444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America safety I/O modules market represents a critical component of industrial automation infrastructure, driving enhanced workplace safety and operational efficiency across manufacturing sectors. These specialized input/output modules serve as essential interfaces between safety devices and control systems, enabling real-time monitoring and control of safety-critical applications. Market dynamics indicate robust growth driven by stringent safety regulations, increasing automation adoption, and the growing emphasis on worker protection in industrial environments.

Industrial safety requirements have become increasingly sophisticated, with safety I/O modules playing a pivotal role in meeting compliance standards such as IEC 61508 and ISO 13849. The market encompasses various module types including digital input modules, analog input modules, relay output modules, and communication modules, each designed to handle specific safety functions. Manufacturing sectors across North America are experiencing accelerated adoption rates, with automotive, oil and gas, chemical processing, and food and beverage industries leading implementation efforts.

Technological advancement continues to shape market evolution, with modern safety I/O modules incorporating advanced diagnostic capabilities, enhanced communication protocols, and improved integration features. The market demonstrates strong growth momentum with projected expansion at a CAGR of 6.8% through the forecast period, driven by increasing industrial automation investments and evolving safety standards.

The North America safety I/O modules market refers to the commercial ecosystem encompassing the design, manufacturing, distribution, and implementation of specialized input/output modules designed to handle safety-critical functions in industrial automation systems. These modules serve as crucial interfaces between field safety devices such as emergency stops, light curtains, safety switches, and central control systems, ensuring reliable and fail-safe operation of industrial processes.

Safety I/O modules are engineered to meet stringent safety integrity levels (SIL) and performance levels (PL) as defined by international safety standards. They incorporate redundant circuitry, diagnostic capabilities, and fault detection mechanisms to ensure continuous monitoring of safety device status and immediate response to hazardous conditions. Market participants include module manufacturers, system integrators, distributors, and end-users across various industrial sectors requiring safety-certified automation solutions.

Functional capabilities of these modules extend beyond basic input/output operations to include advanced features such as safety communication protocols, integrated diagnostics, hot-swappable designs, and seamless integration with distributed control systems and safety programmable logic controllers.

Market leadership in the North America safety I/O modules sector is characterized by strong demand fundamentals driven by regulatory compliance requirements and increasing industrial automation adoption. The market demonstrates resilient growth patterns with digital input modules commanding the largest market share at approximately 42%, followed by analog input modules and relay output modules. Manufacturing industries represent the primary end-user segment, accounting for significant adoption rates across automotive, chemical, and pharmaceutical sectors.

Regional distribution shows the United States maintaining market dominance with over 78% market share, while Canada demonstrates accelerating growth in mining and energy sectors. Key market drivers include stringent occupational safety regulations, increasing workplace safety awareness, and the growing complexity of industrial processes requiring advanced safety monitoring capabilities.

Competitive dynamics feature established automation companies leveraging technological innovation and comprehensive product portfolios to maintain market position. The market benefits from continuous product development focusing on enhanced diagnostic capabilities, improved communication protocols, and greater integration flexibility. Future prospects indicate sustained growth momentum supported by Industry 4.0 initiatives and evolving safety standards requiring more sophisticated monitoring solutions.

Strategic insights reveal several critical factors shaping the North America safety I/O modules market landscape:

Market penetration analysis indicates significant growth opportunities in emerging application areas including renewable energy, water treatment, and advanced manufacturing processes. Technology trends emphasize the importance of cybersecurity features, wireless communication capabilities, and enhanced user interfaces in next-generation safety I/O modules.

Regulatory enforcement serves as the primary market driver, with organizations such as OSHA, CSA, and industry-specific regulatory bodies mandating implementation of certified safety systems. These regulations require comprehensive safety monitoring capabilities that safety I/O modules provide, creating sustained demand across industrial sectors. Compliance requirements continue to evolve, driving ongoing investment in advanced safety infrastructure and module upgrades.

