444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America automated material handling (AMH) and storage systems market represents a transformative segment within the broader industrial automation landscape. This dynamic market encompasses sophisticated technologies designed to streamline warehouse operations, enhance inventory management, and optimize supply chain efficiency across diverse industries. Market growth is driven by increasing demand for operational efficiency, labor cost reduction, and the need to handle growing e-commerce volumes.

Technological advancement continues to reshape the AMH and storage systems landscape, with innovations in robotics, artificial intelligence, and Internet of Things (IoT) integration creating unprecedented opportunities for businesses to modernize their operations. The market demonstrates robust expansion potential, with analysts projecting a compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting strong adoption across manufacturing, retail, and distribution sectors.

Regional dynamics within North America show particularly strong growth in the United States, driven by e-commerce expansion and manufacturing reshoring initiatives. Canada’s market development follows similar trends, with increasing investments in warehouse automation and distribution center modernization. The market’s evolution reflects broader digital transformation trends, positioning AMH and storage systems as critical infrastructure for competitive advantage in modern supply chains.

The North America AMH and storage systems market refers to the comprehensive ecosystem of automated technologies, equipment, and solutions designed to handle, move, store, and retrieve materials within warehouses, distribution centers, and manufacturing facilities across the United States and Canada. This market encompasses a wide range of technologies including automated storage and retrieval systems (AS/RS), conveyor systems, robotic picking solutions, warehouse management software, and integrated material handling equipment.

Core components of AMH and storage systems include sophisticated hardware such as automated guided vehicles (AGVs), robotic arms, high-density storage solutions, and intelligent sorting systems. These technologies work in conjunction with advanced software platforms that orchestrate operations, optimize inventory placement, and coordinate material flow throughout facilities. The integration of these components creates comprehensive automation solutions that significantly enhance operational efficiency and accuracy.

Market scope extends beyond traditional warehousing to include applications in manufacturing, retail fulfillment, pharmaceutical distribution, automotive assembly, and food processing industries. The systems are designed to handle diverse material types, from small consumer goods to heavy industrial components, adapting to specific operational requirements and space constraints while delivering measurable improvements in throughput and cost efficiency.

Market momentum in the North America AMH and storage systems sector reflects a fundamental shift toward intelligent automation across industrial operations. The convergence of technological innovation, labor market challenges, and evolving customer expectations has created a compelling business case for automated material handling solutions. Organizations are increasingly recognizing that strategic investments in AMH technologies deliver competitive advantages through improved operational efficiency, reduced labor dependency, and enhanced customer service capabilities.

Key market drivers include the exponential growth of e-commerce, which has increased demand for rapid order fulfillment and accurate inventory management. Manufacturing sector recovery and reshoring initiatives have further accelerated adoption, with companies seeking to optimize domestic production capabilities. Labor shortages and rising wage costs have made automation investments more attractive, with many organizations reporting productivity improvements of 35-40% following AMH system implementation.

Technology evolution continues to expand market possibilities, with artificial intelligence and machine learning enabling predictive maintenance, dynamic optimization, and adaptive operations. Cloud-based platforms are democratizing access to sophisticated warehouse management capabilities, while modular system designs are making automation accessible to smaller operations. These developments are broadening the addressable market and creating new opportunities for solution providers and end-users alike.

Strategic insights reveal several critical trends shaping the North America AMH and storage systems market landscape:

E-commerce expansion stands as the primary catalyst driving AMH and storage systems adoption across North America. The sustained growth of online retail has created unprecedented demands for rapid, accurate order fulfillment, with consumers expecting same-day or next-day delivery. This has forced retailers and logistics providers to reimagine their distribution strategies, leading to significant investments in automated fulfillment technologies that can process high volumes of small, diverse orders efficiently.

Labor market challenges represent another fundamental driver, with persistent workforce shortages and rising labor costs making automation investments increasingly attractive. Many organizations report difficulty finding and retaining qualified warehouse workers, particularly in competitive labor markets. AMH systems address these challenges by reducing dependency on manual labor while improving working conditions for remaining employees through ergonomic improvements and elimination of repetitive tasks.

