444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America in-store analytics market represents a transformative segment within the retail technology ecosystem, fundamentally reshaping how retailers understand and optimize customer behavior patterns. This sophisticated market encompasses advanced technologies including computer vision, artificial intelligence, IoT sensors, and machine learning algorithms that collectively provide unprecedented insights into shopper journeys, product performance, and operational efficiency metrics.

Market dynamics indicate robust expansion driven by retailers’ increasing demand for data-driven decision making capabilities. The integration of in-store analytics solutions has become essential for competitive differentiation, with adoption rates reaching 68% among major retail chains across North America. These technologies enable retailers to bridge the gap between online and offline customer experiences while maximizing revenue potential through optimized store layouts, inventory management, and personalized customer engagement strategies.

Technological advancement continues to accelerate market growth, with emerging solutions offering real-time analytics capabilities that transform raw data into actionable business intelligence. The market encompasses various analytical approaches including heat mapping, customer flow analysis, dwell time measurement, conversion rate optimization, and demographic profiling, all contributing to enhanced retail performance metrics.

The in-store analytics market refers to the comprehensive ecosystem of technologies, software platforms, and services designed to collect, process, and analyze customer behavior data within physical retail environments. This market encompasses solutions that transform traditional brick-and-mortar stores into intelligent, data-driven spaces capable of understanding customer preferences, optimizing operational efficiency, and enhancing overall shopping experiences through advanced analytical insights.

Core components of in-store analytics include sensor networks, video analytics systems, mobile tracking technologies, point-of-sale integration platforms, and cloud-based analytical engines. These interconnected systems work collaboratively to provide retailers with granular insights into customer movement patterns, product interaction rates, queue management effectiveness, and staff productivity metrics, ultimately enabling evidence-based strategic decision making.

Strategic market positioning reveals the North America in-store analytics market as a critical enabler of retail digital transformation initiatives. The market demonstrates exceptional growth momentum, with projected CAGR of 22.4% reflecting increasing retailer investment in advanced analytical capabilities. This expansion is primarily driven by the urgent need for retailers to compete effectively against e-commerce platforms while maximizing the unique advantages of physical store environments.

Technology adoption patterns show significant penetration across multiple retail segments, with grocery chains, department stores, and specialty retailers leading implementation efforts. The market benefits from declining hardware costs, improved analytical accuracy, and enhanced integration capabilities that make sophisticated analytics accessible to retailers of varying sizes and operational complexity levels.

Competitive landscape dynamics feature established technology providers alongside innovative startups, creating a diverse ecosystem of solution offerings. Market leaders focus on comprehensive platform approaches while specialized vendors target specific analytical niches, resulting in a rich marketplace of complementary and competitive solutions that drive continuous innovation and feature enhancement.

Primary market drivers encompass several interconnected factors that collectively fuel sustained growth and adoption across North American retail markets:

Technology evolution trends demonstrate rapid advancement in analytical accuracy and implementation simplicity, with AI-powered solutions achieving 94% accuracy rates in customer behavior prediction models. These improvements significantly enhance the value proposition for retailers considering analytical solution investments.

Digital transformation imperatives represent the most significant driver propelling in-store analytics adoption across North American retail markets. Retailers face unprecedented pressure to modernize operations while maintaining competitive advantages inherent in physical store environments. This transformation requires sophisticated analytical capabilities that provide actionable insights into customer behavior patterns, operational inefficiencies, and revenue optimization opportunities.

Consumer behavior evolution continues driving analytical solution demand as modern shoppers expect personalized, efficient, and engaging retail experiences. Research indicates that 78% of consumers prefer retailers who demonstrate understanding of their individual preferences and shopping patterns. In-store analytics enables this level of personalization through real-time behavioral analysis and predictive modeling capabilities.

Operational cost pressures compel retailers to maximize efficiency across all business functions, from staff scheduling to inventory management. Advanced analytics solutions provide granular insights that enable 15-25% improvements in operational efficiency metrics while reducing unnecessary overhead expenses through optimized resource allocation strategies.

