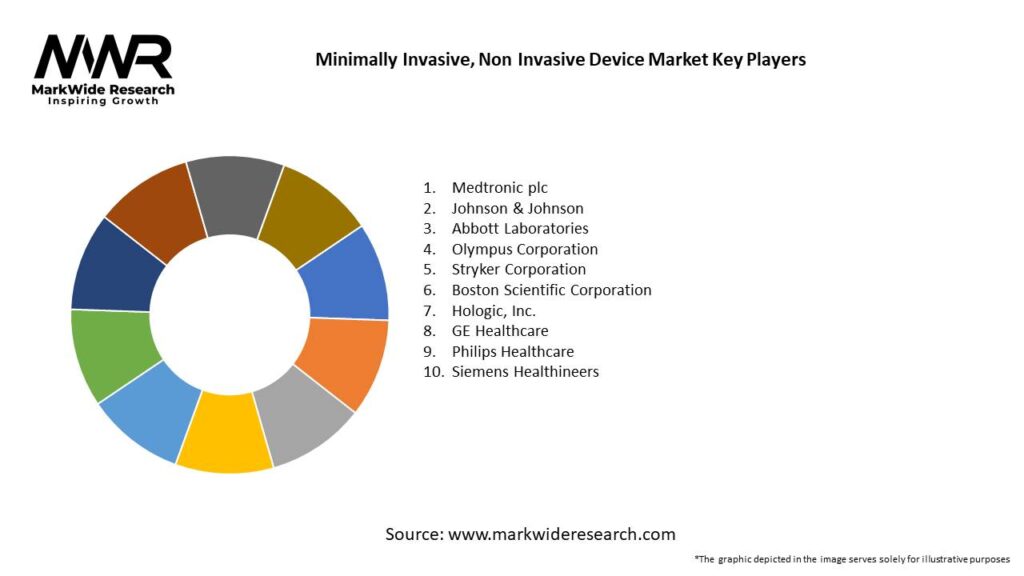

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Technology Convergence: Robotics, AI, and high‑definition 3D imaging are converging to enhance device capabilities.

-

Outpatient Shift: Growth in ambulatory surgery centers (ASCs) fueling demand for portable and point‑of‑care devices.

-

Chronic Disease Burden: Rising incidence of cardiac, orthopedic, and gastrointestinal disorders drives procedural volumes.

-

Patient Preference: Patients increasingly opt for treatments that reduce downtime and improve quality of life.

-

Regulatory Support: Agencies are streamlining approvals for breakthrough devices, accelerating market entry.

Market Drivers

-

Aging Population & Disease Prevalence: Global demographic shift toward older age groups increases demand for less invasive interventions in cardiology, orthopedics, and gastroenterology.

-

Technological Advances: Innovations such as robotic surgical systems (e.g., da Vinci®), energy‑based ablation catheters, and wearable hemodynamic monitors expand clinical applications.

-

Cost Pressures: Health systems seek cost containment—minimally invasive procedures reduce hospital stays, resource utilization, and readmission rates.

-

Patient Demand for Convenience: Faster recovery and outpatient feasibility align with patient demand for minimal disruption and cosmetic considerations.

-

Reimbursement Landscape: Favorable reimbursement in developed markets for outpatient and minimally invasive procedures encourages hospital and ASC adoption.

Market Restraints

-

High Upfront Costs: Surgical robots and advanced imaging platforms require significant capital investment and maintenance expenses.

-

Technical Training Requirements: Steep learning curve and need for credentialing limit adoption in smaller hospitals and emerging markets.

-

Regulatory Hurdles: Variability in approval processes across regions delays time‑to‑market for novel devices.

-

Reimbursement Variability: Inconsistent coverage policies for newer procedures can impede adoption.

-

Competition from Conventional Surgery: Established open‑surgery methods with known outcomes may persist in certain indications.

Market Opportunities

-

Emerging Markets Penetration: Growing healthcare infrastructure in Asia, Latin America, and Middle East presents new growth avenues.

-

Expansion of Robotic Platforms: Development of cost‑effective, compact robotic systems tailored for ASCs and community hospitals.

-

AI‑Driven Procedure Planning: Integration of machine learning algorithms for preoperative planning, intraoperative guidance, and postoperative monitoring.

-

Tele‑Surgery & Remote Proctoring: Enabling expert surgeons to guide procedures in remote locations, expanding access and surgical capacity.

-

New Therapeutic Indications: Use of minimally invasive approaches in oncology (e.g., image‑guided tumor ablation) and neurosurgery (e.g., endovascular stroke interventions).

Market Dynamics

-

Supply Side: Manufacturers invest in R&D, partnerships (e.g., Medtronic‑Digital Surgery), and M&A activity to broaden portfolios and geographic reach.

-

Demand Side: Hospitals, ASCs, and outpatient clinics increase capital budgets for equipment, driven by procedural volume shifts.

