444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America pharmaceutical contract manufacturing organization (CMO) market represents a critical component of the region’s healthcare infrastructure, facilitating drug development and production for pharmaceutical companies across the United States and Canada. This dynamic sector encompasses a comprehensive range of services including active pharmaceutical ingredient (API) manufacturing, formulation development, clinical trial materials production, and commercial-scale manufacturing operations.

Market dynamics in the North American pharmaceutical CMO landscape are characterized by increasing demand for specialized manufacturing capabilities, driven by the growing complexity of modern therapeutics and the need for cost-effective production solutions. The region’s pharmaceutical CMO market is experiencing robust growth, with industry projections indicating a compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting the sector’s expanding role in supporting pharmaceutical innovation.

Regulatory excellence remains a defining characteristic of North American pharmaceutical CMOs, with facilities maintaining stringent compliance with FDA and Health Canada requirements. The market encompasses diverse manufacturing capabilities ranging from traditional small molecule production to advanced biopharmaceutical manufacturing, including monoclonal antibodies, vaccines, and cell and gene therapies. Geographic concentration is particularly notable in established pharmaceutical hubs such as New Jersey, California, North Carolina, and Ontario, where approximately 65% of CMO facilities are strategically located.

The North America pharmaceutical CMO market refers to the comprehensive ecosystem of contract manufacturing organizations that provide specialized pharmaceutical production services to drug developers, biotechnology companies, and established pharmaceutical manufacturers throughout the United States and Canada. These organizations offer end-to-end manufacturing solutions encompassing everything from early-stage development support to large-scale commercial production.

Contract manufacturing organizations serve as strategic partners for pharmaceutical companies seeking to optimize their manufacturing operations, reduce capital expenditure, and access specialized expertise without maintaining in-house production facilities. The CMO model enables pharmaceutical companies to focus on core competencies such as research and development, regulatory affairs, and commercialization while leveraging the manufacturing expertise and capacity of specialized service providers.

Service offerings within the North American pharmaceutical CMO market span multiple categories including API synthesis, formulation development, analytical testing, packaging, and supply chain management. These organizations maintain state-of-the-art facilities equipped with advanced manufacturing technologies and staffed by experienced professionals who understand the complex regulatory requirements governing pharmaceutical production in North America.

Strategic positioning of the North America pharmaceutical CMO market reflects the region’s leadership in global pharmaceutical innovation and manufacturing excellence. The market serves as a critical enabler for pharmaceutical companies seeking to bring innovative therapies to market efficiently while maintaining the highest quality and regulatory compliance standards.

Key growth drivers include the increasing complexity of pharmaceutical products, rising development costs, and the growing trend toward outsourcing non-core manufacturing activities. Biopharmaceutical manufacturing represents a particularly dynamic segment, with specialized biologics production accounting for approximately 42% of total CMO capacity utilization across the region.

Market consolidation continues to shape the competitive landscape, with leading CMOs expanding their capabilities through strategic acquisitions and facility investments. The integration of advanced technologies such as continuous manufacturing, process analytical technology, and digital quality systems is transforming operational efficiency and enabling more flexible, responsive manufacturing operations.

Regional advantages include proximity to major pharmaceutical markets, robust regulatory frameworks, skilled workforce availability, and established supply chain networks. These factors contribute to North America’s position as a preferred destination for pharmaceutical manufacturing partnerships, particularly for companies targeting the lucrative US and Canadian pharmaceutical markets.

Manufacturing specialization within the North American pharmaceutical CMO market reflects the diverse therapeutic areas and product types driving demand for contract manufacturing services. The following key insights highlight critical market dynamics:

Pharmaceutical innovation serves as the primary driver for North America’s pharmaceutical CMO market growth, with increasing numbers of complex therapeutic products requiring specialized manufacturing expertise. The rising cost and complexity of maintaining in-house manufacturing capabilities are compelling pharmaceutical companies to seek external partnerships with established CMOs.

Regulatory compliance requirements continue to drive demand for experienced manufacturing partners who can navigate the complex regulatory landscape governing pharmaceutical production. CMOs with proven track records of regulatory success provide valuable risk mitigation for pharmaceutical companies seeking to ensure product approval and market access.

