444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America industrial valves market represents a critical component of the region’s manufacturing and process industries infrastructure. Industrial valves serve as essential control mechanisms across diverse sectors including oil and gas, chemical processing, water treatment, power generation, and manufacturing facilities. The market encompasses a comprehensive range of valve types designed to regulate, direct, or control fluid flow within piping systems.

Market dynamics indicate robust growth driven by ongoing industrial modernization, infrastructure development, and stringent safety regulations. The region’s mature industrial base, combined with technological advancements in valve design and materials, positions North America as a significant player in the global industrial valves landscape. Growth projections suggest the market will expand at a CAGR of 4.2% through the forecast period, supported by increasing demand from downstream industries.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada and Mexico contributing 15% and 7% respectively. This distribution reflects the concentration of heavy industries, refineries, and manufacturing facilities across these territories. Technological innovation remains a key differentiator, with smart valve technologies and IoT integration driving next-generation solutions.

The North America industrial valves market refers to the comprehensive ecosystem of valve manufacturing, distribution, and application across industrial sectors within the United States, Canada, and Mexico. Industrial valves are mechanical devices designed to control the flow, pressure, and direction of fluids including liquids, gases, and slurries within piping systems and process equipment.

Market scope encompasses various valve categories including gate valves, globe valves, ball valves, butterfly valves, check valves, and specialized control valves. These components serve critical functions in maintaining operational safety, process efficiency, and environmental compliance across industries. Application diversity spans from basic on-off control to sophisticated process automation requiring precise flow modulation and remote monitoring capabilities.

Value chain participants include valve manufacturers, distributors, system integrators, and end-user industries. The market also encompasses aftermarket services including maintenance, repair, and replacement activities that extend valve lifecycle and optimize performance. Regulatory compliance plays a crucial role, with valves required to meet industry-specific standards for safety, environmental protection, and operational reliability.

Strategic analysis reveals the North America industrial valves market as a mature yet evolving sector characterized by steady demand growth and technological transformation. Key market drivers include infrastructure modernization, energy sector expansion, and increasing emphasis on process automation and digitalization. The market benefits from established manufacturing capabilities, robust supply chains, and strong end-user relationships built over decades.

Competitive landscape features both global valve manufacturers and specialized regional players competing across price, technology, and service dimensions. Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand product portfolios and geographic reach. Innovation focus centers on smart valve technologies, predictive maintenance capabilities, and enhanced materials for extreme operating conditions.

Growth opportunities emerge from renewable energy infrastructure development, water treatment facility upgrades, and industrial digitalization initiatives. Market challenges include raw material price volatility, skilled labor shortages, and increasing competition from low-cost international suppliers. Future outlook suggests continued market expansion supported by industrial growth and technological advancement, with digital transformation representing a key differentiating factor for market participants.

Market segmentation analysis reveals distinct growth patterns across valve types and application sectors. Ball valves maintain the largest market share due to their versatility and reliability across diverse applications. Control valves represent the fastest-growing segment, driven by increasing automation adoption and process optimization requirements.

Infrastructure modernization serves as a primary growth driver for the North America industrial valves market. Aging industrial facilities across the region require valve replacement and upgrades to maintain operational efficiency and regulatory compliance. This replacement cycle creates consistent demand for advanced valve technologies offering improved performance, reliability, and maintenance characteristics.

Energy sector expansion continues driving significant valve demand, particularly in oil and gas production, refining, and renewable energy applications. Shale gas development has created substantial opportunities for specialized valves capable of handling high-pressure, high-temperature conditions. Pipeline infrastructure development further amplifies demand for large-diameter valves and automated control systems.

Process automation adoption accelerates across manufacturing industries, driving demand for intelligent valve solutions with integrated sensors and communication capabilities. Industry 4.0 initiatives emphasize connected manufacturing systems where smart valves provide real-time performance data and enable predictive maintenance strategies. Operational efficiency requirements push manufacturers toward automated valve solutions that reduce manual intervention and improve process control precision.

Environmental regulations increasingly mandate advanced valve technologies for emissions control and leak prevention. Fugitive emissions standards require specialized valve designs and materials that minimize environmental impact. Water treatment regulations drive demand for corrosion-resistant valves capable of handling aggressive chemicals and maintaining long-term reliability in critical applications.

Raw material price volatility presents ongoing challenges for valve manufacturers, particularly regarding steel, stainless steel, and specialized alloys. Supply chain disruptions can significantly impact production costs and delivery schedules, affecting competitive positioning and profit margins. Material availability constraints during peak demand periods create additional operational challenges for manufacturers.

