444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America cosmetic and perfumery glass bottle packaging market represents a dynamic and rapidly evolving sector within the broader beauty and personal care industry. This specialized market encompasses the production, distribution, and utilization of glass containers specifically designed for cosmetic products, fragrances, skincare formulations, and luxury beauty items across the United States, Canada, and Mexico. The market has experienced remarkable transformation driven by increasing consumer preference for sustainable packaging solutions, premium product positioning, and the growing emphasis on brand differentiation through sophisticated packaging design.

Market dynamics indicate that the sector is experiencing robust growth, with industry analysts projecting a compound annual growth rate (CAGR) of 6.2% through the forecast period. This expansion is primarily attributed to the rising demand for eco-friendly packaging alternatives, the premiumization trend in the beauty industry, and the increasing adoption of glass packaging by both established brands and emerging cosmetic companies seeking to enhance their market positioning.

Regional distribution shows that the United States dominates the North American market, accounting for approximately 78% of total market share, followed by Canada at 15% and Mexico at 7%. The market encompasses various product categories including perfume bottles, foundation containers, serum vials, cream jars, and specialty packaging for premium cosmetic formulations.

The cosmetic and perfumery glass bottle packaging market refers to the specialized industry segment focused on manufacturing, designing, and supplying glass containers specifically engineered for beauty, personal care, and fragrance products. This market encompasses all aspects of glass packaging solutions, from raw material sourcing and container production to decorative finishing, labeling, and distribution to cosmetic manufacturers and brands.

Glass bottle packaging in the cosmetic industry serves multiple critical functions beyond mere containment. These containers provide superior product protection against UV radiation, chemical interactions, and contamination while offering exceptional aesthetic appeal that enhances brand perception and consumer experience. The market includes various glass types, container shapes, closure systems, and decorative treatments designed to meet the diverse requirements of different cosmetic product categories.

Industry scope extends from basic clear glass containers to sophisticated colored, frosted, and decorated bottles featuring advanced manufacturing techniques such as screen printing, hot stamping, and embossing. The market also encompasses complementary components including caps, pumps, droppers, and other dispensing mechanisms that complete the packaging solution.

Market performance in the North American cosmetic and perfumery glass bottle packaging sector demonstrates strong momentum driven by evolving consumer preferences, sustainability initiatives, and premiumization trends across the beauty industry. The market benefits from increasing demand for environmentally responsible packaging solutions, with glass recycling rates reaching 85% in key metropolitan areas, significantly outperforming alternative packaging materials.

Key growth drivers include the expansion of premium and luxury cosmetic brands, rising consumer awareness regarding sustainable packaging, and the increasing adoption of glass containers by indie beauty brands seeking to differentiate their products in competitive markets. The market also benefits from technological advancements in glass manufacturing processes, enabling more cost-effective production of specialized container designs.

Competitive landscape features a mix of established glass manufacturers, specialized cosmetic packaging companies, and innovative startups focusing on sustainable packaging solutions. Market leaders are investing heavily in research and development to create lighter-weight glass formulations, improved barrier properties, and enhanced decorative capabilities that meet evolving brand requirements.

Regional trends show particularly strong growth in the western United States, driven by the concentration of beauty and personal care companies in California, and increasing demand in the southeastern states where many major cosmetic manufacturers have established production facilities.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with beauty consumers increasingly prioritizing sustainable packaging options and premium product experiences. Research indicates that 73% of consumers are willing to pay premium prices for products packaged in environmentally friendly materials, with glass ranking as the most preferred sustainable packaging option among beauty shoppers.

Market segmentation demonstrates strong performance across multiple product categories, with perfume bottles representing the largest segment, followed by skincare containers and color cosmetic packaging. The market also shows increasing demand for specialized packaging solutions including airless systems, dropper bottles, and pump dispensers.

Environmental consciousness serves as the primary catalyst driving market expansion, with consumers and brands increasingly prioritizing sustainable packaging alternatives. The beauty industry’s commitment to reducing plastic waste has created substantial opportunities for glass packaging manufacturers, as brands seek to align their packaging choices with environmental sustainability goals and consumer expectations.

