444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America 8-bit microcontroller market represents a fundamental segment of the semiconductor industry, driving innovation across diverse applications from consumer electronics to industrial automation. These compact yet powerful processing units continue to demonstrate remarkable resilience and growth potential despite the emergence of more advanced microcontroller architectures. Market dynamics indicate sustained demand driven by cost-effectiveness, power efficiency, and simplified programming requirements that make 8-bit microcontrollers ideal for numerous embedded applications.

Regional market trends show North America maintaining its position as a leading consumer and developer of 8-bit microcontroller technologies. The market experiences consistent growth at approximately 6.2% CAGR, supported by robust demand from automotive electronics, home appliances, and Internet of Things (IoT) applications. Technology adoption patterns reveal increasing integration of advanced features while maintaining the simplicity and cost advantages that define 8-bit architectures.

Industry stakeholders recognize the continued relevance of 8-bit microcontrollers in applications where processing requirements remain moderate but reliability, cost-effectiveness, and power efficiency are paramount. The North American market benefits from strong manufacturing capabilities, established supply chains, and significant research and development investments from major semiconductor companies.

The North America 8-bit microcontroller market refers to the regional segment encompassing the design, manufacturing, distribution, and application of 8-bit microcontroller units across the United States, Canada, and Mexico. These microcontrollers feature 8-bit data processing capabilities, making them suitable for applications requiring basic computational functions while maintaining low power consumption and cost-effective implementation.

8-bit microcontrollers represent single-chip computing solutions that integrate a central processing unit, memory, and input/output peripherals on a single integrated circuit. They process data in 8-bit chunks, providing sufficient computational power for numerous embedded applications while offering advantages in terms of simplicity, power efficiency, and cost-effectiveness compared to higher-bit architectures.

Market scope encompasses various microcontroller families, including popular architectures from leading manufacturers, along with specialized variants designed for specific applications. The definition extends to supporting ecosystems including development tools, programming environments, and application-specific integrated solutions that facilitate widespread adoption across diverse industries.

Strategic market analysis reveals the North America 8-bit microcontroller market maintaining strong momentum despite technological shifts toward higher-bit architectures. The market demonstrates exceptional stability with growth rates consistently exceeding 6% annually, driven by expanding applications in consumer electronics, automotive systems, and emerging IoT implementations.

Key market drivers include the increasing demand for cost-effective embedded solutions, growing adoption of smart home technologies, and expanding automotive electronics integration. The market benefits from approximately 42% market share concentration in consumer electronics applications, while industrial automation and automotive sectors contribute significantly to overall demand growth.

Competitive landscape features established semiconductor leaders maintaining strong positions through continuous innovation and strategic partnerships. Market participants focus on enhancing power efficiency, expanding peripheral integration, and developing specialized variants for emerging applications while preserving the fundamental cost and simplicity advantages of 8-bit architectures.

Future projections indicate sustained market expansion supported by IoT proliferation, smart appliance adoption, and continued demand for cost-effective embedded solutions. The market demonstrates resilience against technological disruption while adapting to evolving application requirements through innovative feature integration and enhanced performance capabilities.

Market intelligence reveals several critical insights shaping the North America 8-bit microcontroller landscape:

Strategic implications suggest that while higher-bit microcontrollers capture attention for advanced applications, 8-bit solutions maintain essential roles in cost-sensitive and power-constrained implementations. Market positioning emphasizes the complementary nature of 8-bit microcontrollers within broader semiconductor portfolios rather than direct competition with advanced architectures.

Primary growth drivers propelling the North America 8-bit microcontroller market encompass diverse technological and economic factors. The increasing penetration of smart home technologies creates substantial demand for cost-effective control solutions, with 8-bit microcontrollers providing optimal price-performance ratios for basic automation functions.

IoT expansion represents a significant driver, particularly for edge devices and sensor nodes requiring minimal processing capabilities but demanding ultra-low power consumption. The market benefits from approximately 38% adoption rate in IoT applications where 8-bit architectures excel in battery-powered implementations and simple data collection tasks.

