444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The NATO ammunition market is a vital component of the defense industry, catering to the ammunition requirements of the member countries of the North Atlantic Treaty Organization (NATO). Ammunition plays a critical role in maintaining the defense and security capabilities of NATO member nations, ensuring their readiness for combat operations and peacekeeping missions. The market for NATO ammunition encompasses various types of ammunition, including small caliber ammunition, artillery shells, rockets, missiles, and other explosive ordnance.

Meaning

The NATO ammunition market refers to the industry involved in the production, distribution, and procurement of ammunition for NATO member countries. This market focuses on meeting the ammunition requirements of armed forces within the NATO alliance, which consists of 30 member nations. The ammunition is designed to meet the specific operational needs and compatibility standards of NATO forces, ensuring interoperability and seamless coordination during joint military operations.

Executive Summary

The NATO ammunition market has witnessed significant growth in recent years due to the increasing defense budgets of member countries and the rising need for advanced ammunition to counter evolving security threats. This report provides a comprehensive analysis of the market, including key market insights, drivers, restraints, opportunities, and market dynamics. It also includes a regional analysis, competitive landscape, segmentation, and category-wise insights, along with a SWOT analysis and examination of key industry trends. The report further explores the impact of the COVID-19 pandemic on the market and presents key industry developments, analyst suggestions, and a future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The NATO ammunition market is influenced by various dynamics, including defense budgets, technological advancements, security threats, and geopolitical factors. The market is characterized by the interplay of supply and demand, driven by the ammunition requirements of NATO member countries. The market dynamics are shaped by the evolving nature of warfare, changing operational doctrines, and the need for interoperability among NATO forces.

On the supply side, ammunition manufacturers strive to develop advanced ammunition solutions that meet NATO standards and address emerging operational needs. This requires continuous research and development investments to enhance performance, reliability, and precision of ammunition systems. Ammunition manufacturers also focus on cost optimization and production efficiency to remain competitive in the market.

On the demand side, NATO member countries allocate defense budgets to procure ammunition for their armed forces. The demand for ammunition is influenced by geopolitical factors, security threats, and evolving warfare tactics. NATO member countries seek ammunition solutions that offer superior accuracy, lethality, and compatibility with their existing military systems. Interoperability and standardization are key considerations, ensuring seamless coordination among NATO forces during joint operations.

The market dynamics are further influenced by regulatory frameworks governing arms export and trade, technological collaborations, industry partnerships, and the impact of emerging technologies such as artificial intelligence and additive manufacturing. Additionally, environmental concerns, sustainability initiatives, and the need for responsible ammunition disposal practices contribute to the evolving market dynamics.

Regional Analysis

The NATO ammunition market spans across multiple regions, with the demand for ammunition driven by the defense requirements of NATO member countries. The regions analyzed in this report include North America, Europe, and other regions.

North America: North America, comprising the United States and Canada, holds a significant share in the NATO ammunition market. The United States, as a leading NATO member and a major global military power, invests heavily in ammunition procurement and modernization programs. The presence of prominent ammunition manufacturers and defense contractors in North America contributes to the market growth in the region.

Europe: Europe is a key region in the NATO ammunition market, as it encompasses a large number of NATO member countries. European countries such as the United Kingdom, Germany, France, Italy, and others have robust defense budgets and actively invest in ammunition systems. The region also witnesses collaborations between European countries and ammunition manufacturers to develop advanced ammunition solutions.

Other Regions: Other regions, including Asia Pacific, Middle East, and Latin America, also contribute to the NATO ammunition market. Some NATO partner countries in these regions procure ammunition from NATO member countries to enhance their defense capabilities and maintain interoperability during joint operations. The market in these regions presents growth opportunities for ammunition suppliers and manufacturers.

The regional analysis provides insights into the demand, procurement patterns, and market dynamics specific to each region, highlighting the key factors driving the growth of the NATO ammunition market in different geographical areas.

Competitive Landscape

Leading Companies in the NATO Ammunition Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