Biopharmaceutical growth represents a significant market driver, with the increasing prevalence of biologics in pharmaceutical pipelines requiring specialized manufacturing infrastructure and expertise. The complexity of biopharmaceutical production processes, including cell culture, purification, and formulation, necessitates partnerships with CMOs possessing advanced biotechnology manufacturing capabilities.

Cost optimization pressures are motivating pharmaceutical companies to evaluate outsourcing strategies that can reduce capital expenditure while maintaining manufacturing quality and flexibility. CMOs offer economies of scale and operational efficiency that can significantly reduce per-unit manufacturing costs, particularly for smaller pharmaceutical companies and specialty product manufacturers.

Market access considerations drive pharmaceutical companies to partner with North American CMOs to ensure reliable supply for the region’s large pharmaceutical markets. Local manufacturing capabilities provide supply chain security and can reduce regulatory complexity associated with international pharmaceutical trade.

Capacity constraints represent a significant challenge within the North American pharmaceutical CMO market, particularly for specialized manufacturing capabilities such as biologics production and advanced therapy manufacturing. Limited availability of qualified manufacturing capacity can create bottlenecks that delay product launches and increase manufacturing costs.

Regulatory complexity continues to pose challenges for CMOs operating in the highly regulated pharmaceutical environment. Maintaining compliance with evolving regulatory requirements requires substantial investment in quality systems, personnel training, and facility upgrades, which can impact operational efficiency and profitability.

Skilled workforce limitations affect the pharmaceutical CMO market’s ability to expand manufacturing capacity and capabilities. The specialized nature of pharmaceutical manufacturing requires experienced professionals with deep technical expertise, and competition for qualified personnel can drive up operational costs and limit growth potential.

Technology investment requirements create financial pressures for CMOs seeking to maintain competitive manufacturing capabilities. The rapid pace of technological advancement in pharmaceutical manufacturing necessitates continuous investment in new equipment, systems, and processes to meet evolving customer requirements.

Supply chain vulnerabilities can impact CMO operations, particularly for organizations dependent on international suppliers for raw materials and specialized components. Global supply chain disruptions can affect manufacturing schedules and increase operational complexity for North American CMOs.

Emerging therapeutic modalities present substantial growth opportunities for North American pharmaceutical CMOs, particularly in areas such as cell and gene therapy, personalized medicine, and advanced biologics. These innovative treatment approaches require specialized manufacturing capabilities that represent significant market expansion potential.

Technology advancement opportunities include the implementation of continuous manufacturing processes, artificial intelligence-driven quality control, and advanced process analytical technologies. CMOs that successfully integrate these technologies can achieve competitive advantages through improved efficiency, quality, and flexibility.

Geographic expansion within North America offers growth potential for established CMOs seeking to increase market presence and manufacturing capacity. Strategic facility investments in emerging pharmaceutical hubs can provide access to new customer bases and specialized talent pools.

Partnership development opportunities exist for CMOs to establish long-term strategic relationships with pharmaceutical companies, particularly in areas such as integrated drug development and supply chain management. These partnerships can provide stable revenue streams and opportunities for collaborative innovation.

Regulatory expertise monetization represents an opportunity for experienced CMOs to leverage their regulatory knowledge and compliance capabilities as value-added services. Consulting and regulatory support services can provide additional revenue streams while strengthening customer relationships.

Competitive intensity within the North American pharmaceutical CMO market is driving continuous improvement in service offerings, manufacturing capabilities, and operational efficiency. Leading CMOs are investing heavily in facility upgrades, technology integration, and workforce development to maintain competitive positioning in this dynamic market environment.

Customer relationship evolution is shifting toward more strategic, long-term partnerships between pharmaceutical companies and CMOs. These relationships often involve collaborative development programs, dedicated manufacturing capacity, and integrated supply chain management, creating mutual value and competitive advantages for both parties.

Technological disruption is transforming traditional pharmaceutical manufacturing approaches, with digital technologies, automation, and advanced analytics enabling more efficient and flexible production operations. CMOs that successfully adopt and integrate these technologies can achieve significant operational improvements and customer value creation.