Automotive electronics integration continues driving demand as vehicles incorporate increasing numbers of electronic control units for basic functions. Applications include lighting control, motor management, and sensor interfaces where 8-bit microcontrollers provide reliable, cost-effective solutions meeting automotive quality standards.

Consumer electronics proliferation maintains steady demand across appliances, toys, and personal devices. The market experiences consistent growth from manufacturers seeking to add smart features to traditional products while maintaining competitive pricing structures.

Industrial automation expansion creates opportunities in sensor networks, basic control systems, and human-machine interfaces. The growing emphasis on distributed intelligence in manufacturing environments favors cost-effective microcontroller solutions for numerous simple control tasks.

Market limitations affecting the North America 8-bit microcontroller segment include technological constraints and competitive pressures from advanced architectures. Processing power limitations restrict applications requiring complex computations, real-time processing, or advanced connectivity features that exceed 8-bit capabilities.

Performance expectations in modern applications increasingly favor higher-bit architectures offering enhanced processing power, memory capacity, and integrated connectivity options. This trend challenges 8-bit microcontrollers in applications where performance requirements continue expanding beyond traditional boundaries.

Development complexity can increase when implementing advanced features within 8-bit constraints, potentially requiring more sophisticated programming techniques and optimization efforts. This complexity may discourage adoption in projects where development time and resources are limited.

Memory limitations inherent in 8-bit architectures restrict application scope, particularly for data-intensive operations or complex algorithm implementations. These constraints become more apparent as application requirements evolve toward greater functionality and feature richness.

Supply chain considerations occasionally impact availability and pricing, particularly for specialized variants or during periods of semiconductor industry disruption. Long-term availability concerns may influence design decisions favoring more current architectures with assured future support.

Emerging opportunities within the North America 8-bit microcontroller market span multiple sectors experiencing digital transformation. The expanding IoT ecosystem presents substantial growth potential, particularly for edge computing applications requiring minimal processing power but demanding exceptional power efficiency and cost-effectiveness.

Smart agriculture applications represent a growing opportunity segment where 8-bit microcontrollers excel in sensor monitoring, irrigation control, and environmental data collection. The market opportunity expands as agricultural technology adoption accelerates across North American farming operations.

Healthcare device integration offers significant potential in portable medical devices, patient monitoring systems, and diagnostic equipment where cost constraints and power efficiency requirements align with 8-bit capabilities. The market benefits from increasing healthcare digitization and remote monitoring trends.

Energy management systems create opportunities in smart grid applications, renewable energy monitoring, and building automation where distributed intelligence requires numerous cost-effective control nodes. The growing emphasis on energy efficiency supports demand for specialized 8-bit solutions.

Educational market expansion presents opportunities as STEM education programs increasingly incorporate hands-on electronics and programming experiences. The simplicity and affordability of 8-bit microcontrollers make them ideal for educational applications and maker communities.

Market dynamics in the North America 8-bit microcontroller sector reflect complex interactions between technological evolution, application requirements, and competitive pressures. The market demonstrates remarkable stability while adapting to changing customer needs through enhanced feature integration and improved performance characteristics.

Supply-demand equilibrium remains generally stable with established manufacturers maintaining consistent production capacity. Market dynamics benefit from mature manufacturing processes and established supply chains, though occasional disruptions impact availability and pricing across the semiconductor industry.

Technological evolution within 8-bit architectures focuses on peripheral integration, power efficiency improvements, and enhanced development tools rather than fundamental architectural changes. This approach maintains compatibility while expanding application possibilities and improving overall system performance.

Competitive dynamics emphasize differentiation through specialized features, development ecosystem quality, and customer support rather than price competition alone. Market participants invest in comprehensive solutions including hardware, software tools, and technical support to maintain customer loyalty.

Customer behavior patterns show increasing sophistication in microcontroller selection, with design engineers evaluating total system cost, development time, and long-term support alongside traditional performance metrics. This evolution drives manufacturers toward more comprehensive solution offerings.

