444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America machine vision systems market represents a rapidly evolving technological landscape that is transforming manufacturing, quality control, and automation processes across diverse industries. Machine vision technology combines advanced cameras, sensors, and artificial intelligence to enable automated inspection, measurement, and guidance applications that were previously dependent on human operators. This sophisticated technology has become increasingly critical for maintaining competitive advantages in manufacturing efficiency and product quality standards.

Market dynamics indicate substantial growth driven by increasing demand for automation, stringent quality control requirements, and the integration of Industry 4.0 principles across North American manufacturing facilities. The region’s strong industrial base, coupled with significant investments in research and development, positions North America as a leading market for machine vision system adoption. Growth projections suggest the market is expanding at a robust CAGR of 8.2% through the forecast period, reflecting the technology’s increasing importance in modern manufacturing operations.

Regional leadership in machine vision adoption stems from the presence of major technology companies, advanced manufacturing capabilities, and supportive regulatory frameworks that encourage automation investments. The United States dominates the market with approximately 75% market share, while Canada contributes significantly to growth through its automotive and electronics manufacturing sectors. Industry applications span automotive, electronics, pharmaceuticals, food and beverage, and aerospace sectors, each driving unique technological requirements and innovation opportunities.

The machine vision systems market refers to the comprehensive ecosystem of hardware, software, and services that enable automated visual inspection, measurement, and guidance applications in industrial and commercial environments. Machine vision technology utilizes digital cameras, specialized lighting, image processing software, and artificial intelligence algorithms to replicate and enhance human visual capabilities in manufacturing and quality control processes.

Core components of machine vision systems include high-resolution cameras, advanced lighting systems, image processing units, and sophisticated software platforms that analyze visual data in real-time. These systems perform critical functions such as defect detection, dimensional measurement, optical character recognition, barcode reading, and robotic guidance. Integration capabilities allow machine vision systems to communicate seamlessly with manufacturing execution systems, programmable logic controllers, and enterprise resource planning platforms.

Technology evolution has transformed machine vision from simple presence/absence detection to complex pattern recognition, deep learning applications, and predictive quality analytics. Modern systems incorporate artificial intelligence and machine learning algorithms that continuously improve inspection accuracy and adapt to new product variations without extensive reprogramming requirements.

Strategic analysis of the North America machine vision systems market reveals a dynamic industry experiencing accelerated growth driven by digital transformation initiatives and increasing quality standards across manufacturing sectors. The market demonstrates strong momentum with adoption rates increasing by 12% annually as companies recognize the critical importance of automated inspection and quality control systems.

Key market drivers include the growing complexity of manufactured products, labor shortages in skilled inspection roles, and increasing regulatory requirements for product quality and traceability. The automotive industry leads adoption with 35% market share, followed by electronics manufacturing at 28%, reflecting these sectors’ stringent quality requirements and high-volume production environments.

Technological advancement continues to expand market opportunities through the integration of artificial intelligence, 3D imaging capabilities, and edge computing solutions that enable real-time decision-making at the point of inspection. Investment trends show increasing focus on smart factory initiatives and Industry 4.0 implementations that position machine vision as a cornerstone technology for competitive manufacturing operations.

Market outlook remains highly positive with expanding applications in emerging sectors such as medical device manufacturing, renewable energy components, and advanced materials processing. The convergence of machine vision with robotics, IoT connectivity, and cloud-based analytics creates new value propositions that extend beyond traditional quality control applications.

Market intelligence reveals several critical insights that define the current state and future trajectory of the North America machine vision systems market:

Primary growth drivers propelling the North America machine vision systems market reflect fundamental shifts in manufacturing priorities and technological capabilities. Quality assurance requirements have intensified across industries as companies face increasing liability concerns, regulatory compliance demands, and customer expectations for defect-free products. This trend particularly impacts automotive, medical device, and aerospace manufacturers where quality failures can result in significant financial and reputational consequences.