Competitive landscape intensification requires retailers to differentiate through superior customer experiences and operational excellence. In-store analytics provides the intelligence necessary to understand customer preferences, optimize store layouts, and create compelling shopping environments that encourage longer visits and increased purchase volumes.

Implementation complexity challenges present significant barriers for retailers considering in-store analytics adoption. Many solutions require substantial technical expertise, extensive system integration efforts, and comprehensive staff training programs that can overwhelm organizations with limited IT resources or change management capabilities.

Privacy and regulatory concerns increasingly impact market growth as consumers become more aware of data collection practices and regulatory frameworks evolve to protect individual privacy rights. Retailers must navigate complex compliance requirements while ensuring customer trust and maintaining analytical effectiveness, creating operational challenges that can delay or complicate implementation efforts.

High initial investment requirements can deter smaller retailers from adopting comprehensive analytical solutions. While technology costs continue declining, the total cost of ownership including hardware, software, integration services, and ongoing maintenance can represent substantial capital commitments that require careful ROI justification and budget allocation planning.

Data quality and integration issues frequently complicate analytical accuracy and effectiveness. Many retailers struggle with fragmented data sources, inconsistent data formats, and legacy system limitations that prevent seamless integration and comprehensive analytical insights, reducing the overall value proposition of analytical investments.

Emerging technology integration presents substantial opportunities for market expansion and solution enhancement. The convergence of artificial intelligence, machine learning, computer vision, and IoT technologies creates possibilities for increasingly sophisticated analytical capabilities that provide deeper insights and more accurate predictive modeling capabilities.

Small and medium retailer adoption represents a significant untapped market segment with substantial growth potential. As solution costs decline and implementation complexity reduces, smaller retailers gain access to analytical capabilities previously available only to large enterprises, expanding the total addressable market considerably.

Vertical market specialization offers opportunities for solution providers to develop industry-specific analytical platforms that address unique requirements of different retail segments. Specialized solutions for grocery stores, fashion retailers, electronics stores, and other vertical markets can command premium pricing while delivering superior value through targeted functionality.

International expansion potential provides growth opportunities as North American solution providers leverage proven technologies and methodologies in emerging global markets. The success of in-store analytics in North America creates a foundation for international market penetration and revenue diversification strategies.

Technology convergence trends fundamentally reshape market dynamics as previously separate analytical capabilities integrate into comprehensive platforms. This convergence enables retailers to access holistic insights that span customer behavior, operational performance, and business intelligence through unified analytical interfaces, significantly enhancing the strategic value of analytical investments.

Vendor ecosystem evolution demonstrates increasing collaboration between technology providers, system integrators, and retail consultants to deliver complete analytical solutions. These partnerships enable more effective implementation processes, reduced time-to-value metrics, and enhanced ongoing support capabilities that improve customer satisfaction and retention rates.

Customer expectation shifts continue influencing market development as consumers increasingly expect personalized, efficient, and engaging retail experiences. According to MarkWide Research analysis, retailers implementing comprehensive in-store analytics report customer satisfaction improvements of 32% on average, demonstrating the direct correlation between analytical capabilities and customer experience quality.

Regulatory landscape changes impact market dynamics through evolving privacy requirements and data protection standards. These changes necessitate solution adaptations that maintain analytical effectiveness while ensuring compliance with emerging regulatory frameworks, creating both challenges and opportunities for solution providers and retailers alike.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into North American in-store analytics market dynamics. Primary research activities included extensive interviews with retail executives, technology vendors, system integrators, and industry analysts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompassed detailed analysis of industry reports, financial statements, regulatory filings, and technology documentation from leading market participants. This research provided quantitative data on market size, growth rates, competitive positioning, and technology adoption patterns across different retail segments and geographic regions.

