444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Morocco rigid plastic packaging market represents a dynamic and rapidly evolving sector within the North African packaging industry. This market encompasses a comprehensive range of rigid plastic containers, bottles, jars, trays, and specialized packaging solutions that serve diverse industries including food and beverages, pharmaceuticals, cosmetics, and consumer goods. The Moroccan market has experienced substantial growth driven by increasing urbanization, rising consumer spending, and expanding manufacturing capabilities across various sectors.

Market dynamics indicate that the rigid plastic packaging sector in Morocco is witnessing significant transformation, with growth rates reaching 8.2% CAGR over recent years. The market benefits from Morocco’s strategic geographic position as a gateway between Europe and Africa, facilitating both domestic consumption and export opportunities. Industrial development initiatives and government support for manufacturing sectors have created favorable conditions for packaging industry expansion.

Consumer preferences are increasingly shifting toward convenient, durable, and sustainable packaging solutions, driving demand for innovative rigid plastic packaging formats. The market serves both traditional sectors such as agriculture and food processing, as well as emerging industries including pharmaceuticals and personal care products. Technological advancement in packaging manufacturing has enabled Moroccan producers to meet international quality standards while maintaining competitive pricing structures.

The Morocco rigid plastic packaging market refers to the comprehensive industry segment encompassing the production, distribution, and consumption of inflexible plastic containers and packaging solutions within Morocco’s domestic and export markets. This market includes various packaging formats manufactured from thermoplastic materials that maintain their structural integrity and shape during handling, storage, and transportation processes.

Rigid plastic packaging distinguishes itself from flexible packaging through its ability to provide superior product protection, extended shelf life, and enhanced brand presentation capabilities. The market encompasses diverse product categories including bottles, jars, containers, trays, caps, closures, and specialized packaging systems designed for specific industry applications. Manufacturing processes involve injection molding, blow molding, thermoforming, and other advanced production techniques that create durable packaging solutions.

Market scope extends across multiple end-use industries, with food and beverage applications representing the largest segment, followed by pharmaceuticals, cosmetics, household products, and industrial applications. The definition encompasses both primary packaging that directly contacts products and secondary packaging used for distribution and retail presentation purposes.

Morocco’s rigid plastic packaging market demonstrates robust growth potential driven by expanding consumer markets, industrial development, and increasing demand for quality packaging solutions. The market benefits from favorable demographic trends, including population growth and rising disposable incomes, which translate into increased consumption of packaged goods across various categories.

Key growth drivers include the expansion of Morocco’s food processing industry, pharmaceutical sector development, and growing export capabilities. The market shows particular strength in beverage packaging, with 42% market share attributed to this segment, followed by food packaging applications. Technological innovation in packaging design and manufacturing processes has enabled local producers to compete effectively with international suppliers while meeting stringent quality requirements.

Strategic positioning within the broader African packaging market provides Morocco with significant advantages for regional expansion and export growth. The market demonstrates resilience through diversified end-use applications and strong domestic demand fundamentals. Investment activity in packaging infrastructure and manufacturing capabilities continues to support market expansion and technological advancement initiatives.

Market analysis reveals several critical insights that define the Morocco rigid plastic packaging landscape. The following key insights provide strategic understanding of market dynamics and growth opportunities:

Economic development serves as a primary driver for Morocco’s rigid plastic packaging market, with expanding industrial sectors creating substantial demand for packaging solutions. The country’s ongoing industrialization efforts, supported by government initiatives and foreign investment, have established a robust foundation for packaging industry growth. Manufacturing sector expansion across food processing, pharmaceuticals, and consumer goods directly translates into increased packaging requirements.

Population growth and urbanization trends contribute significantly to market expansion, with urban populations demonstrating higher consumption rates of packaged goods. Rising disposable incomes enable increased spending on convenience foods, beverages, and consumer products that require rigid plastic packaging solutions. Demographic shifts toward younger, more affluent consumer segments drive demand for innovative packaging formats and premium product presentations.

