444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America hazardous waste handling automation market represents a rapidly evolving sector driven by stringent environmental regulations, workplace safety concerns, and technological advancements in robotic systems. Hazardous waste handling automation encompasses sophisticated technologies including robotic arms, automated sorting systems, remote-controlled equipment, and AI-powered monitoring solutions designed to minimize human exposure to dangerous materials while improving operational efficiency.

Market dynamics indicate substantial growth potential across the region, with increasing adoption rates in industries such as chemical manufacturing, pharmaceuticals, nuclear facilities, and healthcare institutions. The integration of advanced automation technologies has transformed traditional waste management practices, enabling organizations to achieve enhanced safety protocols while maintaining regulatory compliance.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 18% market presence, and Mexico contributing the remaining 4% regional participation. This distribution reflects varying regulatory frameworks, industrial development levels, and technology adoption rates across North American countries.

Technology penetration continues expanding as organizations recognize the critical importance of automated solutions in managing hazardous materials. The market demonstrates robust growth trajectory with increasing investments in research and development, strategic partnerships between technology providers and end-users, and growing awareness of automation benefits in hazardous waste management operations.

The hazardous waste handling automation market refers to the comprehensive ecosystem of automated technologies, robotic systems, and intelligent solutions designed to safely collect, sort, transport, and process dangerous waste materials without direct human intervention. This market encompasses various technological components including robotic manipulators, automated guided vehicles, remote monitoring systems, and AI-powered classification tools that work together to create safer, more efficient waste management operations.

Automation technologies in this context include sophisticated sensors for material identification, robotic systems for physical handling, automated containment solutions, and integrated software platforms for process optimization. These systems are specifically engineered to handle materials classified as hazardous under regulatory frameworks such as RCRA, OSHA standards, and EPA guidelines.

Key applications span across multiple industries where hazardous waste generation is inevitable, including chemical processing facilities, pharmaceutical manufacturing plants, research laboratories, healthcare institutions, nuclear power facilities, and industrial manufacturing operations. The automation solutions provide critical safety barriers between human workers and potentially dangerous materials while maintaining operational efficiency and regulatory compliance.

North America’s hazardous waste handling automation market demonstrates exceptional growth momentum driven by increasing regulatory pressures, technological innovations, and heightened safety awareness across industrial sectors. The market benefits from substantial investments in automation infrastructure, with organizations prioritizing worker safety and environmental protection through advanced technological solutions.

Key market drivers include stringent environmental regulations, rising labor costs, increasing focus on workplace safety, and technological advancements in robotics and artificial intelligence. These factors collectively contribute to accelerated adoption rates, with the market experiencing consistent annual growth as more organizations recognize the strategic value of automated hazardous waste management systems.

Technology segments show varying adoption patterns, with robotic handling systems leading market penetration, followed by automated sorting and classification technologies, remote monitoring solutions, and integrated management platforms. The convergence of these technologies creates comprehensive automation ecosystems that address multiple aspects of hazardous waste handling operations.

Regional analysis reveals strong market concentration in industrial corridors across the United States, with significant growth opportunities emerging in Canadian manufacturing regions and Mexican industrial zones. The market landscape features established technology providers, emerging innovators, and specialized solution developers competing to capture market share through technological differentiation and customer-focused service offerings.

Strategic market insights reveal several critical trends shaping the North American hazardous waste handling automation landscape:

Emerging opportunities include expansion into smaller industrial facilities, development of industry-specific solutions, and integration of advanced technologies such as machine learning and computer vision for enhanced material identification and processing capabilities.

Regulatory enforcement serves as the primary market driver, with agencies implementing stricter guidelines for hazardous waste management across North America. Organizations face increasing penalties for non-compliance, making automated solutions essential for maintaining regulatory adherence while protecting worker safety and environmental integrity.

Workplace safety concerns drive significant adoption as organizations prioritize employee protection through advanced automation technologies. The implementation of automated systems reduces direct human contact with dangerous materials, minimizing exposure risks and potential health complications associated with hazardous waste handling operations.

