444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The mobile business intelligence software market represents a transformative segment within the broader enterprise analytics ecosystem, enabling organizations to access critical data insights through smartphones, tablets, and other mobile devices. This dynamic market has experienced unprecedented growth as businesses increasingly recognize the strategic importance of real-time data accessibility for decision-making processes. Mobile BI solutions have evolved from simple reporting tools to sophisticated platforms that deliver interactive dashboards, predictive analytics, and collaborative features directly to mobile users.

Market dynamics indicate robust expansion driven by the proliferation of mobile devices in enterprise environments and the growing demand for instant access to business-critical information. Organizations across various industries are adopting mobile BI platforms to empower their workforce with data-driven insights regardless of location or time constraints. The market demonstrates strong growth potential with a projected CAGR of 12.8% over the forecast period, reflecting the increasing integration of mobile technologies in business intelligence workflows.

Enterprise mobility trends continue to reshape how organizations approach data analytics, with mobile BI serving as a cornerstone for digital transformation initiatives. The convergence of cloud computing, advanced analytics, and mobile technologies has created unprecedented opportunities for businesses to leverage their data assets more effectively. Real-time analytics capabilities delivered through mobile platforms are becoming essential for maintaining competitive advantage in today’s fast-paced business environment.

The mobile business intelligence software market refers to the comprehensive ecosystem of applications, platforms, and solutions that enable users to access, analyze, and interact with business data through mobile devices such as smartphones and tablets. These solutions transform traditional desktop-bound BI capabilities into flexible, location-independent tools that support real-time decision-making processes across various organizational levels.

Mobile BI software encompasses a wide range of functionalities including interactive dashboards, data visualization tools, reporting capabilities, and advanced analytics features specifically optimized for mobile interfaces. These platforms integrate with existing enterprise data sources, cloud databases, and analytics systems to provide seamless access to critical business information. The technology enables users to monitor key performance indicators, generate reports, and collaborate on data-driven insights while maintaining the security and governance standards required for enterprise environments.

Core components of mobile BI solutions include responsive design frameworks, offline data synchronization capabilities, touch-optimized user interfaces, and integration APIs that connect with various data sources and enterprise systems. These platforms support multiple deployment models including cloud-based, on-premises, and hybrid configurations to meet diverse organizational requirements and security preferences.

Strategic market positioning reveals that mobile business intelligence software has emerged as a critical enabler for digital transformation initiatives across industries. The market demonstrates strong momentum driven by increasing smartphone adoption in enterprise environments, with mobile device penetration reaching significant levels in corporate settings. Organizations are prioritizing mobile-first BI strategies to enhance operational efficiency and support remote workforce requirements.

Technology advancement in areas such as artificial intelligence, machine learning, and natural language processing is revolutionizing mobile BI capabilities. Modern platforms offer sophisticated features including predictive analytics, automated insights generation, and conversational interfaces that make data analysis more accessible to non-technical users. The integration of AI-powered analytics has improved user adoption rates by 34% across various industry segments.

Market consolidation trends indicate increasing collaboration between established BI vendors and mobile technology specialists to deliver comprehensive solutions. Leading providers are investing heavily in mobile-native development approaches and cross-platform compatibility to address diverse user requirements. The competitive landscape continues to evolve as organizations seek integrated platforms that combine traditional BI capabilities with mobile-optimized user experiences.

Investment patterns show growing enterprise commitment to mobile BI initiatives, with organizations allocating substantial resources to modernize their analytics infrastructure. The focus on self-service analytics and democratization of data access is driving demand for intuitive mobile interfaces that enable business users to independently explore and analyze data without extensive technical expertise.

Fundamental market drivers reveal several critical factors shaping the mobile BI landscape:

Technology trends indicate increasing sophistication in mobile BI capabilities, with platforms incorporating advanced visualization techniques, natural language queries, and automated insight generation. The convergence of mobile computing and artificial intelligence is creating new opportunities for predictive analytics and proactive business intelligence delivery.

Digital transformation initiatives serve as the primary catalyst for mobile BI adoption, as organizations seek to modernize their analytics infrastructure and enable data-driven decision making across all organizational levels. The imperative to remain competitive in rapidly evolving markets drives enterprises to invest in technologies that provide real-time insights and operational visibility through mobile platforms.

Workforce mobility trends continue to reshape enterprise technology requirements, with employees increasingly expecting access to business-critical information regardless of location or device. The proliferation of remote work arrangements and field-based operations has created substantial demand for mobile BI solutions that maintain productivity and decision-making capabilities outside traditional office environments. Mobile workforce productivity improvements of 28% have been documented across organizations implementing comprehensive mobile BI strategies.