Premium brand positioning represents another significant driver, as cosmetic companies recognize the value of glass packaging in communicating product quality and luxury positioning. Glass containers provide superior aesthetic appeal, weight, and tactile experience that enhances perceived product value and supports premium pricing strategies across various beauty categories.

Regulatory compliance requirements are increasingly favoring glass packaging solutions, particularly for products containing active ingredients or sensitive formulations that require superior barrier properties. Glass packaging offers excellent chemical compatibility and stability, making it the preferred choice for high-performance skincare products and pharmaceutical-grade cosmetics.

Innovation in manufacturing processes has significantly improved the cost-effectiveness and design flexibility of glass packaging, enabling manufacturers to offer more competitive pricing while maintaining superior quality standards. Advanced production techniques allow for lighter-weight containers, complex shapes, and enhanced decorative capabilities that meet evolving brand requirements.

E-commerce growth has created new opportunities for glass packaging, as online beauty retailers and direct-to-consumer brands seek packaging solutions that provide superior product protection during shipping while maintaining aesthetic appeal for unboxing experiences and social media sharing.

Cost considerations remain a significant challenge for widespread adoption of glass packaging, particularly among mass-market cosmetic brands operating on tight margin structures. Glass containers typically command higher unit costs compared to plastic alternatives, creating barriers for price-sensitive market segments and limiting adoption among budget-conscious brands.

Weight and shipping implications present logistical challenges that impact overall supply chain efficiency and transportation costs. Glass packaging significantly increases product weight, resulting in higher shipping expenses and potential complications for e-commerce fulfillment operations, particularly for international distribution networks.

Fragility concerns create risks throughout the supply chain, from manufacturing and filling operations to retail handling and consumer use. The breakage risk associated with glass packaging requires additional protective measures, specialized handling procedures, and potential liability considerations that can complicate operations for cosmetic manufacturers.

Manufacturing limitations in certain specialized designs and complex shapes can restrict creative packaging options for brands seeking unique container configurations. Technical constraints in glass forming processes may limit the ability to achieve certain aesthetic goals or functional requirements demanded by innovative cosmetic formulations.

Supply chain complexity associated with glass packaging often involves longer lead times, minimum order quantities, and specialized storage requirements that can challenge smaller cosmetic companies and emerging brands with limited working capital and inventory management capabilities.

Sustainable innovation presents substantial growth opportunities as manufacturers develop advanced glass formulations with reduced environmental impact, improved recyclability, and enhanced performance characteristics. The development of bio-based glass materials and carbon-neutral production processes could significantly expand market adoption across environmentally conscious brands.

Smart packaging integration offers promising avenues for market expansion through the incorporation of digital technologies, interactive features, and connectivity solutions that enhance consumer engagement and provide valuable data insights for cosmetic brands. These innovations could justify premium pricing while delivering additional value to both brands and consumers.

Customization services represent a growing opportunity as brands increasingly demand unique packaging solutions that support brand differentiation and market positioning strategies. Advanced decoration techniques, personalization capabilities, and limited-edition packaging options could drive significant revenue growth for specialized glass packaging manufacturers.

Emerging market penetration within North America, particularly in underserved regions and demographic segments, offers expansion opportunities for glass packaging suppliers. The growing Hispanic market in the United States and increasing beauty spending in secondary metropolitan areas present untapped potential for market growth.

Refillable packaging systems align with circular economy principles and offer opportunities for recurring revenue streams while supporting brand sustainability initiatives. The development of innovative refill mechanisms and modular packaging systems could create new market categories and revenue opportunities.

Supply and demand dynamics in the North American cosmetic glass packaging market reflect a complex interplay of factors including raw material availability, manufacturing capacity, and evolving consumer preferences. The market experiences seasonal fluctuations aligned with beauty industry cycles, with peak demand periods coinciding with holiday seasons and new product launches.

Competitive pressures are intensifying as new entrants challenge established players through innovative designs, competitive pricing strategies, and specialized service offerings. According to MarkWide Research analysis, market consolidation trends are emerging as larger packaging companies acquire specialized glass manufacturers to expand their capabilities and market reach.

Technology adoption is accelerating across the industry, with manufacturers investing in automated production systems, quality control technologies, and digital design capabilities that improve efficiency and reduce costs. These technological advancements are enabling more competitive pricing while maintaining high quality standards demanded by cosmetic brands.