Operational efficiency demands continue to intensify as businesses face pressure to optimize costs while improving service levels. AMH and storage systems deliver measurable improvements in key performance indicators, including order accuracy rates exceeding 99.5%, significant reductions in order processing times, and improved inventory turnover. These operational benefits translate directly to improved profitability and customer satisfaction, creating compelling return on investment scenarios.

Technology maturation has made AMH solutions more reliable, cost-effective, and easier to implement than previous generations. Advances in robotics, sensors, and control systems have reduced technical risks while improving system capabilities. Additionally, the availability of cloud-based platforms and modular designs has lowered barriers to entry, making automation accessible to mid-market organizations that previously could not justify the investment.

Capital investment requirements remain a significant barrier for many organizations considering AMH and storage systems implementation. While technology costs have decreased, comprehensive automation projects still require substantial upfront investments that can strain capital budgets, particularly for smaller operations. The complexity of calculating return on investment and justifying expenditures to stakeholders can delay or prevent adoption decisions.

Integration complexity poses ongoing challenges for organizations with existing warehouse management systems and operational processes. Legacy infrastructure may require significant modifications or complete replacement to accommodate new AMH technologies, adding to project costs and implementation timelines. The need for specialized technical expertise during integration phases can further complicate deployment efforts and extend payback periods.

Change management resistance within organizations can slow adoption, particularly when workforce concerns about job displacement create internal opposition to automation initiatives. Successful AMH implementation requires comprehensive change management strategies, employee training programs, and clear communication about how automation will enhance rather than replace human capabilities. Organizations that fail to address these concerns may experience implementation difficulties and suboptimal system utilization.

Technology obsolescence risks concern decision-makers who worry about investing in systems that may become outdated as technology continues to evolve rapidly. The pace of innovation in robotics, artificial intelligence, and automation technologies creates uncertainty about optimal timing for investments and the longevity of current solutions. This concern can lead to delayed decision-making or preference for less advanced but more proven technologies.

Small and medium enterprise (SME) adoption represents a significant untapped opportunity within the North America AMH and storage systems market. As technology costs decline and modular solutions become more accessible, smaller operations are increasingly able to justify automation investments. Cloud-based platforms and subscription-based pricing models are making sophisticated warehouse management capabilities available to organizations that previously could not afford comprehensive AMH systems.

Vertical market expansion offers substantial growth potential as AMH technologies prove their value beyond traditional warehousing applications. Healthcare organizations are implementing automated pharmacy systems and medical supply management solutions, while food and beverage companies are adopting temperature-controlled automated storage systems. The automotive industry continues to expand AMH usage in assembly operations and parts distribution, creating specialized market segments with unique requirements.

Retrofit and modernization projects present significant opportunities as organizations with aging warehouse infrastructure seek to improve efficiency without complete facility replacement. Retrofitting existing facilities with modern AMH technologies can deliver substantial performance improvements at lower costs than new construction, making these projects attractive to cost-conscious organizations seeking competitive advantages.

Artificial intelligence integration is creating new possibilities for intelligent automation that can adapt to changing conditions, optimize operations in real-time, and predict maintenance requirements. Organizations that successfully integrate AI capabilities into their AMH systems can achieve superior performance and operational flexibility, creating competitive advantages that justify premium investments in advanced technologies.

Competitive dynamics within the North America AMH and storage systems market are intensifying as established players face challenges from innovative startups and technology companies entering the automation space. Traditional material handling equipment manufacturers are expanding their capabilities through acquisitions and partnerships, while software companies are developing comprehensive warehouse management platforms that integrate with diverse hardware solutions.

Technology convergence is reshaping market boundaries as robotics, artificial intelligence, and IoT technologies create new solution categories that transcend traditional product classifications. This convergence is enabling more comprehensive, integrated solutions while also creating opportunities for specialized providers to develop niche technologies that address specific operational challenges or industry requirements.