Labor shortage challenges in specialized waste management roles accelerate automation adoption as organizations struggle to find qualified personnel willing to work with hazardous materials. Automated systems address staffing constraints while maintaining operational continuity and safety standards.

Technological advancement in robotics, artificial intelligence, and sensor technologies enables more sophisticated and cost-effective automation solutions. These improvements make automation accessible to smaller organizations while enhancing capabilities for large-scale industrial operations.

Insurance and liability considerations motivate organizations to implement automated systems as risk mitigation strategies. Insurance providers increasingly offer premium reductions for facilities utilizing advanced safety technologies, creating financial incentives for automation adoption.

Operational efficiency demands push organizations toward automation solutions that improve processing speed, accuracy, and consistency in hazardous waste management operations. Automated systems enable 24/7 operations while maintaining consistent performance standards regardless of external factors.

High initial investment requirements represent the most significant market restraint, as comprehensive automation systems demand substantial capital expenditures for equipment procurement, installation, and integration. Many organizations, particularly smaller facilities, struggle to justify the upfront costs despite long-term operational benefits.

Technical complexity challenges organizations lacking specialized expertise in automation technologies. The integration of sophisticated robotic systems, AI-powered analytics, and automated monitoring solutions requires skilled personnel for implementation, maintenance, and optimization, creating barriers for organizations with limited technical resources.

Regulatory uncertainty in emerging technology applications creates hesitation among potential adopters. Organizations remain cautious about investing in automation solutions that may face future regulatory restrictions or require significant modifications to maintain compliance with evolving standards.

Integration difficulties with existing infrastructure and legacy systems pose significant challenges for organizations seeking to implement automation solutions. Compatibility issues, system integration costs, and operational disruption during implementation periods deter some organizations from pursuing automation initiatives.

Maintenance and support requirements for sophisticated automation systems create ongoing operational concerns. Organizations worry about system downtime, repair costs, and the availability of qualified service technicians, particularly in remote or specialized industrial locations.

Technology limitations in handling certain types of hazardous materials or complex waste streams restrict automation applicability in some scenarios. Current technology capabilities may not address all hazardous waste handling requirements, limiting market penetration in specialized applications.

Emerging market segments present substantial growth opportunities as automation technologies become more accessible and cost-effective. Small and medium-sized enterprises increasingly recognize the value proposition of automated hazardous waste handling solutions, creating new market opportunities for technology providers.

Technology advancement opportunities include development of specialized solutions for specific industry applications, integration of advanced AI capabilities for improved material identification, and creation of modular systems that enable phased implementation approaches for budget-conscious organizations.

Geographic expansion potential exists in underserved regions across North America, particularly in emerging industrial areas where hazardous waste generation is increasing but automation adoption remains limited. These markets offer significant growth potential for established technology providers.

Service-based business models create opportunities for companies to offer automation-as-a-service solutions, reducing upfront investment barriers while providing ongoing revenue streams. These models appeal to organizations seeking automation benefits without substantial capital commitments.

Partnership opportunities with waste management companies, environmental consulting firms, and industrial equipment providers enable technology companies to expand market reach and develop comprehensive solution offerings that address broader customer needs.

Regulatory compliance services represent growing opportunities as organizations seek integrated solutions that combine automation technology with regulatory expertise, ensuring compliance while optimizing operational performance through advanced technological capabilities.

Supply chain dynamics in the hazardous waste handling automation market reflect complex interactions between technology providers, system integrators, end-users, and regulatory bodies. The market demonstrates increasing consolidation as larger companies acquire specialized technology providers to create comprehensive solution portfolios.

Competitive dynamics intensify as established industrial automation companies enter the hazardous waste handling segment, bringing substantial resources and established customer relationships. This competition drives innovation while potentially pressuring pricing structures across the market.

Technology evolution continues reshaping market dynamics as artificial intelligence, machine learning, and advanced sensor technologies enable more sophisticated automation capabilities. Organizations increasingly demand integrated solutions that combine multiple technologies into comprehensive waste management systems.

Customer behavior patterns show growing preference for proven, reliable automation solutions with strong service support networks. Organizations prioritize vendors with demonstrated expertise in hazardous materials handling and comprehensive post-installation support capabilities.

