444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America positive displacement pumps market represents a critical segment of the industrial equipment landscape, characterized by robust demand across diverse applications including oil and gas, chemical processing, water treatment, and food and beverage industries. Positive displacement pumps have established themselves as essential components in fluid handling systems, offering precise flow control and reliable performance under varying pressure conditions.

Market dynamics indicate sustained growth driven by increasing industrial automation, stringent environmental regulations, and the need for energy-efficient pumping solutions. The region’s mature industrial infrastructure, combined with ongoing modernization initiatives, creates substantial opportunities for advanced pump technologies. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 5.2% through the forecast period, reflecting strong underlying demand fundamentals.

Regional leadership in manufacturing and processing industries positions North America as a significant consumer of positive displacement pumps. The United States dominates market consumption, accounting for approximately 78% of regional demand, while Canada and Mexico contribute meaningfully to overall market expansion. Technology adoption rates remain high, with smart pump systems and IoT-enabled solutions gaining traction among industrial users seeking operational optimization.

The positive displacement pumps market refers to the commercial ecosystem encompassing the manufacturing, distribution, and application of pumping systems that move fluids by trapping fixed amounts and forcing them into discharge pipes. These pumps operate on the principle of mechanically displacing fluid through cyclic volume changes, ensuring consistent flow rates regardless of system pressure variations.

Key characteristics of positive displacement pumps include their ability to handle viscous fluids, maintain constant flow rates, and provide precise metering capabilities. Unlike centrifugal pumps, these systems create flow through volume displacement rather than kinetic energy transfer, making them ideal for applications requiring accurate fluid delivery and handling of challenging media.

Market scope encompasses various pump types including reciprocating pumps, rotary pumps, and specialized configurations designed for specific industrial applications. The technology serves critical functions in petroleum refining, chemical manufacturing, pharmaceutical production, and municipal water systems, where reliability and precision are paramount.

Strategic analysis reveals the North America positive displacement pumps market is experiencing steady expansion driven by industrial modernization and regulatory compliance requirements. Key growth drivers include increasing demand for energy-efficient solutions, expansion of shale oil and gas production, and rising investments in water infrastructure projects.

Market segmentation shows reciprocating pumps maintaining the largest share, followed by rotary positive displacement pumps and specialized configurations. The oil and gas sector represents the dominant end-use application, accounting for approximately 42% of market demand, while chemical processing and water treatment sectors contribute significantly to overall consumption.

Competitive dynamics feature established manufacturers focusing on technological innovation, product differentiation, and strategic partnerships. Companies are investing heavily in smart pump technologies, predictive maintenance capabilities, and environmentally sustainable solutions to capture emerging market opportunities.

Regional trends indicate strong performance across major industrial centers, with the Gulf Coast region leading in oil and gas applications, while the Great Lakes area shows robust demand from manufacturing and chemical processing industries. Future prospects remain positive, supported by infrastructure modernization initiatives and increasing adoption of advanced pumping technologies.

Primary market insights reveal several critical trends shaping the positive displacement pumps landscape in North America:

Market maturity in North America creates opportunities for value-added services, aftermarket support, and technology upgrades. Customer preferences increasingly favor suppliers offering comprehensive solutions including installation, maintenance, and performance optimization services.

Industrial expansion across North America continues to fuel demand for positive displacement pumps, particularly in energy-intensive sectors requiring reliable fluid handling solutions. Shale oil and gas development has created substantial opportunities for specialized pumping equipment capable of handling challenging applications including hydraulic fracturing and produced water management.

Infrastructure modernization initiatives drive replacement demand as aging pump systems require upgrades to meet current performance and environmental standards. Water treatment expansion supports market growth as municipalities and industries invest in advanced treatment facilities requiring precise chemical dosing and fluid transfer capabilities.

Regulatory compliance requirements increasingly mandate the use of leak-proof, emission-controlled pumping systems, particularly in chemical processing and petroleum refining applications. Energy efficiency mandates encourage adoption of high-efficiency pump technologies that reduce operational costs and environmental impact.