Regulatory evolution continues to influence market dynamics, with agencies such as the FDA implementing new guidance documents and inspection protocols that affect CMO operations. Successful navigation of regulatory changes requires substantial investment in compliance capabilities and quality systems.

Market consolidation trends are creating larger, more capable CMO organizations with expanded service offerings and geographic reach. This consolidation enables economies of scale and enhanced customer service capabilities while potentially reducing competitive intensity in certain market segments.

Comprehensive market analysis of the North American pharmaceutical CMO market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand perspectives on market trends and dynamics.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic publications to develop a comprehensive understanding of market structure and competitive dynamics. This research approach provides historical context and quantitative data to support market analysis and projections.

Market segmentation analysis utilizes both top-down and bottom-up approaches to accurately assess market size and growth potential across different service categories, therapeutic areas, and geographic regions. This methodology ensures comprehensive coverage of market opportunities and challenges.

Competitive intelligence gathering involves systematic analysis of major market participants, including assessment of manufacturing capabilities, service offerings, financial performance, and strategic initiatives. This analysis provides insights into competitive positioning and market share dynamics.

Regulatory analysis includes comprehensive review of current and proposed regulations affecting pharmaceutical manufacturing, quality requirements, and market access considerations. This analysis ensures accurate assessment of regulatory impacts on market development and growth potential.

United States dominance characterizes the North American pharmaceutical CMO market, with the country accounting for approximately 78% of regional manufacturing capacity and hosting the majority of major CMO facilities. Key pharmaceutical manufacturing hubs include New Jersey, California, North Carolina, and Massachusetts, where established infrastructure and skilled workforce availability support extensive CMO operations.

Canadian market presence represents a significant but smaller portion of the regional CMO landscape, with facilities concentrated in Ontario and Quebec provinces. Canadian CMOs benefit from proximity to US markets while offering competitive manufacturing costs and access to government incentives supporting pharmaceutical manufacturing investment.

Geographic distribution of CMO facilities reflects historical pharmaceutical industry development patterns, with the highest concentration of manufacturing capacity located in traditional pharmaceutical corridors along the East Coast and in California. Recent expansion activities have extended CMO presence into emerging markets such as Texas, Colorado, and other states offering favorable business environments.

Regional specialization has emerged in certain geographic areas, with some regions developing particular expertise in biologics manufacturing, specialty pharmaceuticals, or specific therapeutic areas. This specialization enables CMOs to develop deep technical capabilities and attract customers seeking specialized manufacturing services.

Cross-border collaboration between US and Canadian CMOs is facilitated by regulatory harmonization initiatives and established trade relationships. This collaboration enables efficient utilization of manufacturing capacity and expertise across the North American region while supporting pharmaceutical companies’ supply chain optimization strategies.

Market leadership in the North American pharmaceutical CMO sector is characterized by a mix of large, integrated service providers and specialized niche players offering focused capabilities in specific therapeutic areas or manufacturing technologies. The competitive landscape reflects ongoing consolidation trends and strategic capacity expansion initiatives.

Leading pharmaceutical CMOs in North America include:

Competitive differentiation strategies focus on specialized capabilities, regulatory expertise, technology leadership, and customer service excellence. Leading CMOs invest heavily in facility upgrades, technology integration, and workforce development to maintain competitive advantages in this dynamic market environment.

Service-based segmentation of the North American pharmaceutical CMO market reflects the diverse manufacturing and development services offered by contract organizations. Primary service categories include API manufacturing, formulation development, analytical testing, clinical trial materials production, and commercial manufacturing.

By Manufacturing Type:

By Therapeutic Area:

By Company Size:

API manufacturing represents a foundational segment of the North American pharmaceutical CMO market, encompassing both traditional small molecule synthesis and biotechnology-based production processes. This category serves pharmaceutical companies requiring reliable, cost-effective production of active pharmaceutical ingredients while maintaining stringent quality and regulatory compliance standards.

Biologics manufacturing has emerged as the fastest-growing category within the CMO market, driven by the increasing prevalence of biopharmaceutical products in pharmaceutical pipelines. Specialized facilities equipped with mammalian cell culture capabilities, purification systems, and aseptic processing infrastructure support production of monoclonal antibodies, therapeutic proteins, and vaccines.

