444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The NDT in automotive and transportation market represents a critical segment within the broader non-destructive testing industry, focusing specifically on ensuring safety, reliability, and quality across automotive manufacturing and transportation infrastructure. Non-destructive testing (NDT) technologies have become indispensable in automotive production lines, aerospace manufacturing, railway systems, and marine transportation, where component failure can result in catastrophic consequences.

Market dynamics indicate robust growth driven by stringent safety regulations, increasing vehicle production volumes, and the rising complexity of modern transportation systems. The automotive sector’s transition toward electric vehicles and autonomous driving technologies has created new testing requirements, particularly for battery systems, advanced materials, and sophisticated electronic components. Transportation infrastructure modernization initiatives worldwide further amplify demand for comprehensive NDT solutions.

Regional adoption varies significantly, with North America and Europe leading in terms of regulatory compliance and technological advancement, while Asia-Pacific demonstrates the highest growth potential due to expanding automotive manufacturing capabilities. The market encompasses various testing methodologies including ultrasonic testing, radiographic testing, magnetic particle testing, and emerging digital inspection technologies that leverage artificial intelligence and machine learning algorithms.

Industry stakeholders range from automotive OEMs and tier-1 suppliers to specialized NDT service providers and equipment manufacturers. The integration of Industry 4.0 principles has transformed traditional inspection processes, enabling real-time monitoring, predictive maintenance, and automated quality assurance systems that significantly enhance operational efficiency and reduce manufacturing costs.

The NDT in automotive and transportation market refers to the comprehensive ecosystem of non-destructive testing technologies, services, and solutions specifically designed for quality assurance, safety validation, and maintenance applications within automotive manufacturing and transportation sectors. This market encompasses testing methodologies that evaluate material properties, detect defects, and assess structural integrity without causing damage to the tested components.

Core applications include weld inspection in automotive body manufacturing, engine component testing, brake system validation, and structural assessment of transportation infrastructure such as bridges, railways, and aircraft. The market extends beyond traditional automotive manufacturing to encompass electric vehicle battery testing, composite material inspection in aerospace applications, and predictive maintenance solutions for fleet operators.

Technology integration represents a fundamental aspect of this market, combining conventional NDT methods with advanced digital technologies, robotics, and artificial intelligence. Modern NDT solutions provide automated inspection capabilities, real-time data analysis, and integration with manufacturing execution systems, enabling seamless quality control throughout production processes.

Regulatory compliance drives significant market demand, as automotive and transportation industries face increasingly stringent safety standards and quality requirements. International standards such as ISO/TS 16949 for automotive quality management and various aviation safety regulations mandate comprehensive testing protocols that ensure component reliability and passenger safety across all transportation modes.

Market expansion in the NDT automotive and transportation sector reflects the industry’s commitment to safety, quality, and operational excellence. The convergence of traditional testing methodologies with cutting-edge digital technologies has created unprecedented opportunities for innovation and efficiency improvements across manufacturing and maintenance operations.

Key growth drivers include the automotive industry’s electrification trend, increasing adoption of lightweight materials, and the growing emphasis on predictive maintenance strategies. Electric vehicle production requires specialized testing protocols for battery systems, power electronics, and charging infrastructure, creating new market segments and revenue opportunities for NDT providers.

Technological advancement continues to reshape market dynamics, with artificial intelligence, machine learning, and automated inspection systems gaining significant traction. These technologies enable faster inspection cycles, improved defect detection accuracy, and reduced dependency on skilled technicians, addressing critical workforce challenges facing the industry.

Regional market development shows strong growth across emerging economies, particularly in Asia-Pacific, where expanding automotive manufacturing capabilities and infrastructure development projects drive substantial demand for NDT solutions. Established markets in North America and Europe focus on technology upgrades and compliance with evolving safety regulations.

Competitive landscape features a mix of established NDT equipment manufacturers, specialized service providers, and emerging technology companies developing innovative inspection solutions. Strategic partnerships between traditional NDT companies and technology firms accelerate product development and market penetration across diverse transportation applications.

Primary market insights reveal several critical trends shaping the NDT automotive and transportation landscape:

Market segmentation analysis indicates that ultrasonic testing maintains the largest market share due to its versatility and effectiveness across diverse applications, while emerging technologies like digital radiography and computed tomography demonstrate the highest growth rates in specialized applications.