Labor market dynamics create substantial pressure for automation adoption as skilled quality control inspectors become increasingly scarce and expensive. The aging workforce in manufacturing sectors, combined with younger workers’ preference for technology-enabled roles, drives companies to invest in machine vision systems that can maintain quality standards while reducing dependence on human inspectors. Productivity improvements from automated inspection systems typically deliver efficiency gains of 40-60% compared to manual processes.

Technological advancement in artificial intelligence and image processing capabilities enables machine vision systems to handle increasingly complex inspection tasks that were previously impossible to automate. Deep learning algorithms can now detect subtle defects, classify complex patterns, and adapt to product variations with minimal programming requirements. Cost reduction in camera technology, processing power, and software licensing makes machine vision systems accessible to smaller manufacturers and new application areas.

Competitive pressures force manufacturers to optimize production efficiency and minimize waste through precise quality control measures. Machine vision systems provide real-time feedback that enables immediate process adjustments, reducing scrap rates and improving overall equipment effectiveness. Industry 4.0 initiatives create synergistic benefits when machine vision systems integrate with other smart manufacturing technologies.

Implementation challenges present significant barriers to machine vision system adoption, particularly for smaller manufacturers with limited technical expertise and financial resources. Initial capital requirements for comprehensive machine vision solutions can be substantial, especially when considering system integration, employee training, and potential production line modifications. Many companies struggle to justify the upfront investment despite long-term benefits, particularly in industries with thin profit margins.

Technical complexity remains a persistent challenge as machine vision systems require specialized knowledge for proper configuration, maintenance, and optimization. The shortage of qualified technicians and engineers with machine vision expertise creates implementation delays and increases operational risks. Integration difficulties with existing manufacturing systems and legacy equipment can result in unexpected costs and extended deployment timelines.

Performance limitations in certain applications continue to restrict market growth, particularly for highly reflective surfaces, transparent materials, and complex three-dimensional inspections. Environmental factors such as vibration, temperature variations, and lighting conditions can affect system reliability and accuracy. False rejection rates and missed defects remain concerns that require careful system calibration and ongoing maintenance.

Regulatory considerations in some industries create additional complexity for machine vision system validation and compliance documentation. Pharmaceutical and medical device manufacturers must demonstrate system reliability and maintain extensive validation records, adding time and cost to implementation projects. Cybersecurity concerns related to connected machine vision systems create additional requirements for network security and data protection measures.

Emerging applications present substantial growth opportunities as machine vision technology expands beyond traditional manufacturing quality control into new sectors and use cases. Medical device manufacturing represents a particularly promising opportunity with stringent quality requirements and increasing production volumes of complex devices. The renewable energy sector offers significant potential for machine vision applications in solar panel inspection, wind turbine component quality control, and battery manufacturing processes.

Artificial intelligence integration creates opportunities for more sophisticated machine vision solutions that can learn from inspection data and continuously improve performance. Edge computing capabilities enable real-time processing and decision-making without dependence on cloud connectivity, opening opportunities in remote manufacturing locations and mobile inspection applications. The convergence of machine vision with robotics creates new possibilities for automated assembly, packaging, and material handling operations.

Small and medium enterprises represent an underserved market segment with significant growth potential as machine vision technology becomes more affordable and user-friendly. Cloud-based machine vision platforms and software-as-a-service models reduce barriers to entry and enable smaller manufacturers to access advanced inspection capabilities. Retrofit opportunities in existing manufacturing facilities provide substantial market potential as companies modernize production lines.

International expansion opportunities exist as North American machine vision companies leverage their technological expertise to serve growing markets in other regions. Service-based business models including machine vision as a service, remote monitoring, and predictive maintenance create recurring revenue opportunities and stronger customer relationships. The integration of machine vision with augmented reality and digital twin technologies opens new possibilities for remote inspection and virtual quality control applications.

Market forces shaping the North America machine vision systems landscape reflect the complex interplay between technological innovation, economic pressures, and evolving customer requirements. Supply chain optimization initiatives drive demand for machine vision systems that can ensure component quality and traceability throughout manufacturing processes. Companies increasingly recognize that quality issues early in the supply chain can cascade into significant downstream problems and costs.