Data democratization efforts within organizations are driving adoption of self-service mobile BI tools that enable business users to independently access and analyze data without relying on IT departments. This trend toward citizen analytics is supported by increasingly intuitive mobile interfaces and automated insight generation capabilities that reduce technical barriers to data exploration.

Competitive pressure in various industries necessitates faster response times to market changes and customer demands, creating urgency around real-time data access and mobile analytics capabilities. Organizations recognize that delayed access to critical information can result in missed opportunities and competitive disadvantages in today’s fast-paced business environment.

Cloud computing adoption has eliminated many traditional barriers to mobile BI implementation, providing scalable infrastructure and reducing deployment complexity. The availability of cloud-based mobile BI platforms enables organizations to rapidly implement solutions without significant upfront infrastructure investments or lengthy deployment cycles.

Security concerns represent the most significant challenge facing mobile BI adoption, as organizations grapple with protecting sensitive business data accessed through mobile devices. Enterprise security policies often restrict mobile access to critical systems, creating friction between user convenience and data protection requirements. The complexity of managing mobile device security across diverse organizational environments continues to slow adoption rates in security-conscious industries.

Integration complexity poses substantial challenges for organizations with legacy systems and fragmented data architectures. Many enterprises struggle to connect mobile BI platforms with existing data warehouses, ERP systems, and specialized applications, resulting in incomplete or inconsistent data access through mobile interfaces. The technical expertise required for complex integrations often exceeds internal capabilities, necessitating external consulting resources.

Performance limitations on mobile devices can impact user experience when processing large datasets or complex analytical queries. Network connectivity constraints and device processing power restrictions may limit the sophistication of analytics that can be effectively delivered through mobile platforms, particularly in data-intensive use cases.

User adoption barriers include resistance to change among employees accustomed to traditional desktop BI tools and concerns about mobile interface limitations. Training requirements and change management challenges can slow organizational adoption of mobile BI solutions, particularly in industries with less technology-savvy workforces.

Cost considerations encompass not only software licensing but also infrastructure upgrades, security implementations, and ongoing maintenance requirements. Organizations must balance the benefits of mobile BI capabilities against the total cost of ownership, including hidden expenses related to data governance, security compliance, and user support.

Artificial intelligence integration presents unprecedented opportunities for mobile BI vendors to differentiate their offerings through intelligent automation and predictive capabilities. The incorporation of AI-powered insights and natural language processing can significantly enhance user experience and expand the addressable market to include non-technical business users who previously found traditional BI tools too complex.

Industry-specific solutions represent substantial growth opportunities as vendors develop specialized mobile BI applications tailored to unique sector requirements. Healthcare, retail, manufacturing, and financial services industries have distinct mobile analytics needs that create opportunities for focused solution development and market penetration strategies.

Edge computing advancement enables new possibilities for mobile BI by bringing data processing capabilities closer to end users and reducing latency concerns. This technological evolution supports more sophisticated analytics on mobile devices and enables real-time processing of large datasets without relying entirely on cloud connectivity.

Internet of Things integration creates opportunities for mobile BI platforms to serve as central hubs for IoT data visualization and analysis. The proliferation of connected devices across industries generates vast amounts of data that require mobile-accessible analytics platforms for effective monitoring and decision-making.

Emerging market expansion offers significant growth potential as organizations in developing regions increasingly adopt mobile-first technology strategies. The widespread availability of smartphones and improving mobile network infrastructure in these markets creates opportunities for mobile BI vendors to establish strong market positions.

Small and medium enterprise adoption represents an underserved market segment with growing demand for affordable, easy-to-implement mobile BI solutions. The development of simplified, cost-effective platforms specifically designed for SME requirements could unlock substantial market expansion opportunities.

Technological convergence is reshaping the mobile BI landscape as vendors integrate multiple advanced technologies to create comprehensive analytics platforms. The combination of cloud computing, artificial intelligence, and mobile optimization is enabling new capabilities that were previously impossible with traditional BI architectures. This convergence is driving platform consolidation as organizations seek integrated solutions rather than point products.

User experience evolution continues to drive innovation in mobile BI interface design and functionality. Modern platforms emphasize intuitive navigation, touch-optimized interactions, and contextual information delivery that adapts to user roles and preferences. The focus on user-centric design has resulted in adoption rate improvements of 42% across various organizational implementations.