Regulatory compliance serves as the primary market driver, with increasingly stringent safety standards across automotive and transportation sectors mandating comprehensive testing protocols. Government agencies worldwide continuously update regulations to address emerging safety concerns, particularly in areas such as autonomous vehicle development, electric vehicle safety, and transportation infrastructure integrity.

Quality assurance requirements have intensified as manufacturers face growing consumer expectations for product reliability and safety. The automotive industry’s zero-defect manufacturing philosophy drives demand for advanced NDT solutions capable of detecting minute flaws that could compromise component performance or safety. This trend extends to transportation infrastructure, where aging assets require regular inspection to prevent catastrophic failures.

Technological advancement in materials science creates new testing challenges and opportunities. The increasing use of composite materials, advanced high-strength steels, and aluminum alloys in automotive and aerospace applications requires specialized NDT techniques capable of evaluating these materials’ unique properties and potential failure modes.

Electric vehicle adoption represents a significant growth driver, as EV manufacturing introduces new testing requirements for battery systems, power electronics, and charging infrastructure. Battery pack inspection, thermal management system validation, and high-voltage component testing create substantial new market opportunities for NDT providers.

Industry 4.0 integration accelerates demand for smart NDT solutions that provide real-time data integration with manufacturing execution systems. Manufacturers seek inspection technologies that support digital twin concepts, enabling virtual quality monitoring and predictive maintenance capabilities throughout product lifecycles.

Cost reduction pressures drive adoption of automated NDT systems that reduce labor costs while improving inspection consistency and throughput. Organizations increasingly recognize that investing in advanced NDT technologies delivers long-term cost benefits through reduced warranty claims, improved manufacturing efficiency, and enhanced brand reputation.

High implementation costs represent a significant barrier to market expansion, particularly for small and medium-sized manufacturers. Advanced NDT equipment requires substantial capital investment, and the associated training, maintenance, and calibration costs can strain organizational budgets. This challenge is particularly acute for emerging market participants seeking to establish competitive manufacturing capabilities.

Technical complexity of modern NDT systems creates operational challenges for organizations lacking specialized expertise. The integration of artificial intelligence, machine learning, and advanced sensor technologies requires skilled technicians and engineers capable of system operation, maintenance, and data interpretation. The global shortage of qualified NDT professionals exacerbates this challenge.

Standardization gaps across different regions and applications create compliance complexities for global manufacturers. Varying regulatory requirements, testing protocols, and certification processes increase operational costs and complexity, particularly for companies operating across multiple markets with different standards and requirements.

Technology obsolescence concerns affect investment decisions, as rapid technological advancement creates uncertainty about equipment longevity and upgrade requirements. Organizations hesitate to invest in expensive NDT systems that may become outdated within short timeframes, preferring to delay purchases until technology stabilizes.

Integration challenges with existing manufacturing systems and processes can impede NDT adoption. Legacy production lines may require significant modifications to accommodate new inspection technologies, creating additional costs and potential production disruptions during implementation phases.

Data management complexities arise from the vast amounts of inspection data generated by modern NDT systems. Organizations struggle to develop effective data storage, analysis, and retention strategies that comply with regulatory requirements while providing actionable insights for quality improvement and predictive maintenance applications.

Electric vehicle expansion creates substantial opportunities for NDT providers to develop specialized testing solutions for battery systems, power electronics, and charging infrastructure. The unique safety and performance requirements of EV components necessitate innovative inspection approaches that address thermal management, electrical insulation, and structural integrity concerns.

Autonomous vehicle development opens new market segments for NDT applications in sensor validation, electronic component testing, and software-hardware integration verification. The critical safety requirements of autonomous driving systems demand comprehensive testing protocols that ensure reliable operation under diverse environmental conditions.

Infrastructure modernization initiatives worldwide present significant opportunities for NDT service providers specializing in transportation infrastructure assessment. Aging bridges, railways, and airports require regular inspection and maintenance, creating sustained demand for structural health monitoring solutions and predictive maintenance services.

Emerging markets offer substantial growth potential as developing economies expand their automotive manufacturing capabilities and transportation infrastructure. Countries in Asia-Pacific, Latin America, and Africa represent untapped markets for NDT solutions, particularly as local manufacturers seek to meet international quality standards.

