography and infrastructure limitations, yet demonstrate resilience through community-based approaches and local dealer networks.

The Nepal seeds market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of agricultural seeds across Nepal’s diverse agro-ecological zones. This market includes both traditional indigenous varieties preserved by farming communities and modern improved seeds developed through research and breeding programs.

Market participants range from individual smallholder farmers to commercial seed companies, government institutions, and international development organizations. The market operates through formal channels including licensed dealers and agro-vets, as well as informal networks based on farmer-to-farmer seed exchange and community seed banks.

Seed categories within the market encompass food grains, cash crops, vegetables, and fodder crops, each with distinct quality standards, pricing mechanisms, and distribution requirements. The market reflects Nepal’s agricultural heritage while adapting to modern farming needs and climate change challenges.

Nepal’s seeds market stands at a transformative juncture, balancing traditional agricultural practices with modern seed technologies. The market demonstrates steady growth potential driven by government policy support, international development assistance, and increasing farmer awareness of improved varieties. Hybrid seeds adoption has reached approximately 35% penetration in accessible regions, while traditional varieties maintain dominance in remote areas.

Key market drivers include population growth, changing dietary preferences, and climate adaptation needs. The government’s agricultural modernization agenda emphasizes seed sector development through subsidies, quality assurance programs, and infrastructure investments. Private sector participation has increased significantly, with both domestic and international companies establishing operations in Nepal.

Market challenges persist in the form of limited research and development capacity, inadequate storage facilities, and complex regulatory frameworks. However, opportunities abound in organic seed production, climate-resilient varieties, and digital agriculture solutions. The market’s future trajectory depends on continued policy support, infrastructure development, and farmer education initiatives.

Strategic insights reveal several critical factors shaping Nepal’s seeds market dynamics:

Government policy support serves as a primary market driver through the Agricultural Development Strategy and various subsidy programs. The Seed Act 2019 provides regulatory framework for quality assurance while promoting private sector investment. Subsidies covering up to 50% of seed costs for smallholder farmers have significantly boosted demand for improved varieties.

Population growth and urbanization create increasing food demand, necessitating higher agricultural productivity through better seeds. Climate change impacts drive demand for drought-tolerant, disease-resistant, and early-maturing varieties. Farmers increasingly recognize the correlation between seed quality and crop yields, leading to willingness to invest in premium seeds.

International development programs provide technical assistance, funding, and capacity building support to strengthen the seeds sector. Organizations focus on improving seed systems, supporting research institutions, and facilitating technology transfer. Market liberalization policies have encouraged private sector participation and competition, leading to improved product offerings and service quality.

Digital agriculture initiatives enhance farmer access to information about seed varieties, cultivation practices, and market prices. Mobile-based advisory services and e-commerce platforms are gradually transforming traditional seed distribution models.

Infrastructure limitations pose significant challenges to market development, particularly in remote mountainous regions where transportation costs can double seed prices. Storage facilities remain inadequate, leading to post-harvest losses and quality deterioration. Poor road connectivity limits timely seed distribution, especially during critical planting seasons.

Limited research capacity constrains development of locally adapted varieties suited to Nepal’s diverse agro-ecological conditions. Seed production capabilities fall short of domestic demand, necessitating imports that increase costs and reduce farmer access. Quality control mechanisms need strengthening to ensure seed authenticity and performance standards.

Financial constraints affect smallholder farmers’ ability to purchase improved seeds, despite subsidy programs. Risk aversion among traditional farmers creates resistance to adopting new varieties without demonstrated local performance. Limited extension services reduce farmer awareness about proper seed selection, handling, and storage practices.

Regulatory complexities and lengthy approval processes discourage private sector investment in seed development and distribution. Intellectual property protection remains weak, reducing incentives for innovation and technology transfer from international partners.

Organic agriculture expansion presents substantial opportunities for organic seed production and certification. Nepal’s potential for organic farming, supported by favorable climate and traditional practices, creates niche markets for premium organic seeds. Export opportunities to neighboring countries and international markets offer revenue growth potential for specialized seed varieties.

Climate-smart agriculture initiatives create demand for resilient seed varieties adapted to changing weather patterns. Precision agriculture technologies including GPS-guided planting and drone-based monitoring create opportunities for high-tech seed solutions. Digital platforms can revolutionize seed distribution through e-commerce and mobile-based ordering systems.

Public-private partnerships offer mechanisms for combining government policy support with private sector efficiency and innovation. Contract farming arrangements can guarantee seed demand while providing farmers with assured markets and technical support. Research collaborations with international institutions can accelerate variety development and technology transfer.