Formulation development services provide critical support for pharmaceutical companies seeking to optimize drug product characteristics, stability, and manufacturability. These services encompass preformulation studies, formulation optimization, analytical method development, and scale-up activities that bridge the gap between drug discovery and commercial manufacturing.

Clinical trial materials manufacturing represents a specialized category requiring flexible, small-scale production capabilities and rigorous quality control systems. CMOs serving this market segment must maintain capabilities for rapid turnaround, multiple product configurations, and comprehensive documentation to support regulatory submissions.

Specialty manufacturing categories include controlled substances, highly potent compounds, and advanced therapy medicinal products that require specialized facilities, equipment, and expertise. These niche categories often command premium pricing due to the specialized infrastructure and regulatory requirements involved.

Pharmaceutical companies benefit significantly from partnering with North American CMOs through access to specialized manufacturing expertise, reduced capital investment requirements, and enhanced operational flexibility. These partnerships enable pharmaceutical companies to focus resources on core competencies while leveraging CMO capabilities for efficient, compliant manufacturing operations.

Cost optimization represents a primary benefit for pharmaceutical companies utilizing CMO services, with contract manufacturing often providing more favorable economics than maintaining in-house production capabilities. CMOs achieve economies of scale through multi-client operations and specialized infrastructure that individual pharmaceutical companies may not be able to justify economically.

Risk mitigation benefits include reduced regulatory compliance risk through partnership with experienced CMOs possessing proven track records of successful inspections and product approvals. CMOs maintain specialized expertise in regulatory requirements and quality systems that can significantly reduce the risk of manufacturing-related delays or compliance issues.

Market access acceleration is facilitated through CMO partnerships that provide immediate access to manufacturing capacity and expertise, enabling faster time-to-market for new pharmaceutical products. This acceleration is particularly valuable for biotechnology companies and specialty pharmaceutical manufacturers with limited internal manufacturing capabilities.

Technology access benefits include exposure to advanced manufacturing technologies, process improvements, and industry best practices that CMOs develop through their diverse client base and continuous improvement initiatives. This technology transfer can enhance pharmaceutical companies’ overall manufacturing capabilities and product quality.

Strengths:

Weaknesses:

Opportunities:

Threats:

Biologics manufacturing expansion continues to drive significant investment in specialized production capabilities, with CMOs developing advanced bioreactor capacity, purification systems, and aseptic processing infrastructure to meet growing demand for biopharmaceutical products. This trend reflects the pharmaceutical industry’s increasing focus on biologics as a primary growth driver.

Continuous manufacturing adoption is transforming traditional batch-based production processes, enabling more efficient, flexible, and cost-effective pharmaceutical manufacturing. CMOs implementing continuous manufacturing technologies can achieve improved product quality, reduced manufacturing timelines, and enhanced operational efficiency.

Digital transformation initiatives are revolutionizing pharmaceutical manufacturing through implementation of advanced analytics, artificial intelligence, and digital quality systems. These technologies enable real-time monitoring, predictive maintenance, and enhanced process control that improve manufacturing reliability and regulatory compliance.

Sustainability focus is becoming increasingly important in pharmaceutical manufacturing, with CMOs implementing green chemistry principles, waste reduction programs, and energy-efficient operations. Environmental sustainability initiatives are driven by both regulatory requirements and customer demands for responsible manufacturing practices.

Supply chain localization trends are encouraging pharmaceutical companies to establish manufacturing partnerships closer to key markets, reducing supply chain complexity and enhancing security. This trend has been accelerated by recent global disruptions that highlighted vulnerabilities in international supply chains.

Facility expansion projects across North America reflect growing demand for pharmaceutical manufacturing capacity, with major CMOs investing in new facilities and capacity upgrades to serve expanding customer bases. Recent developments include significant investments in biologics manufacturing infrastructure and specialized therapy production capabilities.

Strategic acquisitions continue to reshape the competitive landscape, with leading CMOs acquiring specialized capabilities, geographic presence, and customer relationships through targeted transactions. These acquisitions enable rapid expansion of service offerings and market reach while providing economies of scale.