Research approach for analyzing the North America 8-bit microcontroller market employs comprehensive methodologies combining primary and secondary research techniques. The analysis incorporates quantitative data collection, qualitative insights from industry experts, and systematic evaluation of market trends and competitive dynamics.

Primary research activities include structured interviews with semiconductor manufacturers, system integrators, and end-user organizations across key application segments. Survey methodologies capture market sentiment, adoption patterns, and future planning considerations from diverse stakeholder perspectives.

Secondary research components encompass analysis of industry publications, technical documentation, patent filings, and corporate financial reports. This comprehensive approach ensures thorough understanding of technological developments, market positioning strategies, and competitive landscape evolution.

Data validation processes employ multiple source verification, statistical analysis techniques, and expert review procedures to ensure accuracy and reliability of market insights. Cross-referencing methodologies confirm consistency across different data sources and analytical approaches.

Market modeling techniques utilize statistical forecasting methods, trend analysis, and scenario planning to project future market developments. The methodology incorporates sensitivity analysis to evaluate potential impacts of various market drivers and restraints on overall market performance.

United States market dominates the North America 8-bit microcontroller landscape, accounting for approximately 68% regional market share. The U.S. market benefits from strong semiconductor industry presence, extensive research and development capabilities, and diverse application demand across consumer electronics, automotive, and industrial sectors.

California and Texas represent primary market centers with significant semiconductor manufacturing, design activities, and technology company concentrations. These regions drive innovation in 8-bit microcontroller applications while supporting extensive supply chain networks and technical expertise.

Canadian market dynamics reflect strong demand from automotive electronics, industrial automation, and telecommunications sectors. The market demonstrates steady growth supported by technology adoption in natural resource industries and expanding smart city initiatives across major metropolitan areas.

Mexico’s emerging role in North American semiconductor manufacturing creates opportunities for 8-bit microcontroller production and assembly operations. The market benefits from cost-effective manufacturing capabilities while serving growing domestic demand from automotive and consumer electronics sectors.

Regional integration through trade agreements and supply chain optimization enhances market efficiency and competitiveness. Cross-border collaboration in research, manufacturing, and market development strengthens the overall North American position in global 8-bit microcontroller markets.

Market leadership in the North America 8-bit microcontroller sector features established semiconductor companies maintaining strong positions through continuous innovation and comprehensive product portfolios. The competitive environment emphasizes technological differentiation, customer support quality, and ecosystem development.

Competitive strategies emphasize ecosystem development, including integrated development environments, programming tools, and technical support services. Market participants invest heavily in customer education, application support, and long-term partnership development to maintain competitive advantages.

Innovation focus areas include power efficiency improvements, peripheral integration enhancements, and specialized variants for emerging applications. Companies differentiate through unique features, development tool quality, and comprehensive technical documentation supporting rapid product development.

