444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Morocco flexible plastic packaging market represents a dynamic and rapidly evolving sector within the country’s manufacturing landscape. Flexible plastic packaging has emerged as a cornerstone of Morocco’s packaging industry, driven by increasing consumer demand, expanding retail sectors, and growing food processing activities. The market encompasses a diverse range of products including pouches, bags, films, wraps, and specialized packaging solutions designed to meet the unique requirements of various industries.

Market growth in Morocco’s flexible plastic packaging sector has been particularly robust, with the industry experiencing a compound annual growth rate (CAGR) of 6.8% over recent years. This expansion reflects the country’s strategic position as a gateway between Europe and Africa, coupled with significant investments in manufacturing infrastructure and technological advancement. The market benefits from Morocco’s favorable business environment, skilled workforce, and proximity to major European markets.

Industry dynamics are characterized by increasing adoption of sustainable packaging solutions, technological innovations in barrier properties, and growing demand from the food and beverage sector. The market serves both domestic consumption and export markets, with approximately 35% of production destined for international markets, particularly in Europe and sub-Saharan Africa.

The Morocco flexible plastic packaging market refers to the comprehensive ecosystem of manufacturers, suppliers, and distributors involved in producing flexible packaging solutions using various plastic materials and technologies. Flexible plastic packaging encompasses packaging materials that can be readily shaped, molded, or configured to accommodate different product requirements while maintaining protective and functional properties.

This market segment includes the production and distribution of multilayer films, laminated structures, printed packaging materials, and specialized barrier films designed for food preservation, pharmaceutical protection, and industrial applications. The market operates through integrated supply chains that connect raw material suppliers, converting facilities, printing operations, and end-user industries across Morocco’s diverse economic sectors.

Key characteristics of this market include its focus on lightweight, cost-effective packaging solutions that offer superior product protection, extended shelf life, and enhanced consumer convenience. The market encompasses both commodity packaging products and high-value specialized solutions requiring advanced manufacturing technologies and quality control systems.

Morocco’s flexible plastic packaging market demonstrates exceptional growth potential driven by expanding consumer markets, industrial development, and strategic geographic positioning. The market has established itself as a significant contributor to the country’s manufacturing sector, supporting both domestic consumption and export activities across multiple industries.

Key market drivers include the rapid expansion of the food processing industry, increasing urbanization rates, and growing consumer preference for convenient packaging solutions. The market benefits from government support representing 12% of manufacturing incentives, focused on developing the packaging sector as part of Morocco’s industrial diversification strategy.

Technological advancement plays a crucial role in market development, with manufacturers increasingly adopting advanced extrusion technologies, digital printing capabilities, and sustainable material formulations. The market serves diverse end-user segments including food and beverages, pharmaceuticals, personal care, and industrial applications, each requiring specialized packaging solutions.

Market challenges include raw material price volatility, environmental regulations, and competition from alternative packaging materials. However, the market’s strong fundamentals, supported by strategic investments and technological innovation, position it for continued growth and expansion in both domestic and international markets.

Strategic market insights reveal several critical factors shaping the Morocco flexible plastic packaging landscape:

Primary market drivers propelling the Morocco flexible plastic packaging market include robust economic growth, expanding consumer markets, and strategic industrial development initiatives. The food processing sector represents the largest driver, with increasing domestic food production and export activities requiring sophisticated packaging solutions to maintain product quality and extend shelf life.

Urbanization trends significantly impact market demand, as urban consumers increasingly prefer convenient, portable packaging formats that align with modern lifestyle patterns. The growth of modern retail formats, including supermarkets and convenience stores, drives demand for attractive, functional packaging that enhances product presentation and consumer appeal.

Export market expansion serves as a crucial growth driver, with Morocco’s strategic location and trade agreements facilitating access to European and African markets. The country’s manufacturing export growth of 8.5% annually directly benefits the flexible packaging sector through increased demand for export-ready packaging solutions.

Government industrial policies actively support packaging sector development through investment incentives, infrastructure development, and skills training programs. These initiatives encourage technology transfer, capacity expansion, and quality improvement across the industry.

Consumer behavior changes toward convenience foods, ready-to-eat products, and portion-controlled packaging drive innovation in flexible packaging design and functionality. Environmental consciousness also drives demand for sustainable packaging solutions that reduce waste and environmental impact.

Market restraints affecting the Morocco flexible plastic packaging sector include raw material price volatility, environmental regulations, and intense competition from alternative packaging materials. Petroleum-based raw materials subject the industry to global oil price fluctuations, impacting production costs and profit margins.