Investment patterns indicate increasing venture capital and private equity interest in automation technology companies, particularly those focused on environmental and safety applications. This financial support accelerates technology development and market expansion initiatives.

Regulatory influence continues shaping market dynamics as government agencies develop new standards for automated hazardous waste handling systems. These regulations create both opportunities and challenges for technology providers seeking to maintain compliance while advancing innovation.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the North American hazardous waste handling automation market. The research approach combined primary data collection, secondary research analysis, and expert consultation to develop a complete market understanding.

Primary research activities included structured interviews with industry executives, technology providers, end-users, and regulatory experts across the North American region. These interviews provided firsthand insights into market trends, challenges, opportunities, and competitive dynamics affecting the hazardous waste handling automation sector.

Secondary research analysis encompassed review of industry reports, regulatory documents, company financial statements, patent filings, and academic research publications related to hazardous waste management and automation technologies. This analysis provided historical context and trend identification for market development patterns.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews for clarification, and utilizing statistical analysis techniques to ensure data accuracy and reliability. The validation process helped eliminate inconsistencies and confirm market insights.

Market modeling techniques incorporated quantitative analysis methods to project market trends, assess growth potential, and evaluate competitive positioning. These models considered various factors including regulatory changes, technology advancement rates, and economic conditions affecting market development.

Expert consultation involved discussions with industry specialists, regulatory officials, and technology researchers to validate findings and gain additional perspectives on market dynamics and future development potential in the hazardous waste handling automation sector.

United States market dominates the North American hazardous waste handling automation landscape, accounting for approximately 78% regional market share. The country benefits from stringent regulatory frameworks, advanced industrial infrastructure, and substantial investments in automation technologies across multiple sectors including chemical manufacturing, pharmaceuticals, and nuclear facilities.

Key industrial regions within the United States show varying adoption patterns, with the Gulf Coast chemical corridor, Great Lakes manufacturing region, and California technology centers leading automation implementation. These areas benefit from concentrated industrial activity, regulatory enforcement, and available technical expertise supporting automation initiatives.

Canadian market represents approximately 18% regional market participation, driven by mining operations, chemical processing facilities, and pharmaceutical manufacturing plants. The country’s focus on environmental protection and workplace safety creates favorable conditions for automation adoption, particularly in provinces with significant industrial activity.

Mexico’s emerging market contributes 4% regional market share but demonstrates significant growth potential as industrial development accelerates and environmental regulations strengthen. The country’s expanding manufacturing sector, particularly in automotive and chemical industries, creates increasing demand for automated hazardous waste handling solutions.

Cross-border dynamics influence market development as multinational corporations implement standardized automation solutions across North American operations. This trend drives technology harmonization and creates opportunities for vendors capable of supporting multi-country implementations with consistent service quality.

Regional regulatory variations create both challenges and opportunities for automation providers, as different jurisdictions maintain distinct requirements for hazardous waste management. Companies successful in navigating these regulatory differences gain competitive advantages in multi-regional market segments.

