444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Myanmar used car market represents a rapidly evolving automotive sector that has experienced significant transformation following economic reforms and policy changes. Market dynamics in Myanmar’s pre-owned vehicle segment reflect the country’s growing middle class, urbanization trends, and increasing demand for affordable transportation solutions. The sector has demonstrated remarkable resilience despite economic challenges, with growth rates showing consistent upward momentum at approximately 8.5% annually over recent years.

Consumer preferences in Myanmar’s used car market heavily favor Japanese brands, particularly Toyota, Honda, and Nissan, which collectively account for over 75% market share in the pre-owned segment. The market structure encompasses various distribution channels, from traditional dealerships to emerging online platforms, creating a diverse ecosystem that caters to different consumer segments. Import regulations and government policies significantly influence market dynamics, with recent liberalization measures contributing to increased vehicle availability and competitive pricing.

Geographic distribution shows concentration in major urban centers, with Yangon and Mandalay representing approximately 65% of total market activity. The sector benefits from improving infrastructure, expanding credit facilities, and growing consumer awareness about vehicle quality and maintenance standards.

The Myanmar used car market refers to the comprehensive ecosystem of pre-owned vehicle trading, encompassing import, distribution, retail, and after-sales services within Myanmar’s automotive sector. This market includes all activities related to the buying, selling, and servicing of previously owned passenger cars, commercial vehicles, and specialty automotive products that meet local regulatory requirements and consumer demands.

Market participants include authorized dealers, independent retailers, online platforms, auction houses, and individual sellers who facilitate the transfer of used vehicles from previous owners to new buyers. The sector operates within a regulatory framework that governs vehicle imports, safety standards, emissions requirements, and consumer protection measures. Value chain activities encompass vehicle sourcing, quality assessment, refurbishment, financing, insurance, and ongoing maintenance services.

Economic significance extends beyond simple vehicle transactions, as the used car market supports employment, generates tax revenue, and provides affordable mobility solutions that contribute to economic development and social mobility throughout Myanmar.

Myanmar’s used car market has emerged as a critical component of the country’s automotive landscape, driven by economic liberalization, demographic shifts, and evolving consumer preferences. The sector demonstrates strong fundamentals with sustained growth momentum, supported by increasing disposable income, urbanization trends, and improved access to financing options.

Key market characteristics include a strong preference for Japanese vehicles, growing acceptance of online sales platforms, and increasing sophistication in consumer decision-making processes. The market benefits from relatively young demographics, with approximately 42% of buyers falling within the 25-40 age bracket, indicating strong future demand potential.

Competitive landscape features a mix of established dealerships, emerging digital platforms, and traditional trading networks. Market consolidation trends suggest increasing professionalization, with larger players gaining market share through superior service offerings, financing partnerships, and quality assurance programs. Technology adoption rates show promising growth, with digital platforms experiencing 35% year-over-year growth in user engagement and transaction volumes.

Future prospects remain positive, supported by continued economic development, infrastructure improvements, and evolving regulatory frameworks that promote market transparency and consumer protection.

Consumer behavior analysis reveals distinct patterns in Myanmar’s used car market, with buyers prioritizing reliability, fuel efficiency, and maintenance costs over luxury features or brand prestige. MarkWide Research analysis indicates that practical considerations drive purchasing decisions, with over 68% of buyers citing total cost of ownership as the primary selection criterion.

Market maturation indicators suggest evolving from price-driven to value-driven purchasing decisions, with consumers increasingly willing to pay premiums for quality assurance, warranty coverage, and comprehensive after-sales support.

Economic liberalization serves as the primary catalyst for Myanmar’s used car market expansion, creating favorable conditions for increased vehicle imports, improved financing options, and enhanced consumer purchasing power. GDP growth and rising per capita income levels directly correlate with automotive demand, as more households achieve the financial threshold necessary for vehicle ownership.