Skilled labor shortages affect both valve manufacturing and installation services across North America. Technical expertise requirements for advanced valve technologies exceed available workforce capabilities in many regions. Training costs and time investments required to develop qualified personnel create barriers for companies seeking to expand operations or adopt new technologies.

International competition from low-cost manufacturers, particularly in Asia, pressures pricing across commodity valve segments. Import penetration continues increasing in price-sensitive applications where technical differentiation is limited. Trade policy uncertainties create additional complexity for companies managing global supply chains and market strategies.

Economic cyclicality in key end-user industries creates demand volatility that challenges production planning and inventory management. Capital expenditure deferrals during economic downturns directly impact valve replacement and upgrade projects. Project delays in major industrial developments can significantly affect revenue timing and cash flow for valve suppliers.

Renewable energy infrastructure development creates substantial opportunities for specialized valve applications in wind, solar, and hydroelectric power generation. Energy storage systems require advanced valve technologies for battery cooling, hydrogen storage, and compressed air applications. Grid modernization projects incorporate valve systems for improved efficiency and reliability in power distribution networks.

Water infrastructure upgrades across North America present significant growth opportunities as municipalities and industries invest in treatment facility modernization. Water scarcity concerns drive demand for efficient valve systems that minimize losses and optimize distribution. Smart water networks require intelligent valve solutions with remote monitoring and control capabilities.

Digital transformation initiatives enable valve manufacturers to develop new service-based revenue models through predictive maintenance, performance optimization, and remote monitoring services. Data analytics capabilities create opportunities for value-added services that extend beyond traditional product sales. Subscription models for valve monitoring and maintenance services provide recurring revenue streams.

Specialty applications in emerging industries such as biotechnology, pharmaceuticals, and food processing require customized valve solutions with enhanced sanitary features and precise control capabilities. Regulatory compliance in these sectors creates opportunities for premium-priced, certified valve products. Process innovation in manufacturing drives demand for specialized valve technologies that enable new production methods and improved product quality.

Supply chain integration continues evolving as valve manufacturers seek to optimize costs and improve delivery performance. Vertical integration strategies enable better control over quality and costs while reducing dependence on external suppliers. Strategic partnerships with distributors and system integrators enhance market reach and customer service capabilities.

Technology convergence between traditional valve manufacturing and digital technologies creates new competitive dynamics. Software capabilities become increasingly important as customers seek integrated solutions combining hardware and digital services. Data ownership and analytics capabilities represent new sources of competitive advantage beyond traditional manufacturing excellence.

Customer relationship evolution shifts from transactional product sales toward long-term service partnerships. Total cost of ownership considerations drive purchasing decisions beyond initial valve prices. Performance guarantees and outcome-based contracts become more common as customers seek risk mitigation and predictable operating costs.

Regulatory landscape continues evolving with increasing emphasis on environmental protection, worker safety, and operational reliability. Compliance costs create barriers to entry while favoring established manufacturers with proven track records. Standards harmonization across international markets creates opportunities for companies with global capabilities and certifications.

Primary research methodology encompasses comprehensive interviews with industry executives, technical specialists, and end-user representatives across key market segments. Survey data collection from valve manufacturers, distributors, and major industrial customers provides quantitative insights into market trends, purchasing patterns, and technology adoption rates.

Secondary research incorporates analysis of industry publications, technical standards, regulatory filings, and company financial reports to validate primary findings and identify market trends. Patent analysis reveals innovation patterns and competitive positioning across valve technologies. Trade data analysis provides insights into import/export patterns and regional market dynamics.

Market modeling utilizes econometric techniques to project future demand based on industrial production indices, capital expenditure trends, and demographic factors. Scenario analysis evaluates potential market outcomes under different economic and regulatory conditions. Competitive intelligence gathering through public sources and industry networks provides insights into strategic initiatives and market positioning.

Data validation processes ensure accuracy and reliability through triangulation of multiple sources and expert review. Quality assurance protocols verify data consistency and identify potential biases or gaps in coverage. Continuous monitoring of market developments enables regular updates to research findings and projections.

United States market dominates the North American industrial valves landscape, accounting for approximately 78% of regional demand. Industrial concentration in states such as Texas, Louisiana, and California drives significant valve consumption across petrochemical, refining, and manufacturing sectors. Shale gas development in Pennsylvania, North Dakota, and Texas creates substantial demand for specialized valve applications.

Canadian market contributes approximately 15% of regional volume, with strong demand from oil sands operations, mining, and pulp and paper industries. Energy infrastructure development in Alberta and Saskatchewan drives valve demand for pipeline and processing applications. Manufacturing sector concentration in Ontario and Quebec supports steady demand for industrial valve applications.