Environmental regulations increasingly restrict single-use plastic packaging, requiring manufacturers to invest in sustainable alternatives and recycling technologies. These regulatory changes necessitate significant capital investments and operational modifications that can strain smaller manufacturers.

Technical skill shortages in specialized manufacturing processes limit industry growth potential, particularly in advanced printing, lamination, and quality control operations. The industry requires continuous training and development programs to maintain competitive manufacturing capabilities.

Infrastructure limitations in certain regions affect distribution efficiency and market access, particularly for manufacturers serving rural markets or export destinations. Transportation costs and logistics challenges can impact overall market competitiveness.

Competition from alternative materials including paper-based packaging, biodegradable materials, and rigid packaging solutions challenges market share in certain applications. Manufacturers must continuously innovate to maintain competitive advantages and market position.

Significant market opportunities exist within Morocco’s flexible plastic packaging sector, driven by emerging applications, technological advancement, and expanding market access. The pharmaceutical packaging segment presents substantial growth potential as Morocco develops its pharmaceutical manufacturing capabilities and export activities.

Sustainable packaging solutions offer considerable opportunities for manufacturers willing to invest in biodegradable materials, recyclable formulations, and circular economy approaches. Consumer and regulatory demand for environmentally responsible packaging creates premium market segments with higher value potential.

Digital printing technologies enable customization, short-run production, and rapid market response capabilities that appeal to brand owners seeking differentiation and market agility. These technologies support premium packaging applications and specialized market segments.

Regional market expansion into sub-Saharan Africa presents significant opportunities, with Morocco’s established trade relationships and geographic proximity facilitating market entry. The region’s growing consumer markets and industrial development create demand for quality packaging solutions.

Smart packaging integration incorporating sensors, indicators, and interactive features represents an emerging opportunity for high-value applications in food safety, pharmaceutical compliance, and consumer engagement. These technologies command premium pricing and differentiate products in competitive markets.

Market dynamics in Morocco’s flexible plastic packaging sector reflect the interplay between supply-side capabilities, demand-side requirements, and external market forces. Supply chain integration has become increasingly important, with manufacturers developing closer relationships with raw material suppliers and end-user customers to optimize efficiency and responsiveness.

Technological evolution drives continuous market transformation, with manufacturers adopting advanced extrusion technologies, digital printing systems, and automated quality control processes. These investments enhance production efficiency by approximately 15-20% while improving product quality and consistency.

Competitive dynamics intensify as both domestic and international players compete for market share across different segments. Market leaders focus on technology leadership, quality excellence, and customer service to maintain competitive advantages in an increasingly crowded marketplace.

Regulatory influences shape market development through environmental standards, food safety requirements, and trade regulations. Manufacturers must navigate complex regulatory environments while maintaining operational efficiency and cost competitiveness.

Customer relationship management becomes increasingly critical as end-users demand customized solutions, technical support, and collaborative product development. Successful companies invest in customer-centric approaches that build long-term partnerships and market loyalty.

Comprehensive research methodology employed in analyzing Morocco’s flexible plastic packaging market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability. Primary research activities include structured interviews with industry executives, manufacturing facility visits, and detailed supplier assessments across the value chain.

Secondary research components encompass government statistical data, industry association reports, trade publication analysis, and international market studies. This multi-source approach provides comprehensive market coverage and cross-validation of key findings and trends.

Quantitative analysis methods include market sizing calculations, growth rate projections, and segment performance comparisons using established statistical techniques and forecasting models. Data validation processes ensure consistency and accuracy across all analytical components.

Qualitative research elements focus on understanding market dynamics, competitive positioning, and strategic trends through expert interviews and industry observation. These insights provide context and interpretation for quantitative findings.

Market validation procedures include stakeholder feedback sessions, industry expert reviews, and comparative analysis with similar markets to ensure research conclusions accurately reflect market realities and future potential.

Regional market distribution across Morocco reveals distinct patterns reflecting industrial concentration, population density, and economic activity levels. The Casablanca-Settat region dominates market activity, accounting for approximately 45% of total production capacity, driven by industrial infrastructure, port access, and proximity to major consumer markets.

Rabat-Salé-Kénitra region represents the second-largest market concentration, benefiting from government presence, industrial development policies, and strategic location between major economic centers. This region focuses on high-value packaging applications and export-oriented production.