Urbanization trends significantly impact market dynamics, with rural-to-urban migration creating concentrated demand centers and driving infrastructure development that supports automotive usage. Population density in major cities necessitates reliable transportation solutions, making used cars an attractive option for cost-conscious consumers seeking mobility independence.

Infrastructure development programs, including road construction, fuel distribution networks, and service facility expansion, create enabling environments that support increased vehicle adoption. Government policies promoting economic development and foreign investment contribute to overall market confidence and consumer spending capacity.

Demographic advantages include a relatively young population with growing aspirations for personal mobility, supported by increasing exposure to global automotive trends through digital media and international travel. Technology adoption rates among younger consumers facilitate online research, comparison shopping, and digital transaction processes that modernize traditional buying patterns.

Regulatory uncertainties pose significant challenges for Myanmar’s used car market, with evolving import policies, emissions standards, and safety requirements creating compliance complexities for market participants. Currency fluctuations and exchange rate volatility impact import costs and pricing stability, affecting both dealer margins and consumer affordability.

Infrastructure limitations in rural areas restrict market penetration and service accessibility, limiting growth potential beyond major urban centers. Financing constraints remain problematic, with limited credit history data, high interest rates, and restrictive lending criteria preventing many potential buyers from accessing vehicle loans.

Quality assurance challenges persist due to limited standardization in vehicle inspection, certification processes, and warranty programs. Consumer protection mechanisms require strengthening to build market confidence and reduce transaction risks associated with used vehicle purchases.

Economic volatility and political uncertainties can impact consumer confidence and spending patterns, creating unpredictable demand fluctuations that challenge business planning and inventory management. Skills gaps in automotive service sectors limit after-sales support quality and customer satisfaction levels.

Digital transformation presents substantial opportunities for Myanmar’s used car market, with online platforms, mobile applications, and digital marketing channels offering unprecedented reach and efficiency improvements. E-commerce adoption rates suggest significant potential for virtual showrooms, online financing applications, and digital documentation processes that streamline traditional buying experiences.

Financial inclusion initiatives create opportunities for innovative financing solutions, including microfinance partnerships, peer-to-peer lending platforms, and flexible payment schemes that expand market accessibility. Insurance product development offers potential for comprehensive coverage packages that enhance consumer confidence and protect investment values.

Service sector expansion opportunities include certified pre-owned programs, extended warranty services, and comprehensive maintenance packages that differentiate market participants and create recurring revenue streams. Regional expansion into secondary cities and rural markets presents untapped potential as infrastructure development progresses.

Partnership opportunities with international automotive brands, financial institutions, and technology providers can accelerate market development through knowledge transfer, capital investment, and operational expertise. Export potential to neighboring markets may emerge as Myanmar’s automotive sector matures and develops competitive advantages.

Supply-demand equilibrium in Myanmar’s used car market reflects complex interactions between import volumes, domestic availability, consumer purchasing power, and regulatory frameworks. Market forces demonstrate increasing sophistication as participants adapt to evolving consumer expectations and competitive pressures.

Price dynamics show correlation with global automotive trends, currency exchange rates, and local economic conditions. Seasonal variations align with agricultural cycles, festival periods, and government salary payments, creating predictable demand patterns that experienced dealers leverage for inventory planning and promotional strategies.

Competitive intensity has increased significantly, with traditional dealers facing challenges from online platforms, direct importers, and alternative financing providers. Market consolidation trends suggest advantages for larger, well-capitalized players who can offer comprehensive services, competitive pricing, and quality assurance programs.

Technology integration accelerates market evolution, with digital tools enabling better inventory management, customer relationship management, and operational efficiency improvements. Consumer empowerment through access to information, reviews, and comparison tools shifts bargaining power and demands higher service standards from market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy, reliability, and depth in understanding Myanmar’s used car market dynamics. Primary research includes structured interviews with industry stakeholders, consumer surveys, and field observations across major market centers throughout the country.

