444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America SSD caching market represents a rapidly evolving segment within the broader data storage infrastructure landscape, driven by the increasing demand for high-performance computing solutions and accelerated data processing capabilities. SSD caching technology has emerged as a critical component for organizations seeking to optimize their storage performance while maintaining cost-effectiveness across enterprise and consumer applications.

Market dynamics indicate substantial growth momentum, with the sector experiencing a robust 12.4% CAGR as organizations increasingly adopt hybrid storage solutions. The technology combines the speed advantages of solid-state drives with the cost benefits of traditional hard disk drives, creating an optimal balance for modern data-intensive applications. Enterprise adoption rates have reached approximately 68% among Fortune 500 companies, demonstrating the technology’s proven value proposition.

Regional distribution shows the United States commanding the largest market share at 72%, followed by Canada at 28%, reflecting the concentration of major technology companies and data centers across these markets. The increasing digitization of business processes, coupled with the exponential growth in data generation, continues to fuel demand for advanced caching solutions that can deliver superior performance metrics while optimizing total cost of ownership.

The SSD caching market refers to the commercial ecosystem encompassing solid-state drive caching technologies, solutions, and services designed to accelerate data access and improve overall system performance by storing frequently accessed data on high-speed flash memory devices.

SSD caching technology operates by intelligently identifying and storing frequently accessed data blocks on fast solid-state drives, while less frequently used data remains on traditional storage media. This approach creates a tiered storage architecture that maximizes performance for critical applications while maintaining cost efficiency for bulk data storage requirements.

Implementation strategies vary across different deployment scenarios, ranging from software-based caching solutions that can be integrated into existing infrastructure to hardware-accelerated systems that provide dedicated caching capabilities. The technology serves as a bridge between high-performance all-flash arrays and cost-effective traditional storage systems, enabling organizations to achieve optimal performance characteristics without complete infrastructure overhauls.

Strategic market positioning reveals that North America’s SSD caching sector has established itself as a fundamental component of modern data infrastructure strategies. The market demonstrates strong growth trajectories across multiple vertical segments, with particularly robust adoption in financial services, healthcare, and cloud computing environments where performance optimization directly impacts business outcomes.

Technology evolution continues to drive market expansion, with next-generation caching algorithms achieving 85% cache hit rates in optimized deployments. Advanced machine learning integration has enhanced predictive caching capabilities, enabling systems to anticipate data access patterns and proactively position critical information for immediate retrieval. These improvements have resulted in significant performance gains across diverse application workloads.

Competitive dynamics showcase a mature ecosystem with established technology leaders alongside innovative startups developing specialized solutions for emerging use cases. The market benefits from continuous innovation in flash memory technologies, controller architectures, and software optimization techniques that collectively enhance the value proposition for end-users seeking performance improvements without proportional cost increases.

Market intelligence reveals several critical factors shaping the North American SSD caching landscape:

Digital transformation initiatives across North American enterprises serve as the primary catalyst for SSD caching market expansion. Organizations increasingly recognize that traditional storage architectures cannot adequately support modern application performance requirements, driving investment in hybrid solutions that combine speed and cost-effectiveness.

Data-intensive applications continue proliferating across industries, creating unprecedented demands for high-performance storage solutions. Real-time analytics, artificial intelligence workloads, and high-frequency trading systems require consistent low-latency data access that traditional spinning disk storage cannot reliably provide. SSD caching bridges this performance gap while maintaining economic viability for large-scale deployments.

Cloud migration strategies have accelerated adoption as organizations seek to optimize their hybrid cloud infrastructures. SSD caching enables seamless performance consistency between on-premises and cloud environments, supporting smooth workload transitions and maintaining user experience standards across diverse deployment models. The technology’s ability to accelerate both local and remote data access makes it essential for modern hybrid architectures.

