444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market constitute a critical segment within the aerospace and defense industry, responsible for the upkeep, repair, and overhaul of military aircraft and related systems. This market plays an indispensable role in ensuring the operational readiness, safety, and longevity of military aviation assets, encompassing a wide array of maintenance activities ranging from routine inspections to major structural repairs and upgrades. With defense budgets witnessing sustained allocations for aircraft modernization and fleet expansion, the Military Aircraft MRO market presents a plethora of opportunities for industry participants to capitalize on.

Meaning

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) sector entail a comprehensive spectrum of activities aimed at sustaining the operational effectiveness and airworthiness of military aircraft. This encompasses routine maintenance tasks, corrective repairs, and extensive overhauls necessitated by wear and tear, technological obsolescence, or combat damage. The primordial objective of Military Aircraft MRO is to ensure the continued availability, reliability, and mission readiness of military aviation assets, thereby safeguarding national security interests and operational capabilities.

Executive Summary

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market have emerged as a linchpin within the aerospace and defense ecosystem, driven by burgeoning defense expenditures, evolving geopolitical dynamics, and the imperative for military modernization. This market offers a myriad of opportunities for industry stakeholders, ranging from OEMs (Original Equipment Manufacturers) and MRO service providers to component suppliers and technology integrators. However, it is not devoid of challenges, including stringent regulatory frameworks, budget constraints, and technological complexities. A nuanced understanding of key market insights, drivers, challenges, and trends is indispensable for stakeholders to navigate this dynamic landscape adeptly.

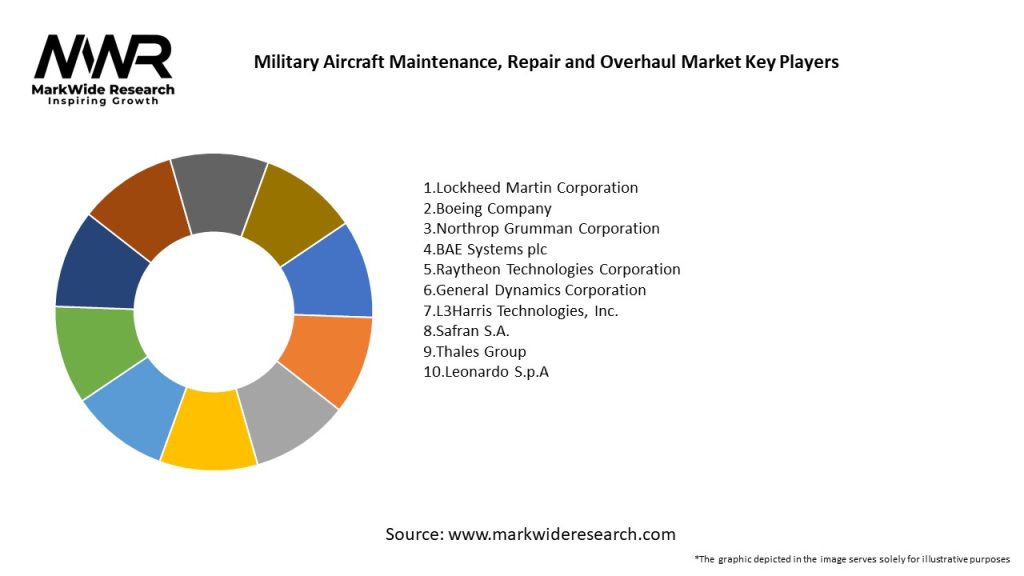

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market operate within a dynamic milieu shaped by multifarious factors, including geopolitical dynamics, technological advancements, regulatory frameworks, and budgetary considerations. These dynamics necessitate a nimble and adaptive approach from industry stakeholders to capitalize on emerging opportunities, mitigate risks, and sustain competitiveness amidst evolving market trends.