Digital transformation initiatives enable NDT providers to develop innovative service models, including remote inspection capabilities, cloud-based data analysis, and subscription-based testing services. These digital solutions reduce operational costs while expanding market reach and service accessibility.

Aerospace sector growth driven by increasing air travel demand and aircraft modernization creates opportunities for specialized NDT applications in composite material inspection, engine component testing, and structural integrity assessment. The aerospace industry’s stringent safety requirements and high-value components justify premium pricing for advanced NDT solutions.

Supply chain evolution significantly impacts NDT market dynamics, as automotive and transportation manufacturers increasingly adopt global sourcing strategies that require consistent quality standards across multiple suppliers and locations. This trend drives demand for standardized NDT protocols and portable inspection equipment that ensures quality consistency regardless of manufacturing location.

Competitive pressure intensifies as manufacturers seek to differentiate their products through superior quality and reliability. NDT becomes a critical competitive advantage, enabling companies to identify and eliminate defects before they reach customers, thereby reducing warranty costs and enhancing brand reputation in increasingly competitive markets.

Technology convergence between traditional NDT methods and emerging digital technologies creates new market dynamics. The integration of artificial intelligence, machine learning, and advanced data analytics transforms NDT from reactive quality control to proactive quality assurance and predictive maintenance capabilities.

Regulatory harmonization efforts across international markets influence NDT adoption patterns and technology development priorities. Standardization initiatives facilitate global trade while creating opportunities for NDT providers to develop solutions that meet multiple regulatory requirements simultaneously.

Workforce demographics impact market dynamics as experienced NDT technicians approach retirement while younger workers show less interest in traditional inspection roles. This demographic shift accelerates demand for automated NDT solutions that reduce dependency on skilled technicians while maintaining inspection quality and reliability.

Economic cycles affect NDT market demand, with economic downturns typically reducing capital equipment purchases while increasing focus on maintenance and asset life extension. Conversely, economic growth periods drive new manufacturing capacity investments and corresponding NDT equipment demand.

Primary research methodologies employed in analyzing the NDT automotive and transportation market include comprehensive surveys of industry participants, in-depth interviews with key stakeholders, and direct observation of NDT applications across various manufacturing and maintenance facilities. These primary sources provide current market insights, technology adoption trends, and future growth projections.

Secondary research encompasses analysis of industry reports, regulatory documents, patent filings, and academic publications related to NDT technologies and applications. This research foundation enables comprehensive understanding of market trends, competitive landscapes, and technological developments shaping the industry.

Market segmentation analysis utilizes both quantitative and qualitative research approaches to identify key market segments, growth drivers, and competitive dynamics. Segmentation criteria include technology type, application area, end-user industry, and geographic region, providing detailed insights into market structure and opportunities.

Competitive analysis involves systematic evaluation of key market participants, including equipment manufacturers, service providers, and technology developers. This analysis encompasses company profiles, product portfolios, market positioning strategies, and financial performance indicators.

Technology assessment methodologies include evaluation of emerging NDT technologies, their potential applications, and market readiness. This assessment considers factors such as technical maturity, cost-effectiveness, regulatory acceptance, and competitive advantages compared to existing solutions.

Regional analysis employs comparative methodologies to assess market development across different geographic regions, considering factors such as regulatory environments, manufacturing capabilities, infrastructure development, and economic conditions that influence NDT adoption and growth patterns.

North America maintains a leading position in the NDT automotive and transportation market, driven by stringent regulatory requirements, advanced manufacturing capabilities, and early adoption of innovative technologies. The region’s automotive industry leadership in electric vehicle development and autonomous driving technologies creates substantial demand for specialized NDT solutions. According to MarkWide Research analysis, North America accounts for approximately 35% of global NDT market share in automotive applications.

Europe demonstrates strong market presence, particularly in aerospace and premium automotive segments where quality and safety requirements are paramount. The region’s emphasis on environmental regulations and sustainable transportation drives demand for lightweight materials testing and electric vehicle component validation. European manufacturers increasingly adopt automated NDT systems to maintain competitive advantages in global markets.

Asia-Pacific represents the fastest-growing regional market, with China, Japan, and India leading expansion efforts. The region’s massive automotive manufacturing capacity and rapid infrastructure development create substantial opportunities for NDT providers. Growth rates in Asia-Pacific exceed 8% annually, driven by increasing quality standards and regulatory compliance requirements.

