444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The natural food and beverage foaming agent market is a pivotal segment within the broader food additives industry, specializing in substances that impart aeration and texture to various consumables. These agents are integral to the creation of frothy textures in beverages and light, airy textures in foods, enhancing sensory appeal and consumer acceptance. As consumer preferences pivot towards healthier and cleaner labels, the demand for natural foaming agents derived from organic and plant-based sources has surged, reshaping the market landscape.

Meaning

Natural food and beverage foaming agents are substances added to food and drink formulations to create stable foam structures. These agents can be derived from natural sources such as plants, seaweeds, and certain proteins. Their function extends beyond mere aesthetics, influencing mouthfeel, taste perception, and overall consumer experience. The shift towards natural alternatives reflects broader trends in clean label preferences and sustainability, driven by heightened consumer awareness and regulatory scrutiny over synthetic additives.

Executive Summary

The natural food and beverage foaming agent market has witnessed robust growth in recent years, propelled by increasing consumer demand for clean label products and sustainable food additives. This segment caters to a diverse range of applications across beverages, dairy products, confectioneries, and baked goods, where foaming agents play a crucial role in texture enhancement and product differentiation. Industry stakeholders face both opportunities and challenges in navigating regulatory complexities, sourcing sustainable ingredients, and meeting evolving consumer expectations.

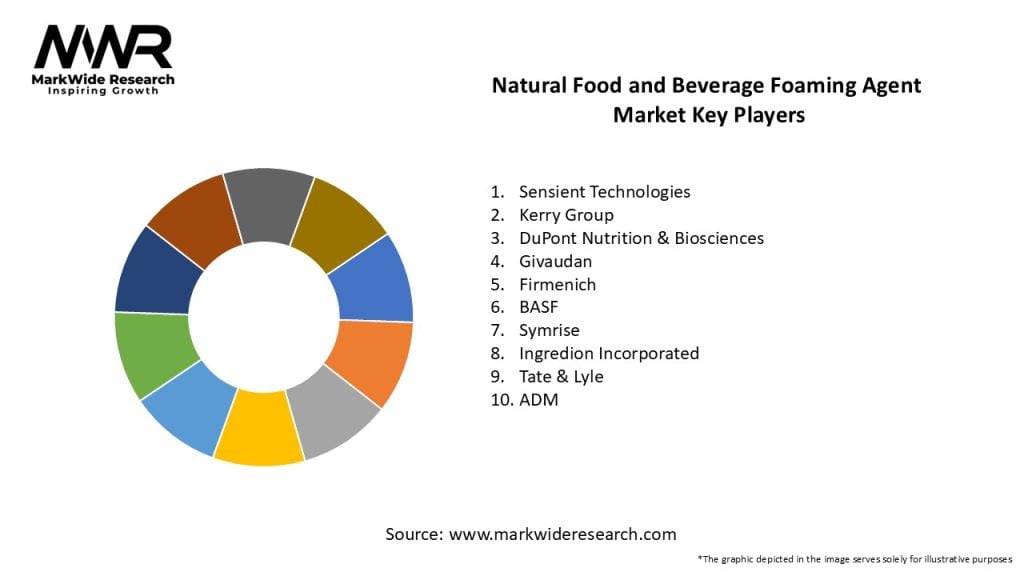

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The natural food and beverage foaming agent market operates within a dynamic landscape shaped by consumer trends, technological advancements, regulatory developments, and competitive forces. Adapting to these dynamics requires agility, innovation, and a deep understanding of market nuances to capitalize on emerging opportunities and mitigate potential risks.

Regional Analysis

Competitive Landscape

Leading Companies in the Natural Food and Beverage Foaming Agent Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