Data validation processes included cross-referencing multiple information sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to ensure data accuracy and reliability. Market projections incorporate conservative assumptions and account for potential economic fluctuations and technology adoption variations.

Industry expert consultations provided additional validation and insights into emerging trends, competitive dynamics, and future market development scenarios. These consultations helped refine market projections and identify key factors that will influence market evolution over the forecast period.

United States market dominance reflects the country’s position as the largest and most mature in-store analytics market within North America, accounting for approximately 82% of regional market share. This dominance stems from the presence of major retail chains, advanced technology infrastructure, and high consumer acceptance of data-driven retail experiences. Major metropolitan areas including New York, Los Angeles, Chicago, and Atlanta serve as primary adoption centers with extensive implementation across various retail formats.

Canadian market development demonstrates steady growth with increasing adoption among major retail chains and specialty stores. The Canadian market benefits from proximity to U.S. technology providers and similar consumer behavior patterns, though adoption rates remain approximately 18 months behind comparable U.S. market segments. Key growth drivers include government initiatives supporting retail digitization and increasing consumer expectations for enhanced shopping experiences.

Regional technology hubs in Silicon Valley, Seattle, Toronto, and Boston drive innovation and solution development within the North American market. These centers house leading technology companies, research institutions, and venture capital firms that collectively advance in-store analytics capabilities through continued investment in artificial intelligence, machine learning, and sensor technologies.

Cross-border collaboration between U.S. and Canadian companies facilitates technology transfer and market development initiatives. Many solution providers maintain operations in both countries to serve multinational retail clients and leverage regional expertise in different market segments and regulatory environments.

Market leadership structure features a diverse ecosystem of established technology companies, specialized analytics providers, and emerging startups that collectively drive innovation and market growth. The competitive landscape demonstrates healthy competition across different solution categories and price points, ensuring continued innovation and customer choice.

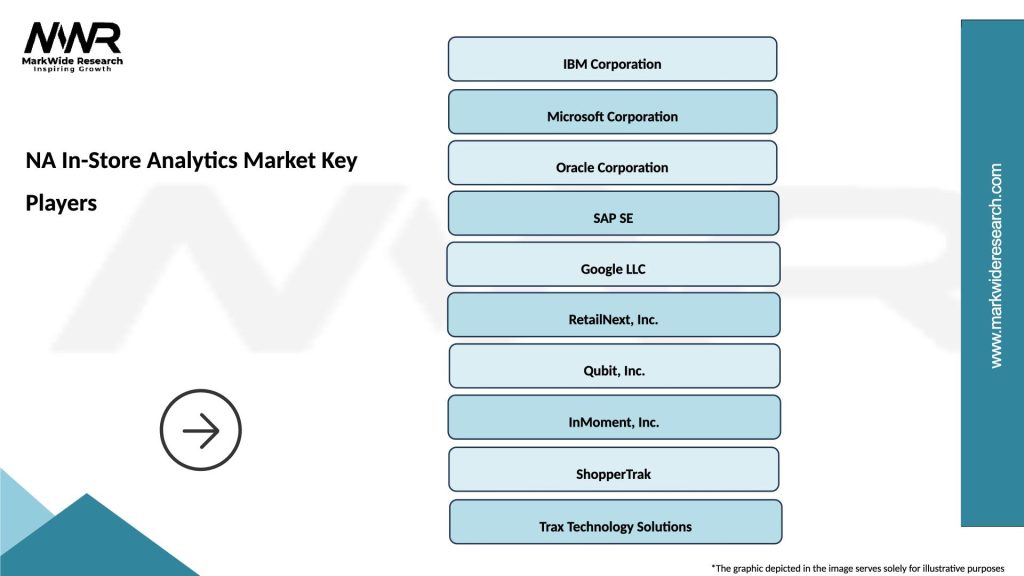

Leading market participants include:

Competitive differentiation strategies focus on solution comprehensiveness, implementation simplicity, analytical accuracy, and integration capabilities. Leading providers invest heavily in artificial intelligence and machine learning technologies to enhance predictive capabilities and automate insight generation processes.