Mexican market represents 7% of regional demand with growing importance due to manufacturing expansion and energy sector development. Automotive industry growth creates opportunities for process valve applications in manufacturing facilities. Oil and gas sector modernization drives demand for advanced valve technologies in offshore and onshore applications.

Regional trade patterns show significant cross-border valve movement, particularly between the United States and Canada due to integrated energy infrastructure. USMCA agreement facilitates trade flows and supply chain integration across the region. Manufacturing clusters along the US-Mexico border create opportunities for valve suppliers serving automotive and electronics industries.

Market leadership is distributed among several global valve manufacturers with strong North American operations and regional specialists focusing on specific applications or technologies. Competitive differentiation occurs through technology innovation, service capabilities, and industry expertise rather than price competition alone.

Strategic initiatives among leading companies include technology development partnerships, acquisition of specialized manufacturers, and expansion of service capabilities. Digital transformation investments focus on smart valve technologies and data analytics capabilities to enhance customer value propositions.

By Valve Type: The market segments into multiple categories based on design and functionality. Ball valves maintain the largest market share due to versatility across applications. Gate valves remain important for on-off applications in large-diameter piping systems. Globe valves serve throttling applications requiring precise flow control. Butterfly valves offer cost-effective solutions for large-volume flow control applications.

By Material: Carbon steel valves dominate volume applications in standard operating conditions. Stainless steel valves serve corrosive environments and sanitary applications. Alloy steel valves handle high-temperature and high-pressure conditions. Exotic materials including titanium and Hastelloy serve specialized chemical processing applications.

By Application: Oil and gas represents the largest application segment, encompassing upstream, midstream, and downstream operations. Chemical processing requires specialized valve designs for handling corrosive and hazardous materials. Water treatment applications demand corrosion-resistant valves with long service life. Power generation includes both conventional and renewable energy applications.

By End-User: Process industries including petrochemicals, chemicals, and pharmaceuticals drive significant valve demand. Utilities encompassing water, wastewater, and power generation require reliable valve solutions. Manufacturing sectors including automotive, aerospace, and general manufacturing utilize valves for process control and safety applications.

Control Valves Category: This segment experiences the highest growth rates due to increasing process automation adoption. Smart control valves with integrated diagnostics and communication capabilities command premium pricing. Digital positioners and valve controllers enhance performance and enable predictive maintenance strategies. Application diversity spans from basic flow control to sophisticated process optimization in critical applications.

Safety Valves Category: Regulatory compliance drives consistent demand for pressure relief and safety valve applications. API and ASME certifications are essential for applications in oil and gas, chemical processing, and power generation. Testing and maintenance requirements create ongoing service revenue opportunities for valve manufacturers and service providers.

Industrial Ball Valves Category: Versatility and reliability make ball valves suitable for diverse applications across industries. Floating and trunnion designs serve different pressure and size requirements. Fire-safe designs meet stringent safety requirements in hydrocarbon applications. Automation compatibility enables integration with control systems for remote operation.

Specialty Valves Category: Cryogenic valves serve LNG and industrial gas applications with specialized materials and designs. High-pressure valves handle extreme conditions in oil and gas production and processing. Sanitary valves meet strict hygiene requirements in food, beverage, and pharmaceutical applications. Nuclear valves require extensive qualification and documentation for power generation applications.

Manufacturers benefit from stable demand patterns driven by replacement cycles and industrial growth. Technology differentiation enables premium pricing for advanced valve solutions with enhanced performance characteristics. Service revenue opportunities through maintenance, repair, and upgrade services provide recurring income streams and strengthen customer relationships.

Distributors leverage established customer relationships and technical expertise to provide value-added services beyond product sales. Inventory management capabilities enable rapid response to customer needs while optimizing working capital requirements. Technical support services enhance customer satisfaction and create competitive differentiation in commodity valve segments.

End Users gain access to advanced valve technologies that improve operational efficiency, reduce maintenance costs, and enhance safety performance. Total cost of ownership optimization through proper valve selection and maintenance practices delivers significant economic benefits. Regulatory compliance support from valve suppliers reduces risk and ensures operational continuity.

System Integrators benefit from comprehensive valve portfolios that enable complete automation solutions for industrial customers. Technical partnerships with valve manufacturers provide access to specialized expertise and support capabilities. Project opportunities in industrial modernization and expansion create demand for integrated valve and control solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Valve Integration represents the most significant trend transforming the industrial valves market. IoT connectivity enables real-time monitoring of valve performance, position, and health status. Predictive analytics capabilities help identify potential failures before they occur, reducing unplanned downtime and maintenance costs. Remote diagnostics allow technicians to troubleshoot valve issues without physical site visits.