Value chain integration opportunities exist for companies to establish comprehensive agricultural solutions combining seeds, fertilizers, and crop protection products. Farmer producer organizations can be strengthened to improve collective bargaining power and market access for both seed procurement and crop marketing.

Supply-demand dynamics in Nepal’s seeds market reflect complex interactions between seasonal patterns, regional variations, and crop preferences. Demand peaks occur during pre-monsoon periods when farmers prepare for major planting seasons. Supply responses often lag due to seed production cycles and limited domestic multiplication capacity.

Price fluctuations result from seasonal demand patterns, import dependencies, and transportation costs. Quality differentiation creates market segments ranging from basic certified seeds to premium hybrid varieties with significant price premiums. Competition between traditional and improved varieties continues to shape market evolution.

Distribution networks operate through multiple channels including government outlets, private dealers, cooperatives, and informal farmer networks. Market integration varies significantly between accessible plains regions and remote mountain areas, creating price disparities and access challenges.

Technology adoption patterns demonstrate gradual shift toward improved varieties, with adoption rates varying by crop type, region, and farmer demographics. Market feedback mechanisms between farmers and seed suppliers remain underdeveloped, limiting responsive product development and service improvements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Nepal’s seeds market. Primary research includes structured interviews with key stakeholders including farmers, seed dealers, government officials, and industry experts across different geographical regions and market segments.

Secondary research incorporates analysis of government statistics, industry reports, academic studies, and international development organization publications. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market insights.

Field surveys conducted across representative districts capture regional variations in seed demand, pricing, and distribution patterns. Focus group discussions with farmer groups provide qualitative insights into decision-making processes, preferences, and challenges in seed selection and procurement.

Market observation techniques include visits to seed markets, dealer outlets, and agricultural fairs to understand market dynamics and competitive positioning. Seasonal analysis tracks market patterns across different agricultural cycles to identify trends and opportunities for market participants.

Terai region dominates Nepal’s seeds market, accounting for approximately 55% of total seed consumption due to intensive agriculture and commercial farming practices. Flat topography and better infrastructure facilitate seed distribution and adoption of mechanized farming techniques. Major crops include rice, wheat, maize, and sugarcane, with increasing adoption of hybrid varieties.

Hill region represents 35% of market share with diverse cropping patterns adapted to sloping terrain and varied microclimates. Traditional varieties maintain stronger presence due to cultural preferences and adaptation to local conditions. Vegetable seeds show particular growth potential due to proximity to urban markets and favorable growing conditions.

Mountain region accounts for 10% of market volume but faces unique challenges related to accessibility and extreme weather conditions. High-altitude crops including barley, buckwheat, and specialty vegetables require adapted varieties with limited commercial availability. Transportation costs significantly impact seed prices and farmer access.

Provincial variations reflect different agricultural priorities and development levels. Province 1 and Madhesh Pradesh show highest commercial seed adoption rates, while remote provinces rely more heavily on traditional varieties and informal seed systems.

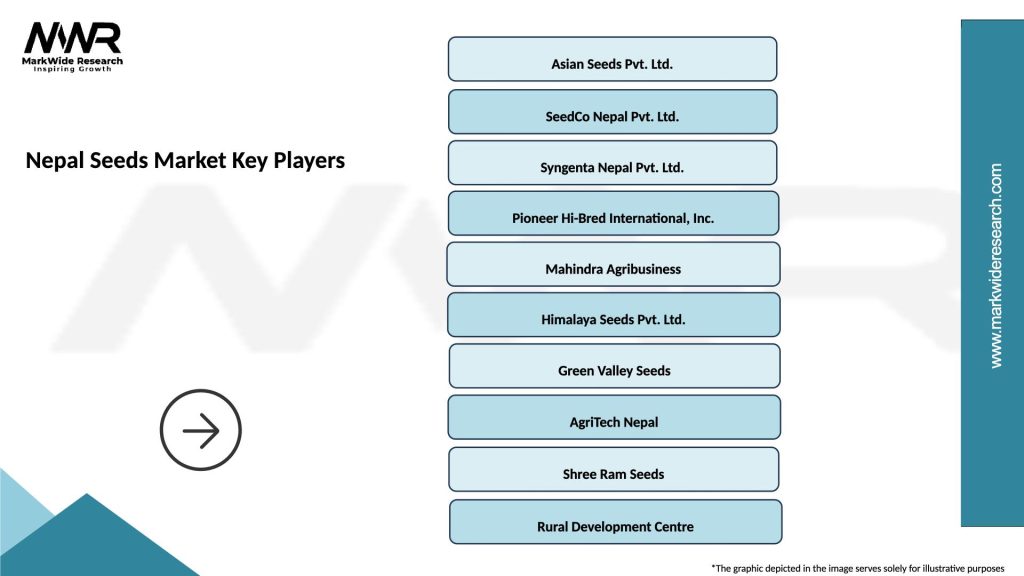

Market competition involves diverse players ranging from multinational corporations to local seed producers and government institutions. Key market participants include:

Competitive strategies focus on product quality, distribution network expansion, and farmer education programs. Market positioning varies from premium hybrid seeds targeting commercial farmers to affordable improved varieties for smallholders. Brand recognition remains limited in rural markets where personal relationships and local recommendations drive purchasing decisions.