Industrial automation expansion represents another significant driver, as manufacturers increasingly adopt automated systems requiring sophisticated safety monitoring capabilities. The integration of safety I/O modules with programmable logic controllers, distributed control systems, and safety instrumented systems enables comprehensive safety management across complex industrial processes. Automation investments demonstrate strong correlation with safety module adoption rates, particularly in high-risk industrial environments.

Workplace safety awareness has intensified following high-profile industrial accidents, prompting organizations to invest in advanced safety monitoring systems. Corporate safety initiatives and insurance requirements drive implementation of comprehensive safety I/O module networks to monitor critical safety devices and ensure rapid response to hazardous conditions. Risk mitigation strategies increasingly emphasize proactive safety monitoring rather than reactive response mechanisms.

Technological advancement in industrial processes creates demand for more sophisticated safety monitoring capabilities. Modern manufacturing equipment operates at higher speeds and greater complexity, requiring advanced safety I/O modules capable of handling multiple safety functions simultaneously while maintaining reliability and response times.

High implementation costs present significant barriers to market expansion, particularly for small and medium-sized enterprises with limited capital budgets. Safety I/O modules require substantial initial investment including module procurement, installation, commissioning, and staff training. Cost considerations often delay implementation decisions, especially in price-sensitive market segments where return on investment timelines extend beyond immediate budget cycles.

Technical complexity associated with safety I/O module integration poses challenges for organizations lacking specialized technical expertise. Proper implementation requires understanding of safety standards, communication protocols, and system integration principles. Skill gaps in industrial automation and safety system design limit adoption rates among organizations without access to qualified technical personnel or external consulting resources.

Legacy system compatibility issues create implementation barriers in facilities with existing automation infrastructure. Retrofitting safety I/O modules into established control systems often requires significant modifications to communication networks, control logic, and operator interfaces. Integration challenges increase project complexity and costs, potentially discouraging adoption among organizations with substantial legacy system investments.

Maintenance requirements and ongoing operational costs impact total cost of ownership calculations. Safety I/O modules require regular testing, calibration, and potential replacement to maintain certification compliance. Operational overhead includes specialized maintenance procedures, documentation requirements, and periodic safety system audits that add to long-term ownership costs.

Industry 4.0 integration presents substantial growth opportunities as manufacturers implement smart factory initiatives requiring advanced safety monitoring capabilities. Safety I/O modules with enhanced communication protocols and data analytics capabilities enable integration with Industrial Internet of Things platforms, creating new value propositions for predictive maintenance and safety performance optimization. Digital transformation initiatives drive demand for intelligent safety modules capable of providing real-time data insights and remote monitoring capabilities.

Emerging industrial sectors offer significant expansion potential, particularly in renewable energy, electric vehicle manufacturing, and advanced materials processing. These industries require specialized safety monitoring solutions that safety I/O module manufacturers can address through targeted product development and application engineering. Market diversification reduces dependence on traditional manufacturing sectors while accessing higher-growth market segments.

Wireless technology adoption creates opportunities for innovative safety I/O module designs that eliminate complex wiring requirements while maintaining safety certification compliance. Wireless safety modules enable flexible installation configurations and reduced installation costs, particularly attractive for retrofit applications and temporary safety monitoring requirements. Technology innovation in wireless safety communication protocols opens new application possibilities.

International expansion opportunities exist as North American safety I/O module manufacturers leverage technological expertise and regulatory compliance experience to access global markets. Export potential includes regions with developing industrial sectors requiring safety infrastructure upgrades and compliance with international safety standards.

Supply chain dynamics in the North America safety I/O modules market reflect complex relationships between component suppliers, module manufacturers, system integrators, and end-users. Component availability significantly impacts production schedules, with semiconductor shortages and specialized safety-certified components creating periodic supply constraints. Manufacturers maintain strategic inventory levels and develop alternative sourcing strategies to ensure consistent product availability.

