444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America alcoholic drinks packaging market represents a dynamic and rapidly evolving sector that encompasses the comprehensive packaging solutions for beer, wine, spirits, and other alcoholic beverages across the United States, Canada, and Mexico. This market has experienced substantial transformation driven by changing consumer preferences, sustainability initiatives, and technological advancements in packaging materials and design. The industry is witnessing a significant shift toward premium packaging solutions that enhance brand differentiation while meeting stringent regulatory requirements and environmental standards.

Market dynamics indicate robust growth potential, with the sector expanding at a compound annual growth rate (CAGR) of 4.2% through the forecast period. This growth trajectory reflects increasing demand for innovative packaging formats, sustainable materials, and enhanced consumer convenience features. The market encompasses various packaging types including glass bottles, aluminum cans, plastic containers, flexible pouches, and specialty packaging solutions designed specifically for alcoholic beverage applications.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 15% market share, and Mexico contributing the remaining 7% market share. The dominance of the US market stems from its large consumer base, diverse alcoholic beverage portfolio, and advanced packaging infrastructure that supports both domestic production and international imports.

The North America alcoholic drinks packaging market refers to the comprehensive ecosystem of packaging materials, technologies, and solutions specifically designed for containing, protecting, and presenting alcoholic beverages including beer, wine, spirits, ciders, and ready-to-drink cocktails across the North American region, encompassing primary, secondary, and tertiary packaging applications.

Primary packaging includes direct product contact materials such as glass bottles, aluminum cans, plastic bottles, and flexible pouches that maintain product integrity and safety. Secondary packaging encompasses outer containers like cardboard boxes, shrink wrap, and multipacks that facilitate handling and retail presentation. Tertiary packaging involves bulk packaging solutions for transportation and distribution including pallets, stretch films, and protective materials.

The market definition extends beyond traditional packaging to include smart packaging technologies, sustainable materials, premium finishing options, and specialized closure systems. This comprehensive approach addresses the unique requirements of alcoholic beverages including light protection, oxygen barrier properties, tamper evidence, and regulatory compliance while supporting brand marketing objectives and consumer convenience.

Strategic market analysis reveals the North America alcoholic drinks packaging market is experiencing unprecedented growth driven by premiumization trends, sustainability mandates, and technological innovation. The sector demonstrates remarkable resilience with consistent expansion across all major packaging categories, supported by robust demand from craft breweries, premium wine producers, and artisanal spirits manufacturers.

Key growth drivers include the rising popularity of craft alcoholic beverages, increasing consumer preference for sustainable packaging options, and growing demand for convenient packaging formats. The market benefits from technological advancement adoption rates of 68% among major packaging manufacturers, indicating strong industry commitment to innovation and modernization.

The competitive landscape features established packaging giants alongside specialized suppliers, creating a dynamic environment that fosters innovation and competitive pricing. Market consolidation trends show increasing collaboration between packaging manufacturers and alcoholic beverage producers to develop customized solutions that meet specific brand requirements and regulatory standards.

Future projections indicate sustained growth momentum with particular strength in sustainable packaging solutions, premium glass packaging, and innovative aluminum can formats. The market is positioned for continued expansion supported by favorable demographic trends, evolving consumer preferences, and ongoing technological advancement in packaging materials and manufacturing processes.

Comprehensive market analysis reveals several critical insights that shape the North America alcoholic drinks packaging landscape:

Primary growth catalysts propelling the North America alcoholic drinks packaging market include several interconnected factors that create sustained demand momentum. The craft beverage revolution represents the most significant driver, with craft breweries, boutique wineries, and artisanal distilleries requiring specialized packaging solutions that reflect their premium positioning and unique brand identities.

Consumer lifestyle evolution drives demand for convenient packaging formats including single-serve containers, portable options, and resealable packages that accommodate modern consumption patterns. The growing popularity of outdoor activities, social gatherings, and on-the-go consumption creates opportunities for innovative packaging solutions that enhance portability and user experience.