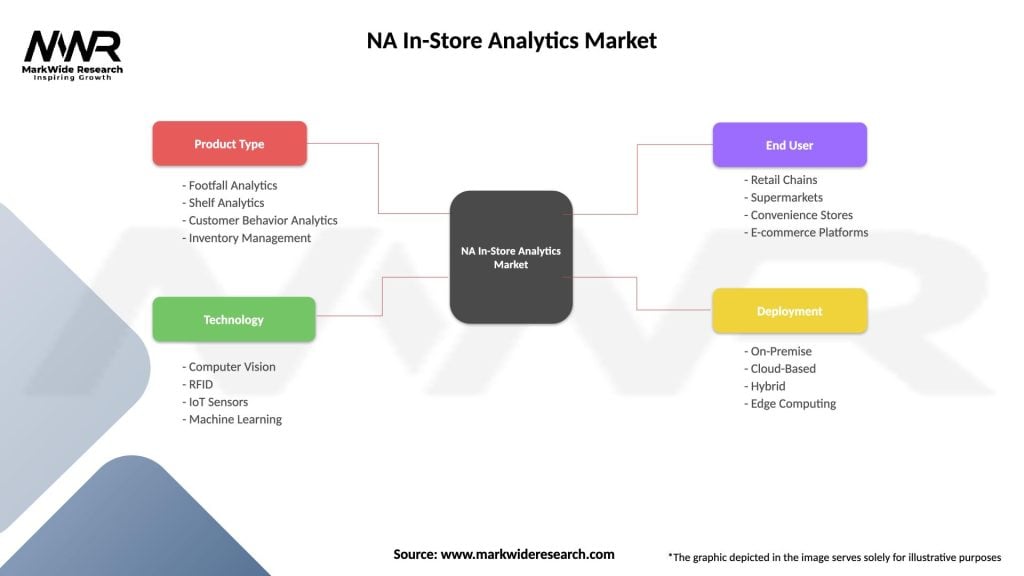

Technology-based segmentation reveals distinct market categories based on analytical approaches and implementation methodologies:

Application-based segmentation demonstrates diverse use cases across retail operations:

Retail format segmentation shows varying adoption patterns across different store types, with department stores leading adoption at 45% implementation rates, followed by grocery chains and specialty retailers demonstrating strong growth in analytical solution deployment.

Grocery retail segment demonstrates exceptional growth in analytics adoption driven by thin profit margins and intense competition. Grocery chains leverage in-store analytics to optimize product placement, reduce waste through demand forecasting, and improve customer flow during peak shopping periods. Advanced analytics enable inventory optimization improvements of 18% while reducing operational costs through efficient staff allocation and energy management.

Fashion retail category utilizes analytics primarily for understanding customer preferences, optimizing seasonal merchandise placement, and improving fitting room utilization. Fashion retailers benefit from demographic analysis capabilities that inform inventory decisions and marketing strategies, resulting in improved sell-through rates and reduced markdown requirements.

Electronics retail segment focuses on product demonstration optimization, customer education effectiveness, and high-value item security monitoring. Electronics retailers use analytics to understand customer research behavior, optimize product display configurations, and improve sales associate effectiveness through data-driven insights into customer needs and preferences.

Department store applications encompass comprehensive customer journey analysis across multiple departments, cross-selling optimization, and seasonal traffic pattern analysis. These large-format retailers benefit from analytics that provide insights into interdepartmental customer flow and enable coordinated marketing strategies that maximize customer lifetime value.

Retailer advantages encompass multiple operational and strategic benefits that justify analytical solution investments:

Technology provider benefits include expanding market opportunities, recurring revenue streams, and opportunities for solution enhancement through customer feedback and usage data. The growing market provides sustainable growth opportunities for established providers while creating entry points for innovative startups with specialized capabilities.