Competitive differentiation through quality excellence motivates manufacturers to invest in advanced machine vision capabilities that can detect defects beyond human visual capabilities. The ability to guarantee consistent quality becomes a key selling point in business-to-business relationships and consumer markets. Data analytics integration transforms machine vision from simple pass/fail inspection to comprehensive quality intelligence that informs process improvements and predictive maintenance strategies.

Technology convergence creates dynamic market conditions as machine vision systems increasingly integrate with artificial intelligence, robotics, and IoT platforms. This convergence enables new applications and value propositions while also increasing system complexity and integration requirements. Vendor consolidation trends in the machine vision industry create opportunities for comprehensive solution providers while potentially reducing competition in specialized market segments.

Customer expectations continue to evolve toward more flexible, intelligent, and user-friendly machine vision solutions that can adapt to changing production requirements without extensive reprogramming. The demand for plug-and-play capabilities drives innovation in system design and software interfaces. Sustainability considerations increasingly influence purchasing decisions as companies seek energy-efficient systems and solutions that reduce waste through improved quality control.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the North America machine vision systems market. Primary research includes extensive interviews with industry executives, technology developers, system integrators, and end-users across key market segments. This direct engagement provides valuable insights into market trends, challenges, and future requirements that may not be apparent from secondary sources alone.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documentation to establish market baselines and identify emerging trends. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth patterns and segment dynamics. Data validation processes ensure consistency and accuracy across multiple information sources.

Industry expert consultation provides specialized knowledge and perspective on technical developments, market dynamics, and competitive positioning. Market segmentation analysis examines growth patterns across different industries, applications, and geographic regions to identify specific opportunities and challenges. Technology assessment evaluates the impact of emerging innovations on market development and competitive dynamics.

Competitive intelligence gathering includes analysis of major market participants, their product portfolios, strategic initiatives, and market positioning. End-user surveys and case studies provide insights into adoption patterns, implementation challenges, and satisfaction levels with current machine vision solutions. This multi-faceted approach ensures comprehensive market understanding and reliable forecasting accuracy.

United States dominance in the North America machine vision systems market reflects the country’s advanced manufacturing base, strong technology sector, and significant research and development investments. Manufacturing concentration in states such as Michigan, Ohio, California, and Texas drives substantial demand for machine vision systems across automotive, electronics, and aerospace industries. The presence of major technology companies and machine vision system manufacturers creates a robust ecosystem for innovation and market development.

California leadership stems from its concentration of electronics manufacturers, semiconductor companies, and technology innovators who require advanced machine vision capabilities for precision manufacturing processes. The state’s market share of approximately 22% reflects both high-tech manufacturing demand and the presence of leading machine vision technology developers. Silicon Valley influence extends beyond direct manufacturing applications to include machine vision integration in consumer electronics and emerging technology sectors.

Canada’s contribution to the regional market focuses primarily on automotive manufacturing, natural resources processing, and advanced materials production. Ontario province leads Canadian adoption with its concentration of automotive assembly plants and tier-one suppliers that require sophisticated quality control systems. Quebec’s aerospace industry drives demand for precision machine vision applications in aircraft component manufacturing and assembly processes.

Regional growth patterns show increasing adoption in the southeastern United States as manufacturing operations relocate from higher-cost regions and international companies establish North American production facilities. Mexico integration through NAFTA agreements creates opportunities for machine vision system deployment in cross-border manufacturing operations and supply chain quality assurance applications. Technology clusters in major metropolitan areas foster innovation and accelerate market development through collaboration between manufacturers, system integrators, and research institutions.