Data governance requirements are becoming increasingly sophisticated as organizations implement mobile BI solutions while maintaining compliance with regulatory standards and internal security policies. The need to balance data accessibility with security and privacy requirements is driving development of advanced governance features within mobile BI platforms.

Vendor ecosystem dynamics show increasing collaboration between traditional BI providers, mobile technology specialists, and cloud infrastructure companies. Strategic partnerships and acquisitions are reshaping the competitive landscape as companies seek to offer comprehensive mobile analytics solutions that address diverse customer requirements.

Market maturation indicators include standardization of mobile BI features, increased price competition, and growing emphasis on specialized industry solutions. As the market evolves from early adoption to mainstream implementation, vendors are focusing on differentiation through advanced capabilities and vertical market expertise.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the mobile business intelligence software market. Primary research activities include extensive interviews with industry executives, technology vendors, and end-user organizations across various sectors to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry reports, vendor documentation, financial statements, and regulatory filings to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and provides historical perspective on industry evolution patterns.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies that leverage multiple data sources to develop accurate market projections. Advanced analytics tools are employed to identify correlations, patterns, and growth drivers that influence market development trajectories.

Qualitative assessment methods focus on understanding market nuances, competitive positioning, and strategic implications that quantitative analysis alone cannot capture. Expert interviews and industry surveys provide insights into market sentiment, adoption barriers, and future development priorities.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and continuous monitoring of market developments. MarkWide Research employs rigorous quality assurance procedures to maintain the highest standards of research integrity and reliability in all market analysis activities.

North American market leadership reflects the region’s advanced technology infrastructure, high smartphone penetration, and early adoption of enterprise mobility solutions. The United States dominates regional market share with 68% of North American mobile BI implementations, driven by large enterprises and technology-forward organizations across various industries. Canadian market growth demonstrates strong momentum in financial services and healthcare sectors.

European market dynamics show significant variation across countries, with the United Kingdom, Germany, and France leading adoption rates. Regulatory requirements such as GDPR have influenced mobile BI development priorities, emphasizing data privacy and security features. The region accounts for approximately 24% of global mobile BI adoption, with strong growth in manufacturing and retail sectors.

Asia-Pacific expansion represents the fastest-growing regional market, driven by rapid digital transformation initiatives and increasing smartphone adoption in enterprise environments. China and India lead regional growth with substantial investments in mobile technology infrastructure and growing demand for business analytics solutions. The region demonstrates annual growth rates exceeding 18% in mobile BI adoption.

Latin American emergence shows promising growth potential as organizations modernize their technology infrastructure and embrace mobile-first strategies. Brazil and Mexico lead regional adoption, particularly in telecommunications and retail industries. Economic development and improving mobile network infrastructure support continued market expansion.

Middle East and Africa development reflects growing recognition of mobile BI benefits among forward-thinking organizations. The UAE and South Africa demonstrate strong adoption rates in financial services and telecommunications sectors. Regional growth is supported by government digital transformation initiatives and increasing foreign investment in technology infrastructure.

Market leadership dynamics reveal a competitive environment characterized by both established enterprise software vendors and innovative mobile-first companies. The competitive landscape continues to evolve as traditional BI providers enhance their mobile capabilities while specialized mobile analytics companies expand their enterprise features.