Tangier-Tetouan-Al Hoceima region has emerged as a significant manufacturing hub, particularly for export-oriented production serving European markets. The region’s manufacturing growth rate of 12% annually reflects substantial investments in industrial infrastructure and logistics capabilities.

Fès-Meknès region specializes in traditional packaging applications serving agricultural and food processing industries. The region’s established manufacturing base and skilled workforce support both domestic market supply and specialized product development.

Marrakech-Safi region focuses on packaging solutions for tourism-related industries, agricultural products, and emerging manufacturing sectors. Regional development initiatives support capacity expansion and technology upgrading across the packaging value chain.

Competitive landscape analysis reveals a diverse market structure combining international corporations, domestic manufacturers, and specialized converters serving different market segments and applications. Market leadership is distributed among several key players, each maintaining distinct competitive advantages and market positioning strategies.

Leading market participants include:

Competitive strategies focus on technology differentiation, customer service excellence, and market specialization. Leading companies invest heavily in research and development, quality systems, and customer relationship management to maintain market position and drive growth.

Market consolidation trends indicate increasing cooperation between manufacturers through strategic partnerships, joint ventures, and technology sharing agreements. These collaborations enhance competitive capabilities while reducing individual investment requirements.

Market segmentation analysis reveals distinct categories based on material type, application, end-user industry, and geographic distribution. By material type, the market encompasses polyethylene films, polypropylene structures, polyester laminates, and specialized barrier materials, each serving specific performance requirements and cost parameters.

By application segments:

By end-user industries:

Food packaging category dominates market activity, driven by Morocco’s expanding food processing industry and export agriculture sector. Fresh produce packaging represents a particularly dynamic segment, with innovations in modified atmosphere packaging and extended shelf-life solutions supporting agricultural export growth.

Pharmaceutical packaging category demonstrates the highest growth potential, with annual growth rates exceeding 10% as Morocco develops its pharmaceutical manufacturing capabilities. This segment requires specialized materials, printing technologies, and quality control systems that command premium pricing.

Industrial packaging category serves diverse manufacturing sectors including chemicals, construction materials, and automotive components. This segment emphasizes durability, chemical resistance, and cost-effectiveness while maintaining adequate product protection.

Consumer goods packaging focuses on aesthetic appeal, brand differentiation, and consumer convenience. This category drives innovation in printing technologies, structural design, and functional features that enhance product presentation and user experience.

Specialty packaging applications including medical devices, electronics, and luxury goods represent emerging opportunities for high-value packaging solutions. These applications require specialized materials, advanced manufacturing processes, and stringent quality control systems.

Industry participants benefit from Morocco’s strategic advantages including geographic location, trade agreements, and government support for manufacturing development. Manufacturers gain access to both domestic and export markets while benefiting from competitive labor costs and improving infrastructure.

Raw material suppliers benefit from growing demand, stable customer relationships, and opportunities for value-added product development. The market’s growth trajectory provides predictable demand patterns that support investment planning and capacity expansion.

End-user industries benefit from improved packaging solutions that enhance product protection, extend shelf life, and reduce total packaging costs. Local manufacturing capabilities provide supply chain security and responsive customer service.

Technology providers find opportunities for equipment sales, technical services, and ongoing support relationships with growing manufacturers. The market’s technology adoption rate creates sustained demand for advanced manufacturing systems.

Government stakeholders benefit from industrial development, employment creation, and export revenue generation. The packaging industry contributes to economic diversification and value-added manufacturing development objectives.

Investors benefit from market growth potential, stable demand patterns, and opportunities for both domestic market development and export expansion. The sector’s fundamentals support long-term investment strategies and sustainable returns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping Morocco’s flexible plastic packaging market. Manufacturers increasingly adopt recyclable materials, biodegradable formulations, and circular economy principles to meet environmental regulations and consumer expectations. This trend drives innovation in material science and manufacturing processes.

Digital printing adoption accelerates across the market, enabling customization, short production runs, and rapid market response capabilities. Digital technologies support brand differentiation, seasonal packaging variations, and specialized market segments that traditional printing methods cannot efficiently serve.

Smart packaging integration emerges as manufacturers explore sensors, indicators, and interactive features that enhance product functionality and consumer engagement. These technologies find applications in food safety monitoring, pharmaceutical compliance, and consumer convenience features.

Supply chain optimization drives closer integration between raw material suppliers, converters, and end-users. Collaborative relationships improve efficiency, reduce costs, and enhance responsiveness to market changes and customer requirements.

