444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The money transfer agencies market plays a crucial role in facilitating the transfer of funds between individuals and businesses across different geographical locations. These agencies provide a convenient and secure means of sending and receiving money, catering to the needs of migrants, travelers, and individuals involved in international trade. With globalization and the increasing number of people moving to different countries for various purposes, the demand for reliable and efficient money transfer services has grown significantly.

Meaning

Money transfer agencies refer to businesses or financial institutions that offer services for transferring money from one location to another. These agencies act as intermediaries, facilitating the transfer of funds between individuals, businesses, or even governments. Money transfers can be done through various channels, including online platforms, mobile apps, agent locations, or bank transfers. The agencies charge a fee or commission for their services, which may vary depending on the transfer amount, destination, and speed of transfer.

Executive Summary

The money transfer agencies market has witnessed steady growth in recent years, driven by factors such as globalization, increasing remittance flows, and advancements in technology. The market is highly competitive, with numerous players offering a wide range of services to cater to diverse customer needs. Key market participants include traditional banks, dedicated money transfer operators, fintech companies, and online platforms. These players strive to differentiate themselves by offering competitive exchange rates, quick transfer speeds, and enhanced convenience.

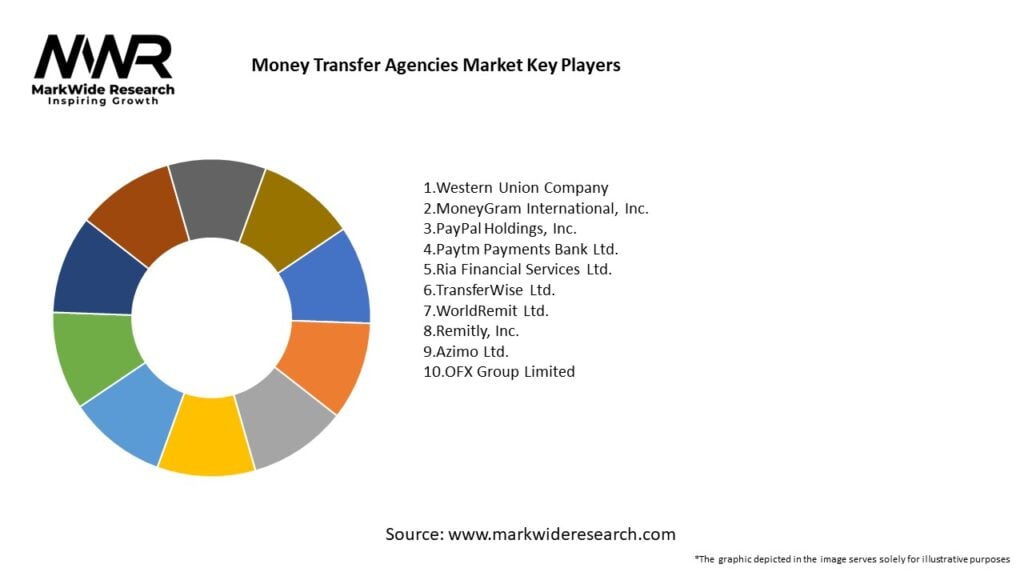

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The money transfer agencies market operates in a dynamic environment influenced by various factors. Changing demographics, economic conditions, technological advancements, and regulatory developments shape the market dynamics. Understanding these dynamics is crucial for agencies to adapt their strategies and remain competitive.

Regional Analysis

The money transfer agencies market exhibits regional variations based on factors such as economic conditions, migration patterns, regulatory frameworks, and cultural preferences. While North America and Europe represent mature markets with a high level of digital adoption, emerging economies in Asia-Pacific, Latin America, and Africa offer significant growth potential due to increasing remittance flows and expanding middle-class populations.