Consumer advantages result from improved shopping experiences, reduced wait times, better product availability, and more personalized service offerings. MarkWide Research data indicates that consumers shopping in analytics-enabled stores report satisfaction improvements of 28% compared to traditional retail environments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping in-store analytics capabilities. Advanced AI algorithms enable real-time behavioral analysis, predictive modeling, and automated insight generation that significantly enhance analytical accuracy and reduce manual analysis requirements. Machine learning capabilities continuously improve analytical precision through pattern recognition and behavioral prediction algorithms.

Edge computing adoption addresses privacy concerns and latency issues by processing analytical data locally rather than transmitting sensitive information to cloud platforms. This trend enables real-time analytics while maintaining customer privacy and reducing bandwidth requirements, making advanced analytics accessible to retailers with limited network infrastructure.

Omnichannel integration connects in-store analytics with online customer data to provide comprehensive customer journey insights. This integration enables retailers to understand customer behavior across all touchpoints and create seamless experiences that leverage the unique advantages of both digital and physical retail channels.

Sustainability analytics emerge as retailers focus on environmental responsibility and operational efficiency. Advanced analytics help optimize energy consumption, reduce waste, and improve resource utilization while maintaining superior customer experiences and operational effectiveness.

Contactless analytics solutions gain prominence as retailers seek to understand customer behavior while respecting privacy preferences and social distancing requirements. These solutions provide valuable insights without requiring direct customer interaction or personal data collection.

Strategic partnerships between technology providers and major retailers accelerate solution development and market adoption. These collaborations enable co-development of specialized analytical capabilities while providing technology companies with real-world testing environments and direct customer feedback for solution enhancement.

Acquisition activities consolidate market capabilities as larger technology companies acquire specialized analytics providers to expand their solution portfolios. Recent acquisitions focus on artificial intelligence capabilities, computer vision technologies, and vertical market expertise that enhance comprehensive platform offerings.

Investment increases in research and development reflect the strategic importance of analytical capabilities for long-term competitive positioning. Major technology companies allocate substantial resources to advancing machine learning algorithms, sensor technologies, and integration platforms that drive next-generation analytical solutions.

Regulatory compliance initiatives address evolving privacy requirements through enhanced data protection capabilities, consent management systems, and anonymization technologies. These developments ensure analytical solutions remain viable while meeting increasingly stringent regulatory requirements and consumer privacy expectations.

Industry standardization efforts promote interoperability and reduce implementation complexity through common data formats, integration protocols, and analytical methodologies. These standards facilitate solution adoption while enabling retailers to avoid vendor lock-in situations and maintain flexibility in technology choices.

Implementation strategy recommendations emphasize phased deployment approaches that minimize risk while demonstrating value through measurable results. Retailers should begin with specific use cases that provide clear ROI metrics before expanding to comprehensive analytical platforms, ensuring stakeholder buy-in and operational success.

Technology selection criteria should prioritize integration capabilities, scalability, and vendor stability over feature richness or lowest initial cost. Successful implementations require solutions that integrate seamlessly with existing systems while providing growth capacity for future analytical requirements and business expansion.

Privacy compliance strategies must address current and anticipated regulatory requirements through proactive data protection measures, transparent customer communication, and robust consent management systems. Retailers should view privacy compliance as a competitive advantage rather than merely a regulatory requirement.

Vendor partnership approaches should emphasize long-term relationships with providers who demonstrate commitment to ongoing innovation, customer support, and solution evolution. Successful analytical implementations require sustained vendor engagement throughout deployment and operational phases.

Staff development investments in analytical skills and change management capabilities are essential for maximizing solution value and ensuring successful adoption. Organizations should allocate resources for training programs, skill development initiatives, and change management support to optimize analytical solution effectiveness.

