444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America freeze-dried fruits and vegetables market represents a dynamic and rapidly expanding segment within the broader food processing industry. This innovative preservation technology has gained significant traction across diverse applications, from emergency food supplies to gourmet culinary ingredients. Market dynamics indicate robust growth driven by increasing consumer awareness of nutritional benefits, extended shelf life advantages, and growing demand for convenient, healthy food options.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with substantial growth momentum. The technology’s ability to retain up to 97% of original nutritional content while extending shelf life to 25-30 years has positioned freeze-dried products as premium alternatives to traditional preservation methods. Consumer preferences are increasingly shifting toward natural, minimally processed foods that maintain original taste profiles and nutritional integrity.

Industry adoption spans multiple sectors including outdoor recreation, military applications, emergency preparedness, and premium food service establishments. The market demonstrates strong resilience with consistent growth patterns, supported by technological advancements in freeze-drying equipment and processes. Innovation trends focus on improving processing efficiency, reducing energy consumption, and expanding product variety to meet evolving consumer demands.

The North America freeze-dried fruits and vegetables market refers to the commercial ecosystem encompassing the production, distribution, and consumption of fruits and vegetables processed through sublimation technology, where frozen water content transitions directly from solid to vapor state, preserving cellular structure and nutritional content while removing moisture for extended shelf life.

Freeze-drying technology involves three distinct phases: freezing, primary drying through sublimation, and secondary drying to remove residual moisture. This process maintains the original shape, color, and nutritional profile of fresh produce while creating lightweight, shelf-stable products. Market participants include raw material suppliers, processing equipment manufacturers, freeze-drying facilities, distributors, and end-use consumers across various sectors.

Product categories encompass individual fruits and vegetables, mixed blends, seasoned varieties, and specialty formulations designed for specific applications. The market serves diverse consumer segments including outdoor enthusiasts, emergency preparedness communities, health-conscious consumers, food service operators, and ingredient manufacturers seeking premium preservation solutions.

Market performance demonstrates exceptional growth trajectory with the North America freeze-dried fruits and vegetables sector experiencing robust expansion across all major segments. Technology adoption continues accelerating as consumers increasingly recognize the superior nutritional retention and convenience benefits of freeze-dried products compared to traditional preservation methods.

Key growth drivers include rising health consciousness, increasing outdoor recreational activities, growing emergency preparedness awareness, and expanding food service applications. The market benefits from approximately 15% annual growth in the outdoor recreation segment, while emergency preparedness applications show steady 8-10% growth rates. Premium positioning allows manufacturers to maintain healthy profit margins despite higher processing costs.

Competitive landscape features established players leveraging advanced processing technologies alongside emerging companies focusing on niche applications and innovative product formulations. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand processing capacity and distribution networks. Future prospects remain highly favorable with projected sustained growth driven by demographic trends, lifestyle changes, and technological improvements.

Strategic analysis reveals several critical insights shaping the North America freeze-dried fruits and vegetables market landscape:

Health consciousness trends represent the primary catalyst driving North America freeze-dried fruits and vegetables market expansion. Consumers increasingly prioritize nutritional value, seeking products that maintain original vitamin, mineral, and antioxidant content. Lifestyle changes toward convenient, healthy eating options support sustained demand growth across multiple demographic segments.

Outdoor recreation growth significantly impacts market dynamics, with camping, hiking, and backpacking activities experiencing renewed popularity. The lightweight, nutritious characteristics of freeze-dried products align perfectly with outdoor enthusiasts’ requirements for portable, high-energy food options. Adventure tourism expansion further amplifies demand for premium outdoor food products.

Emergency preparedness awareness has intensified following recent natural disasters and global supply chain disruptions. Consumers and organizations increasingly invest in long-term food storage solutions, with freeze-dried products offering superior shelf life and nutritional retention. Government initiatives promoting emergency preparedness contribute to sustained market growth.