Latin America shows emerging market potential, particularly in countries like Brazil and Mexico where automotive manufacturing continues expanding. Infrastructure development projects and increasing foreign investment in manufacturing facilities drive demand for NDT solutions, though market development remains constrained by economic volatility and limited technical expertise.

Middle East and Africa present niche opportunities, primarily in aerospace and transportation infrastructure applications. The region’s focus on economic diversification and infrastructure modernization creates demand for NDT services, particularly in countries investing heavily in transportation networks and manufacturing capabilities.

Market leadership in the NDT automotive and transportation sector is characterized by a diverse ecosystem of established equipment manufacturers, specialized service providers, and emerging technology companies. The competitive landscape reflects the industry’s evolution from traditional inspection methods to advanced digital solutions.

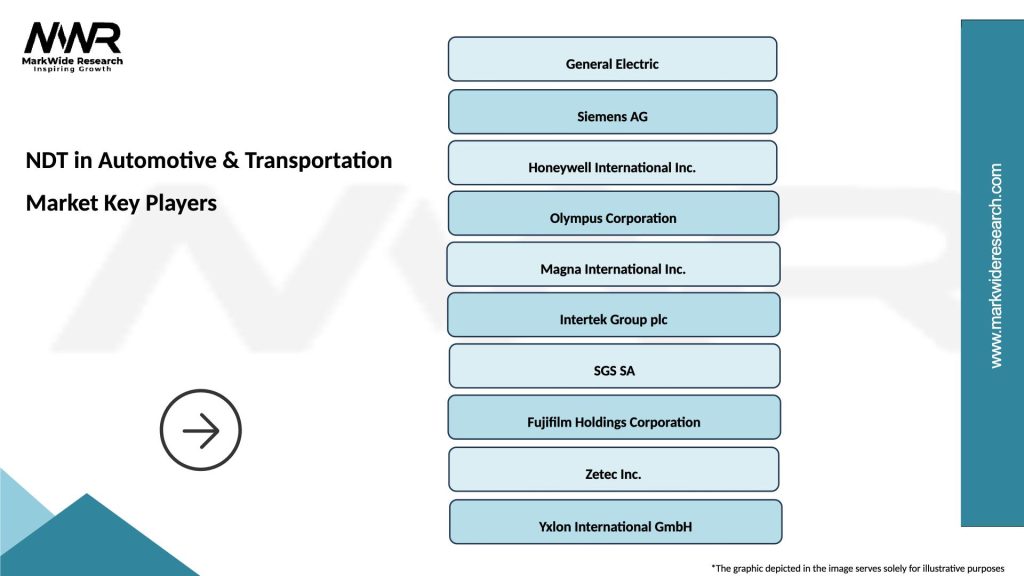

Key market participants include:

Competitive strategies focus on technology innovation, service expansion, and strategic partnerships. Companies increasingly invest in artificial intelligence, machine learning, and automation technologies to differentiate their offerings and address evolving customer requirements.

Market consolidation trends include acquisitions of specialized technology companies by larger NDT providers seeking to expand their technological capabilities and market reach. These consolidation activities accelerate innovation and enable comprehensive solution offerings that address diverse customer needs across automotive and transportation applications.

By Technology:

By Application:

By End-User Industry:

Automotive Manufacturing represents the largest category within the NDT market, driven by high-volume production requirements and stringent quality standards. This category encompasses body-in-white inspection, engine component testing, brake system validation, and electronic component assessment. The transition to electric vehicles creates new subcategories including battery pack inspection and power electronics testing.

Aerospace Applications demand the highest precision and reliability standards, justifying premium pricing for specialized NDT solutions. This category includes composite material inspection, engine component testing, and structural integrity assessment. Advanced technologies like computed tomography and automated ultrasonic testing find primary applications in aerospace manufacturing and maintenance.

Transportation Infrastructure encompasses bridge inspection, railway track assessment, and airport facility maintenance. This category demonstrates steady growth driven by aging infrastructure and increasing safety requirements. Structural health monitoring systems represent an emerging subcategory combining NDT with continuous monitoring capabilities.

Heavy Industry Applications include commercial vehicle manufacturing, marine vessel construction, and industrial equipment production. These applications typically require robust, portable NDT equipment capable of operating in challenging environments while maintaining inspection accuracy and reliability.

