444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America inertial systems market represents a critical component of the region’s advanced navigation and guidance technology landscape. These sophisticated systems, which include inertial navigation systems (INS), inertial measurement units (IMUs), and accelerometers, serve as the backbone for precision navigation across aerospace, defense, automotive, and marine applications. North America maintains its position as a global leader in inertial systems technology, driven by substantial defense spending, robust aerospace industry presence, and increasing adoption of autonomous vehicle technologies.

Market dynamics indicate strong growth momentum, with the region experiencing a 6.8% CAGR driven by technological advancements in MEMS-based inertial sensors and increasing demand for high-precision navigation solutions. The integration of artificial intelligence and machine learning algorithms with traditional inertial systems has created new opportunities for enhanced performance and reduced costs. Defense applications continue to dominate the market, accounting for approximately 45% of total demand, while commercial aerospace and automotive sectors show rapid expansion.

Technological innovation remains at the forefront of market development, with manufacturers focusing on miniaturization, improved accuracy, and enhanced reliability. The shift toward fiber optic gyroscopes and ring laser gyroscopes has revolutionized precision navigation capabilities, enabling applications in GPS-denied environments and critical mission scenarios. Regional market distribution shows the United States commanding 78% market share, followed by Canada with significant contributions from aerospace and defense sectors.

The North America inertial systems market refers to the comprehensive ecosystem of navigation and guidance technologies that utilize the principles of inertia to determine position, orientation, and velocity without external references. These systems measure specific force, angular rate, and magnetic field to provide continuous navigation information, making them essential for applications where GPS signals are unavailable or unreliable.

Inertial systems encompass various technologies including gyroscopes, accelerometers, and magnetometers integrated into sophisticated platforms that deliver precise navigation data. The market includes both platform-based systems, where sensors are mounted on a stabilized platform, and strapdown systems, where sensors are fixed directly to the vehicle or aircraft frame. Modern inertial systems leverage advanced materials, micro-electromechanical systems (MEMS) technology, and sophisticated algorithms to achieve unprecedented levels of accuracy and reliability.

Market scope extends across multiple industries, from traditional aerospace and defense applications to emerging autonomous vehicle technologies and consumer electronics. The integration of inertial systems with other navigation technologies, such as GPS and visual odometry, creates hybrid solutions that offer superior performance and redundancy for critical applications.

Strategic market analysis reveals the North America inertial systems market as a mature yet rapidly evolving sector characterized by continuous technological advancement and expanding application domains. The market demonstrates resilience through diversification across defense, aerospace, automotive, and industrial sectors, with each segment contributing to overall growth momentum.

Key growth drivers include increasing defense modernization programs, rising demand for autonomous vehicle navigation systems, and expanding commercial aerospace activities. The market benefits from substantial R&D investment, with approximately 12% of revenue typically reinvested in technology development and innovation. MEMS technology adoption has democratized inertial systems, enabling cost-effective solutions for consumer and industrial applications previously dominated by expensive traditional systems.

Competitive landscape features established defense contractors alongside innovative technology companies, creating a dynamic environment that fosters innovation and market expansion. The integration of artificial intelligence and advanced signal processing techniques has enhanced system performance while reducing size, weight, and power consumption. Market consolidation through strategic acquisitions and partnerships continues to shape the industry structure, with companies seeking to expand their technological capabilities and market reach.

Market intelligence reveals several critical insights that define the current and future trajectory of the North America inertial systems market:

Defense sector modernization serves as the primary catalyst for inertial systems market growth, with military organizations investing heavily in next-generation navigation and guidance technologies. The need for GPS-independent navigation capabilities in contested environments drives demand for sophisticated inertial systems that can operate reliably without external references. Military applications require systems with exceptional accuracy, durability, and resistance to jamming or interference.

Autonomous vehicle development represents a transformative market driver, as self-driving cars, trucks, and drones require precise positioning and orientation data for safe operation. The automotive industry’s shift toward autonomous driving technologies creates substantial demand for cost-effective, high-performance inertial measurement units. Safety-critical applications in autonomous vehicles necessitate redundant navigation systems, further boosting market demand.

Commercial aerospace expansion continues to drive market growth through increasing aircraft production, fleet modernization, and enhanced navigation requirements. Airlines and aircraft manufacturers seek advanced inertial systems that provide improved fuel efficiency, enhanced safety, and reduced maintenance costs. Next-generation aircraft incorporate sophisticated inertial systems for flight management, autopilot functions, and navigation backup systems.

