444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The military Unmanned Aerial Vehicle (UAV) sensor market has been witnessing significant growth in recent years. UAVs equipped with advanced sensors have revolutionized military operations by providing real-time intelligence, surveillance, and reconnaissance capabilities. These sensors play a crucial role in enhancing situational awareness, target acquisition, and threat detection. The market for military UAV sensors encompasses a wide range of technologies, including electro-optical/infrared (EO/IR) sensors, radar sensors, electronic warfare sensors, and communication sensors.

Meaning

Military UAV sensors are sophisticated devices integrated into unmanned aerial vehicles to capture and process data for various military applications. These sensors enable UAVs to gather critical information, including visual and audio data, environmental parameters, and communication signals, which are crucial for decision-making and mission success.

Executive Summary

The military UAV sensor market is experiencing robust growth, driven by the increasing adoption of UAVs for military applications worldwide. The demand for advanced sensor technologies that enhance the operational capabilities of UAVs is fueling market expansion. Key market players are investing in research and development to develop cutting-edge sensor technologies that provide accurate and real-time data to military personnel. The market is highly competitive, with a focus on product innovation and strategic partnerships to gain a competitive edge.

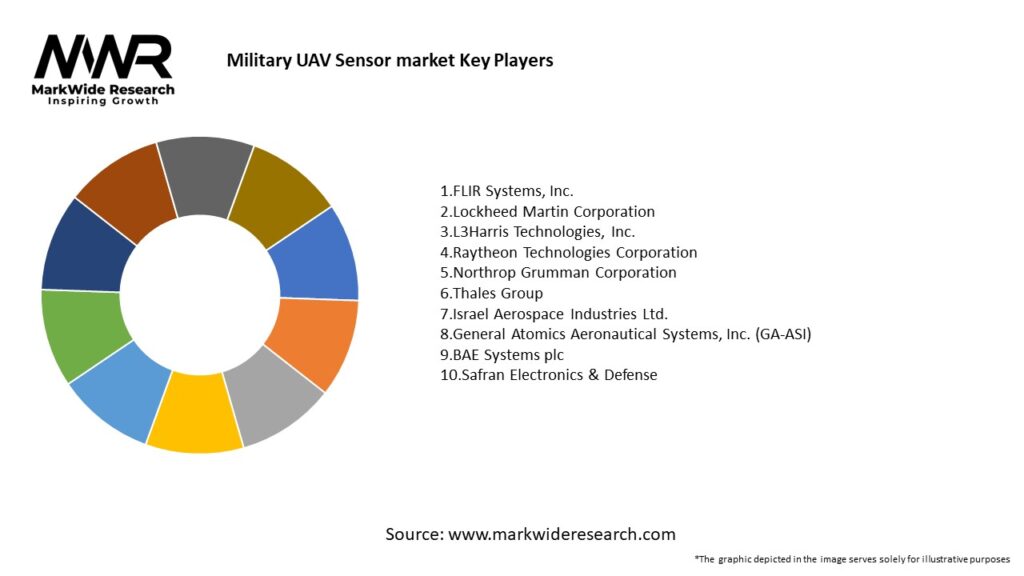

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The military UAV sensor market is driven by several factors that contribute to its growth and development. These market drivers include:

Market Restraints

Despite the favorable market conditions, there are certain challenges that hinder the growth of the military UAV sensor market. These market restraints include:

Market Opportunities

The military UAV sensor market presents several opportunities for growth and expansion. These opportunities include:

Market Dynamics

The military UAV sensor market is driven by a dynamic set of factors that influence its growth and evolution. These market dynamics include technological advancements, changing defense strategies, geopolitical tensions, and industry collaborations. Understanding these dynamics is essential for market participants to adapt their strategies and seize opportunities.

Technological advancements in sensor technologies, such as higher resolution imagery, improved target detection capabilities, and increased communication bandwidth, contribute to the market’s growth. Defense forces are continuously seeking innovative sensor solutions to gain a competitive edge in modern warfare scenarios. Additionally, geopolitical tensions and the need to maintain military superiority drive the demand for advanced sensor systems that enable precise and effective decision-making.

Collaborations and partnerships between sensor manufacturers, UAV manufacturers, and defense agencies play a vital role in driving market growth. By leveraging each other’s expertise, these collaborations foster the development of integrated sensor solutions tailored to specific military applications. The sharing of knowledge, resources, and technologies accelerates innovation and enhances the operational capabilities of military UAVs.

The COVID-19 pandemic has also influenced the military UAV sensor market. The crisis led to disruptions in global supply chains and manufacturing operations, impacting the production and delivery of sensor systems. However, the pandemic has also highlighted the importance of unmanned systems in maintaining military operations while minimizing human exposure. The adoption of UAVs equipped with advanced sensors has accelerated during the pandemic, further driving market growth.

Regional Analysis

The military UAV sensor market exhibits significant regional variations in terms of market size, demand, and technological advancements. The key regions analyzed in this report include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America holds a dominant position in the military UAV sensor market. The region’s strong defense capabilities, substantial defense budgets, and advanced research anddevelopment activities contribute to its market leadership. The United States, in particular, is a major market player, with extensive deployments of military UAVs equipped with advanced sensors for intelligence, surveillance, and reconnaissance purposes. The presence of key sensor manufacturers and defense contractors further strengthens the market in this region.