Service and Maintenance categories focus on in-service inspection and predictive maintenance applications. This segment shows strong growth as organizations adopt proactive maintenance strategies to minimize downtime and extend asset lifecycles. Digital NDT solutions enable remote monitoring and automated analysis capabilities.

Emerging Categories include electric vehicle charging infrastructure inspection, autonomous vehicle sensor validation, and advanced materials testing for next-generation transportation applications. These categories represent significant growth opportunities as transportation technologies continue evolving.

Manufacturers benefit from NDT implementation through improved product quality, reduced warranty costs, and enhanced brand reputation. Advanced NDT systems enable zero-defect manufacturing strategies that eliminate costly recalls and customer dissatisfaction. Integration with manufacturing execution systems provides real-time quality feedback that enables immediate process adjustments and continuous improvement.

Suppliers gain competitive advantages through NDT capabilities that demonstrate quality commitment and regulatory compliance. Tier suppliers in automotive and aerospace industries increasingly require comprehensive NDT capabilities to maintain preferred supplier status with major OEMs. NDT certification enables access to high-value contracts and premium pricing opportunities.

Service Providers benefit from expanding market opportunities as organizations outsource specialized NDT requirements. The complexity of modern NDT technologies creates opportunities for specialized service companies that provide expertise and equipment without requiring customer capital investment. Recurring service contracts provide stable revenue streams and long-term customer relationships.

End Users achieve significant operational benefits including reduced maintenance costs, extended asset lifecycles, and improved safety performance. Predictive maintenance enabled by NDT technologies minimizes unplanned downtime and optimizes maintenance scheduling. Risk mitigation through comprehensive inspection programs protects against catastrophic failures and associated liabilities.

Regulatory Bodies benefit from improved industry compliance and safety performance enabled by advanced NDT capabilities. Standardized inspection protocols and digital documentation facilitate regulatory oversight and enforcement activities. Enhanced inspection capabilities support continuous improvement of safety standards and regulations.

Technology Developers find expanding opportunities for innovation and market growth as NDT requirements become more sophisticated. Integration of artificial intelligence, machine learning, and automation technologies creates new product categories and revenue streams. Partnerships with end users enable development of customized solutions that address specific application requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming NDT applications in automotive and transportation sectors. AI-powered systems enable automated defect recognition, pattern analysis, and predictive maintenance capabilities that surpass traditional inspection methods. Machine learning algorithms continuously improve inspection accuracy while reducing false positive rates and inspection time.

Digital Twin Technology emerges as a transformative trend enabling virtual inspection and monitoring capabilities. Digital twins integrate NDT data with design models and operational parameters, providing comprehensive asset health monitoring and predictive maintenance insights. This technology particularly benefits complex systems like aircraft engines and automotive powertrains.

Portable and Handheld Solutions gain popularity as manufacturers seek flexible inspection capabilities that adapt to diverse production environments. Advanced portable NDT equipment provides laboratory-quality results in field conditions, enabling inspection of large components and assembled systems without requiring dedicated inspection facilities.

Real-time Monitoring systems integrate NDT sensors with manufacturing processes, providing continuous quality assessment and immediate feedback. This trend supports zero-defect manufacturing objectives while reducing inspection cycle times and enabling immediate corrective actions when defects are detected.

Cloud-based Analytics enable centralized data management and analysis across multiple manufacturing locations and inspection systems. Cloud platforms facilitate remote expert consultation, standardized analysis procedures, and comprehensive quality reporting that supports global manufacturing operations.

Robotic Integration automates inspection processes in hazardous or difficult-to-access locations. Robotic NDT systems provide consistent inspection quality while reducing human exposure to radiation and other hazards associated with certain testing methods.

Technology Partnerships between traditional NDT companies and technology firms accelerate innovation and market expansion. Recent collaborations focus on integrating artificial intelligence, machine learning, and advanced sensors to create next-generation inspection solutions that address evolving industry requirements.

Regulatory Updates continue shaping market development, with new standards addressing electric vehicle safety, autonomous vehicle validation, and advanced materials testing. These regulatory changes create opportunities for NDT providers while establishing new compliance requirements for manufacturers.

Acquisition Activity intensifies as larger companies seek to expand their technological capabilities and market reach through strategic acquisitions. Recent acquisitions focus on companies developing AI-powered inspection solutions, specialized testing equipment, and digital service platforms.