Technological advancement in MEMS fabrication and sensor fusion algorithms enables new applications and market segments previously inaccessible due to cost or performance limitations. The development of quantum inertial sensors and other breakthrough technologies promises to revolutionize precision navigation capabilities. Innovation cycles continue to drive market expansion through improved performance and reduced costs.

High development costs associated with advanced inertial systems create significant barriers for market entry and product development. The complex engineering requirements, extensive testing protocols, and certification processes demand substantial financial resources that may limit innovation from smaller companies. R&D investment requirements often exceed the capabilities of emerging market participants, consolidating market power among established players.

Stringent regulatory requirements in aerospace and defense applications create lengthy certification processes that delay product launches and increase development costs. Compliance with military specifications, aviation standards, and safety regulations requires extensive documentation and testing that can span multiple years. Certification complexity particularly affects new entrants and innovative technologies seeking market acceptance.

Technical complexity in system integration and calibration presents ongoing challenges for manufacturers and end users. The sophisticated algorithms, sensor fusion techniques, and error compensation methods require specialized expertise that may be scarce in the market. Skilled workforce limitations can constrain market growth and innovation capabilities across the industry.

Competition from alternative technologies such as GPS, visual navigation systems, and other positioning technologies may limit market expansion in certain applications. The improving performance and decreasing costs of competing navigation solutions create pressure on inertial systems manufacturers to continuously innovate and reduce prices. Technology substitution risks require constant vigilance and adaptation from market participants.

Emerging applications in robotics, unmanned systems, and Internet of Things (IoT) devices present substantial growth opportunities for inertial systems manufacturers. The expanding use of drones for commercial applications, including delivery services, infrastructure inspection, and agricultural monitoring, creates new demand for compact, cost-effective inertial navigation solutions. Robotics integration across manufacturing, healthcare, and service industries drives additional market expansion.

Space exploration initiatives and commercial space activities offer lucrative opportunities for specialized inertial systems designed for harsh space environments. The growing commercial space sector, including satellite constellations, space tourism, and lunar missions, requires advanced navigation and guidance systems. Space applications typically command premium pricing due to stringent performance and reliability requirements.

Smart city infrastructure development creates opportunities for inertial systems in traffic management, autonomous public transportation, and infrastructure monitoring applications. The integration of inertial sensors in smart infrastructure enables real-time monitoring and predictive maintenance capabilities. Urban mobility solutions increasingly rely on precise positioning and navigation technologies.

Consumer electronics integration presents opportunities for high-volume, cost-sensitive applications in smartphones, gaming devices, and wearable technology. The miniaturization of inertial sensors enables new user experiences and applications in consumer products. Mass market adoption can drive significant revenue growth through volume sales despite lower per-unit margins.

Supply chain dynamics in the North America inertial systems market reflect the complex interplay between specialized component suppliers, system integrators, and end users across multiple industries. The market demonstrates strong vertical integration among leading manufacturers who control critical technologies and manufacturing processes. Component sourcing strategies increasingly focus on supply chain resilience and domestic production capabilities, particularly for defense applications.

Innovation cycles drive continuous market evolution, with manufacturers investing heavily in next-generation technologies such as quantum sensors, advanced materials, and artificial intelligence integration. The rapid pace of technological advancement creates both opportunities and challenges, as companies must balance current product optimization with future technology development. Technology roadmaps typically span 5-10 years, requiring sustained investment and strategic planning.

Customer relationships in the inertial systems market are characterized by long-term partnerships, particularly in aerospace and defense sectors where product lifecycles extend over decades. The high switching costs and certification requirements create strong customer loyalty but also demand continuous innovation and support. Service offerings increasingly complement product sales, with manufacturers providing lifecycle support, upgrades, and maintenance services.

Market consolidation continues through strategic acquisitions and partnerships as companies seek to expand their technological capabilities and market reach. The trend toward system-level solutions drives collaboration between inertial systems manufacturers and platform integrators. Strategic alliances enable companies to access new markets and technologies while sharing development risks and costs.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the North America inertial systems market. Primary research involves extensive interviews with industry executives, technology experts, and end users across aerospace, defense, automotive, and industrial sectors. Expert consultations provide qualitative insights into market trends, technological developments, and competitive dynamics.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to establish market baselines and identify emerging trends. Government procurement data, defense spending patterns, and aerospace industry statistics provide quantitative foundations for market sizing and growth projections. Data triangulation ensures consistency and accuracy across multiple information sources.