-

Economic Factors: Rising healthcare expenditure and private insurance coverage in emerging economies support market expansion; economic downturns may delay capital purchases.

-

Regulatory Climate: FDA’s Breakthrough Devices Program and EU’s MDR expedite approvals but increase post‑market surveillance requirements.

Regional Analysis

-

North America: Largest market (≈40% share) due to advanced infrastructure, high healthcare spending, and early technology adoption. Strong presence of key players and robust reimbursement frameworks.

-

Europe: Second largest, led by Germany, UK, and France. Growing ASC network and pan‑European initiatives (e.g., Horizon Europe) support innovation.

-

Asia Pacific: High growth (CAGR >9%) driven by China, Japan, and India—increasing surgeries, rising middle‑class, and government investments in healthcare modernization.

-

Latin America: Moderate growth; Brazil and Mexico lead. Infrastructure improvements and medical tourism in the region bolster demand.

-

Middle East & Africa: Nascent market with selective adoption in GCC countries; opportunities in telemedicine and remote training.

Competitive Landscape

Leading companies in the Minimally Invasive, Non-Invasive Device Market:

- Medtronic plc

- Johnson & Johnson

- Abbott Laboratories

- Olympus Corporation

- Stryker Corporation

- Boston Scientific Corporation

- Hologic, Inc.

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

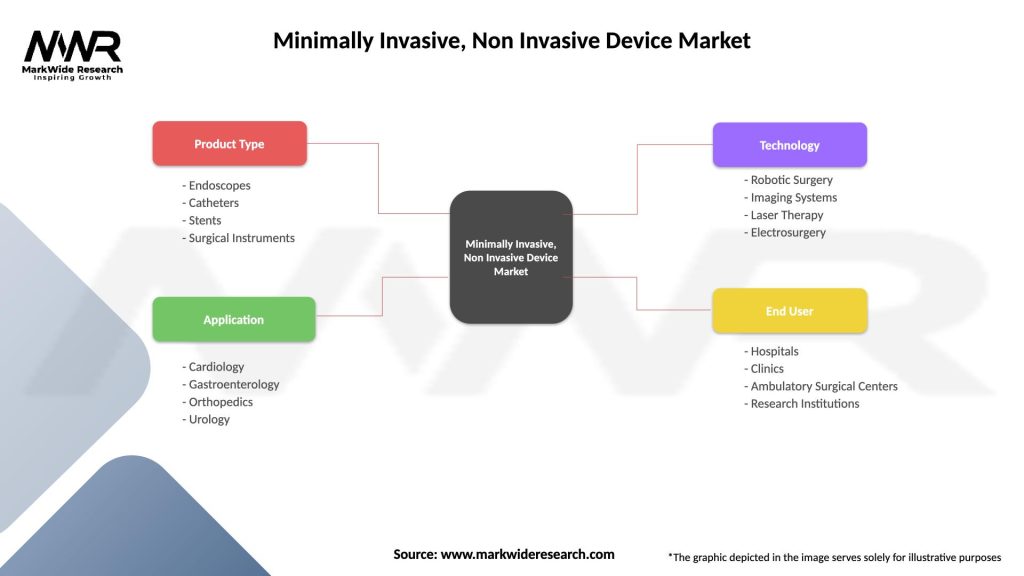

Segmentation

-

By Device Type:

-

Surgical Robotics

-

Endoscopic Devices

-

Catheters & Ablation Systems

-

Imaging & Diagnostics (e.g., ultrasound, OCT)

-

Wearable & Monitoring Devices

-

Others (e.g., external defibrillators)

-

-

By Application:

-

Cardiology (e.g., TAVR, EP ablation)

-

Orthopedics (e.g., MIS joint replacement)

-

Gastroenterology (e.g., endoscopy, colonoscopy)

-

Urology (e.g., laparoscopic prostatectomy)

-

Aesthetics & Dermatology (e.g., laser, radiofrequency devices)

-

General Surgery (e.g., cholecystectomy, appendectomy)

-

-

By End‑User:

-

Hospitals & Surgical Centers

-

Ambulatory Surgery Centers (ASCs)

-

Diagnostic Laboratories & Imaging Centers

-

Home Care Settings (wearables, remote monitoring)

-

-

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Category‑wise Insights

-

Surgical Robotics: Offers enhanced dexterity and 3D vision; fastest growing segment but premium price limits reach.

-

Endoscopic Devices: High volume; continuous miniaturization and disposable scopes enhance safety and reduce cross‑contamination.

-

Catheter & Ablation Systems: Driven by rising cardiac arrhythmia prevalence and vascular disease interventions.

-

Imaging & Diagnostics: Portable ultrasound and optical coherence tomography expanding point‑of‑care diagnostics.