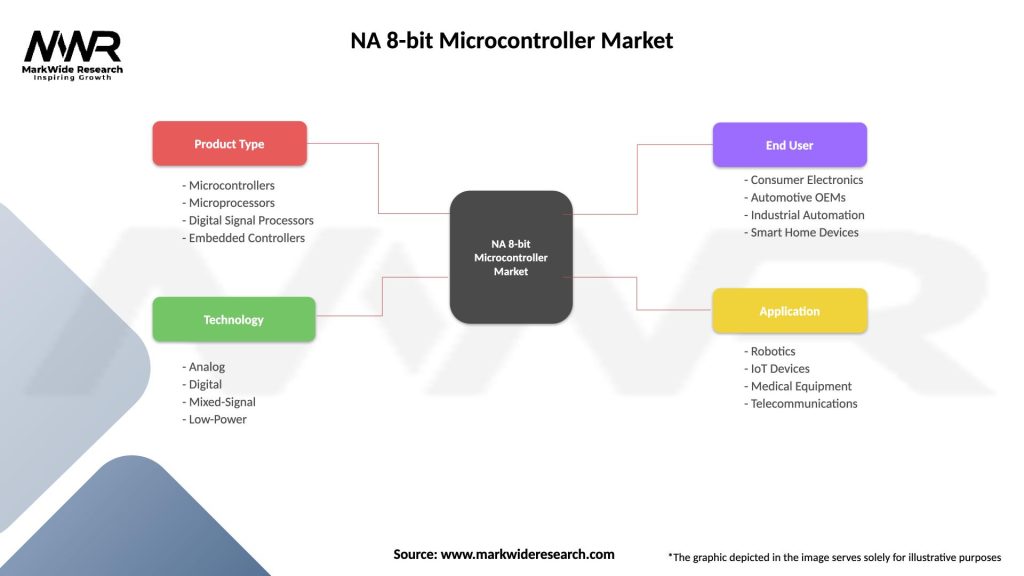

Market segmentation of the North America 8-bit microcontroller market reveals diverse categorization approaches based on architecture, application, and end-user requirements. This comprehensive segmentation enables targeted analysis of specific market dynamics and growth opportunities.

By Architecture:

By Application:

By End-User Industry:

Consumer electronics category maintains the largest market share at approximately 42% of total demand, driven by widespread adoption in home appliances, entertainment devices, and personal electronics. This segment benefits from high-volume production requirements and cost-sensitive design constraints that favor 8-bit solutions.

Automotive electronics segment demonstrates strong growth potential with increasing vehicle electrification and electronic system integration. The category emphasizes reliability, temperature tolerance, and long-term availability requirements that align well with mature 8-bit microcontroller characteristics.

Industrial automation applications show steady expansion as manufacturing operations adopt distributed intelligence and sensor network architectures. This category values robust operation, extended temperature ranges, and proven reliability over cutting-edge performance specifications.

IoT device category represents the fastest-growing segment with approximately 15% annual growth rate, driven by edge computing requirements and battery-powered applications. The segment particularly values ultra-low power consumption and cost-effectiveness for large-scale deployments.

Healthcare device applications demonstrate increasing adoption in portable medical equipment and patient monitoring systems. This category emphasizes regulatory compliance, reliability, and power efficiency for battery-operated devices requiring extended operational life.

Manufacturers benefit from established production processes, mature supply chains, and predictable demand patterns that enable efficient capacity planning and inventory management. The 8-bit microcontroller market offers stable revenue streams with opportunities for differentiation through specialized features and comprehensive customer support.

System designers gain access to cost-effective solutions with simplified development requirements, extensive documentation, and proven reliability records. The availability of comprehensive development tools and technical support reduces time-to-market while minimizing design risks.

End-users experience benefits through cost-effective product implementations, reliable operation, and long-term availability assurance. The mature technology base provides confidence in supply continuity and technical support throughout product lifecycles.

Supply chain participants benefit from stable demand patterns, established distribution networks, and predictable inventory requirements. The market maturity enables efficient logistics planning and inventory optimization across distribution channels.

Technology ecosystem partners including tool vendors, software developers, and service providers benefit from large installed bases and ongoing demand for development support, training, and specialized services supporting 8-bit microcontroller implementations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Power efficiency enhancement represents a dominant trend with manufacturers continuously improving low-power modes, sleep states, and energy management capabilities. According to MarkWide Research analysis, power consumption improvements of 25-30% have been achieved in recent 8-bit microcontroller generations through advanced process technologies and circuit optimization.

Peripheral integration expansion continues as manufacturers incorporate more functionality into single-chip solutions. This trend reduces external component requirements, simplifies system design, and improves overall cost-effectiveness while maintaining the fundamental advantages of 8-bit architectures.

Development tool sophistication advances through enhanced integrated development environments, debugging capabilities, and code optimization tools. These improvements reduce development time and complexity while enabling more efficient utilization of 8-bit microcontroller capabilities.

Application-specific optimization emerges as manufacturers develop specialized variants targeting specific market segments such as automotive, IoT, or industrial applications. This trend enables better alignment between microcontroller capabilities and application requirements.

Ecosystem expansion includes comprehensive support for third-party development tools, software libraries, and reference designs. The trend toward complete solution packages helps customers accelerate product development and reduce implementation risks.