Market modeling utilizes advanced analytical techniques to project future market scenarios based on historical trends, technological developments, and macroeconomic factors. Scenario analysis considers various growth trajectories under different market conditions and regulatory environments. Forecasting models incorporate both bottom-up and top-down approaches to validate market projections and identify potential discrepancies.

Industry validation through expert panels and stakeholder feedback ensures research findings align with market realities and industry expectations. Continuous monitoring of market developments and regular updates to research findings maintain the relevance and accuracy of market intelligence. Quality assurance processes verify data integrity and analytical rigor throughout the research process.

United States dominance in the North America inertial systems market stems from its substantial defense budget, advanced aerospace industry, and leading technology companies. The country hosts major manufacturers including Honeywell, Northrop Grumman, and Raytheon Technologies, which maintain significant market share through technological innovation and strong customer relationships. Defense spending allocation toward modernization programs continues to drive demand for advanced inertial navigation systems.

Regional distribution shows the United States accounting for approximately 78% of market activity, with California, Texas, and Massachusetts serving as primary technology hubs. The concentration of aerospace and defense contractors in these states creates clusters of innovation and manufacturing capability. Government research facilities and universities contribute to ongoing technology development and workforce development initiatives.

Canada represents a significant secondary market, contributing approximately 22% of regional demand through its aerospace industry, defense procurement programs, and natural resources sector applications. Canadian companies like CAE Inc. and partnerships with U.S. manufacturers strengthen the integrated North American market. Cross-border collaboration in defense and aerospace programs creates shared technology development and procurement opportunities.

Market infrastructure across North America benefits from established supply chains, skilled workforce availability, and supportive regulatory environments for technology development. The region’s universities and research institutions provide ongoing innovation support and talent development for the inertial systems industry. Investment climate remains favorable for both domestic and international companies seeking to establish or expand operations in the region.

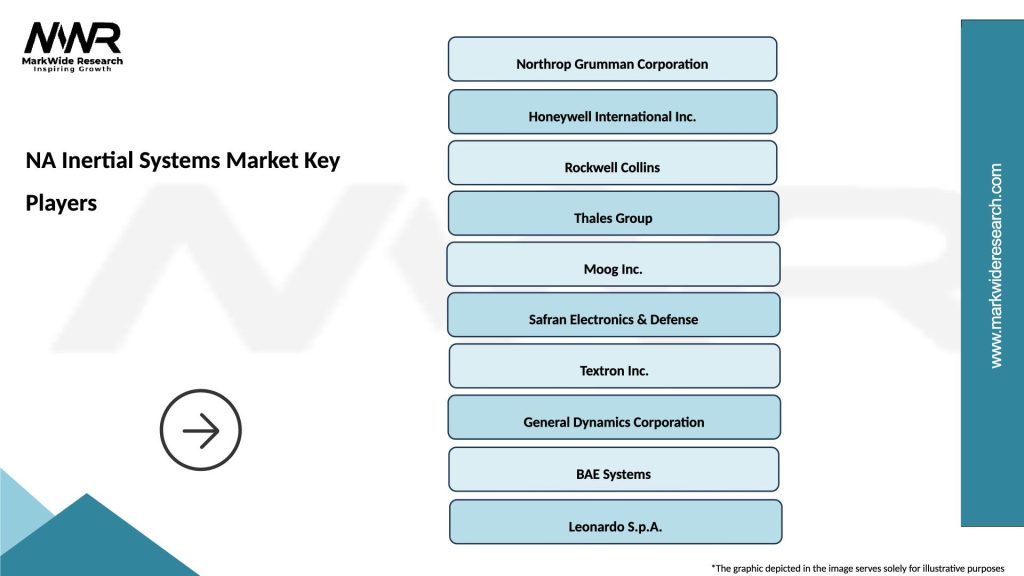

Market leadership in the North America inertial systems sector is characterized by a mix of established defense contractors and specialized technology companies, each bringing unique capabilities and market focus areas:

Competitive strategies focus on technological differentiation, customer relationship management, and strategic partnerships to maintain market position. Companies invest heavily in R&D to develop next-generation technologies while maintaining strong support for existing product lines. Market positioning varies from broad-based solutions providers to specialized niche players focusing on specific applications or technologies.