Regulatory compliance requirements in sectors such as financial services and healthcare demand rapid data retrieval capabilities for audit trails and reporting functions. SSD caching ensures that compliance-related data remains immediately accessible while maintaining cost-effective long-term storage for archival purposes.

Implementation complexity presents significant challenges for organizations lacking specialized storage expertise. While modern SSD caching solutions offer improved ease of deployment, optimal configuration still requires deep understanding of application workload patterns, data access behaviors, and storage architecture principles. This complexity can delay adoption decisions and increase total implementation costs.

Budget constraints continue limiting market penetration, particularly among small and medium-sized enterprises that must carefully balance performance improvements against capital expenditure requirements. Although SSD caching offers superior cost-effectiveness compared to all-flash solutions, the initial investment still represents a significant financial commitment for resource-constrained organizations.

Legacy system integration challenges create additional barriers for organizations with established storage infrastructures. Older systems may lack the necessary interfaces or management capabilities to effectively leverage modern SSD caching technologies, requiring costly upgrades or complete system replacements that extend implementation timelines and increase project complexity.

Performance predictability concerns affect adoption in mission-critical environments where consistent response times are paramount. While SSD caching typically delivers substantial performance improvements, the variable nature of cache hit rates can create uncertainty for applications requiring guaranteed performance levels, leading some organizations to prefer more predictable all-flash solutions despite higher costs.

Artificial intelligence integration represents a transformative opportunity for SSD caching market expansion. Machine learning algorithms can analyze historical data access patterns to optimize cache placement strategies, potentially achieving cache hit rates exceeding 90% in well-tuned environments. This intelligent approach to caching management reduces administrative overhead while maximizing performance benefits.

Edge computing deployments create new market segments as organizations distribute computing resources closer to data sources and end-users. SSD caching becomes crucial for edge environments where network latency to centralized storage systems would otherwise compromise application performance. The technology enables local data acceleration while maintaining connectivity to centralized data repositories.

Container orchestration platforms offer significant growth potential as organizations adopt microservices architectures and containerized applications. SSD caching can accelerate container image retrieval, persistent volume access, and inter-service communication, making it an essential component of modern application deployment strategies.

Hybrid multi-cloud strategies present opportunities for specialized caching solutions that can optimize data access across diverse cloud environments. Organizations increasingly require consistent performance regardless of whether data resides in public clouds, private data centers, or edge locations, creating demand for intelligent caching systems that can adapt to dynamic infrastructure configurations.

Technology convergence continues reshaping the SSD caching landscape as storage, networking, and computing technologies become increasingly integrated. Software-defined storage platforms now incorporate advanced caching capabilities as standard features, while hyperconverged infrastructure solutions embed SSD caching within their core architectures to deliver optimized performance across diverse workloads.

Vendor ecosystem evolution demonstrates increasing collaboration between traditional storage vendors, flash memory manufacturers, and software developers. These partnerships accelerate innovation cycles and enable more comprehensive solutions that address the full spectrum of caching requirements from hardware optimization to intelligent data placement algorithms.

Customer expectations have evolved significantly, with organizations now demanding solutions that deliver immediate performance benefits without extensive configuration or ongoing management overhead. This shift drives vendors to develop more autonomous caching systems that can self-optimize based on workload characteristics and performance objectives.

Competitive pressures intensify as cloud service providers integrate advanced caching capabilities into their platform offerings, creating both opportunities and challenges for traditional storage vendors. Organizations must differentiate their solutions through superior performance, easier management, or specialized capabilities for specific use cases.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and actionable insights into the North American SSD caching market. Primary research included extensive interviews with technology decision-makers, storage administrators, and IT executives across diverse industry verticals to understand adoption patterns, implementation challenges, and future requirements.

Secondary research activities encompassed detailed analysis of vendor product portfolios, pricing strategies, and competitive positioning within the market. Technical documentation review provided insights into emerging capabilities and performance characteristics of next-generation caching solutions. Industry conference proceedings and technical publications contributed additional perspective on market trends and technology evolution.