Product Launches emphasize automation, artificial intelligence, and user-friendly interfaces that reduce operator training requirements. New products integrate multiple testing methods into single platforms, providing comprehensive inspection capabilities while reducing equipment costs and complexity.

Market Expansion initiatives target emerging economies and new application areas. Companies establish local partnerships and service centers to support growing demand in Asia-Pacific, Latin America, and other developing regions with expanding automotive and transportation industries.

Research Investments focus on developing NDT solutions for emerging materials and applications, including carbon fiber composites, advanced ceramics, and additive manufactured components. These investments position companies for future growth as transportation technologies continue evolving.

Investment Priorities should focus on automation and artificial intelligence technologies that address workforce challenges while improving inspection capabilities. Companies investing in these technologies will gain competitive advantages and market share as labor shortages intensify and quality requirements increase.

Market Entry Strategies for new participants should emphasize specialized applications and emerging market segments where established competitors have limited presence. Electric vehicle testing, autonomous vehicle validation, and emerging market expansion offer the best opportunities for new entrants.

Technology Development efforts should prioritize user-friendly interfaces, automated analysis capabilities, and integration with existing manufacturing systems. Solutions that reduce training requirements and provide immediate value will achieve faster market adoption and customer acceptance.

Partnership Opportunities exist between traditional NDT companies and technology firms developing AI, machine learning, and robotics solutions. These partnerships can accelerate innovation while providing access to new markets and customer segments.

Service Model Innovation should explore subscription-based services, remote monitoring capabilities, and cloud-based analytics that provide ongoing value to customers while creating recurring revenue streams. These service models align with customer preferences for operational expense rather than capital investment.

Geographic Expansion strategies should target high-growth regions in Asia-Pacific and Latin America where automotive manufacturing continues expanding. Local partnerships and service capabilities will be essential for success in these markets with unique regulatory and cultural requirements.

Market growth projections indicate sustained expansion driven by electric vehicle adoption, autonomous vehicle development, and infrastructure modernization initiatives. MarkWide Research forecasts indicate the market will experience robust growth rates exceeding 7% annually over the next five years, with emerging technologies and applications driving the majority of this expansion.

Technology evolution will continue transforming NDT applications through artificial intelligence, machine learning, and advanced sensor integration. Future NDT systems will provide predictive capabilities that anticipate component failures before they occur, enabling proactive maintenance strategies that minimize downtime and extend asset lifecycles.

Electric vehicle impact will create substantial new market segments as EV production scales globally. Battery testing, power electronics validation, and charging infrastructure inspection will become major growth drivers, requiring specialized NDT solutions that address unique safety and performance requirements.

Autonomous vehicle development will generate additional demand for NDT applications in sensor validation, electronic component testing, and software-hardware integration verification. The critical safety requirements of autonomous systems will drive comprehensive testing protocols and advanced inspection capabilities.

Regional development patterns indicate continued strong growth in Asia-Pacific markets, with China, India, and Southeast Asian countries leading expansion. These regions will require substantial technology transfer and local capability development to support growing automotive and transportation industries.

Industry consolidation will likely continue as larger companies acquire specialized technology firms and service providers to expand their capabilities and market reach. This consolidation will accelerate innovation while creating more comprehensive solution offerings for customers across diverse applications.

The NDT in automotive and transportation market stands at a pivotal transformation point, driven by technological advancement, regulatory evolution, and changing industry requirements. The convergence of traditional inspection methods with artificial intelligence, automation, and digital technologies creates unprecedented opportunities for innovation and market expansion.

Market fundamentals remain strong, supported by stringent safety regulations, increasing quality requirements, and the automotive industry’s transition toward electrification and autonomous technologies. These trends create sustained demand for advanced NDT solutions while opening new market segments and application areas that promise substantial growth opportunities.

Competitive dynamics favor companies that successfully integrate traditional NDT expertise with emerging digital technologies. Organizations that invest in automation, artificial intelligence, and user-friendly solutions will capture market share while addressing critical workforce challenges facing the industry.

Future success will depend on adaptability to changing market requirements, continuous technology innovation, and strategic positioning in high-growth segments such as electric vehicles and autonomous systems. Companies that develop comprehensive solutions addressing diverse customer needs across multiple transportation applications will achieve sustainable competitive advantages in this evolving market landscape.