Sustainability imperatives increasingly influence purchasing decisions, with consumers actively seeking environmentally responsible packaging options. This trend drives investment in recyclable materials, lightweight designs, and renewable packaging alternatives that reduce environmental impact while maintaining product quality and safety standards.

Regulatory compliance requirements create consistent demand for packaging solutions that meet evolving safety, labeling, and traceability standards. Enhanced regulations regarding product authentication, age verification, and health warnings necessitate sophisticated packaging designs that incorporate compliance features without compromising aesthetic appeal.

E-commerce expansion generates demand for packaging solutions optimized for direct-to-consumer shipping, requiring enhanced protection, tamper evidence, and unboxing experience features that support online alcoholic beverage sales channels.

Significant challenges facing the North America alcoholic drinks packaging market include regulatory complexity, material cost volatility, and sustainability transition costs. Regulatory compliance burden creates substantial operational overhead as packaging manufacturers must navigate varying state and federal requirements while maintaining consistency across diverse jurisdictions.

Raw material price fluctuations impact profitability and planning capabilities, particularly for glass, aluminum, and specialized plastic materials used in alcoholic beverage packaging. These cost variations create challenges for long-term contract negotiations and pricing stability, affecting both manufacturers and their customers.

Environmental transition costs associated with adopting sustainable packaging materials and processes require significant capital investment. Many companies face challenges balancing environmental responsibility with cost management while maintaining product quality and performance standards.

Supply chain disruptions periodically affect material availability and production schedules, creating operational challenges and potential customer service issues. The complexity of global supply chains for specialized packaging materials increases vulnerability to external disruptions and logistical challenges.

Technology adoption barriers include high implementation costs for advanced packaging technologies and the need for specialized expertise to operate sophisticated equipment. Smaller packaging companies may struggle to compete with larger organizations that can more easily absorb technology investment costs.

Emerging opportunities in the North America alcoholic drinks packaging market present substantial growth potential across multiple dimensions. The sustainable packaging revolution creates opportunities for companies developing innovative biodegradable materials, recyclable designs, and circular economy solutions that address environmental concerns while maintaining product integrity.

Smart packaging technologies offer significant growth potential through integration of digital features, authentication systems, and consumer engagement tools. These technologies enable brands to create interactive experiences, combat counterfeiting, and gather valuable consumer data while enhancing product appeal and functionality.

Premium packaging segment expansion provides opportunities for specialized manufacturers focusing on luxury materials, custom designs, and artisanal finishing techniques. The growing demand for premium alcoholic beverages creates corresponding demand for sophisticated packaging solutions that justify higher price points.

Regional market development in underserved areas presents expansion opportunities, particularly in emerging craft beverage markets and regions experiencing economic growth. Strategic geographic expansion can capture new customer bases and diversify revenue streams.

Partnership opportunities with alcoholic beverage producers enable packaging companies to develop customized solutions, secure long-term contracts, and participate in product innovation processes. These collaborative relationships create competitive advantages and market differentiation opportunities.

Complex market dynamics shape the North America alcoholic drinks packaging landscape through interconnected forces that influence supply, demand, and competitive positioning. Consumer behavior evolution drives continuous adaptation in packaging design, materials, and functionality to meet changing preferences and lifestyle requirements.

Competitive intensity among packaging suppliers creates downward pressure on pricing while simultaneously driving innovation and service enhancement. This dynamic environment rewards companies that can effectively balance cost management with technological advancement and customer service excellence.

Regulatory evolution continuously reshapes market requirements, creating both challenges and opportunities for packaging manufacturers. Companies that proactively address regulatory changes often gain competitive advantages through early compliance and enhanced customer relationships.

Supply chain dynamics influence market stability and growth potential, with successful companies developing resilient supplier networks and flexible production capabilities. The ability to manage supply chain complexity while maintaining quality and cost competitiveness becomes increasingly important for market success.