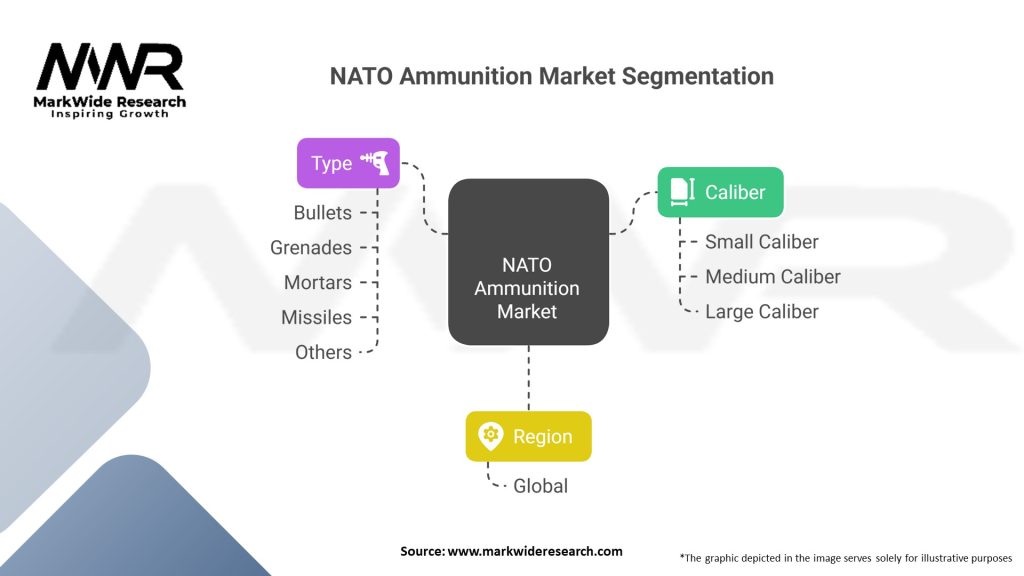

The NATO ammunition market can be segmented based on various parameters, including type, caliber, end-user, and region.

By Type:

By Caliber:

By End-User:

By Region:

Segmentation provides a structured analysis of the NATO ammunition market, enabling a deeper understanding of market trends, demand patterns, and market opportunities based on specific segments.

Category-wise Insights

Small Caliber Ammunition:

Small caliber ammunition, including rifle and pistol ammunition, is a crucial category within the NATO ammunition market. The demand for small caliber ammunition is driven by the requirements of infantry forces, law enforcement agencies, and special operations units. The market for small caliber ammunition is characterized by advancements in bullet design, propellants, and casings, focusing on improved accuracy, penetration, and lethality. The adoption of advanced materials and manufacturing techniques has resulted in lightweight and high-performance small caliber ammunition solutions. The market for small caliber ammunition is expected to witness steady growth due to the increasing demand for individual soldier systems and the modernization of infantry forces within the NATO alliance.

Artillery Shells:

Artillery shells play a vital role in providing fire support to ground forces, and they are extensively used by NATO member countries in various operational scenarios. The market for artillery shells includes a wide range of calibers, such as 105mm, 155mm, and others. Technological advancements in artillery shell design, including improved fuzing mechanisms, enhanced guidance systems, and increased range capabilities, have contributed to their effectiveness on the battlefield. The market for artillery shells is driven by the need for accurate and long-range fire support, as well as the modernization of artillery systems within the NATO alliance.

Rockets and Missiles:

Rockets and missiles are critical assets in modern warfare, providing precision strike capabilities against both stationary and mobile targets. The NATO ammunition market encompasses various types of rockets and missiles, including anti-tank guided missiles (ATGMs), surface-to-air missiles (SAMs), and air-to-surface missiles (ASMs). The market for rockets and missiles is driven by the increasing demand for precision strike capabilities, counter-armor systems, and air defense systems within NATO member countries. Technological advancements in guidance systems, propulsion systems, and warhead technologies have significantly enhanced the capabilities of rockets and missiles, making them essential assets for NATO forces.

Mortar Ammunition:

Mortar ammunition provides indirect fire support to ground forces, enabling them to engage targets in a high trajectory trajectory. The market for mortar ammunition includes various calibers, such as 60mm, 81mm, and 120mm. Mortars are widely used by infantry forces and special operations units for close support, suppressive fire, and counter-mobility operations. The market for mortar ammunition is driven by the increasing demand for lightweight and portable mortar systems, improved accuracy and lethality, and the modernization of infantry forces within the NATO alliance.

Grenades and Other Explosive Ordnance:

Grenades and other explosive ordnance, including anti-personnel mines, demolition charges, and pyrotechnics, form an essential category within the NATO ammunition market. These explosive ordnance items are utilized by infantry forces, special operations units, and engineering units for various purposes, such as area denial, breaching obstacles, and signaling. The market for grenades and other explosive ordnance is driven by the need for effective and reliable battlefield tools, as well as compliance with international treaties and agreements regulating the use of explosive devices.

Category-wise insights provide a detailed analysis of each ammunition category, highlighting the market trends, technological advancements, and demand dynamics specific to that category. This analysis enables stakeholders to identify growth opportunities and make informed business decisions within their respective segments of interest.

Key Benefits for Industry Participants and Stakeholders

The NATO ammunition market presents several key benefits for industry participants and stakeholders, including:

The key benefits for industry participants and stakeholders highlight the potential advantages and growth opportunities associated with the NATO ammunition market, providing incentives for companies to actively participate and invest in this sector.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides an overview of the internal and external factors affecting the NATO ammunition market. This analysis helps stakeholders understand the market’s strengths and weaknesses, identify potential opportunities, and mitigate potential threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

The SWOT analysis provides a comprehensive overview of the market’s internal and external factors, helping stakeholders understand the market’s strengths, weaknesses, opportunities, and threats, and guiding strategic decision-making processes.