Food service innovation drives demand as restaurants and culinary professionals discover freeze-dried ingredients’ versatility and quality. Culinary applications range from garnishes and flavor enhancement to complete meal components, expanding market reach beyond traditional consumer segments. Premium positioning allows food service operators to differentiate menu offerings while maintaining consistent ingredient availability.

High processing costs represent the most significant constraint limiting broader market adoption. Freeze-drying requires specialized equipment, extended processing times, and substantial energy consumption, resulting in premium pricing that restricts mass market penetration. Capital investment requirements for processing facilities create barriers for new market entrants and limit production capacity expansion.

Consumer price sensitivity affects market growth, particularly in price-conscious segments where traditional preservation methods offer lower-cost alternatives. Economic fluctuations can impact discretionary spending on premium food products, creating demand volatility. Competition from conventional dried fruits and vegetables maintains pressure on pricing strategies.

Limited consumer awareness in certain market segments restricts growth potential. Many consumers remain unfamiliar with freeze-drying benefits, requiring extensive education and marketing investments. Distribution challenges in rural areas and smaller markets limit product availability and market penetration opportunities.

Regulatory considerations surrounding food safety, labeling requirements, and organic certification create compliance costs and operational complexity. Supply chain constraints for high-quality raw materials can impact production consistency and cost management, particularly for organic and specialty varieties.

Technological advancement opportunities present significant potential for market expansion through improved processing efficiency and cost reduction. Equipment innovation focusing on energy-efficient freeze-drying systems could substantially reduce production costs, enabling broader market accessibility. Automation integration offers possibilities for increased production capacity and consistent product quality.

Product diversification represents substantial growth opportunities through expanded fruit and vegetable varieties, seasoned blends, and application-specific formulations. Organic segment expansion aligns with consumer preferences for natural, pesticide-free products, commanding premium pricing and strong growth potential. Functional food development incorporating additional nutrients or health benefits could create new market categories.

International expansion opportunities exist as North American companies leverage processing expertise and technology leadership in global markets. Export potential for premium freeze-dried products could generate additional revenue streams while diversifying market risk. Strategic partnerships with international distributors could accelerate market entry and expansion.

E-commerce growth creates direct-to-consumer opportunities, enabling manufacturers to capture higher margins while building brand relationships. Subscription models for emergency preparedness and outdoor recreation segments could generate recurring revenue and improve customer lifetime value. Digital marketing strategies can effectively reach target demographics and build market awareness.

Supply chain dynamics significantly influence the North America freeze-dried fruits and vegetables market, with raw material quality and availability directly impacting production capabilities. Seasonal variations in fresh produce availability require strategic planning and inventory management to maintain consistent production schedules. Supplier relationships with premium fruit and vegetable growers become critical competitive advantages.

Technology evolution continues reshaping market dynamics through improved processing efficiency and product quality enhancements. Equipment manufacturers invest heavily in research and development, creating more energy-efficient and cost-effective freeze-drying systems. Process optimization reduces production times and energy consumption while maintaining superior product characteristics.

Consumer behavior shifts toward health-conscious eating and convenience-focused lifestyles drive sustained demand growth. Demographic trends including aging populations, increased outdoor recreation participation, and growing emergency preparedness awareness support long-term market expansion. Lifestyle changes accelerated by recent global events reinforce the value proposition of shelf-stable, nutritious food options.

Competitive dynamics intensify as established players expand capacity while new entrants target niche applications and specialized products. Innovation competition focuses on product variety, processing efficiency, and cost reduction strategies. Market positioning strategies emphasize quality, nutritional benefits, and application-specific advantages to differentiate offerings in an increasingly crowded marketplace.

Comprehensive research approach employed multiple data collection methodologies to ensure accurate and reliable market analysis. Primary research included extensive interviews with industry executives, processing facility operators, equipment manufacturers, and key distributors across North America. Survey methodology captured consumer preferences, purchasing behaviors, and market trends from representative demographic samples.

