444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The molded underfill material market is witnessing significant growth due to its crucial role in enhancing the reliability and durability of electronic components. With the increasing demand for smaller, faster, and more efficient electronic devices, the need for reliable underfill materials has become paramount. Molded underfill materials provide improved mechanical stress relief, thermal conductivity, and protection against moisture and other environmental factors.

Meaning

Molded underfill material refers to a type of polymer-based material used to fill the gap between the semiconductor chip and the substrate in electronic devices. This material is applied in a liquid or semi-liquid state and is then solidified to provide mechanical support and improve reliability by reducing the thermal and mechanical stresses experienced by the chip during operation.

Executive Summary

The molded underfill material market is poised for substantial growth in the coming years. The increasing demand for portable electronic devices, such as smartphones, tablets, and wearables, is a key driver for market growth. Additionally, advancements in semiconductor packaging technologies, such as flip-chip packaging, further contribute to the demand for molded underfill materials.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

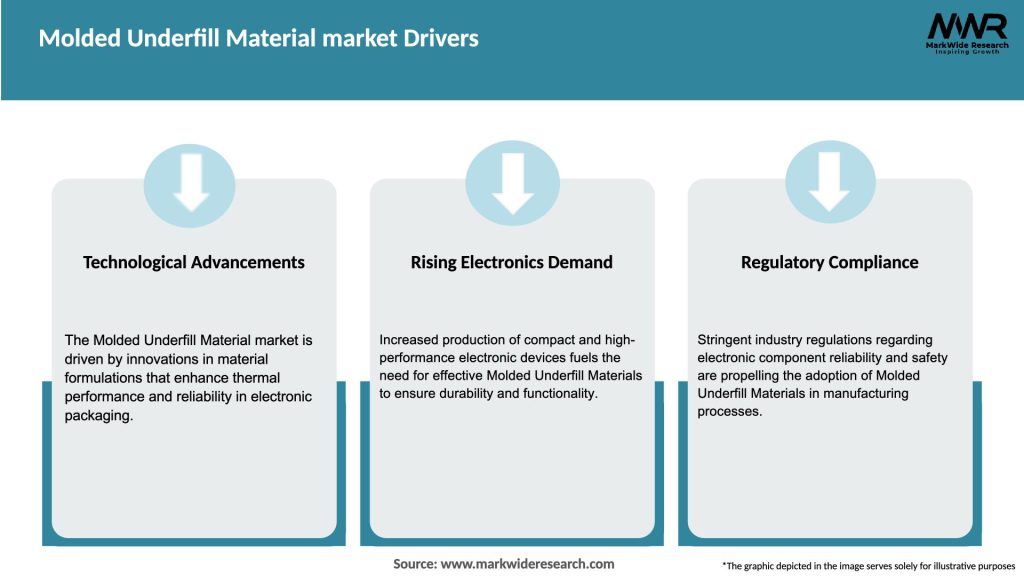

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The molded underfill material market is characterized by intense competition among key players, technological advancements, and continuous innovation. Market dynamics are influenced by factors such as consumer preferences, evolving packaging technologies, and regulatory requirements. To stay competitive, manufacturers need to focus on product development, strategic partnerships, and expanding their geographical presence.

Regional Analysis

North America: The North American molded underfill material market is driven by the presence of major semiconductor manufacturers and the growing demand for advanced electronic devices. The region is witnessing increased investments in research and development activities, fostering technological advancements in molded underfill materials.

Europe: The European market for molded underfill materials is driven by the expanding consumer electronics industry and the rising demand for reliable electronic devices. The region is witnessing collaborations between academic institutions, research organizations, and market players to develop innovative underfill materials.

Asia-Pacific: The Asia-Pacific region dominates the global molded underfill material market due to its established semiconductor industry, particularly in countries like China, Japan, and South Korea. The region’s strong presence in consumer electronics manufacturing and continuous technological advancements contribute to market growth.

Latin America: The Latin American market for molded underfill materials is poised for significant growth due to the expanding electronics industry and increasing consumer disposable income. The region presents opportunities for market players to tap into emerging economies and cater to the growing demand for electronic devices.

Competitive Landscape

Leading Companies in the Molded Underfill Material Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