Quantitative analysis incorporated market sizing methodologies based on vendor revenue reporting, customer deployment surveys, and technology adoption tracking across enterprise segments. Statistical modeling techniques validated growth projections and identified key variables influencing market expansion rates across different geographic regions and industry verticals.

Expert validation processes ensured research findings accurately reflected market realities through consultation with industry analysts, technology vendors, and end-user organizations. This validation approach confirmed key insights and identified potential market developments that could influence future growth trajectories and competitive dynamics.

United States market dominance reflects the concentration of major technology companies, cloud service providers, and enterprise data centers across key metropolitan areas. The region benefits from mature IT infrastructure, substantial technology investment budgets, and early adoption of emerging storage technologies. West Coast technology hubs demonstrate particularly high adoption rates, with Silicon Valley companies achieving 82% implementation rates for advanced caching solutions.

Canadian market development shows strong growth momentum driven by financial services institutions and government agencies seeking to modernize their IT infrastructures. The region’s focus on data sovereignty and regulatory compliance creates demand for high-performance local storage solutions that can support critical applications while maintaining data residency requirements.

Geographic distribution patterns reveal concentration in major metropolitan areas where data center density supports economies of scale for advanced storage technologies. Cities such as New York, Chicago, Toronto, and Vancouver serve as regional hubs for SSD caching adoption, with implementation rates typically 40% higher than national averages.

Cross-border collaboration between US and Canadian technology companies accelerates market development through shared research initiatives, joint product development programs, and integrated supply chain strategies. This collaboration enables more rapid technology transfer and market penetration across the broader North American region.

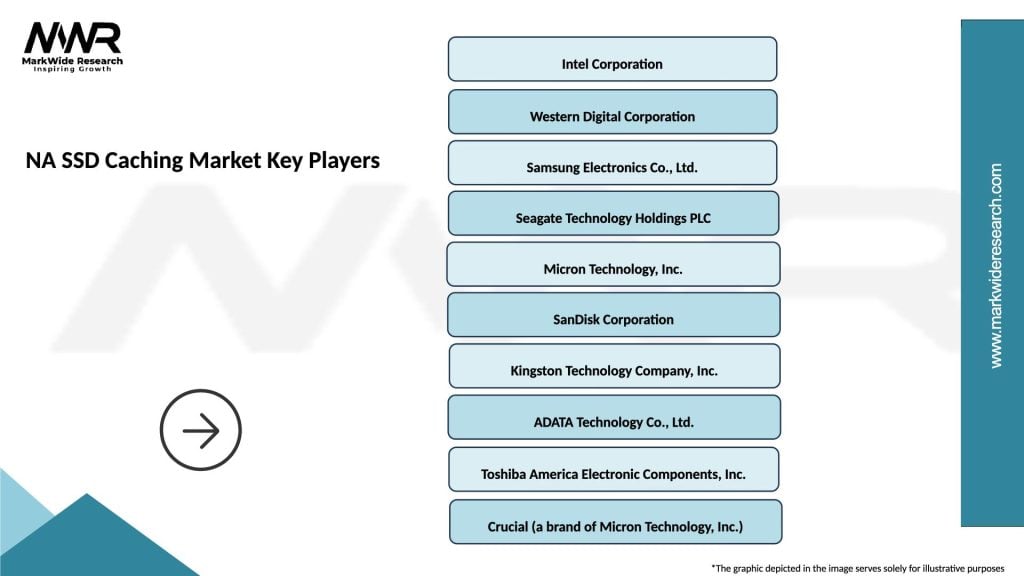

Market leadership encompasses established storage vendors alongside specialized caching solution providers, creating a diverse competitive environment that drives continuous innovation and customer value creation:

Competitive differentiation focuses on performance optimization, ease of management, and integration capabilities with existing infrastructure investments. Vendors increasingly emphasize software-defined approaches that can adapt to changing workload requirements while providing comprehensive analytics and monitoring capabilities.