Export opportunities represent a crucial growth driver, with Morocco’s strategic geographic position facilitating access to European and African markets. The country’s trade agreements and preferential market access arrangements create favorable conditions for packaging industry exports. Agricultural sector modernization generates increased demand for packaging solutions that extend product shelf life and enable efficient distribution to domestic and international markets.

Retail sector development and the expansion of modern trade channels, including supermarkets and hypermarkets, create demand for attractive, functional packaging solutions that enhance product visibility and consumer appeal. E-commerce growth further drives demand for protective packaging solutions that ensure product integrity during transportation and delivery processes.

Raw material costs present significant challenges for Morocco’s rigid plastic packaging market, with petroleum-based resin prices subject to global commodity market volatility. Fluctuating raw material costs impact production economics and pricing strategies, particularly affecting smaller manufacturers with limited purchasing power. Import dependency for specialized resins and additives creates additional cost pressures and supply chain vulnerabilities.

Environmental concerns and increasing regulatory pressure regarding plastic waste management pose challenges for market growth. Growing consumer awareness of environmental issues and government initiatives to reduce plastic waste create pressure for sustainable packaging alternatives. Regulatory compliance requirements for food contact materials and pharmaceutical packaging applications necessitate significant investments in quality systems and testing capabilities.

Competition from alternative packaging materials, including glass, metal, and paper-based solutions, limits market expansion in certain applications. Traditional packaging preferences in some market segments create resistance to plastic packaging adoption. Technical limitations in barrier properties and temperature resistance restrict rigid plastic packaging applications in specialized product categories.

Infrastructure constraints in waste management and recycling systems limit the development of circular economy initiatives within the packaging industry. Limited recycling infrastructure affects the sustainability profile of rigid plastic packaging solutions and creates challenges for manufacturers seeking to implement closed-loop systems.

Sustainable packaging innovation presents substantial opportunities for market expansion, with increasing demand for recyclable, biodegradable, and bio-based rigid plastic packaging solutions. Companies investing in sustainable materials research and development can capture growing market segments focused on environmental responsibility. Circular economy initiatives create opportunities for packaging manufacturers to develop closed-loop systems and recycling programs.

Pharmaceutical sector growth offers significant expansion opportunities, with Morocco’s developing healthcare industry requiring specialized packaging solutions for medicines, medical devices, and healthcare products. The growing pharmaceutical manufacturing sector creates demand for high-barrier, tamper-evident, and child-resistant packaging systems. Regulatory harmonization with international standards opens export opportunities for pharmaceutical packaging products.

Food processing industry expansion creates diverse opportunities for rigid packaging applications, including ready-to-eat meals, dairy products, processed foods, and agricultural exports. Growing consumer demand for convenience foods and extended shelf-life products drives innovation in packaging design and functionality. Export market development for processed food products requires packaging solutions that meet international quality and safety standards.

Technology integration opportunities include smart packaging solutions, digital printing capabilities, and advanced barrier technologies that enhance product protection and consumer engagement. Automation investments can improve production efficiency, reduce costs, and enhance quality consistency throughout manufacturing operations.

Supply chain dynamics within Morocco’s rigid plastic packaging market reflect the complex interplay between raw material suppliers, manufacturers, converters, and end-users across diverse industry sectors. The market demonstrates strong integration between upstream petrochemical suppliers and downstream packaging converters, creating efficient value chains that support competitive pricing and reliable supply availability.

Competitive dynamics show a market structure characterized by both large-scale manufacturers serving major industrial customers and smaller specialized converters focusing on niche applications. Market consolidation trends have created opportunities for efficiency improvements and technology investments, while maintaining space for innovative smaller players. Price competition remains intense, particularly in commodity packaging segments, driving continuous efficiency improvements and cost optimization initiatives.

Innovation dynamics focus on developing packaging solutions that meet evolving consumer preferences for convenience, sustainability, and product protection. Manufacturers invest in research and development to create lightweight designs, enhanced barrier properties, and improved recyclability. Collaboration patterns between packaging suppliers and end-users facilitate customized solution development and long-term partnership arrangements.