Technology partnerships between CMOs and technology providers are accelerating adoption of advanced manufacturing systems, process analytical technologies, and digital quality platforms. These collaborations enable CMOs to offer cutting-edge capabilities while sharing development costs and risks.

Regulatory guidance updates from agencies such as the FDA continue to influence CMO operations and investment priorities, with new guidance documents addressing emerging manufacturing technologies, quality systems, and inspection protocols. CMOs must continuously adapt operations to maintain compliance with evolving regulatory expectations.

Workforce development initiatives are addressing skilled labor shortages through partnerships with educational institutions, training programs, and professional development opportunities. These initiatives are critical for maintaining the specialized expertise required for pharmaceutical manufacturing operations.

Strategic positioning recommendations for pharmaceutical CMOs emphasize the importance of developing specialized capabilities in high-growth therapeutic areas such as cell and gene therapy, personalized medicine, and advanced biologics. MarkWide Research analysis indicates that CMOs with differentiated capabilities in these areas can command premium pricing and establish competitive advantages.

Technology investment priorities should focus on digital transformation initiatives that enhance operational efficiency, quality control, and customer service capabilities. Implementation of advanced analytics, automation systems, and digital quality platforms can provide significant competitive advantages while improving regulatory compliance and operational performance.

Geographic expansion strategies should consider emerging pharmaceutical hubs and underserved markets where manufacturing capacity may be limited. Strategic facility investments in these regions can provide access to new customer bases while potentially offering more favorable operating economics.

Partnership development approaches should emphasize long-term, strategic relationships with pharmaceutical companies rather than transactional service arrangements. Collaborative partnerships that include joint development programs, dedicated capacity, and integrated supply chain management can provide stable revenue streams and mutual competitive advantages.

Regulatory excellence maintenance requires continuous investment in quality systems, personnel training, and facility upgrades to ensure ongoing compliance with evolving regulatory requirements. CMOs that maintain exemplary regulatory track records can differentiate themselves in competitive situations and command premium pricing.

Growth trajectory for the North American pharmaceutical CMO market remains robust, with continued expansion expected across multiple service categories and therapeutic areas. Industry projections suggest sustained growth driven by increasing pharmaceutical innovation, outsourcing trends, and demand for specialized manufacturing capabilities.

Biopharmaceutical manufacturing is expected to represent the fastest-growing segment, with demand for monoclonal antibody production, cell and gene therapy manufacturing, and vaccine production driving significant capacity expansion. CMOs with advanced biologics capabilities are positioned to capture disproportionate growth opportunities.

Technology integration will continue transforming pharmaceutical manufacturing operations, with widespread adoption of continuous manufacturing, advanced analytics, and automation systems expected over the forecast period. CMOs that successfully implement these technologies will achieve competitive advantages through improved efficiency and quality.

Market consolidation trends are expected to continue, with larger CMOs acquiring specialized capabilities and smaller players to expand service offerings and geographic reach. This consolidation will create more comprehensive service providers while potentially reducing competitive intensity in certain market segments.

Regulatory evolution will continue influencing market development, with agencies implementing new guidance documents and inspection protocols that affect CMO operations. Successful navigation of regulatory changes will require substantial investment in compliance capabilities and quality systems, according to MWR analysis of industry trends.

The North American pharmaceutical CMO market represents a dynamic and essential component of the region’s pharmaceutical ecosystem, providing critical manufacturing services that enable pharmaceutical innovation and market access. The market’s continued growth reflects increasing demand for specialized manufacturing capabilities, cost-effective production solutions, and regulatory expertise that CMOs provide to pharmaceutical companies of all sizes.

Strategic opportunities abound for CMOs that can successfully navigate the complex regulatory environment while investing in advanced manufacturing technologies and specialized capabilities. The growing importance of biopharmaceutical manufacturing, emerging therapeutic modalities, and digital transformation initiatives creates substantial potential for organizations positioned to capitalize on these trends.

Competitive success in this market requires continuous investment in facility infrastructure, technology systems, and workforce development to maintain the specialized capabilities that pharmaceutical customers demand. CMOs that can demonstrate regulatory excellence, operational efficiency, and innovative manufacturing solutions will be best positioned to capture growth opportunities and establish lasting competitive advantages in the evolving North American pharmaceutical manufacturing landscape.

