444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The natural household insecticides market is experiencing significant growth driven by the rising demand for eco-friendly pest control solutions and increasing consumer awareness regarding the harmful effects of chemical-based insecticides on human health and the environment. Natural household insecticides are derived from plant-based ingredients, essential oils, and other natural compounds that repel or eliminate common household pests such as mosquitoes, ants, cockroaches, and flies. With the growing emphasis on sustainability and health-conscious living, the market for natural household insecticides offers lucrative opportunities for manufacturers, retailers, and consumers seeking safer and more environmentally friendly alternatives to conventional insecticides.

Meaning

Natural household insecticides refer to pest control products formulated with plant-based ingredients, essential oils, and other natural compounds that repel, deter, or eliminate household pests such as insects and rodents. These products offer a safer, non-toxic, and eco-friendly alternative to chemical-based insecticides, reducing exposure to harmful chemicals and minimizing adverse effects on human health, pets, and the environment. Natural household insecticides are available in various forms such as sprays, powders, baits, traps, and repellents, catering to the diverse needs and preferences of consumers seeking effective and sustainable pest control solutions for their homes.

Executive Summary

The natural household insecticides market is witnessing robust growth driven by factors such as increasing consumer awareness of environmental issues, growing concerns about pesticide residues in food and water, and rising demand for safe and effective pest control solutions for homes and families. Key market players are investing in product innovation, marketing strategies, and distribution channels to capitalize on emerging trends and consumer preferences, driving market expansion and competitiveness in the global natural household insecticides industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The natural household insecticides market is characterized by dynamic trends and factors driving growth and innovation, including consumer preferences for eco-friendly products, regulatory support for natural ingredients, and advancements in formulation technology. Brands need to adapt to market dynamics, anticipate trends, and invest in product development, marketing, and distribution strategies to maintain competitiveness and relevance in the rapidly evolving natural household insecticides industry.

Regional Analysis

The natural household insecticides market is globally distributed, with key regions including North America, Europe, Asia Pacific, Latin America, and Africa. North America and Europe are leading markets for natural household insecticides, driven by factors such as high consumer awareness of environmental issues, stringent regulations on pesticide use, and growing demand for sustainable pest control solutions. Asia Pacific is an emerging market for natural household insecticides, fueled by rising disposable incomes, urbanization, and increasing concerns about pesticide residues in food and water.

Competitive Landscape

Leading Companies in Natural Household Insecticides Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The natural household insecticides market can be segmented based on product type, pest type, formulation, and geography. Product types include sprays, powders, baits, traps, and repellents formulated with natural ingredients such as plant extracts, essential oils, and botanicals. Pest types encompass mosquitoes, ants, cockroaches, flies, spiders, and rodents. Formulations include ready-to-use products, concentrates, and granules designed for indoor and outdoor use.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the demand for natural household insecticides as consumers spend more time at home and prioritize health, hygiene, and safety in their living environments. With increased awareness of hygiene practices and sanitation measures to prevent the spread of infectious diseases, consumers seek natural and non-toxic alternatives to chemical-based insecticides for pest control in their homes, driving sales and adoption of natural household insecticides through online and offline channels.

Key Industry Developments

Analyst Suggestions

Future Outlook

The natural household insecticides market is poised for continued growth and innovation, driven by factors such as increasing consumer demand for eco-friendly products, regulatory support for natural ingredients, and advancements in formulation technology. Brands that lead innovation, differentiation, and sustainability in the natural household insecticides market will establish themselves as industry leaders, driving market expansion, competitiveness, and sustainability in the dynamic and evolving pest control landscape.

Conclusion

In conclusion, the natural household insecticides market presents significant opportunities for manufacturers, retailers, and consumers to promote environmental sustainability, health, and safety through the use of eco-friendly and effective pest control solutions for homes and gardens. By offering high-quality, innovative, and sustainable natural household insecticides, industry stakeholders can meet the growing demand for safer and more environmentally friendly alternatives to chemical-based products, driving market growth, differentiation, and competitiveness in the global pest control industry.