Export market diversification expands beyond traditional European destinations to include African, Middle Eastern, and Asian markets. This diversification reduces market concentration risks while capitalizing on Morocco’s strategic location and trade relationships.

Quality system enhancement reflects increasing customer requirements for international standards, certifications, and quality assurance. Manufacturers invest in quality control systems, testing capabilities, and certification processes to meet export market requirements.

Recent industry developments highlight the dynamic nature of Morocco’s flexible plastic packaging market and the strategic initiatives driving sector growth. Major capacity expansions by leading manufacturers reflect confidence in market growth potential and commitment to serving expanding demand.

Technology partnerships between Moroccan manufacturers and international equipment suppliers facilitate technology transfer, capability enhancement, and quality improvement. These collaborations accelerate adoption of advanced manufacturing processes and quality control systems.

Sustainability initiatives include investments in recycling facilities, development of biodegradable materials, and implementation of circular economy principles. MarkWide Research indicates that 30% of manufacturers have implemented comprehensive sustainability programs within the past two years.

Export market development activities include participation in international trade shows, establishment of distribution partnerships, and development of export-specific product lines. These initiatives support market diversification and revenue growth objectives.

Research and development investments focus on specialized packaging solutions, barrier property enhancement, and cost reduction technologies. Leading companies allocate significant resources to innovation activities that drive competitive differentiation.

Regulatory compliance improvements include implementation of food safety standards, environmental management systems, and quality certifications required for international market access. These developments enhance market credibility and export potential.

Strategic recommendations for Morocco flexible plastic packaging market participants emphasize the importance of technology investment, market diversification, and sustainability leadership. Manufacturers should prioritize advanced manufacturing technologies that improve efficiency, quality, and environmental performance while reducing production costs.

Market diversification strategies should focus on developing specialized applications, expanding geographic reach, and building strategic partnerships that enhance competitive capabilities. Companies should consider joint ventures, technology licensing, and collaborative development programs to accelerate growth.

Sustainability leadership presents opportunities for competitive differentiation and premium market positioning. Early adoption of environmentally responsible materials and processes can establish market leadership positions before regulatory requirements mandate changes.

Export market development should leverage Morocco’s strategic advantages while building capabilities required for international competitiveness. Investment in quality systems, certifications, and customer service capabilities supports export growth objectives.

Innovation focus should emphasize customer-centric solutions that address specific market needs while providing competitive advantages. Collaborative innovation with customers and suppliers can accelerate product development and market acceptance.

Operational excellence initiatives should focus on efficiency improvement, cost reduction, and quality enhancement to maintain competitiveness in increasingly challenging market conditions. Continuous improvement programs support long-term sustainability and growth.

Future market outlook for Morocco’s flexible plastic packaging sector remains highly positive, supported by strong fundamentals, strategic advantages, and growing market opportunities. Market expansion is expected to continue at robust rates, driven by domestic economic growth, export market development, and industrial diversification initiatives.

Technology evolution will continue reshaping market dynamics, with advanced manufacturing processes, digital printing capabilities, and smart packaging features becoming increasingly important competitive factors. Manufacturers investing in technology leadership will capture disproportionate market share and profitability.

Sustainability requirements will intensify, creating both challenges and opportunities for market participants. Companies developing environmentally responsible solutions will benefit from regulatory compliance, customer preference, and premium market positioning.

Regional market integration will expand Morocco’s role as a packaging hub serving North and West African markets. Trade relationships and geographic advantages position Moroccan manufacturers to capture significant market share in growing regional markets.

Industry consolidation may accelerate as companies seek scale advantages, technology access, and market diversification through strategic partnerships and acquisitions. Market leaders will likely expand their competitive advantages through strategic initiatives.

Innovation acceleration will drive development of specialized packaging solutions, advanced materials, and value-added services that differentiate successful companies from commodity producers. Customer-centric innovation will become increasingly important for sustainable competitive advantage.

Morocco’s flexible plastic packaging market represents a dynamic and rapidly growing sector with exceptional potential for continued expansion and development. The market benefits from strategic geographic positioning, government support, and growing demand across multiple end-user industries that create sustainable growth foundations.

Key success factors include technology leadership, quality excellence, sustainability focus, and customer-centric approaches that differentiate successful companies in increasingly competitive markets. Market participants who invest in advanced capabilities while maintaining operational efficiency will capture the greatest opportunities for growth and profitability.

Strategic advantages including trade agreements, skilled workforce, and infrastructure development position Morocco as an attractive location for packaging manufacturing and export activities. These advantages, combined with growing domestic markets, support long-term industry development and investment attractiveness.