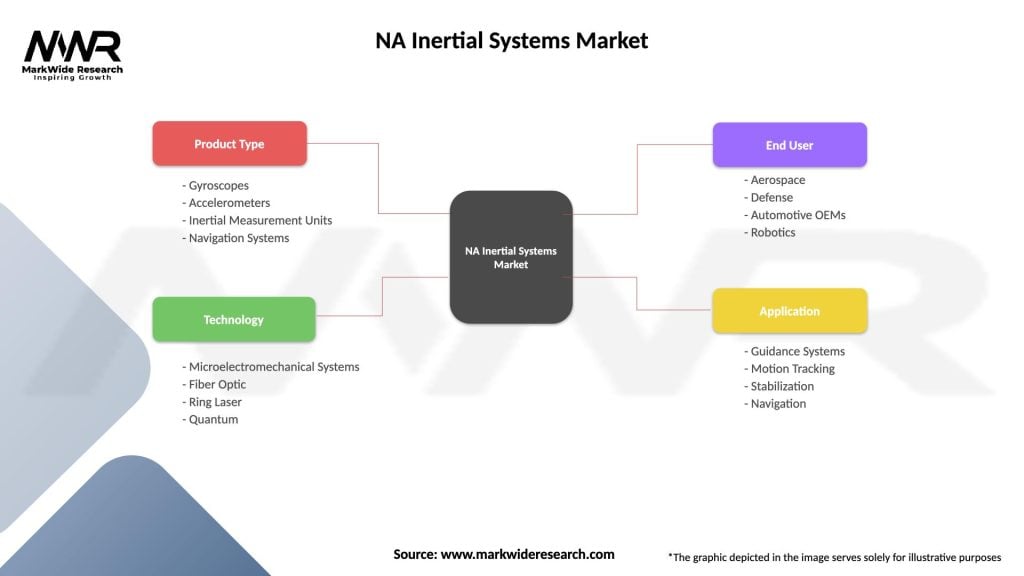

Technology-based segmentation reveals distinct market categories based on underlying sensor technologies and system architectures:

Application-based segmentation demonstrates the diverse market applications across multiple industries:

End-user segmentation reflects the varied customer base and procurement patterns across different sectors, from government defense agencies to commercial manufacturers and technology integrators.

Aerospace applications continue to dominate the inertial systems market, driven by stringent accuracy requirements and safety-critical operations. Commercial aviation demands certified systems that meet international standards for reliability and performance. Military aerospace applications require systems capable of operating in hostile environments with resistance to jamming and interference. The integration of inertial systems with flight management computers and autopilot systems creates comprehensive navigation solutions.

Defense sector applications encompass a broad range of platforms including ground vehicles, naval vessels, and missile systems. Modern military operations increasingly rely on GPS-denied navigation capabilities, making inertial systems essential for mission success. Tactical applications demand compact, rugged systems that can withstand extreme environmental conditions while maintaining precision accuracy.

Automotive integration represents the fastest-growing market segment, with autonomous vehicle development driving demand for cost-effective inertial measurement units. Advanced driver assistance systems (ADAS) incorporate inertial sensors for vehicle stability control, rollover detection, and navigation backup. Electric vehicle platforms increasingly integrate inertial systems for enhanced performance monitoring and safety systems.

Industrial applications span construction, mining, agriculture, and manufacturing sectors where precise positioning and orientation measurement are critical. Robotic systems rely on inertial sensors for navigation and control in dynamic environments. Survey and mapping applications utilize high-precision inertial systems for accurate geospatial data collection and analysis.

Manufacturers benefit from expanding market opportunities across multiple industry sectors, enabling revenue diversification and reduced dependence on any single market segment. The growing demand for inertial systems creates opportunities for both established companies and innovative startups to develop specialized solutions. Technology licensing and partnership opportunities allow companies to leverage their innovations across broader market applications.

End users gain access to increasingly sophisticated navigation and positioning capabilities that enhance operational efficiency, safety, and performance. The integration of inertial systems with other technologies provides comprehensive solutions that address complex navigation challenges. Cost reductions through technological advancement and manufacturing improvements make advanced inertial systems accessible to broader market segments.

Technology suppliers benefit from the growing ecosystem of component manufacturers, software developers, and system integrators supporting the inertial systems market. The demand for specialized components, materials, and manufacturing equipment creates opportunities throughout the supply chain. Innovation partnerships between suppliers and manufacturers drive continuous technology advancement and market expansion.