Raw material dynamics significantly impact market conditions, with glass manufacturing dependent on consistent supplies of silica sand, soda ash, and other key components. Price volatility in raw materials can affect profit margins and pricing strategies throughout the supply chain, influencing market competitiveness and growth patterns.

Regulatory environment continues evolving with increasing focus on packaging sustainability, chemical safety, and environmental impact disclosure requirements that favor glass packaging solutions over alternative materials in many applications.

Data collection for this comprehensive market analysis employed a multi-faceted approach combining primary research, secondary data analysis, and industry expert consultations to ensure accuracy and completeness of market insights. The research methodology incorporated both quantitative and qualitative research techniques to provide a holistic understanding of market dynamics and trends.

Primary research activities included structured interviews with key industry stakeholders, including glass packaging manufacturers, cosmetic brand executives, supply chain managers, and retail partners across major North American markets. Survey methodologies captured insights from over 200 industry professionals representing various market segments and geographic regions.

Secondary research encompassed comprehensive analysis of industry publications, trade association reports, regulatory filings, and company financial statements to validate primary findings and identify additional market trends. This research included examination of patent filings, technology developments, and competitive intelligence gathering from public sources.

Market modeling techniques utilized statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify key growth drivers. The research incorporated economic indicators, demographic trends, and consumer behavior patterns to ensure robust analytical foundations.

Quality assurance measures included data triangulation, expert validation, and cross-referencing of findings across multiple sources to ensure reliability and accuracy of all market insights and projections presented in this analysis.

United States market dominates the North American cosmetic glass packaging landscape, representing the largest share of regional demand driven by the concentration of major beauty brands, advanced manufacturing infrastructure, and sophisticated consumer preferences for premium packaging solutions. Key market centers include California, New York, New Jersey, and Texas, where major cosmetic companies maintain significant operations.

California market specifically shows exceptional growth potential, with Silicon Valley and Los Angeles regions hosting numerous innovative beauty startups and established brands that prioritize sustainable packaging solutions. The state’s environmental regulations and consumer consciousness create favorable conditions for glass packaging adoption across multiple beauty categories.

Canadian market demonstrates steady growth patterns with particular strength in natural and organic beauty products that align well with glass packaging positioning. Major metropolitan areas including Toronto, Vancouver, and Montreal show increasing demand for premium packaging solutions, supported by growing disposable income and beauty spending trends.

Mexican market represents an emerging opportunity with rapid expansion in the beauty and personal care sector. Growing middle-class population, increasing urbanization, and rising beauty consciousness are driving demand for higher-quality packaging solutions, creating opportunities for glass packaging manufacturers to establish market presence.

Regional distribution patterns show concentration in major metropolitan areas with established beauty industry clusters, while rural and secondary markets present untapped potential for expansion as beauty retail channels continue evolving and e-commerce penetration increases across all geographic regions.

Market leadership in the North American cosmetic glass packaging sector features a diverse mix of established glass manufacturers, specialized packaging companies, and innovative startups focused on sustainable solutions. The competitive environment is characterized by ongoing consolidation, strategic partnerships, and continuous innovation in manufacturing processes and design capabilities.

Competitive strategies focus on innovation, sustainability, customization capabilities, and strategic partnerships with major cosmetic brands. Leading companies are investing heavily in research and development to create lighter-weight glass formulations, enhanced barrier properties, and advanced decorative techniques that meet evolving market requirements.

Market positioning varies significantly among competitors, with some focusing on high-volume standard products while others specialize in premium custom solutions for luxury brands. The competitive landscape continues evolving as new technologies and changing consumer preferences create opportunities for innovative packaging solutions.

Product type segmentation reveals distinct market categories with varying growth patterns and competitive dynamics. The market encompasses multiple container types designed for specific cosmetic applications, each with unique requirements for functionality, aesthetics, and manufacturing specifications.

By Product Type:

By Capacity:

By End-User:

Perfume packaging represents the most established and mature segment within the cosmetic glass packaging market, characterized by sophisticated design requirements, premium positioning, and strong brand differentiation needs. This category shows steady growth driven by expanding fragrance collections, limited edition releases, and increasing consumer appreciation for collectible packaging designs.