Innovation competition centers on developing varieties adapted to local conditions, climate resilience, and farmer preferences. Service differentiation includes technical advisory support, credit facilities, and buyback arrangements for produce.

Crop-based segmentation reveals distinct market characteristics and growth patterns:

Technology-based segmentation distinguishes between traditional, improved, and hybrid varieties:

Regional segmentation reflects agro-ecological diversity and market accessibility across Terai, Hill, and Mountain regions with distinct crop preferences and adoption patterns.

Rice Seeds: Constitute the largest market segment with strong preference for traditional varieties in hills and hybrid adoption in Terai. Aromatic rice varieties command premium prices and show export potential. Climate-resilient varieties gain importance due to changing weather patterns.

Maize Seeds: Demonstrate highest hybrid adoption rates with 45% penetration in accessible areas. Nutritionally enhanced varieties including quality protein maize show growing acceptance. Dual-purpose varieties for grain and fodder production meet diverse farmer needs.

Vegetable Seeds: Represent the most dynamic market segment with rapid growth in greenhouse and off-season production. High-value crops including tomatoes, cucumbers, and leafy greens drive market expansion. Organic vegetable seeds show particular promise for export markets.

Wheat Seeds: Focus on disease-resistant varieties adapted to changing climate conditions. Durum wheat varieties gain attention for pasta and noodle production. Early-maturing varieties help farmers optimize cropping patterns.

Farmers benefit from improved seed varieties through higher yields, better disease resistance, and enhanced nutritional quality. Income enhancement results from increased productivity and premium prices for quality produce. Risk reduction through climate-resilient varieties provides stability in uncertain weather conditions.

Seed companies gain access to growing markets with supportive government policies and increasing farmer awareness. Market expansion opportunities exist across diverse agro-ecological zones and crop segments. Technology partnerships with research institutions facilitate product development and local adaptation.

Government stakeholders achieve food security objectives through improved agricultural productivity. Rural development goals advance through enhanced farmer incomes and reduced poverty. Import substitution in seed production contributes to foreign exchange savings.

Development organizations accomplish agricultural transformation objectives through seed system strengthening. Sustainability goals advance through promotion of climate-smart varieties and organic production systems. Capacity building initiatives create lasting institutional improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a significant trend with mobile-based advisory services and e-commerce platforms gaining traction. Precision agriculture adoption, though limited, shows potential for optimizing seed placement and resource utilization. Blockchain technology applications for seed traceability and quality assurance represent future possibilities.

Climate-smart agriculture drives demand for drought-tolerant, flood-resistant, and early-maturing varieties. Biofortification trends focus on nutritionally enhanced seeds addressing malnutrition challenges. Integrated pest management approaches influence seed selection toward naturally resistant varieties.

Organic certification gains importance as farmers target premium markets and export opportunities. Participatory plant breeding approaches involve farmers in variety development processes, ensuring local adaptation and acceptance. Community seed banks strengthen traditional variety conservation while improving access.

Gender inclusion initiatives recognize women’s roles in seed selection and conservation, leading to targeted programs and products. Youth engagement in agriculture drives adoption of modern varieties and farming techniques. MarkWide Research indicates that technology-savvy young farmers show 60% higher adoption rates for improved seeds.

Policy developments include implementation of the new Seed Act with strengthened quality control provisions and streamlined registration processes. National Seed Vision 2025 outlines strategic priorities for achieving seed self-sufficiency and export competitiveness. Subsidy program reforms aim to improve targeting and effectiveness.

Infrastructure investments focus on establishing regional seed testing laboratories and storage facilities. Cold chain development projects aim to maintain seed quality during transportation and storage. Rural road improvements enhance market access for remote farming communities.

Research initiatives include establishment of new crop research programs and strengthening of existing institutions. International collaborations with CGIAR centers and bilateral partners accelerate technology transfer and capacity building. Private sector research investments increase through tax incentives and partnership arrangements.