What is Pharmaceutical CMO?

Pharmaceutical CMO refers to Contract Manufacturing Organizations that provide comprehensive services for the pharmaceutical industry, including drug development, manufacturing, and packaging. These organizations play a crucial role in helping pharmaceutical companies bring their products to market efficiently.

What are the key players in the NA Pharmaceutical CMO Market?

Key players in the NA Pharmaceutical CMO Market include companies like Catalent, Lonza, and Patheon. These firms are known for their extensive capabilities in drug formulation, manufacturing, and supply chain management, among others.

What are the growth factors driving the NA Pharmaceutical CMO Market?

The NA Pharmaceutical CMO Market is driven by factors such as the increasing demand for biologics, the rising trend of outsourcing manufacturing processes, and the need for cost-effective production solutions. Additionally, advancements in technology and regulatory support are contributing to market growth.

What challenges does the NA Pharmaceutical CMO Market face?

The NA Pharmaceutical CMO Market faces challenges such as stringent regulatory requirements, quality control issues, and the need for continuous innovation. These factors can complicate the manufacturing processes and impact the overall efficiency of CMO operations.

What opportunities exist in the NA Pharmaceutical CMO Market?

Opportunities in the NA Pharmaceutical CMO Market include the expansion of personalized medicine, the growth of the biosimilars market, and the increasing focus on sustainable manufacturing practices. These trends present avenues for CMOs to innovate and expand their service offerings.

What trends are shaping the NA Pharmaceutical CMO Market?

Trends shaping the NA Pharmaceutical CMO Market include the rise of digital technologies in manufacturing, the shift towards more flexible production capabilities, and the growing emphasis on supply chain resilience. These trends are influencing how CMOs operate and deliver services to their clients.

NA Pharmaceutical CMO Market

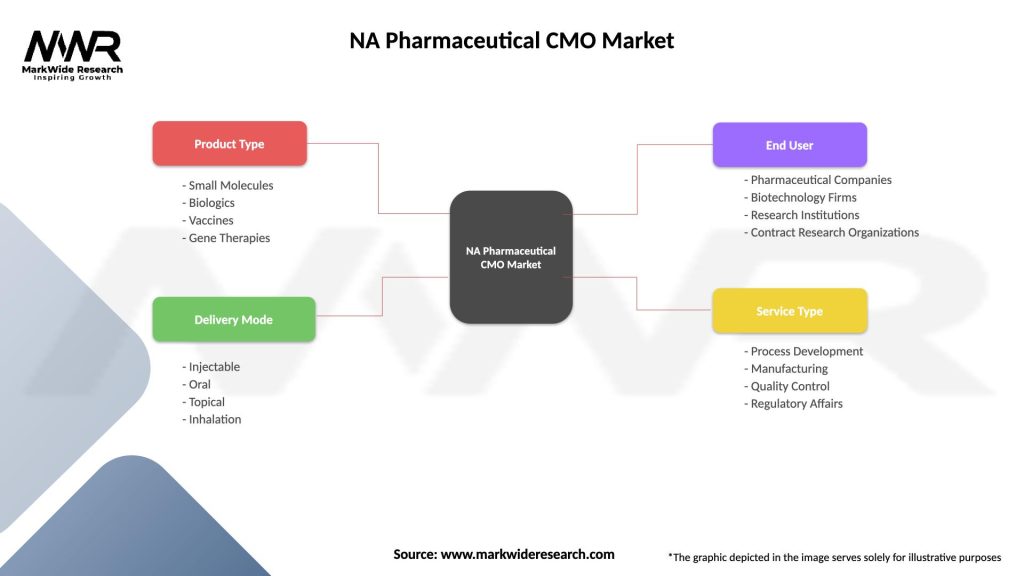

| Segmentation Details | Description |

|---|---|

| Product Type | Small Molecules, Biologics, Vaccines, Gene Therapies |

| Delivery Mode | Injectable, Oral, Topical, Inhalation |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Research Organizations |

| Service Type | Process Development, Manufacturing, Quality Control, Regulatory Affairs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Pharmaceutical CMO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at