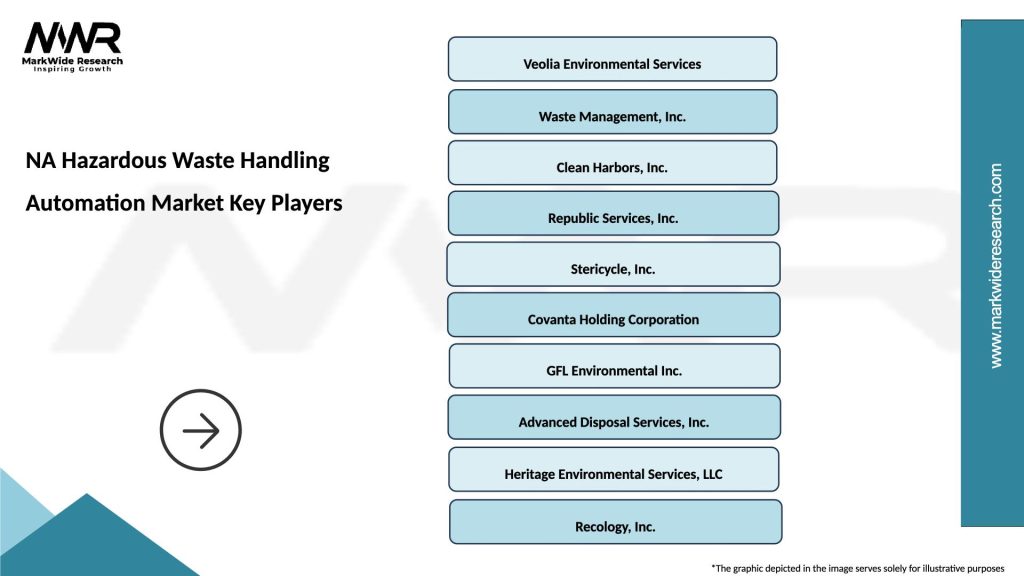

Market leadership in the North American hazardous waste handling automation sector features a diverse mix of established industrial automation companies, specialized robotics providers, and emerging technology innovators. The competitive landscape continues evolving as companies pursue strategic acquisitions and partnerships to strengthen market positions.

Leading market participants include:

Competitive strategies focus on technology differentiation, comprehensive service offerings, regulatory compliance expertise, and strategic partnerships with system integrators and end-users. Companies increasingly emphasize solution customization capabilities and post-installation support services to differentiate their market offerings.

Innovation initiatives drive competitive positioning as companies invest in advanced technologies including artificial intelligence, machine learning, and enhanced sensor capabilities. These technological advancements enable more sophisticated automation solutions while improving safety and operational efficiency for end-users.

Technology-based segmentation reveals distinct market categories based on automation approaches and technological sophistication:

Application-based segmentation demonstrates varying adoption patterns across industry sectors:

Geographic segmentation shows concentration in industrial regions with varying technology adoption rates and regulatory requirements across North American markets.

Robotic handling systems represent the largest market category, driven by proven technology reliability and comprehensive safety benefits. These systems demonstrate exceptional performance in repetitive handling tasks while eliminating human exposure to dangerous materials. Market adoption continues expanding as robotic technology becomes more affordable and easier to integrate.

Automated guided vehicles show strong growth potential in large industrial facilities where material transportation represents significant operational challenges. These systems provide flexible transportation solutions while maintaining safety protocols and operational efficiency. Integration with facility management systems enhances overall automation effectiveness.

Remote monitoring solutions gain importance as organizations seek comprehensive oversight of hazardous waste operations. These systems enable real-time decision making while providing documentation for regulatory compliance. Advanced analytics capabilities support predictive maintenance and process optimization initiatives.

Automated sorting systems address growing complexity in waste stream management as organizations handle increasingly diverse hazardous materials. AI-powered classification technologies improve sorting accuracy while reducing processing time and labor requirements. These systems particularly benefit facilities managing mixed waste streams.

Integrated management platforms emerge as critical components for organizations implementing comprehensive automation strategies. These platforms coordinate multiple automation technologies while providing centralized control and reporting capabilities. Integration capabilities determine overall system effectiveness and operational efficiency.

Market evolution trends indicate increasing convergence of these categories as vendors develop comprehensive solutions combining multiple automation technologies into integrated systems addressing complete hazardous waste handling workflows.

Technology providers benefit from expanding market opportunities driven by regulatory requirements and safety concerns. The growing demand for automation solutions creates sustainable revenue streams while enabling companies to develop specialized expertise in high-value market segments with limited competition.

End-user organizations realize substantial benefits including improved worker safety, reduced liability exposure, enhanced regulatory compliance, and optimized operational efficiency. Automation systems provide consistent performance while eliminating human error risks and reducing long-term operational costs through improved process efficiency.

System integrators gain opportunities to develop specialized expertise in hazardous waste automation while building long-term customer relationships through ongoing service and support requirements. The complexity of these systems creates barriers to entry while rewarding companies with proven implementation capabilities.

Regulatory agencies benefit from improved compliance rates and reduced environmental incidents as automated systems provide better control and documentation of hazardous waste handling operations. Automation technologies support regulatory objectives while reducing enforcement burdens through improved industry compliance.