Market development programs promote farmer education, dealer training, and quality awareness campaigns. Certification schemes for organic and specialty seeds create market differentiation opportunities. Digital agriculture pilots demonstrate potential for transforming traditional farming practices.

Infrastructure development should prioritize seed storage facilities and cold chain systems to maintain quality and reduce losses. Public-private partnerships can leverage government resources with private sector efficiency for sustainable market development. Investment in rural connectivity will significantly improve market access and reduce distribution costs.

Research capacity strengthening requires sustained investment in human resources, equipment, and institutional development. Regional research centers should focus on developing varieties adapted to specific agro-ecological conditions. International partnerships can accelerate technology transfer while building local capabilities.

Regulatory framework improvements should balance quality assurance with market accessibility and innovation incentives. Streamlined approval processes for new varieties can encourage private sector investment while maintaining safety standards. Intellectual property protection mechanisms need strengthening to promote innovation.

Market integration initiatives should focus on connecting smallholder farmers with formal seed distribution networks. Digital platforms can overcome geographical barriers and provide farmers with better information and choices. MWR analysis suggests that integrated approaches combining seeds, credit, and technical support show 40% higher success rates than standalone interventions.

Market growth prospects remain positive driven by government support, increasing farmer awareness, and climate adaptation needs. Technology adoption is expected to accelerate with improved infrastructure and digital agriculture initiatives. Hybrid seed penetration may reach 50% in accessible regions within the next five years.

Organic agriculture expansion will create premium market segments for certified organic seeds. Export opportunities in neighboring countries and international markets offer revenue diversification potential. Climate-resilient varieties will become increasingly important as weather patterns become more unpredictable.

Private sector participation is likely to increase with improved regulatory environment and market opportunities. Consolidation trends may emerge as companies seek economies of scale and market expansion. International partnerships will continue driving technology transfer and capacity building.

Digital transformation will revolutionize seed distribution, farmer services, and market information systems. Precision agriculture adoption may reach 25% penetration in commercial farming areas within a decade. MarkWide Research projects that integrated digital solutions could improve seed distribution efficiency by 35% while reducing costs for farmers in remote areas.

Nepal’s seeds market stands at a critical juncture with substantial opportunities for growth and transformation. The market benefits from strong government support, increasing farmer awareness, and growing recognition of agriculture’s importance for national development. Diverse agro-ecological conditions create opportunities for specialized seed varieties while presenting challenges for market integration and distribution.

Key success factors include continued policy support, infrastructure development, and capacity building across the value chain. Technology adoption and digital transformation offer pathways for overcoming traditional constraints while improving farmer access to quality seeds and information. Climate change adaptation requirements will drive innovation and market evolution.

Stakeholder collaboration between government, private sector, research institutions, and development partners remains essential for sustainable market development. Investment priorities should focus on infrastructure, research capacity, and farmer education to build a robust and responsive seed system. The market’s future success depends on balancing traditional knowledge with modern technology while ensuring accessibility for all farmers across Nepal’s diverse agricultural landscape.

What is Seeds?

Seeds are the reproductive units of flowering plants, capable of developing into another such plant. In the context of agriculture, seeds are crucial for crop production and can vary widely in type, including cereals, pulses, and oilseeds.

What are the key players in the Nepal Seeds Market?

Key players in the Nepal Seeds Market include companies like Himalayan Seeds, Nepal Seed Company, and Syngenta, which are involved in the production and distribution of various seed types, including hybrid and traditional seeds, among others.

What are the growth factors driving the Nepal Seeds Market?

The Nepal Seeds Market is driven by factors such as the increasing demand for high-yielding crop varieties, the adoption of modern agricultural practices, and government initiatives to enhance food security through improved seed quality.

What challenges does the Nepal Seeds Market face?

Challenges in the Nepal Seeds Market include issues related to seed quality control, limited access to advanced seed technology, and the impact of climate change on crop production, which can affect seed viability.

What opportunities exist in the Nepal Seeds Market?

Opportunities in the Nepal Seeds Market include the potential for organic seed production, the development of drought-resistant seed varieties, and the expansion of export markets for high-quality seeds.

What trends are shaping the Nepal Seeds Market?

Trends in the Nepal Seeds Market include the increasing use of biotechnology in seed development, a growing focus on sustainable agricultural practices, and the rise of digital platforms for seed distribution and farmer education.

Nepal Seeds Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vegetable Seeds, Flower Seeds, Fruit Seeds, Herb Seeds |

| Grade | Certified, Non-Certified, Organic, Hybrid |

| End User | Agricultural Farms, Home Gardeners, Commercial Growers, Research Institutions |

| Distribution Channel | Retail Stores, Online Platforms, Agricultural Cooperatives, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nepal Seeds Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at