Market evolution projections indicate continued robust growth driven by advancing technology capabilities, declining implementation costs, and increasing retailer recognition of analytical value. MWR analysis suggests the market will experience sustained expansion with compound annual growth rates exceeding 20% through the forecast period, reflecting strong underlying demand and technology advancement momentum.

Technology advancement trajectories point toward increasingly sophisticated analytical capabilities incorporating artificial intelligence, machine learning, and advanced sensor technologies. Future solutions will provide more accurate insights, automated recommendation systems, and predictive capabilities that enable proactive rather than reactive retail management strategies.

Market democratization trends will make advanced analytical capabilities accessible to smaller retailers through cloud-based solutions, simplified implementation processes, and flexible pricing models. This democratization will significantly expand the total addressable market while driving innovation through diverse use case development and feedback.

Integration evolution will create comprehensive retail intelligence platforms that combine in-store analytics with supply chain management, customer relationship management, and financial planning systems. These integrated platforms will provide holistic business intelligence that enables strategic decision making across all retail operations.

Global expansion opportunities will leverage North American market success to drive international growth, with particular opportunities in European and Asia-Pacific markets where retail digitization initiatives create demand for proven analytical solutions and methodologies.

Market maturation of the North America in-store analytics market reflects the successful transition from experimental technology to essential retail infrastructure. The market demonstrates strong fundamentals with robust growth projections, diverse solution offerings, and proven value propositions that justify continued investment and adoption across retail segments.

Strategic importance of in-store analytics continues increasing as retailers recognize the competitive advantages provided by data-driven decision making capabilities. The technology enables retailers to optimize operations, enhance customer experiences, and maintain competitive positioning in an increasingly challenging retail environment.

Future success factors will include continued technology innovation, effective privacy management, simplified implementation processes, and demonstrated return on investment metrics. Retailers and technology providers who successfully address these factors will benefit from sustained market growth and competitive advantages in the evolving retail landscape.

The North America in-store analytics market represents a fundamental shift toward intelligent retail operations that leverage advanced technology to create superior customer experiences while optimizing business performance. As technology capabilities continue advancing and implementation barriers continue declining, the market is positioned for sustained growth and continued innovation that will reshape retail operations across North America and beyond.

What is In-Store Analytics?

In-Store Analytics refers to the collection and analysis of data related to customer behavior and interactions within a retail environment. This includes tracking foot traffic, dwell time, and purchase patterns to enhance the shopping experience and optimize store layouts.

What are the key players in the NA In-Store Analytics Market?

Key players in the NA In-Store Analytics Market include companies like RetailNext, FootfallCam, and ShopperTrak, which provide solutions for data collection and analysis in retail settings. These companies focus on improving customer insights and operational efficiency, among others.

What are the main drivers of growth in the NA In-Store Analytics Market?

The main drivers of growth in the NA In-Store Analytics Market include the increasing demand for personalized shopping experiences, advancements in data analytics technologies, and the need for retailers to optimize inventory management and store layouts.

What challenges does the NA In-Store Analytics Market face?

Challenges in the NA In-Store Analytics Market include data privacy concerns, the integration of analytics solutions with existing retail systems, and the need for skilled personnel to interpret complex data sets effectively.

What opportunities exist in the NA In-Store Analytics Market?

Opportunities in the NA In-Store Analytics Market include the potential for integrating artificial intelligence and machine learning to enhance data analysis, as well as expanding applications in various retail sectors such as grocery, fashion, and electronics.

What trends are shaping the NA In-Store Analytics Market?

Trends shaping the NA In-Store Analytics Market include the growing use of mobile analytics, the rise of omnichannel retailing, and the increasing focus on customer experience management through real-time data insights.

NA In-Store Analytics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Footfall Analytics, Shelf Analytics, Customer Behavior Analytics, Inventory Management |

| Technology | Computer Vision, RFID, IoT Sensors, Machine Learning |

| End User | Retail Chains, Supermarkets, Convenience Stores, E-commerce Platforms |

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA In-Store Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at