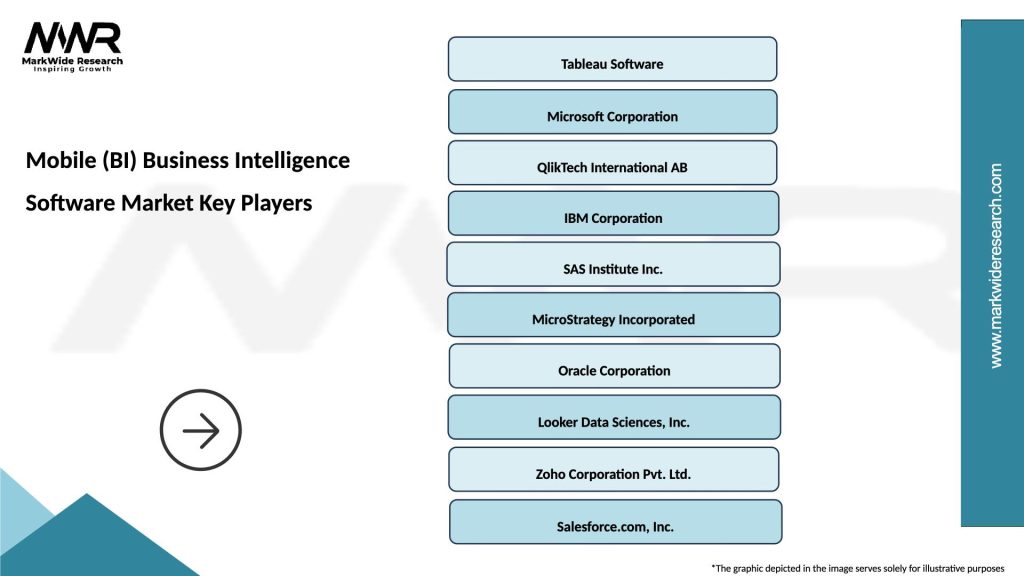

Leading market participants include:

Competitive strategies focus on differentiation through advanced analytics capabilities, industry-specific solutions, and superior user experience design. Vendors are investing heavily in artificial intelligence integration, natural language processing, and automated insight generation to distinguish their mobile BI offerings.

Market consolidation trends include strategic acquisitions and partnerships as companies seek to expand their mobile BI capabilities and market reach. The competitive environment encourages continuous innovation and feature enhancement to maintain market position and customer loyalty.

By Deployment Model:

By Organization Size:

By Industry Vertical:

By Application Type:

Cloud-based mobile BI solutions demonstrate the strongest growth trajectory, driven by their inherent advantages in scalability, accessibility, and cost-effectiveness. Organizations increasingly prefer cloud deployments for their ability to support remote workforce requirements and provide automatic updates and maintenance. The cloud segment growth rate of 15.2% annually reflects strong market preference for flexible, subscription-based mobile BI platforms.

Enterprise segment dominance continues as large organizations lead mobile BI adoption due to their complex data requirements and substantial technology budgets. However, the SME segment shows accelerating growth as vendors develop simplified, affordable solutions specifically designed for smaller organizations. This democratization of mobile BI technology is expanding the total addressable market significantly.

Healthcare industry adoption demonstrates particular strength in mobile BI implementation, driven by the need for real-time patient monitoring, operational efficiency improvements, and regulatory compliance requirements. Healthcare organizations report productivity improvements of 31% through mobile BI implementations, particularly in clinical decision support and resource management applications.

Retail sector applications focus heavily on real-time sales analytics, inventory management, and customer behavior analysis through mobile platforms. The ability to access critical business metrics while in stores or during customer interactions has proven valuable for retail executives and field personnel. Mobile BI adoption in retail environments has enhanced decision-making speed by 45% according to industry studies.

Financial services implementations emphasize security, compliance, and risk management capabilities within mobile BI platforms. Banks and insurance companies require sophisticated security features and regulatory compliance tools that can operate effectively in mobile environments while maintaining data protection standards.

Organizational efficiency gains represent the most significant benefit of mobile BI implementation, enabling faster decision-making processes and improved operational responsiveness. Companies report substantial productivity improvements as employees gain instant access to critical business information regardless of location or time constraints. The ability to monitor key performance indicators in real-time supports proactive management approaches and rapid response to emerging opportunities or challenges.

Cost reduction opportunities emerge through improved operational efficiency, reduced travel requirements for data access, and elimination of paper-based reporting processes. Mobile BI platforms enable organizations to streamline their analytics infrastructure while expanding data accessibility across the organization. The reduction in manual reporting tasks and improved data accuracy contribute to significant cost savings over time.

Competitive advantage development results from enhanced agility and faster response times to market changes. Organizations with effective mobile BI implementations can identify trends, opportunities, and threats more quickly than competitors relying on traditional desktop-based analytics. This responsiveness translates into improved market positioning and better customer service capabilities.

Employee satisfaction improvements occur as workers gain access to the tools and information needed to perform their jobs effectively from any location. Mobile BI platforms support flexible work arrangements and enable field-based employees to access the same analytical capabilities as office-based colleagues. This democratization of data access contributes to higher job satisfaction and employee retention rates.

Customer service enhancement becomes possible through real-time access to customer data, service history, and performance metrics during customer interactions. Sales representatives and customer service personnel can access relevant information instantly, leading to more informed conversations and better customer outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping mobile BI capabilities, with vendors incorporating machine learning algorithms, natural language processing, and automated insight generation into their platforms. These AI-powered features enable non-technical users to interact with data through conversational interfaces and receive proactive alerts about important business developments.

Self-service analytics expansion continues to drive mobile BI development as organizations seek to democratize data access and reduce dependence on IT departments for routine analytics tasks. Modern platforms emphasize intuitive interfaces, drag-and-drop functionality, and automated data preparation capabilities that enable business users to independently create reports and analyze data.