Technology integration pace varies across market segments, creating opportunities for early adopters while challenging traditional approaches. Companies must balance innovation investment with proven technologies to optimize market positioning and customer satisfaction.

Comprehensive research methodology employed for analyzing the North America alcoholic drinks packaging market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research activities include extensive interviews with industry executives, packaging manufacturers, alcoholic beverage producers, and supply chain professionals to gather firsthand insights and market intelligence.

Secondary research components encompass analysis of industry reports, regulatory filings, company financial statements, and trade association publications to establish market baselines and identify trends. This approach provides comprehensive coverage of market dynamics, competitive positioning, and growth drivers across all major market segments.

Quantitative analysis methods include statistical modeling, trend analysis, and market sizing calculations based on production data, consumption patterns, and industry benchmarks. These analytical techniques ensure robust data foundation for market projections and strategic recommendations.

Qualitative assessment procedures involve expert interviews, focus group discussions, and industry observation to understand market nuances, consumer preferences, and emerging trends that quantitative data alone cannot capture. This balanced approach provides comprehensive market understanding and actionable insights.

Data validation processes include cross-referencing multiple sources, expert review, and statistical verification to ensure accuracy and reliability of all market findings and projections presented in this analysis.

United States market dominance reflects the country’s large consumer base, diverse alcoholic beverage industry, and advanced packaging infrastructure. The US market benefits from strong craft brewing sectors, established wine regions, and growing spirits consumption, creating robust demand for innovative packaging solutions across all beverage categories.

California and Texas lead regional demand due to their large populations, active craft beverage scenes, and significant alcoholic beverage production facilities. These states drive innovation in sustainable packaging and premium design solutions that influence national market trends and standards.

Canadian market characteristics include strong environmental consciousness, premium product preferences, and regulatory emphasis on sustainability. The Canadian market demonstrates higher adoption rates of 73% for sustainable packaging solutions compared to the overall North American average, reflecting consumer values and government initiatives.

Mexico’s emerging market potential stems from growing middle-class consumption, increasing craft beverage production, and expanding retail infrastructure. The Mexican market shows particular strength in beer packaging and growing interest in premium wine and spirits packaging solutions.

Cross-border trade dynamics influence packaging standardization and regulatory compliance requirements, creating opportunities for companies that can navigate multiple regulatory environments while maintaining operational efficiency and cost competitiveness across the region.

Market leadership in the North America alcoholic drinks packaging sector features a diverse mix of global corporations, regional specialists, and innovative technology companies. The competitive environment encourages continuous innovation while maintaining focus on cost efficiency and customer service excellence.

Competitive strategies focus on technological innovation, sustainability leadership, and customer partnership development. Successful companies invest heavily in research and development while building strong relationships with alcoholic beverage producers to understand evolving market requirements and preferences.

Market segmentation analysis reveals distinct categories based on packaging type, material composition, beverage application, and end-user requirements. This segmentation approach enables targeted strategy development and market opportunity identification across diverse customer needs and preferences.

By Packaging Type:

By Material Type:

By Beverage Application:

Glass packaging category maintains market leadership due to its premium perception, excellent barrier properties, and recyclability advantages. This segment demonstrates particular strength in wine and premium spirits applications where product quality and brand image considerations outweigh cost concerns. Innovation trends include lightweight designs, unique shapes, and advanced surface treatments that enhance visual appeal while reducing environmental impact.

Aluminum packaging segment shows robust growth driven by beer market expansion and sustainability benefits. The category benefits from excellent recyclability, lightweight properties, and superior printing capabilities that enable vibrant brand graphics and consumer engagement features. Market penetration rates of 85% in the beer segment reflect strong consumer acceptance and operational advantages.

Plastic packaging applications focus on specific use cases where weight, safety, and cost advantages provide competitive benefits. This category serves niche markets including outdoor events, transportation-sensitive applications, and value-oriented product segments while addressing sustainability concerns through recycled content and biodegradable alternatives.