Recent industry developments highlight continued innovation within the 8-bit microcontroller segment despite market maturity. Major manufacturers announce enhanced product families featuring improved power efficiency, expanded peripheral integration, and specialized variants for emerging applications.

Manufacturing process improvements enable better performance characteristics while maintaining cost advantages. Advanced semiconductor fabrication techniques allow integration of more functionality without significantly increasing die size or production costs.

Partnership expansions between microcontroller manufacturers and software tool vendors create more comprehensive development ecosystems. These collaborations enhance customer experience through integrated solutions and streamlined development processes.

Market consolidation activities include strategic acquisitions and partnerships aimed at strengthening product portfolios and market positions. These developments often result in expanded customer support capabilities and enhanced technical resources.

Sustainability initiatives focus on environmentally responsible manufacturing processes, packaging materials, and end-of-life considerations. Industry participants increasingly emphasize environmental stewardship while maintaining cost-effectiveness and performance characteristics.

Strategic recommendations for market participants emphasize leveraging the unique advantages of 8-bit microcontrollers while addressing evolving customer requirements. MWR suggests focusing on application-specific optimization and comprehensive ecosystem development to maintain competitive positioning.

Product development priorities should emphasize power efficiency improvements, peripheral integration expansion, and specialized variants for high-growth application segments. Investment in development tools and customer support capabilities remains crucial for maintaining market position.

Market positioning strategies should clearly communicate the value proposition of 8-bit solutions for appropriate applications rather than competing directly with higher-bit architectures. Emphasis on total system cost, development simplicity, and proven reliability resonates with target customers.

Partnership opportunities exist with software tool vendors, system integrators, and educational institutions to expand market reach and customer engagement. Collaborative approaches can enhance ecosystem value while reducing individual investment requirements.

Long-term sustainability requires continuous innovation within 8-bit constraints while maintaining the fundamental advantages that define market positioning. Focus on emerging applications and evolving customer needs ensures continued relevance in competitive markets.

Market projections indicate sustained growth for the North America 8-bit microcontroller market with projected expansion at approximately 6.5% CAGR over the next five years. Growth drivers include IoT proliferation, smart home adoption, and continued demand for cost-effective embedded solutions across diverse applications.

Technology evolution within 8-bit architectures will likely focus on enhanced power efficiency, expanded peripheral integration, and improved development tools rather than fundamental architectural changes. This approach maintains compatibility while expanding application possibilities.

Application expansion into emerging sectors including smart agriculture, environmental monitoring, and edge computing creates new growth opportunities. The market benefits from increasing recognition of 8-bit solutions’ advantages in specific application contexts.

Competitive dynamics will likely emphasize ecosystem development, customer support quality, and application-specific optimization rather than traditional performance metrics. Success factors include comprehensive solution offerings and strong customer relationships.

Regional market development shows potential for continued growth across North America with particular strength in automotive electronics, industrial automation, and consumer appliance applications. The market maintains resilience against technological disruption while adapting to evolving requirements.

The North America 8-bit microcontroller market demonstrates remarkable resilience and continued relevance despite the emergence of more advanced microcontroller architectures. Market analysis reveals sustained growth opportunities driven by cost-effectiveness, power efficiency, and application-specific advantages that maintain 8-bit solutions’ competitive positioning in numerous embedded applications.

Strategic market positioning emphasizes the complementary role of 8-bit microcontrollers within broader semiconductor portfolios rather than direct competition with higher-bit architectures. This approach recognizes the unique value proposition of 8-bit solutions for applications where processing requirements, cost constraints, and power efficiency considerations align with architectural capabilities.

Future market success depends on continued innovation within 8-bit constraints while maintaining fundamental advantages that define market positioning. The focus on peripheral integration, power efficiency improvements, and comprehensive ecosystem development ensures continued relevance in evolving technology landscapes while serving diverse customer requirements across multiple industry segments.

What is 8-bit Microcontroller?

An 8-bit microcontroller is a compact integrated circuit designed to govern a specific operation in an embedded system, processing data in 8-bit chunks. These microcontrollers are commonly used in applications such as automotive controls, consumer electronics, and industrial automation.