Secondary research encompassed analysis of industry reports, government statistics, trade association data, and company financial statements. Market intelligence gathering included monitoring of product launches, pricing trends, and competitive activities across all major market segments. Technology assessment evaluated processing equipment capabilities, efficiency improvements, and innovation trends.

Data validation processes included cross-referencing multiple sources, statistical analysis of trends, and expert review of findings. Quantitative analysis employed statistical modeling to project market growth, segment performance, and regional variations. Qualitative insights provided context for numerical data through industry expert perspectives and market observation.

Regional analysis covered all major North American markets including detailed state and provincial level assessment. Segmentation analysis examined product categories, application areas, distribution channels, and consumer demographics. Competitive intelligence included comprehensive profiling of major market participants, their strategies, and market positioning approaches.

United States market dominance reflects the country’s large consumer base, established outdoor recreation culture, and advanced food processing infrastructure. Western states including California, Colorado, and Washington demonstrate highest consumption rates, driven by outdoor recreation activities and health-conscious consumer demographics. Market penetration in these regions reaches approximately 65% of target demographics.

Canadian market growth shows strong momentum with increasing awareness of freeze-dried products’ benefits and expanding outdoor recreation participation. Provincial distribution indicates British Columbia and Alberta leading consumption, supported by outdoor tourism and emergency preparedness initiatives. Growth rates in Canada exceed 12% annually across most product categories.

Regional preferences vary significantly, with western regions favoring outdoor recreation applications while eastern markets show stronger emergency preparedness focus. Distribution networks reflect these preferences through specialized retail channels and targeted marketing approaches. Climate considerations influence product selection, with northern regions emphasizing long-term storage capabilities.

Urban versus rural dynamics create distinct market characteristics, with urban areas showing higher premium product acceptance while rural markets emphasize practical applications and value positioning. Demographic analysis reveals age-related preferences, with younger consumers favoring outdoor recreation applications and older demographics prioritizing emergency preparedness and health benefits.

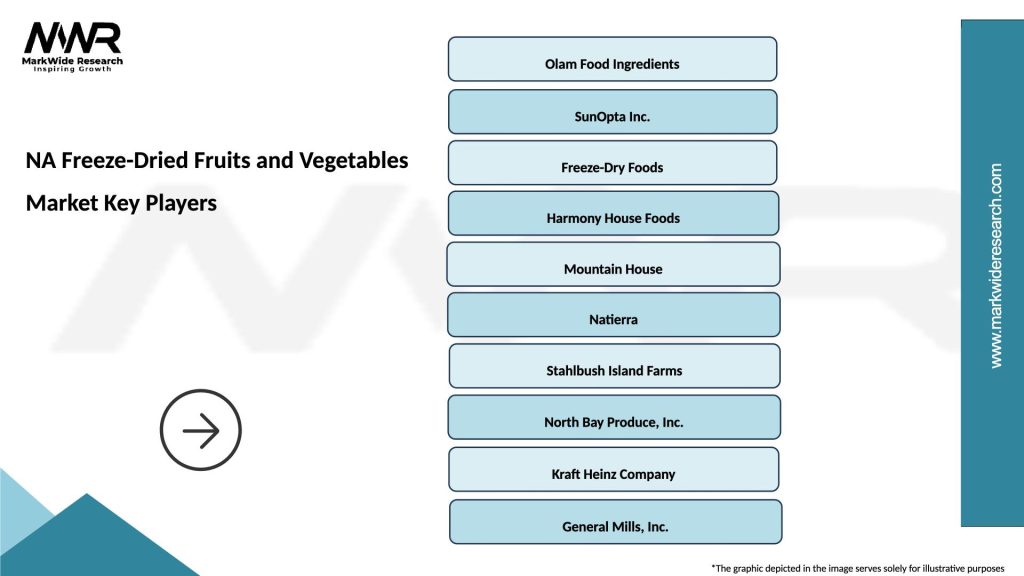

Market leadership is distributed among several established players, each leveraging distinct competitive advantages and market positioning strategies:

Competitive strategies focus on product innovation, distribution expansion, and brand differentiation. Market consolidation trends indicate strategic acquisitions and partnerships as companies seek to expand processing capacity and market reach. Technology investment remains critical for maintaining competitive advantages in processing efficiency and product quality.