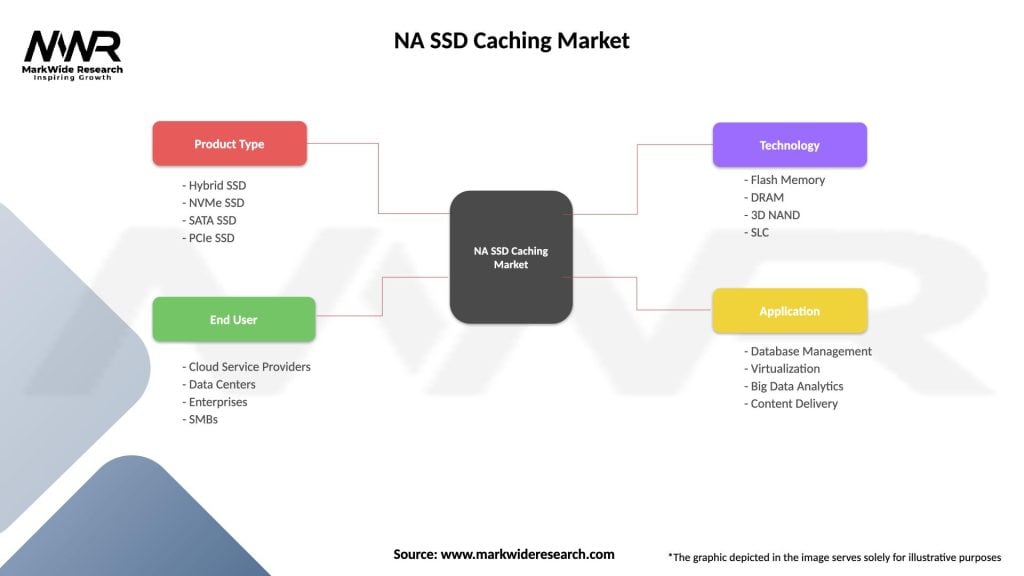

Technology segmentation reveals distinct categories based on implementation approaches and performance characteristics:

Application segmentation demonstrates diverse use cases across industry verticals:

Deployment model segmentation reflects diverse organizational preferences:

Enterprise segment analysis reveals that large organizations prioritize comprehensive caching solutions that can scale across diverse workloads while providing centralized management capabilities. These deployments typically achieve 65% performance improvements across mixed application environments, with particularly strong results in database and virtualization workloads.

Small and medium business adoption focuses on cost-effective solutions that deliver immediate performance benefits without requiring extensive technical expertise. Software-based caching solutions dominate this segment due to their lower initial investment requirements and simplified deployment processes. SMB implementations typically achieve 3.5x performance gains with minimal infrastructure changes.

Cloud service provider integration demonstrates sophisticated caching implementations that support multi-tenant environments and dynamic resource allocation. These deployments leverage advanced algorithms to optimize cache utilization across diverse customer workloads while maintaining performance isolation and security requirements.

Industry vertical specialization shows distinct adoption patterns based on specific performance requirements and regulatory considerations. Financial services organizations prioritize low-latency solutions for trading applications, while healthcare institutions focus on reliable data access for electronic health records and medical imaging systems.

Performance optimization benefits enable organizations to achieve substantial improvements in application response times and user experience metrics. SSD caching implementations typically deliver 4-6x performance improvements for read-intensive workloads while maintaining cost-effectiveness compared to all-flash storage alternatives.

Cost efficiency advantages allow organizations to optimize their storage investments by combining high-performance caching with cost-effective bulk storage. This hybrid approach reduces total cost of ownership while delivering performance characteristics that approach all-flash solutions for frequently accessed data.