Competitive Landscape

Leading Companies in the Money Transfer Agencies Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

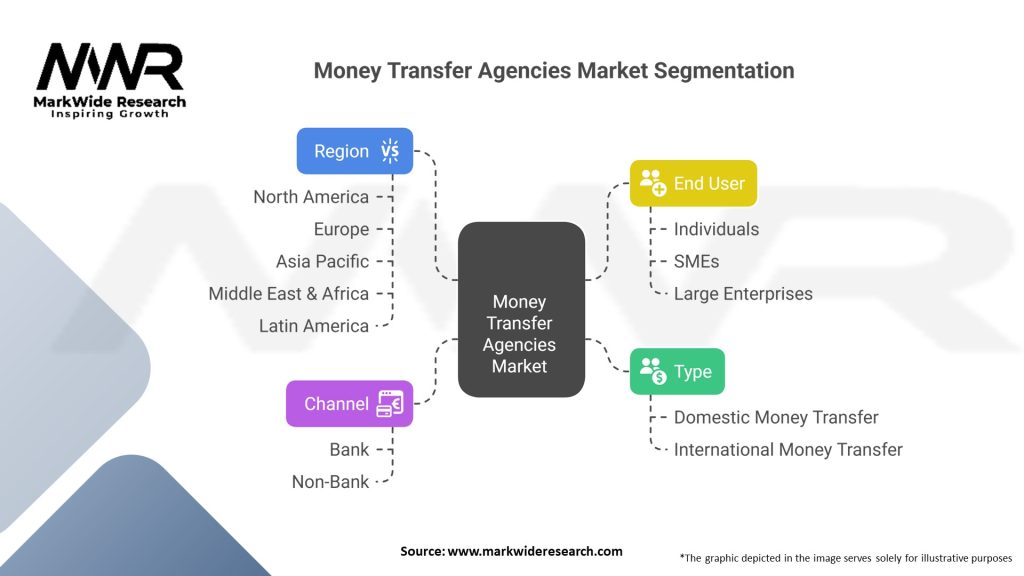

Segmentation

The money transfer agencies market can be segmented based on various factors, including transfer channel, service type, customer segment, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the money transfer agencies market. Some of the key effects include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The money transfer agencies market is expected to continue its growth trajectory in the coming years. Factors such as increasing international migration, rising remittance volumes, technological advancements, and expanding access to financial services in emerging markets will drive market expansion. Money transfer agencies that embrace digital transformation, focus on customer-centricity, and adapt to changing regulatory landscapes are likely to thrive in the evolving market.

Conclusion

The money transfer agencies market serves as a vital link in facilitating the movement of funds across borders. With globalization, increasing migration, and advancements in technology, the demand for secure, efficient, and convenient money transfer services has grown significantly. Money transfer agencies face both opportunities and challenges, driven by factors such as increasing remittance volumes, digital disruption, regulatory compliance, and customer expectations. By embracing technology, enhancing customer experiences, and exploring strategic partnerships, money transfer agencies can capitalize on the market’s potential and navigate the evolving landscape successfully.

What is Money Transfer Agencies?

Money Transfer Agencies are financial institutions that facilitate the transfer of money from one individual or entity to another, often across different geographical locations. They provide services such as remittances, international transfers, and currency exchange, catering to both personal and business needs.

What are the key players in the Money Transfer Agencies Market?

Key players in the Money Transfer Agencies Market include Western Union, MoneyGram, and PayPal, which offer various money transfer services globally. These companies compete on factors such as transaction speed, fees, and customer service, among others.

What are the growth factors driving the Money Transfer Agencies Market?

The Money Transfer Agencies Market is driven by increasing globalization, the rise of e-commerce, and the growing need for remittances among migrant workers. Additionally, advancements in technology and mobile payment solutions are enhancing the accessibility of money transfer services.

What challenges does the Money Transfer Agencies Market face?

The Money Transfer Agencies Market faces challenges such as regulatory compliance, security concerns regarding fraud and cyber threats, and competition from emerging fintech solutions. These factors can impact operational efficiency and customer trust.

What opportunities exist in the Money Transfer Agencies Market?

Opportunities in the Money Transfer Agencies Market include expanding into underbanked regions, leveraging blockchain technology for faster transactions, and developing partnerships with local businesses to enhance service offerings. These strategies can help agencies tap into new customer segments.

What trends are shaping the Money Transfer Agencies Market?

Trends in the Money Transfer Agencies Market include the increasing adoption of digital wallets, the integration of AI for customer service, and the growing popularity of peer-to-peer transfer platforms. These innovations are transforming how consumers engage with money transfer services.

Money Transfer Agencies Market

Segmentation Details:

| Segmentation | Details |

|---|---|

| Type | Domestic Money Transfer, International Money Transfer |

| Channel | Bank, Non-Bank |

| End User | Individuals, SMEs, Large Enterprises |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Money Transfer Agencies Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at