Customer expectations continue to evolve, with organizations demanding more flexible, scalable solutions that can adapt to changing business requirements. The shift toward omnichannel fulfillment strategies requires AMH systems capable of handling diverse order profiles and distribution channels efficiently. This has led to increased emphasis on system flexibility and the ability to reconfigure operations quickly in response to market changes.

Supply chain resilience has become a critical consideration following recent global disruptions, with organizations recognizing the importance of automated systems in maintaining operational continuity. AMH technologies that enhance supply chain visibility, reduce dependency on manual processes, and enable rapid response to disruptions are increasingly valued as strategic investments rather than operational improvements.

Comprehensive market analysis for the North America AMH and storage systems market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and completeness. The methodology incorporates quantitative analysis of market trends, technology adoption rates, and competitive positioning alongside qualitative insights from industry experts, solution providers, and end-user organizations.

Primary research activities include structured interviews with key stakeholders across the value chain, from technology vendors and system integrators to end-user organizations implementing AMH solutions. Survey data collection focuses on adoption drivers, implementation challenges, performance outcomes, and future investment plans. Industry expert consultations provide insights into technology trends, regulatory developments, and market evolution patterns.

Secondary research encompasses analysis of industry publications, company financial reports, patent filings, and regulatory documents to understand market dynamics and competitive landscapes. Technology trend analysis examines emerging innovations and their potential market impact, while economic analysis considers broader factors influencing automation adoption decisions and investment patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of survey responses, and expert review of findings. Market sizing and forecasting models incorporate historical trends, current adoption patterns, and projected technology developments to provide reliable market projections and growth estimates for strategic planning purposes.

United States market dominance is evident in the North America AMH and storage systems landscape, with the country accounting for approximately 85% of regional market activity. The U.S. market benefits from a large manufacturing base, extensive e-commerce infrastructure, and significant investment in supply chain modernization. Key growth regions include the Midwest manufacturing corridor, West Coast technology hubs, and Southeast distribution centers serving national retail networks.

California and Texas lead state-level adoption, driven by large-scale distribution operations supporting major population centers and international trade activities. The presence of technology companies and innovative manufacturers in these states creates demand for advanced AMH solutions and drives technology development. Additionally, labor market pressures in these high-cost regions make automation investments particularly attractive for maintaining competitive operations.

Canadian market development represents approximately 15% of regional activity, with growth concentrated in Ontario and Quebec provinces where manufacturing and distribution activities are most prevalent. Canadian adoption patterns closely follow U.S. trends, with particular strength in automotive, food processing, and retail sectors. Cross-border trade relationships and supply chain integration drive demand for compatible AMH technologies that can support seamless operations.

Regional growth patterns show increasing adoption in secondary markets as technology costs decline and smaller operations recognize automation benefits. According to MarkWide Research analysis, mid-sized metropolitan areas are experiencing accelerated AMH adoption as organizations seek competitive advantages in regional markets. This geographic expansion is broadening the addressable market and creating opportunities for solution providers to serve diverse customer segments.

Market leadership in the North America AMH and storage systems sector is characterized by a diverse ecosystem of established industrial automation companies, specialized material handling providers, and innovative technology startups. The competitive landscape reflects the market’s evolution from traditional mechanical systems to intelligent, software-driven solutions that integrate multiple technologies.

Key market participants include:

Competitive differentiation increasingly centers on software capabilities, system integration expertise, and ability to deliver comprehensive solutions that address specific industry requirements. Companies are investing heavily in artificial intelligence, machine learning, and cloud-based platforms to enhance their solution capabilities and create sustainable competitive advantages in an evolving market landscape.

Technology-based segmentation reveals distinct market categories within the North America AMH and storage systems landscape:

By System Type:

By Application Sector:

By Organization Size:

Automated Storage and Retrieval Systems represent the largest market category, driven by demand for high-density storage solutions that maximize facility utilization while improving inventory accuracy. Modern AS/RS implementations incorporate advanced software algorithms that optimize storage locations based on product velocity, seasonal patterns, and order profiles. These systems deliver inventory accuracy rates exceeding 99.8% while reducing labor requirements and improving safety conditions.