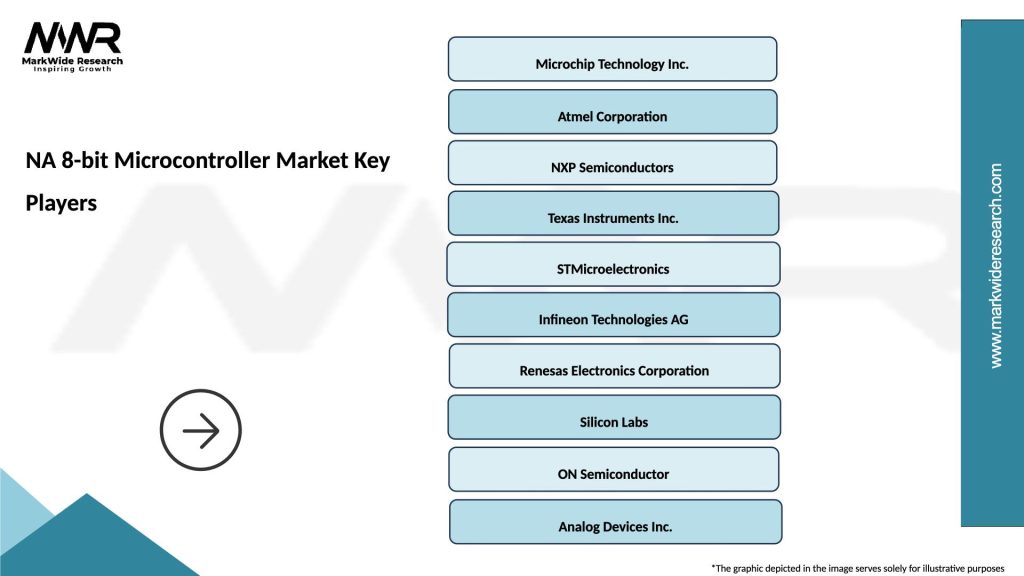

What are the key players in the NA 8-bit Microcontroller Market?

Key players in the NA 8-bit microcontroller market include Microchip Technology, Atmel (now part of Microchip), NXP Semiconductors, and Texas Instruments, among others. These companies are known for their innovative products and extensive portfolios in the microcontroller space.

What are the growth factors driving the NA 8-bit Microcontroller Market?

The growth of the NA 8-bit microcontroller market is driven by the increasing demand for automation in various industries, the rise of IoT devices, and the need for cost-effective solutions in consumer electronics. Additionally, advancements in technology are enhancing the capabilities of these microcontrollers.

What challenges does the NA 8-bit Microcontroller Market face?

The NA 8-bit microcontroller market faces challenges such as competition from more advanced microcontrollers, which offer higher processing power and efficiency. Additionally, the rapid pace of technological change can make it difficult for manufacturers to keep up with evolving consumer demands.

What opportunities exist in the NA 8-bit Microcontroller Market?

Opportunities in the NA 8-bit microcontroller market include the growing trend of smart home devices and the expansion of automotive electronics. As industries continue to adopt automation and smart technologies, the demand for reliable and efficient 8-bit microcontrollers is expected to rise.

What trends are shaping the NA 8-bit Microcontroller Market?

Trends shaping the NA 8-bit microcontroller market include the integration of wireless communication capabilities, the miniaturization of components, and the increasing focus on energy efficiency. These trends are driving innovation and expanding the applications of 8-bit microcontrollers across various sectors.

NA 8-bit Microcontroller Market

| Segmentation Details | Description |

|---|---|

| Product Type | Microcontrollers, Microprocessors, Digital Signal Processors, Embedded Controllers |

| Technology | Analog, Digital, Mixed-Signal, Low-Power |

| End User | Consumer Electronics, Automotive OEMs, Industrial Automation, Smart Home Devices |

| Application | Robotics, IoT Devices, Medical Equipment, Telecommunications |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA 8-bit Microcontroller Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at