Europe is another significant market for military UAV sensors. Countries like the United Kingdom, France, Germany, and Italy have made substantial investments in UAV technology and sensor systems. The European Union’s focus on enhancing its defense capabilities and strengthening border security drives the demand for advanced UAV sensor solutions. The region also witnesses collaborations between defense organizations and sensor manufacturers to develop cutting-edge technologies.

Asia Pacific is expected to witness significant growth in the military UAV sensor market during the forecast period. Increasing defense budgets, territorial disputes, and the modernization of armed forces in countries like China, India, and Japan contribute to market expansion. The Asia Pacific region also offers lucrative opportunities for sensor manufacturers due to the rising adoption of UAVs for surveillance and reconnaissance missions.

In Latin America, countries like Brazil and Mexico are gradually recognizing the advantages of military UAVs and their sensor capabilities. The region’s focus on border surveillance, counter-narcotics operations, and disaster management drives the demand for UAV sensor systems. The market in Latin America is expected to witness steady growth in the coming years.

The Middle East and Africa region also presents significant opportunities for the military UAV sensor market. Geopolitical tensions, counter-terrorism operations, and the need for advanced surveillance systems drive the demand for UAV sensors. Countries like Saudi Arabia, Israel, and the United Arab Emirates are actively investing in UAV technology and sensor systems to enhance their defense capabilities.

Competitive Landscape

Leading Companies in Military UAV Sensor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The military UAV sensor market can be segmented based on sensor type, application, and platform.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the military UAV sensor market can benefit in several ways:

SWOT Analysis

A SWOT analysis of the military UAV sensor market provides an assessment of its strengths, weaknesses, opportunities, and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the military UAV sensor market. While the pandemic led to disruptions in global supply chains and manufacturing operations, it also highlighted the importance of unmanned systems in maintaining military operations while minimizing human exposure. The adoption of UAVs equipped with advanced sensors has accelerated during the pandemic, driven by the need for remote monitoring, surveillance, and reconnaissance capabilities. However, the economic uncertainties caused by the pandemic may impact defense budgets, potentially affecting the procurement of UAV sensor systems.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the military UAV sensor market looks promising, with sustained growth expected in the coming years. Technological advancements, such as AI integration, improved sensor resolutions, and enhanced communication capabilities, will continue to drive market expansion. The increasing adoption of UAVs for military applications, coupled with the rising demand for intelligence, surveillance, and reconnaissance capabilities, will contribute to market growth. Collaborations between sensor manufacturers, UAV manufacturers, and defense organizations will foster innovation and the development of integrated sensor solutions. However, market participants should remain attentive to regulatory challenges, cybersecurity concerns, and geopolitical uncertainties that may impact market dynamics.

Conclusion

The military UAV sensor market is witnessing significant growth, driven by the increasing adoption of UAVs for military applications worldwide. Advanced sensor technologies play a crucial role in enhancing situational awareness, target acquisition, and threat detection. The market offers opportunities for industry participants to expand their market presence through technological advancements, strategic partnerships, and regional market exploration. Despite challenges such as regulatory hurdles and high development costs, the market’s future outlook is positive, with continuous advancements in sensor technologies and the growing demand for UAV capabilities in military operations.

What is Military UAV Sensor?

Military UAV Sensor refers to the various types of sensors used in unmanned aerial vehicles (UAVs) for military applications. These sensors can include electro-optical, infrared, radar, and other advanced technologies that enhance surveillance, reconnaissance, and targeting capabilities.

What are the key players in the Military UAV Sensor market?

Key players in the Military UAV Sensor market include Northrop Grumman, Raytheon Technologies, Lockheed Martin, and Boeing, among others. These companies are known for their innovative sensor technologies and extensive experience in defense applications.

What are the main drivers of growth in the Military UAV Sensor market?

The growth of the Military UAV Sensor market is driven by increasing defense budgets, the rising demand for surveillance and reconnaissance capabilities, and advancements in sensor technologies. Additionally, the need for enhanced situational awareness in military operations contributes to market expansion.

What challenges does the Military UAV Sensor market face?

The Military UAV Sensor market faces challenges such as regulatory hurdles, high development costs, and the need for continuous technological advancements. Additionally, concerns regarding data security and the integration of sensors with existing military systems pose significant challenges.

What opportunities exist in the Military UAV Sensor market?

Opportunities in the Military UAV Sensor market include the development of next-generation sensors, integration of artificial intelligence for data analysis, and expanding applications in border security and disaster response. The increasing use of UAVs in non-traditional military roles also presents new avenues for growth.

What trends are shaping the Military UAV Sensor market?

Trends in the Military UAV Sensor market include the miniaturization of sensors, the use of multi-sensor systems for enhanced data collection, and the growing adoption of autonomous UAVs. Additionally, there is a focus on improving sensor fusion techniques to provide more accurate and actionable intelligence.

Military UAV Sensor market

| Segmentation Details | Description |

|---|---|

| Product Type | Electro-Optical Sensors, Infrared Sensors, Radar Sensors, Lidar Sensors |

| End User | Defense Forces, Government Agencies, Research Institutions, Private Contractors |

| Technology | AI-Driven Analytics, Real-Time Data Processing, Autonomous Navigation, Remote Sensing |

| Application | Surveillance, Reconnaissance, Target Acquisition, Search & Rescue |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Military UAV Sensor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at