Competitive intensity varies across market segments, with established automation companies competing on technological innovation, product reliability, and comprehensive support services. Market positioning strategies emphasize safety certification compliance, integration capabilities, and long-term reliability rather than price competition alone. New market entrants focus on specialized applications or innovative technologies to establish market presence.

Customer relationships play crucial roles in market dynamics, with safety I/O module suppliers developing long-term partnerships with system integrators and end-users. Technical support and application engineering services create competitive differentiation, particularly for complex safety system implementations requiring specialized expertise. Customer loyalty often depends on proven reliability and comprehensive support rather than initial purchase price considerations.

Technology evolution drives continuous market dynamics as safety standards evolve and new communication protocols emerge. Product lifecycle management requires ongoing investment in research and development to maintain competitive positioning and regulatory compliance. Market participants must balance innovation investments with maintaining support for existing product lines and customer installations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the North America safety I/O modules market. Primary research includes structured interviews with industry executives, technical specialists, and end-users across key market segments. Survey methodologies capture quantitative data regarding adoption rates, purchasing decisions, and market trends from representative sample populations.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technical specifications to validate primary research findings and identify market trends. Data triangulation methods ensure consistency across multiple information sources while identifying potential discrepancies requiring additional investigation.

Market modeling techniques incorporate statistical analysis of historical market data, regression analysis of key market drivers, and scenario planning for future market projections. Quantitative analysis includes market sizing calculations, growth rate projections, and segmentation analysis based on verified data sources and validated assumptions.

Expert validation processes involve review of research findings by industry experts, technical specialists, and market participants to ensure accuracy and relevance. Peer review mechanisms include independent verification of key findings and methodology validation by qualified research professionals with relevant industry experience.

United States market dominance reflects the country’s extensive manufacturing base, stringent safety regulations, and advanced industrial automation adoption. The U.S. accounts for approximately 78% of regional market share, driven by strong demand from automotive, chemical, pharmaceutical, and food processing industries. Regional distribution shows particular strength in manufacturing-intensive states including Michigan, Ohio, Texas, and California, where industrial safety requirements drive consistent demand for safety I/O modules.

Canadian market dynamics demonstrate strong growth potential, particularly in mining, oil and gas, and pulp and paper industries where safety requirements are exceptionally stringent. Market penetration in Canada benefits from alignment with U.S. safety standards and cross-border industrial operations requiring consistent safety infrastructure. The Canadian market shows growth rates of approximately 8.2% annually, outpacing the regional average due to increased resource sector investments.

Mexico’s emerging market presents significant growth opportunities as manufacturing operations expand and safety standards align with North American requirements. Industrial development in Mexico includes substantial foreign investment in automotive and electronics manufacturing, creating demand for safety I/O modules meeting international certification standards. Cross-border supply chain integration drives standardization of safety requirements across the NAFTA region.

Regional integration benefits from harmonized safety standards, common certification requirements, and integrated supply chains spanning multiple countries. Market dynamics reflect increasing standardization of safety requirements across North American industrial operations, facilitating market expansion and technology adoption.

Market leadership in the North America safety I/O modules sector features established automation companies with comprehensive product portfolios and extensive technical support capabilities:

Competitive strategies emphasize technological innovation, comprehensive product portfolios, and extensive technical support services. Market positioning reflects differentiation through safety certification compliance, reliability performance, and integration capabilities rather than price competition alone. Strategic partnerships with system integrators and original equipment manufacturers enhance market reach and customer access.

Product type segmentation reveals distinct market dynamics across safety I/O module categories:

Application segmentation demonstrates diverse market opportunities:

End-user segmentation shows varied adoption patterns across industries with manufacturing sectors leading implementation efforts, followed by oil and gas, chemical processing, and utilities sectors.

Digital input modules maintain market leadership through versatility and broad application compatibility across safety device types. These modules excel in handling discrete safety signals from emergency stops, safety switches, and interlock devices. Technology advancement includes enhanced diagnostic capabilities, faster response times, and improved noise immunity. Market demand remains strong with growth rates of approximately 6.5% annually, driven by increasing automation adoption and safety device proliferation.