Secondary research incorporates government statistics, industry reports, trade publications, and academic studies to provide contextual background and validate primary findings. Data triangulation techniques ensure consistency and reliability across different information sources and research approaches.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market developments and identify growth opportunities. Qualitative insights from expert interviews, focus groups, and ethnographic studies provide deeper understanding of consumer motivations, market barriers, and competitive dynamics.

Market segmentation analysis examines various demographic, geographic, and behavioral factors that influence purchasing decisions and market participation. Competitive intelligence gathering includes analysis of pricing strategies, service offerings, marketing approaches, and operational capabilities across different market participants.

Yangon Region dominates Myanmar’s used car market, accounting for approximately 45% of total market activity due to its status as the commercial capital and largest urban center. Market characteristics in Yangon include higher average transaction values, greater brand diversity, and more sophisticated consumer preferences compared to other regions.

Mandalay Region represents the second-largest market segment, with approximately 20% market share, serving as a regional hub for northern Myanmar and cross-border trade activities. Consumer behavior in Mandalay shows strong preference for practical, durable vehicles suitable for diverse terrain and climate conditions.

Naypyidaw demonstrates unique market characteristics as the administrative capital, with government employees and civil servants representing a significant customer segment. Market dynamics reflect stable income patterns and preference for reliable, fuel-efficient vehicles suitable for official and personal use.

Regional cities including Mawlamyine, Pathein, and Taunggyi collectively represent emerging market opportunities with growing middle-class populations and improving infrastructure. Rural markets show increasing potential as road connectivity improves and agricultural incomes rise, though challenges remain regarding service accessibility and financing options.

Border regions present unique opportunities and challenges, with cross-border trade influences, different regulatory considerations, and distinct consumer preferences shaped by proximity to neighboring countries.

Market structure in Myanmar’s used car sector features a diverse mix of participants ranging from large-scale dealerships to individual traders, creating a dynamic competitive environment with varying service levels and specialization areas.

Competitive strategies increasingly focus on service differentiation, quality assurance, financing partnerships, and customer experience improvements. Market leaders leverage economies of scale, brand relationships, and operational efficiency to maintain competitive advantages in pricing and service delivery.

Emerging competitors include online platforms and technology-enabled service providers that challenge traditional business models through innovation, convenience, and transparency improvements.

By Vehicle Type: The Myanmar used car market demonstrates clear segmentation patterns based on vehicle categories, with passenger cars representing the largest segment, followed by commercial vehicles and specialty automotive products.

By Price Range: Market segmentation reflects diverse economic capabilities and consumer preferences across different income levels and usage requirements.

By Customer Type: Distinct buyer categories demonstrate different purchasing patterns, financing needs, and service expectations.

Passenger Car Segment dominates Myanmar’s used car market with approximately 72% of total transactions, reflecting strong consumer preference for personal mobility solutions. Compact vehicles within this category show highest demand due to fuel efficiency, maneuverability in urban environments, and affordable maintenance costs.

Japanese Brand Dominance: Toyota models, particularly Vitz, Corolla, and Camry variants, maintain market leadership through proven reliability, parts availability, and resale value retention. Consumer loyalty to Japanese brands reflects positive ownership experiences and perceived quality advantages over alternative options.

Commercial Vehicle Category represents approximately 18% of market volume, with pickup trucks and small commercial vehicles serving diverse business applications. Growth drivers include expanding small business sector, e-commerce development, and infrastructure construction activities requiring reliable transportation solutions.

Luxury and Premium Segment accounts for a smaller but growing market share, with increasing demand from affluent consumers and business executives. Brand preferences in this category include Lexus, BMW, and Mercedes-Benz, though volumes remain limited by pricing and service infrastructure considerations.

Age Distribution Analysis shows consumer preference for vehicles aged 5-8 years, representing optimal balance between modern features, reliability, and affordability. Depreciation patterns create attractive value propositions for buyers seeking quality vehicles at accessible price points.