Insurance providers experience reduced claim exposure as automated systems minimize workplace accidents and environmental incidents. This risk reduction enables more favorable insurance terms for organizations implementing comprehensive automation solutions, creating additional financial incentives for market adoption.

Environmental consultants find new service opportunities in automation system design, regulatory compliance verification, and performance optimization. The integration of automation technologies with environmental management creates demand for specialized consulting services supporting implementation and ongoing operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping hazardous waste handling automation. AI-powered systems enable more sophisticated material identification, predictive maintenance capabilities, and adaptive process optimization. Organizations increasingly demand intelligent automation solutions that learn from operational data and continuously improve performance.

Modular system design gains prominence as organizations seek flexible automation solutions that can be implemented in phases based on budget constraints and operational requirements. This approach enables scalable implementation while reducing initial investment barriers for smaller organizations.

Cloud-based monitoring and control systems enable remote oversight of hazardous waste handling operations while providing real-time data analytics and reporting capabilities. These systems support centralized management of multiple facilities while ensuring consistent safety and compliance standards.

Collaborative robotics technologies enable safer human-robot interaction in hazardous environments, expanding automation applications where complete human exclusion is not practical. These systems provide enhanced flexibility while maintaining safety protocols for complex operations.

Predictive maintenance capabilities integrated into automation systems reduce downtime while optimizing maintenance costs. Advanced sensor technologies and data analytics enable proactive maintenance scheduling based on actual system condition rather than predetermined intervals.

Sustainability integration drives development of automation solutions that support environmental objectives beyond safety compliance. Organizations increasingly seek systems that optimize resource utilization while minimizing environmental impact throughout the waste handling process.

Strategic acquisitions continue reshaping the competitive landscape as larger automation companies acquire specialized hazardous waste handling technology providers. These acquisitions enable comprehensive solution development while expanding market reach through established customer relationships and distribution networks.

Technology partnerships between robotics manufacturers, software developers, and system integrators create more sophisticated automation solutions addressing complete hazardous waste handling workflows. These collaborations combine complementary expertise while accelerating innovation and market development.

Regulatory developments including updated EPA guidelines and OSHA standards influence automation system requirements and create new market opportunities. MarkWide Research analysis indicates these regulatory changes drive increased automation adoption as organizations seek compliance assurance through technological solutions.

Investment initiatives from venture capital firms and private equity investors accelerate technology development and market expansion. These investments support research and development activities while enabling companies to scale operations and expand geographic coverage.

Pilot program implementations by major industrial companies demonstrate automation capabilities while building market confidence in new technologies. Successful pilot programs often lead to broader implementation initiatives and influence industry adoption patterns.

International expansion by North American automation providers creates opportunities for technology transfer and market development. These expansion initiatives leverage proven solutions while adapting to local regulatory requirements and market conditions.

Technology providers should focus on developing modular, scalable solutions that address varying customer requirements and budget constraints. Emphasis on flexible implementation approaches can expand market accessibility while maintaining solution sophistication for complex applications.

Investment strategies should prioritize companies with proven expertise in hazardous material handling combined with advanced automation capabilities. Organizations demonstrating regulatory compliance expertise and comprehensive service capabilities offer the strongest long-term value propositions.

Market entry strategies for new participants should focus on specialized applications or underserved geographic regions where established competitors have limited presence. Niche specialization can provide competitive advantages while building market credibility and customer relationships.

Partnership development represents critical success factors for companies seeking market expansion. Strategic alliances with system integrators, waste management companies, and industry consultants can accelerate market penetration while reducing customer acquisition costs.

Service model innovation including automation-as-a-service offerings can address market barriers while creating recurring revenue streams. These models appeal to organizations seeking automation benefits without substantial capital commitments or technical expertise requirements.

Regulatory engagement through industry associations and standards development organizations enables companies to influence regulatory development while ensuring solution compliance. Active participation in regulatory processes provides competitive intelligence and market development opportunities.