Technological advancement in pump design, materials, and control systems enables improved performance in demanding applications. Smart manufacturing trends drive integration of connected pump systems that provide real-time performance data and predictive maintenance capabilities, enhancing operational efficiency and reducing unplanned downtime.

High capital costs associated with positive displacement pump systems can limit adoption, particularly among smaller industrial users with constrained budgets. Initial investment requirements for premium pump technologies often exceed those of alternative pumping solutions, creating barriers to market entry for cost-sensitive applications.

Maintenance complexity of positive displacement pumps requires specialized knowledge and skills, potentially increasing operational costs and limiting adoption in facilities with limited technical expertise. Spare parts availability and service support can be challenging for specialized pump configurations, particularly in remote locations.

Competition from alternatives including centrifugal pumps and other fluid handling technologies limits market expansion in certain applications where positive displacement characteristics are not critical. Economic volatility in key end-use sectors, particularly oil and gas, can impact capital equipment spending and delay pump replacement cycles.

Regulatory uncertainty regarding environmental standards and safety requirements can create hesitation among potential buyers, particularly for long-term capital investments. Supply chain disruptions affecting critical components and materials can impact pump availability and pricing, influencing purchase decisions.

Emerging applications in renewable energy systems, including geothermal and concentrated solar power plants, present significant growth opportunities for specialized positive displacement pumps. Biotechnology expansion creates demand for sanitary pump systems capable of handling sensitive biological materials with precise flow control.

Digital transformation initiatives across industrial sectors offer opportunities for smart pump systems incorporating IoT connectivity, predictive analytics, and remote monitoring capabilities. Service market expansion provides revenue opportunities through comprehensive maintenance contracts, performance optimization services, and pump system upgrades.

Sustainability initiatives drive demand for energy-efficient pump technologies and systems designed for extended service life with reduced environmental impact. Customization opportunities exist for application-specific pump solutions addressing unique industrial requirements and challenging operating conditions.

Market consolidation creates opportunities for strategic acquisitions and partnerships, enabling companies to expand their technology portfolios and market reach. Export potential from North American manufacturing bases supports growth through international market expansion, particularly in developing regions with growing industrial sectors.

Supply-demand balance in the North America positive displacement pumps market reflects mature industrial demand patterns with steady growth driven by replacement cycles and capacity expansion projects. Pricing dynamics remain influenced by raw material costs, manufacturing efficiency improvements, and competitive pressures from alternative technologies.

Innovation cycles continue to drive market evolution as manufacturers invest in advanced materials, improved sealing technologies, and smart system integration. Customer expectations increasingly emphasize total cost of ownership rather than initial purchase price, favoring suppliers offering comprehensive value propositions.

Market consolidation trends see larger manufacturers acquiring specialized pump companies to broaden their technology portfolios and market coverage. Distribution channel evolution includes increased direct sales for complex applications while maintaining distributor networks for standard products and aftermarket services.

Regulatory influence continues to shape market dynamics through environmental standards, safety requirements, and energy efficiency mandates. Technology convergence with automation systems, process control equipment, and digital platforms creates new market opportunities while requiring enhanced technical capabilities from suppliers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technical specialists, and end-users across key market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, company reports, regulatory filings, and technical literature to validate market data and identify emerging trends. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth patterns and segment performance.

Market validation processes include cross-referencing data sources, conducting expert interviews, and analyzing historical market patterns to ensure accuracy and reliability. Regional analysis incorporates local market dynamics, regulatory environments, and industrial development patterns to provide comprehensive geographic insights.

Technology assessment evaluates emerging pump technologies, materials innovations, and digital integration trends to identify future market opportunities. Competitive intelligence analyzes company strategies, product portfolios, and market positioning to understand competitive dynamics and strategic implications.

United States dominance in the North America positive displacement pumps market reflects the country’s extensive industrial base, mature oil and gas sector, and significant chemical processing capacity. Regional distribution shows the Gulf Coast accounting for approximately 35% of market demand, driven by petroleum refining and petrochemical industries.

