444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The mobile home insurance market is witnessing significant growth due to the increasing popularity of mobile homes as affordable housing options. Mobile homes, also known as manufactured homes, provide an affordable housing solution for many individuals and families. With the rising demand for mobile homes, the need for insurance coverage to protect these valuable assets has also increased.

Meaning

Mobile home insurance refers to the coverage provided to owners of mobile homes against potential risks and damages. It offers protection for the structure of the mobile home, personal belongings inside the home, and liability coverage in case of accidents or injuries that occur on the property.

Executive Summary

The mobile home insurance market has experienced steady growth in recent years. The market is driven by the increasing number of mobile home owners, rising awareness about the importance of insurance, and the need for financial protection against unexpected events. Additionally, favorable government regulations and technological advancements in the insurance industry have further contributed to market growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The mobile home insurance market is driven by various factors, including increasing demand for affordable housing, rising awareness about insurance, favorable government regulations, and technological advancements. However, it also faces challenges such as limited awareness and understanding among mobile home owners, high premiums, and limited coverage options. Despite these challenges, there are opportunities for insurance providers to leverage technology, form strategic partnerships, and expand into emerging markets to fuel market growth.

Regional Analysis

The mobile home insurance market varies across different regions. North America dominates the market due to the high adoption of mobile homes in the United States and Canada. Europe and Asia Pacific are also witnessing growth in the mobile home insurance market, driven by increasing urbanization and the need for affordable housing options. Latin America and the Middle East and Africa regions are emerging markets with untapped potential for mobile home insurance.

Competitive Landscape

Leading Companies in the Mobile Home Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

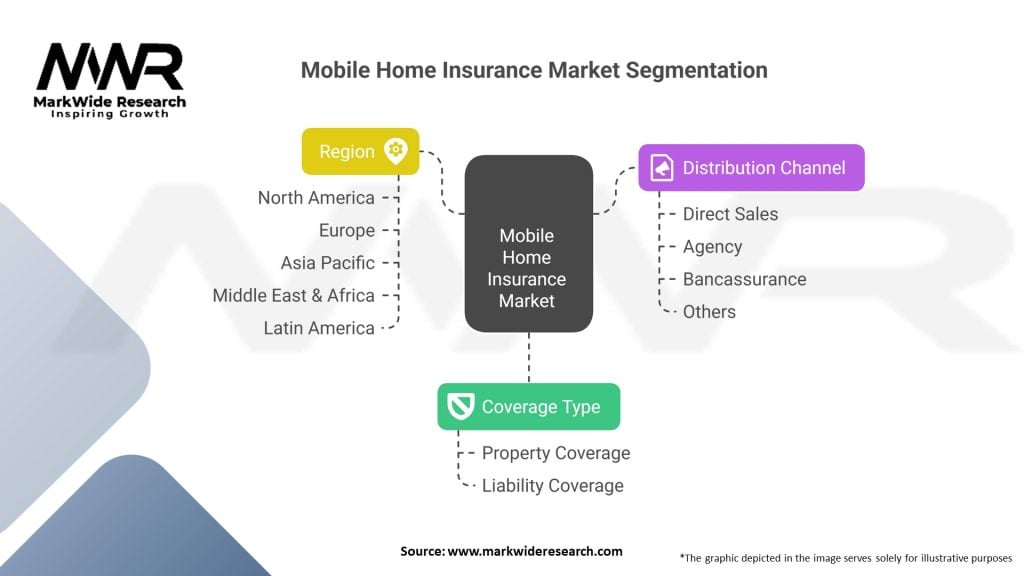

Segmentation

The mobile home insurance market can be segmented based on coverage type, including structural coverage, personal property coverage, and liability coverage. It can also be segmented based on distribution channel, such as insurance agents, brokers, and online platforms.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the mobile home insurance market. On one hand, the pandemic highlighted the need for insurance coverage to protect against unexpected events. The economic uncertainty caused by the pandemic increased the demand for affordable housing options, including mobile homes. On the other hand, the pandemic also led to challenges such as supply chain disruptions and financial constraints, which affected the production and sales of mobile homes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the mobile home insurance market looks promising. The increasing demand for affordable housing solutions, rising awareness about insurance, and technological advancements in the insurance industry are expected to drive market growth. Insurance providers that can adapt to evolving customer needs, offer innovative coverage options, and leverage technology will be well-positioned to succeed in this growing market.

Conclusion

The mobile home insurance market is experiencing significant growth due to the increasing popularity of mobile homes as affordable housing options. The market offers opportunities for insurance providers to expand their product offerings and cater to the unique risks associated with mobile homes. However, challenges such as limited awareness among mobile home owners and high premiums need to be addressed. By increasing awareness, developing innovative coverage options, and embracing technology, insurance providers can capitalize on the market’s potential and provide valuable protection to mobile home owners.

What is Mobile Home Insurance?

Mobile Home Insurance is a type of coverage specifically designed to protect mobile or manufactured homes from various risks, including damage from natural disasters, theft, and liability claims. It typically covers the structure of the home, personal belongings, and additional living expenses in case of a loss.

What are the key players in the Mobile Home Insurance Market?

Key players in the Mobile Home Insurance Market include companies like State Farm, Allstate, and Farmers Insurance, which offer specialized policies for mobile homeowners. These companies provide various coverage options tailored to the unique needs of mobile home residents, among others.

What are the growth factors driving the Mobile Home Insurance Market?

The Mobile Home Insurance Market is driven by factors such as the increasing popularity of mobile homes as affordable housing options and the rising awareness of the importance of insurance coverage among mobile homeowners. Additionally, the growth of the mobile home community and advancements in insurance technology are contributing to market expansion.

What challenges does the Mobile Home Insurance Market face?

The Mobile Home Insurance Market faces challenges such as the perception of mobile homes being less valuable, which can lead to lower insurance uptake. Additionally, regulatory changes and the increasing frequency of natural disasters can complicate underwriting processes and affect premium rates.

What opportunities exist in the Mobile Home Insurance Market?

Opportunities in the Mobile Home Insurance Market include the potential for product innovation, such as customizable insurance packages that cater to specific needs of mobile homeowners. Furthermore, expanding digital platforms for policy management and claims processing can enhance customer experience and attract new clients.

What trends are emerging in the Mobile Home Insurance Market?

Emerging trends in the Mobile Home Insurance Market include the integration of technology in policy management, such as mobile apps for easy access to information and claims filing. Additionally, there is a growing emphasis on sustainable practices and eco-friendly options in insurance offerings, reflecting broader consumer preferences.

Mobile Home Insurance Market

Segmentation Details:

| Segmentation | Details |

|---|---|

| Coverage Type | Property Coverage, Liability Coverage |

| Distribution Channel | Direct Sales, Agency, Bancassurance, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Mobile Home Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at