Skincare containers demonstrate the highest growth potential, with annual growth rates exceeding 8% driven by the expanding skincare market, increasing consumer focus on anti-aging products, and growing demand for specialized formulations requiring superior packaging protection. This segment benefits from premiumization trends and increasing consumer willingness to invest in high-quality skincare products.

Color cosmetics packaging shows moderate growth patterns with opportunities for innovation in dispensing mechanisms, color-matching capabilities, and multi-functional designs. The segment faces competition from alternative packaging materials but maintains strong positioning in premium and luxury market segments where glass packaging enhances perceived product value.

Natural and organic beauty products represent a rapidly expanding category where glass packaging provides significant advantages in terms of product compatibility, sustainability positioning, and consumer perception. This segment shows particular strength in North American markets where natural beauty trends are well-established and continuing to grow.

Men’s grooming products constitute an emerging opportunity within the glass packaging market, as male consumers increasingly embrace premium grooming products and brands seek packaging solutions that communicate quality and sophistication while appealing to masculine aesthetic preferences.

Cosmetic manufacturers benefit significantly from glass packaging adoption through enhanced product protection, extended shelf life, and superior brand positioning capabilities. Glass containers provide excellent barrier properties that protect sensitive formulations from degradation while offering premium aesthetic appeal that supports higher pricing strategies and improved profit margins.

Brand owners gain substantial advantages through glass packaging including enhanced consumer perception, sustainability credentials, and differentiation opportunities in competitive markets. The premium positioning associated with glass packaging enables brands to command higher prices while building stronger emotional connections with environmentally conscious consumers.

Retailers experience benefits through improved product presentation, reduced packaging waste, and alignment with sustainability initiatives that resonate with their customer base. Glass packaging enhances in-store merchandising opportunities and supports premium product positioning that can improve overall category profitability.

Consumers receive value through superior product quality, environmental benefits, and enhanced user experience. Glass packaging provides better product preservation, eliminates concerns about chemical leaching, and offers reusability options that align with sustainable lifestyle choices increasingly important to beauty consumers.

Environmental stakeholders benefit from the recyclability and reduced environmental impact of glass packaging compared to plastic alternatives. The circular economy principles supported by glass packaging contribute to waste reduction goals and environmental sustainability objectives across the beauty industry supply chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable packaging continues driving market transformation as beauty brands increasingly prioritize environmental responsibility and circular economy principles. This trend manifests through growing adoption of recycled glass content, development of refillable packaging systems, and implementation of take-back programs that support glass container reuse and recycling initiatives.

Minimalist design aesthetics are gaining prominence across the cosmetic glass packaging market, with brands embracing clean lines, simple shapes, and understated elegance that appeals to modern consumer preferences. This trend reflects broader lifestyle movements toward simplicity and authenticity while maintaining premium positioning through superior material quality.

Smart packaging integration represents an emerging trend where glass containers incorporate digital technologies including QR codes, NFC chips, and augmented reality features that enhance consumer engagement and provide valuable brand interaction opportunities. These innovations bridge physical and digital experiences while maintaining glass packaging’s premium appeal.

Customization and personalization trends are driving demand for unique packaging solutions that support brand differentiation and consumer connection. Advanced decoration techniques, limited edition designs, and personalized packaging options are becoming increasingly important for brands seeking to create memorable consumer experiences and build brand loyalty.

Lightweight glass formulations address traditional concerns about glass packaging weight while maintaining strength and aesthetic properties. MWR data indicates that new glass compositions can achieve weight reductions of up to 30% compared to traditional formulations, improving shipping efficiency and handling convenience without compromising package integrity.

Manufacturing innovation continues advancing through implementation of Industry 4.0 technologies, automated production systems, and advanced quality control measures that improve efficiency and reduce costs. Leading manufacturers are investing in smart factory technologies that enable real-time monitoring, predictive maintenance, and optimized production scheduling.

Strategic partnerships between glass packaging manufacturers and cosmetic brands are becoming more prevalent, with long-term collaboration agreements that support innovation, sustainability initiatives, and market expansion. These partnerships often include co-development of specialized packaging solutions and exclusive design arrangements.