Robotic systems adoption is accelerating rapidly as technology costs decline and capabilities expand. Collaborative robots (cobots) are particularly popular in applications where human-robot interaction is required, while autonomous mobile robots (AMRs) are replacing traditional AGVs in many applications due to their flexibility and ease of deployment. The integration of artificial intelligence enables these systems to adapt to changing conditions and optimize performance continuously.

Conveyor systems remain fundamental infrastructure in most AMH implementations, with modern solutions incorporating smart sensors, variable speed controls, and predictive maintenance capabilities. Modular conveyor designs enable rapid reconfiguration to accommodate changing operational requirements, while energy-efficient motors and controls reduce operational costs and environmental impact.

Software platforms are increasingly recognized as critical differentiators, with warehouse management systems (WMS) and warehouse control systems (WCS) providing the intelligence that coordinates AMH operations. Cloud-based platforms are democratizing access to sophisticated optimization algorithms and analytics capabilities, enabling smaller operations to benefit from enterprise-level functionality.

Operational efficiency improvements represent the most immediate and measurable benefits for organizations implementing AMH and storage systems. Companies typically experience significant reductions in order processing times, with many reporting throughput improvements of 40-60% following system implementation. These efficiency gains translate directly to improved customer service levels and reduced operational costs, creating sustainable competitive advantages.

Labor optimization benefits extend beyond simple workforce reduction to include improved working conditions, enhanced safety, and better utilization of human capabilities. AMH systems eliminate repetitive, physically demanding tasks while creating opportunities for workers to focus on higher-value activities such as quality control, system monitoring, and customer service. This transformation often results in improved employee satisfaction and retention rates.

Inventory management improvements deliver substantial value through enhanced accuracy, reduced carrying costs, and improved space utilization. Automated systems provide real-time visibility into inventory levels and locations, enabling better demand planning and reducing stockouts. The precision of automated systems also minimizes inventory shrinkage and improves compliance with regulatory requirements in industries such as pharmaceuticals and food processing.

Scalability advantages enable organizations to adapt quickly to changing market conditions and growth opportunities. Modular AMH systems can be expanded or reconfigured to accommodate seasonal fluctuations, new product lines, or changing operational requirements without major disruptions. This flexibility is particularly valuable in dynamic markets where agility and responsiveness are critical success factors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming AMH and storage systems from reactive to predictive and adaptive solutions. AI-powered systems can optimize warehouse layouts, predict maintenance requirements, and adjust operations in real-time based on changing conditions. Machine learning algorithms analyze historical data to improve picking routes, inventory placement, and resource allocation, delivering continuous performance improvements that compound over time.

Cloud-based platforms are democratizing access to sophisticated warehouse management capabilities, enabling smaller organizations to benefit from enterprise-level functionality without major infrastructure investments. Software-as-a-Service models provide scalable solutions that can grow with business requirements while reducing IT overhead and maintenance responsibilities. This trend is expanding the addressable market and creating new business models for solution providers.

Collaborative robotics represents a significant shift toward human-robot collaboration rather than replacement, addressing workforce concerns while maximizing the benefits of automation. Cobots work alongside human workers in shared spaces, handling repetitive tasks while humans focus on complex decision-making and quality control activities. This approach often provides faster return on investment and easier implementation compared to fully automated solutions.

Sustainability initiatives are driving demand for energy-efficient AMH systems and space optimization solutions that reduce environmental impact. Organizations are increasingly considering lifecycle environmental costs in their automation decisions, favoring solutions that minimize energy consumption, reduce waste, and optimize facility utilization. This trend is influencing system design and creating opportunities for providers that prioritize sustainability.

Strategic acquisitions continue to reshape the competitive landscape as established players seek to expand their capabilities and market reach. Recent transactions have focused on acquiring AI and robotics technologies, software platforms, and specialized vertical market expertise. These consolidation activities are creating more comprehensive solution providers while also opening opportunities for innovative startups to develop niche technologies.

Technology partnerships between traditional material handling companies and technology firms are accelerating innovation and solution development. Collaborations between hardware manufacturers and software companies are creating integrated platforms that deliver superior performance and user experience. These partnerships enable faster time-to-market for new solutions while leveraging complementary expertise and resources.