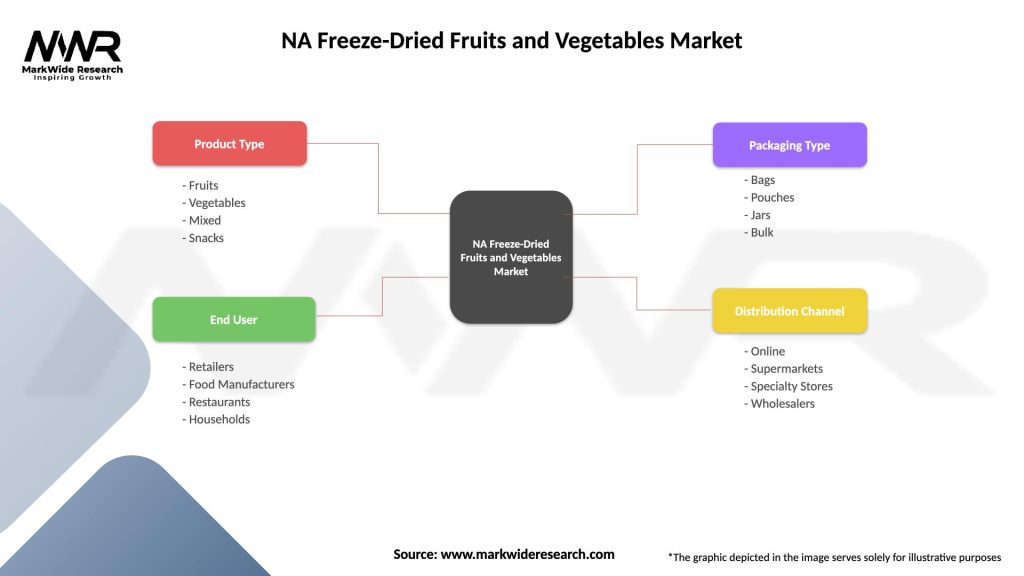

Product segmentation reveals diverse categories serving distinct consumer needs and applications:

By Product Type:

By Application:

By Distribution Channel:

Fruit category dominance reflects consumer preferences for naturally sweet, nutritious snack options that maintain appealing taste profiles after freeze-drying. Strawberries lead individual fruit sales due to excellent rehydration characteristics and broad consumer appeal. Berry varieties collectively represent the largest fruit subcategory, benefiting from high antioxidant content and premium positioning.

Vegetable segment growth accelerates as consumers discover culinary applications and nutritional benefits. Corn products show strongest performance due to excellent texture retention and versatile applications. Mixed vegetable blends gain popularity for convenience and balanced nutrition, particularly in emergency preparedness applications.

Organic category expansion demonstrates 18% annual growth as health-conscious consumers prioritize pesticide-free options despite premium pricing. Certification requirements create barriers to entry but enable significant price premiums for qualified producers. Supply chain complexity for organic raw materials requires strategic supplier relationships and careful inventory management.

Specialty formulations including seasoned varieties and functional food applications represent emerging growth opportunities. Innovation focus on unique flavor combinations and application-specific products creates differentiation possibilities. Custom blending services for food service and institutional customers generate higher margins and customer loyalty.

Manufacturers benefit from premium pricing opportunities and strong profit margins compared to traditional food processing sectors. Technology advantages create competitive moats through processing expertise and equipment investments. Brand loyalty develops strongly in target segments due to product performance and reliability, supporting sustained market positions.

Distributors gain from high-margin products with extended shelf life reducing inventory risks and storage costs. Market growth provides expansion opportunities across multiple channels and customer segments. Product differentiation enables premium positioning and reduced price competition compared to commodity food products.