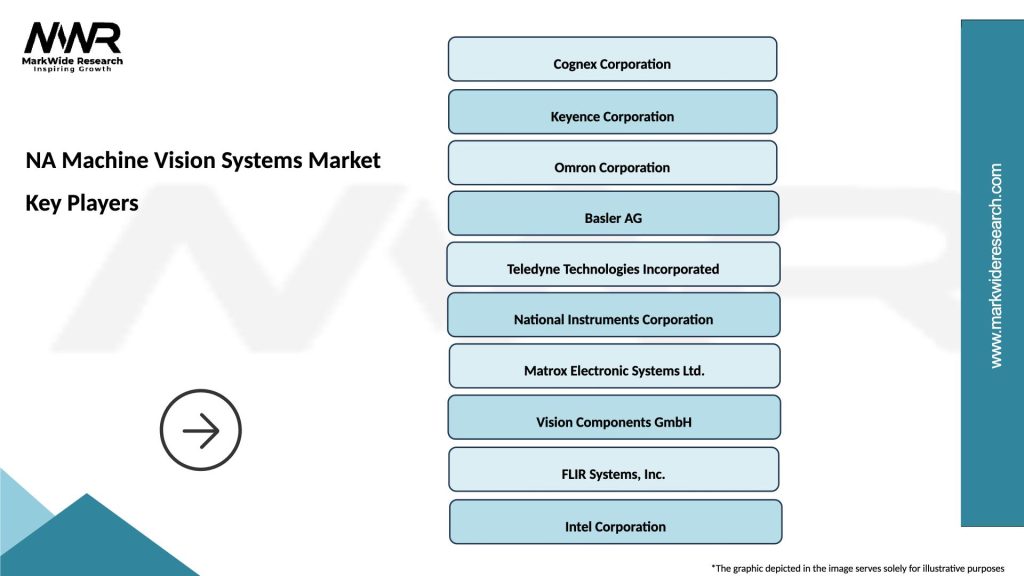

Market leadership in the North America machine vision systems sector is characterized by a mix of established industrial automation companies, specialized machine vision providers, and emerging technology innovators. The competitive environment reflects both consolidation trends and continued innovation from new market entrants.

Competitive strategies emphasize technological differentiation through artificial intelligence integration, ease of use improvements, and comprehensive solution portfolios that address multiple customer requirements. Partnership approaches with system integrators and original equipment manufacturers expand market reach and accelerate customer adoption. Innovation investment focuses on deep learning capabilities, 3D imaging technologies, and cloud-based analytics platforms.

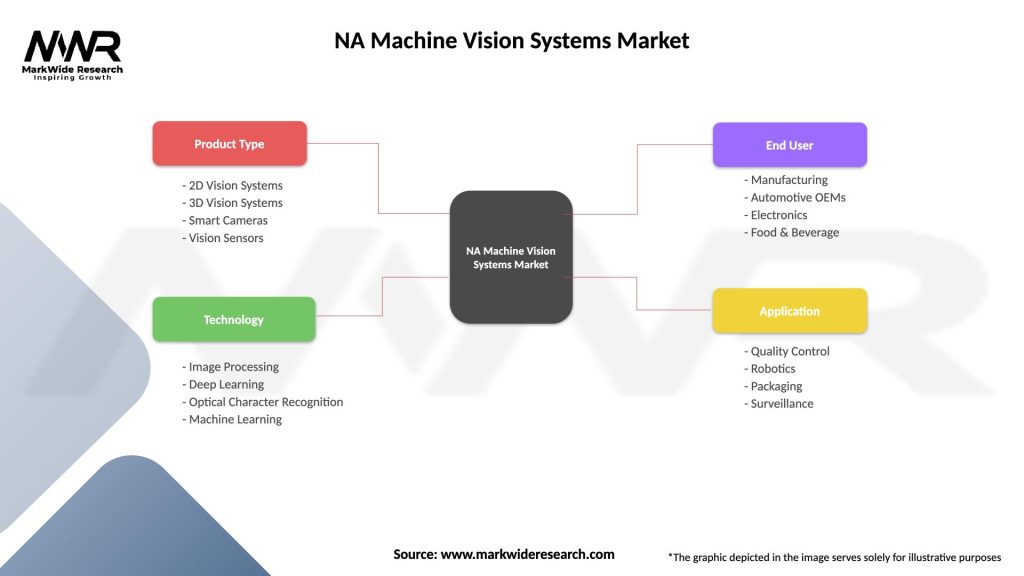

Technology-based segmentation reveals distinct market dynamics across different machine vision system categories:

By Technology:

By Component:

By Application:

By Industry Vertical:

Automotive sector leadership in machine vision adoption reflects the industry’s stringent quality requirements and high-volume production environments that demand reliable automated inspection solutions. Engine component inspection represents the largest application area with growth rates of 9.5% annually driven by increasing engine complexity and emission control requirements. Advanced machine vision systems detect microscopic defects in critical components such as cylinder heads, pistons, and fuel injection systems.