Market Key Trends

The NATO ammunition market is shaped by several key trends that influence market dynamics and provide insights into the future direction of the market. Understanding these trends is crucial for industry participants and stakeholders to identify emerging opportunities and align their strategies accordingly.

Understanding these key trends helps industry participants and stakeholders anticipate market developments, identify emerging opportunities, and align their strategies with the evolving needs of the NATO ammunition market.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the global defense industry, including the NATO ammunition market. The pandemic has disrupted supply chains, caused production delays, and resulted in changes in defense spending priorities.

Despite the challenges posed by the pandemic, the NATO ammunition market is expected to recover gradually as economies reopen, supply chains stabilize, and defense spending resumes. The market is likely to witness a renewed focus on ammunition modernization, training, and readiness as NATO member countries adapt to the evolving security landscape.

Key Industry Developments

The NATO ammunition market has witnessed several key industry developments that have shaped the market landscape and influenced market dynamics. These developments encompass technological advancements, strategic partnerships, contract awards, and regulatory initiatives.

These key industry developments highlight the dynamism and innovation within the NATO ammunition market, as well as the efforts of industry participants to meet the evolving needs of NATO member countries and align with global trends.

Analyst Suggestions

Based on the analysis of the NATO ammunition market, analysts offer the following suggestions to industry participants and stakeholders:

These analyst suggestions provide guidance for industry participants and stakeholders to navigate the challenges and capitalize on the opportunities within the dynamic NATO ammunition market.

Future Outlook

The future outlook for the NATO ammunition market remains positive, driven by various factors, including defense modernization initiatives, technological advancements, and evolving security threats. Key trends, such as the adoption of smart ammunition, precision-guided munitions, and modular ammunition systems, are expected to continue shaping the market.

Despite the challenges posed by the COVID-19 pandemic and evolving geopolitical landscape, the NATO ammunition market is expected to grow steadily, driven by defense investments, technological advancements, and the continuous need for ammunition to support NATO forces. Industry participants that adapt to changing requirements, prioritize innovation, and establish strong partnerships are likely to thrive in this dynamic market.

Conclusion

The NATO ammunition market plays a crucial role in ensuring the defense and security capabilities of NATO member countries. The market is driven by the increasing defense budgets, technological advancements, and evolving security threats within the NATO alliance. The demand for ammunition encompasses various categories, including small caliber ammunition, artillery shells, rockets, missiles, and other explosive ordnance. The market presents opportunities for industry participants to expand their market presence, foster innovation, and establish strategic partnerships. Key trends such as the adoption of smart ammunition, precision-guided munitions, and modular ammunition systems are shaping the market dynamics. However, industry participants need to navigate challenges, including regulatory compliance, geopolitical factors, and the impact of the COVID-19 pandemic.

Looking ahead, the future of the NATO ammunition market appears promising, driven by defense modernization programs, technological advancements, and the growing focus on sustainability and environmental responsibility. Industry participants that invest in research and development, focus on innovation, and adapt to changing requirements will be well-positioned to capitalize on the market opportunities and meet the evolving ammunition needs of NATO member countries.

What is NATO Ammunition?

NATO Ammunition refers to the standardized munitions used by NATO member countries, designed for interoperability among allied forces. This includes various types of ammunition such as small arms, artillery shells, and missiles that meet NATO specifications.

What are the key players in the NATO Ammunition Market?

Key players in the NATO Ammunition Market include companies like Rheinmetall AG, BAE Systems, and General Dynamics, which are known for their advanced munitions and defense solutions. These companies contribute significantly to the development and supply of NATO-compatible ammunition, among others.

What are the growth factors driving the NATO Ammunition Market?

The NATO Ammunition Market is driven by increasing defense budgets among member countries, rising geopolitical tensions, and the need for modernization of military capabilities. Additionally, ongoing conflicts and military operations necessitate a steady supply of reliable ammunition.

What challenges does the NATO Ammunition Market face?

Challenges in the NATO Ammunition Market include stringent regulations regarding arms manufacturing and export, supply chain disruptions, and the high costs associated with research and development of new ammunition technologies. These factors can hinder timely production and delivery.

What opportunities exist in the NATO Ammunition Market?

Opportunities in the NATO Ammunition Market include advancements in smart munitions and precision-guided systems, which enhance operational effectiveness. Additionally, increased collaboration among NATO countries for joint exercises and procurement can lead to expanded market potential.

What trends are shaping the NATO Ammunition Market?

Trends in the NATO Ammunition Market include a shift towards environmentally friendly ammunition solutions and the integration of digital technologies in munitions. There is also a growing emphasis on modular ammunition systems that allow for greater flexibility in military operations.

NATO Ammunition Market

| Segmentation Details | Details |

|---|---|

| Caliber | Small Caliber, Medium Caliber, Large Caliber |

| Type | Bullets, Grenades, Mortars, Missiles, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the NATO Ammunition Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at