Dealers and Retailers benefit from Myanmar’s used car market through expanding customer base, improving profit margins, and opportunities for service diversification. Revenue streams extend beyond vehicle sales to include financing facilitation, insurance products, maintenance services, and parts distribution.

Financial Institutions gain access to growing automotive financing opportunities, with used car loans representing lower risk profiles compared to new vehicle financing. Portfolio diversification through automotive lending supports financial inclusion objectives while generating attractive returns on invested capital.

Consumers benefit from increased vehicle availability, competitive pricing, improved quality standards, and enhanced financing options. Mobility access supports economic opportunities, social connectivity, and lifestyle improvements across diverse demographic segments.

Government Stakeholders realize benefits through increased tax revenues, employment generation, and economic development contributions. Regulatory frameworks that support market development while ensuring consumer protection create positive economic multiplier effects.

Service Providers including mechanics, parts suppliers, and insurance companies benefit from expanding automotive parc and increasing service demand. Skills development opportunities emerge as market sophistication increases and technical requirements evolve.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Platform Adoption represents the most significant trend reshaping Myanmar’s used car market, with online listings, virtual showrooms, and mobile applications transforming traditional buying processes. Consumer behavior increasingly incorporates digital research, comparison shopping, and online engagement before physical vehicle inspection and purchase decisions.

Quality Certification Programs gain importance as consumers demand greater transparency and assurance in used vehicle purchases. Market leaders invest in comprehensive inspection processes, warranty programs, and quality guarantees to differentiate their offerings and build customer confidence.

Financing Innovation includes partnerships between dealers and financial institutions to create accessible loan products, flexible payment terms, and streamlined approval processes. MWR analysis indicates that financing penetration rates show steady improvement as credit infrastructure develops and consumer awareness increases.

Service Integration trends toward comprehensive automotive solutions encompassing sales, financing, insurance, maintenance, and parts supply. One-stop-shop approaches appeal to consumers seeking convenience and simplified vehicle ownership experiences.

Sustainability Considerations emerge as environmental awareness increases, with fuel efficiency, emissions standards, and vehicle lifecycle management becoming important decision factors for environmentally conscious consumers.

Regulatory Modernization initiatives include updated import standards, streamlined registration processes, and enhanced consumer protection measures that support market development while ensuring safety and quality standards. Government policies increasingly recognize the automotive sector’s economic importance and employment generation potential.

Technology Infrastructure improvements encompass digital payment systems, online documentation processes, and mobile connectivity that facilitate modern automotive commerce. Banking sector developments include specialized automotive financing products and improved credit assessment capabilities.

International Partnerships between Myanmar dealers and global automotive brands create opportunities for knowledge transfer, quality improvements, and access to certified pre-owned programs. Training initiatives enhance technical capabilities and service standards across the automotive value chain.

Market Consolidation activities include mergers, acquisitions, and strategic partnerships that create larger, more capable market participants with enhanced service offerings and geographic coverage. Investment flows from domestic and international sources support market development and modernization efforts.

Infrastructure Development projects including road construction, fuel distribution networks, and service facility expansion create enabling environments that support increased vehicle adoption and market growth.

Market Participants should prioritize digital transformation initiatives to remain competitive in evolving market conditions. Investment priorities should include online platform development, customer relationship management systems, and mobile application capabilities that enhance customer experience and operational efficiency.

Quality Assurance programs represent critical differentiation opportunities, with comprehensive vehicle inspection, certification processes, and warranty offerings building customer confidence and supporting premium pricing strategies. Service excellence initiatives should encompass staff training, facility improvements, and customer feedback systems.

Financial Partnership development with banks, microfinance institutions, and alternative lenders can expand market accessibility and customer base. Innovative financing solutions including flexible payment terms, trade-in programs, and insurance bundling create competitive advantages.