Sustainability Focus drives demand for valves that minimize environmental impact through improved sealing technologies and materials selection. Fugitive emissions reduction becomes increasingly important as environmental regulations tighten. Energy efficiency considerations influence valve design to minimize pressure drops and optimize system performance. Recyclable materials gain importance in valve construction to support circular economy initiatives.

Automation Expansion continues across industrial applications as companies seek to improve operational efficiency and reduce labor costs. Actuated valves with electric, pneumatic, or hydraulic operation replace manual valves in many applications. Integration capabilities with distributed control systems enable centralized monitoring and control of valve operations. Safety systems incorporate automated valve shutdown capabilities for emergency response.

Customization Demand increases as industrial processes become more specialized and optimized. Application-specific designs address unique operating conditions and performance requirements. Materials engineering develops specialized alloys and coatings for extreme service conditions. Modular designs enable rapid customization while maintaining cost efficiency through standardized components.

Technology Partnerships between valve manufacturers and software companies accelerate development of smart valve solutions. Collaborative innovation programs focus on integrating artificial intelligence and machine learning capabilities into valve monitoring and control systems. Open standards adoption enables interoperability between different manufacturers’ valve systems and plant control infrastructure.

Manufacturing Modernization initiatives across the industry focus on implementing advanced production technologies including additive manufacturing, robotics, and digital quality systems. 3D printing applications enable rapid prototyping and production of complex valve components. Automated assembly systems improve consistency and reduce labor requirements in valve manufacturing operations.

Acquisition Activity continues as companies seek to expand product portfolios, geographic reach, and technological capabilities. Strategic consolidation enables companies to achieve economies of scale and enhance competitive positioning. Technology acquisitions focus on digital capabilities, specialized materials, and niche application expertise.

Regulatory Developments drive product innovation and market evolution as safety and environmental standards become more stringent. Emissions regulations require advanced sealing technologies and leak detection capabilities. Safety standards mandate enhanced testing and certification requirements for critical applications. Cybersecurity requirements for connected valve systems create new compliance obligations and market opportunities.

MarkWide Research recommends that valve manufacturers prioritize digital transformation initiatives to remain competitive in evolving market conditions. Investment priorities should focus on IoT integration, data analytics capabilities, and service platform development. Partnership strategies with technology companies can accelerate digital capability development while reducing internal investment requirements.

Market positioning strategies should emphasize total cost of ownership benefits rather than initial purchase price advantages. Value proposition development must clearly articulate efficiency improvements, maintenance cost reductions, and reliability enhancements. Customer education programs help industrial buyers understand the economic benefits of advanced valve technologies.

Geographic expansion opportunities exist in emerging markets where industrial development creates demand for advanced valve solutions. Export strategies should leverage North American technology advantages while addressing local market requirements and preferences. Local partnerships can provide market access and reduce entry barriers in international markets.

Talent development initiatives are essential to address skilled labor shortages and support business growth. Training programs should focus on digital technologies, advanced materials, and specialized applications. University partnerships can help develop future workforce capabilities while supporting research and development activities.

Market evolution toward smart, connected valve systems will accelerate over the next decade as industrial digitalization initiatives mature. Growth projections indicate continued expansion at a CAGR of 4.2% through 2030, driven by infrastructure modernization and technology adoption. Digital services are expected to represent an increasing share of total valve industry revenue as manufacturers develop new business models.

Technology convergence between valve hardware and software capabilities will create new competitive dynamics and market opportunities. Artificial intelligence integration will enable autonomous valve operation and optimization in complex industrial processes. Blockchain applications may emerge for valve certification, maintenance tracking, and supply chain transparency.

Sustainability requirements will increasingly influence valve design, materials selection, and manufacturing processes. Circular economy principles will drive development of recyclable and repairable valve designs. Carbon footprint reduction initiatives will affect both valve manufacturing and application optimization strategies.

Market consolidation is expected to continue as companies seek scale advantages and technological capabilities. MWR analysis suggests that successful companies will combine manufacturing excellence with digital service capabilities. Regional specialization may emerge as companies focus on specific applications or geographic markets where they can achieve competitive advantages.

The North America industrial valves market stands at a critical juncture where traditional manufacturing excellence must integrate with digital technologies to meet evolving customer needs. Market fundamentals remain strong, supported by industrial infrastructure requirements, regulatory compliance needs, and ongoing modernization initiatives across key end-user sectors.

