444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Military EO and IR Sensors Market encompasses the development, production, and deployment of electro-optical (EO) and infrared (IR) sensors for military applications. These sensors play a critical role in providing situational awareness, surveillance, target acquisition, and tracking capabilities to military forces across land, sea, and air domains. With the increasing complexity of modern warfare and the growing demand for advanced sensor technologies, the military EO and IR sensors market continue to evolve, offering innovative solutions to address emerging threats and operational requirements.

Meaning

Military EO and IR sensors are advanced electronic devices designed to detect, identify, and track targets using electromagnetic radiation in the visible, infrared, and thermal spectra. These sensors are utilized in a wide range of military platforms, including unmanned aerial vehicles (UAVs), helicopters, armored vehicles, ships, and soldier systems, to enhance situational awareness, reconnaissance, and surveillance capabilities. Military EO and IR sensors enable military forces to operate effectively in diverse environments and combat scenarios, providing crucial information for decision-making and mission execution.

Executive Summary

The Military EO and IR Sensors Market have experienced significant growth in recent years, driven by the increasing adoption of unmanned systems, the modernization of military fleets, and the growing emphasis on network-centric warfare capabilities. Advancements in sensor technology, such as higher resolution, longer detection ranges, and enhanced integration with other sensors and platforms, have expanded the operational capabilities of military forces. However, challenges such as defense budget constraints, export control regulations, and technological obsolescence pose potential hurdles to market growth. Nevertheless, opportunities abound for military EO and IR sensor manufacturers to innovate, collaborate, and address evolving defense requirements in the dynamic global security landscape.

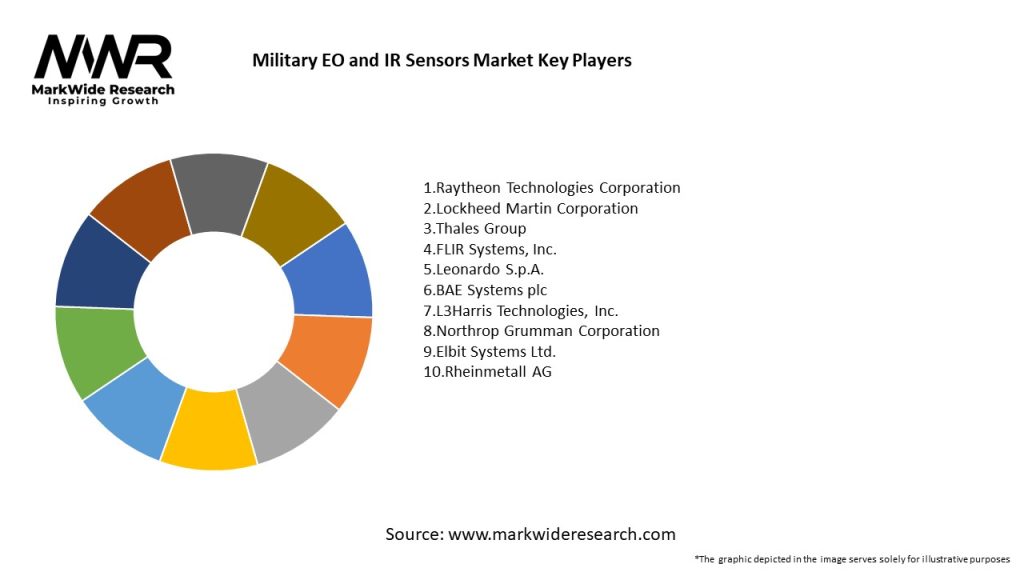

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Military EO and IR Sensors Market operate within a dynamic environment influenced by factors such as evolving threat landscapes, defense budgets, technological advancements, geopolitical tensions, and regulatory frameworks. Manufacturers must navigate these dynamics by investing in innovation, strategic partnerships, international collaborations, and customer relationships to sustain growth and competitiveness in the global defense market.

Regional Analysis

Competitive Landscape

Leading Companies in the Military EO and IR Sensors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