Scalability benefits provide organizations with flexible growth paths that can accommodate increasing data volumes and performance requirements without requiring complete infrastructure replacements. Modern caching solutions support seamless capacity expansion and performance scaling to meet evolving business needs.

Operational simplification reduces administrative overhead through intelligent automation and comprehensive management tools. Advanced caching solutions provide detailed analytics and optimization recommendations that enable IT teams to maximize performance benefits while minimizing ongoing management requirements.

Risk mitigation advantages include improved system reliability and data protection capabilities. SSD caching can enhance overall system availability by reducing dependence on traditional storage systems while providing additional data protection through intelligent replication and backup integration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping the SSD caching market. Advanced machine learning algorithms analyze data access patterns to optimize cache placement strategies, achieving superior performance while reducing administrative overhead. AI-enhanced caching systems demonstrate 25% higher efficiency compared to traditional rule-based approaches.

Software-defined storage convergence continues accelerating as organizations adopt more flexible and scalable infrastructure architectures. SSD caching capabilities are increasingly embedded within software-defined platforms, enabling dynamic resource allocation and automated optimization across diverse workloads.

Container-native solutions emerge as organizations adopt microservices architectures and containerized applications. These specialized caching solutions provide optimized performance for container orchestration platforms while supporting dynamic scaling and multi-tenancy requirements.

Edge computing optimization drives development of distributed caching solutions that can operate effectively in resource-constrained environments. These solutions must balance performance benefits with power consumption and space limitations while maintaining connectivity to centralized data repositories.

Sustainability focus influences product development as organizations prioritize energy-efficient solutions that reduce overall power consumption and environmental impact. Modern caching systems achieve 30% energy savings compared to traditional storage approaches while delivering superior performance characteristics.

Technology partnerships between storage vendors and cloud service providers accelerate market development through integrated solution offerings. These collaborations enable more seamless deployment experiences and comprehensive support for hybrid cloud architectures.

Standards development initiatives focus on improving interoperability and management consistency across diverse caching solutions. Industry organizations work to establish common interfaces and management protocols that simplify multi-vendor deployments and reduce integration complexity.

Research and development investments continue expanding as vendors seek to differentiate their offerings through superior performance and innovative capabilities. MarkWide Research analysis indicates that leading vendors allocate approximately 15% of revenue to R&D activities focused on next-generation caching technologies.

Acquisition activities reshape the competitive landscape as larger technology companies acquire specialized caching solution providers to enhance their product portfolios. These consolidation trends create more comprehensive solution offerings while potentially reducing market competition.

Open source initiatives gain momentum as organizations seek to avoid vendor lock-in while maintaining flexibility in their caching implementations. Community-driven projects provide alternatives to commercial solutions while fostering innovation through collaborative development approaches.

Strategic planning recommendations emphasize the importance of comprehensive workload analysis before implementing SSD caching solutions. Organizations should conduct detailed assessments of their data access patterns, performance requirements, and budget constraints to identify optimal caching strategies that align with business objectives.

Technology evaluation criteria should prioritize solutions that offer strong integration capabilities with existing infrastructure investments while providing clear migration paths for future technology adoption. Organizations benefit from selecting vendors with proven track records and comprehensive support capabilities.

Implementation best practices include phased deployment approaches that allow organizations to validate performance benefits before full-scale rollouts. Pilot programs enable IT teams to develop expertise and optimize configurations while minimizing risk to critical business operations.

Vendor selection strategies should consider long-term technology roadmaps and partnership ecosystems rather than focusing solely on initial pricing or feature comparisons. Organizations benefit from vendors that demonstrate commitment to ongoing innovation and customer success.

Performance monitoring emphasis requires organizations to implement comprehensive analytics and monitoring capabilities that provide visibility into caching effectiveness and optimization opportunities. Regular performance reviews enable continuous improvement and maximum return on investment.