Market evolution indicates continued strong growth driven by regulatory enforcement, technology advancement, and increasing safety awareness across North American industries. The market demonstrates resilient growth characteristics with expanding applications and geographic coverage supporting long-term development potential.

Technology advancement will continue driving market expansion as artificial intelligence, machine learning, and advanced sensor technologies enable more sophisticated automation capabilities. These developments will create new application opportunities while improving cost-effectiveness for existing implementations.

Regulatory trends suggest continued strengthening of hazardous waste management requirements, creating sustained demand for automation solutions. MWR projections indicate regulatory compliance will remain the primary market driver, with safety and efficiency benefits providing additional adoption incentives.

Geographic expansion opportunities will emerge in underserved regions as industrial development accelerates and environmental awareness increases. These markets offer significant growth potential for established technology providers with proven solution capabilities and service expertise.

Market consolidation will likely continue as larger companies acquire specialized technology providers to create comprehensive solution portfolios. This consolidation will benefit customers through improved solution integration while creating challenges for smaller independent providers.

Innovation focus will shift toward integrated solutions combining multiple automation technologies with advanced analytics and artificial intelligence capabilities. Organizations will increasingly demand comprehensive automation ecosystems rather than individual technology components, driving solution convergence and market evolution.

The North American hazardous waste handling automation market represents a dynamic and rapidly evolving sector with substantial growth potential driven by regulatory requirements, safety concerns, and technological advancement. The market demonstrates strong fundamentals with increasing adoption rates across multiple industry segments and geographic regions.

Key success factors for market participants include technology innovation, regulatory compliance expertise, comprehensive service capabilities, and strategic partnership development. Organizations that successfully combine these elements while addressing customer-specific requirements will capture the greatest market opportunities in this expanding sector.

Future market development will be characterized by continued technology convergence, geographic expansion, and solution sophistication as automation becomes increasingly essential for hazardous waste management operations. The market outlook remains positive with sustained growth expected across all major segments and applications, supported by regulatory drivers and technological advancement creating new opportunities for innovation and market expansion.

What is Hazardous Waste Handling Automation?

Hazardous Waste Handling Automation refers to the use of automated systems and technologies to manage and process hazardous waste materials safely and efficiently. This includes the use of robotics, sensors, and software to streamline waste collection, sorting, and disposal processes.

What are the key players in the NA Hazardous Waste Handling Automation Market?

Key players in the NA Hazardous Waste Handling Automation Market include companies like Veolia Environmental Services, Stericycle, and Clean Harbors, which specialize in waste management and environmental services, among others.

What are the main drivers of the NA Hazardous Waste Handling Automation Market?

The main drivers of the NA Hazardous Waste Handling Automation Market include increasing regulatory pressures for safe waste disposal, advancements in automation technology, and the growing need for efficient waste management solutions in industries such as healthcare and manufacturing.

What challenges does the NA Hazardous Waste Handling Automation Market face?

Challenges in the NA Hazardous Waste Handling Automation Market include high initial investment costs for automation technologies, the complexity of hazardous waste regulations, and the need for skilled personnel to operate and maintain automated systems.

What opportunities exist in the NA Hazardous Waste Handling Automation Market?

Opportunities in the NA Hazardous Waste Handling Automation Market include the development of innovative automation solutions tailored for specific industries, the integration of AI and machine learning for improved waste processing, and the expansion of services to emerging markets.

What trends are shaping the NA Hazardous Waste Handling Automation Market?

Trends shaping the NA Hazardous Waste Handling Automation Market include the increasing adoption of IoT technologies for real-time monitoring of waste management processes, the rise of sustainable waste handling practices, and the growing emphasis on reducing environmental impact through automation.

NA Hazardous Waste Handling Automation Market

| Segmentation Details | Description |

|---|---|

| Product Type | Robotic Systems, Automated Containers, Monitoring Equipment, Treatment Units |

| Technology | AI-Based Solutions, IoT Sensors, Cloud Computing, Machine Learning |

| End User | Manufacturing Facilities, Waste Management Companies, Government Agencies, Research Institutions |

| Application | Hazardous Waste Disposal, Recycling Processes, Environmental Monitoring, Compliance Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Hazardous Waste Handling Automation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at