Sustainable packaging solutions represent the fastest-growing category, driven by environmental consciousness and regulatory requirements. This segment includes recycled materials, biodegradable options, and circular economy approaches that reduce environmental impact while maintaining product quality and performance standards.

Smart packaging technologies emerge as a premium category offering enhanced functionality through digital integration, authentication features, and consumer engagement capabilities. These solutions command premium pricing while providing brands with differentiation opportunities and valuable consumer data collection capabilities.

Packaging manufacturers benefit from sustained demand growth, technological advancement opportunities, and market expansion potential across diverse alcoholic beverage segments. The market provides stable revenue streams while offering innovation-driven growth opportunities that reward research and development investment and customer partnership development.

Alcoholic beverage producers gain access to sophisticated packaging solutions that enhance product quality, brand differentiation, and market positioning. Advanced packaging technologies enable premium pricing strategies while sustainable options address environmental responsibility requirements and consumer preferences.

Retail partners benefit from packaging innovations that improve shelf appeal, reduce handling costs, and enhance consumer convenience. Effective packaging solutions drive sales velocity while reducing inventory management complexity and product loss due to damage or deterioration.

Consumers enjoy enhanced product quality, improved convenience features, and sustainable packaging options that align with environmental values. Advanced packaging technologies provide authentication assurance, freshness protection, and engaging brand experiences that enhance overall product satisfaction.

Environmental stakeholders benefit from industry commitment to sustainable packaging development, recycling program expansion, and circular economy initiatives that reduce environmental impact while maintaining product quality and safety standards.

Regulatory authorities gain industry cooperation in compliance initiatives, safety standard implementation, and consumer protection measures through collaborative packaging development that addresses regulatory requirements while supporting market growth objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the North America alcoholic drinks packaging market. Companies increasingly adopt circular economy principles, invest in recyclable materials, and develop biodegradable alternatives that address environmental concerns while maintaining product quality and performance standards.

Premiumization movement drives demand for sophisticated packaging solutions that justify higher price points and enhance brand positioning. This trend includes luxury materials, custom designs, artisanal finishing techniques, and unique packaging formats that create memorable consumer experiences and support premium pricing strategies.

Digital integration advancement incorporates smart technologies including QR codes, NFC tags, augmented reality features, and blockchain authentication systems that enhance consumer engagement while providing brands with valuable data collection and anti-counterfeiting capabilities.

Convenience optimization focuses on packaging formats that accommodate modern lifestyle requirements including portability, resealability, easy opening features, and portion control options that appeal to diverse consumption occasions and demographic preferences.

Customization expansion enables brands to create unique packaging solutions that reflect their identity and target market preferences. This trend includes limited edition designs, seasonal variations, and personalization options that enhance brand loyalty and market differentiation.

Supply chain localization reduces transportation costs and environmental impact while improving supply security and customer service responsiveness. This trend supports regional economic development while addressing sustainability objectives and operational efficiency requirements.

Recent industry developments demonstrate the dynamic nature of the North America alcoholic drinks packaging market and highlight key trends shaping future growth. MarkWide Research analysis indicates accelerating innovation across multiple packaging categories and increasing collaboration between packaging manufacturers and alcoholic beverage producers.

Sustainable material innovations include development of plant-based plastics, recycled glass formulations, and biodegradable packaging alternatives that address environmental concerns while maintaining product protection and shelf appeal. These developments reflect industry commitment to environmental responsibility and regulatory compliance.

Technology integration projects encompass smart packaging implementations, digital printing advancements, and automation improvements that enhance production efficiency while enabling customization and premium features. These technological developments support market differentiation and operational optimization objectives.

Strategic partnerships between packaging companies and beverage producers create collaborative innovation opportunities, secure long-term supply relationships, and enable customized solution development that addresses specific market requirements and brand positioning objectives.