Competitive success will increasingly depend on companies’ ability to deliver integrated solutions combining advanced valve hardware with digital services and analytics capabilities. Technology differentiation through smart valve features, predictive maintenance capabilities, and process optimization services will become essential for maintaining premium market positioning and customer loyalty.

Growth opportunities in renewable energy, water infrastructure, and industrial automation provide pathways for market expansion beyond traditional applications. Service revenue development through digital platforms and outcome-based contracts offers potential for higher margins and more stable revenue streams compared to traditional product sales models.

The future market landscape will reward companies that successfully navigate the transition from traditional valve manufacturing toward comprehensive flow control solutions incorporating hardware, software, and services. Strategic investments in digital capabilities, talent development, and customer relationship management will determine long-term competitive positioning in this evolving industrial valves market.

What is Industrial Valves?

Industrial valves are mechanical devices used to control the flow of fluids in various applications, including water supply, oil and gas, and chemical processing. They play a crucial role in regulating pressure, flow rate, and direction of fluids.

What are the key players in the NA Industrial Valves Market?

Key players in the NA Industrial Valves Market include companies like Emerson Electric Co., Flowserve Corporation, and Valmet Corporation. These companies are known for their innovative valve solutions and extensive product portfolios, among others.

What are the growth factors driving the NA Industrial Valves Market?

The growth of the NA Industrial Valves Market is driven by increasing demand for automation in industries, the expansion of the oil and gas sector, and the need for efficient water management systems. Additionally, the rise in infrastructure development projects contributes to market growth.

What challenges does the NA Industrial Valves Market face?

The NA Industrial Valves Market faces challenges such as fluctuating raw material prices, stringent regulatory requirements, and the need for regular maintenance and upgrades. These factors can impact production costs and operational efficiency.

What opportunities exist in the NA Industrial Valves Market?

Opportunities in the NA Industrial Valves Market include the growing focus on sustainable and energy-efficient solutions, advancements in smart valve technologies, and the increasing adoption of industrial automation. These trends are expected to create new avenues for growth.

What trends are shaping the NA Industrial Valves Market?

Trends shaping the NA Industrial Valves Market include the integration of IoT technologies for predictive maintenance, the development of eco-friendly materials, and the rise of digital twin technology. These innovations are enhancing operational efficiency and reducing environmental impact.

NA Industrial Valves Market

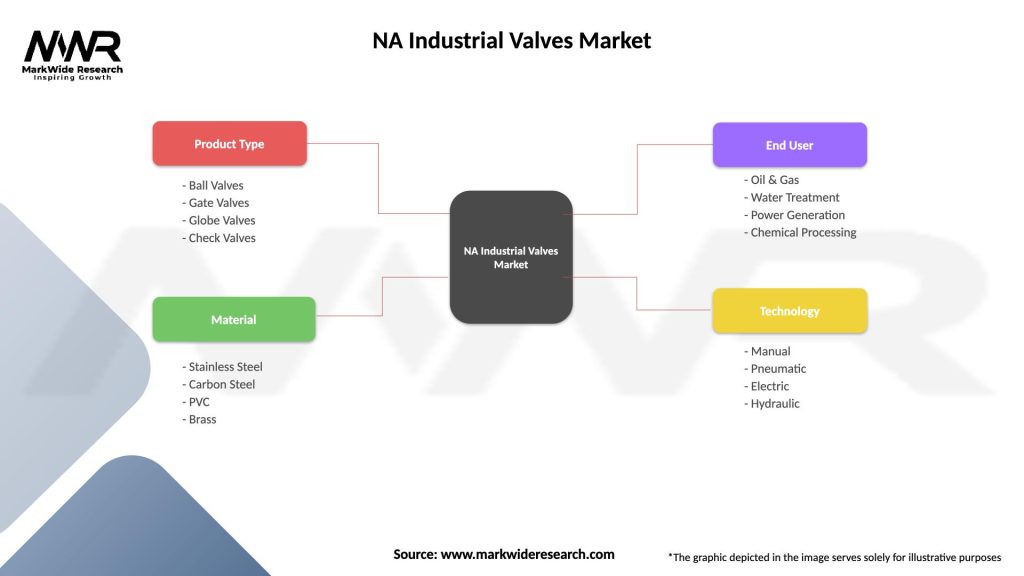

| Segmentation Details | Description |

|---|---|

| Product Type | Ball Valves, Gate Valves, Globe Valves, Check Valves |

| Material | Stainless Steel, Carbon Steel, PVC, Brass |

| End User | Oil & Gas, Water Treatment, Power Generation, Chemical Processing |

| Technology | Manual, Pneumatic, Electric, Hydraulic |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Industrial Valves Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at