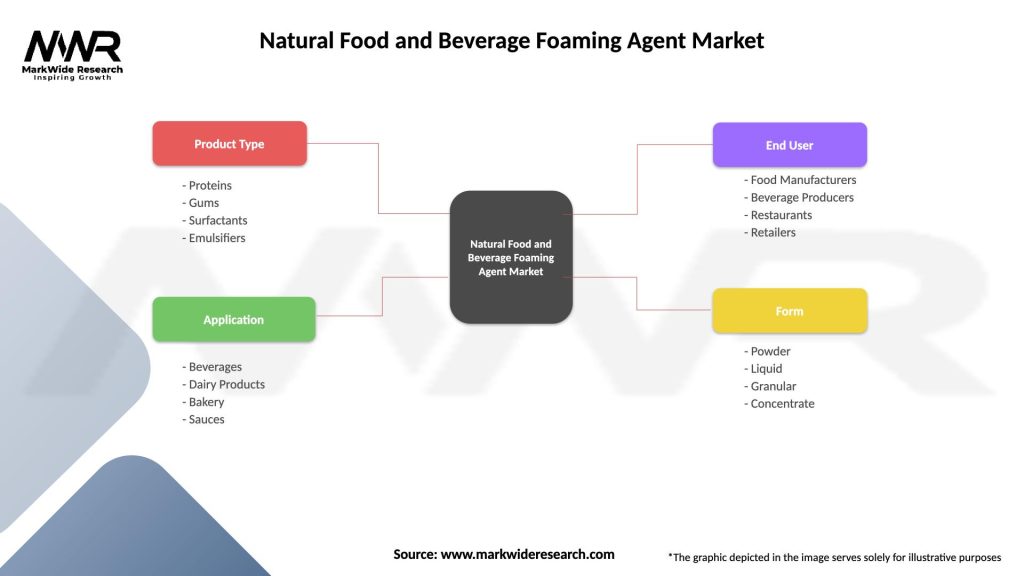

Segmentation

Segmentation facilitates a deeper understanding of market dynamics, consumer preferences, and competitive strategies, enabling stakeholders to tailor their approaches and capitalize on growth opportunities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis empowers industry stakeholders to leverage strengths, mitigate weaknesses, capitalize on opportunities, and navigate threats effectively.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic significantly impacted the natural food and beverage foaming agent market, causing disruptions in supply chains and shifts in consumer demand. Heightened awareness of health and wellness during the pandemic led to increased interest in natural and clean-label products, including foaming agents. While initial disruptions affected production and distribution, the market demonstrated resilience as manufacturers adapted to evolving consumer preferences and stringent hygiene regulations, accelerating the adoption of natural foaming agents in various food and beverage applications.

Key Industry Developments

Industry developments in the natural food and beverage foaming agent market have centered on innovation and sustainability. Manufacturers are focusing on developing plant-based and organic foaming agents to meet the rising demand for clean-label products. Advances in extraction technologies and formulation processes have enhanced the functionality and stability of natural foaming agents, expanding their application scope in beverages, desserts, and dairy products. Additionally, strategic partnerships between ingredient suppliers and food manufacturers have fostered product innovation and market expansion.

Analyst Suggestions

Analysts suggest several strategies for stakeholders in the natural food and beverage foaming agent market to capitalize on emerging opportunities. Investment in research and development is crucial to innovate new formulations that meet consumer expectations for clean-label and sustainable ingredients. Embracing digital marketing strategies to educate consumers about the benefits of natural foaming agents can enhance product visibility and market penetration. Moreover, fostering collaborations across the supply chain and exploring new markets, particularly in Asia Pacific and Latin America, can drive growth amidst evolving regulatory landscapes and competitive pressures.

Future Outlook

The natural food and beverage foaming agent market is poised for sustained growth driven by evolving consumer preferences, technological advancements, and regulatory support for natural ingredients. Industry stakeholders are primed to capitalize on opportunities in clean label products, functional foods, and sustainable sourcing practices, positioning natural foaming agents as essential components in the formulation of healthier, more appealing food and beverage products.

Conclusion

In conclusion, the natural food and beverage foaming agent market represents a dynamic sector within the broader food additives industry, characterized by innovation, sustainability, and consumer-driven demand for clean label products. As manufacturers and suppliers continue to prioritize natural ingredient sourcing, technological innovation, and regulatory compliance, the market is expected to expand across diverse applications and geographic regions. By addressing challenges related to cost, supply chain resilience, and regulatory complexity, stakeholders can harness growth opportunities and differentiate their offerings in a competitive marketplace. The future outlook remains promising, underpinned by ongoing advancements in ingredient science, shifting consumer preferences, and global trends towards healthier, more sustainable food choices.

What is Natural Food and Beverage Foaming Agent?

Natural Food and Beverage Foaming Agents are substances used to create foam in food and beverage products. They enhance texture and mouthfeel, commonly found in products like whipped toppings, dairy products, and carbonated beverages.

What are the key players in the Natural Food and Beverage Foaming Agent Market?

Key players in the Natural Food and Beverage Foaming Agent Market include companies like DuPont, Kerry Group, and ADM. These companies are known for their innovative solutions and extensive product portfolios in the food and beverage sector, among others.

What are the growth factors driving the Natural Food and Beverage Foaming Agent Market?

The growth of the Natural Food and Beverage Foaming Agent Market is driven by increasing consumer demand for natural and clean-label products. Additionally, the rise in the popularity of plant-based beverages and the expansion of the food service industry contribute to market growth.

What challenges does the Natural Food and Beverage Foaming Agent Market face?

The Natural Food and Beverage Foaming Agent Market faces challenges such as regulatory compliance and the need for consistent quality in natural ingredients. Additionally, competition from synthetic foaming agents can hinder market growth.

What opportunities exist in the Natural Food and Beverage Foaming Agent Market?

Opportunities in the Natural Food and Beverage Foaming Agent Market include the development of innovative foaming solutions for new product categories, such as plant-based alternatives. There is also potential for growth in emerging markets where consumer preferences are shifting towards healthier options.

What trends are shaping the Natural Food and Beverage Foaming Agent Market?

Trends in the Natural Food and Beverage Foaming Agent Market include a growing focus on sustainability and the use of organic ingredients. Additionally, advancements in food technology are leading to the creation of more effective and versatile foaming agents.

Natural Food and Beverage Foaming Agent Market

| Segmentation Details | Description |

|---|---|

| Product Type | Proteins, Gums, Surfactants, Emulsifiers |

| Application | Beverages, Dairy Products, Bakery, Sauces |

| End User | Food Manufacturers, Beverage Producers, Restaurants, Retailers |

| Form | Powder, Liquid, Granular, Concentrate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Natural Food and Beverage Foaming Agent Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at