Regulatory compliance initiatives include proactive adaptation to evolving safety standards, environmental regulations, and labeling requirements that demonstrate industry leadership in consumer protection and environmental stewardship while maintaining competitive market positioning.

Market expansion activities encompass geographic growth, new product category development, and acquisition strategies that strengthen market position while diversifying revenue streams and customer bases across the North American region.

Strategic recommendations for North America alcoholic drinks packaging market participants emphasize sustainability leadership, technology adoption, and customer partnership development as key success factors. Companies should prioritize environmental responsibility initiatives while maintaining focus on cost competitiveness and operational efficiency.

Investment priorities should focus on sustainable packaging technologies, digital integration capabilities, and production automation that enhance competitiveness while addressing evolving market requirements. Strategic technology investments enable long-term market positioning and customer satisfaction improvements.

Partnership development with alcoholic beverage producers creates opportunities for customized solution development, long-term contract security, and collaborative innovation that benefits both packaging suppliers and their customers. These relationships provide competitive advantages and market differentiation opportunities.

Market expansion strategies should consider geographic diversification, new product category development, and acquisition opportunities that strengthen market position while managing risk through portfolio diversification and customer base expansion across different market segments.

Regulatory compliance preparation requires proactive monitoring of evolving requirements and early adoption of compliance measures that demonstrate industry leadership while avoiding costly reactive adaptations. This approach builds customer confidence and regulatory relationships that support long-term market success.

Innovation investment in sustainable materials, smart technologies, and premium packaging solutions positions companies for future growth while addressing current market trends and customer preferences that drive purchasing decisions and brand loyalty.

Long-term market projections indicate sustained growth momentum for the North America alcoholic drinks packaging market, driven by demographic trends, lifestyle evolution, and continued innovation in packaging materials and technologies. MWR analysis suggests the market will maintain robust expansion through the forecast period, supported by favorable industry dynamics and consumer preferences.

Growth trajectory expectations point to accelerating demand for sustainable packaging solutions, with environmental packaging adoption rates projected to reach 80% by the end of the forecast period. This trend reflects increasing environmental consciousness and regulatory requirements that favor eco-friendly packaging alternatives.

Technology integration advancement will continue driving market evolution, with smart packaging features becoming standard rather than premium options. Digital integration capabilities will enhance consumer engagement while providing brands with valuable data collection and authentication capabilities that support marketing and security objectives.

Market consolidation trends may accelerate as companies seek scale advantages and technology capabilities through strategic acquisitions and partnerships. This consolidation will likely favor companies with strong sustainability credentials, technological capabilities, and established customer relationships.

Regional market development will continue supporting overall growth, with particular strength expected in emerging craft beverage markets and areas experiencing economic expansion. Geographic diversification will provide growth opportunities while reducing market concentration risks.

Innovation pipeline developments in materials science, manufacturing technology, and design capabilities will create new market opportunities while addressing evolving customer requirements and regulatory standards that shape industry direction and competitive dynamics.

Comprehensive analysis of the North America alcoholic drinks packaging market reveals a dynamic and resilient industry positioned for sustained growth through technological innovation, sustainability leadership, and customer-focused solution development. The market demonstrates strong fundamentals supported by diverse demand drivers, established infrastructure, and continuous adaptation to evolving consumer preferences and regulatory requirements.

Key success factors for market participants include environmental responsibility, technology adoption, customer partnership development, and operational efficiency optimization. Companies that effectively balance these priorities while maintaining focus on quality and cost competitiveness will capture the greatest market opportunities and achieve sustainable competitive advantages.

The North America alcoholic drinks packaging market represents a compelling growth opportunity for stakeholders across the value chain, from packaging manufacturers and beverage producers to retail partners and consumers. Continued innovation, sustainability commitment, and market expansion initiatives will drive long-term success while addressing evolving industry challenges and opportunities in this dynamic market environment.

What is Alcoholic Drinks Packaging?