Geographic Expansion strategies should target secondary cities and emerging markets where competition remains limited and growth potential exists. Market entry approaches should consider local partnerships, adapted service models, and community engagement initiatives.

Sustainability Integration including fuel-efficient vehicle promotion, environmental compliance, and responsible business practices aligns with global trends and appeals to environmentally conscious consumers.

Long-term prospects for Myanmar’s used car market remain positive, supported by continued economic development, demographic advantages, and evolving consumer preferences toward personal mobility solutions. Growth projections indicate sustained expansion at approximately 7-9% annually over the next five years, driven by urbanization, income growth, and infrastructure improvements.

Market evolution trends suggest increasing sophistication in consumer decision-making, service expectations, and quality standards. Digital integration will accelerate, with online platforms, mobile applications, and digital payment systems becoming standard market features rather than competitive differentiators.

Regulatory environment developments are expected to support market growth through streamlined processes, enhanced consumer protection, and alignment with international standards. Policy stability and predictable regulatory frameworks will encourage investment and long-term business planning.

Competitive landscape will likely experience continued consolidation, with successful players expanding through acquisition, partnership, and organic growth strategies. Service differentiation will become increasingly important as price competition intensifies and consumer expectations rise.

Technology adoption will reshape traditional business models, with successful market participants embracing digital transformation, data analytics, and customer-centric service delivery approaches that enhance efficiency and customer satisfaction.

Myanmar’s used car market represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographics, economic development, and increasing consumer demand for personal mobility solutions. Market fundamentals remain strong despite challenges related to regulatory complexity, financing constraints, and infrastructure limitations.

Success factors for market participants include digital transformation adoption, quality assurance program implementation, financial partnership development, and customer-centric service delivery approaches. Competitive advantages will increasingly derive from operational efficiency, service excellence, and ability to adapt to changing consumer preferences and market conditions.

Future opportunities encompass geographic expansion, service diversification, technology integration, and innovative financing solutions that expand market accessibility and enhance customer value propositions. MarkWide Research analysis suggests that companies investing in comprehensive market development strategies, quality improvements, and customer relationship management will achieve sustainable competitive positions in this growing market.

The Myanmar used car market stands positioned for continued growth and development, offering attractive opportunities for well-positioned participants who can navigate regulatory complexities, meet evolving consumer expectations, and leverage technology to enhance operational efficiency and customer satisfaction in this promising automotive sector.

What is Myanmar Used Car?

Myanmar used cars refer to pre-owned vehicles that are available for sale in Myanmar. This market includes a variety of vehicle types, such as sedans, SUVs, and trucks, catering to different consumer needs and preferences.