Vertical market specialization is increasing as solution providers recognize the unique requirements of different industries. Healthcare automation, cold storage solutions, and hazardous material handling represent growing specialization areas where generic solutions are insufficient. This trend is creating opportunities for focused providers while also driving innovation in specialized technologies and applications.

Regulatory developments in areas such as workplace safety, environmental protection, and data security are influencing system design and implementation requirements. New safety standards for human-robot interaction, cybersecurity requirements for connected systems, and environmental regulations are shaping product development priorities and creating compliance-driven demand for system upgrades and replacements.

Strategic investment timing recommendations emphasize the importance of aligning AMH implementations with business growth cycles and operational requirements. Organizations should consider automation investments during periods of stable operations when implementation disruptions can be minimized and benefits can be fully realized. MWR analysis suggests that companies achieving the best results typically plan implementations during off-peak seasons and allow adequate time for employee training and system optimization.

Technology selection criteria should prioritize flexibility, scalability, and integration capabilities over purely technical specifications. Organizations should evaluate solutions based on their ability to adapt to changing requirements, integrate with existing systems, and support future growth. The rapid pace of technological change makes it essential to select platforms that can evolve and incorporate new capabilities without major system replacements.

Implementation best practices emphasize the critical importance of comprehensive change management and employee engagement throughout the automation process. Successful implementations typically involve extensive stakeholder consultation, clear communication about benefits and impacts, and comprehensive training programs. Organizations should also plan for iterative optimization and continuous improvement rather than expecting immediate perfect performance.

Vendor selection strategies should focus on long-term partnership potential rather than purely transactional relationships. The complexity of AMH systems and the ongoing need for support, maintenance, and upgrades make vendor stability and expertise critical success factors. Organizations should evaluate providers based on their industry experience, technical capabilities, and commitment to ongoing innovation and support.

Market evolution over the next decade will be characterized by increasing intelligence, flexibility, and accessibility of AMH and storage systems. Artificial intelligence and machine learning will become standard features rather than premium options, enabling systems that can adapt automatically to changing conditions and optimize performance continuously. This evolution will make automation more attractive to a broader range of organizations and applications.

Technology convergence will continue to blur traditional product boundaries as robotics, AI, IoT, and cloud computing integrate into comprehensive automation platforms. Future systems will be characterized by seamless integration between hardware and software components, with cloud-based intelligence coordinating operations across multiple facilities and supply chain partners. This integration will enable new business models and service offerings that transcend traditional equipment sales.

Market accessibility will expand significantly as technology costs continue to decline and modular, scalable solutions become more prevalent. Small and medium-sized organizations will increasingly adopt AMH technologies, driven by competitive pressures and the availability of affordable, easy-to-implement solutions. This democratization of automation will expand the total addressable market and create opportunities for new business models and service providers.

Sustainability integration will become a fundamental requirement rather than an optional feature, with environmental considerations influencing every aspect of system design and operation. Future AMH systems will be designed for energy efficiency, recyclability, and minimal environmental impact throughout their lifecycle. Organizations will increasingly view sustainability as a competitive advantage and regulatory compliance requirement, driving demand for environmentally responsible automation solutions.

The North America AMH and storage systems market stands at a pivotal point in its evolution, driven by converging forces of technological advancement, operational necessity, and competitive pressure. The market’s robust growth trajectory reflects fundamental changes in how organizations approach material handling and warehouse operations, with automation transitioning from optional efficiency improvement to essential competitive infrastructure.

Market dynamics indicate sustained growth potential as e-commerce expansion, labor market challenges, and operational efficiency demands continue to drive adoption across diverse industries and organization sizes. The increasing accessibility of advanced technologies through cloud-based platforms and modular solutions is democratizing automation benefits and expanding the addressable market significantly.

Future success in this market will depend on solution providers’ ability to deliver flexible, intelligent systems that can adapt to evolving requirements while providing measurable value to end-users. Organizations that strategically invest in AMH technologies while addressing change management and integration challenges will be best positioned to capitalize on the competitive advantages that automation provides in an increasingly dynamic business environment.