Electronics manufacturing drives innovation in high-resolution imaging and precision measurement capabilities required for increasingly miniaturized components and complex circuit board assemblies. Semiconductor inspection applications push the boundaries of machine vision technology with requirements for sub-micron defect detection and ultra-high-speed processing. The sector’s rapid product development cycles create demand for flexible machine vision systems that can quickly adapt to new product specifications.

Pharmaceutical applications emphasize reliability, validation, and regulatory compliance requirements that influence system design and implementation approaches. Tablet inspection systems must detect subtle defects while maintaining extremely low false rejection rates to minimize product waste. Serialization and track-and-trace requirements drive demand for high-speed optical character recognition and barcode reading capabilities integrated with machine vision quality control systems.

Food and beverage industry adoption focuses on foreign object detection, packaging integrity verification, and product consistency monitoring applications. Hygiene requirements influence system design with emphasis on washdown capabilities and stainless steel construction. The sector’s cost-sensitive nature drives demand for cost-effective machine vision solutions that can deliver rapid return on investment through reduced waste and improved product quality.

Manufacturing companies realize substantial operational benefits from machine vision system implementation including improved product quality, reduced labor costs, and enhanced production efficiency. Quality improvements typically result in defect reduction of 70-90% compared to manual inspection processes, leading to decreased warranty claims, customer complaints, and product recalls. Automated inspection enables 100% product screening at production speeds that would be impossible with human inspectors.

Cost reduction benefits extend beyond direct labor savings to include reduced scrap rates, improved yield, and decreased rework requirements. Return on investment calculations typically show payback periods of 12-24 months for machine vision implementations in high-volume manufacturing environments. Energy efficiency improvements and reduced material waste contribute to sustainability goals while improving profitability.

System integrators and solution providers benefit from growing market demand and opportunities to develop specialized expertise in emerging application areas. Recurring revenue opportunities through maintenance contracts, software updates, and system optimization services create stable business models. The complexity of modern machine vision systems increases the value of integration expertise and technical support services.

Technology suppliers including camera manufacturers, software developers, and component suppliers benefit from expanding market opportunities and increasing system sophistication. Innovation drivers such as artificial intelligence integration and 3D imaging capabilities create opportunities for premium pricing and market differentiation. Partnership opportunities with end-users and system integrators accelerate product development and market penetration.

End customers and consumers benefit indirectly through improved product quality, enhanced safety, and reduced costs that manufacturers can pass through as competitive pricing. Traceability capabilities enabled by machine vision systems provide greater transparency and accountability in manufacturing processes, supporting consumer confidence and regulatory compliance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the machine vision systems market, with deep learning algorithms enabling more sophisticated defect detection and classification capabilities. AI-powered systems can learn from inspection data and continuously improve performance without extensive reprogramming, making them particularly valuable for applications with complex or variable inspection requirements. This trend is driving adoption increases of 15% annually among manufacturers seeking competitive advantages through advanced quality control capabilities.

Edge computing adoption enables real-time processing and decision-making at the point of inspection, reducing latency and dependence on cloud connectivity. Local processing capabilities are particularly important for high-speed production lines and applications requiring immediate feedback for process control. The integration of powerful processors and specialized AI chips in machine vision systems supports complex algorithms while maintaining real-time performance requirements.

3D imaging technology advancement expands machine vision capabilities beyond traditional 2D surface inspection to include volumetric measurements, shape analysis, and complex geometric verification. Structured light and time-of-flight technologies enable precise depth measurements and three-dimensional quality control applications that were previously impossible or extremely difficult to automate. This trend particularly benefits automotive, aerospace, and medical device manufacturing sectors with complex component geometries.