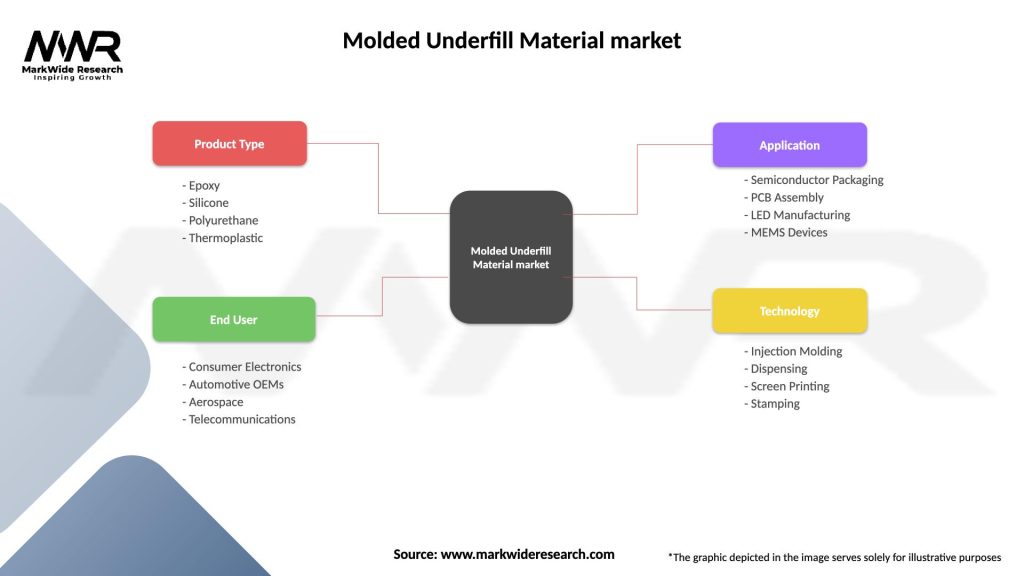

Segmentation

The molded underfill material market can be segmented based on type, application, and end-use industry.

By Type:

By Application:

By End-Use Industry:

Category-wise Insights

Consumer Electronics: The consumer electronics industry is a major consumer of molded underfill materials. The demand for smaller and more reliable electronic devices, such as smartphones, tablets, and wearables, drives the growth of this segment.

Automotive: The automotive industry presents significant opportunities for the molded underfill material market. The increasing integration of electronic components in vehicles, including ADAS and infotainment systems, requires reliable underfill materials to ensure long-term performance and durability.

Telecommunications: The telecommunications industry relies on molded underfill materials for the production of high-performance networking and communication equipment. These materials enable efficient heat dissipation and mechanical stability in telecommunications devices.

Healthcare: Molded underfill materials find applications in healthcare devices, such as medical imaging equipment, monitoring systems, and implantable devices. The healthcare industry’s increasing focus on reliability and longevity drives the adoption of molded underfill materials.

Others: The molded underfill material market also caters to other industries, including aerospace and defense, industrial automation, and energy. These industries benefit from the enhanced reliability and performance offered by underfill materials in their electronic systems.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the molded underfill material market. While the initial phase of the pandemic disrupted supply chains and manufacturing activities, the subsequent rise in remote work, online learning, and telehealth services led to increased demand for electronic devices, thereby driving the market. However, manufacturers faced challenges such as labor shortages, logistics disruptions, and uncertainties in the global economy. Despite these challenges, the market showed resilience and is expected to recover steadily as the global situation stabilizes.

Key Industry Developments

Key developments in the Molded Underfill Material Market include:

Analyst Suggestions

Future Outlook

The molded underfill material market is projected to witness steady growth in the coming years. Factors such as the increasing demand for portable electronic devices, advancements in semiconductor packaging technologies, and the expansion of 5G infrastructure will drive market growth. Manufacturers’ focus on developing innovative underfill materials with improved thermal management, reliability, and sustainability will be key to capitalizing on emerging opportunities.

Conclusion

The molded underfill material market plays a crucial role in enhancing the reliability, durability, and performance of electronic components. With the growing demand for smaller, faster, and more efficient electronic devices, the need for reliable underfill materials continues to rise. Manufacturers are investing in research and development activities to develop advanced molded underfill materials that meet the evolving requirements of the electronics industry. By staying at the forefront of technological advancements, collaborating with industry stakeholders, and addressing sustainability concerns, market players can position themselves for success in this dynamic and promising market.

What is Molded Underfill Material?

Molded Underfill Material refers to a type of encapsulant used in semiconductor packaging to enhance the reliability and performance of electronic components. It is typically applied in the assembly of flip-chip devices, providing mechanical support and protection against environmental factors.

What are the key companies in the Molded Underfill Material market?

Key companies in the Molded Underfill Material market include Henkel AG, Dow Inc., and Sumitomo Bakelite Co., among others.

What are the growth factors driving the Molded Underfill Material market?

The growth of the Molded Underfill Material market is driven by the increasing demand for miniaturized electronic devices, advancements in semiconductor technology, and the rising need for high-performance packaging solutions in industries such as automotive and consumer electronics.

What challenges does the Molded Underfill Material market face?

Challenges in the Molded Underfill Material market include the high cost of raw materials, the complexity of manufacturing processes, and the need for compliance with stringent environmental regulations.

What opportunities exist in the Molded Underfill Material market?

Opportunities in the Molded Underfill Material market include the development of new formulations that enhance thermal conductivity and reliability, as well as the growing adoption of electric vehicles and advanced packaging technologies.

What trends are shaping the Molded Underfill Material market?

Trends in the Molded Underfill Material market include the increasing use of automation in manufacturing processes, the shift towards sustainable materials, and the integration of smart technologies in electronic devices.

Molded Underfill Material market

| Segmentation Details | Description |

|---|---|

| Product Type | Epoxy, Silicone, Polyurethane, Thermoplastic |

| End User | Consumer Electronics, Automotive OEMs, Aerospace, Telecommunications |

| Application | Semiconductor Packaging, PCB Assembly, LED Manufacturing, MEMS Devices |

| Technology | Injection Molding, Dispensing, Screen Printing, Stamping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Molded Underfill Material Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at