Acquisition activity in the market reflects ongoing consolidation trends as larger packaging companies acquire specialized glass manufacturers to expand capabilities and market reach. Recent transactions demonstrate the strategic value placed on glass packaging expertise and established customer relationships within the beauty industry.

Sustainability initiatives are expanding beyond basic recycling to encompass comprehensive environmental programs including carbon footprint reduction, renewable energy adoption, and circular economy implementation. Leading companies are setting ambitious sustainability targets and investing in technologies that support environmental objectives.

Technology advancement in glass decoration and finishing techniques enables more sophisticated aesthetic options while improving production efficiency. New capabilities include advanced printing technologies, innovative surface treatments, and enhanced color options that meet evolving brand requirements for unique packaging solutions.

Market entry strategies for new participants should focus on specialized niches or innovative technologies that differentiate from established competitors. Success factors include developing unique value propositions, establishing strong customer relationships, and investing in manufacturing capabilities that support quality and efficiency requirements.

Investment priorities should emphasize sustainability technologies, automation capabilities, and customer service infrastructure that support long-term competitive positioning. Companies should also consider strategic partnerships or acquisitions that expand market reach and technical capabilities while maintaining focus on core competencies.

Innovation focus areas offering the greatest potential include lightweight glass formulations, smart packaging technologies, and advanced decoration techniques that enhance brand differentiation capabilities. Research and development investments should align with market trends toward sustainability, customization, and digital integration.

Geographic expansion opportunities exist in underserved regions and emerging market segments where beauty industry growth is accelerating. Companies should evaluate market entry strategies that balance investment requirements with growth potential while considering local preferences and competitive dynamics.

Partnership development with key cosmetic brands, sustainability organizations, and technology providers can accelerate market penetration and innovation capabilities. Strategic alliances should focus on mutual value creation and long-term relationship building rather than transactional arrangements.

Market trajectory indicates continued strong growth driven by sustainability trends, premiumization in the beauty industry, and increasing consumer preference for glass packaging solutions. MarkWide Research projects that the market will maintain robust expansion with compound annual growth rates exceeding 6% through the next five years, supported by favorable industry dynamics and evolving consumer preferences.

Technology evolution will likely focus on addressing traditional glass packaging limitations through lightweight formulations, improved manufacturing efficiency, and enhanced functionality. Smart packaging integration and advanced decoration techniques will create new opportunities for brand differentiation and consumer engagement while maintaining glass packaging’s premium positioning.

Sustainability leadership will become increasingly important as environmental regulations tighten and consumer consciousness continues growing. Companies that establish strong sustainability credentials and circular economy capabilities will likely gain competitive advantages and preferred supplier status with major cosmetic brands.

Market consolidation trends are expected to continue as the industry matures and economies of scale become more important for competitive positioning. Successful companies will likely be those that can combine operational efficiency with innovation capabilities and strong customer relationships.

Regional expansion opportunities will emerge as beauty markets develop in secondary metropolitan areas and underserved demographic segments. The growing Hispanic market and increasing beauty spending in emerging regions present significant growth potential for glass packaging suppliers with appropriate market entry strategies.

Market assessment of the North American cosmetic and perfumery glass bottle packaging sector reveals a dynamic and rapidly evolving industry with substantial growth potential driven by sustainability trends, premiumization in the beauty market, and increasing consumer preference for environmentally responsible packaging solutions. The market demonstrates strong fundamentals with diverse growth drivers and expanding applications across multiple beauty categories.

Strategic positioning within this market requires careful consideration of sustainability credentials, innovation capabilities, and customer relationship development. Companies that successfully balance operational efficiency with environmental responsibility and technical innovation will likely achieve sustainable competitive advantages and long-term market success.

Investment opportunities remain attractive for organizations with appropriate market entry strategies, technological capabilities, and financial resources to support growth initiatives. The market’s favorable dynamics, combined with evolving consumer preferences and regulatory trends, create a supportive environment for continued expansion and innovation in cosmetic glass packaging solutions across North America.

What is Cosmetic & Perfumery Glass Bottle Packaging?

Cosmetic & Perfumery Glass Bottle Packaging refers to the use of glass containers specifically designed to hold and preserve cosmetic and fragrance products. This type of packaging is valued for its aesthetic appeal, durability, and ability to maintain product integrity.