Analog input modules demonstrate accelerating growth in process industries requiring continuous safety parameter monitoring. Applications include temperature monitoring, pressure sensing, and flow measurement in safety-critical processes. Market expansion benefits from increasing process complexity and regulatory requirements for continuous safety monitoring. Advanced features include signal conditioning, linearization, and integrated diagnostics.

Relay output modules serve critical functions in safety system implementation, providing reliable switching capabilities for emergency shutdown and safety device control. Product innovation focuses on enhanced contact life, faster switching speeds, and improved diagnostic feedback. Market demand correlates strongly with safety system complexity and emergency response requirements.

Communication modules represent the fastest-growing segment, enabling integration with safety networks and remote monitoring systems. Technology trends emphasize cybersecurity features, wireless capabilities, and protocol standardization. Market growth exceeds 12% annually as industrial digitalization drives demand for connected safety systems.

Manufacturing companies benefit from enhanced workplace safety, regulatory compliance assurance, and reduced liability exposure through comprehensive safety I/O module implementation. Operational advantages include improved process reliability, reduced downtime from safety incidents, and enhanced worker confidence in equipment operation. Cost benefits emerge through reduced insurance premiums, lower accident-related expenses, and improved operational efficiency.

System integrators gain competitive advantages through specialized safety I/O module expertise, enabling differentiated service offerings and higher-value project opportunities. Business benefits include expanded service portfolios, recurring maintenance revenue, and stronger customer relationships through safety system expertise. Technical capabilities in safety module integration create barriers to competition and premium pricing opportunities.

Technology providers access growing market opportunities through innovation in safety I/O module design, communication protocols, and integration capabilities. Strategic advantages include market differentiation through advanced features, recurring revenue from maintenance and upgrades, and expansion into adjacent market segments. Research and development investments in safety technology create sustainable competitive advantages.

End-users achieve improved workplace safety, regulatory compliance, and operational reliability through proper safety I/O module implementation. Long-term benefits include reduced safety incidents, lower operational risks, and enhanced corporate reputation for safety performance. Investment returns include reduced insurance costs, improved worker retention, and enhanced operational efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation drives integration of safety I/O modules with Industrial Internet of Things platforms, enabling predictive maintenance, remote monitoring, and advanced analytics capabilities. Smart safety systems incorporate artificial intelligence and machine learning algorithms to optimize safety performance and predict potential failures before they occur. This trend creates new value propositions beyond basic safety monitoring functions.

Wireless technology adoption accelerates as safety I/O module manufacturers develop certified wireless communication solutions meeting stringent safety requirements. Wireless safety modules eliminate complex wiring requirements while maintaining safety integrity levels, particularly attractive for retrofit applications and mobile equipment monitoring. Cybersecurity features become essential components of wireless safety systems.

Modular system design trends emphasize flexibility and scalability in safety I/O module architectures. Scalable platforms enable customers to start with basic safety monitoring capabilities and expand functionality as requirements evolve. Hot-swappable modules and plug-and-play configurations reduce maintenance downtime and simplify system modifications.

Integration standardization promotes common communication protocols and interface standards across safety I/O module suppliers. Protocol harmonization reduces integration complexity and enables multi-vendor safety system implementations. Industry initiatives focus on developing open standards for safety communication and interoperability.

Sustainability considerations influence safety I/O module design with emphasis on energy efficiency, recyclable materials, and extended product lifecycles. Green technology initiatives include low-power module designs and environmentally responsible manufacturing processes.

Recent technological advancement includes development of next-generation safety I/O modules with enhanced diagnostic capabilities and predictive maintenance features. MarkWide Research analysis indicates that leading manufacturers are investing heavily in artificial intelligence integration and advanced communication protocols to differentiate their product offerings and create new value propositions for customers.