Real-time analytics emphasis reflects growing demand for instant access to current business information rather than historical reporting. Organizations require mobile BI platforms that can process and display real-time data streams from operational systems, IoT devices, and external data sources to support immediate decision-making requirements.

Industry-specific customization is becoming increasingly important as vendors develop specialized features and templates tailored to unique sector requirements. Healthcare, retail, manufacturing, and financial services industries have distinct mobile analytics needs that create opportunities for focused solution development and market differentiation.

Security enhancement priorities drive continuous improvement in mobile BI security features, including advanced authentication methods, data encryption, and access control capabilities. Organizations require comprehensive security frameworks that protect sensitive business information while maintaining user convenience and accessibility.

Cross-platform compatibility ensures mobile BI solutions work effectively across diverse device types, operating systems, and screen sizes. The need to support BYOD policies and heterogeneous mobile environments drives development of responsive design frameworks and universal compatibility features.

Strategic acquisitions continue to reshape the mobile BI landscape as major technology companies acquire specialized vendors to enhance their mobile analytics capabilities. Recent acquisition activity demonstrates the strategic importance of mobile BI in comprehensive enterprise software portfolios and the competitive pressure to offer integrated solutions.

Partnership formations between traditional BI vendors and mobile technology specialists create comprehensive solutions that combine analytical sophistication with mobile optimization. These collaborations enable faster development of advanced mobile BI capabilities and broader market reach for participating companies.

Cloud platform expansions by major cloud infrastructure providers include enhanced mobile BI services and integration capabilities. The availability of mobile-optimized analytics services within comprehensive cloud platforms simplifies deployment and reduces integration complexity for organizations.

Industry standard development efforts focus on establishing common protocols for mobile BI security, data governance, and interoperability. These standardization initiatives support market maturation and reduce implementation risks for organizations considering mobile BI adoption.

Technology innovation announcements regularly introduce new capabilities such as augmented reality data visualization, voice-activated analytics, and advanced AI-powered insights. These innovations demonstrate the continued evolution of mobile BI technology and expanding possibilities for data interaction and analysis.

Regulatory compliance enhancements address evolving data privacy and security requirements across different jurisdictions. Mobile BI vendors continuously update their platforms to support compliance with regulations such as GDPR, CCPA, and industry-specific requirements in healthcare and financial services.

Strategic implementation approaches should prioritize user experience design and change management processes to ensure successful mobile BI adoption. Organizations must invest adequate resources in training programs and support systems that help employees transition from traditional desktop-based analytics to mobile platforms. MWR analysis indicates that organizations with comprehensive change management programs achieve adoption rates that are 58% higher than those without structured implementation approaches.

Security framework development requires careful balance between data protection requirements and user accessibility needs. Organizations should implement comprehensive mobile device management policies, advanced authentication systems, and data encryption protocols while maintaining user-friendly interfaces that encourage adoption rather than creating barriers to usage.

Integration planning must address the complexity of connecting mobile BI platforms with existing enterprise systems, data warehouses, and specialized applications. Organizations should conduct thorough data architecture assessments and develop phased integration approaches that minimize disruption while ensuring comprehensive data access through mobile interfaces.

Vendor selection criteria should emphasize long-term platform viability, security capabilities, and integration flexibility rather than focusing solely on initial cost considerations. Organizations must evaluate vendors’ roadmaps for AI integration, industry-specific features, and commitment to ongoing platform development and support.

Performance optimization strategies should address mobile device limitations and network connectivity constraints that can impact user experience. Organizations should implement data caching, offline synchronization, and progressive loading techniques that ensure consistent performance across diverse mobile environments and usage scenarios.

Governance framework establishment must address data quality, access controls, and compliance requirements specific to mobile environments. Organizations should develop policies that maintain data integrity and security while enabling the flexibility and accessibility that make mobile BI valuable for business users.

Technology evolution trajectories indicate continued advancement in artificial intelligence integration, with mobile BI platforms becoming increasingly intelligent and proactive in delivering relevant insights to users. The convergence of AI, machine learning, and mobile computing will enable predictive analytics capabilities that anticipate user needs and automatically surface important business developments.

Market expansion patterns suggest strong growth potential in emerging markets where mobile-first technology adoption is accelerating. Organizations in developing regions are increasingly bypassing traditional desktop-based BI implementations in favor of mobile-native solutions that align with their technology infrastructure and workforce preferences.