Regulatory dynamics influence market development through food safety standards, environmental regulations, and quality requirements that drive continuous improvement in manufacturing processes and product specifications. Market cyclicality reflects seasonal demand patterns in key end-use sectors, particularly food and beverage applications, requiring flexible production capabilities and inventory management strategies.

Comprehensive market research methodology employed for analyzing Morocco’s rigid plastic packaging market incorporates multiple data collection and analysis approaches to ensure accurate and reliable market insights. The research framework combines primary research through industry interviews, surveys, and field studies with extensive secondary research utilizing industry reports, government statistics, and trade association data.

Primary research activities include structured interviews with key industry stakeholders, including packaging manufacturers, raw material suppliers, end-user companies, and industry associations. Survey methodologies capture quantitative data on market sizes, growth rates, pricing trends, and competitive dynamics across different market segments. Field research involves direct observation of manufacturing facilities, distribution channels, and retail environments to understand operational dynamics and market conditions.

Secondary research encompasses analysis of government trade statistics, industry association reports, company financial statements, and international trade data to validate primary research findings and provide comprehensive market context. Data triangulation techniques ensure accuracy and reliability by cross-referencing multiple data sources and validation methods.

Analytical frameworks include market sizing methodologies, competitive analysis models, and trend analysis techniques that provide strategic insights into market dynamics and future growth opportunities. Quality assurance processes ensure data accuracy, consistency, and relevance throughout the research and analysis phases.

Casablanca-Settat region dominates Morocco’s rigid plastic packaging market, accounting for approximately 38% market share due to its concentration of industrial activities, manufacturing facilities, and major consumer markets. This region benefits from well-developed infrastructure, port facilities, and proximity to key end-user industries including food processing, pharmaceuticals, and consumer goods manufacturing.

Rabat-Salé-Kénitra region represents a significant market segment with strong growth potential, driven by expanding industrial zones and government initiatives to promote manufacturing development. The region shows particular strength in pharmaceutical and cosmetics packaging applications, supported by growing healthcare and personal care industries. Infrastructure investments continue to enhance the region’s attractiveness for packaging industry development.

Tangier-Tetouan-Al Hoceima region demonstrates rapid growth in rigid plastic packaging demand, supported by expanding automotive, textile, and export-oriented manufacturing sectors. The region’s strategic location near European markets creates opportunities for packaging industry exports and international partnerships. Free trade zone developments attract foreign investment and technology transfer in packaging manufacturing.

Marrakech-Safi region shows growing market presence, particularly in food processing and agricultural packaging applications. The region’s agricultural sector modernization drives demand for packaging solutions that support product preservation and market access. Tourism industry development creates additional demand for beverage and food packaging applications throughout the region.

Market leadership in Morocco’s rigid plastic packaging sector is characterized by a mix of domestic manufacturers and international companies with local operations. The competitive landscape demonstrates strong capabilities across various packaging segments, with companies differentiating through technology, quality, and customer service excellence.

Competitive strategies focus on technology advancement, capacity expansion, and market diversification to maintain strong positioning in evolving market conditions. Companies invest in automation, quality systems, and sustainability initiatives to differentiate their offerings and capture growth opportunities.

Product segmentation within Morocco’s rigid plastic packaging market encompasses diverse packaging formats designed for specific applications and performance requirements. The market segments demonstrate varying growth rates and competitive dynamics based on end-user needs and technological requirements.

By Product Type:

By Material Type:

By End-Use Industry:

Beverage packaging category represents the most significant segment within Morocco’s rigid plastic packaging market, driven by expanding consumption of bottled water, soft drinks, and fruit juices. This category benefits from year-round demand, tourism industry growth, and increasing health consciousness driving bottled water consumption. Innovation trends focus on lightweight designs, enhanced barrier properties, and sustainable materials that reduce environmental impact while maintaining product quality.