Texas leadership stems from its dominant position in oil and gas production, refining capacity, and chemical manufacturing. California markets show strong demand from water treatment, food processing, and specialty chemical applications, while maintaining focus on energy-efficient and environmentally compliant pump systems.

Canada’s contribution centers on oil sands operations, mining applications, and pulp and paper industries, with Alberta and Ontario representing the largest provincial markets. Mexican growth reflects expanding manufacturing sectors, infrastructure development, and increasing industrial automation adoption.

Regional trends indicate the Midwest showing steady demand from manufacturing and agricultural processing, while the Northeast focuses on water treatment and pharmaceutical applications. Market maturity varies by region, with established industrial areas emphasizing replacement and upgrade opportunities while emerging regions drive new installation demand.

Market leadership features established manufacturers with comprehensive product portfolios, global manufacturing capabilities, and extensive service networks. Key players compete on technology innovation, application expertise, and total cost of ownership value propositions.

Competitive strategies emphasize technological differentiation, application expertise, and comprehensive service offerings. Market positioning varies from broad-based suppliers serving multiple industries to specialized manufacturers focusing on specific applications or technologies.

Product segmentation reveals distinct market categories based on pump technology, application requirements, and performance characteristics:

By Technology:

By Application:

By End-User:

Reciprocating pump category maintains market leadership through superior performance in high-pressure applications and ability to handle challenging fluids. Technology advancement focuses on improved materials, enhanced sealing systems, and reduced maintenance requirements. Market share for reciprocating pumps stands at approximately 48% of total demand.

Rotary pump segment demonstrates strong growth potential driven by expanding applications in food processing, pharmaceutical manufacturing, and specialty chemical production. Innovation trends emphasize sanitary design, gentle fluid handling, and precise flow control capabilities.

Diaphragm pump category serves critical applications requiring absolute leak prevention and contamination control. Growth drivers include increasing environmental regulations and expanding biotechnology applications requiring sterile fluid handling.

Application-specific insights reveal oil and gas sector demand fluctuating with commodity prices and drilling activity levels. Chemical processing applications show steady growth driven by specialty chemical production and pharmaceutical manufacturing expansion. Water treatment demand remains robust, supported by infrastructure investment and regulatory compliance requirements.

Technology integration across categories increasingly includes smart monitoring systems, predictive maintenance capabilities, and remote operation features. Customization trends reflect growing demand for application-specific solutions addressing unique operating conditions and performance requirements.

Manufacturers benefit from expanding market opportunities driven by industrial growth, technology advancement, and increasing demand for specialized pumping solutions. Product differentiation through advanced materials, smart technologies, and application expertise enables premium pricing and market share gains.

End-users gain from improved pump reliability, energy efficiency, and operational flexibility. Total cost of ownership reductions result from extended service life, reduced maintenance requirements, and optimized energy consumption. Operational benefits include precise flow control, improved process efficiency, and enhanced safety performance.

Distributors and service providers benefit from growing aftermarket opportunities, including maintenance services, spare parts supply, and system upgrades. Value-added services such as pump selection assistance, installation support, and performance optimization create additional revenue streams.

Technology suppliers including component manufacturers, control system providers, and materials suppliers benefit from increasing demand for advanced pump technologies. Innovation opportunities exist in areas such as smart sensors, advanced materials, and digital integration platforms.

Regional economies benefit from manufacturing job creation, technology development, and export opportunities. Industrial competitiveness improves through access to advanced pumping technologies that enhance process efficiency and environmental compliance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trend transforms positive displacement pump operations through IoT integration, predictive analytics, and remote monitoring capabilities. Smart pump systems provide real-time performance data, enabling proactive maintenance and operational optimization. Adoption rates for connected pump systems show annual growth of 12% across industrial applications.

Sustainability focus drives development of energy-efficient pump technologies, environmentally friendly materials, and extended service life designs. Circular economy principles influence pump design for improved recyclability and reduced environmental impact throughout the product lifecycle.

Customization trend reflects increasing demand for application-specific pump solutions addressing unique operating conditions, fluid characteristics, and performance requirements. Modular design approaches enable cost-effective customization while maintaining manufacturing efficiency.