What is Natural Household Insecticides?

Natural household insecticides are pest control products made from naturally derived ingredients, designed to manage insect populations in domestic settings. They are often preferred for their lower toxicity to humans and pets compared to synthetic alternatives.

What are the key players in the Natural Household Insecticides Market?

Key players in the Natural Household Insecticides Market include companies like EcoSMART, Wondercide, and Green Shield Organic, which focus on developing eco-friendly pest control solutions. These companies are known for their innovative products that cater to environmentally conscious consumers, among others.

What are the growth factors driving the Natural Household Insecticides Market?

The growth of the Natural Household Insecticides Market is driven by increasing consumer awareness of health and environmental issues, a rising preference for organic products, and the growing incidence of pest-related problems in households. Additionally, regulatory support for natural products is enhancing market growth.

What challenges does the Natural Household Insecticides Market face?

The Natural Household Insecticides Market faces challenges such as the perception of lower efficacy compared to synthetic insecticides and the limited availability of certain natural ingredients. Additionally, competition from established chemical insecticide brands can hinder market penetration.

What opportunities exist in the Natural Household Insecticides Market?

Opportunities in the Natural Household Insecticides Market include the potential for product innovation, such as developing new formulations that enhance effectiveness. There is also a growing trend towards sustainable living, which can drive demand for natural pest control solutions among eco-conscious consumers.

What trends are shaping the Natural Household Insecticides Market?

Trends shaping the Natural Household Insecticides Market include the increasing popularity of DIY pest control solutions and the rise of e-commerce platforms for product distribution. Additionally, there is a notable shift towards integrating technology in pest management, such as smart traps and monitoring systems.

Natural Household Insecticides Market

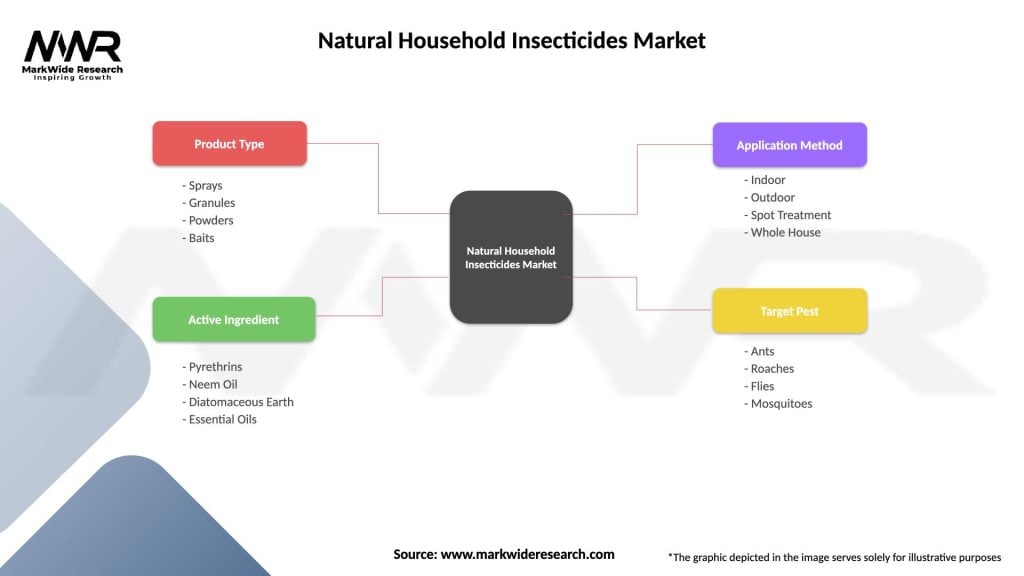

| Segmentation Details | Description |

|---|---|

| Product Type | Sprays, Granules, Powders, Baits |

| Active Ingredient | Pyrethrins, Neem Oil, Diatomaceous Earth, Essential Oils |

| Application Method | Indoor, Outdoor, Spot Treatment, Whole House |

| Target Pest | Ants, Roaches, Flies, Mosquitoes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Natural Household Insecticides Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at