What is NDT in Automotive & Transportation?

NDT, or Non-Destructive Testing, in Automotive & Transportation refers to a range of testing methods used to evaluate the properties of materials and components without causing damage. This includes techniques such as ultrasonic testing, radiographic testing, and magnetic particle testing, which are essential for ensuring safety and reliability in vehicles and transportation infrastructure.

What are the key companies in the NDT in Automotive & Transportation Market?

Key companies in the NDT in Automotive & Transportation Market include SGS SA, Intertek Group plc, and Bureau Veritas, which provide various testing and inspection services. These companies play a crucial role in maintaining quality standards and compliance in the automotive and transportation sectors, among others.

What are the growth factors driving the NDT in Automotive & Transportation Market?

The growth of the NDT in Automotive & Transportation Market is driven by increasing safety regulations, the demand for high-quality materials, and the need for regular maintenance checks. Additionally, advancements in NDT technologies and the rising adoption of electric vehicles are contributing to market expansion.

What challenges does the NDT in Automotive & Transportation Market face?

Challenges in the NDT in Automotive & Transportation Market include the high costs associated with advanced testing equipment and the need for skilled personnel to perform these tests. Furthermore, the rapid pace of technological change can make it difficult for companies to keep up with the latest methods and standards.

What opportunities exist in the NDT in Automotive & Transportation Market?

Opportunities in the NDT in Automotive & Transportation Market include the growing emphasis on sustainability and the integration of NDT with digital technologies such as AI and IoT. These trends can enhance testing efficiency and accuracy, opening new avenues for service providers.

What trends are shaping the NDT in Automotive & Transportation Market?

Trends shaping the NDT in Automotive & Transportation Market include the increasing use of automated testing solutions and the development of portable NDT equipment. Additionally, there is a rising focus on predictive maintenance, which leverages NDT to anticipate failures before they occur.

NDT in Automotive & Transportation Market

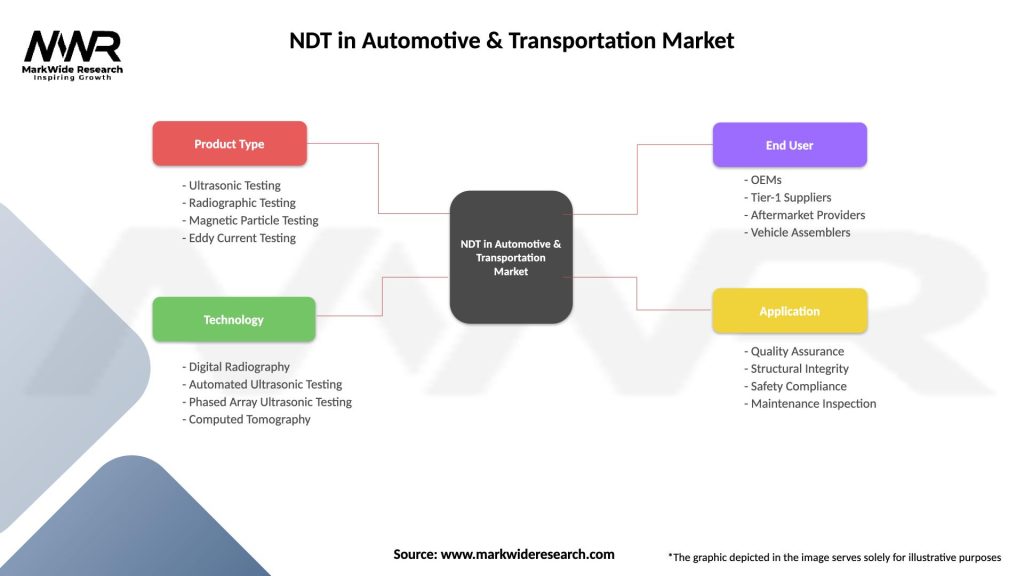

| Segmentation Details | Description |

|---|---|

| Product Type | Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Eddy Current Testing |

| Technology | Digital Radiography, Automated Ultrasonic Testing, Phased Array Ultrasonic Testing, Computed Tomography |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Quality Assurance, Structural Integrity, Safety Compliance, Maintenance Inspection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NDT in Automotive & Transportation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at