Retailers enjoy attractive profit margins and strong customer demand for freeze-dried products. Inventory advantages include extended shelf life and reduced spoilage risks compared to fresh produce. Customer loyalty develops through repeat purchases, particularly in emergency preparedness and outdoor recreation segments.

Consumers receive superior nutritional value, convenience, and shelf life compared to alternative preservation methods. Lifestyle benefits include lightweight portability for outdoor activities and long-term food security for emergency preparedness. Quality advantages encompass taste, texture, and nutritional retention that exceed traditional dried alternatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness focus drives consumer preferences toward minimally processed, nutrient-dense food options. Clean label trends favor freeze-dried products due to minimal ingredient lists and absence of artificial preservatives. Functional food development incorporates additional nutrients and health benefits, creating premium product categories with enhanced value propositions.

Sustainability consciousness influences purchasing decisions as consumers seek environmentally responsible food choices. Reduced food waste through extended shelf life aligns with sustainability goals, while energy-efficient processing improvements address environmental concerns. Packaging innovation focuses on recyclable materials and reduced environmental impact.

Convenience culture accelerates demand for ready-to-eat and easy-preparation food options. Busy lifestyles drive appreciation for shelf-stable products that maintain nutritional quality without refrigeration requirements. Portion control and individual packaging options cater to single-person households and on-the-go consumption patterns.

Technology integration includes smart packaging with QR codes providing preparation instructions and nutritional information. E-commerce growth enables direct-to-consumer relationships and subscription-based purchasing models. Social media influence drives product discovery and brand awareness, particularly among younger demographic segments interested in outdoor recreation and health optimization.

Processing technology advancement continues improving efficiency and reducing energy consumption through innovative equipment design and process optimization. Equipment manufacturers invest heavily in research and development, creating next-generation freeze-drying systems with enhanced capabilities and reduced operating costs. Automation integration increases production consistency while reducing labor requirements.

Product innovation accelerates with new fruit and vegetable varieties, seasoned blends, and application-specific formulations entering the market regularly. Organic certification expansion reflects growing consumer demand for pesticide-free options. Functional food development incorporates additional nutrients, probiotics, and health-promoting compounds.

Market consolidation activities include strategic acquisitions and partnerships as companies seek to expand processing capacity and distribution networks. Vertical integration strategies encompass raw material sourcing, processing, and distribution to improve cost control and quality consistency. International expansion initiatives target global markets with growing demand for premium food products.

Regulatory developments focus on food safety standards, labeling requirements, and organic certification processes. Industry collaboration with regulatory agencies ensures compliance while supporting market growth. Quality standards continue evolving to address consumer expectations and competitive differentiation requirements.

Investment priorities should focus on processing technology upgrades to improve efficiency and reduce production costs. MarkWide Research analysis indicates that companies investing in advanced freeze-drying equipment achieve 20-30% cost reductions while improving product quality and consistency. Capacity expansion in strategic locations could capture growing demand while optimizing distribution costs.

Product development strategies should emphasize organic varieties, functional foods, and application-specific formulations. Market research indicates strong consumer interest in products combining convenience with enhanced nutritional benefits. Innovation investment in unique flavor combinations and specialty blends could create competitive differentiation and premium pricing opportunities.

Marketing initiatives should focus on consumer education about freeze-drying benefits and applications. Digital marketing strategies targeting outdoor recreation enthusiasts and health-conscious consumers could expand market reach cost-effectively. Partnership opportunities with outdoor recreation retailers and emergency preparedness organizations could accelerate market penetration.

Distribution expansion should prioritize e-commerce capabilities and direct-to-consumer relationships. Subscription models for regular customers could improve revenue predictability and customer lifetime value. International market exploration could provide growth opportunities while diversifying market risk and leveraging North American processing expertise.