Food packaging applications demonstrate strong growth potential across dairy products, processed foods, and ready-to-eat meals. The category benefits from changing consumer lifestyles, urbanization trends, and expanding food processing industry capabilities. Technical requirements include food safety compliance, extended shelf life properties, and microwave-safe materials that meet consumer convenience expectations.

Pharmaceutical packaging represents a high-value, specialized category requiring stringent quality standards, regulatory compliance, and advanced barrier properties. This segment shows robust growth driven by expanding healthcare access, pharmaceutical manufacturing development, and increasing medicine consumption. Quality standards necessitate significant investments in clean room facilities, testing capabilities, and certification processes.

Personal care and cosmetics packaging focuses on aesthetic appeal, premium materials, and innovative designs that enhance brand differentiation and consumer appeal. This category demonstrates strong growth potential driven by rising disposable incomes, beauty consciousness, and expanding retail distribution channels. Customization capabilities become increasingly important for brand owners seeking unique packaging solutions.

Manufacturers benefit from Morocco’s rigid plastic packaging market through access to growing domestic demand, export opportunities, and favorable production economics. The market provides opportunities for capacity utilization, technology advancement, and market diversification across multiple end-use sectors. Operational advantages include proximity to raw material suppliers, skilled workforce availability, and government support for industrial development initiatives.

End-user industries gain access to reliable, cost-effective packaging solutions that enhance product protection, shelf life, and market presentation capabilities. Local sourcing reduces supply chain risks, transportation costs, and lead times compared to imported packaging solutions. Customization capabilities enable tailored packaging solutions that meet specific product requirements and brand positioning strategies.

Investors and stakeholders benefit from market growth potential, expanding industrial base, and strategic geographic positioning that supports both domestic and export market development. The market demonstrates resilience through diversified end-use applications and strong fundamental demand drivers. Technology transfer opportunities enable knowledge sharing and capability development within the broader packaging ecosystem.

Government and economic development benefit from job creation, industrial development, export revenue generation, and technology advancement within the packaging sector. The industry contributes to economic diversification, value-added manufacturing, and integration with global supply chains. Environmental benefits emerge through improved recycling infrastructure and sustainable packaging initiatives that support circular economy objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Morocco’s rigid plastic packaging market, with manufacturers increasingly adopting recyclable materials, reducing packaging weight, and implementing circular economy principles. This trend reflects growing environmental awareness among consumers and regulatory pressure for sustainable packaging solutions. Innovation investments focus on developing bio-based materials and improving recycling compatibility across product portfolios.

Digital integration and smart packaging technologies are gaining traction, with manufacturers exploring QR codes, NFC tags, and digital printing capabilities that enhance consumer engagement and supply chain traceability. These technologies enable brand differentiation and provide valuable data insights for manufacturers and brand owners. Automation advancement in production processes improves efficiency, quality consistency, and cost competitiveness.

Customization demand continues to grow as brand owners seek unique packaging solutions that differentiate their products in competitive markets. This trend drives investment in flexible production capabilities, design services, and rapid prototyping technologies. Premium positioning strategies require enhanced aesthetic appeal, functional features, and innovative designs that justify higher price points.

E-commerce packaging requirements are evolving rapidly, with growing demand for protective packaging solutions that ensure product integrity during shipping and delivery. This trend creates opportunities for specialized packaging designs and materials that meet the unique requirements of online retail channels. Supply chain optimization becomes increasingly important as manufacturers seek to reduce costs and improve service levels.

Manufacturing capacity expansion initiatives across Morocco’s packaging industry reflect strong confidence in market growth prospects and export opportunities. Several major manufacturers have announced significant investments in new production facilities, advanced equipment, and technology upgrades that enhance capabilities and competitiveness. Foreign investment in the packaging sector brings international expertise, technology transfer, and access to global markets.

Sustainability initiatives have gained momentum with multiple manufacturers implementing recycling programs, sustainable material sourcing, and circular economy practices. Industry associations and government agencies collaborate on waste management infrastructure development and environmental compliance programs. Certification achievements in international quality standards enable market access and premium positioning opportunities.