Investment community finds attractive opportunities in a market characterized by steady growth, technological innovation, and expanding applications. The strategic importance of inertial systems across defense and commercial sectors provides investment stability and growth potential. Market consolidation trends create opportunities for strategic acquisitions and partnerships that enhance competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization advancement continues to drive market evolution, with MEMS-based inertial sensors achieving unprecedented levels of integration and performance. The development of chip-scale inertial measurement units enables new applications in consumer electronics, wearable devices, and IoT systems. Size reduction efforts focus on maintaining or improving performance while dramatically reducing system footprint and power consumption.

Artificial intelligence integration represents a transformative trend, with machine learning algorithms enhancing sensor fusion, error correction, and predictive maintenance capabilities. AI-powered inertial systems can adapt to changing conditions, optimize performance parameters, and provide intelligent diagnostics. Smart sensors incorporate edge computing capabilities that enable real-time processing and decision-making at the sensor level.

Quantum sensor development promises revolutionary improvements in inertial system accuracy and stability. Quantum gyroscopes and accelerometers leverage quantum mechanical effects to achieve measurement precision orders of magnitude better than traditional systems. Quantum technology research initiatives across North America position the region for next-generation navigation capabilities.

Hybrid navigation systems combine inertial sensors with GPS, visual odometry, and other positioning technologies to create robust, redundant navigation solutions. The integration of multiple sensor modalities provides superior performance and reliability compared to single-technology approaches. Sensor fusion algorithms continue to advance, enabling seamless integration of diverse navigation inputs.

Sustainability focus drives development of environmentally friendly manufacturing processes and recyclable system components. Companies increasingly consider lifecycle environmental impact in product design and manufacturing decisions. Green technology initiatives align with corporate sustainability goals and regulatory requirements.

Recent technological breakthroughs have significantly advanced inertial systems capabilities, with several companies announcing major innovations in sensor accuracy, size reduction, and cost optimization. MarkWide Research analysis indicates that breakthrough developments in quantum sensing and advanced materials are accelerating market transformation. The introduction of silicon photonic gyroscopes and other novel technologies promises to reshape competitive dynamics.

Strategic partnerships between traditional aerospace companies and technology startups are creating new innovation pathways and market opportunities. Major defense contractors are increasingly collaborating with smaller, agile companies to access cutting-edge technologies and accelerate development timelines. Joint ventures and technology licensing agreements enable rapid market expansion and capability enhancement.

Government initiatives supporting advanced manufacturing, research and development, and technology commercialization provide favorable conditions for industry growth. Defense modernization programs and space exploration initiatives drive substantial investment in next-generation inertial systems. Policy support for domestic manufacturing and technology leadership strengthens the competitive position of North American companies.

International expansion efforts by North American companies are creating new revenue streams and market opportunities in emerging economies. Export programs and international partnerships enable technology transfer and market development in regions with growing aerospace and defense sectors. Global presence strategies help companies diversify revenue sources and reduce dependence on domestic markets.

Investment prioritization should focus on companies demonstrating strong technological differentiation and clear pathways to market expansion. Organizations with robust R&D capabilities and strategic partnerships are better positioned to capitalize on emerging opportunities in autonomous vehicles and commercial space applications. Due diligence should evaluate both current market position and future technology roadmaps.

Technology development strategies should emphasize sensor fusion, artificial intelligence integration, and manufacturing cost reduction to remain competitive in evolving markets. Companies should balance investment between improving existing products and developing breakthrough technologies for future applications. Innovation portfolios should span multiple technology generations to ensure sustained competitive advantage.

Market diversification across multiple application sectors reduces risk and creates opportunities for sustained growth despite cyclical variations in individual markets. Companies should develop capabilities that enable them to serve both traditional aerospace/defense customers and emerging commercial applications. Portfolio balance between high-margin specialized systems and volume commercial products optimizes revenue and profitability.

Strategic partnerships with technology companies, research institutions, and international organizations can accelerate innovation and market expansion while sharing development risks and costs. Collaboration strategies should focus on complementary capabilities and shared market objectives. Alliance management requires careful attention to intellectual property protection and competitive positioning.

Market trajectory indicates continued robust growth driven by expanding applications, technological advancement, and increasing demand for precision navigation solutions. The convergence of multiple technology trends, including artificial intelligence, quantum sensing, and advanced materials, will create new market opportunities and competitive dynamics. Growth projections suggest the market will maintain a 6.8% CAGR over the next decade, with particularly strong expansion in automotive and commercial space sectors.