Industry transformation impacts will be most pronounced in sectors with mobile workforces and real-time decision-making requirements. Healthcare, retail, manufacturing, and field services industries will continue driving mobile BI innovation through their specific requirements for location-independent data access and analysis capabilities.

Platform consolidation trends point toward integrated solutions that combine mobile BI with other enterprise mobility capabilities such as workflow automation, collaboration tools, and communication platforms. This convergence will create comprehensive mobile productivity suites that address broader organizational requirements beyond analytics alone.

User experience innovations will focus on natural language interfaces, voice-activated analytics, and augmented reality data visualization techniques that make data interaction more intuitive and accessible. These developments will further democratize data access and expand the potential user base for mobile BI solutions.

Security advancement priorities will address evolving threat landscapes and regulatory requirements through enhanced encryption, zero-trust security models, and advanced authentication mechanisms. The development of security frameworks specifically designed for mobile BI environments will support broader organizational adoption and regulatory compliance.

Market maturation indicators demonstrate that mobile business intelligence software has evolved from a niche technology to an essential component of modern enterprise analytics infrastructure. The convergence of mobile computing, cloud platforms, and artificial intelligence has created unprecedented opportunities for organizations to leverage their data assets more effectively while supporting increasingly mobile and distributed workforces.

Strategic importance of mobile BI continues to grow as organizations recognize its role in enabling faster decision-making, improving operational efficiency, and maintaining competitive advantage in rapidly evolving markets. The technology’s ability to democratize data access and support real-time analytics makes it indispensable for organizations pursuing digital transformation initiatives and data-driven business strategies.

Future development prospects remain highly promising, with continued innovation in AI integration, user experience design, and industry-specific capabilities driving market expansion. The growing emphasis on self-service analytics and the increasing sophistication of mobile devices will support continued adoption across diverse organizational segments and geographic regions.

Implementation success factors emphasize the importance of comprehensive planning, user-centric design, and robust security frameworks in achieving mobile BI objectives. Organizations that invest in proper change management, training programs, and integration strategies will realize the full potential of mobile BI technology while avoiding common implementation pitfalls.

The mobile business intelligence software market represents a fundamental shift in how organizations approach data analytics and decision-making processes. As technology continues to advance and user expectations evolve, mobile BI platforms will become increasingly sophisticated while remaining accessible to business users across all organizational levels, ultimately transforming how enterprises leverage their data assets for competitive advantage.

What is Mobile (BI) Business Intelligence Software?

Mobile (BI) Business Intelligence Software refers to tools and applications that allow users to access and analyze business data on mobile devices. These solutions enable real-time decision-making and data visualization, enhancing business agility and responsiveness.

What are the key players in the Mobile (BI) Business Intelligence Software Market?

Key players in the Mobile (BI) Business Intelligence Software Market include Tableau, Microsoft Power BI, Qlik, and SAP Analytics Cloud, among others. These companies offer a range of solutions that cater to various business needs and industries.

What are the main drivers of growth in the Mobile (BI) Business Intelligence Software Market?

The growth of the Mobile (BI) Business Intelligence Software Market is driven by the increasing demand for real-time data access, the rise of mobile workforce, and the need for data-driven decision-making across various industries. Additionally, advancements in mobile technology and cloud computing are contributing to market expansion.

What challenges does the Mobile (BI) Business Intelligence Software Market face?

Challenges in the Mobile (BI) Business Intelligence Software Market include data security concerns, integration issues with existing systems, and the complexity of data visualization on smaller screens. These factors can hinder user adoption and limit the effectiveness of mobile BI solutions.

What opportunities exist in the Mobile (BI) Business Intelligence Software Market?

Opportunities in the Mobile (BI) Business Intelligence Software Market include the growing trend of remote work, the increasing adoption of artificial intelligence for data analysis, and the expansion of IoT devices that generate vast amounts of data. These trends present avenues for innovation and new product development.

What trends are shaping the Mobile (BI) Business Intelligence Software Market?

Trends shaping the Mobile (BI) Business Intelligence Software Market include the integration of machine learning for predictive analytics, the rise of self-service BI tools, and the emphasis on user-friendly interfaces. These trends are making mobile BI solutions more accessible and effective for a wider range of users.

Mobile (BI) Business Intelligence Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Retail, Healthcare, Manufacturing, Telecommunications |

| Solution | Data Visualization, Predictive Analytics, Reporting Tools, Dashboard Software |

| Industry Vertical | Finance, Education, Transportation, Energy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mobile (BI) Business Intelligence Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at