Technology partnerships between Moroccan manufacturers and international equipment suppliers facilitate knowledge transfer, capability development, and access to advanced production technologies. These collaborations enhance product quality, production efficiency, and innovation capabilities throughout the industry. Research and development investments focus on sustainable materials, barrier technologies, and specialized packaging solutions.

Market consolidation activities include mergers, acquisitions, and strategic partnerships that create larger, more efficient operations with enhanced market coverage and technological capabilities. Export market development initiatives supported by government trade promotion agencies expand international market access and revenue diversification opportunities for domestic manufacturers.

Strategic recommendations for Morocco’s rigid plastic packaging market participants emphasize the importance of sustainability leadership, technology advancement, and market diversification strategies. MarkWide Research analysis indicates that companies investing in sustainable packaging solutions and circular economy initiatives will capture growing market segments focused on environmental responsibility and regulatory compliance.

Technology investment priorities should focus on automation, quality systems, and advanced manufacturing capabilities that improve efficiency and enable premium market positioning. Companies should evaluate opportunities for equipment upgrades, digitalization initiatives, and process optimization that enhance competitiveness. Quality certification achievements in international standards become essential for export market access and customer confidence.

Market expansion strategies should prioritize export development, particularly in African and European markets where Morocco enjoys preferential trade access and competitive advantages. Companies should invest in market research, distribution partnerships, and customer relationship development that support international growth. Product diversification across multiple end-use sectors reduces market risks and creates growth opportunities.

Partnership development with raw material suppliers, technology providers, and end-user customers creates value chain integration opportunities and competitive advantages. Companies should evaluate strategic alliances, joint ventures, and long-term supply agreements that enhance market positioning. Innovation collaboration with research institutions and international partners accelerates product development and technology advancement initiatives.

Long-term growth prospects for Morocco’s rigid plastic packaging market remain highly positive, supported by fundamental demand drivers including population growth, economic development, and expanding industrial capabilities. MWR projections indicate sustained growth momentum with increasing market sophistication and international competitiveness over the forecast period.

Sustainability transformation will continue to reshape market dynamics, with successful companies being those that effectively balance environmental responsibility with performance and cost requirements. The market will likely see increased adoption of recyclable materials, bio-based alternatives, and circular economy practices that meet evolving regulatory and consumer expectations. Innovation acceleration in sustainable packaging solutions creates competitive differentiation opportunities.

Export market development represents a significant growth opportunity, with Morocco’s strategic positioning and trade agreements providing competitive advantages in regional and international markets. The packaging industry will likely benefit from expanding manufacturing sectors and growing demand for Moroccan products in global markets. Technology advancement will enable higher value-added products and premium market positioning.

Market maturation will likely result in industry consolidation, with larger, more efficient operations gaining market share through economies of scale, technology investments, and superior customer service capabilities. The market will demonstrate increasing sophistication in product development, quality standards, and customer relationships. Integration opportunities throughout the value chain will create operational efficiencies and competitive advantages for forward-thinking companies.

Morocco’s rigid plastic packaging market presents compelling opportunities for growth, innovation, and market development across diverse industry sectors. The market benefits from strong fundamental drivers including economic development, population growth, and expanding industrial capabilities that support sustained demand growth. Strategic positioning between European and African markets provides unique competitive advantages for domestic manufacturers seeking export opportunities and international partnerships.

Market evolution toward sustainability, technology advancement, and premium positioning creates opportunities for companies that invest in innovation, quality systems, and environmental responsibility. The packaging industry will continue to play a crucial role in supporting Morocco’s economic development, industrial diversification, and export growth objectives. Competitive success will depend on companies’ ability to adapt to changing market conditions, invest in capabilities, and build strong customer relationships across domestic and international markets.