Long-term growth prospects remain highly favorable for the North America freeze-dried fruits and vegetables market, supported by demographic trends, lifestyle changes, and technological improvements. Market expansion is projected to continue at robust rates, driven by increasing consumer awareness and expanding applications across multiple sectors.

Technology evolution will likely reduce processing costs and improve product quality, enabling broader market accessibility and increased adoption rates. Equipment innovation focusing on energy efficiency and automation could significantly impact production economics. MWR projections indicate potential 25-35% cost reductions through next-generation processing technology over the next decade.

Consumer trends toward health consciousness, convenience, and emergency preparedness will continue supporting sustained demand growth. Demographic shifts including aging populations and increased outdoor recreation participation create favorable market conditions. Lifestyle changes accelerated by recent global events reinforce the value proposition of shelf-stable, nutritious food options.

Market maturation will likely bring increased competition and consolidation, requiring companies to focus on differentiation through innovation, quality, and customer service. International expansion opportunities could provide significant growth potential for established North American producers. Sustainability initiatives will become increasingly important for market positioning and consumer acceptance.

The North America freeze-dried fruits and vegetables market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by consumer health consciousness, outdoor recreation trends, and emergency preparedness awareness. Technology advantages in preservation quality and shelf life extension create compelling value propositions across diverse application segments.

Market fundamentals remain strong with established demand drivers, premium positioning opportunities, and expanding consumer awareness supporting sustained growth trajectories. Competitive dynamics favor companies investing in processing technology, product innovation, and market education initiatives. Regional analysis indicates continued expansion opportunities across North American markets with varying demographic preferences and application focus areas.

Future success will depend on strategic investments in technology advancement, product development, and market expansion initiatives. Companies that effectively balance cost management with quality maintenance while expanding consumer awareness will capture the greatest market opportunities. The freeze-dried fruits and vegetables market is positioned for continued robust growth, offering attractive opportunities for industry participants and stakeholders committed to long-term market development and customer value creation.

What is Freeze-Dried Fruits and Vegetables?

Freeze-dried fruits and vegetables are food products that have had their moisture removed through a freeze-drying process, preserving their nutrients, flavor, and texture. This method allows for long shelf life and convenient storage, making them popular for snacks, meals, and emergency food supplies.

What are the key players in the NA Freeze-Dried Fruits and Vegetables Market?

Key players in the NA Freeze-Dried Fruits and Vegetables Market include companies like Oregon Freeze Dry, Freeze-Dry Foods, and Natierra, which specialize in producing high-quality freeze-dried products for various applications, including retail and food service, among others.

What are the growth factors driving the NA Freeze-Dried Fruits and Vegetables Market?

The growth of the NA Freeze-Dried Fruits and Vegetables Market is driven by increasing consumer demand for healthy snacks, the convenience of long-lasting food products, and the rising popularity of outdoor activities that require lightweight, nutritious food options.

What challenges does the NA Freeze-Dried Fruits and Vegetables Market face?

Challenges in the NA Freeze-Dried Fruits and Vegetables Market include high production costs associated with the freeze-drying process and competition from other preservation methods, such as dehydration and canning, which may offer lower price points.

What opportunities exist in the NA Freeze-Dried Fruits and Vegetables Market?

Opportunities in the NA Freeze-Dried Fruits and Vegetables Market include expanding product lines to cater to health-conscious consumers, developing innovative packaging solutions, and increasing distribution channels through e-commerce platforms.

What trends are shaping the NA Freeze-Dried Fruits and Vegetables Market?

Trends in the NA Freeze-Dried Fruits and Vegetables Market include a growing interest in plant-based diets, the rise of organic freeze-dried options, and the incorporation of freeze-dried ingredients into various culinary applications, such as smoothies and baked goods.

NA Freeze-Dried Fruits and Vegetables Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fruits, Vegetables, Mixed, Snacks |

| End User | Retailers, Food Manufacturers, Restaurants, Households |

| Packaging Type | Bags, Pouches, Jars, Bulk |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Freeze-Dried Fruits and Vegetables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at