Alcoholic Drinks Packaging refers to the materials and methods used to contain and protect alcoholic beverages, including bottles, cans, and cartons. This packaging plays a crucial role in preserving product quality, ensuring safety, and enhancing consumer appeal.

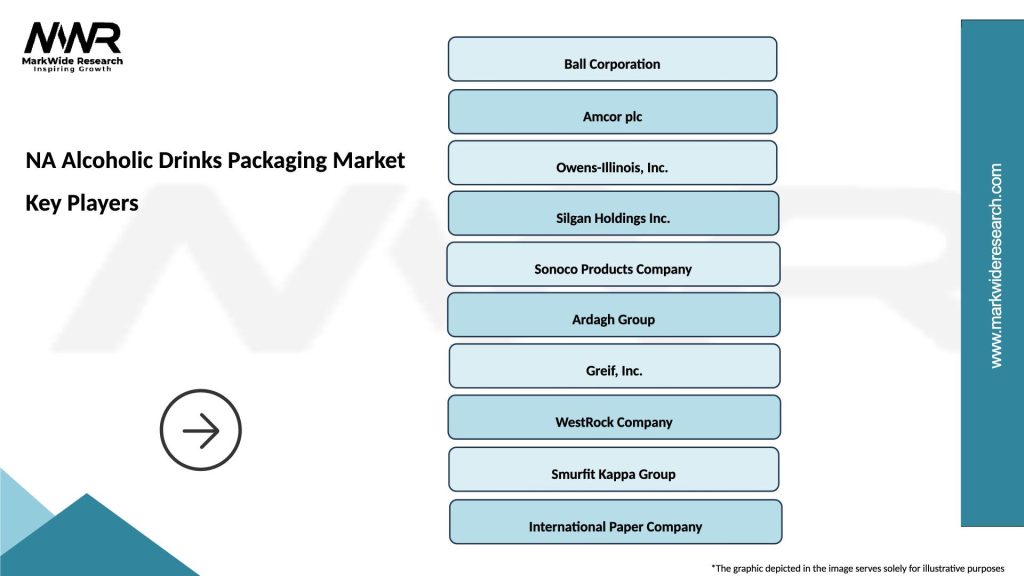

What are the key players in the NA Alcoholic Drinks Packaging Market?

Key players in the NA Alcoholic Drinks Packaging Market include Amcor, Ball Corporation, and Crown Holdings, among others. These companies are known for their innovative packaging solutions and commitment to sustainability in the beverage industry.

What are the growth factors driving the NA Alcoholic Drinks Packaging Market?

The NA Alcoholic Drinks Packaging Market is driven by increasing consumer demand for convenience and ready-to-drink products. Additionally, the rise in craft breweries and premium alcoholic beverages is contributing to the growth of innovative packaging solutions.

What challenges does the NA Alcoholic Drinks Packaging Market face?

Challenges in the NA Alcoholic Drinks Packaging Market include regulatory compliance regarding materials and recycling, as well as competition from alternative packaging solutions. Additionally, fluctuating raw material prices can impact production costs.

What opportunities exist in the NA Alcoholic Drinks Packaging Market?

Opportunities in the NA Alcoholic Drinks Packaging Market include the growing trend of eco-friendly packaging and the increasing popularity of e-commerce for beverage sales. Companies are also exploring smart packaging technologies to enhance consumer engagement.

What trends are shaping the NA Alcoholic Drinks Packaging Market?

Trends in the NA Alcoholic Drinks Packaging Market include a shift towards sustainable materials, such as biodegradable and recyclable options. Additionally, there is a rising interest in unique and eye-catching designs that attract consumers in a competitive market.

NA Alcoholic Drinks Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Cans, Kegs, Pouches |

| Material | Glass, Aluminum, Plastic, Cardboard |

| Closure Type | Crown Caps, Screw Caps, Corks, Snap-On Lids |

| Labeling Technology | Digital Printing, Flexographic Printing, Screen Printing, Embossing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Alcoholic Drinks Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at