Cloud connectivity and analytics integration transforms machine vision from standalone inspection tools to components of comprehensive quality intelligence systems. Data aggregation and analysis across multiple production lines and facilities enable predictive quality management and process optimization strategies. Remote monitoring and diagnostic capabilities reduce maintenance costs and improve system reliability through proactive intervention.

User interface simplification makes machine vision systems more accessible to operators without specialized technical training, expanding potential applications and reducing implementation barriers. Intuitive software platforms with graphical programming interfaces and automated setup procedures accelerate deployment and reduce ongoing operational complexity.

Strategic acquisitions continue to reshape the competitive landscape as major industrial automation companies expand their machine vision capabilities through targeted purchases of specialized technology providers. Consolidation trends create opportunities for comprehensive solution providers while potentially reducing competition in niche market segments. These developments enable integrated offerings that combine machine vision with broader automation and control systems.

Technology partnerships between machine vision companies and artificial intelligence specialists accelerate the development and deployment of AI-powered inspection solutions. Collaboration initiatives with semiconductor manufacturers drive advancement in specialized processing chips optimized for machine vision applications. University research partnerships contribute to fundamental technology advancement and workforce development programs.

Product innovations focus on ease of use, artificial intelligence integration, and expanded application capabilities that address evolving customer requirements. Modular system designs enable flexible configurations that can adapt to different inspection requirements and production environments. Software platform developments emphasize cloud connectivity, remote monitoring, and predictive analytics capabilities.

Market expansion initiatives target underserved industry segments and geographic regions with tailored solutions and go-to-market strategies. Vertical market specialization creates opportunities for deep industry expertise and customized solution development. International expansion efforts leverage North American technology leadership to serve growing global markets for advanced manufacturing solutions.

Regulatory developments in industries such as pharmaceuticals and medical devices create new requirements for machine vision system validation and compliance documentation. Standards evolution addresses cybersecurity, data privacy, and system interoperability requirements that influence product development and market adoption patterns.

Investment priorities should focus on artificial intelligence capabilities and edge computing technologies that enable more sophisticated and responsive machine vision applications. MarkWide Research analysis indicates that companies investing in AI-powered machine vision solutions achieve competitive advantages of 25-40% in quality control effectiveness compared to traditional systems. Organizations should prioritize solutions that can adapt and learn from inspection data to improve performance over time.

Implementation strategies should emphasize phased deployment approaches that demonstrate value quickly while building organizational capabilities and confidence in machine vision technology. Pilot project selection should focus on applications with clear return on investment potential and manageable technical complexity. Success in initial implementations creates momentum for broader organizational adoption and more ambitious projects.

Vendor selection criteria should prioritize suppliers with strong technical support capabilities, comprehensive training programs, and proven integration expertise. Long-term partnerships with machine vision providers offer greater value than transactional relationships, particularly for complex applications requiring ongoing optimization and support. Evaluation processes should consider total cost of ownership including training, maintenance, and upgrade requirements.

Skills development represents a critical success factor for machine vision implementation and ongoing optimization. Training investments in technical staff and operators ensure maximum value realization from machine vision systems and reduce dependence on external support. Cross-functional teams including quality, engineering, and IT personnel facilitate successful integration with existing manufacturing systems.

Technology roadmap planning should consider emerging trends such as augmented reality integration, advanced analytics, and autonomous quality management systems that may influence future machine vision requirements. Scalability considerations ensure that current investments can support future expansion and technology evolution without requiring complete system replacement.

Market trajectory for North America machine vision systems remains strongly positive with accelerating adoption driven by artificial intelligence integration, Industry 4.0 initiatives, and increasing quality requirements across manufacturing sectors. Growth projections indicate continued expansion at CAGR rates exceeding 8% through the next five years, supported by technological advancement and expanding application opportunities in emerging industries.