Future success in Morocco’s rigid plastic packaging market will require strategic focus on sustainability leadership, technology advancement, and market diversification that creates long-term competitive advantages and stakeholder value. Companies that effectively balance growth ambitions with environmental responsibility and operational excellence will capture the most significant opportunities in this dynamic and evolving market landscape.

What is Rigid Plastic Packaging?

Rigid Plastic Packaging refers to containers and packaging materials made from plastic that maintain their shape and structure. This type of packaging is commonly used for food, beverages, and consumer goods due to its durability and versatility.

What are the key players in the Morocco Rigid Plastic Packaging Market?

Key players in the Morocco Rigid Plastic Packaging Market include companies like Plastipak Packaging, Amcor, and Berry Global, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the growth factors driving the Morocco Rigid Plastic Packaging Market?

The growth of the Morocco Rigid Plastic Packaging Market is driven by increasing consumer demand for convenient packaging, the rise of e-commerce, and the need for sustainable packaging solutions. Additionally, the food and beverage sector’s expansion significantly contributes to market growth.

What challenges does the Morocco Rigid Plastic Packaging Market face?

The Morocco Rigid Plastic Packaging Market faces challenges such as regulatory pressures regarding plastic waste, competition from alternative materials, and fluctuating raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the Morocco Rigid Plastic Packaging Market?

Opportunities in the Morocco Rigid Plastic Packaging Market include the development of biodegradable plastics, innovations in packaging design, and the growing trend of sustainable packaging. These factors can enhance market competitiveness and attract environmentally conscious consumers.

What trends are shaping the Morocco Rigid Plastic Packaging Market?

Trends shaping the Morocco Rigid Plastic Packaging Market include the increasing adoption of smart packaging technologies, the shift towards lightweight materials, and the focus on recycling and circular economy practices. These trends reflect the industry’s response to consumer preferences and environmental concerns.

Morocco Rigid Plastic Packaging Market

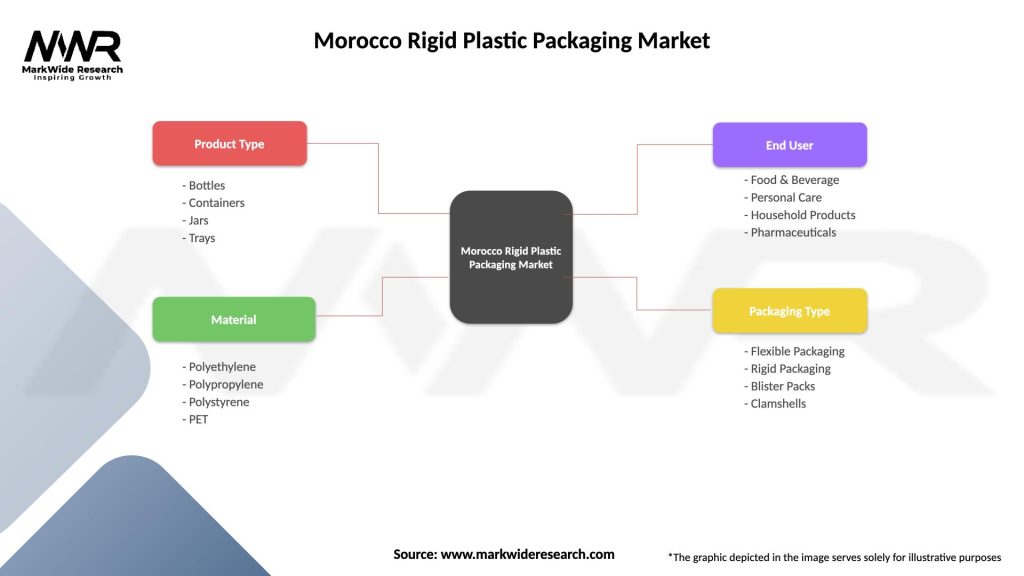

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Jars, Trays |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Household Products, Pharmaceuticals |

| Packaging Type | Flexible Packaging, Rigid Packaging, Blister Packs, Clamshells |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Morocco Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at