Future market development will be shaped by sustainability requirements, technology advancement, and regional market integration that create new opportunities while challenging traditional business models. Companies adapting to these trends while maintaining competitive excellence will thrive in the evolving market landscape.

Overall market prospects remain highly favorable, with strong fundamentals, diverse growth drivers, and strategic positioning supporting continued expansion and development. The Morocco flexible plastic packaging market is well-positioned to capitalize on emerging opportunities while contributing to the country’s economic development and industrial diversification objectives.

What is Flexible Plastic Packaging?

Flexible Plastic Packaging refers to packaging made from flexible materials that can be easily shaped and molded. This type of packaging is widely used in various industries, including food, pharmaceuticals, and consumer goods, due to its lightweight and versatile nature.

What are the key players in the Morocco Flexible Plastic Packaging Market?

Key players in the Morocco Flexible Plastic Packaging Market include companies like Novolex, Amcor, and Sealed Air, which are known for their innovative packaging solutions. These companies focus on sustainability and efficiency in their product offerings, among others.

What are the growth factors driving the Morocco Flexible Plastic Packaging Market?

The growth of the Morocco Flexible Plastic Packaging Market is driven by increasing demand for convenient packaging solutions, rising consumer preference for ready-to-eat meals, and the expansion of e-commerce. Additionally, advancements in packaging technology are enhancing product shelf life and reducing waste.

What challenges does the Morocco Flexible Plastic Packaging Market face?

The Morocco Flexible Plastic Packaging Market faces challenges such as environmental concerns regarding plastic waste and regulatory pressures for sustainable packaging solutions. Additionally, fluctuating raw material prices can impact production costs and profitability.

What opportunities exist in the Morocco Flexible Plastic Packaging Market?

Opportunities in the Morocco Flexible Plastic Packaging Market include the growing trend towards eco-friendly packaging solutions and the increasing demand for customized packaging designs. Furthermore, innovations in biodegradable materials present new avenues for market expansion.

What trends are shaping the Morocco Flexible Plastic Packaging Market?

Trends shaping the Morocco Flexible Plastic Packaging Market include the rise of smart packaging technologies, which enhance consumer engagement, and the shift towards sustainable materials. Additionally, the integration of digital printing in packaging design is becoming increasingly popular.

Morocco Flexible Plastic Packaging Market

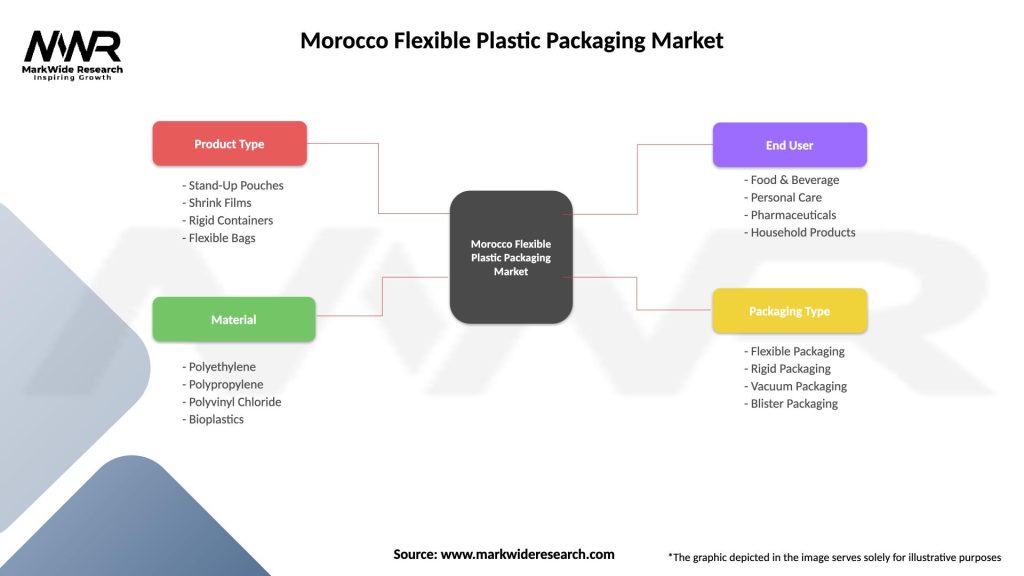

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Shrink Films, Rigid Containers, Flexible Bags |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Bioplastics |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Blister Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Morocco Flexible Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at