Service transformation shifts focus from transactional equipment sales to comprehensive service relationships including performance guarantees, predictive maintenance, and operational optimization. Outcome-based contracts align supplier and customer interests in achieving optimal pump performance.

Material advancement incorporates new alloys, coatings, and composite materials improving pump durability, corrosion resistance, and performance in challenging applications. Additive manufacturing enables production of complex geometries and rapid prototyping of specialized components.

Technology partnerships between pump manufacturers and digital technology companies accelerate development of smart pumping solutions. Strategic alliances focus on integrating artificial intelligence, machine learning, and advanced analytics into pump control systems.

Manufacturing investments in North America support reshoring initiatives and capacity expansion to meet growing domestic demand. Automation upgrades in production facilities improve manufacturing efficiency and product quality while reducing costs.

Acquisition activity continues as larger manufacturers seek to expand their technology portfolios and market coverage through strategic acquisitions of specialized pump companies. Market consolidation creates opportunities for enhanced R&D investment and global market reach.

Regulatory developments including updated environmental standards and safety requirements drive technology innovation and market opportunities for compliant pump systems. Industry standards evolution reflects advancing technology capabilities and changing application requirements.

Research initiatives focus on next-generation pump technologies including magnetic drive systems, advanced materials, and integrated digital capabilities. University partnerships support fundamental research and workforce development for the pump industry.

MarkWide Research recommends manufacturers focus on digital transformation initiatives to differentiate their offerings and capture emerging market opportunities. Investment priorities should emphasize IoT integration, predictive analytics capabilities, and comprehensive service platforms that enhance customer value propositions.

Market expansion strategies should target emerging applications in renewable energy, biotechnology, and specialty chemicals where positive displacement pump characteristics provide competitive advantages. Geographic diversification within North America can reduce dependence on cyclical industries and capture regional growth opportunities.

Technology development should prioritize energy efficiency improvements, advanced materials integration, and modular design approaches enabling cost-effective customization. Sustainability initiatives including lifecycle assessment and circular economy principles will become increasingly important for market competitiveness.

Service capabilities expansion through predictive maintenance, performance optimization, and outcome-based contracts can create sustainable competitive advantages and recurring revenue streams. Digital service platforms should integrate seamlessly with customer operations and provide actionable insights for operational improvement.

Partnership strategies with technology companies, system integrators, and end-user industries can accelerate innovation and market penetration. Collaborative approaches to product development and market expansion will be essential for success in evolving market conditions.

Long-term prospects for the North America positive displacement pumps market remain positive, supported by industrial modernization, infrastructure investment, and technology advancement. Growth projections indicate sustained expansion at a CAGR of 5.2% through the next decade, driven by replacement demand and emerging applications.

Technology evolution will continue transforming pump capabilities through digital integration, advanced materials, and improved efficiency. Smart pump systems are expected to represent over 60% of premium segment sales within five years, reflecting accelerating digital adoption across industrial sectors.

Market structure evolution may see increased consolidation as manufacturers seek scale advantages and technology capabilities. Service business growth will likely outpace equipment sales, creating opportunities for companies with strong aftermarket capabilities and digital service platforms.

Application diversification into renewable energy, biotechnology, and advanced manufacturing will provide new growth avenues beyond traditional industrial markets. Sustainability requirements will increasingly influence pump selection criteria and technology development priorities.

Regional dynamics may shift with changing industrial patterns, energy sector evolution, and infrastructure investment priorities. MWR analysis suggests continued United States market dominance while Canada and Mexico contribute meaningfully to overall regional growth through industrial expansion and modernization initiatives.

The North America positive displacement pumps market demonstrates resilient growth characteristics supported by diverse industrial demand, technology advancement, and evolving application requirements. Market fundamentals remain strong despite cyclical challenges in key end-use sectors, with steady replacement demand and emerging opportunities driving sustained expansion.

Technology transformation through digitalization, advanced materials, and improved efficiency creates significant opportunities for market participants willing to invest in innovation and customer value creation. Competitive success will increasingly depend on comprehensive solution capabilities rather than product features alone, emphasizing the importance of service excellence and digital integration.