Strategic partnerships between safety I/O module manufacturers and software companies enable comprehensive safety management platforms combining hardware monitoring with advanced analytics and reporting capabilities. Collaboration initiatives focus on developing integrated solutions that address complete safety system requirements rather than individual component needs.

Regulatory developments include updates to international safety standards incorporating requirements for cybersecurity, wireless communication, and digital safety systems. Standards evolution drives product development priorities and creates opportunities for innovative safety I/O module designs meeting emerging requirements.

Market consolidation activities include strategic acquisitions and mergers among safety I/O module suppliers seeking to expand product portfolios and market reach. Industry restructuring creates larger, more comprehensive safety automation companies capable of providing complete safety system solutions.

Investment trends show increasing venture capital and private equity interest in safety technology companies developing innovative safety I/O module solutions and related software platforms. Funding activities support research and development initiatives and market expansion efforts.

Strategic recommendations for market participants emphasize the importance of technology innovation and comprehensive solution development. Product development should focus on wireless capabilities, enhanced diagnostics, and seamless integration with digital platforms to address evolving customer requirements. Companies should invest in cybersecurity features and artificial intelligence capabilities to maintain competitive positioning.

Market expansion strategies should target emerging industrial sectors including renewable energy, electric vehicle manufacturing, and advanced materials processing. Diversification efforts reduce dependence on traditional manufacturing sectors while accessing higher-growth market opportunities. Geographic expansion into international markets leverages North American safety expertise and regulatory compliance experience.

Partnership development with system integrators, software companies, and original equipment manufacturers enhances market reach and creates comprehensive solution offerings. Collaborative approaches enable companies to address complete customer requirements rather than individual component needs, creating stronger competitive positioning and customer relationships.

Investment priorities should emphasize research and development in emerging technologies, manufacturing capacity expansion, and technical support capabilities. Resource allocation should balance innovation investments with maintaining support for existing product lines and customer installations. Training and certification programs ensure adequate technical expertise for proper implementation and support.

Market projections indicate sustained growth momentum for the North America safety I/O modules market, with expansion expected to continue at a CAGR of 6.8% through the forecast period. Growth drivers include increasing industrial automation adoption, evolving safety regulations, and growing emphasis on workplace safety across industrial sectors. Technology advancement and digital transformation initiatives create additional growth opportunities.

Technology evolution will emphasize wireless communication capabilities, artificial intelligence integration, and enhanced cybersecurity features. Innovation trends include development of self-diagnosing modules, predictive maintenance capabilities, and seamless integration with Industrial Internet of Things platforms. According to MWR projections, wireless safety I/O modules may achieve 25% market penetration within the next five years.

Market expansion opportunities exist in emerging industrial sectors and international markets where North American safety expertise and technology leadership provide competitive advantages. Application diversification beyond traditional manufacturing includes renewable energy, infrastructure monitoring, and smart building applications requiring certified safety monitoring capabilities.

Competitive dynamics will continue emphasizing technological innovation, comprehensive solution offerings, and superior customer support rather than price competition alone. Market consolidation may accelerate as companies seek to achieve economies of scale and expand technological capabilities through strategic acquisitions and partnerships.

The North America safety I/O modules market demonstrates robust fundamentals driven by regulatory requirements, industrial automation expansion, and increasing workplace safety awareness. Market dynamics favor continued growth with technological innovation creating new opportunities for enhanced safety monitoring capabilities and system integration. The market benefits from strong regulatory support, established supplier ecosystems, and proven technology reliability.

Strategic positioning requires emphasis on technology leadership, comprehensive solution development, and superior customer support to maintain competitive advantages. Future success depends on adaptation to digital transformation trends, wireless technology adoption, and emerging application requirements across diverse industrial sectors. Companies investing in innovation and market expansion are well-positioned to capitalize on sustained growth opportunities in this essential industrial automation market segment.

What is Safety I/O Modules?