What is AMH and Storage Systems?

AMH and Storage Systems refer to automated material handling solutions and storage technologies that enhance efficiency in logistics and warehousing. These systems include robotics, conveyor systems, and automated storage and retrieval systems, which are essential for optimizing supply chain operations.

What are the key players in the NA AMH and Storage Systems Market?

Key players in the NA AMH and Storage Systems Market include companies like Dematic, Swisslog, and Honeywell Intelligrated. These companies are known for their innovative solutions in automation and storage technologies, among others.

What are the growth factors driving the NA AMH and Storage Systems Market?

The growth of the NA AMH and Storage Systems Market is driven by the increasing demand for automation in warehouses, the rise of e-commerce, and the need for efficient inventory management. Additionally, advancements in technology and the focus on reducing operational costs contribute to market expansion.

What challenges does the NA AMH and Storage Systems Market face?

The NA AMH and Storage Systems Market faces challenges such as high initial investment costs and the complexity of integrating new systems with existing infrastructure. Additionally, the rapid pace of technological change can make it difficult for companies to keep up.

What opportunities exist in the NA AMH and Storage Systems Market?

Opportunities in the NA AMH and Storage Systems Market include the growing trend of smart warehouses and the adoption of IoT technologies. Furthermore, the increasing focus on sustainability and energy-efficient solutions presents new avenues for innovation.

What trends are shaping the NA AMH and Storage Systems Market?

Trends shaping the NA AMH and Storage Systems Market include the rise of artificial intelligence in automation, the integration of robotics for improved efficiency, and the shift towards modular and scalable storage solutions. These trends are transforming how businesses manage their supply chains.

NA AMH and Storage Systems Market

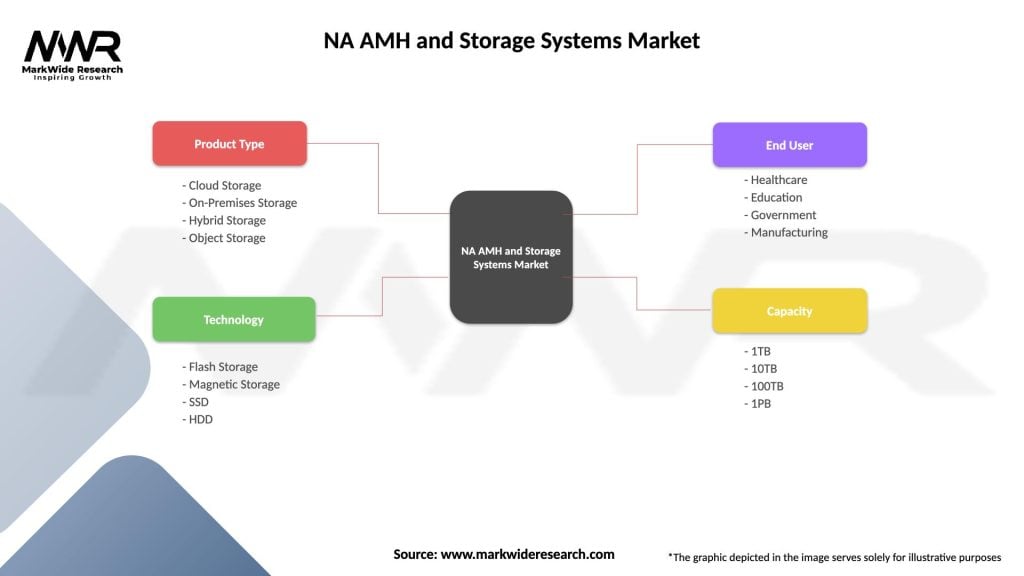

| Segmentation Details | Description |

|---|---|

| Product Type | Cloud Storage, On-Premises Storage, Hybrid Storage, Object Storage |

| Technology | Flash Storage, Magnetic Storage, SSD, HDD |

| End User | Healthcare, Education, Government, Manufacturing |

| Capacity | 1TB, 10TB, 100TB, 1PB |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA AMH and Storage Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at