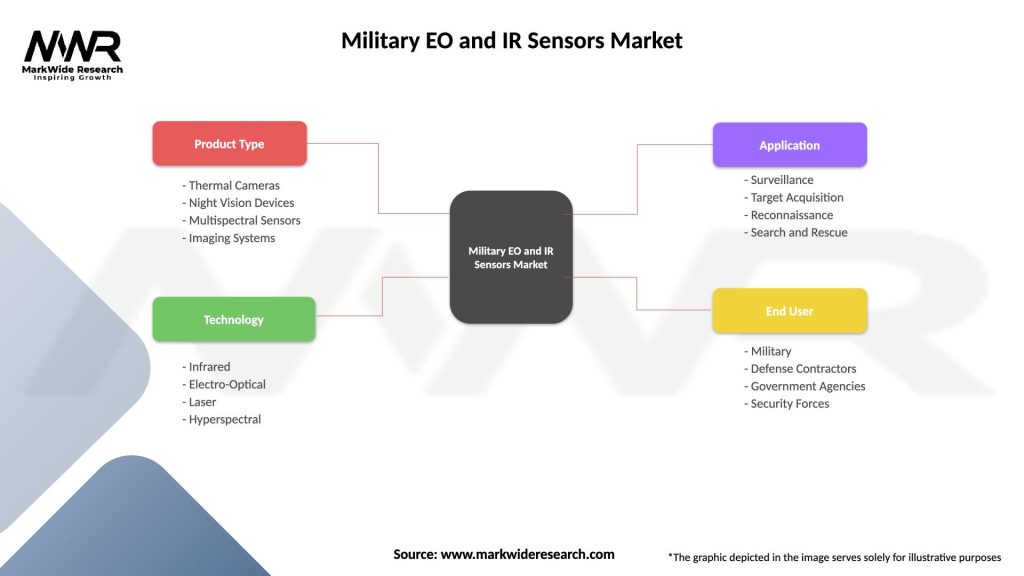

Segmentation

The Military EO and IR Sensors Market can be segmented based on various factors, including technology type, platform, wavelength band, application, and geography. Common segmentation categories include:

Segmentation enables a more granular analysis of market trends, customer preferences, and competitive dynamics, facilitating targeted marketing strategies, product development initiatives, and market expansion efforts.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had mixed effects on the Military EO and IR Sensors Market. While the initial disruption to supply chains, manufacturing operations, and defense procurement programs impacted market growth and investment, the subsequent recovery and resilience of defense spending, coupled with emerging security threats and geopolitical tensions, have driven demand for EO and IR sensor solutions for military applications. The pandemic has accelerated trends such as unmanned systems integration, digitalization, and remote operations, further fueling market opportunities for sensor manufacturers to innovate and adapt to evolving defense requirements.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Military EO and IR Sensors Market are poised for growth in the coming years, driven by increasing defense spending, emerging security threats, technological advancements, and the adoption of unmanned systems, network-centric warfare, and digital battlefield concepts. Despite challenges such as defense budget constraints, export control regulations, and geopolitical tensions, opportunities abound for EO and IR sensor manufacturers to innovate, collaborate, and address evolving defense requirements, ensuring continued growth and competitiveness in the global defense market.

Conclusion

The Military EO and IR Sensors Market play a critical role in enhancing the situational awareness, reconnaissance, and targeting capabilities of military forces worldwide. With advancements in sensor technology, integration with unmanned systems, and adoption of network-centric warfare concepts, EO and IR sensors are becoming indispensable assets for modern militaries operating in diverse and dynamic operational environments. While challenges such as defense budget constraints, export control regulations, and technological obsolescence remain, opportunities abound for sensor manufacturers to innovate, collaborate, and address emerging defense requirements, ensuring continued growth and competitiveness in the global defense market. By staying agile, adaptive, and customer-focused, EO and IR sensor manufacturers can navigate market dynamics, capitalize on emerging trends, and contribute to the defense and security of nations in the 21st century.

What is Military EO and IR Sensors?

Military EO and IR Sensors refer to electro-optical and infrared devices used for surveillance, targeting, and reconnaissance in military applications. These sensors are crucial for enhancing situational awareness and operational effectiveness on the battlefield.

What are the key players in the Military EO and IR Sensors Market?

Key players in the Military EO and IR Sensors Market include Raytheon Technologies, Northrop Grumman, Thales Group, and Leonardo S.p.A., among others. These companies are known for their advanced sensor technologies and solutions tailored for defense applications.

What are the main drivers of the Military EO and IR Sensors Market?

The main drivers of the Military EO and IR Sensors Market include the increasing demand for advanced surveillance systems, the need for enhanced situational awareness, and the growing focus on modernizing military capabilities. Additionally, geopolitical tensions are prompting nations to invest in advanced sensor technologies.

What challenges does the Military EO and IR Sensors Market face?

The Military EO and IR Sensors Market faces challenges such as high development costs, rapid technological advancements, and stringent regulatory requirements. Additionally, the integration of these sensors into existing military systems can be complex and resource-intensive.

What opportunities exist in the Military EO and IR Sensors Market?

Opportunities in the Military EO and IR Sensors Market include the development of next-generation sensors with improved capabilities, the integration of artificial intelligence for enhanced data analysis, and the expansion of applications in unmanned systems. These advancements can significantly enhance military operations.

What trends are shaping the Military EO and IR Sensors Market?

Trends shaping the Military EO and IR Sensors Market include the increasing use of miniaturized sensors, advancements in sensor fusion technologies, and the growing adoption of unmanned aerial vehicles (UAVs) equipped with EO and IR sensors. These trends are driving innovation and improving operational efficiency.

Military EO and IR Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Thermal Cameras, Night Vision Devices, Multispectral Sensors, Imaging Systems |

| Technology | Infrared, Electro-Optical, Laser, Hyperspectral |

| Application | Surveillance, Target Acquisition, Reconnaissance, Search and Rescue |

| End User | Military, Defense Contractors, Government Agencies, Security Forces |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Military EO and IR Sensors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at