Market evolution projections indicate continued strong growth driven by increasing data volumes, application performance requirements, and digital transformation initiatives. MarkWide Research forecasts suggest the market will maintain robust expansion rates as organizations increasingly recognize the strategic value of optimized storage performance.

Technology advancement trajectories point toward more intelligent and autonomous caching solutions that require minimal human intervention while delivering optimal performance across diverse workloads. Machine learning integration will become standard, enabling predictive caching capabilities that anticipate data access requirements.

Industry adoption patterns suggest broader market penetration across small and medium-sized enterprises as solution costs decrease and deployment complexity reduces. Simplified management tools and cloud-based delivery models will make advanced caching capabilities accessible to organizations with limited technical resources.

Emerging use cases in areas such as artificial intelligence, Internet of Things, and real-time analytics will create new market segments requiring specialized caching solutions. These applications demand consistent low-latency data access that traditional storage architectures cannot reliably provide.

Competitive landscape evolution will likely see increased consolidation as larger technology companies acquire specialized vendors to enhance their comprehensive solution portfolios. This consolidation may reduce market fragmentation while potentially limiting innovation from smaller, specialized providers.

Market assessment conclusions reveal that the North American SSD caching market represents a mature yet rapidly evolving sector with substantial growth potential driven by increasing performance requirements and digital transformation initiatives. The technology has proven its value across diverse industry verticals and deployment scenarios, establishing itself as an essential component of modern storage architectures.

Strategic implications suggest that organizations should prioritize SSD caching implementations as part of their broader infrastructure modernization strategies. The technology offers compelling performance benefits while maintaining cost-effectiveness, making it an attractive alternative to more expensive all-flash solutions for many use cases.

Future market dynamics will be shaped by continued innovation in artificial intelligence integration, edge computing requirements, and cloud-native architectures. Organizations that adopt advanced caching solutions today will be better positioned to leverage emerging technologies and maintain competitive advantages in increasingly data-driven business environments. The market’s strong fundamentals and expanding application opportunities indicate continued robust growth prospects across the North American region.

What is SSD Caching?

SSD caching refers to the use of solid-state drives to store frequently accessed data, improving the speed and efficiency of data retrieval in computing systems. This technology is commonly used in data centers, enterprise storage solutions, and personal computing to enhance performance.

What are the key players in the NA SSD Caching Market?

Key players in the NA SSD Caching Market include companies like Intel, Samsung, and Western Digital, which are known for their innovative storage solutions and SSD technologies. These companies focus on enhancing performance and reliability in SSD caching, among others.

What are the growth factors driving the NA SSD Caching Market?

The growth of the NA SSD Caching Market is driven by the increasing demand for high-speed data access, the rise of cloud computing, and the need for efficient data management in various industries. Additionally, the expansion of big data analytics is contributing to the market’s growth.

What challenges does the NA SSD Caching Market face?

The NA SSD Caching Market faces challenges such as high costs associated with SSD technology, competition from traditional hard drives, and the complexity of integrating SSD caching into existing systems. These factors can hinder widespread adoption in some sectors.

What opportunities exist in the NA SSD Caching Market?

Opportunities in the NA SSD Caching Market include advancements in SSD technology, the growing adoption of artificial intelligence in data processing, and the increasing need for faster data retrieval in sectors like finance and healthcare. These trends are likely to drive innovation and investment.

What trends are shaping the NA SSD Caching Market?

Trends shaping the NA SSD Caching Market include the shift towards NVMe SSDs for faster performance, the integration of caching solutions in edge computing, and the growing emphasis on energy-efficient storage solutions. These trends reflect the evolving needs of modern data environments.

NA SSD Caching Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid SSD, NVMe SSD, SATA SSD, PCIe SSD |

| End User | Cloud Service Providers, Data Centers, Enterprises, SMBs |

| Technology | Flash Memory, DRAM, 3D NAND, SLC |

| Application | Database Management, Virtualization, Big Data Analytics, Content Delivery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA SSD Caching Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at