Technology evolution will focus on achieving higher accuracy, smaller size, lower power consumption, and reduced costs to enable broader market adoption. The development of quantum inertial sensors and AI-enhanced systems will create new performance benchmarks and application possibilities. Innovation cycles are expected to accelerate as competition intensifies and customer requirements become more demanding.

Market structure may experience continued consolidation as companies seek to achieve scale advantages and comprehensive technology portfolios. Strategic acquisitions and partnerships will likely reshape competitive dynamics and create new market leaders. Industry evolution toward system-level solutions and integrated platforms will favor companies with broad technological capabilities and strong customer relationships.

Regulatory environment will continue to influence market development through certification requirements, export controls, and technology transfer restrictions. Companies must navigate complex regulatory landscapes while maintaining innovation momentum and market competitiveness. Compliance strategies will become increasingly important for market success and international expansion.

Global competition will intensify as international companies develop advanced capabilities and seek to challenge North American market leadership. Maintaining technological advantage and market position will require sustained investment in R&D, manufacturing capability, and customer relationships. Competitive positioning strategies must balance domestic market protection with international expansion opportunities.

The North America inertial systems market stands at a pivotal juncture, characterized by robust growth prospects, technological transformation, and expanding application domains. The market’s foundation in aerospace and defense sectors provides stability, while emerging opportunities in autonomous vehicles, commercial space, and industrial applications offer substantial growth potential. Market dynamics reflect the successful balance between serving traditional high-value customers and developing cost-effective solutions for volume markets.

Technological innovation remains the primary driver of market evolution, with advances in MEMS technology, artificial intelligence integration, and quantum sensing creating new possibilities for precision navigation. The region’s strong innovation ecosystem, supported by leading universities, research institutions, and technology companies, positions North America to maintain its global leadership in inertial systems technology. Investment in R&D continues to yield breakthrough technologies that expand market opportunities and enhance competitive positioning.

Strategic considerations for market participants include balancing investment between current product optimization and future technology development, diversifying across multiple application sectors, and building strategic partnerships that accelerate innovation and market expansion. The market rewards companies that can successfully navigate complex regulatory requirements while delivering innovative solutions that meet evolving customer needs. Success factors increasingly include technological differentiation, operational excellence, and strategic market positioning across diverse industry sectors.

Future market success will depend on companies’ ability to adapt to changing customer requirements, leverage emerging technologies, and maintain competitive advantages in an increasingly dynamic marketplace. The North America inertial systems market offers substantial opportunities for growth and innovation, supported by strong fundamentals and expanding application possibilities across multiple high-growth sectors.

What is NA Inertial Systems?

NA Inertial Systems refers to technologies that measure and report the motion and orientation of objects using sensors such as accelerometers and gyroscopes. These systems are widely used in applications like navigation, robotics, and aerospace.

What are the key players in the NA Inertial Systems Market?

Key players in the NA Inertial Systems Market include Honeywell International Inc., Northrop Grumman Corporation, and Thales Group, among others. These companies are known for their advanced technologies and solutions in inertial navigation systems.

What are the growth factors driving the NA Inertial Systems Market?

The growth of the NA Inertial Systems Market is driven by increasing demand for autonomous vehicles, advancements in aerospace technologies, and the rising need for accurate navigation systems in defense applications. These factors contribute to the expanding use of inertial systems across various sectors.

What challenges does the NA Inertial Systems Market face?

The NA Inertial Systems Market faces challenges such as high costs associated with advanced inertial systems and competition from alternative navigation technologies like GPS. Additionally, the complexity of integrating these systems into existing platforms can hinder market growth.

What opportunities exist in the NA Inertial Systems Market?

Opportunities in the NA Inertial Systems Market include the growing demand for smart devices and IoT applications, which require precise motion sensing. Furthermore, the expansion of the aerospace and defense sectors presents significant growth potential for inertial systems.

What trends are shaping the NA Inertial Systems Market?

Trends in the NA Inertial Systems Market include the miniaturization of sensors, the integration of artificial intelligence for enhanced data processing, and the development of multi-sensor fusion technologies. These innovations are improving the performance and applicability of inertial systems.

NA Inertial Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gyroscopes, Accelerometers, Inertial Measurement Units, Navigation Systems |

| Technology | Microelectromechanical Systems, Fiber Optic, Ring Laser, Quantum |

| End User | Aerospace, Defense, Automotive OEMs, Robotics |

| Application | Guidance Systems, Motion Tracking, Stabilization, Navigation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Inertial Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at