444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The military 3D and 4D printing market is witnessing significant growth due to the increasing adoption of additive manufacturing technologies in the defense industry. 3D printing, also known as additive manufacturing, involves the creation of three-dimensional objects by layering materials based on a digital design. 4D printing takes it a step further by introducing materials that can change their shape or functionality over time. This innovative technology offers numerous advantages, including cost savings, customization capabilities, and reduced lead times for manufacturing complex parts.

Meaning

Military 3D and 4D printing refer to the application of additive manufacturing technologies in the defense sector. It enables the production of various components, including prototypes, spare parts, tools, and even weapons, with enhanced efficiency and precision. This technology allows military organizations to overcome supply chain challenges, reduce reliance on traditional manufacturing methods, and achieve faster turnaround times for critical equipment.

Executive Summary

The military 3D and 4D printing market is experiencing rapid growth, driven by advancements in technology and the need for more agile defense manufacturing processes. This report provides key insights into the market, including market drivers, restraints, opportunities, and regional analysis. Additionally, it delves into the competitive landscape, segmentation, and industry trends, along with the impact of COVID-19 and future outlook.

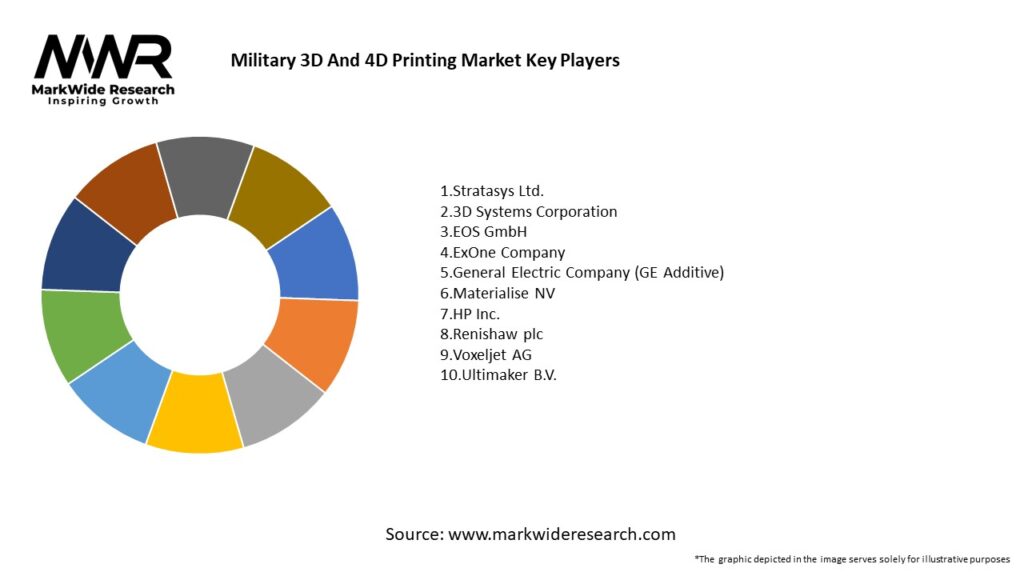

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The military 3D and 4D printing market is poised for substantial growth due to several key factors. The increasing demand for lightweight and durable military equipment, cost-effective production methods, and the ability to rapidly manufacture customized components are driving market expansion. Moreover, governments’ focus on strengthening defense capabilities and reducing logistics burdens is further fueling the adoption of 3D and 4D printing in the military sector.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The military 3D and 4D printing market is dynamic, driven by continuous technological advancements and collaborations between defense organizations and additive manufacturing companies. The industry is witnessing strategic partnerships, research and development initiatives, and investments to unlock the full potential of this transformative technology. Furthermore, the increasing adoption of 3D printing in the aerospace and automotive industries is also expected to positively impact the military sector.

Regional Analysis

The military 3D and 4D printing market exhibit regional variations based on defense budgets, technological capabilities, and strategic priorities. North America is a dominant market due to the presence of major defense manufacturers and ongoing investments in research and development. Europe is also witnessing substantial growth, driven by collaborations between defense agencies and additive manufacturing companies. Asia-Pacific is emerging as a significant market, with countries like China and India focusing on strengthening their defense capabilities through innovative manufacturing processes.

Competitive Landscape

Leading Companies in Military 3D And 4D Printing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The military 3D and 4D printing market can be segmented based on technology, application, and component. By technology, it includes fused deposition modeling (FDM), stereolithography (SLA), selective laser sintering (SLS), and others. Applications of military 3D and 4D printing encompass prototyping, tooling, functional parts, and others. Components include hardware, software, and materials.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has highlighted the significance of resilient and agile defense manufacturing capabilities. The disruptions caused by global supply chain limitations emphasized the need for on-demand production and local manufacturing capabilities. 3D and 4D printing emerged as valuable solutions to address supply chain vulnerabilities, enabling the rapid production of critical medical supplies and equipment. This crisis has further accelerated the adoption of additive manufacturing in the military sector.

Key Industry Developments

Analyst Suggestions

Future Outlook

The military 3D and 4D printing market is poised for robust growth in the coming years. Advancements in technology, expanding applications, and increasing adoption by defense organizations will be the key drivers of market expansion. The industry will witness further developments in materials, hardware, and software, leading to more efficient and capable additive manufacturing systems. With ongoing investments and strategic partnerships, the military sector will continue to leverage 3D and 4D printing to revolutionize defense manufacturing processes.

Conclusion

Military 3D and 4D printing technologies are transforming the defense manufacturing landscape, offering numerous advantages such as cost savings, customization capabilities, and reduced lead times. The market is driven by the need for enhanced operational efficiency, cost-effective production methods, and the ability to rapidly manufacture customized components. Despite challenges, the military sector is increasingly adopting additive manufacturing to strengthen defense capabilities and overcome supply chain limitations. Strategic investments in research and development, collaborations, and standardization efforts will play a vital role in unlocking the full potential of military 3D and 4D printing, shaping the future of defense manufacturing.

Military 3D And 4D Printing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Metal, Polymer, Composite, Ceramics |

| Technology | Fused Deposition Modeling, Stereolithography, Selective Laser Sintering, Binder Jetting |

| End User | Defense Contractors, Government Agencies, Research Institutions, Aerospace Manufacturers |

| Application | Prototyping, Tooling, Production Parts, Customization |

Leading Companies in Military 3D And 4D Printing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at