Strategic positioning for future growth requires balanced focus on core market defense and emerging opportunity capture. Companies that successfully navigate technology transitions, develop comprehensive service capabilities, and establish strong customer partnerships will be best positioned for long-term success in this evolving market landscape.

What is Positive Displacement Pumps?

Positive displacement pumps are a type of pump that moves fluid by trapping a fixed amount and forcing it into the discharge pipe. They are commonly used in various applications, including oil and gas, chemical processing, and water treatment.

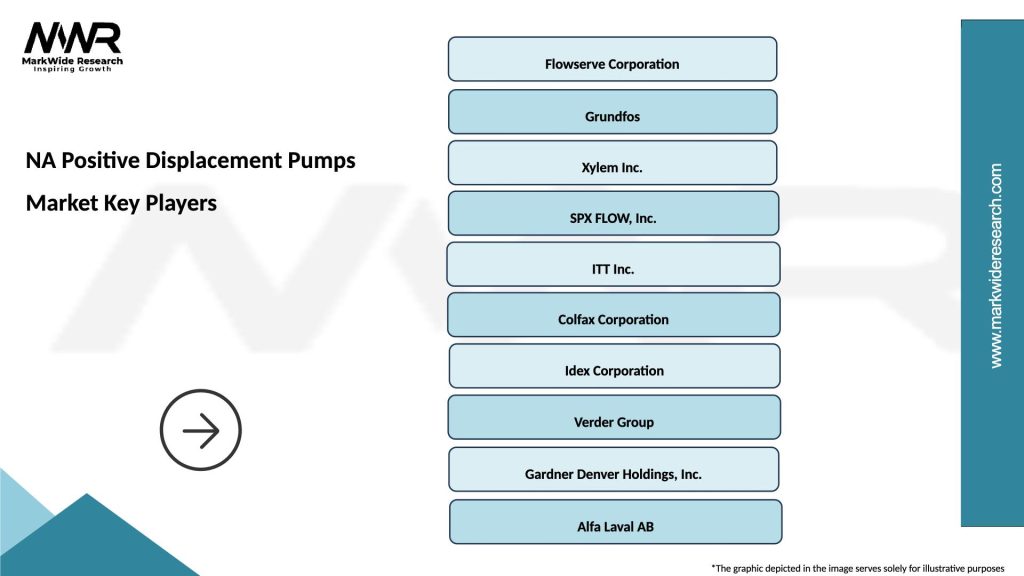

What are the key players in the NA Positive Displacement Pumps Market?

Key players in the NA Positive Displacement Pumps Market include companies like Grundfos, Flowserve, and Gardner Denver, which are known for their innovative pump solutions and extensive product lines, among others.

What are the main drivers of the NA Positive Displacement Pumps Market?

The main drivers of the NA Positive Displacement Pumps Market include the increasing demand for efficient fluid handling in industries such as pharmaceuticals and food processing, as well as the growing need for reliable pumping solutions in oil and gas applications.

What challenges does the NA Positive Displacement Pumps Market face?

Challenges in the NA Positive Displacement Pumps Market include the high initial costs of advanced pump systems and the need for regular maintenance, which can deter some potential users from adopting these technologies.

What opportunities exist in the NA Positive Displacement Pumps Market?

Opportunities in the NA Positive Displacement Pumps Market include the development of smart pump technologies and the increasing focus on energy-efficient solutions, which can enhance operational efficiency across various sectors.

What trends are shaping the NA Positive Displacement Pumps Market?

Trends shaping the NA Positive Displacement Pumps Market include the integration of IoT technologies for real-time monitoring and predictive maintenance, as well as a growing emphasis on sustainability and reducing environmental impact in pump operations.

NA Positive Displacement Pumps Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gear Pumps, Diaphragm Pumps, Screw Pumps, Vane Pumps |

| End User | Oil & Gas, Water Treatment, Food & Beverage, Chemical Processing |

| Technology | Hydraulic, Pneumatic, Electric, Mechanical |

| Application | Transfer, Metering, Mixing, Recirculation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Positive Displacement Pumps Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at