What are the key players in the NA Cosmetic & Perfumery Glass Bottle Packaging Market?

Key players in the NA Cosmetic & Perfumery Glass Bottle Packaging Market include companies like O.Berk Company, Gerresheimer AG, and Amcor, among others. These companies are known for their innovative designs and sustainable packaging solutions.

What are the growth factors driving the NA Cosmetic & Perfumery Glass Bottle Packaging Market?

The growth of the NA Cosmetic & Perfumery Glass Bottle Packaging Market is driven by increasing consumer demand for premium packaging, the rise of eco-friendly products, and the expansion of the beauty and personal care industry. Additionally, the trend towards sustainable packaging solutions is influencing market dynamics.

What challenges does the NA Cosmetic & Perfumery Glass Bottle Packaging Market face?

The NA Cosmetic & Perfumery Glass Bottle Packaging Market faces challenges such as high production costs associated with glass manufacturing and the risk of breakage during transportation. Additionally, competition from alternative packaging materials like plastics can impact market growth.

What opportunities exist in the NA Cosmetic & Perfumery Glass Bottle Packaging Market?

Opportunities in the NA Cosmetic & Perfumery Glass Bottle Packaging Market include the growing trend of personalized packaging and the increasing focus on sustainability. Innovations in glass recycling and lightweight glass options also present potential growth avenues.

What trends are shaping the NA Cosmetic & Perfumery Glass Bottle Packaging Market?

Trends shaping the NA Cosmetic & Perfumery Glass Bottle Packaging Market include the rise of minimalist design aesthetics, the use of smart packaging technologies, and an emphasis on sustainable materials. These trends reflect changing consumer preferences towards eco-conscious and visually appealing products.

NA Cosmetic & Perfumery Glass Bottle Packaging Market

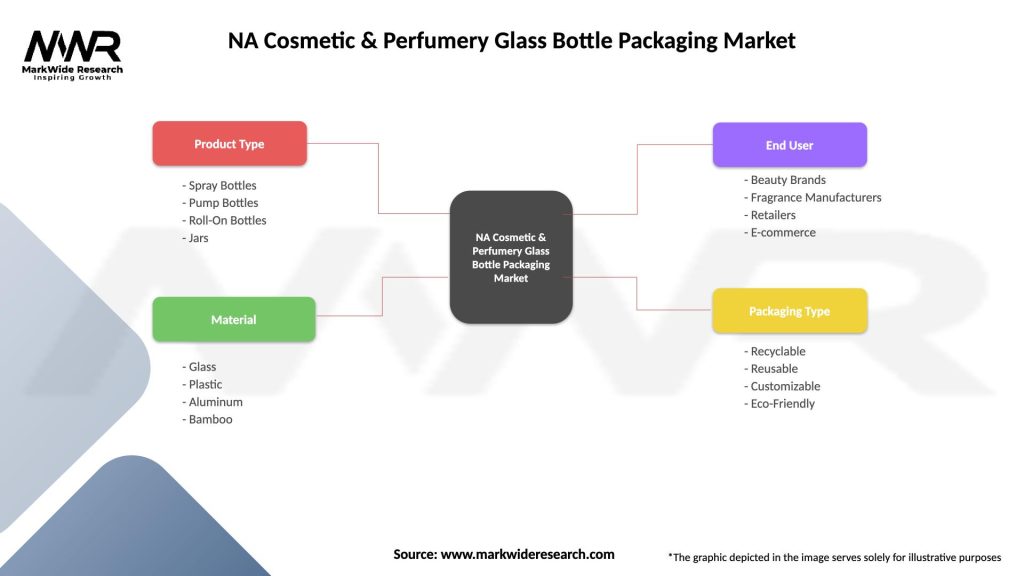

| Segmentation Details | Description |

|---|---|

| Product Type | Spray Bottles, Pump Bottles, Roll-On Bottles, Jars |

| Material | Glass, Plastic, Aluminum, Bamboo |

| End User | Beauty Brands, Fragrance Manufacturers, Retailers, E-commerce |

| Packaging Type | Recyclable, Reusable, Customizable, Eco-Friendly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Cosmetic & Perfumery Glass Bottle Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at