Safety I/O Modules are devices used in industrial automation systems to ensure safe operation by monitoring and controlling input and output signals. They play a critical role in applications such as emergency stop systems, safety interlocks, and machine safeguarding.

What are the key players in the NA Safety I/O Modules Market?

Key players in the NA Safety I/O Modules Market include Siemens, Rockwell Automation, Schneider Electric, and ABB, among others. These companies are known for their innovative safety solutions and extensive product portfolios.

What are the main drivers of the NA Safety I/O Modules Market?

The main drivers of the NA Safety I/O Modules Market include the increasing focus on workplace safety, stringent regulatory requirements, and the growing adoption of automation in various industries such as manufacturing and oil and gas.

What challenges does the NA Safety I/O Modules Market face?

The NA Safety I/O Modules Market faces challenges such as high initial costs of implementation and the complexity of integrating safety systems with existing automation infrastructure. Additionally, the rapid pace of technological change can make it difficult for companies to keep up.

What opportunities exist in the NA Safety I/O Modules Market?

Opportunities in the NA Safety I/O Modules Market include the increasing demand for smart manufacturing solutions and the integration of IoT technologies. These advancements can enhance safety monitoring and improve operational efficiency across various sectors.

What trends are shaping the NA Safety I/O Modules Market?

Trends shaping the NA Safety I/O Modules Market include the rise of Industry Four Point Zero, which emphasizes automation and data exchange, and the growing emphasis on predictive maintenance. These trends are driving innovation in safety technologies and solutions.

NA Safety I/O Modules Market

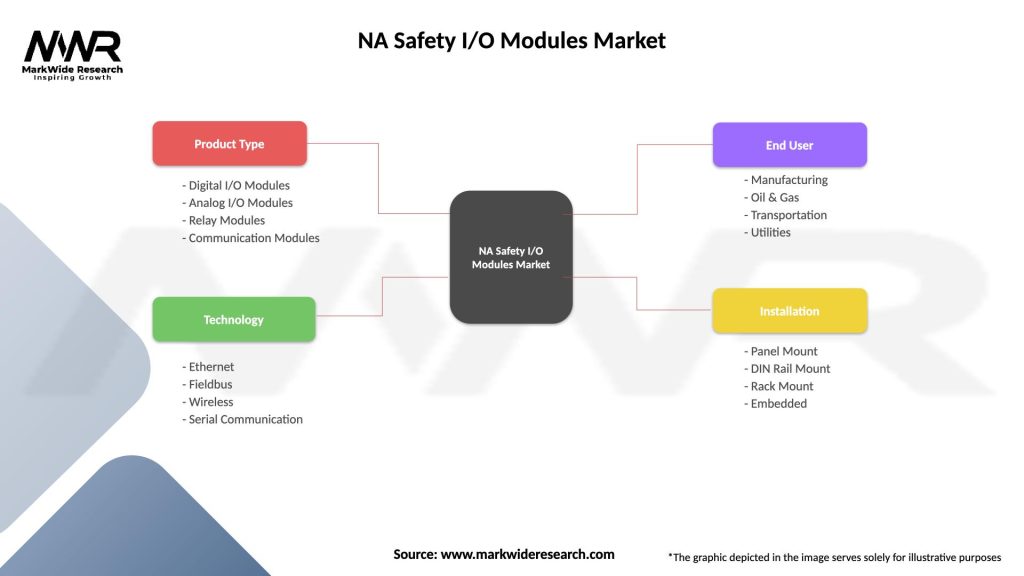

| Segmentation Details | Description |

|---|---|

| Product Type | Digital I/O Modules, Analog I/O Modules, Relay Modules, Communication Modules |

| Technology | Ethernet, Fieldbus, Wireless, Serial Communication |

| End User | Manufacturing, Oil & Gas, Transportation, Utilities |

| Installation | Panel Mount, DIN Rail Mount, Rack Mount, Embedded |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Safety I/O Modules Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at