444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Multi-Currency Checker Market is witnessing significant growth and innovation as businesses and individuals engage in cross-border transactions and international trade. Multi-currency checkers, also known as currency converters or exchange rate calculators, play a crucial role in facilitating seamless currency conversions and enabling users to monitor and manage multiple currencies efficiently. With the globalization of businesses, the rise of e-commerce, and the increasing popularity of travel and tourism, the demand for multi-currency checkers is expected to rise, presenting opportunities for software developers, financial institutions, and service providers in the market.

Meaning

A multi-currency checker is a software tool or application that allows users to convert one currency into another based on prevailing exchange rates. These tools typically provide real-time or near-real-time exchange rate information sourced from financial markets, central banks, or currency exchange platforms. Multi-currency checkers are commonly used by travelers, international businesses, online retailers, and individuals engaged in cross-border transactions to calculate and compare currency values, estimate costs, and make informed financial decisions. By offering convenience, accuracy, and transparency in currency conversions, multi-currency checkers simplify the complexities of dealing with multiple currencies and help users save time and money.

Executive Summary

The Multi-Currency Checker Market is experiencing rapid growth driven by factors such as increasing international travel, cross-border e-commerce, and globalization of businesses. This executive summary provides an overview of the market landscape, highlighting key trends, drivers, challenges, and opportunities shaping the future of multi-currency checkers. As businesses and consumers navigate the complexities of global finance, the demand for user-friendly, reliable, and feature-rich currency conversion tools is expected to grow, driving innovation and competition in the market.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Multi-Currency Checker Market operates in a dynamic environment influenced by factors such as economic conditions, technological advancements, regulatory changes, and consumer preferences. These dynamics shape market trends, customer behaviors, and competitive strategies, requiring providers to adapt and innovate to stay ahead in the rapidly evolving market landscape.

Regional Analysis

The Multi-Currency Checker Market exhibits regional variations in adoption, usage, and regulatory frameworks. While developed economies with high levels of international trade and travel drive demand for multi-currency checkers, emerging markets with growing e-commerce and digital payment adoption offer untapped opportunities for market expansion. Regional differences in currency regulations, exchange rate regimes, and consumer preferences influence the competitive landscape and market dynamics, requiring providers to tailor their offerings to local market needs and regulatory requirements.

Competitive Landscape

The competitive landscape of the Multi-Currency Checker Market is characterized by a diverse mix of providers, including financial institutions, fintech startups, currency exchange platforms, and software developers. Key players in the market offer a range of currency conversion solutions tailored to the needs of consumers, businesses, travelers, and financial institutions. Competitive factors such as pricing, exchange rates, user experience, platform compatibility, and value-added features drive customer choices and influence market dynamics, prompting providers to innovate and differentiate their offerings to gain a competitive edge.

Segmentation

The Multi-Currency Checker Market can be segmented based on various factors such as:

Segmentation enables providers to target specific customer segments, customize their offerings, and address unique market requirements, enhancing market competitiveness and customer satisfaction.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Multi-Currency Checker Market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the Multi-Currency Checker Market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors helps market participants identify strategic priorities, capitalize on market opportunities, and mitigate potential threats in the Multi-Currency Checker Market.

Market Key Trends

Key trends shaping the Multi-Currency Checker Market include:

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the Multi-Currency Checker Market. While travel restrictions and economic uncertainties have led to a decline in international travel and tourism-related currency transactions, the shift towards remote work, online shopping, and digital payments has accelerated the adoption of multi-currency checkers among individuals and businesses. As economies recover and travel restrictions ease, the market is expected to rebound, driven by pent-up demand for international travel, cross-border trade, and e-commerce transactions.

Key Industry Developments

Recent developments in the Multi-Currency Checker Market include:

Analyst Suggestions

Analysts suggest the following strategies for success in the Multi-Currency Checker Market:

Future Outlook

The future outlook for the Multi-Currency Checker Market is optimistic, driven by factors such as increasing globalization, digitalization, cross-border trade, and financial inclusion. As businesses and consumers continue to engage in international transactions and cross-border activities, the demand for multi-currency checkers is expected to grow, presenting opportunities for market players to innovate, expand market reach, and capitalize on emerging trends and technologies.

Conclusion

In conclusion, the Multi-Currency Checker Market is poised for growth and innovation as businesses and individuals navigate the complexities of global finance, cross-border transactions, and international commerce. With increasing globalization, digitalization, and market competition, multi-currency checkers play a crucial role in facilitating seamless currency conversions, managing currency risks, and enhancing financial decision-making. By embracing technological advancements, regulatory compliance, and customer-centric strategies, market participants can unlock opportunities, overcome challenges, and succeed in the dynamic and competitive Multi-Currency Checker Market.

Multi-Currency Checker Market

| Segmentation Details | Description |

|---|---|

| Product Type | Web-Based, Mobile App, Desktop Software, API Integration |

| End User | Retailers, Financial Institutions, Travelers, E-Commerce Platforms |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

| Feature | Real-Time Conversion, Historical Data, Multi-Language Support, Alerts |

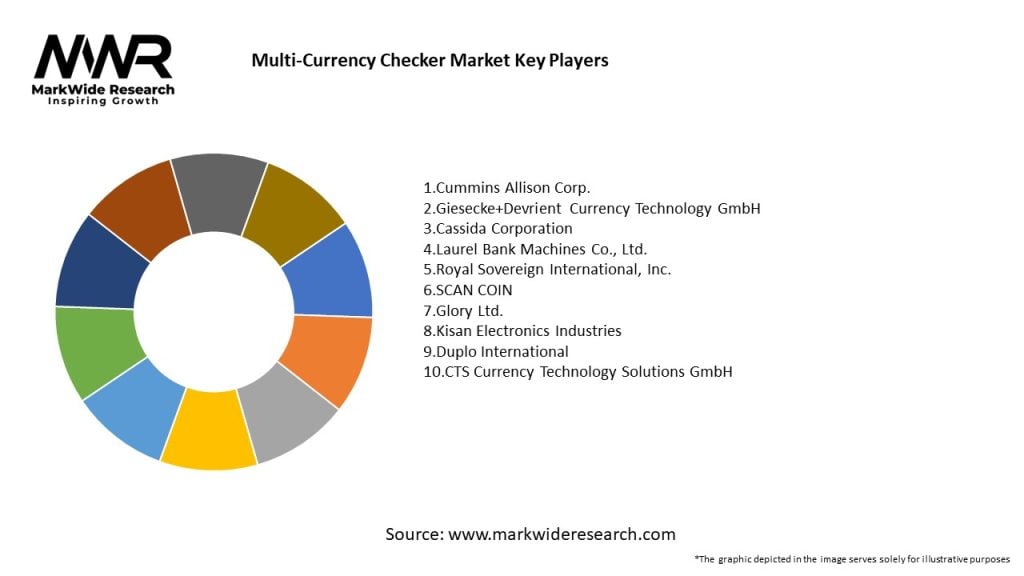

Leading companies in the Multi-Currency Checker Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at