Technology evolution will continue to focus on artificial intelligence capabilities, 3D imaging advancement, and edge computing integration that enable more sophisticated and autonomous inspection applications. Machine learning algorithms will become standard features in machine vision systems, providing adaptive capabilities that improve performance and reduce maintenance requirements. The convergence of machine vision with robotics and IoT platforms creates new possibilities for integrated automation solutions.

Application expansion into new industry sectors including renewable energy, advanced materials, and biotechnology offers substantial growth opportunities beyond traditional manufacturing markets. Service-based business models including machine vision as a service and remote monitoring solutions will reduce barriers to entry and expand market accessibility for smaller manufacturers. Cloud-based platforms will enable new capabilities while reducing on-site technical requirements.

Competitive dynamics will continue to favor companies that can combine technological innovation with comprehensive support services and industry expertise. MWR forecasts suggest that market consolidation will continue while new entrants focus on specialized applications and emerging technologies. Partnership strategies between technology providers and system integrators will become increasingly important for market success.

Regional leadership in North America will be maintained through continued investment in research and development, strong manufacturing base, and supportive regulatory environment for automation adoption. International expansion opportunities will leverage North American technology leadership to serve growing global markets while domestic demand continues to drive innovation and market development.

The North America machine vision systems market represents a dynamic and rapidly evolving technology sector that is fundamentally transforming manufacturing quality control and automation processes across diverse industries. Strong market fundamentals including technological leadership, diverse industrial base, and supportive investment environment position the region for continued growth and innovation in machine vision applications.

Key success factors for market participants include artificial intelligence integration, comprehensive solution portfolios, and strong technical support capabilities that address evolving customer requirements. The convergence of machine vision with broader Industry 4.0 initiatives creates new value propositions and competitive advantages for early adopters. Investment trends favor solutions that combine advanced technology with ease of use and rapid return on investment.

Future opportunities extend beyond traditional manufacturing applications to include emerging sectors such as renewable energy, medical devices, and advanced materials processing. The evolution toward intelligent, connected, and autonomous machine vision systems will drive continued market expansion and technology advancement. Strategic positioning for long-term success requires balanced investment in technology innovation, market development, and organizational capabilities that can adapt to rapidly changing customer requirements and competitive dynamics in this essential manufacturing technology sector.

What is Machine Vision Systems?

Machine Vision Systems refer to technologies that enable machines to interpret and understand visual information from the world, often used in quality control, automation, and robotics. These systems utilize cameras, sensors, and software to analyze images and make decisions based on visual data.

What are the key players in the NA Machine Vision Systems Market?

Key players in the NA Machine Vision Systems Market include Cognex Corporation, Keyence Corporation, and Omron Corporation, which are known for their innovative solutions in industrial automation and quality inspection, among others.

What are the main drivers of growth in the NA Machine Vision Systems Market?

The main drivers of growth in the NA Machine Vision Systems Market include the increasing demand for automation in manufacturing, the need for quality assurance in production processes, and advancements in artificial intelligence and image processing technologies.

What challenges does the NA Machine Vision Systems Market face?

Challenges in the NA Machine Vision Systems Market include the high initial investment costs for implementation, the complexity of integrating these systems with existing processes, and the need for skilled personnel to operate and maintain the technology.

What opportunities exist in the NA Machine Vision Systems Market?

Opportunities in the NA Machine Vision Systems Market include the expansion of applications in sectors such as automotive, electronics, and pharmaceuticals, as well as the potential for growth in emerging technologies like deep learning and smart manufacturing.

What trends are shaping the NA Machine Vision Systems Market?

Trends shaping the NA Machine Vision Systems Market include the increasing adoption of AI and machine learning for enhanced image analysis, the rise of smart factories, and the integration of machine vision with IoT devices for real-time monitoring and data collection.

NA Machine Vision Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | 2D Vision Systems, 3D Vision Systems, Smart Cameras, Vision Sensors |

| Technology | Image Processing, Deep Learning, Optical Character Recognition, Machine Learning |

| End User | Manufacturing, Automotive OEMs, Electronics, Food & Beverage |

| Application | Quality Control, Robotics, Packaging, Surveillance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Machine Vision Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at