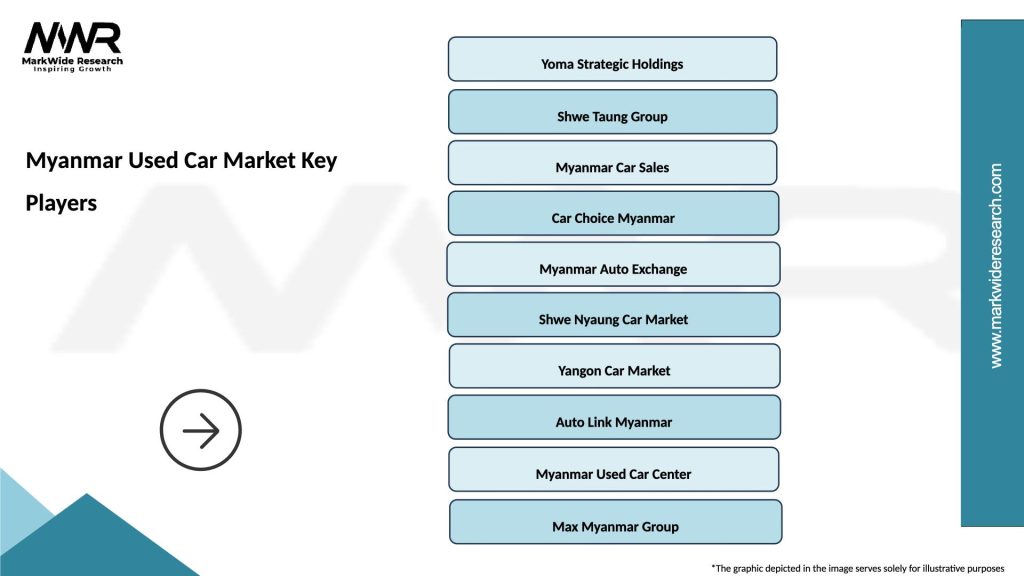

What are the key players in the Myanmar Used Car Market?

Key players in the Myanmar used car market include companies like Carlist, Myanmar Car, and Yoma Fleet, which provide platforms for buying and selling used vehicles. These companies facilitate transactions and offer various services to enhance the customer experience, among others.

What are the growth factors driving the Myanmar Used Car Market?

The growth of the Myanmar used car market is driven by increasing urbanization, rising disposable incomes, and a growing middle class. Additionally, the demand for affordable transportation options is contributing to the market’s expansion.

What challenges does the Myanmar Used Car Market face?

The Myanmar used car market faces challenges such as a lack of financing options for buyers and concerns over vehicle quality and history. Additionally, regulatory hurdles and limited consumer awareness can hinder market growth.

What opportunities exist in the Myanmar Used Car Market?

Opportunities in the Myanmar used car market include the potential for online sales platforms and increased investment in vehicle inspection services. Furthermore, the growing interest in electric vehicles presents a new segment for market expansion.

What trends are shaping the Myanmar Used Car Market?

Trends in the Myanmar used car market include the rise of digital platforms for buying and selling vehicles and an increasing focus on customer service. Additionally, there is a growing interest in environmentally friendly vehicles, influencing consumer choices.

Myanmar Used Car Market

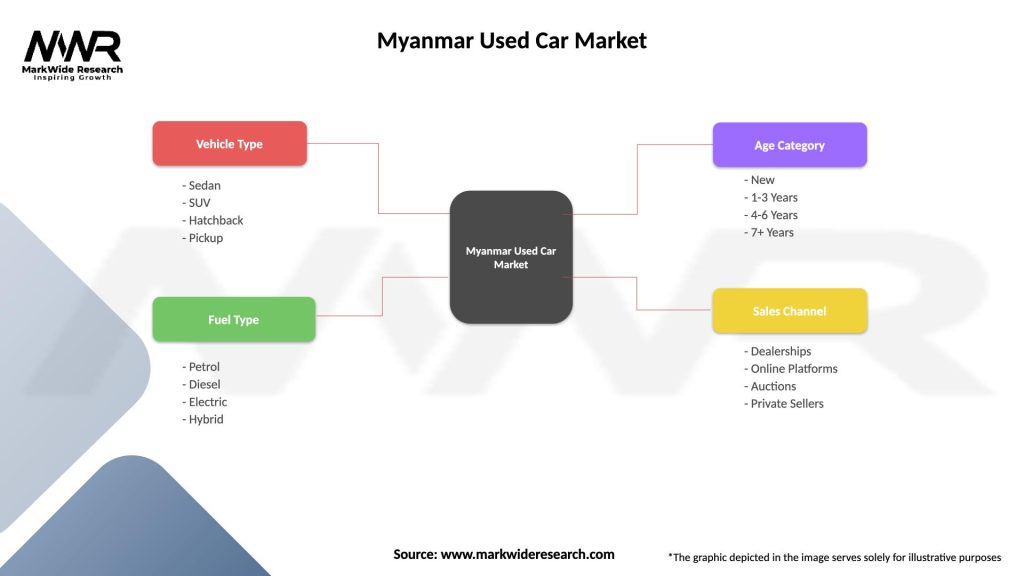

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Pickup |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Myanmar Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at