-

Wearables & Monitoring: Non‑invasive glucose monitors, pulse oximeters, and remote ECG devices support chronic disease management.

Key Benefits for Industry Participants and Stakeholders

-

Improved Patient Outcomes: Less trauma, fewer complications, and faster recoveries enhance patient satisfaction and throughput.

-

Economic Efficiency: Reduced length of stay and reuse‑rate optimization can offset high capital costs.

-

Competitive Differentiation: Early adopters of cutting‑edge devices can position themselves as centers of excellence.

-

Access Expansion: Tele‑mentoring and portable systems enable outreach to underserved or remote regions.

-

Regulatory & Reimbursement Leverage: Demonstrating cost‑effectiveness and quality improvements can lead to favorable coverage policies.

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| • Technological leadership (robotics, AI, imaging). • High patient preference for less invasive procedures. • Strong R&D investment by key players. |

• High initial capital and maintenance costs. • Complex training and credentialing requirements. • Interoperability and standardization gaps. |

| Opportunities | Threats |

|---|---|

| • Emerging market expansion (Asia, Latin America). • AI and data analytics integration for workflow optimization. • Outpatient and home‑based care growth. |

• Economic downturns impacting capital budgets. • Privacy and data security concerns. • Competitive pressure from conventional procedures and alternative technologies. |

Market Key Trends

-

AI‑Powered Surgical Assistance: Real‑time analytics for surgical guidance, error detection, and performance benchmarking.

-

Cloud‑Connected Platforms: Remote proctoring, predictive maintenance, and software‑as‑a‑service (SaaS) models for device management.

-

Disposable & Cost‑Effective Instruments: Single‑use scopes and instrument sets to reduce cross‑infection and sterilization costs.

-

3D Printing & Custom Implants: Patient‑specific surgical guides and implants produced via additive manufacturing.

-

Wearable & Implantable Monitors: Continuous vital‑sign monitoring and closed‑loop therapy systems (e.g., automated insulin delivery).

Covid-19 Impact

-

Acceleration of Telehealth & Remote Monitoring: Surge in demand for non‑contact diagnostics and wearable sensors.

-

Temporary Elective Surgery Halt: Short‑term revenue impact on MIS device sales, followed by backlog‑driven recovery.

-

Supply Chain Disruptions: Delays in component and consumable deliveries prompted local sourcing and inventory buffer strategies.

-

Infection Control Focus: Heightened interest in disposable devices and antimicrobial materials to reduce nosocomial infection risks.

Key Industry Developments

-

Medtronic‑Digital Surgery Alliance: Joint venture to develop interoperable robotic platforms with AI capabilities.

-

CMR Surgical Series E Funding: US$ 240 million investment to scale production of the Versius surgical robot.

-

Ethicon (J&J) Advanced Energy Devices: Launch of ultrasonic and bipolar energy instruments for tissue sealing in MIS.

-

GE HealthCare Portable Ultrasound: AI‑enabled handheld scanners for point‑of‑care diagnostics in remote and ASC settings.

-

Verb Technological Collaborations: Partnerships with hospitals to refine next‑gen robotics and haptic feedback systems.

Analyst Suggestions

-

Broaden Training Programs: Invest in simulation‑based education and virtual reality platforms to accelerate surgeon proficiency.

-

Foster Interoperability: Adopt open architectures and industry standards (e.g., DICOM, HL7) to facilitate device integration.

-

Develop Flexible Financing Models: Offer leasing, pay‑per‑procedure, or outcome‑based pricing to lower entry barriers for providers.

-

Enhance Cybersecurity: Implement robust encryption, user authentication, and data governance frameworks to protect patient data.

-

Pursue Strategic Alliances: Collaborate with tech companies, payers, and academic centers to co‑develop solutions and real‑world evidence.

Future Outlook

The minimally invasive and non‑invasive device market is on the cusp of a paradigm shift toward “Intelligent Surgery”—combining robotics, AI-driven analytics, and real‑time imaging to deliver personalized, precision care. As devices become more compact, affordable, and integrated with telemedicine platforms, expect widespread adoption beyond tertiary centers into community hospitals and ASCs. Regulatory bodies will likely accelerate frameworks for digital and AI‑based devices, balancing innovation with patient safety. Ultimately, the synergy of technology and clinical expertise will drive better outcomes, optimize costs, and democratize access to advanced medical procedures globally.

Conclusion

The Minimally Invasive & Non‑Invasive Device Market represents a high‑growth intersection of cutting‑edge technology and evolving healthcare delivery models. Fueled by patient demand for safer, faster, and less traumatic treatments, combined with healthcare systems’ imperative to contain costs and improve outcomes, this market will continue its upward trajectory. Stakeholders who embrace innovation—AI, robotics, telehealth—and address challenges—cost, training, interoperability—will shape the future of surgery and diagnostics, delivering the promise of next‑generation, patient‑centric care across the care continuum.