Regional Analysis

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market exhibit regional variations influenced by factors such as defense spending, military modernization priorities, and geopolitical dynamics. Let’s delve into key regional insights:

Competitive Landscape

Leading Companies in the Military Aircraft Maintenance, Repair and Overhaul Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market can be segmented based on various parameters, including:

Segmentation enables a granular understanding of customer needs, market dynamics, and competitive landscapes, facilitating targeted strategies and customized solutions delivery.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis elucidates the strategic position of the Military Aircraft Maintenance, Repair, and Overhaul (MRO) market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis empowers MRO providers to capitalize on strengths, mitigate weaknesses, seize opportunities, and navigate threats in the dynamic Military Aircraft MRO market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has exerted a multifaceted impact on the Military Aircraft Maintenance, Repair, and Overhaul (MRO) market, including:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market are poised for robust growth in the foreseeable future, propelled by escalating defense expenditures, technological advancements, and evolving geopolitical dynamics. However, navigating challenges such as budgetary constraints, regulatory compliance, and technological disruptions necessitates strategic foresight, agility, and innovation. The industry’s trajectory will be shaped by digital transformation initiatives, sustainable practices, and collaborative partnerships, enabling MRO providers to deliver superior value propositions and thrive in the dynamic aerospace and defense landscape.

Conclusion

The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market occupy a pivotal position within the aerospace and defense industry, underpinning the sustained operational readiness, safety, and effectiveness of military aviation assets. With burgeoning defense expenditures, technological advancements, and evolving customer requirements, the MRO market offers a plethora of opportunities for industry stakeholders to capitalize on. However, navigating challenges such as budgetary constraints, regulatory complexities, and technological disruptions necessitates adept strategies, collaborative partnerships, and continuous innovation. By embracing digital transformation, fostering sustainable practices, and investing in workforce development, MRO providers can chart a course towards sustained growth, resilience, and leadership in the dynamic aerospace and defense ecosystem.

What is Military Aircraft Maintenance, Repair and Overhaul?

Military Aircraft Maintenance, Repair and Overhaul refers to the processes involved in the upkeep, repair, and refurbishment of military aircraft to ensure their operational readiness and safety. This includes routine maintenance, major repairs, and upgrades to extend the lifespan of the aircraft.

What are the key players in the Military Aircraft Maintenance, Repair and Overhaul Market?

Key players in the Military Aircraft Maintenance, Repair and Overhaul Market include companies like Lockheed Martin, Northrop Grumman, and Boeing, which provide comprehensive MRO services for various military aircraft types, among others.

What are the growth factors driving the Military Aircraft Maintenance, Repair and Overhaul Market?

The growth of the Military Aircraft Maintenance, Repair and Overhaul Market is driven by increasing defense budgets, the need for modernization of aging aircraft fleets, and advancements in maintenance technologies that enhance efficiency and safety.

What challenges does the Military Aircraft Maintenance, Repair and Overhaul Market face?

Challenges in the Military Aircraft Maintenance, Repair and Overhaul Market include budget constraints, the complexity of modern aircraft systems, and the need for skilled labor to perform specialized maintenance tasks.

What opportunities exist in the Military Aircraft Maintenance, Repair and Overhaul Market?

Opportunities in the Military Aircraft Maintenance, Repair and Overhaul Market include the adoption of predictive maintenance technologies, the expansion of MRO services to unmanned aerial vehicles, and partnerships between private companies and government agencies.

What trends are shaping the Military Aircraft Maintenance, Repair and Overhaul Market?

Trends in the Military Aircraft Maintenance, Repair and Overhaul Market include the increasing use of digital technologies for maintenance tracking, the integration of artificial intelligence for predictive analytics, and a focus on sustainability practices in MRO operations.

Military Aircraft Maintenance, Repair and Overhaul Market

| Segmentation Details | Description |

|---|---|

| Service Type | Routine Maintenance, Structural Repair, Component Overhaul, Upgrades |

| End User | Military Forces, Defense Contractors, Government Agencies, Private Operators |

| Aircraft Type | Fighter Jets, Transport Aircraft, Helicopters, Drones |

| Maintenance Level | Line Maintenance, Base Maintenance, Depot Maintenance, Heavy Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Military Aircraft Maintenance, Repair and Overhaul Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at